Andrew Coyne Is Dead Wrong on CPP Investments' Active Management

The Canada Pension Plan Fund had a bad year last year. You’d never know it to read the latest annual report from the fund’s managers, the CPP Investment Board, which spends much of its nearly 80,000 words boasting how, thanks to the herculean efforts of its employees and the sophisticated investment stratagems of its managers, it eked out an 8-per-cent return on investment for the CPP’s beneficiaries.

But of course it did: asset markets generally were up wildly last year. As an investment manager, you’d have to have gone pretty far out of your way not to have earned a sizable return. Indeed, the fund’s benchmark “reference portfolio,” a composite of global equity and bond indexes, gained 19.9 per cent on the year.

What does that mean? It means that if the fund’s managers had stopped trying to pick stocks and just bought index-linked ETFs like the rest of us – a strategy, known as passive management, that could be executed by your average high-school student – they would have earned more than twice as much on their investments last year as they in fact did.

That’s not the news, however. The news is not that the fund trailed its benchmark in its most recent fiscal year. The news is that it is now trailing it, on average, over the entire 18-year period since the fund, until then a small, low-cost outfit that mostly just bought the indexes, went all in on active management.

The fund acknowledges as much, though not until page 39 of the report, where it confesses to having earned “negative 0.1% annualized or negative $42.7-billion since inception of active management in 2006,” relative to the reference portfolio. Indeed: while the fund has earned 7.7 per cent annually since then, the reference portfolio has earned 7.8 per cent. (All figures here are based on CPPIB annual reports, 1999 to 2024.)

This is a staggering, if predictable, result. I say predictable, because most actively managed funds – two-thirds in any given year, nearly all of them over longer periods – underperform the market, especially after fees are included. That’s not because their managers are stupid. It’s because, in order to beat the average, even the smartest manager has to somehow beat all the other smart managers out there. Generally speaking, it’s a wash.

But then, “active management” doesn’t quite capture the transformation in the CPPIB after 2006. Essentially it turned itself into a giant hedge fund, picking stocks, taking seats on boards, and plunging heavily into an increasingly esoteric mix of assets: real estate, private equity, infrastructure, and God knows what else.

The fund’s staffing levels, consequently, exploded: from roughly 150 employees in 2006 to more than 2,100 today. So did its costs, particularly the fees paid to external investment managers: from $36-million in 2006 to $3.5-billion in 2024, a near hundredfold increase.

Over all, combining management fees, operating expenses and transaction costs, the fund’s expenses now exceed $5.5-billion annually – more than $46-billion in total since 2006. And yet, for as long as the fund’s returns after expenses exceeded what it could have earned had it stuck to the passive management strategy – measured by the reference portfolio – it could claim it was all worth it.

But now even that has been blown to bits. All that has been achieved in the course of that 18-year, $46-billion spending orgy has been to lose $42.7-billion for the nation’s pensioners.

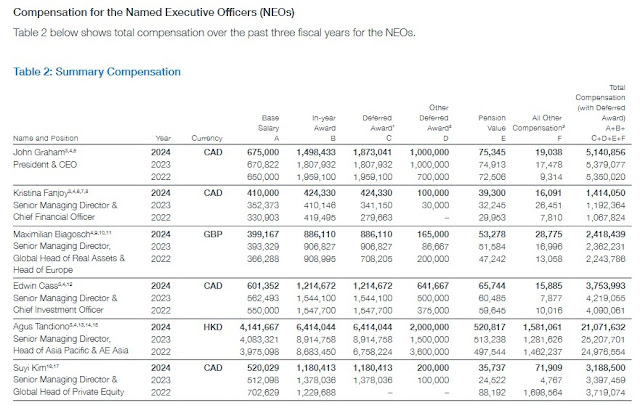

Well, that, and to enrich the fund’s managers. The fund’s five highest-paid executives now receive compensation averaging nearly $4-million a year, almost five times as much as in 2006. Compensation across its entire staff averages more than $500,000.

All of this may in fact understate matters. For one thing, it assumes the fund’s self-chosen benchmark, the reference portfolio, with its mix of 85-per-cent equity and 15-per-cent bonds, carries the same risk as the fund’s actual portfolio. If not – if the fund is in fact riskier than that – then it should not merely be matching the reference portfolio, but beating it handily (since riskier investments tend to earn more).

