CDPQ's CEO on Being Named 2022 Fund of the Year

Industry analysts and commentators usually group all Canadian Funds together. However, each of them has a distinct risk and investment profile. The Caisse de dépôt et placement du Québec (CDPQ) is unique in that it manages both public capital and pension contributions, and in that it juggles a dual mandate of achieving optimal financial returns as well as contributing to the economic development of the province of Québec.

CDPQ invests on behalf of 47 different depositor groups, although three quarters of its capital comes from three pension plans: Finances Québec, Retraite Québec and RREGOP. It also manages the monies of several insurance plans, including those in the healthcare and automobile sectors.

Québec presents the right ecosystem for CDPQ to thrive, with a diversified economy based on the services sector and abundant in natural resources. If it were a country, the Francophone province would be the world’s 42nd largest economy. At the same time, CDPQ has immensely benefitted Québec’s development over the years and plans to increase its investment footprint from today’s US$ 59 billion to US$ 74 billion (CAD$ 100 billion) by 2026.

La Caisse has grown its assets under management (AuM) non-stop for the past 15 years. That is, until 2022, when sovereign investors worldwide have endured significant (paper) losses, as reflected in page 17 of this report. Yet, the -7.9% reported by CDPQ for the first six months of the year outperformed its benchmark (-10.5%) and the average of State-Owned Investors around the world (-9.7%).

In fact, CDPQ has become one of the world’s most sizeable, active, and sophisticated global investors. In the past ten years, the fund has consistently been among the top 10 investors, and is also a frequent seller, identifying the right opportunities to monetize assets domestically and overseas. According to data compiled by Global SWF, CDPQ would have invested over US$ 10 billion in 2022 in private markets alone.

Lastly, the Québec fund has been a trailblazer when it comes to sustainability and has put its money where its mouth is. In 2018, it sent a strong message by directly tying employees’ variable compensation to the achievement of climate targets. In 2021, it renewed its climate ambitions with an aggressive set of objectives, and its President and CEO, Charles Emond, currently sits on the Steering Group of the UN-convened Net-Zero Asset Owner Alliance.

A Robust Platform with Dedicated Subsidiaries and Branches:

CDPQ has evolved significantly as an organization in the past decade. Just like its Canadian peers, it has a sound corporate governance model, with a Board of Directors of up to 15 members, two thirds of which must be independent. The fund is driven by the CEO and senior executives of the various investment units. In addition to the different asset classes, CDPQ has three subsidiaries with separate boards and directors:

Ivanhoé Cambridge: US$ 52 billion real estate (equity) investor with a mixed portfolio across 15+ countries. It recently opened an office in Sydney.

Otéra Capital: US$ 21 billion real estate (debt) investor with a portfolio in 37 areas of North America. Its 150+ staff sit in Montréal, Toronto, and New York. The latter was opened in June 2022 with a former exec of Related.

CDPQ Infra: Chaired by CDPQ’s CEO, the infrastructure subsidiary acts as a principal owner and contractor for major projects and focuses on building sustainable transport infrastructure for communities like the REM light rail network in Montréal.

In addition, CDPQ itself employs 1,454 staff, 89% of whom sit in Canada and 162 overseas, in 9 different posts. São Paulo was the latest office to be opened in 2018, in order to co-manage the US$ 14 billion Latin American portfolio, along with Mexico City. Eduardo Farhat replaced Denis Jungerman as the head of Brazil in August 2022.

For its impact in the development of Québec, for its leadership among sovereign investors and public investors worldwide, for its significant investment activity during 2022, and, more broadly, for its contribution to the advancement of the industry, Global SWF believes that Caisse de dépôt et placement du Québec (CDPQ) is a worthy recipient of the 2022 Fund of the Year award. We were delighted to present the award to Charles Emond, its Chief Executive Officer, and to speak with him about the fund’s recent evolution and ambitions.

[GSWF] CDPQ was established 57 years ago to manage the province’s newly created retirement plan. How has the fund’s strategy changed and how will it continue to evolve in the years to come?

[CDPQ] La Caisse was created in 1965 at a time when Québec was expanding and has grown considerably since then, becoming Canada’s second largest public investor. One thing that characterizes us is our dual mandate: serving our 47 depositors and contributing to the province’s economic development. We can distinguish three buckets of evolution:

Asset diversification into private markets, which we started in the 1970s, and infrastructure among others;

Our global expansion in the last 10-15 years, with 75% invested out of Canada and 14 offices; and

Sustainability efforts including climate strategy and objectives.

