Top Funds' Activity in Q4 2020

The latest round of 13F filings from institutional investors is out, revealing to the world the stocks that some of the richest and most successful investors have been buying and selling.

Takeaways From 13F Season: Investors who follow particular fund managers can easily look up what each was buying and selling in the quarter, but other investors may be more interested in overall themes from 13F filings. The fourth quarter of 2020 was a big quarter for the S&P 500, and investors were likely interested in what top managers were buying and selling heading into 2021.

Google parent Alphabet has the attention of fund managers in Q4, with Tepper and Klarman selling and Soros buying.

Auto stocks have been hot in the market, and Cooperman was buying General Motors on the strength while Soros was taking profits.

Buffett took huge new positions in Verizon and Chevron, both of which pay dividend yields above 4.4%. Buffett also reduced exposure to bank stocks in the quarter, selling Wells Fargo, JPMorgan, M&T and PNC.

Several fund managers traded ETFs to play particular themes. Tepper bet on the Energy Sector by buying the XLE fund while Soros made a big bet on emerging markets by buying the EEM fund.

Here’s a rundown of how the smart money was playing some of the most popular stocks last quarter.

David Einhorn’s Greenlight Capital

Notable Q4 Buys/Increases:

Danimer Scientific Inc (NYSE: DNMR)

Fubotv Inc (NYSE: FUBO)

Concentrix Corp (NASDAQ: CNXC)

Dillard's, Inc. (NYSE: DDS)

Sonos Inc (NASDAQ: SONO)

Consol Energy Inc (NYSE: CEIX)

Notable Q4 Sells/Reductions:

David Tepper’s Appaloosa Management

Notable Q4 Buys/Increases:

Amazon.com, Inc. (NASDAQ: AMZN)

Occidental Petroleum Corporation (NYSE: OXY)

Energy Select Sector SPDR Fund (NYSE: XLE)

QUALCOMM, Inc. (NASDAQ: QCOM)

Facebook, Inc. (NASDAQ: FB)

Microsoft Corporation (NASDAQ: MSFT)

Twitter Inc (NYSE: TWTR)

Notable Q4 Sells/Reductions:

PG&E Corporation (NYSE: PCG)

Micron Technology, Inc. (NASDAQ: MU)

AT&T Inc. (NYSE: T)

Alibaba Group Holding Ltd - ADR (NYSE: BABA)

Netflix Inc (NASDAQ: NFLX)

Leon Cooperman’s Omega Advisors

Notable Q4 Buys/Increases:

Mp Materials Corp (NYSE: MP)

General Motors Company (NYSE: GM)

Barings BDC Inc (NYSE: BBDC)

Energy Transfer LP Unit (NYSE: ET)

Comcast Corporation (NASDAQ: CMCSA)

Notable Q4 Sells/Reductions:

AMC NETWORKS INC (NASDAQ: AMCX)

Barry Rosenstein’s Jana Partners

Notable Q4 Buys/Increases:

Laboratory Corp. of America Holdings (NYSE: LH)

W R Grace & Co (NYSE: GRA)

Tegna Inc. (NYSE: TGNA)

TreeHouse Foods Inc. (NYSE: THS)

Notable Q4 Sells/Reductions:

Callaway Golf Co (NYSE: ELY)

Jeff Smith’s Starboard Value

Notable Q4 Buys/Increases:

ON Semiconductor (NASDAQ: ON)

ACI Worldwide (NASDAQ: ACIW)

Corteva (NYSE: CTVA)

NortonLifeLock (NASDAQ: NLOK)

Notable Q4 Sells/Reductions:

Warren Buffett’s Berkshire Hathaway

Notable Q4 Buys/Increases:

Verizon Communications Inc. (NYSE: VZ)

Merck & Co., Inc. (NYSE: MRK)

AbbVie Inc (NYSE: ABBV)

T-Mobile Us Inc (NASDAQ: TMUS)

Chevron Corporation (NYSE: CVX)

Notable Q4 Sells/Reductions:

Apple Inc (NASDAQ: AAPL)

Wells Fargo & Co (NYSE: WFC)

Barrick Gold Corp (NYSE: GOLD)

M&T Bank Corporation (NYSE: MTB)

PNC Financial Services Group Inc (NYSE: PNC)

Pfizer Inc. (NYSE: PFE)

JPMorgan Chase & Co. (NYSE: JPM)

George Soros’ Soros Fund Management

Notable Q4 Buys/Increases:

Quantumscape Corp (NYSE: QS)

iShares MSCI Emerging Markets ETF (NYSE: EEM)

Walt Disney Co (NYSE: DIS)

Amazon.com, Inc. (NASDAQ: AMZN)

Nike Inc (NYSE: NKE)

Uber Technologies Inc (NASDAQ: UBER)

Notable Q4 Sells/Reductions:

Carl Icahn’s Icahn Capital

Notable Q4 Buys/Increases:

