PSP Investments' CEO Discusses Fiscal Year 2022 Results and More

- Ten-year net annualized return of 9.8% leads to $25.9 billion in cumulative net investment gains above Reference Portfolio, indicative of long-term added value through portfolio construction and active management decisions

- Five-year net annualized return of 9.0% leads to $19.7 billion in cumulative net investment gains above Reference Portfolio

- One-year total portfolio net return of 10.9% outperforms Reference Portfolio

- Continued focus on risk management supports agile response to markets in a rapidly evolving global landscape

- Inaugural green bond issuance, first climate strategy and bespoke Green Asset Taxonomy indicate continuing focus on integrating ESG factors into responsible investment decision-making

- Shift to a hybrid workplace poised to attract and retain top talent in a highly competitive environment

Montréal, Canada, June 9, 2022 - The Public Sector Pension Investment Board (PSP Investments) ended its fiscal year on March 31, 2022, with $230.5 billion of net assets under management (AUM) and a 10.9% one-year net portfolio return. Net assets under management grew by nearly $26 billion, up 12.7% from $204.5 billion at the end of the previous fiscal year. Net contributions represented $3.5 billion, while $22.5 billion was generated from net income.

From a long-term investment approach perspective, PSP Investments measures success at the total fund level through the following performance objectives and their related benchmarks:

- Achieve a return – net of expenses– greater than the return of the Reference Portfolio over a 10-year period: During fiscal year 2022, PSP Investments achieved a 10-year net annualized return of 9.8% against the Reference Portfolio benchmark of 8.4%, leading to $25.9 billion in cumulative net investment gains above the Reference Portfolio. This outperformance of 1.4% per annum represents the value added by PSP Investments’ strategic asset allocation decisions and active asset management activities.

- Achieve a return – net of expenses – exceeding the Total Fund Benchmark return over 10-year and 5-year periods: During fiscal year 2022, PSP Investments achieved a 10-year net annualized return of 9.8% against the Total Fund Benchmark of 8.6% and a 5-year net annualized return of 9.0% against the Total Fund Benchmark of 7.9%. This represents an outperformance of 1.2% per annum (or $16 billion over 10 years) and 1.1% per annum (or $10.6 billion over 5 years) respectively.

During fiscal year 2022, PSP investments continued to generate strong net income as the markets recovered, translating into a higher AUM of $230.5B at the end of the fiscal year as compared to $204.5B at the end of fiscal year 2021. PSP Investments’ increase in operating costs was lower than the average AUM growth of 18.0% and was in line with its strategic and operational priorities including talent retention and total fund performance. Due to a combination of sound cost management and the increase in net AUM, PSP Investments’ total cost ratio decreased below our expected average costs and represents the lowest ratio in the last seven fiscal years.

“In the wake of the pandemic, PSP Investments delivered solid, above-benchmark performance,” said Neil Cunningham, President and Chief Executive Officer at PSP Investments. “We did so at the same time as raising our climate ambition by developing our first climate strategy and a bespoke green asset taxonomy. These actions enable us to use our capital and influence to support the transition to global net-zero greenhouse gas emissions by 2050.”

“Our 10-year and five-year performance indicates the long-term value we add through patient capital, portfolio construction and active investment activities,” said Eduard van Gelderen, Senior Vice President and Chief Investment Officer at PSP Investments. “The broad diversification of our portfolio across public and private asset classes, industries, geographies and currencies has been a key factor in helping us reduce risk and improve resilience.”

[1] This tables excludes Cash and Cash equivalents. All amounts in Canadian dollars, unless stated otherwise.

As at March 31, 2022:

Capital Markets, comprised of Public Market Equities and Fixed Income, ended the fiscal year with $99.9 billion of net AUM, an increase of $2.4 billion from the end of fiscal year 2021. The group generated portfolio income of $2.9 billion, for a one-year return of 3.0% versus the benchmark return of 1.3%. The five-year annualized return was 7.4%, compared to the 6.6% benchmark return. Public Market Equities, with a year-end AUM of $59.1 billion, a one year-return of 6.0% and a five-year return of 10.1% (versus 3.3% and 8.8% for the respective benchmark returns), was able to outperform as global equity markets were impacted by the emergence of highly contagious COVID-19 variants. The majority of Public Market Equities’ positive relative performance in fiscal year 2022 came from alternative investments, where many investments were well-positioned to take advantage of market dislocations induced by a notable increase in macroeconomic events. Fixed Income ended the fiscal year with a net AUM of $40.7 billion and outperformed its one-year benchmark by 0.2% and its five-year benchmark by 0.1%.

