CPP Investments' CEO Discusses Fiscal Year 2024 Results

Canada's biggest pension fund earned an eight per cent return last year, but significantly underperformed the 19.9 per cent return of its reference portfolio.

The lower return for the Canada Pension Plan Investment Board in its fiscal year ending March 31 can be explained in part by higher volatility in the stock-focused benchmark portfolio compared with the diversified, long-term return focus for the pension fund, chief executive John Graham said on Wednesday.

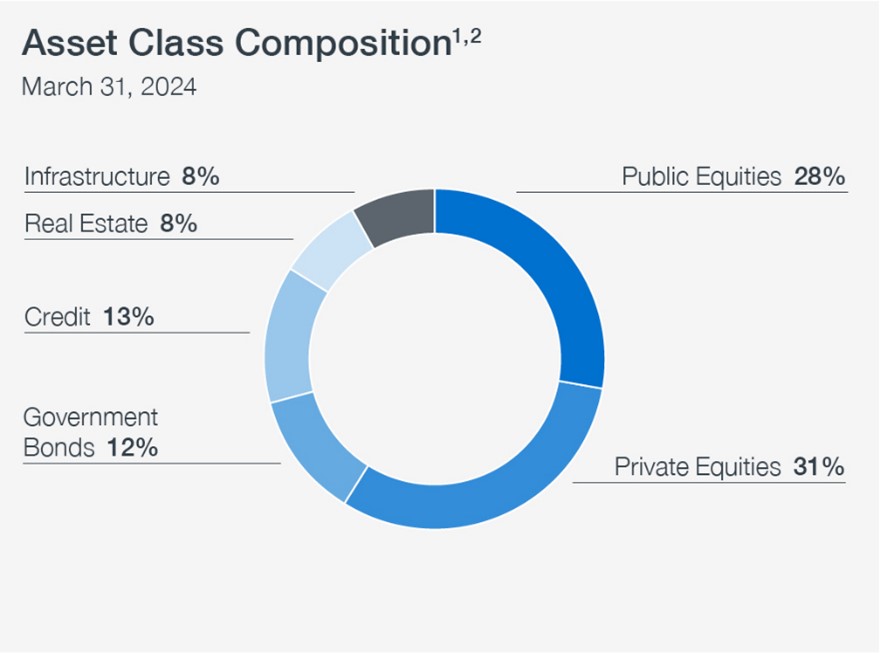

The reference portfolio, made of 85 per cent global equity and 15 per cent Canadian bonds, benefited last year from stock price surges in the seven largest U.S. tech stocks (known as the Magnificent Seven), while the pension fund has a much broader portfolio that is also invested in infrastructure, real estate, private equities and credit.

"Against a very simple, naive construct like the reference portfolio that has become very concentrated with Magnificent Seven, I think we would expect to have wild swings in performance right now," Graham said in an interview.

He added that CPPIB's returns looked "really good" against a more diversified benchmark, which would be more the norm in the pension industry where stable, long-term performance is the goal.

The pension fund's returns over the past 10 years have also fallen short of the reference portfolio, but only by 0.3 per cent.

Looking ahead, a diversified portfolio could be even more important, as Graham said he sees returns reverting back to long-term trends, down from the higher returns of the past twenty years that were boosted by trends like falling interest rates and booming Chinese growth.

"It's going to be harder to generate returns over the next 10 years than it has been over the past 20," he said.

"Inflation is stickier than expected, stickier in the Americas for sure, and geopolitics is kind of front and centre and certainly having an impact on how the world is rewiring itself."

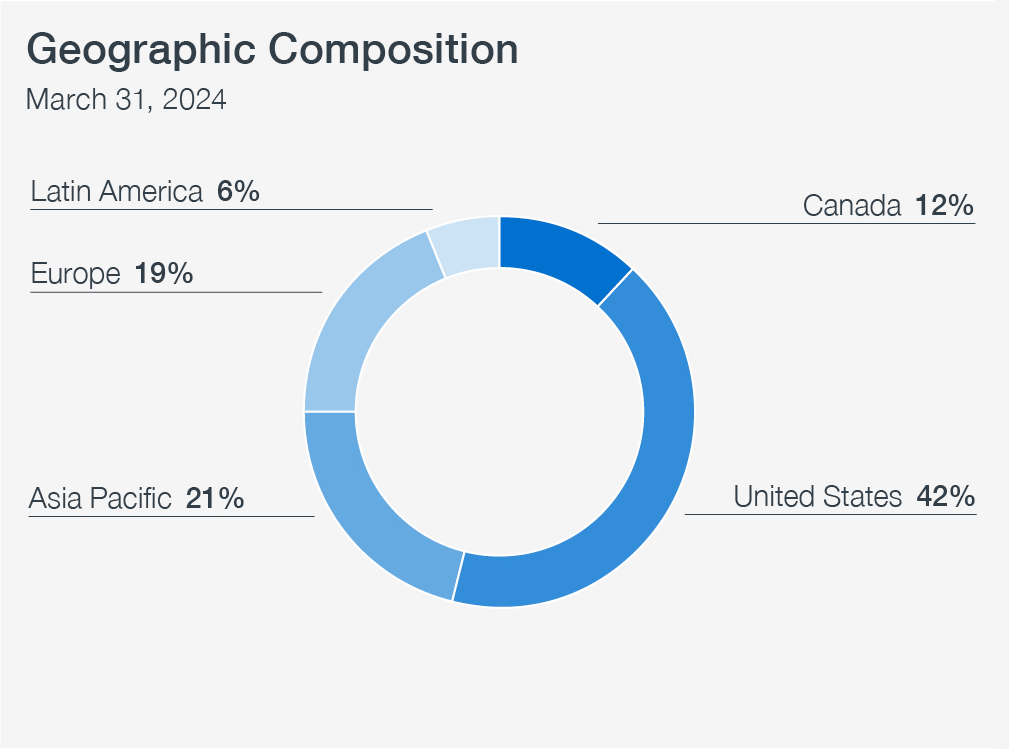

Shifting trends in recent years has led CPPIB to pull away from emerging markets toward developed markets where the opportunities are better, Graham said.

The shift hasn't, however, resulted in a higher proportion of investments going to Canada, something the federal government is trying to encourage.

CPPIB's portfolio had 12 per cent in Canada as of the end of March, down from around 16 per cent in 2019, and 31 per cent in 2014.