Icahn Enterprises LP Common Stock (NYSE: IEP)

Bausch Health Companies Inc (NYSE: BHC)

Dana Inc (NYSE: DAN)

Xerox Holdings Corp (NYSE: XRX)

Notable Q4 Sells/Reductions:

Bill Ackman’s Pershing Square Capital

Notable Q4 Buys/Increases: (none)

Notable Q4 Sells/Reductions:

Starbucks Corporation (NASDAQ: SBUX)

Restaurant Brands International Inc (NYSE: QSR)

Lowe’s Companies Inc (NYSE: LOW)

Agilent Technologies Inc (NYSE: A)

Hilton Hotels Corporation (NYSE: HLT)

Seth Klarman’s Baupost Group

Notable Q4 Buys/Increases:

Intel Corporation (NASDAQ: INTC)

Marathon Petroleum Corp (NYSE: MPC)

Facebook, Inc. (NASDAQ: FB)

eBay Inc (NASDAQ: EBAY)

Notable Q4 Sells/Reductions:

It's that time of the year again where we get to peek into the portfolios of the world's top money managers, with a customary 45 day lag.

Now, you might wonder why a 45 day lag? If Cathie Wood, founder, CEO & CIO of ARK Invest and the hottest portfolio manager on the planet right now can post her daily activity of what they bought and sold in the ARK funds (for example, see her ARK Innovation ETF (ARKK) holdings here), then why can't all these top funds do the same?

The answer? They don't want you to have access to their daily activity and refuse to be as transparent as Ms. Wood is.

Anyway, before I cover 13F holdings, let's go over some market news as the S&P 500 fell slightly on Friday to end a losing week:

Stocks came under pressure Friday afternoon, reversing early gains.

The Dow Jones Industrial Average finished the day up less than 1 point at 31,494.32 after climbing more than 150 points earlier in the session. The S&P 500 finished down 0.19% at 3,906.71 while the Nasdaq Composite gained less than 0.1% to finish at 13,874.46.

Though the major indexes traded higher for most of the morning, a combination of rising interest rates and profit taking in some of the market’s largest technology companies appeared to dampen optimism after noon.

For the week, the S&P 500 lost 0.71% while the Nasdaq shed 1.57%. The Dow fared better with a slight gain of 0.11%.

Cyclical stocks outperformed the broader market with the materials, energy and industrials sectors up 1.8%, 1.7% and 1.6%, respectively. Utilities and consumer staples stocks were among the biggest laggards.

Small-cap stocks, which also tend to track the ups and downs of the broader economy, clinched solid gains Friday at the expense of some of the market’s largest members. The Russell 2000 added 2% while Facebook, Amazon, Netflix, and Microsoft all fell. Apple ended the week down 4%.

Not all of technology underperformed as chipmakers proved resilient. Applied Materials, which makes the equipment used to manufacture semiconductors, gave a better-than-expected second-quarter forecast after the bell Thursday. The shares gained 5.3% Friday.

The strength among economically sensitive stocks came after Treasury Secretary Janet Yellen told CNBC Thursday after the bell that more stimulus is necessary even as some economic data suggested a rebound is already underway. She added a $1.9 trillion stimulus deal could help the U.S. get back to full employment in a year.

“We think it’s very important to have a big package [that] addresses the pain this has caused – 15 million Americans behind on their rent, 24 million adults and 12 million children who don’t have enough to eat, small businesses failing,” Yellen told CNBC’s Sara Eisen during a “Closing Bell” interview.

“I think the price of doing too little is much higher than the price of doing something big. We think that the benefits will far outweigh the costs in the longer run,” she added.

Still, the stock market’s rally to records stalled a bit this week as fears of rising rates and higher inflation crept in.

Some investors have said pessimism over a jump in interest rates and the potential for inflation have kept Wall Street in check in recent sessions. The 10-year Treasury yield this week rose to the highest in nearly a year, and on Friday rose another 5 basis points to 1.34%.

“I think that this week may have put a little bit of inflation fear into people. Not necessarily in the short term, but this could turn really quickly,” said JJ Kinahan, chief market strategist at TD Ameritrade.

“You saw some pretty decent-sized swings this week in rates. I don’t want to get too carried away – it’s not like the 10-year is creeping above 2%,” he continued. But “I just think that because of the velocity of how quickly we started the year, it may just be a little bit of people taking a breather.”

Yellen, though, said she doesn’t believe inflation should be the biggest concern.

“Inflation has been very low for over a decade, and you know it’s a risk, but it’s a risk that the Federal Reserve and others have tools to address,” she said. “The greater risk is of scarring the people, having this pandemic take a permanent lifelong toll on their lives and livelihoods.”

Many on Wall Street agree with Yellen that a large stimulus is needed and that a trillion-dollar package, along with a smooth economic reopening this year, will cause the market rally to continue.

