CPPIB Gains 3.1% in Fiscal 2020

Pete Evans of CBC News reports CPP adds $17 billion to assets now worth more than $409 billion despite the pandemic:

Michel told me the last quarter of their fiscal year was a reminder that "economic shocks will happen from time to time" which is why they focus on the long term and building a resilient portfolio.

He noted that the Dow Jones Industrial Average lost 23% in Q1 (last quarter of CPPIB's fiscal year), its worst quarterly performance in its 135-year history.

However, despite the massive shock, CPPIB was still able to deliver a 3.1% gain in fiscal 2020, handily outperforming its benchmark which lost 3.1% over the same period.

"This speaks to our active management and diversification which leads to a resilient portfolio. As you know, our comparative advantages are our long horizon, scale, the certainty of our assets, strong culture, partnering capability and our Total Portfolio Approach to investing. All these elements were critical to our success in 2020."

Indeed, while 3.1% gain doesn't sound like a lot, especially when compared to its peers which reported their results based on the 2019 calendar year, the truth is they are extremely impressive relative to its Reference Portfolio (benchmark portfolio).

Moreover, CPPIB gained 12.6% on a 2019 calendar-year basis, which is in line with what its large peers like the Caisse reported.

But its the relative performance to its Reference Portfolio which is striking. Michel told me its Reference Portfolio which is made up of 85% S&P global mid and large cap stocks and 15% nominal bonds issued by Canadian governments, lost 3.1% over the same period (base CPP benchmark; additional CPP benchmark gained 0.7%; for details, see answer to question 12 here).

I bluntly asked him whether it's prudent to have a benchmark made up of 85% global stocks and he said this benchmark was based on consultations with their provincial and federal stewards, reflects their long-term liabilities and the fact that base CPP is partially, not fully funded. Moreover, the benchmark was adopted slowly over the last five years shifting from 70/30 to 75/25 to 80/20 to finally 85/15.

Michel told me in light of COVID-19, they had to rewrite the entire Fiscal 2020 Annual Report, which is no easy feat as it takes months to prepare it (you can read the highlights here).

I would definitely read Dr. Heather Munroe-Blum's report on page 2 as well as Mark Machin's message on page 5.

One thing I noted is CPPIB's senior managers continue to execute on their 2025 strategy approved by the Board two years ago. As Mark notes: "We remain confident in the long-term trends that underpin our convictions and strategy."

It's important to note that CPPIB measures its success over a very long period, which is why you see them emphasizing 5 and 10-year results.

Michel Leduc also emphasized that CPPIB's active management approach, which some have wrongly criticized, and has added significant dollar vaue add over the last ten years.

As Mark Machin notes in his message:

I told Michel, private equity has reached its Minsky moment, there is a paradigm shift going on in real estate, infrastructure assets related to transportation (airports, ports, toll roads) are also getting hit and hedge funds continue to underperform.

He didn't deny they took their lumps on Neiman Marcus and that is why diversification across geographies, sectors and vintage years is so important.

When I asked him about the drop in revenues at Highway 407 which CPPIB has a controlling stake, he replied: "No doubt about it, revenues dropped dramatically because of the forced lockdown but let me ask you something, when they reopen the economy, do you think people will be driving into work or taking public transit?".

I said it depends as many premiere tech companies are telling their employees they can "work from home forever" and as I stated in my comment last week on the paradigm shift in real estate, the competition for top talent is heating up and tech companies typically set new trends, so I expect working from home will become the new normal (it's also better for a sustainable economy).

Michel told me their thematic investing team is in charge of figuring out the next big trends and they are the team which will capitalize on shifts in consumer behavior in a post-COVID world.

Of course this team figured out logistics properties was a hot area to invest in long before the pandemic hit, and that is an important secular trend which will remain with us for decades.

He gave me another example of grocery stores which safely do online delivery and how this is an emerging trend which will stay with us.

The most important things Michel Leduc wanted to highlight were these:

In fact, Neil Beaumont, Senior Managing Director & Chief Financial and Risk Officer, explains how they assess and determine the fair value of their investments here (also see below).

As far as the Fund returns by asset class, here they are for fiscal 2019 and fiscal 2020:

As you can see, the best returns were in marketable government bonds (+16%) followed by Emerging and Foreign Private Equity (+8% and +6% respectively). Energy and resources got hit the hardest (-23%) but it's the performance in Infrastructure (-1% vs +14% last fiscal year) which really stands out.

