Ray Dalio's Quest to Reform Capitalism?

Ray Dalio, co-CIO and Co-Chairman of Bridgewater Associates, the world's biggest hedge fund, recently posted a comment on LinkedIn, Why and How Capitalism Needs to Be Reformed (Parts 1 & 2):

I posted that exchange below even though I found Kernen to be incredibly ignorant, annoying and downright rude (he has to learn to shut up but Ray told him to let him talk).

I also posted the 60 Minutes clip where Dalio called the wealth gap a "national emergency." Together with his wife Barbara, they are donating $100 million to Connecticut's public school system to help even the playing field.

Now, before I share my thoughts, I posted something on LinkedIn over the weekend, The Black Day the Nazis Attacked Greece, a fascinating historical look at a battle that helped shape the outcome of the Second World War and yet it receives little to no attention.

[Note: For all you history buffs, one of the best books I ever read on the battle of Crete was G.C. Kiriakopoulos's Ten Days to Destiny. Yes, it's a bit embellished, probably not as scholarly accurate and balanced as Anthony Beevor's seminal book on the battle of Crete, but it gives you a great first-hand account of what took place 80 years ago and who were the key players. Honestly, Hollywood should make a movie based on this battle but it's too busy on the Avengers and dumbing down the world's population. Yeah, capitalism needs to be reformed!]

What does this have to do with Ray Dalio's comment above? Well, in my moments of reflection, I too am very concerned about what I see as rising and unsustainable inequality and the political and social ramifications of these tensions we see being played out all over the world where populism is on the rise.

Let me blunt. I worry that our electronically-lobotomized population transfixed on the latest iGadget, Facebook, Instagram and Twitter post, is too stupid to realize the bigger picture that Ray Dalio is warning of.

More worrisome, I don't think many of Ray's fellow capitalists on the right or left side of the political spectrum fully understand what is going on and why we are at an important juncture here. Most are completely oblivious and think as long as they make the silly Forbes list of the rich and famous, then all is well with capitalism as we know it (they are in for a very rude awakening).

And if I push further, I'm not even sure Ray Dalio fully understands why we are reaching the limits of capitalism, why the system is on course to implode and what are the inherent contradictions in reforming a system that necessarily means more rising inequality allowing him and other "capitalists" to retain power.

Last year, Jonathan Nitzan shared this with me:

Still, all this aside, I commend Ray for shining a light on what I consider to be the defining public policy issue of our time, namely, rising and unsustainable inequality.

In his comment, he rightly notes that what is going on at US public schools is akin to child abuse. Desperately poor, malnourished kids, many of whom come from broken homes, do not have equal opportunity and this is a national tragedy and a long-term economic blight for the country.

In this blog, I often discuss another scourge impacting the US, pension poverty. As more and more people retire with little to no savings, pension poverty is on the rise, exacerbating inequality.

Who cares? As long as capitalists at the very top are printing hundreds of millions of dollars every month, the system is working, right?

Wrong. The system is full of problems and the two most disadvantaged and vulnerable groups in the US -- poor kids and poor elderly -- are routinely neglected and nobody is arguing to reform the system in their and the country's favor.

The problem? Structural factors which are ingrained in the system favoring the ultrawealthy. For example, a friend sent me an article this weekend, The IRS Tried to Take on the Ultrawealthy. It Didn’t Go Well. If you think the ultrawealthy pay their fair share of taxes, think again.

Also, Harvard University has long argued that stock buybacks have led to enormous profits without prosperity and yet everyone remains willfully blind to the ugly truth behind buybacks, that for the most part, stock buybacks enrich the bosses even when business sags. Of course, Goldman and other big banks are warning, banning buybacks will crash the market (and their profit margins).

What else? Why is it that gap between CEO compensation and that of an average worker (not to mention lower median) is infinitely higher in the US than in Japan or Germany? Is it because the system is infinitely better?

Of course not, it's all part of institutional discrimination ensuring the elites keep obtaining a disproportionate slice of the pie. As long as capitalists make more money, the stock market keeps rising and the system works, for the 0.0001% at the very top.

Also, why are we treating all capitalists alike? I think Jeff Bezos, Bill Gates, the late Steve Jobs and Sam Walton, are true capitalists who took huge risks to build their fortunes. I can't say the same about hedge fund and private equity billionaires who rode the wave and owe their vast wealth mostly to a broken model where they charge insane fees to "deliver alpha" to public pensions and other large institutional investors.

But even in the tech world, I have a serious problem granting Jeff Bezos, Bill Gates, Mark Zuckerberg, Larry Page, Sergey Brin, and all these tech "superstars" enormous power and wealth given the virtual monopolistic environment they operate under.

I guess what I'm trying to say is when you really analyze US capitalism very carefully, you realize there are a lot of layers to the system that promote rising and unsustainable inequality and unless we address all these issues, nothing is going to change.

In fact, the older I get, the more cynical I become, the more I understand one of my mentors at McGill University, Tom Naylor, the combative economist.

Naylor used to warn us "the world is a sewer" and he was right, the world is a sewer, full of serious structural problems that are not being addressed or even discussed properly in an open and democratic society.

Having said all this, I leave you with a few thoughts on reforming capitalism. One is from George Orwell's classic book, Animal Farm: “All animals are equal, but some animals are more equal than others.”

And the other is from Winston Churchill: "The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.'"

Churchill also said “capitalism is the worst economic system, except for all the others,” and even though he's right about that, it doesn't mean we shouldn't reform capitalism to make sure it benefits more people, ensuring everyone has equal opportunity to move up in society no matter their background, and more importantly, ensuring no group falls through the cracks.

Below, Ray Dalio appeared on CNBC Squawk Box this morning to discuss why capitalism needs to be reformed. Also, take the time to watch the full CBS 60 Minutes interview here, it's excellent.

SummaryOn Monday morning, Ray Dalio was on CNBC arguing with Joe Kernen that capitalism doesn’t need to be destroyed but it does need to be reformed.