“A big part of our rationale for additional gains from here is dependent on a continued belief that the major drivers that helped carry the market to current levels will remain intact,” Scott Wren, Wells Fargo’s senior global market strategist, said in a note. One of the drivers is “additional stimulus from Congress that will help bridge the gap between now and when vaccines are widely distributed.”

The House of Representatives will try to pass a $1.9 trillion coronavirus relief plan before the end of February, Speaker Nancy Pelosi said Thursday. Democratic Congressional leaders may try to pass a package without votes from Republicans.

After a temporary pullback in December, homebuyers returned to the market in January despite record low supply. Closed sales of existing homes in January increased 0.6% compared with December, according to the National Association of Realtors.

Sales ended the month at a seasonally adjusted, annualized rate of 6.69 million units. That figure is 23.7% higher compared with January 2020 and the second-highest sales pace since April 2006.

The big story this week is the rise in long bond rates with the yield on the 10-year Treasury note on the verge of making a new 52-week high:

That's why I don't get too flustered about rates creeping up, they'd have to jump well above 2% for there to be a really significant sell-off.

And to be honest, I think the bond market is wrong, far too worried about inflation which isn't going to happen.

Having said this, the vaccine rollout is going well all around the world (except here in Canada) and I suspect we will reach herd immunity in many OECD countries by late summer.

Once this second stimulus package passes in the US, it will also help boost the ongoing economic recovery, that will boost the US dollar and put a little more pressure on long bond yields.(I see us hovering around 1.6% on the 10-year by summer).

Again, the backup in yields is more of a growth story, nothing to do with inflation which is more cyclical, not secular in nature.

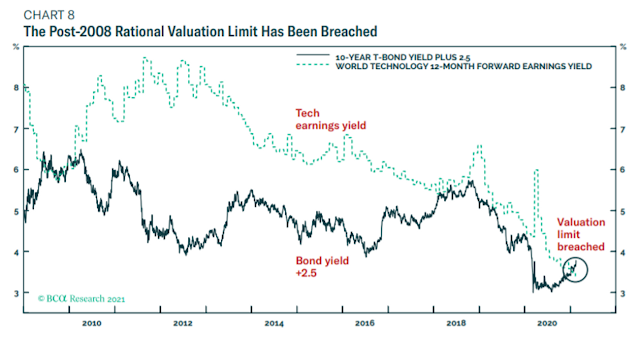

But the backup in long bond yields will put pressure on growth stocks, and it can turn a rational bubble into an irrational one:

Dhaval Joshi, chief European investment strategist for BCA Research, has said for some time that low yields meant the rally into stocks and other assets, made sense — a rational bubble, if you will. “Rational, because the nosebleed valuations are justified by a fundamental driver. And not just any fundamental driver, but the most fundamental driver of all – the bond yield,” he writes.

But not now. Forward price-to-earnings multiples have been rising even as yields have climbed. The earnings yield in the most growth-focused sector, technology, has now been surpassed by the bond yield plus a fixed amount, as the chart shows.There are three ways this can resolve. One, is for stock prices to decline; another is for bond yields to decline; a third is for neither to move but earnings to rise, to improve stock valuations. (That third factor looks unlikely, for now, at the tail end of earnings season.)“Our current recommendation is to stay tactically neutral for the next few weeks to see whether risk-asset valuations can revert to rationality. This means keep existing investments in the market, but hold fire on new deployments of cash,” says Joshi. “If valuation reverts to rationality in any of the three ways listed above, then investors can safely deploy new cash into the market.”

And what about if not? Joshi says if the market turns irrational, the key will be to look if investors at longer-time horizons join the party. “As investors with longer and longer time horizons join the irrational bubble, there will be well-defined moments of heightened fragility, at which correction risk increases. This is what burst the irrational bubble in 2000, and will burst any new irrational bubble.”

Looking at the weekly chart of US long bond prices, I wouldn't be surprised if the selling pressure (backup in bond yields) subsides here as the move was a bit too extreme in my opinion:

If long bond prices continue to drop -- ie. long bond yields continue to back up -- then expect there to be some real fireworks in certain vulnerable sectors of the stock market which ran up like crazy since last March.

That remains to be seen, one thing is for sure, the backup in long bond yields helped propel cyclical shares higher this week and it hurt utilities and other dividend sectors:

Alright, the information above gives you a good macro background of where we are now.

Keeping this in mind, let's go back now to see what top funds bought and sold during the last quarter of the year.

