Real Estate Bets Roil Canadian Pension Funds?

Almost no major Canadian pension manager has been spared.

The largest fund, Canada Pension Plan Investment Board, lost five per cent on its property portfolio in its last fiscal year as the commercial real estate slump deepened. For the Public Sector Pension Investment Board, the pain amounted to a staggering 16 per cent loss on those bets, the worst fiscal year performance for those investments since the global financial crisis.

With the property market upended by higher borrowing costs, Canadian pensions — known for their massive real estate businesses that were the envy of the investing world for years — are feeling the sting. And it’s leading at least four major funds to now drastically retool their operations.

“What’s worked famously well for the last 35 years may not work so well for the next five to 10,” Jo Taylor, chief executive officer of the $248 billion Ontario Teachers’ Pension Plan, said in an interview at Bloomberg’s Toronto office.

Taylor’s fund is grappling with the worst four-year run at its real estate operation since it was transformed by the acquisition of a business called Cadillac Fairview in 2000. That company came to be one of the fund’s crown jewels and the single biggest in its portfolio. But last year, Taylor took authority for most future real estate investments away from Cadillac Fairview and brought them in-house, just like the plan’s other asset classes.

The second-largest Canadian plan, Caisse de Depot et Placement du Quebec, lost 6.2 per cent on real estate bets in fiscal 2023, the worst since the pandemic hit three years earlier. In January, the fund said it would combine that real estate business with another specializing in lending against properties, a merger that’s expected to save the plan $100 million annually.

The reorganizations change an approach that had made Canada’s pension funds powerhouses in the property market. Despite managing just six per cent of global pension assets, Canadian funds are responsible for 60 per cent of the total value of private real estate deals that directly involve a pension, according to research from CEM Benchmarking and Sebastien Betermier at Montreal’s McGill University.

Cadillac Fairview, for instance, played a leading role expanding Toronto’s financial district and came to control many of Canada’s top-performing shopping malls.

The move to more streamlined and centralized structures amounts to a blueprint for how some of the world’s most prolific property buyers think the game has changed. Real estate investing has become tougher as higher interest rates pummeled valuations and lenders pulled back. It’s also a recognition that the asset class has become more global and more niche, with tighter margins, and stiffer competition from other types of investments.

“The real estate sector is changing dramatically,” said Jim Clayton, a professor at Toronto’s York University. “At the same time, we now have this structural shift in the way we work and live which has sped up post-Covid. So I think you have people really rethinking what real estate is.”

That’s leading to changes in how the Canadians funds invest as well as what they bet on. CDPQ is now looking to do more of its real estate investing with co-investors or through third-party managers, rather than handling it all on its own, according to people familiar with the matter who asked not to be identified citing private information.

“You have a few pension funds asking themselves right now, should I continue to go as direct or actually take a step back?” said Betermier, the associate professor of finance who studies Canada’s pension funds at McGill.

His research shows that the Canadian funds’ huge real estate companies help them capture bigger margins than competitors that rely on middlemen, but they also make the Canadian funds less nimble — they can’t easily shift money into other types of assets.

“Whenever you are deep into one subsidiary, you lose a little bit of flexibility because you are dependent on one particular asset class or one set of skills, as opposed to a capital allocator that might be more nimble,” he said.

Nimble investing

Being flexible in real estate investing has also become more important as more niche building types such as warehouses, life science buildings and data centers emerge as some of the better-performing properties. Canadian pensions have invested in a range of those assets, with many working to pile more money in.

But it can be tough to be nimble when the office and retail properties hit hardest by the shift to remote work and online shopping still make up such a large part of the funds’ legacy portfolios. CPPIB has sought to pull back from some office bets, selling stakes in three properties at steep discounts recently, including a deal to offload one in Manhattan for just US$1. Those efforts helped shrink the plan’s office exposure to six per cent of real assets at the end of March from nine per cent a year earlier, according to its annual report.

For many years, Ontario Teachers focused heavily on Canada through Cadillac Fairview. The pension now wants to focus its bets outside its home market, a move that the CEO, Taylor, argued is easier done from within the larger fund rather than through the real estate company.

“There are probably more decisions to reflect on, in terms of what we invest in next than perhaps what we’ve done in the past,” Taylor said. “Raising debt for real estate is without question more difficult than it has been. The input cost of building a property as opposed to buying a property has changed in terms of what it costs to get product. You look at real estate through a carbon lens, it’s different.”

Some funds are using the opportunity to cut back on their property exposure overall. Real estate bets made up about eight per cent of CPPIB’s investments in its fiscal 2024 year, compared with 12 per cent five years ago.

“We have other asset classes coming into the portfolio,” CPPIB’s CEO John Graham said in an interview. “Credit would be one of them. Energy would be another portfolio we want to continue to grow. And infrastructure is one that we’ll look to kind of modestly grow out over the next few years.”

Staying the course

The Ontario Municipal Employees Retirement System — which helped create New York City’s Hudson Yards — is among the pension funds staying the course with real estate.

Blake Hutcheson, the fund’s CEO, said it’s aiming to hold onto its office properties. The buildings have continued to generate good income but were hit by losses because appraisers marked down their values, he said. The fund’s overall real estate portfolio slumped 7.2 per cent last year.

Hutcheson said Omers already works with its real estate subsidiary, Oxford Properties, the same way it does with the teams investing in any other asset class. He interprets the organizational changes going on at some of the other Canadian pensions as efforts to more closely integrate their real estate operations with their main funds.

