A Correction or Something Far Worse?

Evelyn Cheng of CNBC reports, The stock market is officially in a correction... here's what usually happens next:

You can also read this New York Times article going over how the market has entered correction territory.

Is it a correction or something worse? Nobody really knows but take some solace from what Canada's largest pension fund is saying. Matt Scuffham of Reuters reports, Canada's biggest public pension plan sees opportunity in market slump:

Canada's second largest pension fund, the Caisse, is doing the same thing except its focus right now is on Montreal’s $6.3-billion rail project which is getting under way with SNC overseeing construction.

This is a massive greenfield infrastructure project, one of a kind among global pensions and one that will help Quebec's economy and deliver great returns to the Caisse's depositors over the long-run.

More on this project next week. It's Friday, so I want to focus on markets as it's been a very volatile week.

A buddy of mine who is a broker called me earlier to ask me my market thoughts. Every time he calls me it's because markets are tanking and his clients are freaking out. "I don't hear from them when the Dow is up 100 or 200 points a day for a month but the minute we have a violent correction, the phones don't stop ringing."

I told him: "That's human nature. People are fickle, it's all about greed and fear. They think they're going to become rich off stocks and stocks only go up. Well, they just got a rude awakening and they realize they need to work at a real job for longer to retire comfortably."

But I also added that no matter how volatile it is, for me, this is still a correction, one that I've argued we desperately needed because irrational compacency was setting in.

Let me first share three daily (short-term) charts going over recent action on the Dow Jones ETF (DIA), S&P 500 ETF (SPY) and Nasdaq Powershares ETF (QQQ). You can click on the images to enlarge:

As you can see, they all look similar, a very nice long uptrend above the 50-day moving average and then "BAM!" they all got slammed hard over the last week, slicing through their 50-day and 100-day moving averages and fast approaching the all-important 200-day moving average, a key support level.

The ferocity of the down moves this week and huge volatility is why investors are on edge. If you're sitting at the Fed, ECB, Bank of Japan, or the Swiss National Bank, you definitely want to start defending some of these key technical levels next week or else full-blown panic might set in.

Now, let's also take a longer-term view of these same index ETFs, looking at the weekly charts going back five years (click on images to enlarge):

As you can see, the weekly decline is violent but when you look at a longer time frame (5-year weekly chart), it's still a bull market and the technician in me thinks this correction back to the 40-week moving average should be bought (I showed the 50-week moving average above to keep it the same as the daily moving average charts).

Having said this, technical charts are nice but they guarantee nothing. What if the correction becomes self-reinforcing and all of a sudden we get a full-blown panic?

I'm still keeping a watchful eye on high-yied bonds (HYG) which sold off a little more this week but remain in a firm uptrend on the weekly chart:

This remains the canary in the coal mine, one that isn't flashing panic yet.

Nevertheless, this morning I was reading the Merrill Lynch market indicator that correctly flashed sell signal last week is still bearish, that earnings may be getting too strong for the market's own good, and that nearly 20% of the S&P 500 is already in a bear market, a reminder that stocks move a lot more violently than an index, especially when the Dow is experiencing intra-day swings of 1000+ points!

But this just presents long-term opportunities to long-term investors like CPPIB, the Caisse and other large global pension funds who aren't trying to time the markets to pick a bottom. In fact, just like APG, CPPIB and other large Canadian pensions are also pushing the limits on factor investing, shunning the traditional index approach to investing which makes sense for retail investors.

And while retail investors cannot use this high level of sophistication to pick a basket of stocks based on factor investing, there are plenty of ETFs I'd recommend in this environment.

For example, in my last comment discussing why PSP's chief is headed to BlackRock, I recommended PSP's new President and CEO, Neil Cunningham, put 50% of his money in US long bonds (TLT) and another 50% in the S&P 500 low vol ETF (SPLV) and "just relax, sleep well at night, and have fun being PSP's new president and CEO!"

Why did I make this recommendation at this time? Well, I don't buy scary bond market stories and don't believe we're in a Treasury bond bear market driven by wage inflation which will derail markets.

In short, I keep ignoring gurus like Paul Tudor Jones who claim 'inflation is about to appear with a vengeance' and keep buying the dips in US long bonds (TLT) as yields back up.