Zero Hedge provided a good snapshot summary of some of the key position changes revealed at the more popular hedge funds in the 4th quarter, courtesy of Bloomberg:

ADAGE CAPITAL PARTNERS

- Top new buys: BMY, LSPD, SAGE, PH, OXY, TWTR, RKT, WEC, ANNX, CMI

- Top exits: PFE, CCK, TM, GRA, HSC, ATR, WM, SIRI, VMC, PCG

- Boosted stakes in: AMZN, JNJ, ST, BRK/B, HZNP, UPS, UAA, HON, DHR, TXN

- Cut stakes in: OTIS, ROST, CSCO, BAC, RTX, C, FIVE, ITT, FCX, BMRN

APPALOOSA

- Top exits: AVGO, QCOM, VST, TSLA, HUM

- Boosted stakes in: PCG, MU, MSFT, ET

- Cut stakes in: AMZN, T, GOOG, BABA, FB, NFLX, PYPL, WFC, V, MO

BALYASNY ASSET MANAGEMENT

- Top new buys: LULU, BAC, GOOGL, TJX, SNX, ROP, CARR, VAR, TMUS, XOM

- Top exits: JPM, FLT, NSC, C, NKE, AZN, SAIC, TWLO, LSTR, CTLT

- Boosted stakes in: MCD, CTSH, MDT, SWKS, WAT, CMCSA, RTX, TWTR, AJG, MSI

- Cut stakes in: FISV, QGEN, LITE, NXPI, QRVO, ITW, DKS, GM, LHX, HOLX

BAUPOST GROUP

- Top new buys: PSTH, MU, AMAT, PEAK, HWM

- Top exits: AKBA, HCA, ABC, UNVR, VTR

- Boosted stakes in: PCG, SSNC, VRNT, HDS, VSAT

- Cut stakes in: EBAY, GOOG, TBPH, HPQ, FB, VIST, CLNY, FOXA, QRVO

BERKSHIRE HATHAWAY

- Top new buys: ABBV, MRK, BMY, SNOW, TMUS, PFE

- Top exits: COST

- Boosted stakes in: BAC, GM, KR, LILAK

- Cut stakes in: WFC, JPM, PNC, GOLD, MTB, LBTYA, AXTA, DVA, AAPL

BRIDGEWATER ASSOCIATES

- Top new buys: WMT, PG, KO, JNJ, PEP, MCD, ABT, MDLZ, EL, DHR

- Top exits: INDA, LMT, PM, FIS, MO, CI, FISV, ADP, AMT, TMUS

- Boosted stakes in: BABA, EEM, VWO, IEMG, COST, SBUX, JD, TGT, NIO, DG

- Cut stakes in: IVV, SPY, FXI, MCHI, EWY, EWZ, LOW, HD, SHW, SINA

COATUE MANAGEMENT

- Top new buys: SNOW, RUN, Z, NUAN, LB, ZG, GPS, DECK, AEO, URBN

- Top exits: BA, HWM, SFIX, NOW, TDG, BBBY, TWTR, SKT, HD, AAP

- Boosted stakes in: TSLA, GPN, SQ, PLAN, UBER, SHOP, FB, DIS, DOCU, NFLX

- Cut stakes in: LBRDK, DXCM, SMAR, OKTA, MU, GH, DDD, SRNE, SDC, LRCX

CORSAIR CAPITAL MANAGEMENT

- Top new buys: PSTH, ECPG, BERY, CCK, APG, PCG, GSAH, MS, LKQ, GVA

- Top exits: IWO, REPH, HGV, IWM, SMIT, GSL

- Boosted stakes in: VRT, GDDY, NATR

- Cut stakes in: QQQ, BXRX, PRSP, VOYA, PLYA, CHNG, STAR, HMHC, C, WMB

CORVEX MANAGEMENT

- Top new buys: ILMN, FE, ACM, TWTR, DIS, ZEN, HCA, NAV, FIVE

- Top exits: IAA, CNC, TIF, FLMN, CZR

- Boosted stakes in: EXC, BABA, ATVI, CNP, ATUS, CMCSA, HUM, LYV, EVRG

- Cut stakes in: MSGS, AMZN, PCG, NFLX, ADBE, TMUS

D1 CAPITAL PARTNERS

- Top new buys: U, IR, BEKE, BLL, DT, SNOW, OM, GDRX, ADI, CD

- Top exits: AMZN, AZO, FLT, BFAM, ESTC, TSM, SBUX, API, ALLO, HST

- Boosted stakes in: CVNA, JD, MSFT, EXPE, GOOGL, PNC, LYV, FB, RH, JPM

- Cut stakes in: BABA, NFLX, LVS, DHR, FIS, HLT, AVB, ORLY, PLAN, HPP

DUQUESNE FAMILY OFFICE

- Top new buys: NUAN, GDX, NEE, XLI, EXPE, CVNA, PANW, ADI, SNE, NET

- Top exits: XBI, HD, WFC, CB, INSM, SRPT, AZO, MAR, CRWD, TCDA

- Boosted stakes in: MSFT, PENN, BABA, TMUS, SBUX, MELI, AMZN, JD, VZ, FIS

- Cut stakes in: JPM, PYPL, WDAY, GOOGL, BKNG, CCL, LYV, FSLY, REGN, NFLX

ELLIOTT MANAGEMENT

- Top new buys: UNIT, CUB

