OTPP Faces Hit on Crypto Trading Platform FTX

David Milstead and Temur Durrani of the Globe and Mail report Ontario Teachers’ Pension Plan faces a hit on investment in crypto trading platform FTX:

A big cryptocurrency investment by the Ontario Teachers’ Pension Plan is in jeopardy amid the latest market turmoil for the sector. Ontario Teachers’ Pension Plan faces a hit on investment in crypto trading platform FTX

Teachers, which is Canada’s third-largest pension fund, invested in trading platform FTX Ltd. a year ago at an announced US$25-billion valuation. Teachers watched Tuesday as FTX sold itself to rival Binance Holdings Ltd. after facing what Binance called a “liquidity crunch” for FTX.

Tokens such as bitcoin plunged to multiyear lows as investors rushed to exit the digital asset market upon Tuesday’s news from FTX.

The situation marks the second such stumble for a major Canadian pension plan in the world of crypto. In August, the Caisse de dépôt et placement du Québec completely wrote off its US$150-million investment in crypto platform Celsius Network Ltd., which filed for bankruptcy protection in July.

Bahamas-based FTX is the second-largest crypto-exchange in the world, with Binance in first place, according to industry data from CoinMarketCap, the leading price-tracking website for cryptocurrencies. Binance, which was initially based in China but now claims no official headquarters, acquired CoinMarketCap in 2020.

Changpeng Zhao, chief executive of Binance, tweeted on Tuesday that FTX had asked his company for help that afternoon. “There is a significant liquidity crunch. To protect users, we signed a non-binding LOI intending to fully acquire FTX.com and help cover the liquidity crunch,” he wrote, referring to a letter of intent.

FTX’s chief executive Sam Bankman-Fried confirmed the agreement, tweeting that only the non-U.S. businesses of FTX and Binance will be affected by Tuesday’s deal. He said the U.S. operations for both companies are separate and will be unaffected, noting that the deal has not closed and the companies have more due diligence to do.

Terms of the deal were not known, but the assertion of a “liquidity crunch” suggests the value of Teachers’ equity in FTX is at risk.

“Given the fluid nature of the situation we have no comment right now,” Teachers’ spokesperson Dan Madge said Tuesday. He declined to say how large the investment was but noted that FTX was not included in the pension plan’s list of investments of more than $200-million in its 2021 annual report.

The situation also calls into question FTX’s plans to officially launch its business in Canada by acquiring Bitvo Inc., a Calgary-based crypto-exchange that is regulated by all 13 provincial and territorial securities commissions across this country. That deal, for which neither FTX nor Bitvo would reveal the exact terms or valuation, was expected to close in the third quarter this year, pending regulatory approval.

Reached by phone Tuesday, Bitvo chief executive Pamela Draper declined to comment about the FTX situation or how it would affect her deal with that company.

A spokesperson for FTX declined to comment on Tuesday. Binance did not respond to requests for comment from The Globe and Mail.

On Tuesday, bitcoin fell sharply, trading at around US$18,000, the lowest level for that token since 2020. It is a far cry from the price of bitcoin last year, which in November, 2021, traded at US$68,000. Other cryptocurrencies also plunged Tuesday, with ether dropping to around US$1,300, which is 16-per-cent lower than the day before. The largest declines were posted by FTX’s own token, FTT, which fell more than 75 per cent, trading at around US$5.27 on Tuesday.

The Caisse bought in to Celsius as part of a US$400-million funding round that valued the company at about US$3-billion in late 2021.

“In this case, we came in too early,” Charles Emond, chief executive of the Caisse, said in August. “I’d say maybe there was too much focus on the company’s potential than on the real state of affairs,” he said, when Caisse announced the writedown.

Teachers first bought its FTX stake in October, 2021, as part of a US$420-million funding round. It was one of 69 investors, but FTX listed it first in its announcement of the financing. Teachers has never disclosed exactly how much it invested.

