OTPP and CDPQ's Half-Year Results

The Ontario Teachers’ Pension Plan (OTPP) announced net assets top $200 billion in first half of 2019:

Below, Ron Mock, outgoing president and CEO of Ontario Teachers' Pension Plan, says making deals with the Googles and Tencents of the world is "critical." He talks about "moving slowly" on cannabis investments and the odds of a downturn in the next couple of years.Listen carefully to Ron, he highlights all the critical points OTPP and others are grappling with to deliver on their long-term mission.

Update: OTPP's CIO Ziad Hindo was kind enough to share this after reading my comment:

Ontario Teachers’ Pension Plan (Ontario Teachers’) today announced its net assets reached $201.4 billion as of June 30, 2019, a $10.3 billion increase from December 31, 2018. The total-fund net return was 6.3% for the first six months of the year.OTPP is starting its first half of the year on a positive note. My quick thoughts:

“Our focus is on achieving stable results that help deliver financial security to our members through a variety of market conditions,” said Ron Mock, President and Chief Executive Officer. “Our balanced portfolio approach is delivering strong returns that are in line with our long-term objectives.”

Mid-year results provide a snapshot of the Plan performance over a six-month period, while historical returns underscore the long-term sustainability of our investment strategy. As at December 31, 2018, the last date for which there are full year figures, the Plan has had an annualized total fund net return of 9.7% since inception. The five- and ten-year net returns, also as at December 31, 2018, were 8.0% and 10.1%, respectively.

“In the first half of the year, we had positive performance across every asset class in our portfolio, led by fixed income” said Ziad Hindo, Chief Investment Officer. “Over the last few years, we have been transitioning the asset mix to a more balanced approach from a risk perspective and as part of this transition, we increased our allocation to the fixed income asset class.”

The nature of Ontario Teachers’ business involves planning for the future. We take the long view on how we invest, what we invest in, and the integration of responsible investing practices into our investment decisions. Core to these plans is a larger focus on being global when it comes to the investments we make and the talent we hire.

“We demonstrated our focus on expanding globally in the first half of the year with the announcement of Jo Taylor, who has 35 years of experience investing around the world, as our next CEO, and the launch of our global Teachers’ Innovation Platform, which will pursue growth equity and late-stage venture capital investments in disruptive technology,” added Mock. “We are also very proud of the continued advancements we have made in attracting top talent and deploying technology to enhance our decision making and service model.”

Total fund local return was 7.8%. The Plan invests in 35 global currencies and in more than 50 countries, but reports its assets and liabilities in Canadian dollars. In the first half of 2019, currency had a negative 1.3% impact on the total fund, resulting in a loss of $2.5 billion that was mainly driven by the appreciation of the Canadian dollar relative to various global currencies including the US dollar, Euro and British Pound.

About Ontario Teachers’

The Ontario Teachers' Pension Plan (Ontario Teachers') is Canada's largest single-profession pension plan, with $201.4 billion in net assets at June 30, 2019. It holds a diverse global portfolio of assets, approximately 80% of which is managed in-house, and has earned an annual total-fund net return of 9.7% since the plan's founding in 1990 (all figures as at Dec. 31, 2018 unless noted). Ontario Teachers' is an independent organization headquartered in Toronto. Its Asia-Pacific region office is located in Hong Kong and its Europe, Middle East & Africa region office is in London. The defined-benefit plan, which is fully funded, invests and administers the pensions of the province of Ontario's 327,000 active and retired teachers. For more information, visit otpp.com and follow us on Twitter @OtppInfo.

- Global equities, especially US equities, rebounded nicely following the vicious sell-off in Q4 2018. As of now, the S&P 500 is up 16% year-to-date led by technology shares which are up 28%. The strong gains in US equities have helped all pensions but as I discuss below, these gains have not offset the rise in liabilities from the huge drop in long bond yields.

- More importantly, and perhaps more impressive, is the rally in global bonds which saw global and US long bond yields plunge to record or multi-year lows. As I recently explained, bond market jitters are overdone as convexity hedging by mortgage funds and CTAs front-running them exacerbated the move but if global deflation sets in (say China devalues the yuan in response to trade war), then we have not seen the secular lows in US Treasury or global bond yields.