Graham said the portfolio is still heavily overweighted on Canada given its roughly three per cent of global GDP, and there is a lot the country has going for it including interesting opportunities in the energy sector.

But he said it's also important to have growth, and to figure out how to create large investment opportunities, and a conducive investing backdrop in areas like regulations and permitting.

"At the end of the day, the markets will go off of growth."

Some of the biggest global transactions the fund made last year included boosting its holdings in U.S.-based renewables developer Pattern Energy Group by US$905 million; an agreement to invest up to US$2.9 billion in NetCo, Italy's largest fixed telecoms network; and the sale of its stake in the Hohe See and Albatros wind farms off the shores of Germany for $374 million in proceeds.

The investment in Pattern fits within CPPIB's plans to double its green and transition assets by 2030 as it works toward a 2050 net-zero target. The fund has however resisted calls to set interim emission reduction targets, as many other pensions already have.

The fund remains focused on economywide reductions and helping companies transition, said Graham, rather than short-term targets.

"Really focusing on investing in companies, and investing in their decarbonization plans, and not focused on short-term, because in the short term, we could even see the carbon in our portfolio increase."

Elsewhere, CPPIB reduced its exposure to real estate by one percentage point to eight per cent as it made several office real estate sales in a struggling market.

The real estate portfolio lost five per cent last year as higher interest rates and work-from-home trends affected office valuations.

"Office, you know, had a challenging year, and we took some lumps on it, but made tough decisions and I think we're in a great position going forward."

CPPIB's net assets totalled $632.3 billion on March 31, up from $570.0 billion a year earlier.

The increase in net assets included $46.4 billion in net income and $15.9 billion in net transfers from the Canada Pension Plan.

Earlier today, CPP Investments issued a press release stating net assets total $632.3 billion at end of fiscal year 2024:

Highlights1:

- Net assets increase by $62.3 billion

- Net annual return of 8.0%

- 10-year net return of 9.2%

- Cumulative net income of $432.4 billion since inception in 1999

TORONTO, ON (May 22, 2024): Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2024, with net assets of $632.3 billion, compared to $570.0 billion at the end of fiscal 2023. The $62.3 billion increase in net assets consisted of $46.4 billion in net income and $15.9 billion in net transfers from the Canada Pension Plan (CPP).

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 8.0% for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualized net return of 9.2%. Since its inception in 1999, CPP Investments has contributed $432.4 billion in cumulative net income to the Fund.

“The CPP Fund’s growth this year continued the trend of reaching heights several years ahead of initial actuarial projections,” said John Graham, President & CEO. “Solid performance by all of the investment departments and key corporate functions helps demonstrate how our strategy is on track.”

Annual results were positively impacted by strong public equity market performance, gains in our private equity portfolio, as well as investments in credit, infrastructure and energy. This was offset by overall weaker performance of emerging markets compared to developed markets and lower performance of real estate assets.

“Since the creation of CPP Investments 25 years ago, we have made a number of strategic decisions that have generated significant value above initial projections, with investment returns comprising more than two-thirds of total Fund assets to date,” added Graham. “As we head into our next quarter century, we are mindful of continuing geopolitical and economic uncertainties that may affect the investment environment, however, we have strong conviction that our people and our strategy will allow us to continue to deliver on our mandate for generations to come.”

Performance of the Base and Additional CPP Accounts

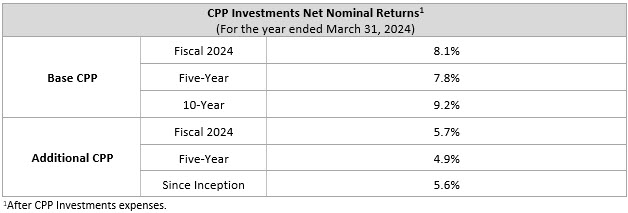

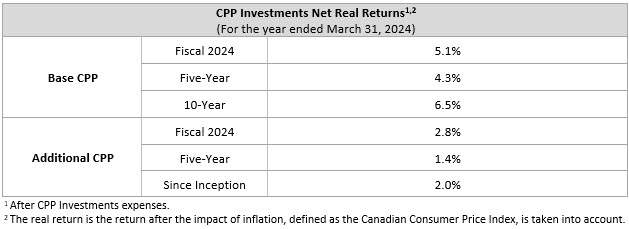

The base CPP account ended the fiscal year on March 31, 2024, with net assets of $593.8 billion, compared to $546.2 billion at the end of fiscal 2023. The $47.6 billion increase in net assets consisted of $44.4 billion in net income and $3.2 billion in net transfers from the CPP. The base CPP account achieved an 8.1% net return for the fiscal year and a five-year annualized net return of 7.8%.

The additional CPP account ended the fiscal year on March 31, 2024, with net assets of $38.5 billion, compared to $23.8 billion at the end of fiscal 2023. The $14.7 billion increase in net assets consisted of $2.0 billion in net income and $12.7 billion in net transfers from the CPP. The additional CPP account achieved a 5.7% net return for the fiscal year and a five-year annualized net return of 4.9%.

The additional CPP was designed with a different legislative funding target and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

Relative Performance

The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. CPP Investments was created to invest and help grow the CPP Fund, maximizing returns without undue risk of loss.

CPP Investments expresses our risk targets through simple, two-asset class Reference Portfolios comprising a mix of Canadian governments’ bonds and global public equities (including Canada). The Reference Portfolios reflect the targeted level of market risk that we believe will maximize returns for each of the base CPP and additional CPP accounts, while also serving as a point of measurement when assessing the Fund’s performance over the long term. CPP Investments’ performance relative to the Reference Portfolios can be measured in percentage or dollar terms, after deducting all expenses.

On a relative basis, the aggregated Reference Portfolios’ return of 19.9% exceeded the Fund’s net return of 8.0% by 11.9%. As a result, in fiscal 2024, net value-added for the Fund was negative 11.9% or negative $64.1 billion. Over the five-year and 10-year periods, net value-added was negative 2.0% and negative 0.3%, respectively.

CPP Investments has deliberately and prudently constructed a portfolio that is significantly more diversified than the Reference Portfolios, by asset type, region and sector, and includes considerable weightings in private equity and real assets. This is designed to ensure portfolio resilience against the volatility that can impact net value-added – as experienced this year – and generate more consistent returns compared with a portfolio that is mainly exposed to public equity markets. In fiscal 2024, strong performance of the U.S. public equity market, led by technology stocks, was reflected in the performance of the Reference Portfolios.