Well, who can say? When an asset is publicly traded, we have a pretty good idea of what it is worth, how much it is earning, and with what degree of volatility or risk. But much of the fund’s portfolio is now invested in assets, such as bridges and shopping centres, that are rarely if ever traded.

The CPPIB likes to tout this as an advantage: Rather than chase short-term returns, it can, by virtue of its “unique mandate,” invest for the long haul. Maybe so. But if it turns out, years from now, that these assets are not worth anything like what the fund was claiming, it will be too late, won’t it?

A friend of mine sent me Coyne's latest hit piece stating this:

CPP Investments continues to get lambasted. They wanted independence from government, well they are getting a dose of it. With independence comes accountability and, guess what, they aren’t delivering.Pretty harsh and I painstakingly tried to explain to my friend that the goal of CPP Investments isn't to try to match its Reference Portfolio or beat it and that it's true that no pension fund (not just CPP Investments) or fund manager has consistently beaten the S&P 500 over the last 20 years, that doesn't mean active managers are "useless".

This is the same crowd that has insisted on reducing their exposure to Canadian equities because they can secure better risk adjusted returns elsewhere. Hogwash. They are directing more money to fund managers outside of Canada because it increased their own international personal profile.

If you can’t generate 200 bps of alpha over 20 years, you are useless.

I think Coyne and my friend are mixing a lot of things up so let me try to explain it in simple terms.

Let's go back to 2006 when CPP Investments started to implement its active management strategy to invest more in private equity, real estate, infrastructure, hedge funds, and later came private debt.

What if at the time, the federal government and provincial governments got together and said let's fire all these pension fund managers and just shove the money into the S&P 500 ETF (SPY).

This way they get exposure to the 500 largest US companies with global exposure and there are no worries about beating an index, CPP Investments would have become a giant index fund.

And let's say they were prudent and said you know what, we won't bet it all on stocks, we will put 70% in the SPY and the rest in the long-term US Treasuries.

None of this paying private equity managers and hedge fund managers big fees, no illiquid asset classes like real estate or infrastructure, liquid indexes with negligible fees.

This way you save on fees and doling out millions to pension fund managers who keep touting how sophisticated they are as they change benchmarks to game them.

No-brainer, right? The stewards of the Canada Pension Plan screwed up by creating CPP Investment and PSP Investments back in 1999 and should have just indexed it all.

This is essentially what Norway did around the same time with its giant wealth fund and things are running very smoothly there with NBIM managing these assets at a fraction of the cost.

Well, it's not as simple as that.

Norway's giant fund is essentially a giant beta fund whose performance is basically tied to global public equities and global bonds.

That's fine for them as they are not a pension fund looking to meet long-term liabilities and they can live with the wild gyrations of that asset mix in years like 2022 when both stocks and bonds got clobbered as rates backed up on inflation fears.

Pension funds are not there to beat the S&P 500 every year, that's not their goal.

Their success is based on having more than enough assets to cover long-dated liabilities.

Moreover, and this is really important to understand, pension funds cannot afford the volatility of an S&P 500 because they need to make sure the contribution rate remains stable over time.

So, with that in mind, back in 2006, CPP Investments initiated its active management strategy to invest more assets in private markets that are less liquid than public markets but also less efficient and if the approach is right, they can generate great long-term returns with less volatility.

What do I mean by if the approach is right? This is really important, so follow along.

CPP Investments has 31% of its assets in private equity, investing with the world's premiere PE funds.

On its fund investments, it pays fees and the better these funds perform, the more fees they pay out.

But this also allows them to partner up with top PE firms on larger transactions, co-investing alongside them where they pay no fees (a form of direct investing).

This approach of fund investing/ co-investing is really the ultimate secret to their success because it allows them to scale into this asset class, maintain a hefty allocation and reduce fee drag.

In order to this right, you need to hire competent people not just in investment units, but also finance and risk management and pay them properly.

And CPP Investments also co-invests in other private markets or invests directly in infrastructure or real estate where they pay no fees.

