CPP Investments' Fiscal Q3 Results and a Decade of Alpha Ahead

Canada Pension Plan Investment Board reported a 1.9-per-cent return for the quarter ended Dec. 31, trailing the broader markets and the benchmark measure it uses to evaluate its annual returns.

The latest quarterly return fell short of the S&P Global LargeMidCap Index’s Canadian-dollar return of 4.4 per cent in the quarter. When CPPIB releases annual results, it uses that stock index for 85 per cent of its “reference portfolio,” a comparison with passive investing that demonstrates how much value it has added through its investing efforts. (Canadian bonds, as measured by the FTSE Canada All Government Bond Index, make up the rest.)

CPPIB’s reference portfolio had a return of roughly 3.7 per cent in the quarter, The Globe and Mail calculates.

While CPPIB reports quarterly, it only uses the reference portfolio as a comparison for annual returns. Instead, it points to its multigenerational mandate and emphasizes the long-term returns.

CPPIB said Thursday its annualized 10-year return was 10 per cent and its five-year return was 8.1 per cent. The Dec. 31 quarter is CPPIB’s third fiscal quarter; it will wrap up its year March 31.

CPPIB closed the quarter with assets of $536-billion, compared with $529-billion at the end of the previous quarter. The $7-billion increase consisted of $10-billion in investment earnings less $3-billion in net outflows from the Canada Pension Plan, as payments to pensioners exceeded contributions.

All CPPIB returns are reported after costs.

The Canada Pension Plan, founded in 1966, is the primary national retirement program for working Canadians. The government created CPPIB in 1999 to professionally manage the plan’s money. Over time, CPPIB has embraced active management and its blend of stocks, bonds, real estate, infrastructure, private equity and other specialized investments has outperformed public markets and its reference portfolio.

CPPIB does not release quarterly investment returns for each investment segment, but offered general comments, saying the rebound in public equity markets in the quarter was offset by private asset values that “remained relatively flat.” Private assets include real estate and infrastructure holdings.

In a statement, CPPIB chief executive officer John Graham said “despite the enduring global economic headwinds, our active management strategy enabled us to outperform markets over the first nine months of our fiscal year.”

For the nine-month fiscal period, the fund reported a portfolio loss of 2.2 per cent.

In a recent interview with The Globe and Mail, Mr. Graham said he sees CPPIB at the beginning of “the decade of alpha” – a period when active investors with the luxury to pick and choose between countries, companies and assets should be able to beat benchmarks and stand out.

“Just harvesting market returns has been a very successful strategy over the past 20 years because of these tailwinds. And right now, it is about picking your spots. It’s about picking the right geographies, the right asset classes and the right securities.”

The Canadian Press also reports CPP Investments earned 1.9 per cent net return for third quarter:

TORONTO - The Canada Pension Plan Investment Board says it earned a net return of 1.9 per cent for its third quarter.

Chief executive John Graham says the gains came due to a rebound in public equity markets, while the fund’s private asset values remained relatively flat.

The county’s largest pension fund manager says its net assets at Dec. 31 totalled $536 billion, up from $529 billion at the end of the previous quarter.

CPP Investments says the increase included $10 billion in net income, less $3 billion in net Canada Pension Plan outflows.

The fund noted that it typically receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments topping contributions in the final part of the year.

For the nine months ended Dec. 31, CPP Investments says the fund posted a net return of negative 2.2 per cent.

This report by The Canadian Press was first published Feb. 9, 2023.

CPP Investments issued a press release stating its net assets totaled $536 billion at the end of the third quarter of fiscal 2023:

Third-Quarter Performance1:

- Net assets increase by $7 billion

- 10-year annualized net return of 10.0%

- 31st Actuarial Report confirms financial sustainability of the CPP

TORONTO, ON (February 9, 2023): Canada Pension Plan Investment Board (CPP Investments) ended its third quarter of fiscal 2023 on December 31, 2022, with net assets of $536 billion, compared to $529 billion at the end of the previous quarter.

The $7 billion increase in net assets for the quarter consisted of $10 billion in net income less $3 billion in net Canada Pension Plan (CPP) outflows. CPP Investments routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

In the five-year period up to and including the third quarter of fiscal 2023, CPP Investments has contributed $166 billion in cumulative net income to the Fund, and over a 10-year period, it has contributed $308 billion to the Fund on a net basis.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved five-year and 10-year annualized net returns of 8.1% and 10.0%, respectively. For the quarter, the Fund’s net return was 1.9%.

For the nine-month fiscal year-to-date period, the Fund decreased by $3 billion consisting of a decline in net assets of $12 billion, plus $9 billion in net CPP contributions. For the period, the Fund’s net return was negative 2.2%.

“Our diversified portfolio delivered gains this quarter due to a rebound in public equity markets, while our private asset values remained relatively flat. Despite the enduring global economic headwinds, our active management strategy enabled us to outperform markets over the first nine months of our fiscal year,” said John Graham, President & CEO. “While we expect these market pressures to persist in 2023, our resilient portfolio continues to deliver strong, long-term results.”