The pension plan housed the investment in its Teachers’ Innovation Platform, a portion of the portfolio dedicated to high-growth, yet high-risk, investments. As of June 30, the $8.2-billion portfolio represented just 3 per cent of Teachers’ $242.5-billion in assets.

Teachers, which manages the pensions of Ontario’s 333,000 active and retired teachers, reported a 1.2-per-cent return for the six months ended June 30. By way of comparison, Royal Bank of Canada’s RBC I&TS All Plan Universe saw defined benefit pension plan assets – as measured by a typical mix of publicly held stocks and bonds – shrink 14.7 per cent over that period.

Teachers chief executive Jo Taylor told Reuters in mid-September that the FTX investment was, “In terms of the risk profile, probably the lowest risk profile you can have in that it’s everybody else is trading on your platform.”

He said the investment was part of Teachers’ strategy to learn about the crypto business and whether it gives the right balance of risks and returns. “I don’t think we have the answer to that question yet,” Mr. Taylor said.

Coin Edition also reports Ontario Teachers’ Pension Plan took a hit on investment in FTX:

- Ontario Teachers Pension Plan’s investment in FTX is being sold due to a liquidity crisis.

- There are ongoing discussions about competitor crypto exchange Binance acquiring FTX.

- The loss incurred by the fund due to poor crypto investments is not unique to this Canadian pension plan.

The Ontario Teachers Pension Plan placed a significant bet on crypto when it invested in FTX, one of the biggest crypto exchanges, in 2021. Currently, the exchange is being sold due to a liquidity crisis.

At that time, Ontario Teachers invested twice in FTX, taking part in each of its $400 million Series C rounds and its $420 million USD round from last October.

FTX is currently in talks to be acquired by rival cryptocurrency exchange Binance while the former business experiences a liquidity crisis.

The CEO of Binance announced that his business had signed a letter of intent that is not legally enforceable for Binance to buy FTX. The deal’s financial details have not been made public.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022The problems with FTX are a result of a general decline in cryptocurrency. Despite this turbulence, Ontario Teachers has recently maintained its FTX investment, calling it “certainly the lowest risk profile you can have.”

According to Reuters, Ontario Teachers CEO Jo Taylor stated in September that FTX was doing well and that the company was confident in its investment despite the unpredictability of the crypto market.

The fund is not the only Canadian pension investment firm that has recently suffered losses due to subpar crypto investment.

The Caisse de dépôt et placement du Québec contributed $150 million to Celsius’ $400 million USD funding round last year as part of its investment. Caisse made its first crypto investment in the purchase and held a 4% equity share in Celsius.

Celsius filed for bankruptcy in July 2022, and the Quebec-based pension fund wrote off its investment. Charles Emond, the CEO of Caisse, has now acknowledged that his company entered the crypto market “too early” and described it as a market in transition.

On Tuesday, the Binance/FTX deal sent bitcoin and other cryptos spiraling:

On Wednesday, Tanaya Macheel of CNBC reports that bitcoin tumbles to its lowest in nearly 2 years; Solana drops another 40%:Crypto investors couldn’t make up their minds on Tuesday whether they liked Binance’s proposed purchase of rival FTX.

In the immediate aftermath of the announced deal, they sent bitcoin’s price tumbling well below $20,000, its support of the last two weeks. Hours later, prices were bounding above the threshold. But by the afternoon, the largest cryptocurrency by market capitalization had plummeted under $19,000 for the first time since mid September. BTC was recently trading at about $18,500, down more than 10% over the previous 24 hours and its first time under $19,000 since mid October.

Ether and most major altcoins whipsawed similarly. The second largest crypto in market value was recently changing hands just above $1,300, a more than 15% drop from Monday, same time, and its lowest level in more than two weeks.

The carnage swept up tokens from all parts of the crypto spectrum. FTX’s FTT was trading at just over $5, a more than 75% decline during the past 24 hours. Solana's SOL, which had tumbled Monday on speculation that Bankman-Fried's trading firm, Alameda Research, might have to dump some of its holdings in a bid to raise liquidity, was off over 20%. Binance’s BNB token outperformed the market, but was still down about 4%.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, was down a whopping 10%.