This tells me they aggressively wrote down some infrastructure assets this fiscal year (Highway 407, ports, airports) and will wait till next fiscal year to reevaluate them once revenues start coming back.

I expect the exact same thing will occur across all of Canada's large pensions which are heavily invested in private markets.

Lastly, here is a summary table of compensation of some of the senior managers:

Yes, Mark Machin made close to $6 million but he's running the most important pension fund in Canada and he and his senior managers featured below have delivered outstanding long-term results.

That's all from me. Admittedly, this comment is long but I tried to cover the most important things.

Please take the time to read CPPIB's entire Fiscal 2020 Annual Report, which is very well written (if pressed for time, you can read the highlights here).

I thank Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications, for taking the time to chat with me yesterday and invite him to have lunch at Milos the next time he's in Montreal (hopefully Mark Machin can join us and this COVID nightmare will be behind us).

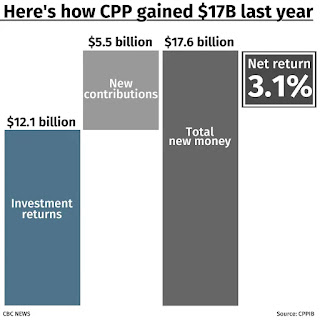

Below, in fiscal 2020, CPPIB's net assets grew to $409.6 billion, comprising $12.1 billion in net income and $5.5 billion in net CPP contributions received. Despite the market conditions in their fourth quarter, the Fund earned a net annual return of 3.1%, after all costs. Listen to Mark Machin, President & CEO, discuss their results.

Machin discussed the fund's fiscal year-end results, the impact of the coronavirus pandemic on its portfolio holdings, and the outlook for commercial real estate with Bloomberg's Erik Schatzker on "Bloomberg Markets: European Close."

He also talked about the latest quarter with BNN Bloomberg's Amanda Lang stating "there was nowhere to hide". “There were some remarkable opportunities. I think a lot of things have come back right now, so they’re not massive, burning opportunities given how much the force of government and central bank support has really put huge amounts of liquidity back into markets.”

Lastly, fair value assessments are some of the most important pieces of information that CPPIB's senior managers use to manage the Fund’s assets. Neil Beaumont, Senior Managing Director & Chief Financial and Risk Officer, explains how they assess and determine the fair value of their investments. Take the time to watch this, it's important to understand they don't "fudge" the numbers.

The Canada Pension Plan earned a return of 3.1 per cent after expenses during the financial year ended March 31, the board that manages the fund's money reported Tuesday.Barbara Shecter of the National Post also reports that CPPIB's post-pandemic returns unlikely to match past decade's:

Net assets for Canada's national pension plan totalled $409.6 billion as of the end of March, up from $392 billion at the end of the previous financial year.

The $17.6-billion year-over-year increase included $12.1 billion in net income from its investments. The other $5.5 billion came from contributions of more than 20 million Canadian workers covered by the plan.

In the past five years, investment returns have added $123 billion to the fund's assets, the Canada Pension Plan Investment Board said Tuesday.

While the plan made money for the year as a whole, the fourth quarter was a challenging one because of COVID-19. The fund said fixed-income assets did well as investors fled for safety, but values of stock-based investments fell.

"Despite severe downward pressure in our final quarter, the fund's 12.6 per cent return on a 2019 calendar-year basis combined with the relative resilience of our diversified portfolio helped cushion the impact," chief executive officer Mark Machin said.

"Amid the significant number of concerns many Canadians have today, the sustainability of the fund is one thing they shouldn't worry about. The fund's long-term returns continue to help ensure the security of Canadians' retirement benefits."

A three per cent return may not sound impressive, but Michel Leduc, a senior investment executive with the fund, said in an interview that the fund's financial performance in the middle of a serious economic crisis is a testament to its strategy.

The CPP measures its own performance against a series of market-based benchmarks, the main one being the Reference Portfolio. That reference portfolio declined by 3.1 per cent in the past year, the same amount that CPP increased by.

'Quite resilient'

Leduc noted that the Dow Jones Industrial Average lost 23 per cent in the first three months of this year, its worst quarterly performance in its 135-year history.