For information on which of our decisions we believe are adding the most value, please refer to page 37 of the CPP Investments Fiscal 2024 Annual Report.

Asset Class and Geography Composition

CPP Investments, inclusive of both the base CPP and additional CPP Investment Portfolios, is diversified across asset classes and geographies.

1 Refer to page 69 of the Annual Report for a breakdown of the composition of each asset class.

2 Credit consists of public and private credit investments, of which $59.8 billion forms part of the Active Portfolio and $19.5 billion forms part of the Balancing Portfolio as at March 31, 2024, both managed by the Credit Investments department.

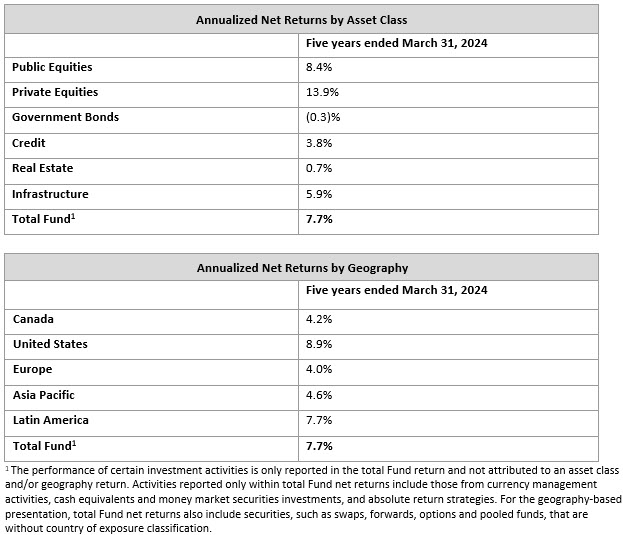

Performance by Asset Class and Geography

Five-year Fund returns by asset class and geography are reported in the tables below. In fiscal 2024, both emerging and developed markets contributed positively to our annual and five-year returns. A more detailed breakdown of performance by investment department is included on page 47 of the Fiscal 2024 Annual Report.

Managing CPP Investments Costs

Discipline in cost management is a main thrust of our public accountability as we continue to build an internationally competitive enterprise that seeks to create enduring value for multiple generations of beneficiaries of the CPP.To generate $46.4 billion of net income, CPP Investments directly and indirectly incurred $1,617 million of operating expenses, $1,449 million in investment management fees and $2,067 million in performance fees paid to external managers, as well as $427 million of transaction-related expenses.

Operating expenses increased by $77 million due to inflationary pressure impacting salaries, employee benefits, and our technology infrastructure. Our operating expense ratio was 27.5 basis points (bps), which is below the five-year average of 28.3 bps and below the 28.6 bps in fiscal 2023.

Management fees decreased by $10 million, remaining broadly in line with the prior year. Performance fees increased by $302 million driven by more realization events in the private equity portfolio compared to the prior year.

Transaction-related expenses, which increased by $11 million, vary from year to year according to the number, size and complexity of our investing activities. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage.

Page 26 of the Fiscal 2024 Annual Report provides a discussion of how we manage our costs. For a complete overview of CPP Investments combined expenses, including year-over-year comparisons, refer to page 45.

Operational Highlights for the YearCorporate developments

- Ranked one of the world’s top-performing public pension funds by Global SWF when measuring annualized returns between fiscal years 2014 and 2023 (Global SWF Data Platform, May 2024).

- Issued a joint statement with Canada’s leading pension plan investment managers that calls on companies to embrace the new International Sustainability Standards Board disclosure framework. The new framework will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions.

Board appointments

- Welcomed the designation of Dean Connor as Chairperson of the Board of Directors, effective October 27, 2023. Mr. Connor succeeded Dr. Heather Munroe-Blum, CPP Investments’ Chairperson since 2014, whose final term as Chairperson and Director expired in October. Mr. Connor has served on the Board since August 2021.

- Welcomed the appointment of Nadir Mohamed to the Board of Directors and the reappointments of Ashleigh Everett, John Montalbano, Mary Phibbs and Boon Sim as Directors of the Board for three-year terms effective October 2023.

Executive announcements

- Separated the roles of Chief Investment Officer (CIO) and Head of Total Fund Management to allow for more dynamic management of our portfolio, as well as balance sheet management and tactical positioning. CIO Edwin Cass now oversees all investment departments and Manroop Jhooty was appointed Senior Managing Director & Head of Total Fund Management, where he leads the balancing and financing portfolio, which is invested in global public securities, as well as balance sheet management, tactical positioning, trading and portfolio design.

Transaction Highlights for the Year

Active Equities

- Completed an investment in Inspira, one of Brazil’s leading private K-12 education providers, serving over 57,000 students across more than 100 schools, in a R$1 billion (C$270 million) investment round led by Advent International.

- Invested C$534 million in KPN, bringing our ownership stake to 2.9%. KPN is a leading telecommunications company in the Netherlands.

- Invested C$400 million in SK Hynix, a South Korean supplier of dynamic and flash memory chips, increasing our ownership stake to 0.4%.

- Invested an additional C$258 million in LY Corp., a Japanese holding company that owns and manages a portfolio of businesses including Yahoo! Japan, increasing our ownership stake to 3%.

- Invested C$435 million for a stake of approximately 1% in Evolution AB, a Sweden-based company that develops, produces, markets and licenses online casino solutions to gaming operators.

Credit Investments

- Committed US$325 million to TPG AG Essential Housing Fund III, which provides financing to U.S. single-family homebuilders for production-ready, fully entitled land.

- Formed a US$750 million strategic capital partnership with Redwood Trust, Inc., a publicly listed U.S. mortgage real estate investment trust. The partnership consists of a newly formed US$500 million Asset Joint Venture and a US$250 million corporate secured financing facility to Redwood Trust.

- Committed US$300 million to an India-based asset manager that focuses on structured and private credit opportunities in the country.

- Committed to provide up to US$138 million in financing to VoltaGrid LLC through a term loan. Based in the U.S., VoltaGrid is an energy management and generation company, which provides power, alternate fuels and emissions reduction solutions.

- Committed US$500 million to Quantum Capital Solutions Fund II, which will invest primarily in asset-level joint ventures and hybrid credit investments within the conventional energy sector in the U.S.