Private Equity ended the fiscal year with net AUM of $35.4 billion, up $3.7 billion from the end of the previous fiscal year, and generated portfolio income of $8.6 billion, resulting in a one-year return of 27.6% versus the benchmark return of 19.5%. The five-year annualized return was 17.6% versus a benchmark of 17.2%. The strong performance highlights the strength and quality of the private equity portfolio, both in co-investments and funds. In addition to a favourable valuation environment, portfolio income has been driven by strong earnings growth and cashflows, particularly in the financials and healthcare sectors. The growth of the portfolio was driven by $6.3 billion in valuation gains and $6.4 billion in acquisitions. During the fiscal year, Private Equity deployed $4.4 billion of capital through funds and $2.0 billion in new co-investments which included supporting growth in existing portfolio companies.

Credit Investments ended the fiscal year with net AUM of $21.9 billion, up by $7.4 billion from the end of the previous fiscal year, and generated portfolio income of $1.2 billion, resulting in a 7.5% one-year return that exceeded the benchmark return of -0.5%. The 7.9% five-year annualized return also beat the 2.6% benchmark return. Record levels of acquisition activity by private equity sponsors led to significant opportunities for Credit Investments across the debt capital spectrum.

Real Estate ended the fiscal year with $31.1 billion in net AUM, up by $4.3 billion from the end of the previous fiscal year, and generated $6.4 billion in portfolio income, resulting in a 24.8% one-year return, versus 30.2% for the benchmark return. The 8.7% five-year return exceeded the 8.0% return for the benchmark. Real Estate focused on deploying into high conviction sectors, resulting in key acquisitions within the industrial, residential, life science and studio sectors.

Infrastructure ended the fiscal year with $23.5 billion in net AUM, a $5.1 billion increase from the end of the previous fiscal year and generated $2.7 billion of portfolio income. The one-year return of 13.9% was below the benchmark return of 16.1%. The five-year annualized return of 10.4% exceeded the 6.4% benchmark return. During the fiscal year, Infrastructure deployed $4.8 billion of capital in direct and co-investments and $1.3 billion through the funds. New investments supported energy-friendly transition across Europe and Oceania by acquiring equity participations in utilities and industrials.

Natural Resources ended the fiscal year with net AUM of

$11.6 billion, an increase of $1.9 billion from the end of the previous fiscal year, and generated portfolio income of $1.6 billion, for a one-year return of 15.9%, versus 26.3% for the benchmark return. The 8.5% five-year annualized return beat the benchmark return of 7.6%. The fiscal year was marked by significant valuation gains of $1.3 billion and continued strong deployment of $1.9 billion, mainly in Oceania and the US.Corporate Highlights

We launched the execution of our new strategic plan, PSP Forward, with the vision to be an insightful global investor and valued partner that is selective across markets and is focused on the long-term. Key accomplishments for fiscal year 2022 include:

- We released our Green Bond Framework and issued a C$1.0 billion 10-year Green Bond to fund projects that demonstrate positive environmental and climate outcomes. PSP Investments’ Green Bond Framework is aligned with existing standards in green bond and sustainable debt markets, and was awarded a rating of “Medium Green” and the highest possible governance score of “Excellent” by CICERO Shades of Green.

- We prioritized climate change as an important focus area company-wide during fiscal year 2022 and committed to use our capital and influence to contribute to the transition to global net zero greenhouse gas emissions (GHG) by 2050. By implementing our climate strategy, we expect to reduce our portfolio GHG emissions intensity by 20% to 25% by 2026, from a 2021 baseline. We outlined a clear and straightforward approach for achieving our commitments that include substantial investments in green and transition assets, the latter being those that will require capital and assertive mitigation plans to reduce their carbon intensity along a science-based trajectory. Developed during fiscal year 2022, the climate strategy was launched in April 2022 and is available on our website.

- We continued to enhance our data-driven approach to integrating ESG factors into our investment and asset management processes and practices. We developed an ESG Composite Score that incorporates the standards of the Sustainability Accounting Standards Board and enables our investment teams to integrate ESG information with data-driven insights as we quantitatively assess and monitor a company’s ESG performance. We ranked among the founding members of the ESG Data Convergence Project, the first LP-GP partnership aiming to standardize ESG reporting in the private equity industry We also joined the Institutional Limited Partners Association’s Diversity in Action Initiative and participated in various other industry collaboration initiatives including the Investor Leadership Network, the Sustainable Action Finance Council and Focusing Capital on the Long Term.

