Ignore the Backup in Long Bond Yields?

The Dow Jones Industrial Average fell slightly on Friday to end a downbeat week as investors weighed the potential for additional fiscal stimulus.

The 30-stock average slid 28.09 points, or 0.1%, to 28,335.57 as Intel shares struggled. The S&P 500 gained 0.3% to close at 3,465.39 and the Nasdaq Composite closed 0.4% higher at 11,548.28.

“I think everyone is in wait-and-see mode,” said Mike Katz, partner at Seven Points Capital. “There’s a lot of back and forth on stimulus and every headline makes the market move a little bit, but there’s no follow-through because we don’t have a clear picture on that front.”

The Dow and S&P 500 snapped a three-week winning streak and the Nasdaq posted its first weekly loss in five weeks. The S&P 500 lost 0.5% for the week. The Dow and Nasdaq dipped 0.95% and 1.1%, respectively.

Treasury Secretary Steven Mnuchin said Friday that House Speaker Nancy Pelosi, D-Calif., is “still dug in” on a number of issues regarding fiscal stimulus. He added: “If she wants to compromise, there will be a deal. But we’ve made lots of progress in lots of areas, but there’s still some significant areas that we’re working through.”

President Donald Trump also said Friday that he does not want the aid deal to bail out Democratic states. The major averages fell to their session lows on those remarks.

Traders have been keeping an eye on Washington in recent weeks as they gauge the prospects for new coronavirus aid to be pushed through. Several market experts and economists, including Federal Reserve Chairman Jerome Powell, think it is imperative that lawmakers reach a deal on another stimulus package.

“Governmental powers are still trying to put together another economic relief package,” said Jim Paulsen, chief investment strategist at The Leuthold Group. “However, despite the July expiration of unemployment benefits provided by the CARES Act, here, two-and-a-half months later, U.S. economic momentum is remarkably healthy.”

Intel shares fell 10.6% following the release of mixed quarterly numbers for the chipmaker. The company’s earnings were in line with analyst expectations, but revenue from its data center business fell short of analyst estimates.

It was a tough week for the tech sector, falling more than 2%, amid concerns that a Democratic sweep on Nov. 3 could put pressure on the high-flying stock group.

“We see a Democratic sweep as having the most uncertainty and tail risk for [the] large-cap internet sector,” Bank of America analysts said in a note. Specifically, the analysts think a “Blue Wave” could lead to higher taxes and tougher regulation for tech companies.

Alright, it's Friday, time to chill out a bit and do my weekly market comment.

Let's begin with the debate last night. It was infinitely better than the first one (a disaster) as the candidates toned it down and focused on policies. It also helped that new rules were adopted and the moderator was superb and kept them both engaged and focused:

How Kristen Welker Moderated The Debate Exceptionally Well https://t.co/swCIIF4UG9

— Leo Kolivakis (@PensionPulse) October 23, 2020

Who will be the next president of the United States? The polls clearly put Biden ahead of Trump but I don't trust these polls because many Americans will quietly vote for Trump, even if he rubs them the wrong way.

I'll put it to you this way, millions of Americans have already voted and the majority of the people had already made up their mind before last night's debate.

Betting markets: Trump gets rare debate praise, but Biden retains wide Election Day advantage via @TeflonGeek https://t.co/uM8Vw8cMTb pic.twitter.com/3dPHv6SmAP

— Yahoo Finance (@YahooFinance) October 23, 2020

I doubt the debate will influence anyone one way or another. My own feeling is Trump won last night's debate, hammering Biden on the economy and Biden was shaky at times and said some things on oil industry which will piss off Texas and Pennsylvania.

Don't get me wrong, Trump is often impulsive and unhinged but last night he stayed on message and was more focused (for the most part, said a few stupid things too).

Will it make a difference? Who knows? All I know is according to experts, Trump can still win the election, despite lagging in the polls:

Two weeks from the 2016 election, Clinton had a 6.1 per cent lead over Trump, according to national polls from the time.

But 2016 showed that national leads can be irrelevant, as the number of votes you win is less important than where you win them. Winning the battleground states is a far more likely way to secure an overall victory, according to Clifford Young, president of Ipsos Public Affairs.

“It’s trending Biden in the polls, but the lead in some states is about the same as Clinton had in 2016, so there’s a lot of uncertainty,” he said.