[GSWF] Québec is among the world’s Top 50 economies and outpaced other Canadian provinces in 2021. What role is CDPQ playing in the development and sustainability of such growth?

[CDPQ] Investing in Québec has always been our raison d’être and is not mutually exclusive with our overseas efforts. Our assets in Québec have usually performed very well because it is an ecosystem we know very well. Today, we have about US$ 59 billion invested in Québec across different asset classes, compared to the size of the economy of US$ 380 billion. Considering our depositors – which represent about 6 million Quebecers – we have a huge domestic impact and the good thing about Québec’s economy is that it is very well diversified, which plays to our strength as an investor and advisor.

[GSWF] Canadian Funds demonstrated their resilience in 2022, with investment returns better than their global peers – why do you think that is and what makes CDPQ successful?

[CDPQ] The Canadian model has done very well by applying strong governance criteria, the expansion into private markets and inflation-protected assets; and the ability to manage these assets internally. At CDPQ, we manage 85% of our portfolio internally, which allows us to manage the portfolio at a lower cost and play a more active role in the governance of our investments – including with operating partners who add value over the lifecycle of the investment – that can make an important difference to our performance.

[GSWF] CDPQ has raised over US$7 billion in debt in the past two years including green bonds. How important is to diversify your capital base and how much is coming from overseas?

[CDPQ] Maintaining good levels of liquidity has become very important, especially in the past 10 years. For us, raising debt is one tool among many of creating liquidity as well as a tool for portfolio construction. By issuing in various markets, from USD to Euro and CAD, it allows us to stay in the market, diversify our investor base and our funding sources. The quality of our assets, liquidity position result in a very strong credit profile, allowing us to maintain a AAA rating, which is very attractive in the market and represents great value for investors. In terms of who buys this debt, 75% is central banks and banks, with the balance distributed to asset managers and insurers. From a geographical standpoint, our investors come mainly from North America (45%), followed by EMEA (35%), Asia and Latin America (20%). As with our assets under management which are diversified across the world, we try to diversify and keep a broad investor base, but at the same time have a very conservative capital structure and maintain a senior debt leverage level below 10%.

[GSWF] CDPQ was especially active this 2022 – what transaction/s are you proudest of?

[CDPQ] We are proud of all our teams globally but there have been a few noteworthy investments this year, namely:

Over 50 investments in Quebec-based companies, our local market;

The acquisition of 22% of Jebel Ali Free Zone in the UAE for US$ 4.0 billion, which was a trophy asset and seeks to leverage our relationship with DP World and our growth across the Southeast Asia and East Africa regions;

Our US$ 0.5 billion investment in Shizen Energy, which is a renewable energy leader and our first direct deal in Japan and seeks to dip our toes in the transition from fossil fuels to green energy in Asia;

Ivanhoé Cambridge announcing a partnership – and two investments – with NVELOP to expand “Hub & Flow” in Germany for our European portfolio aimed at building a platform of logistics properties along key supply chains;

Our fixed income team supporting KKR’s acquisition and the energy transition plan of France-based Albioma SA, representing the inaugural transaction for our CAD $10 billion transition envelope; and

Our recent acquisition of 100% of Akiem, the leading provider of locomotive leasing services in Europe that is operating 75% of its fleet on electricity, which plays well into our decarbonization efforts.

[GSWF] Infrastructure is a huge asset class for CDPQ. Where do you see the best opportunities?

[CDPQ] Infrastructure has grown from 6% to 13% of our portfolio, and we expect to raise it to 16% by 2026. This means an extra allocation of US$ 18 billion in the next four years, though we may reduce North America in relative terms. Regarding sub-sectors, we are big into renewables and transportation, and we also like Telecom, and are finishing some parts of the REM (light-rail project) in Montreal. Our competitive edge in infrastructure is that we can go for large tickets where there is less competition, take control positions and do almost everything internally.

[GSWF] CDPQ’s portfolio is truly global – where do you see future growth? What is CDPQ Global’s role?

[CDPQ] Today, two thirds of our portfolio sit in North America and a potential tectonic shift would probably be for us increasing our weight in Asia, although that would depend on the asset classes. For example, in Private Credit there may be a push in the US and Europe. In Infrastructure, it could be all around the world including emerging markets, given our expertise. And in Real Estate it could be more granular including new cities in the US, in Japan or in Australia.