If the CPP were just to have matched the stock market, "the fund would be would be $23 billion smaller today," he said. "You've got to look at in the context of going through an economic shock which we know we're going to go through from time to time…. To preserve $23 billion … I would say to Canadians that their fund is quite resilient and the active management put the fund in that safe harbour."

The Chief Actuary of Canada audits the CPP every three years to assess its ability to cover its obligations. At the last review in December 2018, the chief actuary deemed the CPP was on track to meet its obligations for the next 75 years at least, assuming the fund can earn a return of 3.95 per cent above inflation.

The CPPIB has achieved a real return of eight per cent, on average, over the past 10 years, and 6.1 per cent over the past five.

Buying opportunities

Leduc said the current downturn could lead to some attractive buying opportunities for CPP, but that doesn't mean the fund is running off on a buying spree without making sure that any investments fit the long-term objectives.

"We're one of the few institutional investors around the world that can pretty much acquire anything," he said. "We will look at opportunities, very carefully, but it's not the Wild West … we're not going out and buying everything."

While on track in terms of performance, the CPP has faced some criticism for the amount of money it spends on costs as it has grown and expanded over the years.

While its total value has quadrupled from $96 billion to $409 billion since 2006, that growth has come with added costs, as CPPIB now employs 1,824 employees around the world — 11 times more than the 164 it did back then. It only had one office then; today it has nine, including two in the U.S., two in Europe, two in Asia, one in Brazil and one in Australia.

That growth has come at a cost: CPPIB incurred more than $1.2 billion in expenses last year. That's about 30 cents out of every $100 invested, a slightly lower ratio than the previous year's level of 32 cents.

All told, CPP racked up $3.4 billion in expenses, management fees and transaction costs last year. That's up from $3.2 billion the year before.

CPP said it is "committed to maintaining cost discipline as we continue to build a globally competitive platform that will enhance our ability to invest over the long term."

The coronavirus pandemic and the economic fallout from efforts to contain it will have a long-term effect on the Canada Pension Plan Investment Board’s $409.6 billion fund, CPPIB chief executive Mark Machin said Tuesday, after the fund posted its worst annual performance since the financial crisis in 2009.Finally, Paula Sambo of Bloomberg News reports CPPIB has its worst year since 2009 as virus hits stock returns:

“I don’t expect as good returns in the next 10 years as they have been in the last 10 years,” Machin said in an interview after the CPP fund posted a 3.1 per cent annual return for the year ended March 31, a period that also contained punishingly low oil prices and deep interest rate cuts.

While there was a positive return for the fiscal year, that was largely due to strong investment gains in the first nine months. Among CPPIB’s holdings, energy and resources were hit particularly hard, posting the worst performance of the year at -23.4 per cent, compared to -0.6 per cent a year earlier.

Over the past 10 years, the fund’s net rate of return is 9.9 per cent, and $235.2 billion has been generated in net investment income after costs.

Machin said CPPIB, which invests on behalf of the Canada Pension Plan, doesn’t intend to make big changes to the portfolio despite the recent market conditions, which were described in the fund’s results as “devastating.” He noted that diversification of geography and asset classes helped weather the latest crisis.

“While there was nowhere to hide in the world, some countries were coming out of it as others were going into it,” he said, noting that countries in Asia and even Europe began to ease economic restrictions while North American was locking down to try to slow the spread of COVID-19.

Flights to safety, including government bonds, also boosted parts of the portfolio. This shifted specified weightings, which caused CPPIB to rebalance the portfolio, in part by buying lower-priced equity and credit investments and selling sovereign bonds.

Machin said the pension management organization is keeping a close eye on geopolitical developments around the world, such as trade tensions between the United States and China, some of which pre-dated the pandemic.

“Those tensions are very real and it’s not just tensions with the U.S., it’s tensions with a lot of places around the world,” he said.

“We need to be aware of where policy is today, where policy may go tomorrow, and how that’s going to impact those two economies and economies around the world, and companies, and sectors, and markets. It’s important for us to really understand where things might go on all of those fronts.”

For the time being, though, CPPIB remains committed to increasing its exposure to emerging markets including China, he said. Investments in emerging markets totalled $87.6 billion, or 21.4 per cent of total assets, at the end of fiscal 2020. That was up from $77.9 billion, or 19.9 per cent of assets a year earlier.