I was fortunate enough to be raised in a middle-class family by parents who took good care of me, to go to good public schools, and to come into a job market that offered me equal opportunity. I was raised with the belief that having equal opportunity to have basic care, good education, and employment is what is fair and best for our collective well-being. To have these things and use them to build a great life is what was meant by living the American Dream.

At age 12 one might say that I became a capitalist because that’s when I took the money I earned doing various jobs, like delivering newspapers, mowing lawns, and caddying and put it in the stock market when the stock market was hot. That got me hooked on the economic investing game which I’ve played for most of the last 50 years. To succeed at this game I needed to gain a practical understanding of how economies and markets work. My exposure to most economic systems in most countries over many years taught me that the ability to make money, save it, and put it into capital (i.e., capitalism) is the most effective motivator of people and allocator of resources to raise people’s living standards. Over these many years I have also seen capitalism evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots. This is creating widening income/wealth/opportunity gaps that pose existential threats to the United States because these gaps are bringing about damaging domestic and international conflicts and weakening America’s condition.

I think that most capitalists don’t know how to divide the economic pie well and most socialists don’t know how to grow it well, yet we are now at a juncture in which either a) people of different ideological inclinations will work together to skillfully re-engineer the system so that the pie is both divided and grown well or b) we will have great conflict and some form of revolution that will hurt most everyone and will shrink the pie.

I believe that all good things taken to an extreme can be self-destructive and that everything must evolve or die. This is now true for capitalism. In this report I show why I believe that capitalism is now not working for the majority of Americans, I diagnose why it is producing these inadequate results, and I offer some suggestions for what can be done to reform it. Because this report is rather long, I will present it in two parts: part one outlining the problem and part two offering my diagnosis of it and some suggestions for reform.

Why and How Capitalism Needs to Be Reformed

Before I explain why I believe that capitalism needs to be reformed, I will explain where I’m coming from, which has shaped my perspective. I will then show the indicators that make it clear to me that the outcomes capitalism is producing are inconsistent with what I believe our goals are. Then I will give my diagnosis of why capitalism is producing these inadequate outcomes and conclude by offering some thoughts about how it can be reformed to produce better outcomes.

Part 1

Where I’m Coming From

I was lucky enough to grow up in a middle-class family raised by parents who cared for me, to be educated in a good public school, and to be able to go into a job market that offered me equal opportunity. One might say that I lived the American Dream. At the time, I and most everyone around me believed that we as a society had to strive to provide these basic things (especially equal education and equal job opportunity) to everyone. That was the concept of equal opportunity, which most people believed to be both fair and productive.

I suppose I became a capitalist at age 12 because that’s when I took the money I earned from doing various jobs like delivering newspapers, mowing lawns, and caddying, and put it in the stock market when the stock market was hot in the 1960s. That got me hooked on the investing game. I went to college and graduate school even though I didn’t have enough money to pay the tuitions because I could borrow the money from a government student loan program. Then I entered a job market that provided me equal opportunity, and I was on my way.

Because I loved playing the markets I chose to be a global macro investor, which is what I’ve been for about 50 years. That required me to gain a practical understanding of how economies and markets work. Over those years, I’ve had exposure to all sorts of economic systems in most countries and have come to understand why the ability to make money, save it, and put it into capital (i.e., capitalism) is an effective motivator of people and allocator of resources that raises people’s living standards. It is an effective motivator of people because it rewards people for their productive activities with money that can be used to get all that money can buy. And it is an effective allocator of resources because the creation of profit requires that the output created is more valuable than the resources that go into creating it. Being productive leads people to make money, which leads them to acquire capital (which is their savings in investment vehicles), which both protects the saver by providing money when it is later needed and provides capital resources to those who can combine them with their ideas and convert them into the profits and productivities that raise our living standards. That is the capitalist system.

Over those many years, I have seen communism come and go and have seen that all countries that made their economies work well, including “communist China,” have made capitalism an integral part of their systems for these reasons. Communism’s philosophy of “from each according to his ability, to each according to his needs” turned out to be naïve because people were not motivated to work hard if they didn’t get commensurately rewarded, so prosperity suffered. Capitalism, which connects pay to productivity and creates efficient capital markets that facilitate savings and the availability of buying power to fuel people’s productivity, worked much better.

I’ve also studied what makes countries succeed and fail by taking a mechanistic perspective rather than an ideological one because my ability to deal with economies and markets in a practical way is what I have been scored on. If you’d like to see a summary of my research that shows what makes countries succeed and fail, it’s here (link). In a nutshell, poor education, a poor culture (one that impedes people from operating effectively together), poor infrastructure, and too much debt cause bad economic results. The best results come when there is more rather than less of: a) equal opportunity in education and in work, b) good family or family-like upbringing through the high school years, c) civilized behavior within a system that most people believe is fair, and d) free and well-regulated markets for goods, services, labor, and capital that provide incentives, savings, and financing opportunities to most people.

Naturally, I have watched these things closely over the years in all countries, especially in the US. I will now show the results that our system is producing that have led me to believe capitalism isn’t working well for most Americans.

Why I Believe That Capitalism Is Not Working Well for Most Americans

In this section, I will show you a large batch of stats and charts that paint the picture. Perhaps there are too many for your taste. If you feel that you’re getting past the point of diminishing returns, I suggest that you either quickly scan the rest by just reading the sentences in bold or skip ahead to the next section which explains why I think that not reforming capitalism would be an existential threat to the US.

To begin, I’d like to show you the differences that exist between the haves and the have-nots. Because these differences are hidden in the averages, I broke the economy into the top 40% and the bottom 60% of income earners.[1] That way we could see what the lives of the bottom 60% (i.e., the majority) look like and could compare them with those of the top 40%. What I found is shown in this study. While I suggest that you read it, I will quickly give you a bunch of stats that paint the picture here.