The idea with CDPQ Global was to make sure that we find the right partners and can also have an open dialogue with the regulatory authorities, governmental representatives, etc. In today’s environment, governmental affairs have become crucial. I am a big believer of having boots on the ground and having strong local representatives.

[GSWF] Can you walk us through your commitment to Indonesia’s INA and your international partnerships?

[CDPQ] Selecting the right partners when investing abroad is key to us as we benefit from their expertise, local networks and can come into big projects with more confidence and conviction. We signed an MoU with INA along with APG and a subsidiary of ADIA, which we thought was an ideal combination. We really like Indonesia; I had the chance of meeting with INA’s CEO when I was in that region recently, and we believe it is a country that offers a large pool of opportunities. The work is ongoing, and INA is looking at different opportunities that will also give us an edge on responsible investing.

[GSWF] CDPQ issued a very ambitious climate strategy in 2021 – how important is decarbonization for you?

[CDPQ] Decarbonization is now part of our culture and DNA, and we have made it our priority. Since 2017, we have set ambitious targets which we have exceeded, and in 2021, we raised the bar once more reducing carbon intensity. Today, for every dollar we own, we have 50% less of carbon intensity than we had five years ago. In terms of our portfolio, 80% of the US$ 304 billion are now low carbon emission assets. We are also investing in assets from heavy-emitting sectors as part our CAD$ 10 billion transition envelope, which is a great risk-return proposition for our clients. We have set very ambitious targets for 2025 and 2030 and we are one of the world’s only public investors (the first and the largest) to have compensation tied to carbon reduction targets since 2017.

[GSWF] CDPQ employs over 2,300 people in 11 countries – how do you expect these figures to grow?

[CDPQ] We have been growing at a pace of about 100 people a year for the past five or six years, which aligns with our growth in assets and objectives. However, our structure is quite lean, and our costs are quite low when compared to some of our peers. What keeps me awake at night is the battle for talent, which is real not only at CDPQ but all over the world. Ours is a very competitive market, but we believe our brand of constructive capital – which also appeals to the next generation – as well as our global mandate, makes us an attractive proposition. We deploy a lot of effort in this because if we don’t have people, we don’t have assets, and we don’t have returns.

An increasingly global and diversified portfolio:

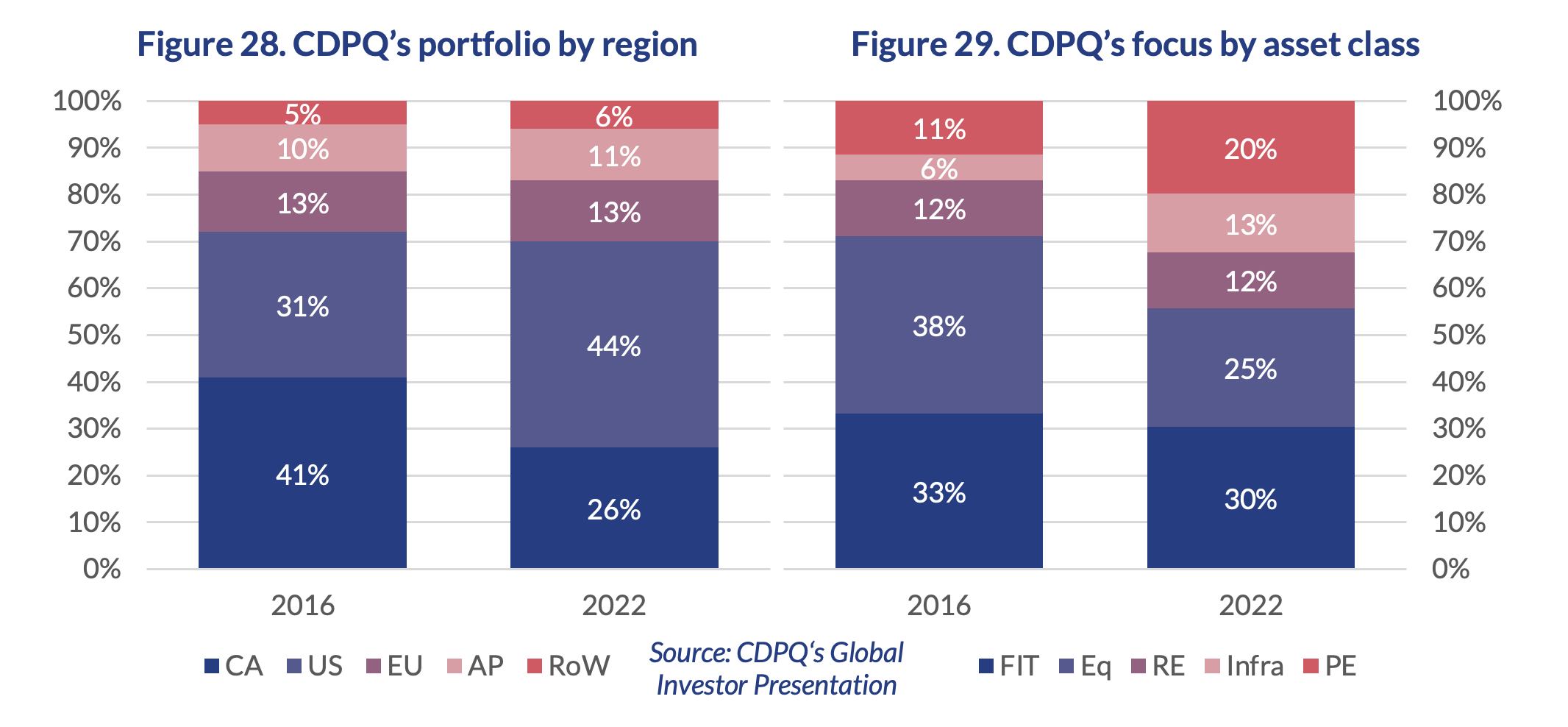

CDPQ’s portfolio has changed significantly since 2016 as it evolves and matures as a global investor. On the one hand, the domestic portfolio was reduced to 26% of the total pie, to the benefit of US-based assets and securities. On the other hand, the weight of Listed Equities in the overall portfolio decreased in 13% to the benefit of Private Equity and Infrastructure. The resulting 44% in illiquid markets puts the Québec investor at similar levels as CPP and OTPP in Canada, and as Temasek and Mubadala internationally.

The trend may continue in that direction as CDPQ aims at increasing its infrastructure portfolio to 16% in the next four years, including additional efforts in emerging markets that may also change the geographical split. That said, the fund will continue to be a key domestic investor and aims to increase its Québec portfolio (most of the Canadian investments) from today’s US$ 59 billion to US$ 74 billion (CAD$ 100 billion) by 2026.

A Busy Year:

CDPQ had a very strong 2022 in terms of deal activity. Some of the largest transactions recorded include:

A truly green investor:

CDPQ announced its first climate strategy in October 2017 in the wake of the Paris agreement. The document promised to factor in climate change in the investment decision process, a US$ 6 billion increase in low carbon investments up to 2020, and a 25% reduction in its carbon footprint by 2025. Months later, the variable component of the staff’s salary was linked to the achievement of climate targets, creating a direct incentive.

Looking to build on this experience to intensify its efforts in achieving a net-zero portfolio by 2050, the Canadian fund issued a revised climate strategy in September 2021. The new policy builds on the previous two pillars and created two new goals: a US$ 7.4 billion decarbonization portfolio and an exit from oil production. The new targets are directly linked to UN’s Sustainable Development Goals #11 & #13 around Climate Action.

One of the main challenges in tracking green policies is the lack of clarity and transparency around key performance indicators. In the absence of regulatory pressures and internationally recognized structures, leading funds have adopted various formats and publish different metrics, which makes it difficult to evaluate different practices, complicates comparative analysis, and allows funds to publish the most flattering statistics.

However, CDPQ pursues a comprehensive reporting of its sustainability actions and produces regular reporting of its carbon footprint, which reveals the impact of its investments on the environment. Approximately 80% of the fund’s global portfolio are either low-intensity or carbon neutral (“green”) assets.

As a reflection of its efforts around Responsible Investing, our latest GSR Scoreboard, issued in July 2022, gave a perfect score of 10/10 to CDPQ in the Sustainability elements, which only 10% of the 200 State-Owned Investors achieved. The Québec fund was at the top of the general leader board with a 96% score, along with three other PPFs (CPP, BCI and PGGM), and four SWFs (ISIF, Temasek, Future Fund and NZ Super).

Let me begin by congratulating CDPQ for being named SWF's 2022 fund of the year and congratulate Diego Lopez for conducting an excellent interview with Charles Emond, its President and CEO.