Machin said less than 11 per cent of the CPPIB portfolio is invested in China, which is about one-third of the amount invested in the United States. Before the pandemic hit, the huge and booming Chinese economy was seen as a major draw for the Canadian fund. A year ago, Machin told the Financial Post he expected the portfolio allocation to China to be in the “mid-teens” by 2025, in keeping with the strategy of boosting the representation of emerging markets including India, China, and Brazil to 33 per cent in that timeframe.

He indicated no change to that strategy during Tuesday’s interview, and noted that equities had declined by far less in China than in Canada, the U.S., or the United Kingdom.

For the fiscal year, CPPIB’s investments in China — where key holdings include a long-term stake in e-commerce company Alibaba — produced returns of 9.8 per cent, he added.

The fund’s overall growth to $409.6 billion in fiscal 2020 was driven by $12.1 billion in net income and $5.5 billion in net CPP contributions.

Canada Pension Plan Investment Board returned 3.1 per cent for the fiscal year, its worst showing since the financial crisis, as the selloff in equity markets and energy in February and March hurt the fund.CPPIB put out a press release on its fiscal 2020 results and while I won't post it all because it's too long, this is the critical part:

Net assets were $409.6 billion as of March 31, the fund’s fiscal year-end. That represented growth of $17.6 billion, consisting of of $12.1 billion in net income from investments and $5.5 billion in new contributions, CPPIB said in a statement Tuesday.

The numbers mean Canada’s largest pension fund suffered about $15.8 billion in investment losses in the first three months of 2020. The fund had reported $27.9 billion in investment gains for the nine months ended Dec. 31.

“Despite severe downward pressure in our final quarter, the fund’s 12.6 per cent return on a 2019 calendar-year basis, combined with the relative resilience of our diversified portfolio, helped cushion the impact,” Chief Executive Officer Mark Machin said in the statement.

The fund’s 10-year and five-year annualized net nominal returns were 9.9 per cent and 7.7 per cent, respectively, which “should give Canadians comfort that, even with periodic shocks, their pensions ultimately draw from decades of steady performance,” Machin said.

The fund’s 3.1 per cent investment gain outperformed its benchmark portfolio’s 3.1 per cent loss, which equates to a value-added return of $23.4 billion for the year, after deducting all costs, the fund said.

Losses in Resources

CPPIB is designed to serve contributors and beneficiaries for decades, so long-term results are a more appropriate measure of performance than quarterly or annual cycles, the fund said.

“The COVID-19 pandemic poses a massive challenge for health, societies and economies globally. Amid the significant number of concerns many Canadians have today, the sustainability of the fund is one thing they shouldn’t worry about,” Machin said.

The fund’s holdings of Canadian public equities lost 12.2 per cent for the year and emerging markets stocks dropped 9.1 per cent, while foreign stocks generated a return of 1.6 per cent.

All credit investments returned 0.5 per cent and real estate returned 5.1 per cent, while infrastructure dropped one per cent. Canadian private equity investments lost 5.1 per cent, while foreign PE returned six per cent. Energy and resources lost 23.4 per cent.

Caisse de Depot et Placement du Quebec returned 10.4 per cent in 2019 as stocks and fixed income shielded Canada’s second-largest pension fund manager from a poor performance in real estate. Ontario Teachers’ Pension Plan delivered a 10.4 per cent return last year, lagging its 12.2 per cent benchmark. The failure to beat the hurdle tends to happen when public equities have exceptional returns, Teachers said.

Ontario Municipal Employees Retirement System returned 11.9 per cent on its investments last year, pushing assets to $109 billion. The pension fund cut its stock holdings last year and added to its infrastructure bets.

Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2020, with net assets of $409.6 billion, compared to $392.0 billion at the end of fiscal 2019. The $17.6 billion increase in net assets consisted of $12.1 billion in net income after all CPP Investments costs and $5.5 billion in net Canada Pension Plan (CPP) contributions.Alright, I reached out to Mark Machin and Michel Leduc yesterday and wanted to go over their results but Mark was busy with various media obligations so Michel was kind enough to step in and have a brief chat with me.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 9.9% and 7.7%, respectively. For the fiscal year, the Fund returned 3.1% net of all CPP Investments costs.

Steady gains from global active investment programs over the first three quarters of the fiscal year pushed Fund performance forward. Fixed income investments performed well in the fourth quarter, reflecting investors’ search for safer investments and the expectation for lower interest rates across major markets. However, the steep decline in global equity markets in March 2020 had a significant effect on results as the financial impacts of the COVID-19 pandemic tore through virtually every economy.