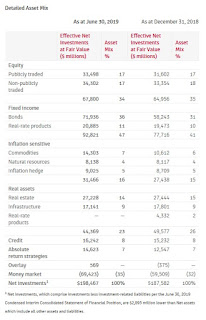

- OTPP has 36% of its portfolio in Bonds as of the end of June, a whopping 5% increase from the end of 2018 which tells me they significantly reduced risk coming into the year and hedged downside risk accordingly. OTPP is a pension plan that matches assets and liabilities very closely. Just like the Healthcare of Ontario Pension Plan (HOOPP), it has a large portion of its portfolio in bonds because it's fully funded and wants to de-risk and match assets with liabilities very closely. Its exposure to global nominal bonds really helped the overall portfolio in the first half of the year, which is something its CIO Ziad Hindo noted above.

- Note, however, that as bond yields drop precipitously, the liabilities of OTPP and other pensions rise significantly, swamping any increase in assets. This is because the duration of liabilities is a lot bigger than the duration of assets so any significant drop in long bond yields will disproportionately impact OTPP's liabilities and those of other pensions. This is critically important to understand because pensions aren't about raw performance over some benchmark, the most important thing is their long-term sustainability and making sure they're fully funded.

- There was no discussion whatsoever about the plan's liabilities in the mid-year results and I didn't expect any since OTPP covers its liabilities in-depth in its annual report (see page 7). As at January 1, 2019, the plan had a preliminary surplus of $10.0 billion based on an average contribution rate of 11% and 100% inflation protection being provided on all pensions. I suspect this is not going to be the case at the start of 2020, especially if long bond rates stay at multi-year lows or head lower. It will impact the plan's funded status but rest assured, even if OTPP gets into a deficit again in the future if another crisis hits us, it has many levers including conditional inflation protection to address any shortfall and is on more solid footing right now to address another crisis.

- The rise of the Canadian dollar did detract from performance in the first half of the year. Currency had a negative 1.3% impact on the total fund as at June 30th mostly owing to OTPP's US investments across public and privates assets. In my last comment on how CPPIB is preparing for the next downturn, I discussed currency risk at length and stated "HOOPP hedges it completely and benefits when the Canadian dollar rallies versus the greenback and other currencies and OTPP put in some hedges to limit foreign currency swings and their effect on their overall portfolio swings but most of Canada's large pensions have adopted CPPIB's approach which is to not hedge their foreign currency exposure." I suspect OTPP partially hedges most currencies but not the USD but I'm awaiting more clarification on this so don't quote me. In any case, looking at the Canadian dollar ETF (FXC), I see it has weakened since June 30th and if a global crisis occurs, I expect it to get clobbered as energy prices get hit and the economy deteriorates significantly. Long term, I'm bullish on the US economy and the US dollar and believe it will continue to dominate the global economy because of its strong technology and financial sectors. In short, Warren Buffett is right, never short the United States over the long run.

- Going forward, OTPP's focus will be on global expansion. Its next CEO, Jo Taylor, will commence in his new role at the beginning of next year, and I profiled him here. Teachers' is on a hiring spree in Asia and Europe to attract qualified staff to expand its investments in public and mostly private markets in these regions. Jo Taylor is resolute, he wants to expand Teachers' brand globally and that was why he was primarily chosen to be the next CEO.

La Caisse de dépôt et placement du Québec (CDPQ) today published an update of its performance as at June 30, 2019. Over five years, CDPQ generated an annualized return of 8.3%, representing net investment results of $103.8 billion and total assets of $326.7 billion. Over six months, the average return on depositors’ funds was 6.1%, generating net investment results of $18.4 billion.A couple of quick points on CDPQ's mid-year results:

HIGHLIGHTS

In a highly competitive environment, CDPQ is pursuing its strategy of being selective in its investments and teaming up with partners that are recognized in targeted markets and sectors.