- Our technology and digital strategy remains a key strategy enabler, supporting PSP Investments with scalable systems, organized data and advanced analytics. In fiscal year 2022, we continued to modernize and simplify our technology platforms and data governance to enable efficient global investment operations. We also initiated the build-out of our self-serve analytics capabilities and continued incubating use cases within our advanced analytics framework.

- We took action to respond to the opportunity of reimagining the future of work following the workplace disruptions created by the pandemic. One of the changes we embraced was the shift of employee expectations related to flexibility on where, when and how work gets done. During fiscal year 2022, we developed a principles-based hybrid workforce model to facilitate the transition to a new way of working. We placed a heightened focus on the employee experience, building trust, leading with empathy, managing with accountability, leveraging inclusivity and promoting collaboration and well-being.

- Nurturing an inclusive and respectful work environment has been at the top of our people agenda for many years. We recognize the importance of equity, inclusion and diversity (Ei&D) – a cornerstone of our corporate culture - in attracting and retaining top talent and building high-performing teams. We conducted our second annual employee self-identification survey in fiscal year 2022 to continue to better understand our workforce demographics and measure progress. Spearheaded by our Ei&D Council and its eight affinity groups, we continued to embed Ei&D into our workplace culture and developed a three-year roadmap for delivering on our Ei&D priorities. As a notable example, our Veteran Integration Program celebrated its one-year anniversary and is currently recruiting for the next cohort of participants. Our efforts were recognized with a Canadian HR Award in the category Excellence in Diversity and Inclusion and a ranking as a Montréal Top Employer for a fifth consecutive year.

Other corporate highlights include:

- We are deeply committed to the communities where we operate. During fiscal year 2022, our PSP Gives Back campaign raised close to $500,000 (including PSP Investments’ matching donations), which represented a 14% increase over last year. Funds benefited a range of local charities in Montréal, Hong-Kong, London and New York.

- We remain deeply concerned about the humanitarian impact inflicted by Russia’s invasion of Ukraine. While PSP Investments does not have material exposure to Russian investments and does not hold any private direct investments in Russia, we have some exposure through passive index replication and external investment manager activities. As stated in our press release, we took immediate steps to divest of our Russian holdings, committing to exit this market completely as soon as conditions permit, and we continue to actively monitor the evolving risks and implications for our portfolio and investment activities. As a special initiative, we partnered with the International Committee of the Red Cross and raised $139,000 over a three-week period through a combination of employee donations and PSP Investments’ matching contributions.

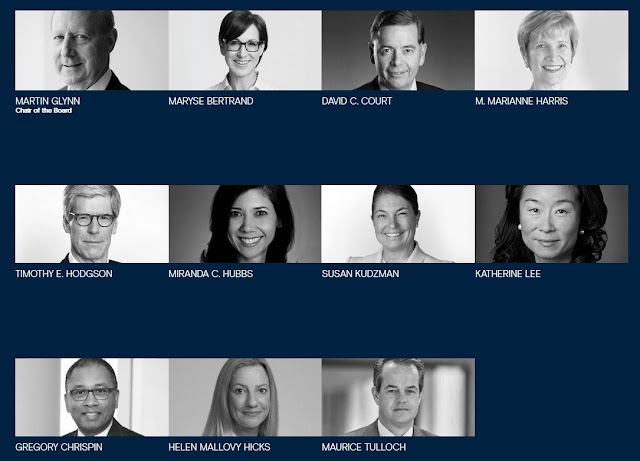

- Board succession planning was an important topic in fiscal year 2022. Mr. Garnet Garven and Mr. William Mackinnon fully completed their mandates. PSP Investments thanked them for their years of exceptional service and welcomed the arrival of three new directors – Mr. Gregory Chrispin, Ms. Helen Mallovy Hicks, and Mr. Maurice Tulloch – and the reappointment of Ms. Miranda Hubbs. PSP Investments’ Board comprises six women and five men, and during fiscal year 2023, all four of the Board’s standing committees will be chaired by women.

