CDPQ's Vincent Delisle on Why They See Opportunities in Bonds

Canada's second largest pension fund Caisse de dépôt et placement du Québec sees opportunities in global fixed income assets after a recent sell-off, and expects global markets to stabilize in the first half of 2023, a top executive said.

"Fixed income assets are definitely more attractive than they were couple of months ago," Caisse's Executive Vice President Vincent Delisle said in an interview on Wednesday.

Caisse, which oversees about C$391.6 billion ($285 billion) in assets, says it sees opportunities in private credit, where where non-banking institutions provide loans to companies.

It plans to continue its push into global fixed income markets, where yields in some pockets have nearly doubled to 7%from 4% last year, while U.S. Treasury bond yields have jumped from zero percent to 4%, said Delisle, who is also head of Caisse's fixed income unit.

"We think fixed income also will catch back its safe haven status when we get a harder landing or global recession in 2023," he said.

Global bond markets have this year witnessed their worst sell-off since 1949 due to hawkish central banks, according to a report by Bank of America in September. Delisle expects bond markets to settle down before stock markets do.

Bond markets suffered a further blow when the British government announced tax cuts last month that were later reversed, leading to a global sell-off of gilts.

Caisse does not have significant exposure to UK and Europe debt markets but is closely watching political instability in UK as it affects its defensive sectors such as currencies, Delisle said.

The current source of discomfort for the markets is central banks fighting inflation, and for the markets to calm down it was imperative to see friendlier central banks, he said.

"To get friendlier central banks, inflation needs to come down and for inflation to come down the growth needs to slow down dramatically," Delisle said.

Delisle is betting that Caisse's diversified portfolio will help it weather the volatility.

About 30% of Caisse's total investments are in fixed income, while public equities make up 28% and private equity accounts for 20% of its investment portfolio. The rest is made up of real estate and infrastructure investments.

The fund reported a negative return of 7.9% in the quarter ending June 2022, with fixed income falling 13% - the steepest fall among its portfolios.

CPP Investments, Canada's largest pension fund, said last week it was seeking bargains after recent market declines.

For those of you who don't know him, Vincent Delisle is Executive Vice-President and Head of Liquid Markets at CDPQ since August 2020:

In this role, he leads the teams responsible for the Equity Markets and Fixed Income portfolios. He also leads the Investment Funds and External Management teams, the Global Research team, as well as the Quantitative Strategies and Data Science team. His mandate includes developing successful investment strategies for CDPQ and ensuring their execution by optimizing the risk-return relationship for the portfolios under his responsibility. He sits on the Executive and Investment Risk Committees.

Mr. Delisle has 25 years of experience in asset allocation strategy, global equity markets and portfolio management. Before joining CDPQ, he was Co Chief Investment Officer at Hexavest for two years.

From 2004 to 2018, he worked at Scotia Bank, where he served as Director of Equity Research, Québec and Managing Director, Portfolio and Quantitative Strategy in the Capital Markets division. In these roles, he was the bank’s chief strategist, and his investment recommendations were followed by thousands of brokers who advised individuals and by Scotia Bank’s institutional clients around the world.

From 1997 to 2004, he was a Portfolio Strategist at Desjardins Securities. He began his career trading stocks and bonds at investment firm Eterna Trust. He holds a Bachelor’s Degree in Finance from Université Laval and is a CFA Charterholder.

Connections

For each of the six years from 2013 to 2018, in recognition by his peers for the quality of his work, Mr. Delisle was ranked #1 Analyst in Portfolio Strategy in the prestigious Greenwich Associates rankings and for three years in Brendan Woods International rankings. A skilled communicator, he has given numerous media interviews on topics related to equity markets.

I remember Vincent when he was working at Scotia as Managing Director, Portfolio and Quantitative Strategy, and he always presented in-depth and unique research insights covering all markets.

He's also a very nice guy and I'm glad he had a chance to share his thoughts on battered bonds with Divya Rajagopal of Reuters.