Although Clinton gained nearly 2.9 million more votes than Trump in 2016, he was able to claim victory in Wisconsin, Michigan and Pennsylvania, which was enough to grab the presidency.

Anyway, will let you read the entire article here but this is the critical part:

[...] in examining what went wrong with the 2016 polls, Pew Research Center looked at a variety of reasons, including that some respondents may not be honest when answering polls, the nonpartisan think tank stated.

“Some have also suggested that many of those who were polled simply were not honest about whom they intended to vote for,” Pew Research Center stated. “The idea of so-called ‘shy Trumpers’ suggests that support for Trump was socially undesirable, and that his supporters were unwilling to admit their support to pollsters.”

However, Pew Research said this theory “might account for a small amount of the error in 2016 polls, but it was not among the main reasons.”

Still, this reaffirms my belief that this election will be a lot closer than polls suggest and Trump might eke out another victory.

I'll put it to you this way, if the pandemic didn't occur, Trump would have been a shoo-in to be re-elected (don't shoot the messenger, call it like I see it).

One last thing, during the debate last night, Trump said it was Nancy Pelosi holding back another stimulus package.

I don't know if that's true but yesterday the House Speaker cautioned that it could take “a while” for Congress to actually write and vote on relief legislation, with the clock ticking toward the 2020 election.

With the elections around the corner, I doubt they will pass a stimulus bill as Democrats are taking a calculated bet here that they will sweep.

I say "calculated" because if it doesn't materialize, it could backfire on them in a spectacular way.

Alright, enough politics, let's get to markets.

It seems like another boring week but Martin Roberge of Canaccord Genuity notes the market stability masks a strong divergence between growth and value stocks, with the latter resurrecting on the back of a marked increase in bond yields.

In fact, on bonds, Martin notes the following:

Our focus this week is on US 10-year T-bond yields. The reflation trade appears in full force with bond yields rising ~10bps over the past week. Prospects of a blue wave on November 3, with growing odds for a new stimulus bill, rising inflation expectations and investors looking at the recovery beyond the pandemic are all legitimate reasons to call for higher bond yields. But in the short term, we doubt that bond yields will rise much above the 1% mark. First, as the second panel of our Chart of the Week illustrates, the combined short interest on IEF-US (10y T-bonds ETF) and TLT-US (30y) is already back near cycle highs. Rampant bearish sentiment on US T-bonds usually provides a powerful contrarian signal. Second, low bond yields help the government to finance its growing debt load and the Fed has been vocal on the need for additional stimulus. Third, with the Fed adopting an average inflation target framework, higher bond yields would work against achieving this goal, in our view. Finally, US banks are loaded with Treasuries, considering that they account for roughly 6% of total assets (third panel). As bond vigilantes seem to be testing the Fed’s resolve, it will be interesting to see if the central bank will draw a line in the sand, either through rising bond purchases or through forward guidance.

I agree with Martin, the rise in bond yields isn't anything to get worried about and it presents another buying opportunity in bonds.

When I look at the 5-year iShares 20+ Treasury Bond ETF (TLT), a price index (bond yields move inversely from prices), I see a buying opportunity setting up here:

Moreover, whenever I see Zero Hedge posting a comment on how CTAs are getting ready to liquidate their Treasuries, I take it as a contrarian indicator:

CTAs Are Approaching A Liquidation Trigger Point As They Sell Treasuries | Zero Hedge https://t.co/MrGkovvhyP

— Leo Kolivakis (@PensionPulse) October 23, 2020

What else? My former colleague, Brian Romanchuk, posted an excellent comment on his Bond Economics blog explaining why central banks are always involved with government finances. You can read it here.

Do you really think the Fed is going to allow long bond yields to continue going up? No way, they want to make sure the housing market stays strong and that the economic recovery builds momentum so that inflation can come back and overshoot its target.

Of course, inflation won't come back in a sustainable way and as I explained on this blog three years ago, deflation is headed for the US, and the pandemic has only exacerbated this trend.

Why? Millions of people are unemployed, hundreds of thousands of small businesses are shuttering, the pandemic has exacerbated inequality and shattered retirement dreams, it's only getting worse out there when you look at the big picture concerning inflation vs deflation.

Deflation is winning. Period. I don't care what big bad bond bears are telling you, we have yet to see the secular lows on US long bond yields.