- Top exits: T, RYAAY, SPR

- Boosted stakes in: DELL, CRMD

- Cut stakes in: WELL, RILY

ENGAGED CAPITAL

- Top new buys: EVH, MX

- Top exits: SMPL

- Boosted stakes in: NCR, STKL, IWM

- Cut stakes in: MED, RCII

GREENLIGHT CAPITAL

- Top new buys: SNX, NCR, TWTR, INTC, INGR, DDS, UHAL, ICPT, GHC, PANA

- Top exits: TPX, SATS, WHR, XELA

- Boosted stakes in: GLD, AAWW, JACK, REZI, NBSE

- Cut stakes in: AER, GDX, GPOR, CNX, APG, TECK, CC, CHNG

ICAHN

- Boosted stakes in: IEP, XRX

- Cut stakes in: HLF, LNG

IMPALA ASSET MANAGEMENT

- Top new buys: FDX, RKT, FCX, VALE, SBSW, FND, MHK, ALK, THO, AGQ

- Top exits: QCOM, HES, VAC, DOOO, MU, TGT, DKS, SKX, TJX, CRNC

- Boosted stakes in: KSU, WYNN, KNX, KL, CMI, SBLK, CNK, CENX

- Cut stakes in: RIO, SIX, DRI, HOG, TOL, ADNT, TTWO, NSC, MT, LPX

LAKEWOOD CAPITAL MANAGEMENT

- Top new buys: LBRDK, TMUS, CWH, GLD, LOW, UPWK, SAIC, VVV, MIK

- Top exits: YNDX, BLDR, NKLA, SHAK

- Boosted stakes in: ABG, ANTM, COF, C, SKX, APO, BHC

- Cut stakes in: BIDU, BC, CI, CMCSA, CWK, AXS, GOOGL, WRK, FB, GS

LANSDOWNE

- Top new buys: IDA, BLDP, EQT, CDE, LOOP, KCAC, RIDE

- Top exits: ONEM, GE, SMMT, GDX, AAL, NKE, SALT

- Boosted stakes in: FCX, TSM, OTIS, FSLR, EGO, DAR, ETN, COG, TMUS, AG

- Cut stakes in: C, MU, DAL, LRCX, AMAT, LUV, UAL, AES, ADI, VMC

LONG POND

- Top new buys: GLPI, PGRE, EXPE, NTST, H, MGP, XHR, RLJ

- Top exits: FR, SEAS, INVH, MAR, HST, BXP, TRNO, DRH, ESRT, REXR

- Boosted stakes in: EQR, AVB, SHO, WELL, AIV, RHP, DEI, HPP, CPT, JBGS

- Cut stakes in: HLT, PEAK, WH, SBRA, MAA, MAC, HGV, LVS

MAGNETAR FINANCIAL

- Top new buys: VAR, MXIM, MPLN, BMCH, GLIBA

- Top exits: QGEN, PAYA, UTZ, FSR, HYLN, CCC, PACB, SNY, PCG, IR

- Boosted stakes in: EHC, ABBV, GRUB, PIC, SYNH, NVS, PTAC, MRK, CHNG, AVTR

- Cut stakes in: UBER, VLDR, LCA, AZN, BDX, NOVA, HCAC, PRGO, PKI, PAE

MAVERICK CAPITAL

- Top new buys: BX, NKE, GPN, BECN, GPRO, OSH, GME, MCD, LB, TGT

- Top exits: BTI, STNE, IRBT, SCHW, NTAP, GIS, CHGG, FL, PLCE, BIG

- Boosted stakes in: LRCX, GLW, TGTX, LOGI, FLT, PRSP, DD, AMAT, LIVN, AXP

- Cut stakes in: GOOG, NFLX, AVTR, DLTR, MSFT, APD, AMZN, FB, HUM, ALNY

MELVIN CAPITAL MANAGEMENT

- Top new buys: ALGN, MCD, DDOG, TJX, AMD, MSCI, WDAY, SBAC, LYV, TEAM

- Top exits: CRM, FLT, FIS, CSGP, WEN, YUM, TWLO, NFLX, FB, VRSN

- Boosted stakes in: BABA, PINS, NKE, NOW, EXPE, ADBE, FISV, GOOGL, DOCU, LVS

- Cut stakes in: AZO, PYPL, AMZN, MSFT, DPZ, JD, RACE, DECK, CAR, BURL

OAKTREE CAPITAL MANAGEMENT

- Top new buys: MEG, UNIT, VALE, AMX, CEO, EQR, GTXMQ, XPEV, LEA

- Top exits: TMHC, BABA, CZR, IHRT, CCO, SRNE, BCEI

- Boosted stakes in: TRMD, NMIH, IBN, EGLE, KC, TV, ASC, ITUB

- Cut stakes in: CCS, AU, TSM, PBR, MELI, BBD, API, GTH, INDA, BIDU

OMEGA ADVISORS

- Top new buys: GOOGL, ATH, VRT, MSI, FVAC, EPD, MNRL

- Top exits: JPM, CNC, GTN, VICI, DNRCQ

- Boosted stakes in: COOP, OCN, ASPU, FCRD, NAVI, STKL, AMCX, ASH, FOE, SNR

- Cut stakes in: CI, PE, SRGA, GCI, NBR, LEE, ABR

PERSHING SQUARE

- Cut stakes in: A, HLT, LOW

SOROBAN CAPITAL

- Top new buys: ADI, PSTH, FISV, FIS, ARMK