There has been little or no real income growth for most people for decades. As shown in the chart below on the left, prime-age workers in the bottom 60% have had no real (i.e., inflation-adjusted) income growth since 1980. That was at a time when incomes for the top 10% have doubled and those of the top 1% have tripled.[i] As shown in the chart to the right, the percentage of children who grow up to earn more than their parents has fallen from 90% in 1970 to 50% today. That’s for the population as a whole. For most of those in the lower 60%, the prospects are worse.

As shown below, the income gap is about as high as ever and the wealth gap is the highest since the late 1930s. Today, the wealth of the top 1% of the population is more than that of the bottom 90% of the population combined, which is the same sort of wealth gap that existed during the 1935-40 period (a period that brought in an era of great internal and external conflicts for most countries). Those in the top 40% now have on average more than 10 times as much wealth as those in the bottom 60%.[iv] That is up from six times in 1980.

Most people in the bottom 60% are poor. For example, only about a third of the bottom 60% save any of their income in cash or financial assets.[vii] According to a recent Federal Reserve study, 40% of all Americans would struggle to raise $400 in the event of an emergency.[viii]

And they are increasingly getting stuck being poor. The following chart shows the odds of someone in the bottom quintile moving up to the middle quintile or higher in a 10-year period. Those odds declined from about 23% in 1990 to only 14% as of 2011.

While most Americans think of the US as being a country of great economic mobility and opportunity, its economic mobility rate is now one of the worst in the developed world for the bottom. As shown below, in the US, people in the bottom income quartile have a 40% chance of having a father in the bottom quartile (in the father’s prime earning years) and people in the top quartile have only about an 8% chance of having a father in the bottom quartile, suggesting half of the average probability of moving up and one of the worst probabilities of the countries analyzed. In a country of equal opportunity, that would not exist.

One’s income growth results from one’s productivity growth, which results from one’s personal development. So let’s look at how we are developing people. Let’s start with children.

To me, the most intolerable situation is how our system fails to take good care of so many of our children. As I will show, a large number of them are poor, malnourished (physically and mentally), and poorly educated. More specifically:

The domino effects of these conditions are costly. Low incomes, poorly funded schools, and weak family support for children lead to poor academic achievement, which leads to low productivity and low incomes of people who become economic burdens on the society.

- The childhood poverty rate in the US is now 17.5% and has not meaningfully improved for decades.[xi] In the US in 2017, around 17% of children lived in food-insecure homes where at least one family member was unable to acquire adequate food due to insufficient money or other resources.[xii] Unicef reports that the US is worse than average in the percent of children living in a food-insecure household (with the US faring worse than Poland, Greece, and Chile).[xiii]

Though there are bright spots in the American education system such as our few great universities, the US population as a whole scores very poorly relative to the rest of the developed world in standardized tests for a given education level. More specifically:

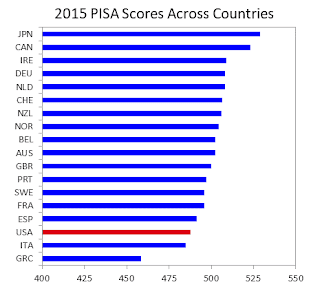

- Looking at the most respected (PISA) test scores, the US is currently around the bottom 15th percentile of the developed world. As shown below, the US scores lower than virtually all developed countries other than Italy and Greece. That stands in the way of many people having adequate living standards and of US competitiveness.

Differences in these scores are tied to poverty levels—i.e., high-poverty schools (measured by the share of students eligible for free/reduced-price lunch) have PISA test scores around 25% lower than schools with the lowest levels of poverty.

- Among developed (i.e., OECD) countries, the US has the third-worst difference in shortages of teaching staff between advantaged and disadvantaged schools.

The stats that show that the US does a poor job of tending to the needs of its poor students relative to how most other countries do it are never-ending. Here are a few more:

These poor educational results lead to a high percentage of students being inadequately prepared for work and having emotional problems that become manifest in damaging behaviors. Disadvantaged students in the US are far more likely to report social and/or emotional issues than in most other developed countries, including not being socially integrated at school, severe test anxiety, and low satisfaction with life.

- The proportion of disadvantaged students who have at least a year of pre-primary education is lower in the US compared to the average OECD country.[xvii]

- Among OECD countries, the US has the second-worst child poverty rate as of 2008 among single-parent households who aren’t working—a failure of the social safety net.[xviii]

- 34% of high-poverty schools experienced high levels of chronic student absence, versus only 10% of high-income schools.[xx] Even in Connecticut, one of the wealthiest states by per capita income, 22% of youth are disengaged (i.e., either missing more than 25 days of school a year, failing two or more courses, or being suspended multiple times) or disconnected (young people not enrolled in school and without a high school degree).[xxi] Disconnected youth in Connecticut are five times more likely to end up incarcerated and 33% more likely to be struggling with substance abuse (full report linked here).

- Comparing the high school graduation rates of Connecticut school districts to child poverty rates shows a tight relationship across the state: a 1% higher child poverty rate equates to about 1% lower graduation rates.

Scatters of Educational Spending and Outcomes for US States

- Across states, there is a strong relationship between spending per student and educational outcomes.