The key takeaways I got from reading this are the following:

- CDPQ is looking to expand its private credit portfolio (see my recent comment on Vena Energy here)

- With long bond yields in some markets nearly doubling to 7% from 4% and with the 10-year US Treasury bond yield jumping over 4%, there are attractive opportunities in fixed income.

- A hard landing is coming in 2023 (likely the latter half) and you want to have bonds to hedge downside risks even if they performed miserably (along with stocks) so far this year.

- Vincent expects bond markets to settle down before stock markets do.

We heard similar messages from OTPP's CEO, OTPP's CIO and HOOPP's CIO, long bonds are more attractive here.

Alright, it's Friday, stocks are looking good into the close but it's been a choppy week with winners (NFLX, T) and losers (SNAP, VZ):

Friday’s gains put the market on track for a positive week, with the four major averages up more than 4%. The gains have come despite the 10-year Treasury yield surging to its highest level since 2008 and a mixed bag of corporate earnings reports.

“I think at the end of last week market’s got a little bit oversold technically. And as we’ve seen so many times in the past, when things get negative enough it becomes some sort of a contrarian indicator for a bounce,” said Randy Frederick, managing director of trading and derivatives at the Schwab Center for Financial Research.

“But like every other bounce we’ve had, it hasn’t been very well sustained. ... A bounce today doesn’t necessarily mean it’s going to continue into next week. If it does, I suspect it won’t be more than a day or two,” Frederick added.

Next week, we have big tech earnings and I expect them to be decent overall, driving this bear market rally further up:

We are going into month-end, there will be some rebalancing into beaten up sectors, and typically the next three months are seasonally good for stocks.

That doesn't guarantee anything.

With the Fed in hawk mode, don't expect miracles, this is just another bear market rally. I'm just saying don't be surprised if it persists even if it's very volatile.

While stocks were up for the week, bonds were battered as the yield on the 10-year Treasury note closed at 4.21% on Friday after opening at 4.33%, its highest level since 2008, sending long bond prices down further:

The only somewhat good news is high yield bonds seem to have stabilized here but they remain weak:

There are opportunities in fixed income, that's for sure, but everyone is trying to gauge how far the Fed will go hiking rates.

The sharp reversal in the 10-year yield Friday may be a signal that Treasury yields have temporarily topped out, after a wild ride higher this week.

That remains to be seen.

Right now, the market is pricing in 75 basis points at the November meeting and another 75 basis points in December, but some Fed watchers think the Fed might tread lighter in December:

The Fed is barreling towards a fourth straight 75-basis-point rate rise at the November FOMC meeting.

— Nick Timiraos (@NickTimiraos) October 21, 2022

⁰That meeting could serve as a critical staging ground for future plans, including whether and how to step down to 50 basis points in December https://t.co/vPMSXDjHL8

It's possible but unlikely if core inflation pressures persist, something Minneapolis Fed President Neel Kashkari noted two days ago, stating the Fed may need to push its benchmark policy rate above 4.75% if underlying inflation does not stop rising:

"I've said publicly that I could easily see us getting into the mid-4%s early next year," Kashkari said at a panel at the Women Corporate Directors, Minnesota Chapter, in Minneapolis."

But if we don't see progress in underlying inflation or core inflation, I don't see why I would advocate stopping at 4.5%, or 4.75% or something like that. We need to see actual progress in core inflation and services inflation and we are not seeing it yet."

The big problem is the Fed was late to admit core inflation is a problem and decided to shift its policy very aggressively and this will have ramifications on the real economy, something Francois Trahan of Trahan Macro Research noted earlier today on Linkedin:

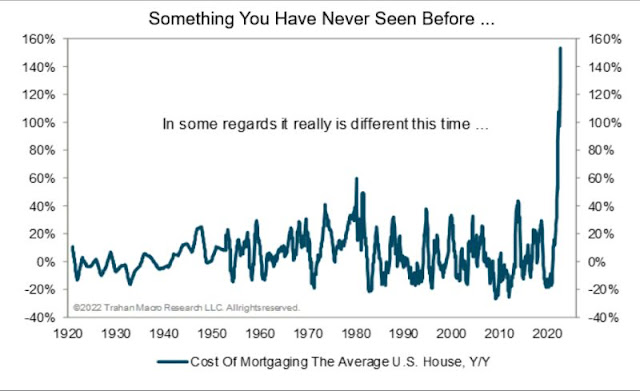

I try to avoid using the words "it's different this time". The reality is that every business cycle has circumstances that are peculiar to it but that does not mean that the end game or outcome is any different from prior cycles. One peculiarity of the current cycle that none of us have ever experienced before is the speed of the combined adjustment in inflation/interest rates. A series that encapsulates both of these forces in the U.S. is the cost of mortgaging the average house. One could buy the average house in early 2021 and get a 30-year fixed mortgage as low as 2.82% (national average on Feb. 9, 2021). That would have added up to about $10,000 in mortgage payments over the course of a year. Fast forward 20 months later and the price of that average house is significantly higher (inflation effect) and the same 30-year fixed mortgage rate is now 7.32% (interest rate effect). For contrast, these home price and interest rate levels now add up to a little over $30,000 in annual mortgage costs.

There have been periods across history where the cost of mortgaging the average house added up to a higher share of household income than what we are currently witnessing (early 1980s!). Still, the pace of the change in home prices/mortgage rates is faster than anything seen in the past century. In my experience, the pattern in interest rates eventually ends up being the pattern we see in the data (i.e. rates go up quickly, GDP eventually goes down quickly and vice versa). This is at the heart of why I turned bearish in September of 2021 and why I am deeply concerned about the economy in 2023/2024. The economic data will be in freefall at some point.

Food for thought for the weekend.

I agree with Francois, the speed and magnitude of rate increases is something we haven't seen in a very long time and it will definitely hurt the US economy next year.

Rate increases work with a lag, typically 18 to 24 months, so you'll be seeing an avalanche of negative data in the second half of 2023 and stocks should bottom six months before the economy (it could be more of a lead, but stocks do lead).

All this to say, CDPQ, OTPP, HOOPP and others are right to see value in long bonds but Vanguard isn't confident US Treasury rates have peaked after painful bond market losses:

“The risk-reward profiles of various market sectors—including Treasurys, corporates, emerging markets, and long-term municipals—are more attractive than they were six months ago,” said Vanguard.

But the Fed’s battle with high inflation isn’t over, with investors expecting another large rate hike from the U.S. central bank as it aims to bring the soaring cost of living under control.

“Policymakers have made it abundantly clear that little else matters until price stability is attained, which means near-term volatility is likely,” Vanguard said. “We are not confident that we have seen the peaks in U.S. Treasury rates.”

I'm not confident either but institutional investors are wise to be adding long bonds here to hedge their portfolios.

If things go really bad, they may never see these rates in a very long time.

Of course, if rates keep creeping up because the Fed doesn't pause or pivot as core inflation persists, it will hurt their fixed income portfolios.

That's why you need a diversified portfolio across public and private markets, to weather the storm.

Below, CNBC’s ‘Halftime Report’ investment committee, Kari Firestone, Jason Snipe, Sarat Sethi and Joe Terranova discuss the Treasury market, inflation and the Fed.

Second, Gregory Staples, DWS Group head of fixed income North America and Stephanie Roth of JPMorgan Private Bank, talk about the surge in bond yields. They are on "Bloomberg The Open."

And Lisa Shalett, Morgan Stanley Wealth Management chief investment officer, and Barry Bannister, chief equity strategist at Stifel, join 'Squawk on the Street' to discuss how Shalet is accessing today's investing landscape, how much seasonality is a factor in this week's stock markets, and more.

Lastly, Jeremy Siegel, Wharton School of Business professor, joined 'Squawk Box' earlier this week to discuss what happens to the US economy after two 75 basis point rate hikes in November and December, if the Fed's policies have worked and more.

Comments

Post a Comment