- Invested US$100 million in financing to support EQT’s acquisition of Zeus, a leading contract manufacturer in the medical devices industry based in the U.S.

- Invested £93 million in a debt facility to Vårgrønn, owner of a 20% stake in Dogger Bank Wind Farm, which is an offshore wind farm currently under construction, located off the coast of the U.K.

- Entered into a newly formed venture with Blackstone Real Estate Debt Strategies, Blackstone Real Estate Income Trust, Inc., and funds affiliated with Rialto Capital and acquired a 20% equity stake for US$1.2 billion in a venture that holds a US$16.8 billion senior commercial mortgage loan portfolio, primarily located in the New York metropolitan area.

- Invested A$300 million (C$268 million) in a first-lien term loan to TEG, a leading integrated live entertainment and ticketing service provider in Australia.

- Committed to invest C$197 million in financing to support CapVest Partners in its acquisition of Recochem. Headquartered in Canada, Recochem is a global manufacturer and distributor of aftermarket transportation and household fluids.

Private Equity

- Committed US$50 million to Sands Capital Life Sciences Pulse III. Based in the Washington D.C. area, Sands Capital Life Sciences Pulse III invests in growth-stage life sciences tools, diagnostics, and therapeutics companies primarily in the U.S.

- Invested US$30 million in Sogo Medical Group, a leading dispensing pharmacy chain and hospital services provider in Japan, alongside CVC Capital.

- Invested C$84 million for a minority stake in Plusgrade, alongside General Atlantic. Headquartered in Montreal, Canada, Plusgrade is a leading provider of ancillary revenue optimization solutions for the travel industry.

- Committed €100 million to Montagu VII SCSp, which focuses on Northern European mid-market buyouts in healthcare, critical data, financial services, digital infrastructure and education.

- Invested US$50 million in Zeus, alongside EQT. Based in the U.S., Zeus is a leading contract manufacturer in the medical devices industry.

- Invested US$27 million in HRBrain, a leading human resources software provider in Japan, alongside BPEA EQT Middle Market Growth Fund.

- Closed two commitments with Northleaf Capital Partners, a Toronto-headquartered global private markets investment firm: C$200 million to an evergreen separately managed account that provides access to the Canadian private equity market through mid-market buyout and growth funds, secondary investments and direct investments; and C$50 million to Northleaf Venture Catalyst Fund III, a Canada-focused venture capital fund that invests in Canadian venture capital and growth funds, secondary investments and direct investments.

- Committed €500 million to CVC Capital Partners IX, L.P., which focuses on control and shared-control buyouts across industries primarily in Europe and the Americas.

- Invested NZ$105 million (C$88 million) to acquire a 9.4% stake in Pushpay Holdings Ltd., a New Zealand-headquartered payments software provider for churches, alongside BGH Capital.

- Agreed to the partial realization of our investment in Visma, a leading provider of mission-critical cloud software in Europe, retaining an approximate 2% stake in the company. Net proceeds from the sale are expected to be approximately C$700 million. Our original investment was made in 2019.

- Completed the sale of Inmarsat, a European satellite service provider, to Viasat Inc., a U.S.-based global communications company, in which we now own an approximate 9% stake. Net cash proceeds from the sale were US$206 million.

Real Assets

- Established a new real estate investment and operating platform focused on purpose-built student accommodation (PBSA) in continental Europe through the acquisition of our joint venture partner’s minority stake in Round Hill European Student Accommodation Partnership and the full acquisition of Nido Living, a leading European PBSA operator and manager. Through these combined transactions, we are investing up to C$40 million in the platform.

- Invested INR 18.2 billion (C$297 million) in the units of National Highways Infra Trust (NHIT), an infrastructure investment trust sponsored by the National Highways Authority of India. We have invested INR 36.8 billion (C$614 million) in NHIT since 2021 and hold 25% of the units.

- Funded £380 million in total follow-on investments to Octopus Energy through the fiscal year to support the company’s continued global growth. Octopus Energy is a global clean energy technology pioneer based in the U.K. Our partnership was established in 2021 and we currently have a 12% ownership stake.

- Committed to acquire a 17.5% interest in Netco for up to €2.0 billion as part of the Optics BidCo investor group. Netco is an extensive telecommunications network in Italy. The transaction is expected to close in the summer of 2024.

- Increased our commitment to Boldyn Networks, a leading shared network infrastructure provider in the U.S. and globally, alongside partners AIMCo and Manulife, to support the company’s ongoing growth strategy, including the agreed acquisition of Apogee Telecom. We have committed approximately C$3.5 billion towards Boldyn Networks since 2009 and hold an 86% ownership stake.

- Invested an additional C$540 million in Interise Trust (formerly known as IndInfravit Trust), our Indian toll roads portfolio company, in which we now own a 60.8% stake, to help fund the acquisition of four operating road concessions. In fiscal Q4, we acquired a 50% stake in the Investment Manager of Interise Trust for C$8 million, alongside our partners, OMERS and ACP, who acquired 25% each.

- Signed a definitive agreement in support of the proposed merger between Aera Energy, one of California’s major energy producers, and California Resources Corporation, an independent energy and carbon management company in the U.S. Through this transaction, we will receive newly issued shares of common stock upon close of the transaction, expected to represent approximately 11.2% of the combined company.

- Announced a new partnership with Amsterdam-based Power2X, in which we plan to invest an initial €130 million to accelerate its growth as a development platform and fund green molecule projects. Power2X is a leading European green molecule developer and advisor focused on the decarbonization of industrial value chains.

- Invested C$1,438 million to acquire a 24.99% stake in FCC Servicios Medio Ambiente Holding, SAU, the environmental services division of Spanish conglomerate Fomento de Construcciones y Contratas, S.A. FCC Servicios Medio Ambiente is a leading waste management operator in Iberia, the U.K. and Central Europe, with a growing presence in the U.S.

- Sold our 45% stake in 1455 Market Street, an office building in San Francisco, California. Net proceeds from the sale were approximately US$44 million. Our original investment was made in 2015.

- Signed an agreement to sell our 45% stake in 10 East 53rd Street, an office building in Manhattan, New York. Net proceeds from the sale are expected to be approximately US$7 million. Our original investment was made in 2012.

- Sold three office properties in Houston, Texas, including the Phoenix Tower. Net proceeds from the sales were approximately US$62 million. Our original investments were made in 2017.