“The FTT token will find it very hard if not impossible to recover while SOL and ecosystem tokens are likely to suffer losses too as trust appears to be eroded entirely,” wrote Joe DiPasquale, CEO of crypto fund manager BitBull Capital, in an email to CoinDesk, although he noted optimistically that “we don’t “expect bitcoin to face an extreme scenario. In fact, it could see increased inflows as market participants withdraw from riskier assets.”

“Either way, the sooner this gets resolved the better it is for the space, especially as it is likely to draw more attention from regulators,” DiPasquale wrote.

As U.S. voters went to the polls for midterm elections, stocks continued their momentum from Monday as the tech-heavy Nasdaq and S&P 500 rose a few fractions of a percentage point, while the the Dow Jones Industrial Average (DJIA) was up 1%.

Safe haven gold also had another upbeat day, climbing 2.2%.

In an email, Marieke Fament, CEO of the NEAR Foundation, called said that "consolidation is inevitable in crypto's current bear market,” but also saw FTX’s problems and the proposed acquisition as a potential learning experience.

“There's nowhere to hide during crypto winter – and developments such as the acquisition of FTX by Binance underscores the challenges and lack of transparency behind the scenes of some key players –which undermine the reputation of crypto,” Fament said. “Moving forward, the ecosystem is going to learn from these mistakes and hopefully create a stronger sector that puts honesty, transparency and consumer protection at the heart of their businesses."

Cryptocurrencies extended their slide for a second day Wednesday as the market digested the fallout of FTX and Binance’s offer to bail it out.

Bitcoin fell 7% to $16,929.01, according to Coin Metrics. Earlier in the day it hit a new bear market low of $16,521.60, its lowest level since November 2020, according to Coin Metrics. It reached its all-time high of $68,982.20 one year ago Thursday. Meanwhile, ether fell 12% to $1,162.46.

The Solana token also continued to fall. It was last down 40%, after plunging 26.4% on Tuesday. Alameda Research, the trading firm owned by Sam Bankman-Fried, who also runs FTX, was a big and early backer of the Solana project.

“Market factors such as providing SOL token liquidity as well as support for Solana ecosystem projects on FTX exchange has been an important driver for Solana’s success,” Bernstein’s Gautam Chhugani said in a note Wednesday. “This is an adverse event for the Solana ecosystem in the short run. Further, given FTX/Alameda’s balance sheet situation, there may be near term pressure on its Solana holdings, as the situation resolves.”

Prices were under pressure to start the day but dropped further mid-morning following a report that Binance is unlikely to go through with its planned acquisition upon review of FTX’s financials.

“We’re just 36 hours into the due diligence process. Once we have completed that, we will make a decision based on what’s in the best interest of Binance’s users across the globe,” the company said in a statement shared with CNBC. “We’ll share more information when we have a more substantive update to provide.”

The Bankman-Fried empire unraveled quickly after a report last week showed a large portion of Alameda’s balance sheet was concentrated in FTX Token (FTT), the native token of the FTX trading platform. After some light sparring on Twitter with SBF, Binance CEO Changpeng Zhao announced his company was offloading the FTT on its books, leading to a run on the popular FTX exchange and a liquidity crisis.

FTX counts some of the biggest names in finance — including SoftBank, BlackRock, Tiger Global, Thoma Bravo, Sequoia and Paradigm — among its investors.

FTT was down 26% Wednesday, after tumbling more than 75% the day before.

The bombshell is likely to set the crypto industry back, but to what extent remains to be seen. Analysts foresee further regulatory scrutiny of offshore exchanges, where the majority of crypto derivatives trading takes place. It’s also unclear how much financial contagion will spill into the rest of the market.

Additionally, Bankman-Fried had recently been lauded as a “white knight” in the industry as he came to the rescue of crypto services firms like BlockFi and Voyager that almost didn’t survive the crypto contagion of this spring.