In Infrastructure, CDPQ conducted major transactions over the six-month period, including acquiring a 30% stake in Vertical Bridge, the largest private owner and manager of telecommunications infrastructure in the United States, and purchasing a natural gas transportation network in Brazil with Engie, a global energy leader. Jointly with DP World, it also acquired 45% stakes in two ports in Chile. In Private Equity, CDPQ invested in Allied Universal, a North American leader in security services, and acquired a 27% stake in Hilco Global, a financial services company with a global footprint. In Credit, CDPQ concluded a £150-million loan to Lightsource BP to finance a portfolio of over 100 solar energy projects across various countries and announced the creation of a new US$250-million credit platform in India alongside partner Edelweiss.

Ivanhoé Cambridge, in partnership with Oxford, acquired IDI Logistics, one of the largest logistics real estate developers and managers in the United States, in an investment totalling $4.6 billion. In the United Kingdom, Ivanhoé Cambridge invested in five logistics development projects through its PLP platform. With the ongoing objective of increasing its presence in new market segments, CDPQ’s real estate subsidiary also announced a US$1-billion commitment to Ark, the new real estate acquisition and development platform of The We Company, a global leader in creating collaborative environments. It also announced a partnership with ICAMAP to create ICAWOOD, a fund to develop low-carbon offices in the Greater Paris region.

In Québec, nearly $300 million was invested in new economy companies, including a new investment in AlayaCare, and additional investments in iNovia Capital, AddÉnergie, Metro Supply Chain Group and TrackTiK, partners of CDPQ for many years. During the six-month period, CDPQ also launched a $250-million fund to develop and commercialize artificial intelligence solutions, with a first investment in Dialogue, a technology platform for the health care industry.

PERFORMANCE HIGHLIGHTS

As at June 30, 2019, depositors’ net assets totalled $326.7 billion, up $17.2 billion from $309.5 billion as at December 31, 2018. This growth is attributable to net investment results of $18.4 billion and net depositor withdrawals of $1.2 billion.

Over five years, CDPQ’s annualized return was 8.3%, higher than its benchmark index, which stood at 7.2%, and representing $12.6 billion in value added. Over the period, the annualized returns of CDPQ’s eight largest clients varied between 7.6% and 9.1%.

The pillars of CDPQ’s strategy implemented over the past few years have all contributed to the five-year performance. Increased exposure to global markets is profitable, as is the increase in real asset and credit investments. For example, the Infrastructure portfolio generated an annualized return of over 10% during the period. The absolute-return management strategy was also a strong contributor to the return and value added generated over the period, with Equity Markets portfolios alone adding over $6.5 billion in value. The Private Equity portfolio, with more than three quarters managed in-house rather than through funds, also provided a high 12% annualized return.

Over six months, CDPQ posted a 6.1% return compared to 7.5% for its benchmark portfolio. The difference is largely attributable to the Real Assets class, where the Real Estate and Infrastructure portfolios generated lower returns than their benchmark indexes. By definition, these are long-term assets whose performance cannot be measured over a six-month period. The Infrastructure portfolio performed as expected over the period, but it compared to a benchmark index comprised of over 200 stocks that benefit from booming public markets. In Real Estate, the six-month return reflects downside pressure on traditional sectors to the benefit of new market segments such as industrial and logistics real estate and mixed-use buildings. The Ivanhoé Cambridge portfolio continues its repositioning in that regard, as evidenced by multiple investments in recent years. For example, in two years, the industrial and logistics real estate sector went from 1% to 12% of the overall portfolio, with a medium-term goal of reaching 20%.

During the period, the Fixed Income portfolios delivered a solid 7.0% return, supported by the decrease in interest rates, narrowing of credit spreads and superior performance of credit in growth markets. The Equity Markets portfolio, with a strong focus on quality, performed as expected in a bull market – generating a sustained 9.7% return with a lower level of risk.

FINANCIAL REPORTING

CDPQ’s annualized operating expenses stood at 23 cents per $100 of average net assets, a level which compares favourably with that of its industry and is unchanged from the same date last year.