“Our long-term returns of 9.9% over 10 years should give Canadians comfort that, even with periodic shocks, their pensions ultimately draw from decades of steady performance,” said Mark Machin, President & Chief Executive Officer, CPP Investments. “Despite severe downward pressure in our final quarter, the Fund’s 12.6% return on a 2019 calendar-year basis combined with the relative resilience of our diversified portfolio, helped cushion the impact.”

In the five-year period up to and including fiscal 2020, CPP Investments has contributed $123.4 billion in cumulative net income to the Fund after CPP Investments costs. Since CPP Investments’ inception in 1999, it has contributed $259.7 billion on a net basis.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, taking into account the factors that may affect the funding of the CPP and the CPP’s ability to meet its financial obligations. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance compared to quarterly or annual cycles.

“The COVID-19 pandemic poses a massive challenge for health, societies and economies globally. Amid the significant number of concerns many Canadians have today, the sustainability of the Fund is one thing they shouldn’t worry about,” said Mr. Machin. “The Fund’s long-term returns continue to help ensure the security of Canadians’ retirement benefits.”

Michel told me the last quarter of their fiscal year was a reminder that "economic shocks will happen from time to time" which is why they focus on the long term and building a resilient portfolio.

He noted that the Dow Jones Industrial Average lost 23% in Q1 (last quarter of CPPIB's fiscal year), its worst quarterly performance in its 135-year history.

However, despite the massive shock, CPPIB was still able to deliver a 3.1% gain in fiscal 2020, handily outperforming its benchmark which lost 3.1% over the same period.

"This speaks to our active management and diversification which leads to a resilient portfolio. As you know, our comparative advantages are our long horizon, scale, the certainty of our assets, strong culture, partnering capability and our Total Portfolio Approach to investing. All these elements were critical to our success in 2020."

Indeed, while 3.1% gain doesn't sound like a lot, especially when compared to its peers which reported their results based on the 2019 calendar year, the truth is they are extremely impressive relative to its Reference Portfolio (benchmark portfolio).

Moreover, CPPIB gained 12.6% on a 2019 calendar-year basis, which is in line with what its large peers like the Caisse reported.

But its the relative performance to its Reference Portfolio which is striking. Michel told me its Reference Portfolio which is made up of 85% S&P global mid and large cap stocks and 15% nominal bonds issued by Canadian governments, lost 3.1% over the same period (base CPP benchmark; additional CPP benchmark gained 0.7%; for details, see answer to question 12 here).

I bluntly asked him whether it's prudent to have a benchmark made up of 85% global stocks and he said this benchmark was based on consultations with their provincial and federal stewards, reflects their long-term liabilities and the fact that base CPP is partially, not fully funded. Moreover, the benchmark was adopted slowly over the last five years shifting from 70/30 to 75/25 to 80/20 to finally 85/15.

Michel told me in light of COVID-19, they had to rewrite the entire Fiscal 2020 Annual Report, which is no easy feat as it takes months to prepare it (you can read the highlights here).

I would definitely read Dr. Heather Munroe-Blum's report on page 2 as well as Mark Machin's message on page 5.

One thing I noted is CPPIB's senior managers continue to execute on their 2025 strategy approved by the Board two years ago. As Mark notes: "We remain confident in the long-term trends that underpin our convictions and strategy."

It's important to note that CPPIB measures its success over a very long period, which is why you see them emphasizing 5 and 10-year results.

Michel Leduc also emphasized that CPPIB's active management approach, which some have wrongly criticized, and has added significant dollar vaue add over the last ten years.

As Mark Machin notes in his message:

Our dollar value-added (DVA) compared with our Reference Portfolios for the fiscal year was $23.5 billion as a result of the continued resilience of many of our investment programs. DVA is a volatile measure, and so again we look at our results over a longer horizon. Since inception of our active management strategy, we have now delivered $52.6 billion in compounded DVA.But as Mark also notes, returns are coming down across all asset classes so that will put pressure on the Fund to remain very disciplined and make sure they add value wherever they can.

Our long-term returns are expected to exceed what the Fund needs to remain sustainable. I say that with confidence because this year the Fund’s sustainability was independently validated by the Office of the Chief Actuary. And while that report was produced prior to the COVID-19 pandemic, it does account for financial market volatility, changes to long-term demographic trends, and so on.