For newcomers to the crypto market, he and FTX became the faces of the industry, securing the naming rights to the Miami Heat basketball team’s stadium last year, bringing Tom Brady and Giselle Bündchen on as ambassadors of the company, and becoming a megadonor to Democratic politics.

“Given the public-facing nature of FTX CEO Sam Bankman-Fried and the size of FTX, we believe that the week’s events could cause some loss of consumer confidence in the crypto industry, beyond that seen in the aftermath of the 3AC, Celsius, and Voyager events that took place earlier this year,” especially if contagion takes hold and crypto prices keep dropping, KBW analysts said in a note Tuesday. “It may take time for customers to regain trust in the industry, broadly speaking (and we think regulation could help this).”

And David Yaffe-Bellany of the New York Times reports on how the fall of a crypto titan puts an industry on edge:

The undoing of the crypto billionaire Sam Bankman-Fried happened on Twitter.

Over the last two years, the 30-year-old entrepreneur gained a reputation as one of the smartest, most trusted figures in crypto. He built his cryptocurrency exchange FTX into a $32 billion company. He spent hundreds of millions of dollars to prop up other struggling crypto companies. And he became a major political donor to Joseph R. Biden Jr.’s presidential campaign as well as a frequent, welcome presence in the halls of Congress.

Then, in a matter of days his young empire collapsed, and it was Mr. Bankman-Fried who needed the bailout.

In a shocking implosion that was a hammer blow to the crypto market’s credibility, Mr. Bankman-Fried said on Tuesday that he planned to sell his suddenly struggling company to an archrival.

Mr. Bankman-Fried fell at the hands of Changpeng Zhao, the chief executive of Binance, the only crypto exchange bigger than FTX. After reports circulated that one of Mr. Bankman-Fried’s other businesses was on shaky financial footing, a Twitter post by Mr. Zhao, who is known online as CZ, essentially started a bank run that crippled FTX. On Tuesday, Binance announced that it had agreed in principle to buy its biggest competitor, though it remains unclear whether the deal will go through.

“CZ executed a pincer movement,” said Lee Reiners, a crypto expert who teaches at Duke University Law School. “He surprised all of us.”

Many of crypto's foundational myths have already been punctured this year, and Mr. Bankman-Fried’s rapid fall suggests that no company in this freewheeling, loosely regulated industry is safe from extreme volatility. As news spread of FTX’s collapse, crypto markets took a battering, with Bitcoin and Ether both dropping more than 15 percent since Tuesday.

On Tuesday, Mr. Bankman-Fried framed the Binance takeover as a measure to ensure that FTX customers did not lose their money. But the deal is not finalized and its exact terms remain unsettled, leaving open the possibility that FTX’s hundreds of thousands of customers could lose their funds and set off another crash in crypto prices.

“This episode highlights the vulnerability of the entire crypto edifice,” said Eswar Prasad, a Cornell University economics professor. “Even large and apparently financially solid institutions turn out to have fragile and shaky foundations that crumble at the least hint of trouble.”

A spokesman for FTX declined to comment. A Binance spokeswoman did not respond to a request for comment.

Unlike some other crypto companies that have imploded this year, FTX was almost mainstream. Mr. Bankman-Fried ran a commercial during the Super Bowl and bought the naming rights to the Miami Heat’s basketball arena. He was profiled in virtually every major news outlet, including The New York Times, and had nearly a million followers on Twitter.

“It’s like if the person you thought was Hermione turned out to be Voldemort,” the crypto journalist Laura Shin tweeted on Wednesday.

As the company collapsed, FTX’s venture investors were in the dark about Mr. Bankman-Fried’s plans, and employees had little guidance. Other companies scrambled to distance themselves. “There can’t be a ‘run on the bank’ at Coinbase,” Alesia Haas, the U.S. crypto exchange’s chief financial officer, wrote in a blog post. “We hold customer assets 1:1.”

In a note to Binance employees that was posted on Twitter, Mr. Zhao said that FTX’s demise “is not good for anyone in the industry.”