ABOUT CAISSE DE DÉPÔT ET PLACEMENT DU QUÉBEC

Caisse de dépôt et placement du Québec (CDPQ) is a long-term institutional investor that manages funds primarily for public and parapublic pension and insurance plans. As at June 30, 2019, it held CAD 326.7 billion in net assets. As one of Canada’s leading institutional fund managers, CDPQ invests globally in major financial markets, private equity, infrastructure, real estate and private debt. For more information, visit cdpq.com, follow us on Twitter @LaCDPQ or consult our Facebook or LinkedIn pages.

- You will notice Fixed Income is up 7% in the first half of the year, edging out the benchmark index which posted a 6.9% return. Over the last five years, the Fixed Income group has outperformed its index (4.6% vs 3.9%) mostly owing to credit risk and private debt in that portfolio (they have been short long term nominal bonds for years and have been on the wrong side of that trade).

- Equities were up 8.6% in the first half of the year, underperforming the benchmark which was up 9.4%. Here, I assume this is public and private equities. Also, I know the Caisse has a value tilt so it will underperform when growth stocks are outperforming which they have been this year as global interest rates plunge to new lows. Over five years, however, Equities have outperformed the index by 200 basis points (10.4% vs 8.4%) but again, this includes Private Equity which has been a stellar performer over the last five years. Interestingly, the Caisse just made a USD $500 million minority investment in Sanfer, one of Mexico’s leading independent pharmaceutical companies (that's a significant amount, a true testament to the Caisse's long-term strategy in Mexico).

- The big surprise for me was that Real Assets have significantly underperformed the benchmark in the first half of the year by 480 basis points or 4.8% (-1.4% vs 3.4%). I don't know exactly what went wrong in the first half of the year but over the last five years, Real Assets have returned 9%, in line with their benchmark (9.1%). Moreover, the Caisse's CEO Michael Sabia is on the record stating Real Assets are critical to the Caisse's long-term strategy. It's worth noting the Caisse just announced a new real estate chief, Nathalie Palladitcheff, to head up Ivanhoé Cambridge, its main real estate subsidiary. Also, in late May, another woman, Rana Ghorayeb, was appointed as President and CEO of Otéra Capital, the commercial real estate lending subsidiary of the Caisse. These two ladies are now two of the most powerful women in the institutional real estate investment world and they're very humble and capable and deserved these nominations.

- For some reason, Ontario Teachers' didn't post broad asset class returns like the Caisse and I would have been curios to compare them purely out of curiosity (no two pensions are alike).

Below, Ron Mock, outgoing president and CEO of Ontario Teachers' Pension Plan, says making deals with the Googles and Tencents of the world is "critical." He talks about "moving slowly" on cannabis investments and the odds of a downturn in the next couple of years.Listen carefully to Ron, he highlights all the critical points OTPP and others are grappling with to deliver on their long-term mission.

Update: OTPP's CIO Ziad Hindo was kind enough to share this after reading my comment:

"Regarding currencies, as we stated in the annual report (p. 20), we do manage currencies from total Fund perspective and selectively hedge part of that exposure (the page has a chart highlighting international exposure and a second chart with currency exposure). "I thank Ziad for clarifying this point on currency hedging. Also, Wayne Kozun, a former SVP at OTPP and now CIO of Forthlane Partners, shared this with me:

In my opinion you shouldn't hedge unless you have a very strong belief that a currency is going to weaken/strengthen. That is because over the long term I don't think that currencies have an expected return and I think that pension plans can shouldn't worry about short term volatility. Hedging also creates a liquidity mismatch as hedges generally roll every few months whereas the assets are generally very long term. If currencies move against you this can cause you to have to come up with Billions of $ at an inopportune time.I thank Wayne for his wise insights and agree with him.

The C$ has generally depreciated in times of crisis - 2008 is a great example of this. It fell from parity to 1.30 in the latter half of 2008. If you had hedges on you may have had to come up with tens of billions of dollars to pay MTM on your hedges - right at the time that your equity book is getting crushed. The CDP had this problem which was exacerbated by their large holdings of ABCP at the time.

Comments

Post a Comment