The other part of my recommendation to Neil, the S&P 500 low vol ETF (SPLV), has to do with my Outlook 2018: Return to Stability, where I warned people to prepare for Risk-Off markets and to take the necessary steps to turn their portfolios more defensive.

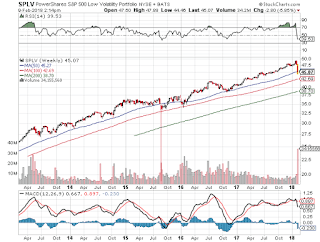

If you look at the daily and weekly chart of the S&P 500 low vol ETF (SPLV), you'll see it got whacked hard as rates backed up because there are a lot of safe dividend stocks in this well diversified ETF (click on image):

Still, the daily chart shows me this low-vol ETF is oversold here and the weekly tells me now is the time to buy and hold it or at least scale into it.

The last part of my investment recommendation has to do with my bullish views on the US dollar (UUP) which I think is turning the corner and primed for a very nice reversal as global PMIs top out here:

For all these reasons, I recommend that anyone who wants to "sleep well at night" put 50% of their money in US long bonds (TLT) and another 50% in the S&P 500 low vol ETF (SPLV) at these levels and stop worrying about the wild gyrations in the stock market.

I realize this is a play on bond yields declining precipitously from these levels, which is my macro call and one I'm sticking with until the end of the year.

I simply don't buy the US wage inflation hype and agree with Jeffrey Snider, there are big outliers in consumer credit which suggest a slowing US and global economy ahead.

You will notice I avoided discussing the blowup in the XIV and a bunch of nonsense short-volatility ETNs because quite frankly, I'm happy this garbage died as the silence of the VIX came to a screaming halt.

As far as other vol blowups this week, I think AQR's Cliff Asness nailed it in his tweet below:

Karl Gauvin of OpenMind Capital here in Montreal shared similar views with me in an email yesterday:

All this to say, stop reading hyper sensational scary stories on Zero Hedge about how the volatility blowups will cause the next market crash. If anything, these blowups are a good thing, got rid of a lot of garbage that needed to be exterminated, and allows the market to resume its long-term uptrend on more solid footing.

Hope you enjoyed this market comment, please remember to kindly support this blog by donating on the top right-hand side under my picture. I thank all of you who take the time to donate, it's greatly appreciated.

Below, while Blackstone's Byron Wien believes the market decline isn't completely over, technical strategist Katie Stockton told CNBC on Friday that the correction in the S&P 500 index does not look like the start of a bearish reversal.

I agree, I don't see a crash but I definitely think people should rotate into more defensive, low-vol sectors (SPLV) here and buy some US long bonds (TLT) at these levels to hedge against a more pronounced decline in stocks.

Unfortunately, buying the dips with no protection could prove costly in this environment.

The S&P 500 fell officially into correction territory on Thursday, down more than 10 percent from its record reached in January.

If this is just a run-of-the-mill correction, then we are looking at another four months of pain, history shows. If the losses deepen into a bear market (down 20 percent), then it could be 22 months before we revisit these highs, history shows.

"The average bull market 'correction' is 13 percent over four months and takes just four months to recover," Goldman Sachs Chief Global Equity Strategist Peter Oppenheimer said in a Jan. 29 report.

But the pain lasts nearly two years on average if the S&P falls at least 20 percent from its record high — past 2,298 — into bear market territory, the report said. The average decline in a bear market is 30 percent, according to Goldman.

The last week of stock market drops has taken the S&P 500 into correction territory for the first time in two years

Stocks remain in an upward bull market trend, the second longest in history.

S&P 500 corrections and bear markets since WWII

You can also read this New York Times article going over how the market has entered correction territory.

Is it a correction or something worse? Nobody really knows but take some solace from what Canada's largest pension fund is saying. Matt Scuffham of Reuters reports, Canada's biggest public pension plan sees opportunity in market slump:

The Canada Pension Plan Investment Board (CPPIB), Canada's biggest public pension plan, sees short-term and long-term opportunities arising from the sell-off across global equity markets, its Chief Executive Mark Machin said on Friday.Is CPPIB right to invest in stocks after the drubbing this week? Of course, it‘s a large pension fund with a long investment horizon, as prices decline in stocks, corporate bonds, private equity, real estate and infrastructure, it definitely should be looking at all opportunities to invest across public and private markets.