The income/education/wealth/opportunity gap reinforces the income/education/wealth/opportunity gap:

- Recent research for the US suggests that children under age 5 who were granted access to food stamps experienced better health and education outcomes—an estimated 18% increase in high school graduation rates—which led them to be much less likely to rely on other welfare programs later in life.[xxiv]

- Students who come from poor families and try to go to college are less well prepared. For example, those who come from families earning less than $20,000 score on average 260 points (out of 1600) worse on the SAT than students from families earning $200,000+ do, and the gap is increasing.[xxv] The gap in test scores between children at the top and bottom of the income distribution is estimated to be 75% higher today than it was in the early 1940s, according to a 2011 study.[xxvi]

- Yet children living in poorer neighborhoods on average receive about $1,000 less state and local funding per student than those in the more prosperous neighborhoods.[xxvii] This is despite the fact that the federal government (according to its Title I funding formula) assumes it costs a district 40% more per year to educate lower-income students to the same standard as typical students.[xxviii] As a result, schools in low-income areas are typically severely underfunded. On average, in public schools 94% of teachers have to pay for supplies with their own money—often including basic cleaning supplies—and it is worse in the poorest public schools.[xxix]

- A related problem is that many teachers who have to deal with these stressful conditions are underpaid and under-respected. When I was growing up, doctors, lawyers, and teachers were the most respected professions. Now, teachers make only 68% of what other university graduates make, which is significantly less than they make in other OECD developed countries.[xxx] Even looking at weekly earnings to adjust for the length of the school year and controlling for other things that impact pay (like age and years of experience), teachers earned 19% less than comparable workers in 2017, versus only 2% less in 1994.[xxxi] Even worse, they don’t get the respect that they deserve.

To me, leaving so many children in poverty and not educating them well is the equivalent of child abuse, and it is economically stupid.

- Richer communities tend to have public schools that are far better funded than poorer communities, which reinforces the income/wealth/opportunity gap. One of the main reasons for this funding gap is that the Constitution made education a state issue, and most states made local schools primarily locally funded so that rich towns have well-funded public schools and poor towns have poorly funded public schools. More specifically, around 45% of school funding comes from local governments, primarily through property taxes, while only around 8% comes from the federal government, and the rest is from state governments.[xxxii] Thus, there can be enormous variations in the wealth/income of individual communities. Also, the top 40% of income earners spend almost five times as much on their children’s education as the bottom 60% of income earners do, while those in the top 20% spend about six times as much as those in the bottom 20% do.[xxxiii]

- Underfunded public schools are suffering in quality. For instance, PISA data shows that students at US schools with significant teaching staff shortages score 10.5% worse on testing than students at schools with no teacher shortages. Similarly, a shortage of lab equipment is associated with a 16.7% drop in student scores, and shortages of library materials are associated with a 15.1% drop in student scores.[xxxiv]

- By comparison, private schools on average both spend considerably more on students and produce better outcomes. Private schools in the US spend about 70% more per student than public schools do, with the median private school spending about $23,000 per student in 2016, compared to about $14,000 for the average public school.[xxxv] This higher spending translates to higher test scores: in the last round of PISA testing, US private school students scored on average 4.3% higher than public school students across math, reading, and science exams. Over the three PISA surveys since 2009, private school students have scored on average 6.9% higher.[xxxvi]

- Not surprisingly, Americans have much less confidence in public schools today than they have had at any point over the last five decades. Today, only 29% of Americans have a “great deal” or “quite a lot” of trust in the public education system. In 1975, 62% of Americans trusted public schools.[xxxvii]

The weakening of the family and good parental guidance has also been an important adverse influence:

Here are a few stats that convey how the family unit has changed over the years:

Bad childcare and bad education lead to badly behaved adults hence higher crime rates that inflict terrible costs on the society:

- In 1960, 73% of children lived with two married parents who had never been divorced, and 13% lived in a household without two married parents.[2] In 2014, the share of children living in a household without two married parents was 38% (and now less than half live in households with two parents in a first marriage). Those stats are for the average of all households in the US. The family support for those in low-education, low-income households is much less. Around 60% of children of parents with less than high school education don’t live in households with two married parents, while only 14% of children of parents who graduated college are in such households.[xxxviii]

- The probability of being incarcerated is closely related to education levels: among Americans aged 28-33, 35% of male high school dropouts have been incarcerated versus around 10% of male high school graduates and only 2% of male college graduates.[xxxix]

- Between 1991 and 2007, the number of children with a parent in state or federal prison grew 80%.[xl] Today, an estimated 2.7 million children in the US have a parent in prison or jail—that is 1 in every 28 children (3.6% of all children).[xli]

The health consequences and economic costs of low education and poverty are terrible:

- The United States’ incarceration rate is nearly five times the average of other developed countries and three times that of emerging countries.[xlii] The direct cost of keeping people incarcerated is staggering and has grown rapidly: state correctional costs quadrupled over the past two decades and now top $50 billion a year, consuming 1 in every 15 general fund dollars.[xliii]

- This bad cycle perpetuates itself as criminal/arrest records make it much more difficult to find a job, which depresses earnings. Serving time, even relatively brief periods, reduces hourly wages for men by approximately 11%, the time employed by 9 weeks per year, and annual earnings by 40%.[xliv]

These conditions pose an existential risk for the US.

- For example, for those in the bottom 60% premature deaths are up by about 20% since 2000.[xlv] Men from the lowest 20% of the income distribution can expect to live about 10 fewer years than men from the top 20%.[xlvi]

- The US is just about the only major industrialized country with flat/slightly rising premature death rates. The biggest contributors to that change are an increase in deaths by drugs/poisoning (having more than doubled since 2000) and an increase in suicides (up over 50% since 2000).[xlvii]

- Since 1990, the share of Americans who say that in the last year they put off medical treatment for a serious condition because of cost has roughly doubled, from 11% in 1991 to 19% today.[xlviii]

- Those who are unemployed or those making less than $35,000 per year have worse health, with 20% of each group reporting poor health, about three times the rate for the rest of the population.[xlix]

- The impacts of childhood poverty alone in the US are estimated to increase health expenditures by 1.2% of GDP.[L]

The previously described income/wealth/opportunity gap and its manifestations pose existential threats to the US because these conditions weaken the US economically, threaten to bring about painful and counterproductive domestic conflict, and undermine the United States’ strength relative to that of its global competitors.

These gaps weaken us economically because:

In addition to social and economic bad consequences, the income/wealth/opportunity gap is leading to dangerous social and political divisions that threaten our cohesive fabric and capitalism itself.

