Another Bumpy Year Ahead?

Tom Lauricella of the WSJ reports, Bridgewater Takes Grim View of 2012:

Tom Lauricella of the WSJ reports, Bridgewater Takes Grim View of 2012:

Pretty depressing stuff coming from one of the best hedge funds in the world. And I have a feeling they are right, we might be entering a lost decade(s).Bridgewater Associates has made big money for investors in recent years by staying bearish on much of the global economy. As the new year rings in, the hedge fund firm has no plans to change that gloomy view.

Robert Prince, co-chief investment officer at Bridgewater, and his managers at the world's biggest hedge fund firm are preparing for at least a decade of slow growth and high unemployment for the big developed economies. Mr. Prince describes those economies—the U.S. and Europe, in particular—as "zombies" and says they will remain that way until they work through their mountains of debt.

But it's not all bad news as there are signs the US economy is growing and might surprise everyone to the upside in 2012. Also, there is so much liquidity out there that you will likely see spectacular moves in underlying sectors on any given year. Gregory Zuckerman of the WSJ reports, Fasten Your Seatbelts, It's Going to Be a Bumpy Year:

2011 was a year of surprises. An Arab revolution no one predicted. A downgrade of the U.S.'s formerly pristine debt rating. European debt troubles that threatened the future of the continent's common currency.

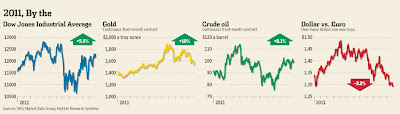

Perhaps the biggest surprise of them all: The ability of the U.S. stock market to all but shrug off that turbulence, even as most foreign markets fell.

Sure, U.S. stocks sank at various parts of the year, including the period after the debt downgrade. But a late-year rally left major averages about where they began, as if the year was placid, not full of panic.

Last week, stocks fell 0.6% leaving the Dow Jones Industrial Average up 5.5% on the year. The Nasdaq Composite closed the year down 1.8%, and the Standard & Poor's 500-stock index was flat (actually off 0.003%).

Predicting what 2012's surprises will be is no easy task. Last year's Sunday Journal outlook warned of rising interest rates and falling bond prices. But the experts were confounded: U.S. government bonds continued to rally.

We did get some predictions correct, such as anticipating China's ability to rein in inflation without causing a severe economic downturn. It's not clear whether Chinese leaders will continue to have such success in 2012, however.

Here are some possible surprises for 2012 and beyond, based on views of some leading investors and analysts:

Stock Strength

Most experts predict a slow slog for stocks in 2012, as the U.S. economy struggles and Europe works to avoid a recession.

But just as stocks did better than one might have expected in 2011, given all the turbulence, they again may surprise on the upside this year, argues Tobias Levkovich, Citigroup's chief U.S. equity strategist.

His rationale: European leaders may do enough to address their nations' debt issues that "fears subside," he says. U.S. elections also could spur politicians to address the nation's own fiscal imbalances.

And U.S. companies, sitting on record amounts of cash and tapping super-low interest rates, could step up their acquisitions, also helping the market. Mr. Levkovich says energy and telecom companies could see the most acquisitions.

Stocks are at their most inexpensive levels in decades, says Mr. Levkovich, who argues investors could be surprised by a stronger stock market than even his firm's official forecast of 15%.

During the second half of the year, "I expect a historic reallocation trade out of safe-haven Treasurys into risk assets" such as stocks, says Joe Terranova, author of "Buy High, Sell Higher" and chief market strategist for Virtus Investment Partners.

James Paulsen, chief investment strategist at Wells Capital Management, says foreign markets may do even better than the U.S. in 2012, as fears of a global slowdown subside. He favors emerging-markets stocks.

Housing Rebound

Investors have been hoping for a real-estate rebound for five years, only to be disappointed. It could happen in 2012.

Housing-related shares have climbed more than 30% since the end of September, a sign investors are beginning to anticipate a possible rebound. Some of the largest and best-performing hedge funds have been buying shares such as Beazer Homes (BZH) and PulteGroup (PHM). (See this week's Barron's Insight for another view of the housing industry.)