- Top exits: NOC

- Boosted stakes in: YUM, ATUS, MSFT, CSX, RTX

- Cut stakes in: FB, SNE, AMZN

SOROS FUND MANAGEMENT

- Top new buys: QQQ, PLTR, XLI, MCHP, U, VAR, MXIM, DIS, MCHI, NGHC

- Top exits: TDG, GRFS, BK, BAC, JPM, GS, PNC, USB, WFC, TFC

- Boosted stakes in: DHI, DRI, ARMK, GM, ATVI, PFSI, TIF, MT, CHTR, APTV

- Cut stakes in: IGSB, PCG, TMUS, NLOK, PTON, C, GOOGL, OTIS, LPLA, LQD

STARBOARD

- Top new buys: SPY, CTVA

- Top exits: EBAY

- Boosted stakes in: ACM, ACIW, IWN, GDOT, IWR, MMSI, SCOR, BOX

- Cut stakes in: NLOK, AAP, IWM, CERN, CVLT

TEMASEK HOLDINGS

- Top new buys: DCT, SNOW, SE, IAU, GOVT, SCHP, XLK, BNTX, EWT, IWM

- Top exits: FIS, VRT, PDD, NIO

- Boosted stakes in: PYPL, AMZN, IBN, HDB, DDOG

- Cut stakes in: TME, TMO

THIRD POINT

- Top new buys: PCG, MSFT, TDG, FTV, EXPE, PINS, AVTR, CZR, PLNT, GDRX

- Top exits: BAX, RTX, NKE, EVRG, ATVI, TTWO, GPS, CNNE

- Boosted stakes in: BABA, JD, BKI, FB, V, BURL, INTU, TEL, ETRN, SHY

- Cut stakes in: GB, IQV, ADBE, DIS, AMZN, IAA

TIGER GLOBAL

- Top new buys: SNOW, GSX, BEKE, SUMO, BIGC, JAMF, FROG, GDRX, CD, ASAN

- Top exits: NEWR, ATH, CHWY

- Boosted stakes in: PDD, CRWD, PTON, ZM, NOW, AMZN, UBER, WDAY, TEAM, MSFT

- Cut stakes in: SVMK, PYPL, TWLO, CRM, BABA

TUDOR INVESTMENT

- Top new buys: NGHC, KDP, GDRX, VICI, HEC, FSLR, LIN, RXT, DLR, RPAY

- Top exits: SOXX, O, X, TMUS, TME, NLOK, SCHW, AVB, SJM, CDAY

- Boosted stakes in: GRUB, GLIBA, KC, BDX, GOOGL, AMT, TEAM, CVX, ADBE, AMD

- Cut stakes in: PCG, CRWD, UBER, ATHM, NFLX, SBAC, ESS, BXP, THO, BXMT

VIKING GLOBAL INVESTORS

- Top new buys: TSM, AVB, AMD, RTX, GOOGL, CSGP, ZBH, BILL, BMY, OTIS

- Top exits: UBER, JD, CRM, PLAN, LOW, SHW, LIN, NFLX, DHR, BABA

- Boosted stakes in: MSFT, TMUS, MELI, FIS, CME, JPM, BKNG, PH, NUAN, HLT

- Cut stakes in: AMZN, CMCSA, CI, LVS, ALL, DRI, FTV, SE, RPRX, WDAY

Source: Bloomberg

Again, this is all lagged data, which is why I'm going to show you how to look at stocks (any stock) in real time so you can stop fretting over what Soros et al. are buying and selling.

I'm going to use shares of Bausch Health Companies (BHC), a top holding of Paulson, ValueAct, Glenview and now Icahn (see full list of top institutional holders here).

First, let's look at the weekly chart. Go to stockcharts.com and type in BHC and change setting for it's weekly and go back 5 years. For the purposes of this exercise, I used the 10, 50 and 200 week moving averages:

You see how it's breaking out here, well above its 10-week moving average and making a new three-year high? Also, the weekly MACD is positive and rising which supports more gains ahead.

What about short term moves? I typically use one year daily charts and the 9 and 20 day exponential moving averages to see if a stock is overbought or oversold in the short run:

Using the daily chart, it tells me shares of BHC are a little overbought in the short-term and might correct a little but if they hold key levels, it's a buying opportunity to load up as the weekly chart tells me it's headed much higher.