“Regulators will scrutinize exchanges even more,” he wrote. “Licenses around the globe will be harder to get.”

Until this week, Mr. Bankman-Fried, known by his initials SBF, was widely regarded as one of the industry’s most astute and formidable leaders.

In 2017, he founded Alameda Research, a crypto trading firm, that made a fortune exploiting arbitrage opportunities in the Bitcoin market. He parlayed that success into the creation of FTX, which was based in Hong Kong before relocating to the Bahamas last year.

FTX’s business was built on a type of risky trade — in which investors borrow money to make big bets of the future value of cryptocurrencies — that remains illegal in the United States. But Mr. Bankman-Fried started a smaller U.S. affiliate that offered more conservative trading options, while lobbying American regulators to approve the riskier model. As the company grew, he became a prolific political donor, contributing more than $5 million to Mr. Biden’s 2020 election effort.

He also embarked on a marketing blitz. In April, Mr. Bankman-Fried hosted a dazzling conference in the Bahamas, where he appeared onstage with former President Bill Clinton and former British Prime Minister Tony Blair. At one point, he was worth an estimated $24 billion, according to Forbes, making him the second-richest crypto businessman behind Mr. Zhao. Mr. Bankman-Fried vowed to one day give his entire fortune away.

When the crypto market crashed in May, Mr. Bankman-Fried was hailed as a savior. He lent the troubled crypto company Voyager Digital $485 million and bailed out BlockFi, a crypto lending firm, with a $400 million credit line.

But in recent weeks, he started to face blowback in the industry. He was criticized by crypto enthusiasts for supporting regulatory proposals that they viewed as an affront to the philosophical principles of the technology.

Then last week, the crypto publication CoinDesk reported on a leaked balance sheet showing that a large portion of Alameda’s assets consisted of FTT, a token that FTX had invented to ease trading on its platform. The news stoked fears that a plunge in FTT’s value could cripple both FTX and Alameda, which are closely entangled.

A former FTX investor, Mr. Zhao still held a large quantity of FTT, which Mr. Bankman-Fried had given to him to buy back equity in FTX. Mr. Zhao also seemed to be growing disgruntled with his colleague. In October, Mr. Bankman-Fried had made a joke on Twitter suggesting that Mr. Zhao was not allowed to enter Washington, an apparent reference to the scrutiny Binance has faced from U.S. regulators.

Over the weekend, Mr. Zhao announced on Twitter that Binance would sell its holdings of FTT. He insisted that he was not engaging in a “move against a competitor.” But he later compared the FTT token to Luna, a cryptocurrency that crashed in May, setting off a broader crisis.

“We won’t support people who lobby against other industry players behind their backs,” he added on Twitter.

The impact was immediate. Over three days, customers withdrew more than $6 billion from FTX. Mr. Bankman-Fried said on Twitter that “a competitor is going after us with false rumors.”

Around the same time, Mr. Bankman-Fried was calling possible investors as he tried to raise money, according to two people familiar with the conversations. But it was not clear how much he would need, one person said. The stakes were clearly high, though: Mr. Bankman-Fried explained that FTX was in an emergency situation, according to the other person.

On Tuesday, Mr. Bankman-Fried struck the agreement with Mr. Zhao. “Binance has shown time and again that they are committed to a more decentralized global economy,” he wrote. “We are in the best of hands.”

In his note to employees, Mr. Zhao said he was as shocked as anyone. “I had very little knowledge of the internal state of things at FTX,” he wrote. “I was surprised when he wanted to talk.”

But the takeover is far from a done deal. In a series of tweets, Mr. Zhao stressed that “Binance has the discretion to pull out from the deal at any time,” he said.

The companies still have to go through a due diligence process. Both FTX and Binance are based outside the United States, but regulators in other countries may try to intervene. “Every regulator is going to be looking for a way to exercise jurisdiction over this deal,” said Joseph Castelluccio, a lawyer who specializes in digital assets.

