Are U.S. Stocks In A Bubble?

Even if the S&P 500 is only up about 2 percent year-to-date, it's still sitting at record levels. This means economists, analysts, and investors are inevitably asking one big question: Are stocks overvalued?

Over the weekend, Goldman Sachs published a massive research piece asking if equity market valuations are in "dangerous territory." To answer the question, the bank pits Nobel laureate Robert Shiller and Wharton professor Jeremy Siegel against each other.

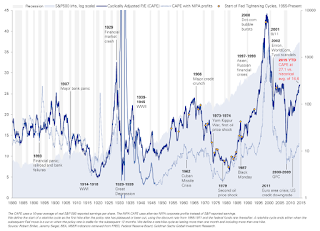

First, though, a preface. U.S. equities look expensive by a number of measures, Goldman notes. For a start, the typical stock in the S&P 500 trades at 18.1 times forward earnings, which ranks in the 98th percentile of historical valuation since 1976. The overall index has an aggregate forward price-to-earnings multiple of 17.3, which is a rise of 64 percent since September 2011, compared with the median expansion of 48 percent during nine previous price-to-earnings expansion phases.

You can see the trend in the below chart from Goldman's note (click on image below).

This next Goldman chart shows that after each of the three prior first interest rate hikes from the Federal Reserve, price-to-earnings multiples contracted by an average of 8 percent (click on image below). This is concerning, Goldman says, since earnings multiples have been a key driver of returns over the past few years. Because of this, the bank's analysts expect dividends to be the sole contributor to the 2 percent total return they are forecasting for the S&P 500 during the next 12 months.

With those stock market metrics in mind, Goldman turns to Nobel Prize winner and Yale professor Robert Shiller to ask whether equities are overvalued. Shiller points out that one metric he looks at is sitting at levels it hasn't seen since 2000:

One of the indicators in (my stock market confidence indices; click on image below) series is based on a single question that I have asked individual and institutional investors over the years along the lines of, "Do you think the stock market is overvalued, undervalued, or about right?" Lately, what I call "valuation confidence" captured by this question has been on a downward trend, and for individual investors recently reached its lowest point since the stock market peak in 2000. The fact that people don't believe in the valuation of the market is a source of concern and might be a symptom of a bubble, though I don't know that we have enough data to prove it's a bubble.

When asked how worried he is about the prospects for the market over the next six months, Shiller says that his concern has risen with the market and that there could very well be a correction in the next year, although the timing of such market events is inevitably difficult. He advised people to both save more and diversify their investments because their portfolios probably won't do as well as they had hoped — even over the longer term.

Next, Goldman talks to Wharton professor Jeremy Siegel, who has continued to be on the bullish side with his buy and hold strategy.

Siegel says he believes stocks are only slightly above their historical valuations today and the level is "completely justified" due to low interest rates. To those that claim the stock market is in a bubble, Siegel says he is in complete disagreement. "In no way do current levels that are nowhere near those highs (of March 2000) qualify as a bubble," he says.

Siegel adds that there isn't much that would dissuade him from holding equities over the medium term and recommended investors allocate 50 percent of their portfolios to the U.S., 25 percent to non-U.S. developed markets, and 25 percent to emerging markets.

So, who is right? The author of Irrational Exuberance or the author of Stocks For The Long-Run? I've read both books (part of my personal collection of over 1000 finance books). They are both exceptional economists and well-known market oracles who are regularly interviewed on financial news networks.

Of course, Shiller and Siegel are also well-known friends so there is at least one place where they are in agreement and that is the bond market. Both economists said it was fair to say bonds are overvalued and some concern is justified, although neither of them would commit to calling it a bubble. Shiller said that historically the bond market doesn't tend to crash like the stock market. Siegel steered away from calling it a bubble due to his expectation that both short- and long-term rates will remain low.

If you ask me, they're both right. Last April, I warned you the real risk in the stock market is a liquidity surge unlike anything you've ever seen before. In that comment, I mentioned a bunch of small biotechs I track and trade and was specific that investors and traders should hone in on the biotech sector (IBB and XBI) as it's in the midst on a long secular bull market that started back in 2008, roughly around the time I wrote my comment on the age of biotech.