I was going to begin my new year with this post but I ended up interviewing PSP Investments' President and CEO yesterday on their partnership with AIMCo to explore and invest in private loans.

If you haven't read my last comment, I urge you to do so here.

I must say, I chuckle when people tell me "I can't keep up with your comments" because the who's who of the pension world reads them and if were in their shoes, I'd want to read my comments too.

Every year, I have one goal, be better than last year.

This year, I started off with my Outlook 2023 which is a must read comment of the year. I even pinned it on my Twitter profile at the very top and will continue to deliver top content for my readers throughout the year.

[Update: I pinned my new comment on whether private debt is the next subprime debt crisis at the top of my Twitter profile.]

As I stated yesterday, it's going to be a tough year (or two) across public and private markets, so we all need to work a little harder to weather the storm ahead.

That goes for all asset classes, including private debt which is the flavor du jour, and even hedge funds which performed well last year (mental note #1: remind me to write a comment on how to properly grill your hedge fund managers so they don't pull the wool over your eyes).

Anyways, it's going to be tough.

Pretty much every CEO from CPP Investments' John Graham to OTPP's Jo Taylor, to BCI’s Gordon Fyfe and CDPQ's Charles Emond has said this publicly but I expect it to be even tougher and longer than what some expect (John Graham told me last June when he was in town that that he expects a protracted downturn).

What does this mean in practice? It means every asset class needs to properly account for all the risks in their portfolio, be it real estate and infrastructure or private and public equities and credit.

Here's a good question risk managers can ask their private debt group: "When you look into your total unitranche loans, what percentage are made up of second lien loans?"

If they look at you with a blank stare, start to really worry.

Alright, back to CDPQ and this interview with Charles Emond.

I am on record stating CDPQ is THE global leader in responsible investing and it has nothing to do with the fourth pillar of the climate strategy it unveiled last year -- ie, exiting out of oil production.

In fact, I'm against blanket divestment because I believe in engagement and to be truthful, in a year like last year when energy stocks were up 60% while the rest of the market got clobbered, it costs your clients returns to miss those years.

Now, as I stated, it's not the end of the world. Renewable energy stocks like First Solar (FSLR) and others had an exceptional year too last year so there were alternatives, and CDPQ is investing in renewable energy across private and public markets.

They decided to exit oil production but their climate strategy remains one of the most aggressive in terms of lowering their carbon footprint and they have incentivized their investment professionals to take this strategy into account when doing their own asset class strategy and investments.

That brings me to a very important point, the competition for talent is going to be fierce in the next few years across all of Canada's large pension funds.

And make no mistake, it's not just about compensation, it's about culture and vision and hiring the right people with the requisite experience and skill set to add alpha and lead in a very difficult environment.

One of my new year's resolution — apart form losing all the weight I gained over the holidays from stuffing my face with delicious food — is to be more frank and transparent on my blog.

No more sugarcoating nonsense, I will get it off my chest and it may piss some of you off but you need to here the truth.

To be brutally honest, I'm not impressed with the way Canada's large pension funds screen potential candidates through their cookie cutter shallow approaches and they all use the same software and approach, so they're all guilty of this.

Don't get me wrong, if you check off the right boxes -- you're a woman, gay, trans, disabled, indigenous, have a CFA, FRM, PhD, you might get screened in (likely will not), but generally speaking the entire hiring approach at all these large shops needs to be bombed and revamped from the ground up. It's beyond pathetic and trust me, I know.

There needs to be more transparency and accountability. Also, if you already have identified an internal candidate you love, then don't bother with the whole dog & pony show of posting the job on your website, you know you're not going to hire someone external, you're just doing it to appease your Board.

(Mental note #2: Write a comment on how to bomb and revamp hiring processes at Canada's large pension funds).

Obviously, it's not a total disaster but it can be significantly improved and in my humble but brutally honest opinion, most HR departments aren't that good, they're lazy and trying to do the bare minimum (I told you, this is my opinion, doesn't mean I'm right!).

The real problem is bad hiring processes lead to bad culture and hiring the wrong people who don't know how to manage properly in difficult circumstances.

I know, CDPQ ranked among the world’s 20 best places to work for 2022 and generally speaking, it is a great place to work, has gotten considerably better under Charles Emond's leadership, but there's room for improvement (you need to get rid of some rotten apples and rejig things there too).

The good thing about Charles Emond is he's young and open to constructive criticism.

