Big Tech Crushes It. Now What?

Stocks wiped out earlier losses and closed higher on Friday as the biggest tech companies and market leaders — Amazon, Apple and Facebook — soared after posting stellar quarterly results.

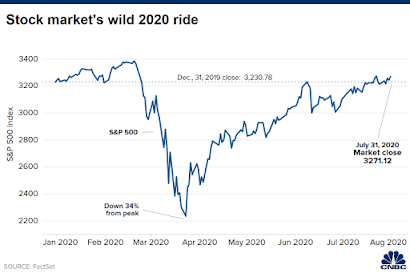

The Dow Jones Industrial Average rose 114.67 points, or 0.4%, to 26,428.32 after dropping about 300 points at its low of the day. The S&P 500 climbed 0.7%, or 24.90 points, to 3,271.12, while the Nasdaq Composite gained 1.4%, or 157.46 points, to 10,745.27, led by a 10% jump in Apple shares.

The major equity averages also wrapped up the month of July with solid gains and posted their fourth straight positive month. The S&P 500 gained 5.5% in July, while the Dow and the Nasdaq Composite rose 2.3% and 6.8%, respectively.Still, a few negative headlines capped the gains in the broader market Friday:

- Emergency unemployment benefits are set to expire Friday and Congress and the White House still seem far apart on an agreement. White House Chief of staff Mark Meadows said Democratic leaders have rejected four offers regarding the coronavirus relief bill.

- Dow-component Chevron fell 2.7% after the oil giant reported an $8.3 billion loss in the second quarter as the pandemic “significantly reduced demand.”

- Consumer sentiment deteriorated this month amid a resurgence in new coronavirus cases. University of Michigan’s consumer sentiment index came in at 72.5 for July, down from June’s 78.1 and below Dow Jones estimates of 72.7.

- Stocks linked to an economic recovery like banks and retailers were lower as investors assessed the biggest quarterly gross domestic product contraction on record and persistently weak job growth. JPMorgan and Home Depot both ended the day in the red.

Big Tech crushes expectationsApple reported a blowout quarter, sending shares up 10.4% to a new all-time high. The company said its overall sales expanded by 11%, and it also announced a 4-for-1 stock split. With Friday’s rally, Apple took over Saudi Aramco to become the world’s most valuable company.

Amazon, meanwhile, jumped 3.7% as the company saw its sales skyrocket during the coronavirus pandemic. Facebook shares rallied more than 7% as the social media giant posted revenue growth of 11% even amid the coronavirus pandemic slowdown.

Google-parent Alphabet also posted better-than-expected earnings, but the company’s overall revenue declined for the first time in its history. Revenue for Google Cloud were also just below analyst expectations. Alphabet shares fell more than 3% on Friday.

“Obviously, no one was doubting any of those companies so the fact they all exceeded expectations isn’t exactly shocking,” Adam Crisafulli of Vital Knowledge, said in a note Friday. “Investors are now trying to smooth out some of the numbers (i.e. how much of the monster upside was a function of extremely conservative guidance along w/an unsustainable spike in revenue and decline in expenses?)”

Big Tech has been the stalwart on Wall Street this year. Amazon and Apple are up 71% and 44%, respectively, in 2020. Facebook and Alphabet have risen double digits over that time period.

Meanwhile, investors continued to flock to safe-haven assets amid the uncertainty about the economic recovery. Gold futures spiked to an all-time high of $2,005.4 an ounce on Friday, crossing the $2,000 mark for the first time.

It's Friday, here were the big moves today in shares of Apple, Amazon and Facebook:

Amazon and Apple have been leading tech shares and the entire market higher:

Apple shares actually dipped to roughly $370 a share a week ago and exploded up this week. That was a nice trade as it never pierced below its 50-day moving average but I totally missed it.

But even with all the explosive moves in a few big tech stocks today, the Dow could only muster a gain of 114 points which tells me this is a very narrow rally and once the big funds start selling, this entire stock market rally is in trouble.

I'm also highly skeptical of Apple's revenues which conveniently "smashed" expectations. Maybe people are using their stimulus money to buy a new iPhone but that money is running out and with the economy in the doldrums, I just don't see how Apple will continue to crush its earnings.

Don't get me wrong, it's a great company, run very well, and has a balance sheet that others can only dream of, but how much of the good news is already priced into its shares?

The same thing goes for Amazon and other tech shares which seem to be levitating up in this surreal market, totally oblivious to the global pandemic.

Speaking of surreal markets, Seth Klarman said the Federal Reserve is treating investors like children and is helping create bizarre market conditions that are unsupported by economic data:

“Surreal doesn’t even begin to describe this moment,” Klarman said in a letter to investors reviewed by Bloomberg News. Investor “psychology is surprisingly ebullient even though business fundamentals are often dreadful,” he added.

The culprit is the Fed, Klarman said in the 16-page letter.

“Investors are being infantilized by the relentless Federal Reserve activity,” said Klarman, who runs hedge fund firm Baupost Group. “It’s as if the Fed considers them foolish children, unable to rationally set the prices of securities so it must intervene. When the market has a tantrum, the benevolent Fed has a soothing yet enabling response.”

Going further, he said: “As with the 30-year-olds still living in their parents’ basements, we can only wonder whether the markets will ever be expected to make it on their own.”

Klarman said “we were significant net sellers” as prices rallied in the second quarter. The hedge fund delivered a gain of about 10% in the three months ended June 30, and was down about 2% for the first half of the year, according to a person familiar with the matter.

Baupost’s cash balance was 31% on June 30, up from 26% disclosed in April, the result of selling a recently purchased portfolio of mortgage-backed securities and one corporate debt holding, as well as net stock sales.

A spokeswoman at Boston-based Baupost declined to comment.

Keynes always said markets can stay irrational longer than you can stay solvent and the real pain trade remains up, so I wouldn't be surprised if this folly continues until the fall.

But the truth is you just don't know, these markets can turn on a dime, trying to predict them is next to impossible.

Still, when I look at the daily chart of the QQQs, it looks bullish but toppish here and I wouldn't be surprised if the big rally in tech comes to a grinding halt:

What remains to be seen is whether a rotation out of tech into other sectors occurs, giving the overall market room to continue grinding higher:

With the Fed reiterating this week that it remains in super accommodative mode, I don't see what will stop the rally in stocks unless we get renewed tensions with China or no renewal of the emergency unemployment benefits.

Investors now have a choice, to buy some beaten down value plays hoping the rally will broaden out or to continue plowing money into big tech names hoping the momentum will carry tech to another incredible year like last year despite the pandemic.

Both of these options make me very uneasy for a lot of reasons and other much larger investors face the same dilemma.

Anyway, here is the performance breakdown of the S&P sectors this week:

Not surprisingly, technology led all other sectors, gaining 5% this week and energy underperformed, declining by 4.3%.

Typically, when tech shares outperform massively like this week, quant funds take their profits, so I expect a pullback next week.

And here are the top performing large cap stocks this week:

The one that caught my attention was UPS since I was tracking it from the end of March to May but forgot about it and didn't pull the trigger when shares were below $100:

These are trading markets, you need to really pay close attention and it's not just big tech making all the big gains.

Below, CNBC's Jim Cramer raves about Apple's quarterly earnings results and how he thinks the company has managed to become so successful.

And Howard Ward, chief investment officer of growth equities at GAMCO, joins "Squawk Box" to discuss why longer-term, investors can feel comfortable buying tech stocks.

Comments

Post a Comment