- They slow our economic growth because the marginal propensity to spend of wealthy people is much less than the marginal propensity to spend of people who are short of money.

- They result in suboptimal talent development and lead to a large percentage of the population undertaking damaging activities rather than contributing activities.

I believe that, as a principle, if there is a very big gap in the economic conditions of people who share a budget and there is an economic downturn, there is a high risk of bad conflict.

Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another. For that reason, I am worried what the next economic downturn will be like, especially as central banks have limited ability to reverse it and we have so much political polarity and populism.

The problem is that capitalists typically don’t know how to divide the pie well and socialists typically don’t know how to grow it well. While one might hope that when such economic polarity and poor conditions exist, leaders would pull together to reform the system to both divide the economic pie and make it grow better (which is certainly doable and the best path), they typically become progressively more extreme and fight more than cooperate.

In order to understand the phenomenon of populism, two years ago I did a study of it in which I looked at 14 iconic cases and observed the patterns and the forces behind them. If you are interested in it, you can read it here. In brief, I learned that populism arises when strong fighters/leaders of the right or of the left who are looking to fight and defeat the opposition come to power and escalate their conflict with the opposition, which typically galvanizes around comparably strong/fighting leaders. The most important thing to watch as populism develops is how conflict is handled—whether the opposing forces can coexist to make progress or whether they increasingly “go to war” to block and hurt each other and cause gridlock. In the worst cases, this conflict causes economic problems (e.g., via paralyzing strikes and demonstrations) and can even lead to moves from democratic leadership to autocratic leadership as happened in a number of countries in the 1930s.

We are now seeing conflicts between populists of the left and populists of the right increasing around the world in much the same way as they did in the 1930s when the income and wealth gaps were comparably large. In the US, the ideological polarity is greater than it has ever been and the willingness to compromise is less than it’s ever been. The chart on the left shows how conservative Republican senators and representatives have been and how liberal Democratic senators and representatives have been going back to 1900. As you can see, they are each more extreme and they are more divided than ever before. The chart on the right shows what percentage of them have voted along party lines going back to 1790, which is now the greatest ever. In other words, they have more polar extreme positions and they are more solidified in those positions than ever. And we are coming into a presidential election year. We can expect a hell of a battle.

It doesn’t take a genius to know that when a system is producing outcomes that are so inconsistent with its goals, it needs to be reformed. In the next part, I will explore why it is producing these substandard outcomes and what I think should be done to reform it.

Part 2

My Diagnosis of Why Capitalism Is Now Not Working Well for the Majority of People

I believe that reality works like a machine with cause/effect relationships that produce outcomes, and that when the outcomes fall short of the goals one needs to diagnose why the machine is working inadequately and then reform it. I also believe that most everything happens over and over again through history, and by observing and thinking through these patterns one can better understand how reality works and acquire timeless and universal principles for dealing with it better. I believe that the previously shown outcomes are unacceptable, so that we first need to look at how the economic machine is producing these outcomes and then think about how to reform it.

Contrary to what populists of the left and populists of the right are saying, these unacceptable outcomes aren’t due to either a) evil rich people doing bad things to poor people or b) lazy poor people and bureaucratic inefficiencies, as much as they are due to how the capitalist system is now working.

I believe that all good things taken to an extreme become self-destructive and everything must evolve or die, and that these principles now apply to capitalism. While the pursuit of profit is usually an effective motivator and resource allocator for creating productivity and for providing those who are productive with buying power, it is now producing a self-reinforcing feedback loop that widens the income/wealth/opportunity gap to the point that capitalism and the American Dream are in jeopardy. That is because capitalism is now working in a way in which people and companies find it profitable to have policies and make technologies that lessen their people costs, which lessens a large percentage of the population’s share of society’s resources. Those companies and people who are richer have greater buying power, which motivates those who seek profit to shift their resources to produce what the haves want relative to what the have-nots want, which includes fundamentally required things like good care and education for the have-not children. We just saw this exemplified in the college admissions cheating scandal.

As a result of this dynamic, the system is producing self-reinforcing spirals up for the haves and down for the have-nots, which are leading to harmful excesses at the top and harmful deprivations at the bottom. More specifically, I believe that:

- The pursuit of profit and greater efficiencies has led to the invention of new technologies that replace people, which has made companies run more efficiently, rewarded those who invented these technologies, and hurt those who were replaced by them. This force will accelerate over the next several years, and there is no plan to deal with it well.

- The pursuit of greater profits and greater company efficiencies has also led companies to produce in other countries and to replace American workers with cost-effective foreign workers, which was good for these companies’ profits and efficiencies but bad for the American workers’ incomes. Of course, this globalization also allowed less expensive and perhaps better quality foreign goods to come into the US, which has been good for both the foreign sellers and the American buyers of them and bad for the American companies and workers who compete with them.

Because of these two forces, the share of revenue that has gone to profits has increased relative to the share that has gone to the worker. The charts below show the percentage of corporate revenue that has gone to profits and the percentage that has gone to employee compensation since 1929.

3. Central banks’ printing of money and buying of financial assets (which were necessary to deal with the 2008 debt crisis and to stimulate economic growth) drove up the prices of financial assets, which helped make people who own financial assets richer relative to those who don’t own them. When the Federal Reserve (and most other central banks) buys financial assets to put money in the economy in order to stimulate the economy, the sellers of those financial assets (who are rich enough to have financial assets) a) get richer because the financial asset prices rise and b) are more likely to buy financial assets than to buy goods and services, which makes the rich richer and flush with money and credit while the majority of people who are poor don’t get money and credit because they are less creditworthy. From being in the investment business, I see that there is a glut of investment money chasing investments at the same time as there is an extreme shortage of money among most people. In other words, money is clogged at the top because if you’re one of those who has money or good ideas of how to make money you can have more money than you need because lenders will freely lend it to you and investors will compete to give it to you. On the other hand, if you’re not in financially good shape nobody will lend to you or invest in you and the government doesn’t help materially because the government doesn’t do that.What I Think Should Be Done

4. Policy makers pay too much attention to budgets relative to returns on investments. For example, not spending money on educating our children well might be good from a budget perspective, but it’s really stupid from an investment perspective. Looking at the funding through a budget lens doesn’t lead one to take into consideration the all-in economic picture—e.g., it doesn’t take into consideration the all-in costs to the society of having poorly educated people. While focusing on the budget is what fiscal conservatives typically do, fiscal liberals have typically shown themselves to borrow too much money and fail to spend it wisely to produce the economic returns that are required to service the debts they have taken on, so they often end up with debt crises. The budget hawk conservatives and the pro-spending/borrowing liberals have trouble focusing on, working together for, and achieving good “double bottom line” return on investments (i.e., investments that produce both good social returns and good economic returns).