- During fiscal year 2022, Ms. Michelle Ostermann joined PSP Investments as Senior Vice President and Global Head of Capital Markets Investments. Mr. Patrick Samson, formerly Senior Managing Director and Global Head of Infrastructure, was appointed Senior Vice President and Global Head of Real Assets.

- During fiscal year 2022, Mr. Neil Cunningham, President and CEO, announced his planned retirement at the end of our next fiscal year, on March 31, 2023. PSP Investments has thrived under Mr. Cunningham’s leadership, with important advances on its strategy and presence in international markets, leading to strong financial performance.

“I want to thank PSP Investments’ management, employees and Board of Directors for their dedication over the past couple of years; their commitment and resilience have been nothing short of amazing,” said Neil Cunningham, President and Chief Executive Officer of PSP Investments. “Despite all challenges and difficulties posed by the pandemic and global affairs, we remained ever mindful of our responsibility to create a better tomorrow for the 900,000 contributors and beneficiaries on whose behalf we invest. While I will be retiring in March 2023, I have confidence in the passion and abilities of my colleagues to ensure PSP Investments’ future sustainability and performance.”

For more information on PSP Investments’ fiscal year 2022 performance, visit our website and download the annual report. In a break from our previous practice, our Responsible Investment Report will be released in the fall of 2022.

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is one of Canada’s largest pension investment managers with $230.5 billion of net assets under management as of March 31, 2022. It manages a diversified global portfolio composed of investments in capital markets, private equity, real estate, infrastructure, natural resources and credit investments. Established in 1999, PSP Investments manages and invests amounts transferred to it by the Government of Canada for the pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has its principal business office in Montréal and offices in New York, London and Hong Kong. For more information, visit investpsp.com or follow us on Twitter and LinkedIn.

Earlier today, I had a chance to talk to Neil Cunningham, President and CEO of PSP Investments.

I will get to our discussion below but first recommend you take the time to download and read PSP's FY 20022 Annual Report which is available here (click on discover our Annual Report).

Importantly, here is the table of contents, and I highly recommend you read Management's discussion of fund performance and results on page 35 to really understand total fund approach as well as activities at an asset class level (page 48).

The the entire report is excellent and it is also well worth reading PSP's Responsible Investment approach:

The report begins by giving you a broad overview of PSP Investments:

A few critical points:

- Net assets under management are now $230.5 billion, making it the fourth largest pension investment manager in Canada behind CPP Investments, CDPQ, and Ontario Teachers' Pension Plan which respectively manage $539 billion, $420 billion and $242 billion. PSP Investments, however, is still getting massive contributions and by next year, it will become the third largest pension fund in Canada.

- There are now over 900,000 contributors and beneficiaries (ie. active and retired members). PSP Investments manages the amounts transferred to it by the Government of Canada for the funding of benefits earned from April 1, 2000 by members of the public sector pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and, since March 1, 2007, the Reserve Force.

- There are 895 employees at PSP working across many groups, IT, Finance, Investments, Risk, etc.

- PSP Investments invests in over 100 sectors and industries all over the world and if you look at its asset mix, 29% is in Real Assets (acts as a nice hedge against inflation and delivers better yields than bonds over the long run), 42% in Equity (both public and private), 20% in government bonds (part of liquidity management and hedge against deflation) and 9.5% in Credit (private debt which also has an embedded inflation kicker with a lag). The important point is the asset mix is well diversified and along with active management, it has contributed to PSP Investments' solid long-term returns.

Next, I read Martin Glynn's message (Chair of the Board):

I note this part from Mr. Glynn's message:

Climate change was another important focus area for the Board. PSP Investments has been reporting against the Task Force on Climate-related Financial Disclosures (TCFD) recommendations since fiscal 2020. However, simply reporting on climate risks is not enough, as the extreme weather events in my home province of British Columbia, and around the world, reminded us in 2021. Strong action is needed on many fronts to address the growing climate crisis.

While climate change has been a focus area for our Board and management for many years, the organization took a significant step forward in fiscal 2022 in developing a comprehensive climate strategy. The Board fully supports PSP Investments’ pragmatic, data-driven approach, which is focused on achieving real-world positive impact and creating long-term value in the interest of the pension plan contributors and beneficiaries.

What else? PSP Investments' Board of Directors remains solid and I did note the addition of Gregory Chrispin who recently retired from the Desjardins Group, where he held the position

of Executive Vice President, Wealth Management and Life and Health

Insurance. He will be sitting on the Investment and Risk Committee as well as the HR and Compensation Committee.