The Chief Actuary’s latest assumption is that, over the 75years following 2018, the base CPP account is on track to earn an average annual real rate of return of 3.95% above the rate of Canadian consumer price inflation, after all costs. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%. As of this year, CPP Investments’ average annual real rate of return over a 10-year period is 8.1%.

I told Michel, private equity has reached its Minsky moment, there is a paradigm shift going on in real estate, infrastructure assets related to transportation (airports, ports, toll roads) are also getting hit and hedge funds continue to underperform.

He didn't deny they took their lumps on Neiman Marcus and that is why diversification across geographies, sectors and vintage years is so important.

When I asked him about the drop in revenues at Highway 407 which CPPIB has a controlling stake, he replied: "No doubt about it, revenues dropped dramatically because of the forced lockdown but let me ask you something, when they reopen the economy, do you think people will be driving into work or taking public transit?".

I said it depends as many premiere tech companies are telling their employees they can "work from home forever" and as I stated in my comment last week on the paradigm shift in real estate, the competition for top talent is heating up and tech companies typically set new trends, so I expect working from home will become the new normal (it's also better for a sustainable economy).

Michel told me their thematic investing team is in charge of figuring out the next big trends and they are the team which will capitalize on shifts in consumer behavior in a post-COVID world.

Of course this team figured out logistics properties was a hot area to invest in long before the pandemic hit, and that is an important secular trend which will remain with us for decades.

He gave me another example of grocery stores which safely do online delivery and how this is an emerging trend which will stay with us.

The most important things Michel Leduc wanted to highlight were these:

- They improved their processes dedicated to fair value in private markets

- They use independent auditors to determine whether their fair value is robust and these auditors often find that their valuations are very conservative in private markets.

In fact, Neil Beaumont, Senior Managing Director & Chief Financial and Risk Officer, explains how they assess and determine the fair value of their investments here (also see below).

As far as the Fund returns by asset class, here they are for fiscal 2019 and fiscal 2020:

As you can see, the best returns were in marketable government bonds (+16%) followed by Emerging and Foreign Private Equity (+8% and +6% respectively). Energy and resources got hit the hardest (-23%) but it's the performance in Infrastructure (-1% vs +14% last fiscal year) which really stands out.

This tells me they aggressively wrote down some infrastructure assets this fiscal year (Highway 407, ports, airports) and will wait till next fiscal year to reevaluate them once revenues start coming back.

I expect the exact same thing will occur across all of Canada's large pensions which are heavily invested in private markets.

Lastly, here is a summary table of compensation of some of the senior managers:

Yes, Mark Machin made close to $6 million but he's running the most important pension fund in Canada and he and his senior managers featured below have delivered outstanding long-term results.

That's all from me. Admittedly, this comment is long but I tried to cover the most important things.

Please take the time to read CPPIB's entire Fiscal 2020 Annual Report, which is very well written (if pressed for time, you can read the highlights here).

I thank Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications, for taking the time to chat with me yesterday and invite him to have lunch at Milos the next time he's in Montreal (hopefully Mark Machin can join us and this COVID nightmare will be behind us).

Below, in fiscal 2020, CPPIB's net assets grew to $409.6 billion, comprising $12.1 billion in net income and $5.5 billion in net CPP contributions received. Despite the market conditions in their fourth quarter, the Fund earned a net annual return of 3.1%, after all costs. Listen to Mark Machin, President & CEO, discuss their results.

Machin discussed the fund's fiscal year-end results, the impact of the coronavirus pandemic on its portfolio holdings, and the outlook for commercial real estate with Bloomberg's Erik Schatzker on "Bloomberg Markets: European Close."

He also talked about the latest quarter with BNN Bloomberg's Amanda Lang stating "there was nowhere to hide". “There were some remarkable opportunities. I think a lot of things have come back right now, so they’re not massive, burning opportunities given how much the force of government and central bank support has really put huge amounts of liquidity back into markets.”

Lastly, fair value assessments are some of the most important pieces of information that CPPIB's senior managers use to manage the Fund’s assets. Neil Beaumont, Senior Managing Director & Chief Financial and Risk Officer, explains how they assess and determine the fair value of their investments. Take the time to watch this, it's important to understand they don't "fudge" the numbers.

Comments

Post a Comment