- Agreed to a restructure and sale of a 21% partial interest in the Kendall Square Development Venture (KDV I) in South Korea. Net proceeds from the sale will be approximately US$245 million. KDV I is a joint venture set up in 2015 alongside APG and ESR to develop modern logistics real estate assets in prime locations within major strategic logistics hubs in South Korea.

Transaction Highlights Following the Year-End

- Signed an agreement to sell Amitra Capital Limited, which specializes in managing European non-performing loans and real estate investments, to Arrow Global Group Limited. Established in 2019, we retain our current direct economic interest in all of the portfolios managed by Amitra Capital.

- Entered into a definitive agreement to jointly acquire ALLETE, Inc. alongside Global Infrastructure Partners for US$6.2 billion, including the assumption of debt. Headquartered in Duluth, Minnesota, ALLETE is focused on addressing the clean-energy transition by expanding renewables, reducing carbon, enhancing grid resiliency, and driving innovation.

- Committed US$450 million to Ontic, a provider of specialized parts and repair services for established aerospace technologies, headquartered in the U.K.

- Realized a partial interest of our stake in Viking Holdings for expected net proceeds of C$714 million through the company’s initial public offering. Viking Holdings is a global cruise operator and travel company. Our initial investment in the company was made in 2016 and we maintain a 15% stake.

- Committed US$100 million to Kedaara Capital Fund IV, which will focus on mid-market buyout and minority growth investments in India.

- Agreed to sell our ownership stake in Dorna Sports, an international sports management, media and marketing company, which holds the global rights to organize the MotoGP and WSBK Championships. Net proceeds from the transaction are expected to be approximately C$1.9 billion, of which approximately 75% is in cash and 25% in Series C Liberty Formula One tracking stock. Our original investment was made in 2013.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 22 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2024, the Fund totalled $632.3 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Earlier this afternoon, I had a chance to speak with CEO John Graham on F2024 results.

I want to thank him and thank Frank Switzer for setting up the call and sending me documents to review.

CPP Investments is the "Big One", the most important pension fund in Canada, the one everyone tracks closely.

Now, before I get to my discussion with John, I'd like to cover some things in the annual report which you can download here.

First, the message from Dean Connor who took over as Chairperson from Dr. Heather Munroe-Blum after she successfully completed 12 years as Chairperson of that board:

I think it's worth reminding my readers a little about the new Chairperson:

Dean Connor was appointed to the Board in 2021 and has more than four decades of global experience in financial services and executive consulting. Between 2011 and 2021, Mr. Connor served as President & CEO of Sun Life Financial Inc., a leading financial services company. Prior to this, he held senior roles with Sun Life, including Head of Canadian Operations and Chief Operating Officer. Mr. Connor previously had a 28-year tenure with a human resource consulting firm, where he rose to be President for the Americas, a position he held until 2006.

Mr. Connor qualified as a Fellow of the Society of Actuaries and the Canadian Institute of Actuaries. He holds an Honours Business Administration degree from the Ivey School of Business at Western University. Mr. Connor currently serves as Chair of the Board for the University Health Network in Toronto and as a member of the Ivey Advisory Board. He was named Canada’s Outstanding CEO of the Year for 2017, Ivey’s Business Leader of the Year for 2018 and one of the Top CEOs in the World for 2019 by the Harvard Business Review.

“Dean’s long history of leadership, coupled with his extensive global experience in financial services makes him ideally suited to be an effective Chairperson for CPP Investments,” said Dr. Munroe-Blum. “The Board unanimously agrees that Dean’s excellent reputation as a leader on our Board, his commitment to strong corporate governance and his extensive global experience will allow him to help lead the Board in its oversight duties in an exemplary fashion, helping guide CPP Investments as it grows to become a trillion-dollar fund.”

“I am deeply honoured to assume the role of Chairperson and to build on Heather’s outstanding leadership,” said Mr. Connor. “I look forward to working closely with my fellow Directors, President & CEO John Graham, and his management team as CPP Investments continues to deliver on its purpose to provide a foundation upon which 21 million contributors and beneficiaries can build their financial security in retirement.”

Mr. Connor was clear in his message that CPP Investments' governance is why the organization has enjoyed long-term success:

This year, we mark the 25th anniversary of CPP Investments. Over this time, the organization has evolved into a sophisticated investment organization, with net assets of $632.3 billion and investments that reach across more than 50 global markets, including $74 billion invested herein Canada.

Many Canadians aren’t aware of this, but CPP Investments is acknowledged globally as the gold standard for pension investment management. Our success is directly linked to the foresight of its founding leaders who designed a governance structure that allowed the organization to invest with a clear, single mandate – and to do so professionally and independent of government.

As an organization that serves generations of Canadians, we must keep progressing. This past year, the Board reviewed and approved the next stage of CPP Investments’ evolving strategy – harnessing the organization’s collective capabilities – while adapting to the changing environment and the growing size and complexity of the Fund. The Board is confident that this will keep us on the right path to continue to deliver strong, sustainable long-term returns for current and future CPP contributors and beneficiaries.

Next, take the time to read President & CEO John Graham's message:

I note the following:

As the CPP Fund grows, CPP Investments has increasingly become a part of the public discourse on the best way to bolster the financial security of future generations. This includes whether public pension plans are investing enough in Canada and whether Alberta should withdraw from the CPP.

With the CPP Fund’s long history of strong financial performance, the case is clear for sticking with a well- established global investment strategy. But I also deeply respect the right of Albertans to ask questions, seek information, and make their own informed choices about their pensions. That is why we created a website (YourCPP.ca) with the facts about our national pension model. What I return to time and again, is that when it comes to pensions, there is strength in numbers. Pooling contributions from more than 22 million Canadians helps protect the CPP Fund from market volatility and changing demographics. We use our scale as a competitive edge to gain access to transactions around the world that help grow the CPP Fund. There are also advantages in the CPP’s portability, as it allows Canadians access to their CPP pension wherever they choose to retire.

The case is also clear for investing in Canada, which is why 12% of our portfolio is invested here. To put that into perspective, Canada makes up just 3% of global GDP. We invest four times more than Canada’s global economic weight because we recognize the excellent investment opportunities in our home market. At the same time, our mandate is to maximize returns without undue risk, taking into consideration the factors that affect the funding of the plan. That requires careful diversification — a key element of a resilient pension plan, and one of our core investment beliefs. Our contributors live and work in Canada, but to restrict their money to that single market would undermine the long-term sustainability of the Fund.

