Did Markets Just Get Facebooked?

Facebook's sudden and stunning vulnerability threatens to undercut the foundation of the stock market rally since Donald Trump was elected president.At this writing, the Dow is up 120 points, S&P is flattish and the Nasdaq is down 1% mostly owing to the bloodbath in Facebook, down almost 20% today.

The social media giant has been the cornerstone of the FAANG trade — Facebook, Amazon, Apple, Netflix and Google parent Alphabet. Just by itself, Facebook has gained more than 80 percent since Trump's November 2016 victory. The S&P 500 more broadly is up some 35 percent during the time period.

But a disappointing earnings report Wednesday, particularly regarding its growth forecast, had investors fleeing the company Thursday and pulling down tech stocks in general. Other market indexes were not impacted as strongly.

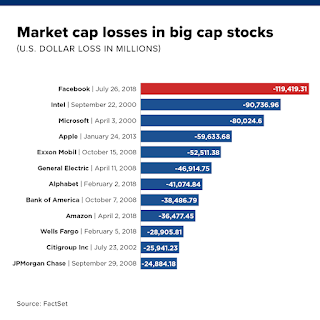

Facebook was off more than 18 percent Thursday morning, costing the company more than $120 billion of its market cap. The loss by the social media giant pulled down the technology sector broadly, with the Nasdaq index losing more than 1 percent.

Of the other FAANG components, Apple shares were slightly positive while Amazon fell 2.2 percent and both Netflix and Alphabet also were negative.

Since the election, information technology stocks on the S&P 500 have gained 63.8 percent, easily the best among all sectors in the index, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

As those gains have occurred, the FAANG stocks have assumed outsize positions in many broad-market index funds.

For instance, the top four holdings in the $266 billion SPDR S&P 500 Trust ETF are Apple, Microsoft, Amazon and Facebook. Together, the four companies comprise more than 10 percent of the index's weighting.

"This is just another example of a classic, late-cycle development often found in tired bull markets – the hot money chase indeed," Larry McDonald, author of the Bear Traps Report newsletter, said in a recent post. "As more and more capital flows into passive index funds, more and more FAANG shares MUST be owned. Returns appear far better than the rest of the market's offerings, so even more capital flows in – it's a toxic, self-fulfilling cycle – when broken the declines will be HISTORIC."

McDonald said he expects the FAANG stocks to be targeted by the government, which will have to fund new tax revenue to pay for underfunded entitlement programs.

The good news is that the rest of the market was generally undisturbed for now. In fact, the Dow industrials, of which Facebook is not a member, surged some 150 points early on, boosting the blue chips by more than 0.5 percent. Even the S&P 500, which does have Facebook exposure, was off only fractionally.

So, let me begin with Facebook (FB) by looking at the one-year daily chart and five-year weekly chart (click on images):

As you can see, momentum chasers got massacred buying the "Facebook breakout" above the 50-day moving average prior to earnings thinking it's headed higher. They got destroyed.

And there could be more downside ahead. The 52-week low is $148 a share so we might revisit it and if things really get bad in markets, don't be surprised if Facebook's share price tests its 200-week moving average ($127) or goes even lower.

Importantly, this isn't another 'buy the dip' scenario like in March when Zuckerberg was summoned to testify on Capitol Hill, the guidance was poor, user numbers are declining and increased security costs will shrink margins.

That's my two cents but who knows what will happen as many big hedge funds will undoubtedly buy the dip again hoping shares will climb back up.

Unfortunately, hope isn't a good strategy for these markets. You really need to hedge your equity risk or you will face more Facebook-type haircuts.

The good news is Amazon (AMZN) is reporting after the bell today and barring any negative surprise, I expect decent numbers and the Nasdaq should be fine tomorrow (if Amazon disappoints, watch out, it will get ugly out there).

I also expect strong US GDP figures Friday morning as administration officials have been talking it up (they know it's a great report), so that too will help ease the Facebook fallout.

But markets are weakening, the global economy is slowing and so is the US economy where the housing market is showing signs of cracking as international buyers are dropping out.

And while everyone is fixated on Facebook, I'm fixated on emerging market stocks (EEM) and bonds (EMB) as well as the US dollar (UUP) which is still at a 52-week high (click on images):

So far, the carnage has somewhat eased in emerging markets but it remains to be seen if this is a temporary reprieve as one bond-market veteran is bracing for more defaults.

Keep your eyes peeled on these charts because if we do get a crisis in emerging markets, it will spill over and clobber risk assets all over the world.

This week, I read a special report written by Tony Boeckh, Editor-in-Chief at Alpine Macro. Tony has over 50 years of experience analyzing the economy and markets and he wrote a great report which you should all read (contact info@alpinemacro.com to obtain it).

Tony examined liquidity conditions which are showing modest weakening now so he thinks it's premature to get overly bearish. His main concern is that the Fed will pay too much attention to low unemployment, GDP growth (coincident indicators) and rising inflation (lagging indicator) and tighten too much.

Surprisingly, he isn't as worried about the flattening yield curve as many others including me are, stating the following:

In recent decades, the yield curve has inverted an average of 4-5 months before a market top and about 11 months before the start of a recession. However, these time lags are quite variable and the yield curve has given both false positives and false negatives when it comes to bear markets. The 1987 crash occurred when the curve was still quite steeply positive and the 1998 inversion was not followed by a serious bear market, nor by a recession in the U.S. Investors should be wary of putting too much faith in the yield curve and overreacting to its levelling slope. It is only one of many monetary indicators to follow.Ed Yardeni, another veteran market analyst, had similar views on the yield curve not being bearish for stocks but François Trahan at Cornerstone Macro has done extensive research on the yield curve and it clearly points to a slowdown ahead and the continued dominance of Risk-Off markets.

This is why I keep warning my readers it's time to get defensive, not time to play momentum on your favorite tech stocks hoping for another tech mania.

The problem with technology (XLK) is it's overbought. Every major hedge fund and all index funds are loaded to the hilt on tech stocks which admittedly is also a response to a slowing economy and Risk-Off markets (click on image):

But tech stocks don't go up forever and when they get hit, they get whacked hard so investors need to reposition their portfolio accordingly to prepare for the coming slowdown.

In fact, Tony Boeckh concluded his special report by cautioning to avoid expensive stocks and I agree.

There are plenty of great tech stocks but they're all fully if not overvalued so one mistake, one slip, and investors risk facing a Facebook-type haircut.

And the problem with a lot of young traders on Wall Street these days is they've never lived through a really bad bear market, they don't know how to trade in such an environment, and to be frank, many of them are going to get their heads handed to them buying the big dips.

Then again, as I conclude this comment, Amazon just reported mixed results, beating on earnings but missing on revenues and the stock is up after the bell so it portends well for Friday. A great GDP report should also lift markets unless investors sell the news fearing the Fed will overreact.

Please note I am taking Friday off and will be back next week.

Below, Facebook's $100 billion-plus rout is the biggest loss in stock market history and Wall Street reacts.

More importantly, a 'storm is brewing’ in the US economy, says economist Diane Swonk and many investors are ill-prepared for the coming slowdown. Listen to her views, I'll be back next week.

Comments

Post a Comment