Mr. Chrispin is a great addition to the Board and along with many others including Timothy Hodgson and Susan Kudzman, his presence adds great experience and knowledge to this board.

Keep in mind, overseeing PSP Investments is a lot of work and these board members are working hard to make sure everything from Audit, to Governance and HR, to Investment and Risk are all running smoothly.

Next, take the time to read the message from PSP's President and CEO, Neil Cunningham:

I note the positive message on investing for a better tomorrow:

The time is right to take all that society has learned over the past couple of years, and indeed over the last century, to build a more inclusive and sustainable economic system and a fairer world.

Within our organization, there is great energy and momentum to take on this challenge, as we work to deliver on our Purpose and our PSP Forward strategy. Our fiscal 2022 performance speaks to our capabilities and potential for success. Amidst a volatile global equity environment and rising interest rates, we achieved a 10.9% one-year return driven largely by strong returns in our private asset classes. Net assets under management reached a record-high $230.5 billion, up from $204.5 billion at the end of fiscal 2021. A summary of the year’s financial and non-financial highlights can be found on pages 11 to 13 of this report.

While I will be retiring in March 2023, I have no doubt about the passion and abilities of my colleagues to realize our ambitions. The additions of Patrick Samson, Senior Vice President and Global Head of Real Assets, and Michelle Ostermann, Senior Vice President and Global Head of Capital Markets, to our executive committee in fiscal 2022, and new talent and capabilities in our management and professional ranks, make us stronger.

I would like to thank our Board for its trust, support and counsel over the four years that I have had the privilege of leading PSP Investments. I would also like to recognize my colleagues, whose commitment and resilience over the past two years, in particular, has been nothing short of amazing. PSP Investments’ continued momentum is a testament to their talent and efforts, and I am so thankful for them.

I applaud Neil and PSP's entire senior management team, not just for the outstanding long-term results but for also taking diversity, equity and inclusion very seriously and fostering an inclusive and flexible culture at the organization.

As an aside, I still get people asking me "who will replace Neil?" and I tell them there are great external AND internal candidates and whoever the Board decides on, I'm certain this person (no matter who she or he is) will build on the foundations Neil and his colleagues have built and lean on this experienced team.

Discussion with Neil Cunningham, President and CEO of PSP Investments

Alright, let me get to my discussion with Neil from earlier today. This time I checked my Windows Voice Recorder twice to make sure it doesn't sound like Alvin and the chipmunks.

Let me begin by thanking Neil for taking the time to talk to me. I also want to thank Maria Constantinescu for setting this Teams meeting up and for sending me material ahead of time. I would also like to publicly congratulate her on her well-deserved promotion.

For purposes of being as brief as possible, please refer to my April comment on PSP's inaugural climate strategy where Neil discussed this strategy in detail with me.

Neil and I go back years. He joined PSP in June 2004 and I had joined the organization the prior year, in October 2003 soon after Gordon Fyfe took over as CEO (I was Gordon's first investment hire and those were fun times).

I have nothing but fond memories of Neil and told him it's going to be strange seeing him leave after so many years at PSP. He left an indelible mark on the organization, his colleagues and all the employees who had the pleasure of knowing and working with him.

I told him I thought he was an amazing addition to PSP, he has a lot to be proud of and it's kind of sad knowing the end of an era is coming next March but he deserves a nice retirement.

Neil replied: "Thank you, Leo, the time has passed quickly, it's probably because I always really enjoyed what I did."

Anyway, I began by asking him to give me an overview on asset allocation, major initiatives (like the climate strategy) and other things that happened over the last fiscal year:

We always start as you know, high level and long term. The most important number for us is long-term performance compared to the Reference Portfolio (a 10-year net annualized return of 9.8% against the Reference Portfolio benchmark of 8.4%, leading to $25.9 billion in cumulative net investment gains above the Reference Portfolio). That's what our mandate is, that's what drives everything else in the organization, the diversification, the asset mix and ultimately the performance of the total fund. This isn't just an accumulation of the sum of the parts but there is the sharing of knowledge and sharing of ideas which contribute to the overall performance. My focus, and it's one of the pillars of our strategic plan called PSP Forward which we just finished the first year of, is the single fund or One PSP. Many organizations have similar objectives, we have taken it to the point where our compensation plan is focused that way, our strategic plan is focused that way and so is our structure. For instance, our executive team meets weekly, fortunately not always virtually, and so does our investment committee. Part of the discussion is approving investments and part of it 'what are you seeing out there, what is going on in the market, is there more money or less money?', the kind of dynamic you expect in the short-term which may be indicative of a longer term trend. So the performance for us is really the accumulation of a lot of really good thinking over the long term and that's what puts us in the position we are in. We can go into the asset classes and see the long-term performance is there and that is very heartening.