For the previously explained reasons, I believe that capitalism is a fundamentally sound system that is now not working well for the majority of people, so it must be reformed to provide many more equal opportunities and to be more productive. To make the changes, I believe something like the following is needed.

a. Create private-public partnerships (including governments, philanthropists, and companies) that would jointly vet and invest in double bottom line projects that would be judged on the basis of their social and economic performance results relative to clear metrics. That would both increase the funding for and the quality of projects because people who have to put their own money on the line would be responsible for them. (For examples, see the Appendix.)

- Leadership from the top. I have a principle that you will not effect change unless you affect the people who have their hands on the levers of power so that they move them to change things the way you want them to change. So there need to be powerful forces from the top of the country that proclaim the income/wealth/opportunity gap to be a national emergency and take on the responsibility for reengineering the system so that it works better.

- Bipartisan and skilled shapers of policy working together to redesign the system so it works better. I believe that we will do this in a bipartisan and skilled way or we will hurt each other. So I believe the leadership should create a bipartisan commission to bring together skilled people from different communities to come up with a plan to reengineer the system to simultaneously divide and increase the economic pie better. That plan will show how to raise money and spend/invest it well to produce good double bottom line returns.

- Clear metrics that can be used to judge success and hold the people in charge accountable for achieving it. In running the things I run, I like to have clear metrics that show how those who are responsible for things are doing and have rewards and punishments that are based on how these metrics change. Having these would produce the accountability and feedback loop that are required to achieve success. To the extent possible, I’d bring that sort of accountability down to the individual level to encourage an accountability culture in which individuals are aware of whether they are net contributors or net detractors to the society, and the individuals and the society make attempts to make them net contributors.

- Redistribution of resources that will improve both the well-beings and the productivities of the vast majority of people. As an economic engineer, naturally I think about how money might be obtained from taxes, borrowing, businesses, and philanthropy, and how it would flow to affect prices and economies. For example, I think about how a change in personal tax rates might occur and how changes in them relative to corporate tax rates would affect how money would flow, and how changes in tax rates in one location relative to another location would drive flows and outcomes in them. I also think a lot about how the money raised will be spent—e.g., how much will be spent on programs that will improve both social and economic outcomes, and how much will be redistributive. Such decisions would of course be up to the people on the bipartisan commission and the leadership to decide and are way too complicated an engineering exercise for me to opine on here. I can, however, give my big picture inclinations. Above all else, I’d want to achieve good double bottom line results. To do that I’d:

b. Raise money in ways that both improve conditions and improve the economy’s productivity by taking into consideration the all-in costs for the society (e.g., I’d tax pollution and various causes of bad health that have sizable economic costs for the society).

c. Raise more from the top via taxes that would be engineered to not have disruptive effects on productivity and that would be earmarked to help those in the middle and the bottom primarily in ways that also improve the economy’s overall level of productivity, so that the spending on these programs is largely paid for by the cost savings and income improvements that they create. Having said that, I also believe that the society has to establish minimum standards of healthcare and education that are provided to those who are unable to take care of themselves.

5. Coordination of monetary and fiscal policies. Because money is clogged at the top and because the capacity of central banks to ease enough to reverse the next economic downturn is limited, fiscal policy will have to be more coordinated with monetary policy, which can happen while maintaining the Federal Reserve’s independence. If done well, this will both stimulate economic growth and reduce the effects that quantitative easing has on increasing the wealth gap by shifting money and credit into the hands of those who have a higher propensity to spend from those who have a higher propensity to save and from those who need it less to those who need it more.

Looking Ahead

In assessing the position we are in, we can look at both cause-effect relationships and historical comparisons. The most relevant causes that are leading to the effects we are seeing are:

The last time that this configuration of influences existed was in the late 1930s when there were great conflicts and economic and political systems were overturned. For the fundamental reasons explained earlier, I believe that we are at the sort of critical juncture in which the biggest issue will be how we deal with each other rather than any other constraints.

- The high debt levels that led to the 2008 debt crisis (and have since increased) led to…

- Central banks printing a lot of money and buying financial assets, which pushed asset prices up and pushed interest rates down. This has benefited those with financial assets (i.e., the haves) and has left central banks with less power to stimulate the economy.

- These factors and new technologies created very wide income/wealth/opportunity and values gaps, which are expected to increase and are leading to…

- Increased populism of the left and populism of the right that are causing greater domestic and international conflicts at the same time as…

- There is a rising power (China) to compete with the existing dominant world power (the United States), which will lead to competitions that will be economic, ideological, and military and will be determined by the two powers' relative skills and technological abilities. This competition will establish what the new world order will be like via-à-vis the rest of the world.

There are enough resources to go around to deal with the risky issues and produce much more equal opportunity plus improved productivity that will grow the pie. My big worry is that the sides will be intransigent in their positions so that capitalism will either a) be abandoned or b) not be reformed because those on the right will fight for keeping it as it is and those on the left will fight against it. So to me, the biggest questions are a) whether populists of the right or populists of the left will gain control and/or have conflicts that will adversely affect the operations of government, the economy, and international relations or b) whether sensible and skilled people from all sides can work together to reform the system so it works well for the majority of people.