The fund, which manages Canada's national pension fund and invests on behalf of 20 million Canadians, is a major investor in global equity and bond markets as well as being one of the world's biggest infrastructure and real estate investors.

"The short-term opportunities are things that our public market investing desks will be looking at," Machin said in an interview. "They will be looking at better entry points into stocks that they’ve had under research for a long time or they hold and this would be a good opportunity for them to get into at a better price."

Machin had said last year that the fund was being priced out of infrastructure deals because of investor demand for the assets leading to inflated prices, but on Friday he said prices could start to normalize in infrastructure, real estate and private equity markets.

"It's been increasingly challenging to find those opportunities at good prices so a bit of normalization in markets is quite helpful for us to find more opportunities," he said.

The fund on Friday said it achieved a return of 4 percent on its investments in the latest quarter, helped by strong equity markets.

The CPPIB said it ended its third quarter to Dec. 31 with net assets of C$337 billion ($267 billion), compared with C$328 billion at the end of the previous quarter.

Over the last 10 years, the CPPIB has seen returns of 7.4 percent, it said.

Canadian pension plans, on average, achieved returns of 4.4 percent in the latest quarter, according to research published by RBC Investor & Treasury Services on Tuesday.

Canada's second largest pension fund, the Caisse, is doing the same thing except its focus right now is on Montreal’s $6.3-billion rail project which is getting under way with SNC overseeing construction.

This is a massive greenfield infrastructure project, one of a kind among global pensions and one that will help Quebec's economy and deliver great returns to the Caisse's depositors over the long-run.

More on this project next week. It's Friday, so I want to focus on markets as it's been a very volatile week.

A buddy of mine who is a broker called me earlier to ask me my market thoughts. Every time he calls me it's because markets are tanking and his clients are freaking out. "I don't hear from them when the Dow is up 100 or 200 points a day for a month but the minute we have a violent correction, the phones don't stop ringing."

I told him: "That's human nature. People are fickle, it's all about greed and fear. They think they're going to become rich off stocks and stocks only go up. Well, they just got a rude awakening and they realize they need to work at a real job for longer to retire comfortably."

But I also added that no matter how volatile it is, for me, this is still a correction, one that I've argued we desperately needed because irrational compacency was setting in.

Let me first share three daily (short-term) charts going over recent action on the Dow Jones ETF (DIA), S&P 500 ETF (SPY) and Nasdaq Powershares ETF (QQQ). You can click on the images to enlarge:

As you can see, they all look similar, a very nice long uptrend above the 50-day moving average and then "BAM!" they all got slammed hard over the last week, slicing through their 50-day and 100-day moving averages and fast approaching the all-important 200-day moving average, a key support level.

The ferocity of the down moves this week and huge volatility is why investors are on edge. If you're sitting at the Fed, ECB, Bank of Japan, or the Swiss National Bank, you definitely want to start defending some of these key technical levels next week or else full-blown panic might set in.

Now, let's also take a longer-term view of these same index ETFs, looking at the weekly charts going back five years (click on images to enlarge):

As you can see, the weekly decline is violent but when you look at a longer time frame (5-year weekly chart), it's still a bull market and the technician in me thinks this correction back to the 40-week moving average should be bought (I showed the 50-week moving average above to keep it the same as the daily moving average charts).

Having said this, technical charts are nice but they guarantee nothing. What if the correction becomes self-reinforcing and all of a sudden we get a full-blown panic?

I'm still keeping a watchful eye on high-yied bonds (HYG) which sold off a little more this week but remain in a firm uptrend on the weekly chart:

This remains the canary in the coal mine, one that isn't flashing panic yet.

Nevertheless, this morning I was reading the Merrill Lynch market indicator that correctly flashed sell signal last week is still bearish, that earnings may be getting too strong for the market's own good, and that nearly 20% of the S&P 500 is already in a bear market, a reminder that stocks move a lot more violently than an index, especially when the Dow is experiencing intra-day swings of 1000+ points!

But this just presents long-term opportunities to long-term investors like CPPIB, the Caisse and other large global pension funds who aren't trying to time the markets to pick a bottom. In fact, just like APG, CPPIB and other large Canadian pensions are also pushing the limits on factor investing, shunning the traditional index approach to investing which makes sense for retail investors.