I told him I did see that and Private Equity has done well but I also noticed Natural Resources (run by Marc Drouin) has taken off under his tenure, and that may be as a hedge against inflation along with Infrastructure and Real Estate (all part of Real Assets headed up by Patrick Samson).

Neil responded:

It's definitely purposeful (the inflation hedge) but there is a lot to unpack in what you just said. Starting with the asset mix which is reviewed annually, looking at the LTCMAs (long term capital market assumptions) and expectations. One of the things you will see in the future is an expansion of exposure in the Asia Pacific region as global GNP gets shifted around. Our portfolio tends to track it, not exactly but to a certain point. You will see that in the future as we continue that process and the asset classes don't necessarily need to be fully diversified across all the geographies because the diversification is at a certain level. So, the asset classes are really focused on investing in what they know and understand.

You mentioned a few so let me talk about them. Private Equity, you see in the numbers, we reset that strategy seven years ago and the 1 and 5-year returns really reflect how successful that team has been in the reset strategy and I give them full credit for doing that.

I pressed him on this reset strategy:

It was under new leadership. Simon Marc is running that group globally but very focused on specific general partners and one of the requirements of general partners for us is that they provide co-investment opportunities. That portfolio is kind of 50/50 between funds and directs (which includes co-investments) and that's a specific target. The GPs and that strategy was a new approach really when Simon Marc joined seven years ago. These things take time to generate the results.

He went on:

The other thing I'd say is all the asset classes, we operate with a target allocation for each one but with guard rails on a couple of percentage points either way. So when you mentioned Real Estate moving 13, 14, 15 per cent, you’d expect that as AUM move over time and asset class performance doesn't track total fund performance as opportunities present themselves to either invest or divest. So, each of the asset classes has the flexibility to move within the guard rails but the fund continues to grow, so the absolute number will continue to grow even if the relative doesn't in terms of allocation. That's something Eduard (van Gelderen, the CIO) and his group look at on an annual basis, do the LTCMAs and correlations justify the same asset mix or should we make an adjustment?

Neil then made a comment on Natural Resources:

That to me is a huge success in that we built the asset class without having the ability to buy scale. Timber was different, you may remember we did our first investment there on Vancouver island and that was really the genesis of the asset class. But branching into agriculture, we built it one farm at a time by building up strategic partnerships and managing them at a certain level but giving them the leeway to expand their businesses in various areas. We built an $11.5 business which is now roughly 2/3 agriculture, and we built it partner by partner, farm by farm into a really interesting asset class. One of the problems with that asset class is actually benchmarking it which is an indication that it's highly useful for us because if you can't benchmark it, it's an indication that it's not correlated to other things. It's one of the reasons we like it so much and of course, as you say, it has inflation protection naturally built into it.I told Neil that I honestly don't know many other large Canadian pensions who have done as much in agriculture as what PSP has done (OTPP a bit but nowhere near as much).

Neil concurred and told me it wasn't easy to build that asset class:

Because it's not an asset class which is as established as others, you can't just call an investment banker to say I need exposure to this asset class. It was a lot of people making a lot of trips to places where that portfolio is located. A lot of it is in Australia, Western US and Western Canada. That's a lot of time on planes, building relationships becoming known in the market. Now it's at a point where the growth is almost organic in the sense if you have an existing platform (partnerships), literally you can buy the farm next door. It's a proprietary form of organic expansion now that the footprint is there. You know the expression it's a long hard road to being an overnight success, right? The team members put a lot of sweat equity into building this out and it's paying up.

We then moved on to Infrastructure (headed by Patrick Charbonneau):

The biggest challenge in Infrastructure is everybody else wants to invest in it too, so it's getting the deal flow. We've had success by having ownership and control of the platforms, so when you have a limited numbers of buyers, you want make sure you're at the table. We have a platform in airports, in ports and other aspects of infrastructure. Once again, it's not necessarily organic but they're positioning themselves on where they need to be in order to get the deal flow.It is a very competitive space and PSP and others are competing with the best of the best (like Brookfield and others) on some of these deals.