We will soon know a lot more about which paths are most likely because over the next two years there will be defining elections in the US, the UK, Italy, Spain, France, Germany, and the European Parliament. How they turn out will have significant effects on how the conflicts raised in this report will be dealt with, which will influence how money will flow between people, markets, states, and countries and will determine the relative strengths of most people and countries. I will be paying close attention to all this and will keep you informed.

Appendix: My Perspective On Double Bottom Line Investing

I felt that I should give some examples of good double bottom line investing so that’s what this appendix is about. From doing my philanthropic work, I see great double bottom line investments all the time, and I only see a small percentage of them so I know that there are vastly more. Since my wife and I focus especially in education and microfinance, my window is more in these areas than elsewhere though we have been exposed to many in other areas such as healthcare, the reform of the criminal justice system, environmental protection, etc. For example, a few of the good double bottom line investments that I came across are:

Since these areas are great double bottom line investments for the country, it would be great if they were brought to scale with government support. I believe that partnerships between philanthropy, government, and business for these types of investments are powerful because they would both increase the amount of funding and result in better vetting of the projects and programs. I know that I see plenty of good deals that I’d love to maximize the funding for that would be cost-effective for governments, other philanthropists, and businesses to support. For example, my wife and our philanthropy team are now working on an agreement in which the Dalio Philanthropies will donate $100 million to programs for the most underfunded school districts and for microfinance in Connecticut if the state donates $100 million and if other philanthropists and businesses in Connecticut also donate another $100 million. That will bring more money, better due diligence, more partnership to our Connecticut community, and positive expected net financial returns (after considering the costs of not educating and supporting our children well) for the benefit of the state.

- Early childhood education programs that produce returns of about 10-15% annualized in the form of cost savings for the government when one accounts for the lifetime benefits for the students and society. That is because they lead to better school performance, higher earnings, and lower odds of committing crimes, all of which have direct economic benefits for society.[liii]

- Relatively inexpensive interventions that lead to lower high school dropout rates in grades 8 and 9 can pay for themselves many times over. Moving these young students into practical higher education or trade jobs when done well is highly cost-effective. For example, the lifetime earnings of a college graduate are over $1 million higher than those of a high school dropout.[liv]

- School finance reforms show that a 10% increase in per-pupil spending can have a meaningful impact on educational outcomes for low-income students, producing a higher ROI than spending on higher-income students. Overall, researchers have found that additional school spending has an IRR of roughly 10%.[lv]

- Microfinance. For every dollar donated/invested in this, approximately $12 is lent, paid back, and lent again over the next 10 years to disadvantaged people to start and build their businesses.[lvi]

- Numerous infrastructure spending plans that can facilitate trade and improve productivity/efficiency. From 33 studies that looked at the ROI of infrastructure investment, it is estimated that smart infrastructure programs have a 10-20% rate of return in terms of increased economic activity, making it a good trade for the government to borrow money and invest in infrastructure.[lvii]

- Public health/preventative healthcare interventions also can have very positive ROIs. From 52 studies that looked at the ROI of preventative health programs (covering a variety of program types, including vaccines, home blood pressure monitoring, smoking cessation, etc.), on average the programs created $14 of benefit for every $1 of cost.[lviii]

[1] Actually, we broke it into many other subcategories and then aggregated them into these two groups for simplicity in presenting the results.

[i] https://wir2018.wid.world/part-2.html

[ii] Based on data from the Current Population Survey. https://cps.ipums.org/cps/

[iii] http://www.equality-of-opportunity.org/papers/abs_mobility_paper.pdf, 34.

[iv] As of 2016; based on data from Survey of Consumer Finances.

[v] Income chart (on left) shows fiscal income shares. Data from World Inequality Database. (https://wid.world/country/usa/)

[vi] Data from Census Bureau

[vii] As of 2016; based on data from Survey of Consumer Finances.

[viii] Survey of Consumer Finances (https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf)

[ix] https://www.minneapolisfed.org/institute/working-papers/17-06.pdf

[x] https://www.oecd.org/social/soc/Social-mobility-2018-Overview-MainFindings.pdf; estimates for China based on Kelly Labar, “Intergenerational Mobility in China”, (https://halshs.archives-ouvertes.fr/halshs-00556982/document). Note that methodologies varied between countries in the OECD study.

[xi] US Census Bureau, Current Population Survey, 1960 to 2018 Annual Social and Economic Supplements, History Poverty Tables, Table 3.(https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-people.html)

[xii] https://www.ers.usda.gov/webdocs/publications/90023/err-256.pdf, 10.

[xiii] https://www.weforum.org/agenda/2017/06/these-rich-countries-have-high-levels-of-child-poverty/

[xiv] http://www.oecd.org/pisa/data/

[xv] http://www.oecd.org/pisa/data/

[xvi] OECD (2016), PISA 2015 Results (Volume I): Excellence and Equity in Education, PISA, OECD Publishing, Paris, 231.

I posted that exchange below even though I found Kernen to be incredibly ignorant, annoying and downright rude (he has to learn to shut up but Ray told him to let him talk).

I also posted the 60 Minutes clip where Dalio called the wealth gap a "national emergency." Together with his wife Barbara, they are donating $100 million to Connecticut's public school system to help even the playing field.

Now, before I share my thoughts, I posted something on LinkedIn over the weekend, The Black Day the Nazis Attacked Greece, a fascinating historical look at a battle that helped shape the outcome of the Second World War and yet it receives little to no attention.

[Note: For all you history buffs, one of the best books I ever read on the battle of Crete was G.C. Kiriakopoulos's Ten Days to Destiny. Yes, it's a bit embellished, probably not as scholarly accurate and balanced as Anthony Beevor's seminal book on the battle of Crete, but it gives you a great first-hand account of what took place 80 years ago and who were the key players. Honestly, Hollywood should make a movie based on this battle but it's too busy on the Avengers and dumbing down the world's population. Yeah, capitalism needs to be reformed!]