Now, I agree with John, the strength of our national pension fund comes in numbers and it would only hurt all Canadians if Alberta left the CPP (it won't, mark it).

As for investing more domestically, I've covered this issue in detail and recently went over why Bob Baldwin and Erin O'Toole think we shouldn't mess with the Maple Eight.

I personally do not like the global GDP argument for investing less in Canada, think it's weak.

China makes up a much larger fraction of global GDP but is fraught with geopolitical risks.

A better argument is to look at which country offers the best opportunities globally to invest -- the United States by far -- and focus on outcomes, not global GDP (see my discussion below).

Having said this, John is right, CPP Investments will surpass the trillion-dollar mark in a few years, do we really want to invest more in Canada as the Fund grows?

This isn't a prudent diversification strategy no matter what you think about investing in our own backyard.

Discussion with John Graham, CEO of CPP Investments

Alright, let me get right into my discussion with John Graham and I will add some charts along the way to highlight things.

We began by discussing the breakdown of Canadian public vs private markets allocations vs those in China, part of a series of questions I had asked in an email beforehand.

Frank Switzer said they cannot break it down that way as it's not part of their public disclosures but they provided me with more colour.

What I told them is I'm a stickler for transparency and since they are managing the assets of the Canada Pension Plan, it's a good idea to have a section in the annual report entitled "Investing in Canada," so Canadians can understand where the Fund invests domestically (and critics can stop emailing me questions).

John added some useful insights:

If I look at the assets we invest in Canada over the past year, I think every department probably increased their assets in Canada. Public equities, private equities, real estate, infrastructure and energy. Those would be the biggest asset classes in Canada. Credit would be a little bit smaller because it's a smaller alternative credit space in Canada compared to the US and Europe.

One technical nuance here that you'll appreciate is the way we report the Canadian assets, it's actually a net number, net of the financing we do as we do use leverage on the portfolio. So even though Canadian assets went from 14% to 12%, over the past year it's a very constructive financing in Canada so we increased our financing in Canada so the netted off was increased.

We take the feedback and we can think about how we incorporate more on our Canadian investments in the annual report.

That prompted me to explaining to John why I don't like the argument that Canada only represents 3% or less of global GDP and therefore we should invest less domestically. Again, China represents a much larger chunk of global GDP but is fraught with geopolitical risks.

I explained to him why I'm more of an outcomes person and like to invest globally where the best opportunities lie, mostly in the US and Europe.

I also stated while I don't agree with Australia'’s law forcing their pensions to invest 10% in domestic equities, there needs to be better explanations as to where they invest so critics can understand and I also cited the case of Norway's giant sovereign/ pension fund which invests 98% of its assets abroad (mostly in public markets).

John replied:

On the GDP component, right now we have 12-14% sitting in Canada and I think Canadian GDP is roughly 2% of global. Just from a portfolio construction perspective, the way we think about it is we blend market capitalization and GDP weighted and I think those are important components. The GDP gives you an indication of the size of the economy. The market capitalization gives you an indication of the depth and liquidity of the market.

And you mentioned China, we are closer to a market cap weighting than a GDP weighting in China. In Canada, we are quite a bit above both. That is due to the investible opportunity set and liquidity in the market and I agree with your point, we should focus on pricing these risks appropriately and capital will flow where it finds best opportunities.

On China, I told him my understanding is most of the investments there are passive equity exposure but John corrected me:

I wouldn't say it's all passive. If you look at the chart where we show currencies right now, the renmibi is about 5% of the portfolio, and that would be a blend of active and passive sitting in there. Probably more passive now than it has been historically but blend of active and passive. I think that's the right amount and as we said before, I think it's important to have exposure and try to understand the world's second largest economy but how much we have and how you gain exposure is really important and those questions of passive vs active, direct vs indirect, even how you want to get into like physical vs derivative, we think through all that. If you look at that currency chart, I think it's roughly 5% of the assets.Since time was constrained, I got right into the asset class performance starting with Credit Investments noting in fiscal 2024, it delivered 13.6% surpassing the return of all other asset classes including Private Equity which returned 9.6%:

I asked John who was formerly the Head of Credit Investments to provide my readers with more flavour:

A little technical note. The return (of 13.6%) you're referring to is in Credit Investments. Our broader Credit portfolio delivered just over 10%. The Credit Investment portfolio is an active credit portfolio which tends to be non investment grade credit, corporate credit and structured credit plus Antares, our US middle market lending platform. And those components of the market in particular did very well because they recovered from the previous year. So, the non investment grade we had a very strong year. Investment grade did well but not as well as they're longer duration assets and yields went up, so there was the marked-to-market component there.

In Credit Investments, Europe in particular did really well where you saw some of the assets there have a really good recovery. And Antares did great, it had another fantastic year.

I noted CPP Investments has 31% of its assets in private equity and they do a lot of sponsored debt given their strategic relationships.

John replied:

Correct, think about the past year in the sponsored finance area, there wasn't that much new issuance but there were interesting opportunities when they did come to market and it really attracted pricing. But over the past past 12-18 months, we also watched spreads compress in the corporate state. Part of the valuation uplift was due to spread compression and the large financing which we benefited from having a large portfolio.

I've always been a fan of sponsored finance where you have partners you know in the equity box and you have along history with them and a long history of how they will behave during the ups and downs of the market.

I told him I had a discussion with Andrew Edgell earlier this year and was still worried about a credit event but agreed with him, it's the newer inexperienced funds taking higher risks that will bear the brunt of a credit event.

John replied:

We have a great lens through Antares. It used to be owned by GE. It's a sponsored platform with sponsored backed loans where they had periods of credit events but Antares has a 20-25 year history and going back to the financial crisis where you might see a credit event but through the cycle but it performed well. It comes back to being a disciplined underwriter and ensuring you have a staple of partners that you lend to.

I asked John if Antares makes up 25% of the Credit Investments portfolio and he told me no, it's less than that (Frank Switzer later told me that Antares represents approximately 15% of the net assets in the Credit Investments group).

I asked him if it's fair to say the 13.6% return in Credit Investments can't continue and it's more realistic to expect high single digits, low teens as returns.