And while retail investors cannot use this high level of sophistication to pick a basket of stocks based on factor investing, there are plenty of ETFs I'd recommend in this environment.

For example, in my last comment discussing why PSP's chief is headed to BlackRock, I recommended PSP's new President and CEO, Neil Cunningham, put 50% of his money in US long bonds (TLT) and another 50% in the S&P 500 low vol ETF (SPLV) and "just relax, sleep well at night, and have fun being PSP's new president and CEO!"

Why did I make this recommendation at this time? Well, I don't buy scary bond market stories and don't believe we're in a Treasury bond bear market driven by wage inflation which will derail markets.

In short, I keep ignoring gurus like Paul Tudor Jones who claim 'inflation is about to appear with a vengeance' and keep buying the dips in US long bonds (TLT) as yields back up.

The other part of my recommendation to Neil, the S&P 500 low vol ETF (SPLV), has to do with my Outlook 2018: Return to Stability, where I warned people to prepare for Risk-Off markets and to take the necessary steps to turn their portfolios more defensive.

If you look at the daily and weekly chart of the S&P 500 low vol ETF (SPLV), you'll see it got whacked hard as rates backed up because there are a lot of safe dividend stocks in this well diversified ETF (click on image):

Still, the daily chart shows me this low-vol ETF is oversold here and the weekly tells me now is the time to buy and hold it or at least scale into it.

The last part of my investment recommendation has to do with my bullish views on the US dollar (UUP) which I think is turning the corner and primed for a very nice reversal as global PMIs top out here:

For all these reasons, I recommend that anyone who wants to "sleep well at night" put 50% of their money in US long bonds (TLT) and another 50% in the S&P 500 low vol ETF (SPLV) at these levels and stop worrying about the wild gyrations in the stock market.

I realize this is a play on bond yields declining precipitously from these levels, which is my macro call and one I'm sticking with until the end of the year.

I simply don't buy the US wage inflation hype and agree with Jeffrey Snider, there are big outliers in consumer credit which suggest a slowing US and global economy ahead.

You will notice I avoided discussing the blowup in the XIV and a bunch of nonsense short-volatility ETNs because quite frankly, I'm happy this garbage died as the silence of the VIX came to a screaming halt.

As far as other vol blowups this week, I think AQR's Cliff Asness nailed it in his tweet below:

The vol fund story is subtler than what we hear. It is not shocking that funds that explicitly bet on calm by selling tail insurance get creamed, even wiped out, in a big sell-off. It is shocking, at least to me, how small the event that killed them was. This was not 10/19/87.— Clifford Asness (@CliffordAsness) February 7, 2018

Karl Gauvin of OpenMind Capital here in Montreal shared similar views with me in an email yesterday:

Amazing how peoples don't know how to manage VIX futures! If you manage a short VIX strategy you need to have a Stop Loss set at 2 points of Vol to avoid going belly up. Using this with Volatility Regime is an additional feature that adds value. And even more important, the short VIX futures position should always be covered by a long deep out of money call option on the VIX...with at least 3-month maturity.You can read Karl's volatility regime update on LinkedIn here.

With our vol signal, we would have bought back all our VIX futures last Friday. Too bad I have stop trading this strategy last year.

All this to say, stop reading hyper sensational scary stories on Zero Hedge about how the volatility blowups will cause the next market crash. If anything, these blowups are a good thing, got rid of a lot of garbage that needed to be exterminated, and allows the market to resume its long-term uptrend on more solid footing.

Hope you enjoyed this market comment, please remember to kindly support this blog by donating on the top right-hand side under my picture. I thank all of you who take the time to donate, it's greatly appreciated.

Below, while Blackstone's Byron Wien believes the market decline isn't completely over, technical strategist Katie Stockton told CNBC on Friday that the correction in the S&P 500 index does not look like the start of a bearish reversal.

I agree, I don't see a crash but I definitely think people should rotate into more defensive, low-vol sectors (SPLV) here and buy some US long bonds (TLT) at these levels to hedge against a more pronounced decline in stocks.

Unfortunately, buying the dips with no protection could prove costly in this environment.

Comments

Post a Comment