Among FTX employees, confusion reigns. Mr. Bankman-Fried announced the deal to staff around the same time the news was posted on Twitter. Employees in the United States and abroad were blindsided, according to two people familiar with the matter.

“I owe a huge debt to all of you for following me, and I’ll do what I can to make that right,” Mr. Bankman-Fried wrote on Tuesday in a note to staff, which was obtained by The Times. “I’m sorry.”

The fall from grace was also reflected in the size of his fortune. According to a Bloomberg wealth index, Mr. Bankman-Fried, now worth $991.5 million, is no longer a billionaire.

I'm giving you a lot of background information to properly understand what is going on with this FTX fiasco which has embroiled Ontario Teachers' and other high profile investors.

Mr. Bankman-Fried's fall from grace will undoubtedly be the subject of some future Netflix documentary but it's also a cautionary tale for small and large investors that the cryptocurrency market is fraught with risks.

I've always claimed the two biggest concerns I had with cryptocurrencies are 1) whale risk and 2) regulatory risk.

Well, a lot of whales have lost a fortune betting on cryptos and regulatory risk is only rising as these blowups occur.

As far as Ontario Teachers' investment in FTX, I'll state the same thing as I stated on CDPQ's investment in Celsius, it's unfortunate but it's peanuts relative to the size of Teachers' massive portfolio.

I didn't bother contacting Jo Taylor, Ziad Hindo, Olivia Steedman or Dan Madge today to discuss FTX.

What you are reading are purely my thoughts.

The way I see it is OTPP is a mature pension plan whose members are aging and while it invests the bulk of its assets in core infrastructure, real estate and private equity, it needs to take some bigger risks to capitalize on potential future disruptors.

That is the mandate of Teachers' Venture Growth headed by Olivia Steedman:

Our strategy

At Teachers' Venture Growth (TVG), we invest directly in innovative, late-stage companies (Series B onward) that are using technology to shape a better future. As active investors, we partner with founders and management teams to provide global expertise, resources and guidance, rolling up our sleeves to support them in fulfilling their bold visions. We prefer to lead rounds but will also participate alongside like-minded partners. TVG also selectively invests indirectly through fund commitments to some of the world’s leading venture capital and growth equity firms. We invest across North America, Europe and Asia.

A long-term direct investment approachAs part of one of the world’s largest pension plans, we take great pride in our responsibility to provide retirement security for more than 333,000 teachers across Ontario. Because we pay pensions over multiple decades, we bring a long-term perspective to investing. Our capital can be flexible and grow with the needs of our portfolio companies. We don’t have a cap on how much we can invest or limits on how long we can invest. We have the resources and expertise to guide our portfolio companies to become generational businesses. We have a proven, global track record backed by 30+ years of expertise across asset classes and C$242.5-billion in net assets.

Our portfolio

Our global portfolio spans multiple sectors and stages. As part of Ontario Teachers' large, diversified portfolio, Teachers' Venture Growth can provide unique strategic partnerships and platforms, and cross-over support capabilities for companies looking to go public.

Now, as you can see, Teachers' Venture Growth (TVG) has a portfolio of roughly $8 billion of $242 billion in total assets under management, making up roughly 3% of OTPP's total assets.

It is invested in 26 companies and one of them was FTX.

We don't have the exact details of how much Teachers' invested in FTX but let's assume it was $250 million, which is on the high end and a total assumption on my part, then that represents 0.1% of the total portfolio.

In other words, even if Teachers' writes down all of FTX, it's a pittance in terms of its total portfolio just like Celsius is a pittance of CDPQ's total portfolio.

Of course, we will get the armchair investors questioning why pensions invested in Celsius or FTX but it's easy to criticize after the investment was made and a blowup occurred.

I can tell you in 1998 a lot of institutional investors got enamored by a quant hedge fund run by Nobel-prize winners (LTCM) and nobody was thinking it will blow up.

It's the nature of the beast, especially in venture and late-stage capital, you're going to have winners and losers.