John responded:

When you break down credit, there's yield, then there's the pluses and minuses of spread compression and over the past year there were benefits from that spread compression juicing returns. But longer term over the cycle, it comes down to avoiding losses.So expectations are in line with what you said, higher single digit returns.I mentioned to him they are looking to double the size of the Credit portfolio over the next five years so I guess they see great opportunities.

He replied:

We see great opportunities and one of my beliefs in Credit is you need a broad mandate so we participate in corporate credit, structured credit, investment grade, non-investment grade. We also participate in real estate credit, infrastructure credit in different geographies and that's allowed the portfolio to grow.

The fundamental challenge of growing credit portfolios is they don't have capital appreciation unlike equity or infrastructure so to grow it means you have to invest more and it's a short duration asset class.

It's a treadmill, you're running on a treadmill all the time and if you're expected life is 4-5 years, you have to replace that to stand still.

I asked John how much of this opportunity set depends on private equity activity and the availability of sponsored backed debt.

He replied:

Certainly a reasonable component of it is sponsored finance and so if sponsored finance isn't active, it won't shrink because it means it will not be taken out of things but it won't grow at the same rate. I've said this before, the PE model doesn't really work if first lien debt is over 10%. The model works when first lien debt is priced a few hundred basis points above the reference rate.

Next, we moved on to private equity where I was a bit surprised they delivered a 9,6% return last fiscal year given what peers reported (their fiscal year ends on calendar year).

John responded:A couple of things on our private equity portfolio. The portfolio has a lot of directs and a lot of funds in it. Our year-end is March 31st so we picked up a little bump from that last quarter in the return. But our direct private equity portfolio did quite well, it actually performed quite well.And if you look into, one of the things you'll see, it's actually got some really big public positions in it because they're positions we IPOed over the last few years. So with the robustness of public markets, we actually benefited from those big public positions in the direct private equity portfolio. In addition, we had a few big realizations like Dorna and that was a fantastic outcome. So the whole direct private equity portfolio pulled up the returns for the whole portfolio.

This is important because private equity remains the most important asset class at CPP Investments.

We moved on to Real Assets where returns were more muted and I asked John to provide some more colour there breaking it down the performance in real estate, infrastructure and energy.

He replied:

When we report private equity, sometimes energy is tucked in there but it's not in the PE department. The Energy portfolio which is a combination of conventional and renewable energy did quite well. It had a solid year in the teens. The infrastructure portfolio delivered 2.6% and real estate was -5% (5-year 5.9% for Infra and ,7% for RE). So I would say Energy did quite well, infrastructure did okay and in real estate we continue to take some lumps in the office portfolio (6% of Real Assets portfolio).

Infrastructure when I look at the portfolio going forward, I'm quite optimistic, I think it's in good shape. Part of the valuation change was due to discount rates changing. These are long duration assets with cash flows so they're impacted by the discount rate.

Real estate is a tale of multiple cities and sectors where you have logistics, data centres, residential doing okay but office feeling some pain. I'm actually quite comfortable with the position of the portfolio today and we've asked the teams to make some really tough decisions.

John was clear: "Investing is about where you make money in the future so I tell the teams to make sure very dollar is in the highest and best use and that they're spending their time on driving future returns."

I then moved on to Total Fund Management which returned 6.4% in Fiscal 2024 and asked him if that's tactical asset allocation.

He replied:

No, how to think of TFM is it's the passive portfolio. We are 75-80% active and then we have a big passive portfolio that is largely there for liquidity. So the investments departments -- Active Equities, CMFI, Real Assets, CI and PE -- manage the active from the asset classes and TFM is attributed the returns from the passive portfolio which consists of Public Equities and Fixed Income portfolios (mostly fixed income).

That brought me to the discussion of CPP Investments' Reference Portfolio of 85% MCSI World Index and 15% Canadian nominal government bonds. I told John I never liked it as it's not exactly representative of the Fund's overall portfolio and too heavily tilted in public equities which are very concentrated now in a few mega cap tech names.

So, even though CPP Investments' portfolio is producing excellent risk-adjusted returns over the long run, there are years where it significantly underperforms its Reference Portfolio when stocks are on fire and peaking in the cycle:

There's another reason why I bring this up because I know people who think the CPP Fund should just be indexed to the S&P 500 and we shouldn't pay pension fund managers big bonuses if they're underperforming their Reference Portfolio.

John replied:

The portfolio is acting as it was designed to act. As you know, you have to build these portfolios to withstand a wide range of macroeconomic conditions. I describe the portfolio as a bit of a supertanker, it needs to push through things. And the portfolio is performing as designed. One of the big reasons is we diversify across asset classes, geographies and sectors.

It is expected that a highly diversified portfolio would have a lot of relative volatility against something as simple as a Reference Portfolio. And if you think about our portfolio, it has become more diversified over the last five years and the Reference Portfolio has become less diversified.

I think this is one of the bigger themes and probably a longer conversation, namely, the concentration in the public market and it's not just equities, there are other markets that are highly concentrated. The accessibility in private markets and the impact of liquidity in both the public and private market.

So the Reference Portfolio is actually a risk target that we have. Once we set the risk, we do not want to replicate the Reference Portfolio by design because it's too concentrated and not the prudent approach for a large institutional investor.

What you will see from us going forward is every investment department has a benchmark that is representative of their asset class and then we aggregate all the different asset classes as a benchmark portfolio and we will start providing more transparency and visibility how we think about the disclosure of performance because that is what we are asking people to beat, the aggregation of our asset class benchmarks. That is actually the portfolio that we spend 99% of our time thinking about and trying to beat versus the Reference Portfolio.

So the reference Portfolio is actually a risk target, it's not something we try to beat. So you'll see a couple of lines in the annual report, the aggregation of the asset class benchmarks which is more in line with what you see our peers using, we will show more of that.

Performance measurement is a bit of a mosaic as you know and that's a really important piece and we will share more.

I think this is important for a lot of reasons especially as base CPP assets become less important relative to additional CPP assets (we are far from that point) which are more diversified and in line with large peers' portfolios.