Bears contend that many potential homeowners have become more comfortable renting, while noting enormous excess housing supply. But rental prices are soaring, which could push some to look for homes in 2012. And inventories of unsold homes are shrinking.

A bull market for housing prices is far off, according to Goldman Sachs, which expects a bottom for the market in 2013. But because investors try to anticipate shifts before they occur, these stocks could be strong in 2012, ahead of this change.

Oil Slips

Oil prices finished the year at about $100 a barrel amid predictions that prices will stay strong through 2012. Responding to U.S. economic pressure over its nuclear program, Iran last week threatened to close the Straits of Hormuz, a move that could shut off about 20% of world oil supply and push prices higher.

But markets didn't move much after the Iran threat, suggesting the price of oil already assumes the potential for disruptions. If no such troubles materialize, prices could fall back.

If growthi continues to slow in China, along with other emerging-markets nations, that also could push prices lower. Oil production from Iraq could soar if the political and security situation in the country calms. That all would keep a lid on gasoline prices, giving consumers a lift.

Meanwhile, natural-gas prices have been tumbling for several years, amid the discovery of new supply in the shale regions of the U.S., as well as unlikely places such as Israel and Cyprus.

Such production should continue to ramp up in 2012, making it less expensive to warm homes.

Japan, U.S. Headaches

Japan has been piling up debts for years. They now amount to more than twice the nation's annual output. Yet, investors have flocked to the nation's currency, the yen, viewing it as a haven. That could end in 2012, says Gary Evans, author of the Global Macro Monitor blog.

"The yen will weaken significantly" unless the Japanese government really addresses deficit and debt issues, says Mr. Evans. "The trigger could be a disorderly default in Europe that could cause investors to reassess" the risk of the currencies and debt of various nations heretofore considered safe.

Japan's bonds also could tumble, as local investors, such as the nation's largest public pension fund, continue to slow their buying and foreign investors avoid buying the debt. It all could pressure Japanese shares and add instability to an already-volatile global markets.

Something even more troubling: A 2012 currency and debt selloff in Japan could lead to worries about something similar in 2013 for the U.S., another nation with heavy debts but seen as a harbor recently in the global rough seas.

John Brynjolfsson, who runs hedge fund Armored Wolf, says the Chinese currency, the yuan, will even emerge as a strong competitor to the euro and U.S. dollar.

Treasury Troubles

In recent years, analysts predicted problems for U.S. Treasury securities. Despite that, bonds kept rallying, as investors sought safety. Today, conventional wisdom is that these bonds are a good place to park cash, given turbulent global markets. That might signal time to lighten up.

Certainly, it's hard to get much lower than a yield of 1.878% for the benchmark 10-year Treasury. (Bond yields move in the opposite direction of price.)

If signs of inflation arise, perhaps if the U.S. economy demonstrates stronger-than-expected growth, a selloff could result. Or investors could simply shift to investments with better outlooks and dump one that may not even top inflation.

"In this new climate of European debt concerns, I haven't heard anyone suggest shorting Treasurys," says Mr. Terranova, a sign of an end of the bull market. He, however, is anticipating a selloff of Treasurys that "will be a once-in-a-generation" investment opportunity.

I'll keep it brief. My prediction is that bonds will continue doing well in 2012 and stocks will grind higher. It will be bumpy but stay long risk assets. Forget all the negative news. Eurozone will not implode, no major slowdown in China, Japan is just fine (ignore Kyle Bass), and the world will keep chugging along at a slower pace than what we've been used to in the last 20 years.

Finally, Bloomberg reports that tankers hauling liquefied natural gas at sea will earn record rates in 2012 as demand reaches an all- time high, beating returns from vessels carrying oil and coal, according to the world’s biggest shipping hedge fund. That's hardly grim news for the global economy. And below, some optimistic comments on the US housing market.

Comments

Post a Comment