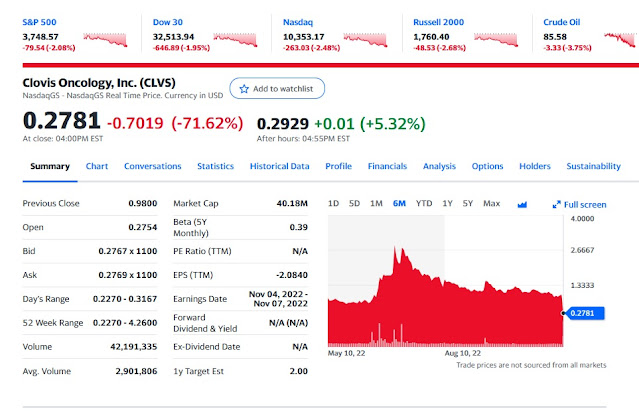

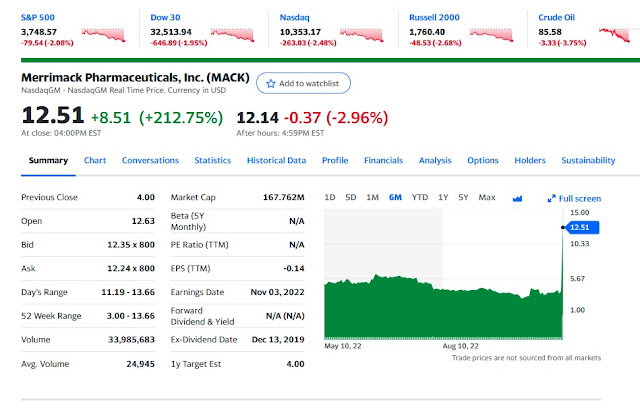

The best way I can describe it is pretend you invested most of your portfolio in fixed income and blue chip dividend stocks but reserved 5% of your total portfolio to invest in very risky small cap biotech stocks which are binary by nature. And today you saw one of them Clovis Oncology (CLVS) got destroyed because it warned it's running out of cash and another one Merrimack Pharmaceuticals (MACK) is up huge after positive trial data from its pancreatic cancer drug treatment:

That is the way you should think of Teachers' Venture Growth except their investments are less risky than small cap biotech stocks.

Teachers' invested in FTX alongside other top VC and institutional investors and Jo Taylor, Ziad Hindo and Olivia Steedman know there are risks to all these investments but if one of two of them deliver huge returns, it can swamp out all the losses from others.

That is the nature of this beast and all of Canada's large pensions invest in risky startups or late-stage companies.

They didn't all invest in Celsius or FTX but hindsight is 20/20, I am sure CDPQ and Teachers' wish they didn't invest in Celsius and FTX.

Who cares? They will write them down and move on, lesson learned.

In this business, you need to take risks to make big returns and this FTX debacle says nothing about Teachers' Venture Growth which is doing a great job.

The problem is the VC cycle has turned south, a brutal winter lies ahead.

I saw it when I was working at the BDC back in 2008-2010, their VC portfolio got annihilated, it was really horrific.

Before that stint, I remember working at PSP and pleaded with Doug Leone of Sequoia Capital to meet with Gordon Fyfe and Derek Murphy, former CEO and Head of Private Equity, to talk about venture capital.

After a few calls, Leone told me back in 2005: "Alright kid, you're persistent so I'll meet them, but our last fund of $500 million was oversubscribed by $4.5 billion and we are fighting internally on whether Harvard or Yale gets a bigger allocation. The best advice I can give pensions is don't invest in venture capital, you'll lose your shirt."

Times have changed since then but I think that the easy money days in VC La La Land are definitely over and tough times lie ahead.

It's going to be brutal, I know it, I feel it and experts I talk with in Silicon Valley totally agree with me.

It doesn't mean that Teachers' and other large Canadian pensions should stop investing in VC and late-stage growth companies, it means the landscape will be a lot harder and you need to temper your expectations.