What happens if Democrats win and pass a huge stimulus bill? What if Trump gets re-elected and Republicans pass one?

So what? The secular trends I've been discussing on this blog for years remain intact, at best, bond yields will remain ultra-low for another decade.

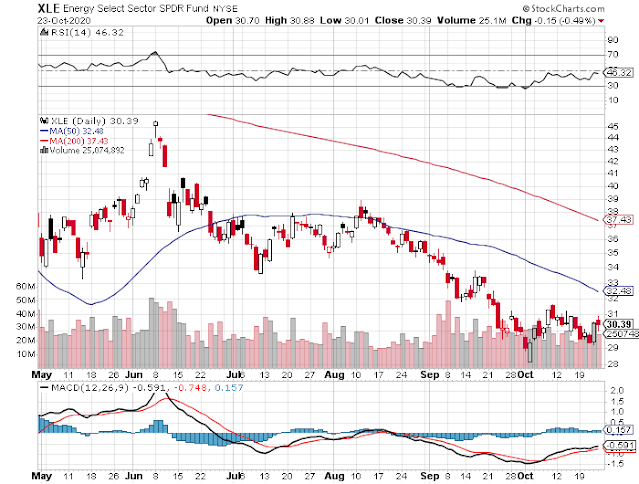

Of course, bond yields creeping up is bad for Technology (XLK) and Homebuilders (XHB) but great for Financials (XLF) and Energy (XLE).

But if you look at the charts above, it looks like tech and homebuilder stocks are experiencing a normal pullback, energy and financial stocks are popping but remain very weak.

It's very tough making big tactical calls on stock sectors, there may very well be a shift out of growth stocks (IWF) into value stocks (IWD), but I think it's too early to make that call and I remain unconvinced:

I'll put it to you this way, if growth falters because of the second and third wave of coronavirus going on all over the world, bond yields will decline and growth stocks will once again be bid up at the expense of value.

It's that simple but people get caught up in making big calls on bonds without understanding what the hell they are talking about.

Here's my advice, the next time you hear someone warning you that a big, bad bond bear market is just getting underway, do me a favor, ignore them or tell them to start reading this blog because they're utterly clueless.

Alright, let me wrap things up. For the week, here is the S&P sector performance:

And here are the best performing large cap stocks of the week:

Shares of Snap Inc (SNAP) soared this week and are having a great year:

Oh how I wish I snapped up some of these shares back in March (let it simmer down now).

That's it from me folks, enjoy your weekend, I'll be back next Friday with another market comment.

Below, Ed Yardeni, president and chief investment strategist at Yardeni Research, says the Federal Reserve will be very concerned and may act if the bond yield moves above 1% and is advising clients to stay in US equities. He speaks with Bloomberg's Vonnie Quinn on "Bloomberg Markets."

And CNBC's "Halftime Report" team talks with BlackRock’s bond king Rick Rieder about why he foresees the market is going significantly higher.

Third, Marko Kolanovic, J.P. Morgan's global head of macro quant and derivatives strategy, joins CNBC's "Halftime Report" team to discuss how he views the market action.

Fourth, Hugh Hendry, former hedge fund manager, says a lot of "zealotry" has been taken out of central banking and explains why he thinks monetary policy is too tight. He speaks with Bloomberg's Jonathan Ferro on "Bloomberg The Open."

Fifth, in a recent panel hosted by the Council on Foreign Relations, Bridgewater's Director of Investment Research Rebecca Patterson was asked whether investors seem overly bullish about the prospects for a vaccine and pandemic recovery.

She explains that the disparate performance of various industries seen during the pandemic does not reflect optimism towards its imminent end, and how today’s coordinated monetary and fiscal policy (MP3) has led investors towards equities, reflected in part in the recent pronounced rally of technology stocks. Great insights, take the time to listen to her.

Sixth, an astute blog reader of mine sent me Steven Van Metre’s latest macro comment explaining in great detail why there’s a big problem in the lending markets and why banks continue to troll speculators. Take the time to watch this, love his self-deprecating humour but the message is deadly serious.

Lastly, President Donald Trump and former Vice President Joe Biden participate in the second 2020 presidential debate at Belmont University in Nashville, TN. Trust me, it was much better than the first one.

>

Comments

Post a Comment