In a more recent comment examining the so-called biotech and buyback bubble, I urged my readers to keep buying the dips on biotechs (interestingly, Soros, Bonderman and others are racking up gains on cancer-fighting pharma firms). I also stated the buyback mania will continue as long as rates remain low and companies find it cheap to borrow and buy back their own shares, padding up the ridiculously bloated compensation of their senior executives which is spinning out of control.

But I also keep warning you that making money in these rough and tumble markets is a very tough slug and you need to be prepared for insane volatility if you want to make extraordinary returns.

Importantly, even if the Fed stands ready to raise rates, these rates remain at historic low levels which means that equities can keep surging higher but it won't be a straight line up. Along with historic low rates comes massive volatility and the hottest sectors -- the ones all the top funds are trading -- will be the most volatile ones. And if you want to make money in hot stocks, you better learn to buy the dips and sell the rips or else you will get killed.

What about buy and hold and not timing the markets? Although I definitely believe timing markets is a loser's proposition, in these rigged markets dominated by large pockets of "dark pools" and "high-frequency algorithmic trading" you better not get too smug because any stock can get clobbered in a flash crash second and markets can turn on a dime.

So what will derail this endless rally? Byron Wien says it's all about the Fed which put $3 trillion into the stock market. Bill Gross thinks the end is near and Paul Singer says bonds are the "bigger short" which doesn't bode well for a generation of traders who have never experienced a rate hike.

In fact, both Siegel and Shiller agree that the bond market is scary and rates are headed back up. Of course, Siegel says that is a good thing, reflecting improving fundamentals, and that even if rates start rising, they will remain low for a decade and be supportive to further multiple expansion in stocks.

A lot of people are buying the global reflation story hook, line and sinker. It doesn't matter if China is slowing or that their stock market is truly in a bubble. According to global reflationists, the U.S., Europe and Japan will pick up the slack and we should start seeing a material pickup in oil and commodity prices over the next six to twelve months.

I remain very skeptical on this global hope trade. Europe can't even address the ongoing crisis in Greece, let alone the deep structural problems plaguing the peripheral economies, like mounting long-term unemployment. The decline in the euro has led to a temporary pickup in economic activity and inflation but this relief rally will eventually run out of gas and some countries are still faltering.

Also, as I've repeatedly stated, if there truly is a global recovery underway, pay attention to emerging markets (EEM), including China (FXI), Brazil (EWZ) and Russia (RSX) and sector ETFs like energy (XLE), oil services (OIH), commodities (GSG) and metals and mining (XME) which are early cyclicals.

Interestingly, everyone is focused on oil (USO) as a gauge of global economic activity but if you look at coal stocks (KOL) you have to wonder what's all the fuss about? (click on image below):

Many well known coal stocks I track have been decimated over the last couple of years, down 70% to 90+%, and some have gone bankrupt while others are in danger of going belly up (click on image):

I should know. I recommended a lump of coal for Christmas back in December 2012 and got annihilated trading Patriot Coal the week it went bankrupt (it recently filed for Chapter 11 again). That was a very painful lesson in trading countertrend rallies and while coal stocks are bouncing here, the big trend remains down.

My friend and former PSP colleague, Fred Lecoq, keeps telling me: "unless you have the weekly (indicators) on your side, be very careful trading countertrend rallies, you can get killed at any time."

This is why I can confidently tell you that even though you will see powerful countertrend rallies in energy (XLE), oil services (OIH), and even metals and mining (XME), be very careful buying these sectors or individual companies (click on images below) because there could be a lot more pain ahead.

Of course, if you believe that global reflation is right around the corner, you should be buying these sectors and companies now for big gains ahead.

I remain highly skeptical and think many investors are confusing powerful countertrend rallies due to currency fluctuations and are underestimating the real potential of global deflation down the road, especially if the Fed moves on rates too early.

Below, the U.S. Federal Reserve should consider lifting interest rates sooner rather than later to tackle speculative bubbles in the housing and stock markets, Nobel Prize-winning economist Robert Shiller told CNBC on Monday.

Second, Jeremy Siegel, The Wharton School professor, explains why he thinks the markets will likely rally after the Federal Reserve raises interest rates. Also, Siegel shares his thoughts on market valuations amid a low-rate environment.

Lastly, former Fed Chair Bernanke said stock prices have risen rapidly over the past six years or so, but had been severely depressed; and current Fed Chair Yellen says equity valuations are generally quite high. The FMHR traders weigh in.

Comments

Post a Comment