Alright, those are my thoughts, please don't email me about Teachers' taking a hit on FTX, I have stated what I think here and will leave it at that.

Below, a year ago, Sam Bankman-Fried, Founder and CEO, FTX talked to Bloomberg’s Joe Weisenthal about the incredible growth in the crypto space, his own journey, and what he sees for the future of the crypto markets.

And CNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Alex McDougall, the president & CEO of Stablecorp Inc., discusses the impact of the proposed agreement between Binance and FTX on crypto markets, what would happen in the event the deal does not go through and what can help restore investor trust.

Update: The Guardian reports cryptocurrency prices plunged for a second-straight day on Wednesday after crypto exchange Binance announced it was pulling out of its deal to purchase its failing rival FTX Trading:

Bitcoin and other cryptocurrencies were broadly lower on rumors and news reports that the Binance-FTX deal was in trouble. The CEOs of the two exchanges – Sam Bankman-Freid of FTX and Changpeng Zhao of Binance – had publicly agreed to a merger Tuesday, pending the ability for Binance to perform due diligence of FTX’s balance sheet.

That due diligence apparently led to significant concerns that convinced it to pull out of the deal, Binance said in a statement Wednesday.

“In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” Binance said.

The price of Bitcoin plunged more than 12% to $16,084, according to CoinDesk, its lowest level since December 2020. It had been above $20,000 earlier in the week. The other major cryptocurrency, Ethereum, was down 13%.

FTX had agreed to sell itself to Binance after experiencing the cryptocurrency equivalent of a bank run. Customers fled the exchange after becoming concerned about whether FTX had sufficient capital. The sudden sale was a shocking turn of events for Bankman-Fried, who was hailed as somewhat of a savior earlier this year when he helped shore up a number of cryptocurrency companies that ran into financial trouble.

Shares of publicly traded exchanges exposed to crypto also plunged on the news. Robinhood shares closed down roughly 14% and Coinbase shares lost around 10%.

FTX is the latest cryptocurrency company this year to come under financial pressure as crypto assets have collapsed in value. Other failures include Celsius, a bank-like company that took in crypto deposits in exchange for yield, as well as an Asia-based hedge fund known as Three Arrows Capital.

Also, FTX investors have been warned that the crypto exchange may be forced to file for bankruptcy protection if it doesn't get a cash infusion, Bloomberg reported Wednesday.

The news follows reports that Binance balked at an earlier promise to buy the troubled trading empire after looking at its books. Bloomberg reported the FTX exchange faces an $8 billion shortfall.

Also, Venture capital firm Sequoia Capital said it will mark down to zero its investment of over $210 million in cryptocurrency exchange FTX, as possibilities of bankruptcy loom.

"Based on our current understanding, we are marking our investment down to $0," the Silicon Valley-based firm said Wednesday.

"The fund remains in good shape," it said in a statement posted on its Twitter account

Stay tuned, expect more fallout from this FTX debacle.

***

On Thursday, OTPP released a statement on FTX:

In October 2021, Ontario Teachers’ invested a total of US$75 million in both FTX International and its US entity (FTX.US). In January 2022, we made a follow-on investment of US$20 million in FTX.US. These investments were made through our Teachers’ Venture Growth (TVG) platform, alongside a number of global investors, to gain small-scale exposure to an emerging area in the financial technology sector.

TVG was established in 2019 to invest in emerging technology companies raising late-stage venture and growth capital. TVG’s investments are structured to provide Ontario Teachers’ with returns commensurate with the risk undertaken and to provide proprietary insights that inform investing elsewhere across the Plan. Naturally, not all of the investments in this early-stage asset class perform to expectations. However since inception, TVG has delivered solidly on intended objectives. While there is uncertainty about the future of FTX, any financial loss on this investment will have limited impact on the Plan, given this investment represents less than 0.05% of our total net assets.

Well said, let's move on from FTX.

Update: See my latest comment on whether the FTX disaster exposes weak due diligence from top investors.

Comments

Post a Comment