This allows the Fund to properly diversify across geographies and asset classes and it provides the Fund with diversified income streams.

Andrew Coyne clearly doesn't understand any of this. He’s a smart journalist who probably read Burton Malkiel's classic "A Random Walk Down Wall Street" and now he thinks he's an investment guru too and all those fund managers at CPP Investments are overpaid and pulling wool over Canadians' eyes.

He's also publicly stating nonsense like CPP Investments is a now a giant hedge fund taking huge risks with Canadians' pension assets.

This is all nonsense, pure nonsense.

Yes, CPP Investments invests across public and private markets all over the world but it does so to maximize its risk-adjusted returns.

A couple of days ago, I went over CPP Investments' F2024 results with CEO John Graham and we did get into the Reference Portfolio and its use at the Fund and whether it's time to change it to reflect the diversified nature of their portfolio:

John was clear: "Investing is about where you make money in the future so I tell the teams to make sure very dollar is in the highest and best use and that they're spending their time on driving future returns."

I then moved on to Total Fund Management which returned 6.4% in Fiscal 2024 and asked him if that's tactical asset allocation.

He replied:

No, how to think of TFM is it's the passive portfolio. We are 75-80% active and then we have a big passive portfolio that is largely there for liquidity. So the investments departments -- Active Equities, CMFI, Real Assets, CI and PE -- manage the active from the asset classes and TFM is attributed the returns from the passive portfolio which consists of Public Equities and Fixed Income portfolios (mostly fixed income).That brought me to the discussion of CPP Investments' Reference Portfolio of 85% MCSI World Index and 15% Canadian nominal government bonds. I told John I never liked it as it's not exactly representative of the Fund's overall portfolio and too heavily tilted in public equities which are very concentrated now in a few mega cap tech names.

So, even though CPP Investments' portfolio is producing excellent risk-adjusted returns over the long run, there are years where it significantly underperforms its Reference Portfolio when stocks are on fire and peaking in the cycle:

There's another reason why I bring this up because I know people who think the CPP Fund should just be indexed to the S&P 500 and we shouldn't pay pension fund managers big bonuses if they're underperforming their Reference Portfolio.

John replied:

The portfolio is acting as it was designed to act. As you know, you have to build these portfolios to withstand a wide range of macroeconomic conditions. I describe the portfolio as a bit of a supertanker, it needs to push through things. And the portfolio is performing as designed. One of the big reasons is we diversify across asset classes, geographies and sectors.

It is expected that a highly diversified portfolio would have a lot of relative volatility against something as simple as a Reference Portfolio. And if you think about our portfolio, it has become more diversified over the last five years and the Reference Portfolio has become less diversified.

I think this is one of the bigger themes and probably a longer conversation, namely, the concentration in the public market and it's not just equities, there are other markets that are highly concentrated. The accessibility in private markets and the impact of liquidity in both the public and private market.

So the Reference Portfolio is actually a risk target that we have. Once we set the risk, we do not want to replicate the Reference Portfolio by design because it's too concentrated and not the prudent approach for a large institutional investor.

What you will see from us going forward is every investment department has a benchmark that is representative of their asset class and then we aggregate all the different asset classes as a benchmark portfolio and we will start providing more transparency and visibility how we think about the disclosure of performance because that is what we are asking people to beat, the aggregation of our asset class benchmarks. That is actually the portfolio that we spend 99% of our time thinking about and trying to beat versus the Reference Portfolio.

So the reference Portfolio is actually a risk target, it's not something we try to beat. So you'll see a couple of lines in the annual report, the aggregation of the asset class benchmarks which is more in line with what you see our peers using, we will show more of that.

Performance measurement is a bit of a mosaic as you know and that's a really important piece and we will share more.

I think this is important for a lot of reasons especially as base CPP assets become less important relative to additional CPP assets (we are far from that point) which are more diversified and in line with large peers' portfolios.