Now, this isn't a science but it can help you navigate a lot of stocks which move, especially meme stocks that were pumped and dumped recently.

Look at the daily chart on BlackBerry (BB) shares:

Now look at the weekly chart:

You see how it spiked to over $28 on the daily, was way overbought and has corrected hard ever since?

Now, I want to see if it holds its 10-week moving average or goes to test its 200-week moving average.

The key point I want to make here, no matter which stock you're buying or selling, you need to make informed decisions and above and beyond the fundamentals, you need to know your key daily and weekly levels or else you're flying blind.

Stop worrying about what top fund managers bought and sold last quarter, start understanding the macro backdrop (most important thing) and then analyze stocks and other risk assets using daily and weekly charts (and monthly if you have access to them).

Capiche? What else? Shares of Palantir (PLTR) soared today, up 15% on massive volume after WallStreetBets touted it (after Cathie Wood touted it earlier this week on CNBC):

This stock is fairly new, doesn't have much history, so I only use the daily chart to gauge it:

And? What does this daily chart tell me? It tells me not to get too excited until the stock breaks above $30 and sustains an uptrend.

The same thing with that Yahoo Finance snapshot of the one -month chart I provided above, it tells me not to get excited about today's pop and not to chase it.

In fact, I'd probably be shorting it here if I was a professional hedge fund trader but managing my risk very tightly as stocks like this can explode up.

My point is do not get too excited, I know many hedge funds and top funds own shares of Palantir (see full list here), but I don't care, I stay emotionless and analyze it like I'd analyze any other stock.

The same goes for QuantumScape, another hot stock with a short history. Here, the daily looks good but not great as the daily MACD is still negative:

I know Fidelity, Soros, Millennium, Baillie Gifford and other top funds loaded up on it in Q4 (see full list here) but that doesn't tel me whether they played the massive run-up and sold or are still holding it (they probably pumped, dumped and bought it back at the end of Q4).

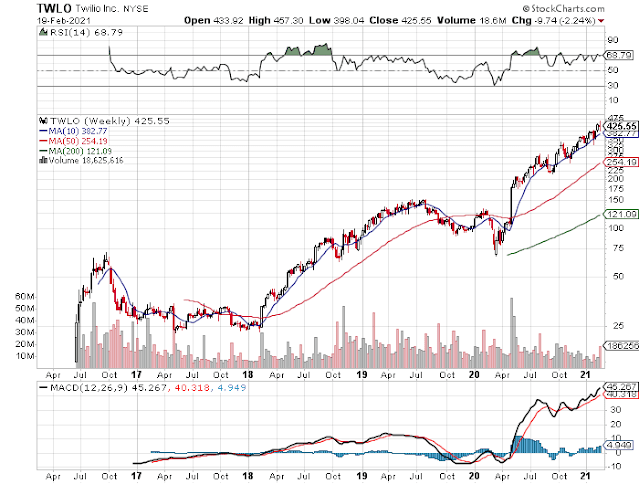

Let's look at another one, Twilio Inc (TWLO), a top holding of Cathie Wood's ARK Innovation fund:

Both the daily and weekly chart tell me this stock is in a bullish uptrend but the daily tells me it's overbought in the short term and is due for a correction and has to hold key levels (like its 10-week moving average).

What about GameStock (GME) which continues to be the most heavily shorted stock in the stock market?

First, look at the 5-year weekly chart:

I would have bought this at $20 and probably gotten rid of it in the low 40s (didn't touch it) and missed the explosive upside.

But look at its daily chart, it's telling me to stay the hell away from this stock:

Sure, short sellers will cover, it might go to $55 but they will come back in hard and short it even harder (short sellers aren’t stupid, they periodically cover to reel in more buyers and then slam them).

Who bought GME in Q4 of 2020? The full list is available here and some big name hedge funds like Maverick Capital made a killing but I know they're long gone now.

That brings me to another important point, be careful with these WallStreetBets stocks, I'm almost sure they are in cahoots with big hedge funds pumping and dumping stocks.

Every week I see pump-and-dumps in the stock market and I know it's big hedgies driving the insane action, mostly in small biotechs but not exclusively, they do it all over.

Where is the SEC? The SEC doesn't care as long as big hedge funds make a killing and pay big banks big fees (read my comment on YOLOers of the world uniting, the game is totally rigged!).

Alright, let me wrap it up there, there are a lot of interesting stocks I wanted to cover like Freeport McMoran (FCX), Cameco (CCJ), Haliburton (HAL), Vale (VALE) and BioCryst Pharmaceuticals (BCRX) but you definitely don't pay me enough to cover all these stocks and a lot more.

Use the information above wisely, use 13F filings wisely, stay disciplined, stay nimble, manage your position and portfolio risk well, these markets may look easy and made for trading but one wrong move taking too much risk and you're dead.