I then talked about Real Estate, an asset class he ran for a long time before assuming the role of CEO, and asked him if there was a major shift there:

Oh yes, I think so Leo. If you take a step back, Real Estate historically was the major food groups: Retail, Office, Industrial and Multifamily. Each of those the dynamic has changed. Retail, obvious one. Office became more obvious with the pandemic and people wondering what percentage of occupancy will be reestablished once we figure out what the new normal will be. And that combined with a greater awareness of climate, how green your office will be. What we used to call Industrial, we now call Logistics, and a logistics facility today is very different from an industrial building of ten years ago. And in Multifamily, you're seeing a lot of offshoots that are different from the traditional apartment building. You're seeing student housing, manufacturing housing, and as you know, we have a big stake in retirement housing. Each of these major food groups have changed and to that we added new niche properties like studios, self-storage, and life sciences. So Real Estate is much more service and operationally oriented in order to understand the dynamics of what you want to invest in. For us, that means we really have to do a good job in choosing our operating partners who have the expertise in those areas, and the results in Real Estate reflect that we've been successful in that.I then asked him about Credit and Capital Markets:

In terms of Credit, you're right, David (Scudellari) and his team have done a fantastic job. Their success is based on relationships they've established largely with general partners (GPs) and their agility and capability to move quickly and provide solutions that these GPs need, especially if it's a buyout situation. That's allowed us to get premium pricing and take down a bigger piece of the transaction and benefit from a syndication effort later, it's allowed us to get origination income we wouldn't get if we were a passive participant. That to me is a very big success.

As far as Capital Markets where Michelle Ostermann has assumed a new role as Global Head:

As you said, it's a new portfolio. The value add has come largely from the Absolute Return portfolio and that was the case this year as well. And she is doing a terrific job on focusing that group on the ultimate objective which is top of the house, how are you contributing to PSP achieving its long-term mandate. As you know, and we've talked about this before, we, like many other firms, grew up in silos. The number one objective of our strategic plan is getting everybody thinking about the single portfolio and how what I do contributes to the long-term success of PSP in that portfolio and Michelle is doing a terrific job of orienting her team in that direction.As far as the role of the CIO and his group's role in contributing to PSP One:

His team sets the macro state on how you allocate the assets but it's in consultation with the asset class heads, it's an iterative process. For him to say we should have this much of this asset class, he needs to know what that asset class is planning on doing, what we are good at in that asset class, where we can add value. That equation goes into the LTCMA discussion. If someone were to run a highly opportunistic strategy, then that would have a higher expected return but higher volatility and correlation and that needs to be built in to the overall portfolio allocation through the Monte Carlo simulations that they go through. So it's both top down and bottom up driven and an iterative process in order to put together a portfolio that stays within the risk budget but outperforms from a performance perspective.

We wrapped it up by talking about any final thoughts before he retires:

We are very focused on a smooth transition. I'm looking forward to working hard on all our strategies right up till the end of March and focusing the organization on doing that which I would say is very much the case. The other thing, we didn't talk about climate today but talked about before, I think the opportunities for investing, it's not just energy transition but total economy transition really when you think about all the different aspects of it and all the industries with some investment can improve their GHG footprint. I think there's a very good investment theme around that we are going to be focusing a lot of energy on.

If I was going to summarize it all, I'd say look, what a great year we had, in terms of performance, it's clear, in terms of coming up with a new climate strategy with the goals we set, with the green asset taxonomy which is really helpful to the discussion, the work we've done getting people back to the office. But you know in the end, it's all leading to a 5 and 10 year performance against our mandate and that's where we are really doing well.

Indeed, everyone at PSP should be proud of the organization's success, the Board, the senior executives and all the employees.

I would urge all of you to once again take the time to read the FY 2022 Annual Report here.

Once again, I thank Neil for another great discussion, if he comes off as being really smart and thoughtful, that's because he is. He’s also a genuinely nice person.

I ended off by asking him if we can get together again before he retires and asked him for a favor which I hope he can help me with.

Below, an older Responsible Asset Owners panel session from last July featuring Chris Ailman, CIO of CalSTRS, Michelle Ostermann, then at RMPI Railpen and Elizabeth Burton, CIO of Hawaii Employees’ Retirement System who recently tendered her resignation and will depart there at the end of the month. Take the time to listen to it and get to know Michelle a little better.

Comments

Post a Comment