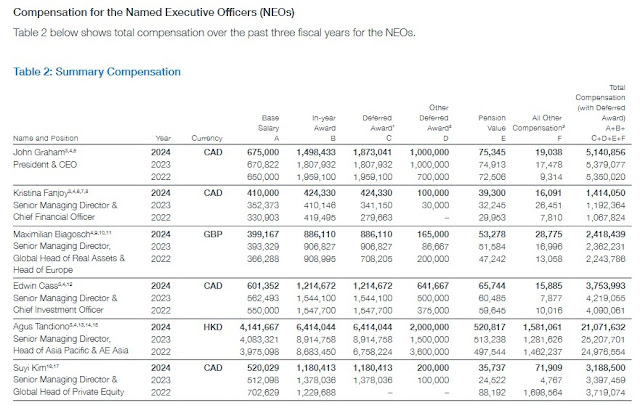

It's also important for compensation and paying people properly for the long-term performance they're delivering (compensation table and footnotes are on page 75 of Annual Report):

On this last point, John told me this:

You'll see over the previous year, the underperformance relative to the Reference Portfolio did impact compensation but from our perspective, it's not an adequate passive investment because it's too concentrated. We are not quite at the Nortel phase but when the US comprises such a large amount of the global equities and the Magnificent Seven make up a large chunk of that, for an organization with time horizon we have, we think it's more prudent to be highly diversified.

I told John the way I measure success is the Fund's long-term assets relative to what the Chief Actuary of Canada initially expected the Fund to deliver:

That is the ultimate measure of success, the rest isn't as important.

John ended on this sobering note:

I think the investment landscape in general over the last twenty years benefited from a pretty constructive environment with respect to rates, inflation and geopolitics. Going forward that may not necessarily be the case with rates being higher, inflation stickier and geopolitics front and center. We know markets have reversion to the mean. I think we participated and did well as markets did well but as I told Frank (Switzer), I think we are about to start playing playoff hockey these days.

I completely agree, this is my sense as well, the big beta effect will come to an end and a much harsher reality will set in and everyone including yours truly will need to roll up their sleeves to generate returns.

Alright, let me wrap it up there and once again thank John Graham and Frank Switzer for this amazing discussion.

Please remember that I work hard in bringing you these timely and insightful comments and appreciate all of you who support this blog financially. There simply is nothing else like it on the market.

Below, The CPP Fund increased by $62.3 billion in Fiscal 2024, ending the year at $632.3 billion in net assets. Watch this video to learn more.

Also, John Graham, CEO of the Canada Pension Plan Investment Board, told BNN Bloomberg on Wednesday that the portfolio “performed as designed” and added that diversification across various asset classes and geographies was key to the fund’s performance.

"In a portfolio like ours you can’t swing around in the markets. You can’t make tactical views,” he said.

He added his team has built a "supertanker that will move through rough waters and a range of macroeconomic conditions."

Update: After reading my comment, Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications at CPP Investments, sent me this note:

Thank you for your continuing coverage of the pension fund sector, including financial performance results. These deeper insights are important to stakeholders and participants.

There's a lot we can discuss about your comments (not about critique only healthy discussion and debate).

One thing stands out however that is worth two sides. Indeed, 100% agree about transparency. There's broad consensus that strong results over any length of time is predicated on investment professionals carrying out their work without distraction from political interference. This must be earned every day - to achieve public trust and confidence as the bedrock of any financial system (especially a national retirement fund that seeks to provide everyone some foundation to achieve dignity in retirement) - because formal safeguards in legislation, for example, only provide for the minimum. Transparency is the way to earn that trust.

People too quickly equate transparency with disclosure. We could use up thousands of pages debating the true social good achieved with blanket disclosure rules within the sphere of public securities regulation compelling mountains of pages (digital or otherwise) that few retail investors can consume to truly help them.

So, transparency needs a goal. We offer that the goal is not to tick the box of some obscure rule that no one remembers why it exists or worse, not to blatantly feed political motives. More on that later.

For us, the push to be as transparent as possible is to achieve understanding. We want people to achieve greater perspective on what we do and why we do it. As one tiny example is that we work hard to produce materials - written using grading systems such as Flesch-Kincaid (Dr. Seuss is 1 and Globe & Mail seeks to keep below 10 score) - but we think through the rationale for what we share and why against the goal of understanding for the sake of public trust via transparency.

There is a point of sharing data and information that simply creates confusion or is contradictory to how we seek to design, construct, and deliver portfolios. Take the reporting of different slices of programs for example. We aren't the 1980s conglomerate GE that every unit is first or second in their markets or subject to be pruned or fixed otherwise. Portfolio construction - as I know you know - aims to deliver balance with strategies that aren't closely correlated. By design you expect things to zig and others zag. Of course attribution matters and we occasionally make decisions about the merits of strategies. There's a balance.

On this invest in Canada matter: I agree that we can package things better. I say this with caution. Canadians are deeply concerned about the potential for interference. This is only second to solvency as top of mind. The push by some to compel more detail on what we do in Canada isn't necessarily for trust and confidence.

Look at the Public Accountability Statements imposed on the big banks and large life insurers in Canada. If you go back to what triggered that (an answer to the USA community reinvestment acts) believing that disclosure by province will create competition among them to do more philanthropy or more community activity. Perhaps that's legitimate in that context.

However, all the pension funds are solving for different liabilities and risks. The CPP is subject to national mortality, fertility, economic productivity, sectoral limits, immigration, etc. The combination and compounding of all these can only compel a prudent investor to seek sufficient protection to avoid concentration risk with any home bias. Do we believe that the invitation to compare and contrast different exposure levels as constructive to understanding?

What about all the foreign governments around the world who see us as the standard bearer for engaged, productive and patient capital - secured by not succumbing to political pressures and distorted actions as an agent of state? Do we have preferred access to prized assets for Canada because of that desirable status? Trust me when I say they are watching closely. What does it signal to them that we are making a big deal about a country bias?? We believe in transparency for intelligent understanding and especially do no harm.

If I leave you with anything it is that we can always do better and we work hard to enhance ways to create a better understanding of what we do and why - and we do embrace changes year after year.

There is a lot to mull over here but I can sum it up to this, there's a fine balance between transparency and disclosure where more disclosure can lead to more confusion and political interference.

I understand this but also believe (from what I was told) that there is a legislative push in Ottawa for a lot more disclosure from all our pension funds as to where they invest.

Lastly, I agree with Michel, governance is a work in progress and every pension fund should be aiming to improve all aspects of their governance every year.

Also, please note I included the compensation table of the named executive officers above and still think the Reference Portfolio is not appropriate for compensation purposes (see John's comments above to understand why).

Comments

Post a Comment