What does this have to do with Ray Dalio's comment above? Well, in my moments of reflection, I too am very concerned about what I see as rising and unsustainable inequality and the political and social ramifications of these tensions we see being played out all over the world where populism is on the rise.

Let me blunt. I worry that our electronically-lobotomized population transfixed on the latest iGadget, Facebook, Instagram and Twitter post, is too stupid to realize the bigger picture that Ray Dalio is warning of.

More worrisome, I don't think many of Ray's fellow capitalists on the right or left side of the political spectrum fully understand what is going on and why we are at an important juncture here. Most are completely oblivious and think as long as they make the silly Forbes list of the rich and famous, then all is well with capitalism as we know it (they are in for a very rude awakening).

And if I push further, I'm not even sure Ray Dalio fully understands why we are reaching the limits of capitalism, why the system is on course to implode and what are the inherent contradictions in reforming a system that necessarily means more rising inequality allowing him and other "capitalists" to retain power.

Last year, Jonathan Nitzan shared this with me:

Conventional economics associates income -- and therefore its distribution -- with factor productivity. This theory, formulated by J.B. Clark in 1899, remains dominant. Its main claim is that if the Dalios of this world earn 25,000 times the salary of their workers, it is only because they are 25,000 times more productive, and if society wants to reduce this inequality gap, it can do so only by making workers more productive.I think Jonathan and Shimshon Bichler are two intellectual powerhouses who are producing very important research. You should go to their archives here to read their latest research and Ray should invite them over to his offices in Connecticut to get some radical transparency on capitalism as a mode of power.

The problem with this 'modest proposal' is threefold.

First, their claims to the contrary notwithstanding, economists do not know how to measure factor productivity, and therefore have no proof whatsoever that that this "productivity" correlates with income.

Second, income does correlate, and rather tightly, with measured hierarchical power -- see the 2018 article of Blair Fix on 'The Trouble with Human Capital Theory' (http://bnarchives.yorku.ca/568/).

Third and finally, calls by "enlightened investors" to do something about growing inequality betray their built-in schizophrenia: on the one hand, their very quest for power forces them to increase income inequality without end, while, on the other hand, they realize that ultimately, this very process is bound to spell their own demise.

Still, all this aside, I commend Ray for shining a light on what I consider to be the defining public policy issue of our time, namely, rising and unsustainable inequality.

In his comment, he rightly notes that what is going on at US public schools is akin to child abuse. Desperately poor, malnourished kids, many of whom come from broken homes, do not have equal opportunity and this is a national tragedy and a long-term economic blight for the country.

In this blog, I often discuss another scourge impacting the US, pension poverty. As more and more people retire with little to no savings, pension poverty is on the rise, exacerbating inequality.

Who cares? As long as capitalists at the very top are printing hundreds of millions of dollars every month, the system is working, right?

Wrong. The system is full of problems and the two most disadvantaged and vulnerable groups in the US -- poor kids and poor elderly -- are routinely neglected and nobody is arguing to reform the system in their and the country's favor.

The problem? Structural factors which are ingrained in the system favoring the ultrawealthy. For example, a friend sent me an article this weekend, The IRS Tried to Take on the Ultrawealthy. It Didn’t Go Well. If you think the ultrawealthy pay their fair share of taxes, think again.

Also, Harvard University has long argued that stock buybacks have led to enormous profits without prosperity and yet everyone remains willfully blind to the ugly truth behind buybacks, that for the most part, stock buybacks enrich the bosses even when business sags. Of course, Goldman and other big banks are warning, banning buybacks will crash the market (and their profit margins).

What else? Why is it that gap between CEO compensation and that of an average worker (not to mention lower median) is infinitely higher in the US than in Japan or Germany? Is it because the system is infinitely better?

Of course not, it's all part of institutional discrimination ensuring the elites keep obtaining a disproportionate slice of the pie. As long as capitalists make more money, the stock market keeps rising and the system works, for the 0.0001% at the very top.

Also, why are we treating all capitalists alike? I think Jeff Bezos, Bill Gates, the late Steve Jobs and Sam Walton, are true capitalists who took huge risks to build their fortunes. I can't say the same about hedge fund and private equity billionaires who rode the wave and owe their vast wealth mostly to a broken model where they charge insane fees to "deliver alpha" to public pensions and other large institutional investors.

But even in the tech world, I have a serious problem granting Jeff Bezos, Bill Gates, Mark Zuckerberg, Larry Page, Sergey Brin, and all these tech "superstars" enormous power and wealth given the virtual monopolistic environment they operate under.

I guess what I'm trying to say is when you really analyze US capitalism very carefully, you realize there are a lot of layers to the system that promote rising and unsustainable inequality and unless we address all these issues, nothing is going to change.

In fact, the older I get, the more cynical I become, the more I understand one of my mentors at McGill University, Tom Naylor, the combative economist.

Naylor used to warn us "the world is a sewer" and he was right, the world is a sewer, full of serious structural problems that are not being addressed or even discussed properly in an open and democratic society.

Having said all this, I leave you with a few thoughts on reforming capitalism. One is from George Orwell's classic book, Animal Farm: “All animals are equal, but some animals are more equal than others.”

And the other is from Winston Churchill: "The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.'"

Churchill also said “capitalism is the worst economic system, except for all the others,” and even though he's right about that, it doesn't mean we shouldn't reform capitalism to make sure it benefits more people, ensuring everyone has equal opportunity to move up in society no matter their background, and more importantly, ensuring no group falls through the cracks.

Below, Ray Dalio appeared on CNBC Squawk Box this morning to discuss why capitalism needs to be reformed. Also, take the time to watch the full CBS 60 Minutes interview here, it's excellent.

Comments

Post a Comment