Trust me, it takes years of analyzing macro markets and stocks across all sectors to be a great investor and trader, I'm just giving you a glimpse of what I look at on a daily level.

The majority of the people out there are better off buying the S&P 500 ETF (SPY), the Nasdaq (QQQ) and emerging markets (EEM) although they make me nervous now.

I typically end these quarterly comments with links to top funds and their holdings but the new Nasdaq site doesn't provide this information yet (only for stocks, you type in your symbol at the top, scroll down the left hand side and click on institutiotnal holdings).

Alternatively, you can copy and paste the following link in your web browser:

https://www.nasdaq.com/market-activity/stocks/XYZ/institutional-holdings

Just change XYZ for the stock symbol of your choice to see which funds own it as of the end of last quarter (remember, the data is lagged by 45 days).

Once the new Nasdaq site starts provided fund data, I will edit this comment to add the links.

The links below take you straight to their top holdings and then click on the column head "Change (%)" to see where they increased and decreased their holdings (you have to click once or twice to see).

These funds are run almost exclusively by men but one of the most impressive ones, ARK, is run by a lady called Cathie Wood, the best investor you never heard of (well, by now, you've all heard of her).

Top multi-strategy and event driven hedge funds

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Peak6 Investments

6) Kingdon Capital Management

7) Millennium Management

8) Farallon Capital Management

9) HBK Investments

10) Highbridge Capital Management

11) Highland Capital Management

12) Hudson Bay Capital Management

13) Pentwater Capital Management

14) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

15) ExodusPoint Capital Management

16) Carlson Capital Management

17) Magnetar Capital

18) Whitebox Advisors

19) QVT Financial

20) Paloma Partners

21) Weiss Multi-Strategy Advisors

22) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Element Capital

12) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Numeric Investors now part of Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Associates

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) Broadfin Capital

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Sectoral Asset Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) RTW Investments

18) Bridger Capital Management

19) Boxer Capital

20) Bridgeway Capital Management

21) Cohen & Steers

22) Cardinal Capital Management

23) Munder Capital Management

24) Diamondhill Capital Management

25) Cortina Asset Management

26) Geneva Capital Management

27) Criterion Capital Management

28) Daruma Capital Management

29) 12 West Capital Management

30) RA Capital Management

31) Sarissa Capital Management

32) Rock Springs Capital Management

33) Senzar Asset Management

34) Southeastern Asset Management

35) Sphera Funds

36) Tang Capital Management

37) Thomson Horstmann & Bryant

38) Ecor1 Capital

39) Opaleye Management

40) NEA Management Company

41) Great Point Partners

42) Tekla Capital Management

43) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Pan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

Below, ARK Invest founder, CIO and CEO Cathie Wood is the hottest portfolio manager on the planet right now, delivering incredible returns, and she appeared on CNBC's Halftime Report earlier to discuss her Tesla, Teledoc and Zoom positions and the future of a bitcoin ETF with Scott Wapner and Bob Pisani.

Whether or not you agree with her, take the time to listen to her insights. You can see the holdings of the ARK Innovation Fund ETF (ARKK) by clicking here, it is updated every day. The holdings for other ARK funds are available here.

And yesterday, the US House Comittee on Financial Services held hearings online to look into the GameStop saga. the hearings featured Robinhood CEO, Vlad Tenev, Melvin Capital CEO Gabriel Plotkin and Ken Griffin, CEO of Citadel.

I wasn't impressed, some parts were revealing but there was way too much moralizing by some Democrats who used this forum to chastize rich hedge fund managers.

But I didn't agree with everything Ken Griffin said, praising Gabriel Plotkin as "one of the best traders of his generation" (umm, he might be great at picking stocks but his risk management totally sucks!) and truth be told, I thought AOC asked the best questions (she did her homework and others should have ceded their time to her). Still, if you have patience, take the time to watch this.

The hedge fund manager who impressed me the most last year wasn't even Chase Coleman, although he delivered great results and cashed in big time, it was Perceptive Advisors' Joseph Edelman, who picked some great biotech winners like Novavax (NVAX) and many others. When it comes to biotech, they are at the top of their game.

Third, Interactive Brokers founder and chairman Thomas Peterffy says there's nobody to blame, but there is a clear problem in the system that caused the massive run in GameStop stock. He joined 'Closing Bell' earlier this week to discuss a simple fix to the problem which the SEC can regulate (don't hold your breath).

Lastly, take the time to watch an interview with hedge fund legend Stanley Druckenmiller where he discusses his current outlook on the market, his approach to risk management throughout his career, and his perspective on the conversation surrounding the role of capitalism in American society.

My favorite part is when he talks about VaR and how he doesn't need it because he looks at his portfolio's P&L. Great interview, don't agree with him on everything but love listening to his insights.

Comments

Post a Comment