It's also important for compensation and paying people properly for the long-term performance they're delivering (compensation table and footnotes are on page 75 of Annual Report):

On this last point, John told me this:

You'll see over the previous year, the underperformance relative to the Reference Portfolio did impact compensation but from our perspective, it's not an adequate passive investment because it's too concentrated. We are not quite at the Nortel phase but when the US comprises such a large amount of the global equities and the Magnificent Seven make up a large chunk of that, for an organization with time horizon we have, we think it's more prudent to be highly diversified.I told John the way I measure success is the Fund's long-term assets relative to what the Chief Actuary of Canada initially expected the Fund to deliver:

That is the ultimate measure of success, the rest isn't as important.

John ended on this sobering note:

I think the investment landscape in general over the last twenty years benefited from a pretty constructive environment with respect to rates, inflation and geopolitics. Going forward that may not necessarily be the case with rates being higher, inflation stickier and geopolitics front and center. We know markets have reversion to the mean. I think we participated and did well as markets did well but as I told Frank (Switzer), I think we are about to start playing playoff hockey these days.I completely agree, this is my sense as well, the big beta effect will come to an end and a much harsher reality will set in and everyone including yours truly will need to roll up their sleeves to generate returns.

In short, concentration risks abound, not just in public equities but in credit markets too and if you think the next 20 years are going to look anything like the last 20 years, you're delusional!

So with all due respect to Andrew Coyne and even some of my smart skeptical friends who mistakenly believe active management has been a failure at CPP Investments and other Maple Eight funds, they don't know what they're talking about.

Yes, we are paying Maple Eight pension managers a lot of money to manage pension assets -- a lot of money -- no doubt about it but you also have to understand their strategies and why you want competent people managing these billions in assets.

The long-term results speak for themselves and again, the most important chart above is assets relative to initial projections of Chief Actuary of Canada.

This obsessive focus on beating the Reference Portfolio is so wrong and quite frankly, stupid.

None of Canada's Maple Eight beat their benchmark last year.

So what? They all delivered solid results and remain fully funded which is what counts the most.

And they are using all their advantages wisely even in public markets, using total return swaps to gain index exposure and trying to beat it using cash on hand investing elsewhere.

I can go on and on about how Andrew Coyne's latest opinion piece is really bad but it's the job of CPP Investments to take on these comments head on, not mine.

They need to step up their communications game and tackle their fiercest critics.

Canadians read Andrew Coyne, not Leo Kolivakis's Pension Pulse!

Lastly, something else to ponder.

Norway's giant wealth fund invests a small fraction of its assets in unlisted real estate and infrastructure and recently tried to invest in private equity and was denied.

Could it be they also see the massive concentration risks in public equities and want to start diversifying that mammoth portfolio?

Maybe, I certainly would be nervous if I was them.

And for all of you who think indexing is the way to invest, it is but when concentration risk is this high, you better know what your indexing into it and be prepared for huge volatility.

Alright, let me wrap it up there, wish everyone a nice weekend and my American readers a nice Memorial Day weekend.

Below, John Graham, CEO of the Canada Pension Plan Investment Board, told BNN Bloomberg on Wednesday that the portfolio “performed as designed” and added that diversification across various asset classes and geographies was key to the fund’s performance.

"In a portfolio like ours you can’t swing around in the markets. You can’t make tactical views,” he said.

He added his team has built a "supertanker that will move through rough waters and a range of macroeconomic conditions."

Update: Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications at CPP Investments, sent me this in response to Coyne's latest article:

It's true, I can't remember how many hit pieces Coyne has written on CPP Investments in the past and it's always the same argument, active management is too expensive, ignoring the fact that the Fund just like other Maple Eight funds manages the bulk of these assets internally to significantly reduce costs and add important geographic/ asset class and strategy diversification.It wasn’t a surprise. Quite the opposite - it was anticipated with near 100% certainty. It is worth noting Mr Coyne has written about his displeasure with the Canada Pension Plan and CPP Investments no less than 35 times over the years. That’s an astonishing volume. He is also very consistent in his themes.Look, he is a very intelligent person and has written brilliantly on complex themes. His recent (April 27) column on Canada’s growth agenda is one example. When it comes to the management of a national retirement fund and truly understanding benchmarks (and ignoring performance relative to the world at large), and the conditions underlying the merits of active management - he is simply blinded, in my view, by ideology. We all have our own biases so fair enough.

Comments

Post a Comment