“We don’t give them money and say, ‘Go spend it.’ They go through the exact same process as our private equity business and the like,” he said. “So the synergies that the others hope to achieve, we’ve been achieving for decades.”

Alright, it's Tuesday, took a long weekend to enjoy St-Jean-Baptiste Day and going to take another long weekend for Canada Day and probably more throughout the summer.

Anyway, this article caught my attention for a lot of reasons.

First, no doubt about it, losses in real estate piled up last year at Canada's large pension funds as they took writedowns mostly in offices where secular headwinds remain.

And some pension funds took bigger writedowns than others in real estate most likely because they were late to take writedowns or didn't' take any last year.

Here I'm thinking of PSP Investments which just reported solid numbers despite a negative 16% return in their real estate portfolio. I covered their results with CEO Deb Orida recently here.

On real estate, she noted this:

You've written about it and you'll see our results there when you get the annual report. I won't pretend we escaped the downturn in that sector. But even though this year wasn't great (-15.9%), over the long term we delivered a 6.1% 10-year annualized return. We continue to think it should be part of a broadly diversified portfolio and we are happy with the leadership we have in place there.I pressed her, asking if it's the same headwinds in office hurting every other fund. Deb replied:

We certainly have seen the structural change in office that has impacted the whole market with the behavioural change, work from home. I think the sector saw this year the lagged impact on cap rates from rising rates and the fact that the market is starting to see some transactions which is allowing the valuations to reflect that cap rate expansion.

Keep in mind, REITs got clobbered in 2022 as rates backed up and private real estate valuations lag, so it wasn't a shocker to see Canadian pension funds take writedowns in underpeforming office assets.

But you should also be aware that diversification plays a big role in real estate and other private market assets like private equity and infrastructure.

So, if offices used to be 15-20% of the portfolio, now they're below 10% on average and industrial/ logistics and residential/multifamily make up close to 50% or more of most real estate portfolios these days, with some offices, retail which is coming back a bit after the pandemic, and niche sectors like student housing, storage, data centers, medical lab offices filling the gaps.

And even in offices, class A buildings with amenities and highest energy efficiency are still in high demand so we need to be careful reading too much into the slump in office buildings.

Moreover, in some countries, working from home isn't an option.

Have higher rates cooled down activities throughout real estate and across geographies?

No doubt but real estate will always remain a critical asset class at Canada's large pension funds.

Lastly, you'll note that CDPQ and OTPP decided to bring their real estate activities internally while OMERS decided not to.

OMERS manages third party capital so subsidiaries make more sense there as they rely on their brand to attract assets.

As far as OTPP, it absolutely needs to continue diversifying its real estate portfolio globally and the OTPP brand will help with this global expansion.

At CDPQ, it's all about cost cutting and having all activities managed internally. Ivanhoe Cambridge is keeping its brand but real estate activities now fall under CDPQ's purview.

As we all know by now, post-pandemic, there are clear secular shifts going on in real estate.

Hybrid work is here to stay and as the population grows and traffic creates more congestion, it will remain this way forever in my opinion.

Moreover, workers want more flexibility and a better quality of life.

So, offices are not going away but demand for class B and C office buildings is declining fast as tenants look to sign long-term leases with owners of class A, energy efficient buildings.

All this to say, don't read too much into a negative year in real estate, you have to continue to look at the asset class over the long run and it will continue to provide important diversification benefits.

Anyway, I recently covered how Ivanhoé Cambridge and Walker and Dunlop Investment Partners will increase their multifamily preferred equity partnership to US$500 million here.

Below,

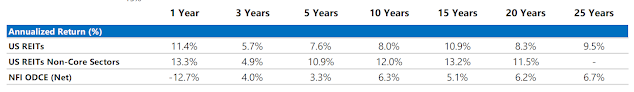

Interesting comment. For your interest, here are US REITs passive performance vs US private core funds. The difference can be explained by public REITs having more exposure to “next gen” real estate. Non-core below doesn’t mean value-add or opportunistic it only means data centers, self-storage, cold storage, medical office etc. It is difficult to get scale in these “next gen” sectors when a private portfolio is $10s of billions.

Q4 2023

US REITs is represented by the FTSE Nareit All Equity REITs Index, a capitalization-weighted, time-weighted index of publicly traded US REITs that invest predominantly in the equity ownership of real estate. US REITs Non-Core Sectors is represented by the FTSE Nareit All Equity REITs Index minus the following sectors: Retail, Apartments, Office and Industrial. 2Core private real estate is represented by the NFI-ODCE (net) index, a capitalization-weighted, time-weighted index currently consisting of 25 private real estate funds pursuing a core investment strategy focused predominantly on US assets.

He added :

It’s the % in the growth “next gen” sectors publicly that is the majority of the reason. 56% publicly and a material amount of the pie for a long time vs privately that is playing catch-up in their sector exposures. They are now starting to privatize the REIT platforms that were responsible for outperformance. i.e. Blackstone, KKR (see this article on the biggest data center acquisition).

56% of the whole US REIT Index is “next gen” exposure where each REIT is solely focused on a vertical such as data centers, self-storage, medical office etc.

The US core funds were at 7% in “next gen” but this will evolve over time now given what is happening in the office sector.

Examples are: Digital Realty, Equinix, Public Storage but increasingly these REITs are being privatized to support their continued growth. See link in previous email.

Comments

Post a Comment