His predecessor, Michael Sabia, did some really great things -- the REM, placed more women at senior levels, made sure that CDPQ's governance and risk management was significantly bolstered after the 2008 ABCP fiasco (mental note 3: write a book on that fiasco, Netflix will pick it up as a series) -- but Sabia was a terrible manager of employees and rarely ventured down from his 11th floor office to talk to them one on one.

Someone asked me recently what I thought of Sabia and I said he did good things, he is super smart and an extremely hard worker but he's too hierarchical in his management style, ruled CDPQ with an iron fist, and was more at ease hobnobbing with the Desmarais family in their stunning estate in Sagard than conversing with CDPQ's lowly employees.

In short, Sabia is an elitist at heart and I say this with all respect since I met him and think he's nice when you meet him one on one, but you get this feeling he's a bit full of himself and thinks he's the smartest guy in the room (I don't know why, the smartest and most humble guy in Canada by far is Charles Taylor, everyone else is a pea-brain compared to him).

Now, to be fair, Charles Emond is younger than Michael Sabia and while I'm sure he too courts Quebec's elites, he has a more down to earth approach and when you speak to him, you'll understand what I mean.

In my opinion, he's an excellent leader, has a vision, wants to be better every year and is more receptive to looking at things differently and that is an important trait to have in the environment we are heading into.

In fact, I like this quote he gave the Milken Institute Power of Ideas:

“I hope we will remember our capacity to adapt. The next big challenge may be completely different, and we should continue to build on our ability to reinvent ourselves while upholding our deepest convictions.”

— Charles Emond (President and CEO, CDPQ)

The world is continuously evolving, you need to hire and retain top talent which exhibits different perspectives to be able to adapt to the change we are going to go through.

I haven't met Charles yet but I am looking forward to having a private meeting with him and Deb Orida of PSP at one point.

One thing I will tell Charles is CDPQ is great at Infrastructure and Real Estate.

I recently posted a Q& A with Ivanhoe Cambridge CEO Nathalie Palladitcheff and think she and her team are doing a great job in a difficult environment.

The same goes for Emanuel Jaclot and CDPQ's Infrastructure group. They were extremely busy last year doing some huge transactions but it will slow down this year.

As far as CDPQ Infra, Jean-Marc Arbaud and his team did a superb job with the REM but what will they do once this mega project is completed?

Arbaud is ready to retire and I have told Charles he needs to hire someone else at one point who can export that REM's model and success to the rest of the world -- someone who crucially has international experience working on major infrastructure projects abroad.

With all due respect, right now CDPQ Infra doesn't have the right people who know how to court international investors to replicate the REM model abroad (I know this for a fact).

And that is truly a shame. The REM was Michael Sabia's vision, I give him all the credit for that major greenfield project, but Charles Emond and the Board need to figure out what to do with CDPQ Infra once the REM is completed, and I'm not sure they have this figured out.

There are other ideas I have on seeding hedge fund talent and more but I won't bore you with the details. I'm not being paid enough for my strategic thoughts!

Lastly, unlike its large Canadian peers, CDPQ does have a dual mandate and invests heavily in Quebec.

In early December, I wrote a post on how CDPQ is targeting $100 billion in Quebec assets by 2026.

This will be across public and private assets but mostly in infrastructure and real estate.

So Charles Emond also has the political pressure to deal with Quebec's politicians and that's no picnic, just ask Hydro Quebec's CEO Sophie Brochu who earlier today announced on LinkedIn she will be stepping down from her role on April 11th:

Ms. Brochu took on Quebec's Minister of Economy, Innovation and Energy Pierre Fitzgibbon and lost.Quebec politics are savage but luckily our politicians know better than to meddle with CDPQ (Quebec's Minister of Finance Eric Girard knows all too well the importance of governance at CDPQ and not to meddle in its affairs).

Alright, let me wrap it up there and wish CDPQ and quite frankly all of Canada's large pension funds success during this very tough (more like brutal) year.

Below, the new year is already looking up for the province's pension fund, the Caisse de dépôt et placement du Québec. It was recognized as the world's best public pension fund manager for 2022. What's more, it also ranked among the top 20 best places in the world to work. Global's Tim Sargeant reports.

Also, after three years of a five-year term, the head of Hydro-Québec announced Tuesday that she is stepping down. Sophie Brochu’s departure is creating a shock wave through the public utility’s ranks and in the world of politics. Global’s Gloria Henriquez reports. Read more here.

Comments

Post a Comment