Performance of the Base and Additional CPP Accounts

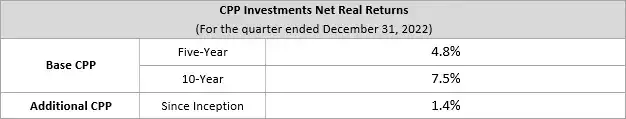

The base CPP account ended its third quarter of fiscal 2023 on December 31, 2022, with net assets of $517 billion, compared to $512 billion at the end of the previous quarter. The $5 billion increase in assets consisted of $10 billion in net income, less $4 billion in net base CPP outflows. The base CPP account achieved a 1.9% net return for the quarter, and a five-year annualized net return of 8.1%.

The additional CPP account ended its third quarter of fiscal 2023 on December 31, 2022, with net assets of $19 billion, compared to $17 billion at the end of the previous quarter. The $2 billion increase in assets consisted of $209 million in net income and $1 billion in net additional CPP contributions. The additional CPP account achieved a 1.2% net return for the quarter, and an annualized net return of 5.0% since inception in 2019.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada (OCA), an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

“The Chief Actuary has concluded through her most recent review that the Canada Pension Plan remains sustainable for the long term at current contribution rates. It is especially important during times of economic uncertainty that contributors and beneficiaries know the CPP Fund will be there to provide a foundation for their retirement income now and for generations to come,” added Mr. Graham. “Notably, the report outlines that due to strong investment performance over the three-year period from 2018 to 2021, investment income was more than $100 billion higher in 2021 than expected in the previous report.”

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Board of Directors appointment

- Welcomed Judith Athaide to the Board of Directors. Appointed in November 2022, Ms. Athaide is President and CEO of The Cogent Group Inc., and a corporate director. She previously held a variety of senior commercial and technical roles in the energy industry, as well as academic positions at the Universities of Alberta, Brandon, Calgary and Mount Royal.

Executive announcement

- Subsequent to quarter end, appointed Kristen Walters as Senior Managing Director & Chief Risk Officer. In this role, Ms. Walters will be responsible for the Fund’s global risk management functions including leading the long-term strategy for effectively incorporating risk perspectives into all investment and operational processes.

Corporate development

- Published The Decarbonization Imperative through the CPP Investments Insights Institute: an updated proposal for helping corporate boards and management develop transparent and credible plans to achieve net-zero goals and, in turn, create long-term value.

Third-Quarter Investment Highlights:

Credit Investments

- Invested US$40 million in sustainable home improvement loans originated by GoodLeap LLC through a one-time whole-loan purchase with capital managed by Blackstone’s Asset Based Finance Group. GoodLeap LLC is a sustainable home-solutions marketplace based in the U.S.

Private Equity

- Committed US$100 million to the General Atlantic Investment Partners 2023, L.P. fund, which will focus on growth equity opportunities globally.

- Invested US$53 million in Howden Group Holdings, a leading international insurance intermediary group, alongside General Atlantic.

- Provided sponsorship across capital structures for an investment in EcoCeres, Inc., an Asia-based leading biorefinery platform that converts waste-based biomass into biofuels and biochemicals.

- Invested US$150 million into the Hermes GPE Secondaries Opportunities Fund, which will focus on secondaries transactions involving middle-market companies and General Partners within Europe.

- Committed US$100 million to the Baring Private Equity Asia EQT Mid-Market Growth Fund, a newly established joint middle-market Asia-Pacific private equity investment platform.

- Invested US$53 million for a 2.7% stake in IIFL Wealth, a leading wealth and asset management firm in India, alongside Bain Capital Asia.

- Invested US$180 million for a 10% stake in Tricor Group, a leading Asia-focused provider of business and corporate services based in Hong Kong, alongside BPEA EQT.

Real Assets

- Invested approximately US$200 million in Redaptive, a leading U.S.-based Energy-as-a-Service provider that funds and installs energy efficiency and energy generation solutions for commercial and industrial customers.

- Agreed to sell our 49% stake in L&T Infrastructure Development Projects Limited (L&T IDPL). Gross proceeds to CPP Investments from the sale are expected to be approximately C$220 million, before closing adjustments and other terms of the transaction. The transaction is subject to customary closing conditions and regulatory approvals.

- Awarded an 80,418-acre floating offshore wind lease off the central coast of California for US$150 million, through Golden State Wind, our 50%/50% joint venture with Ocean Winds.

- Invested R$2.5 billion (C$639 million) for a stake of approximately 9.5% in V.Tal, the largest neutral fibre-to-the-home network provider in Brazil.

- Committed US$30 million to Chestnut Carbon, a nature-based carbon offset developer focused on retail land across the U.S. through afforestation/reforestation as well as improved forestry management projects.

- Entered into an agreement with Royal Schiphol Group to acquire a stake of 1.59% in Aéroports de Paris, an international airport operator based in Paris. Upon completion, this increases our total ownership stake to 5.64%, valued at €698 million at current market prices (as at December 31, 2022).

Transaction Highlights Following the Quarter

- Committed an additional C$322 million to the Japanese Data Centre Development venture with Mitsui & Co. Ltd, established in 2021. The venture is focused on hyper-scale data centre developments in Japan.

- Sold 4.9 million shares of common stock in Civitas Resources, Inc., through a repurchase agreement with the company, resulting in aggregate consideration of approximately US$300 million. We will continue to own approximately 21% in Civitas Resources, an oil and gas producer in Colorado.

- Committed US$40 million into Viewpoint Software, an entity engagement software provider headquartered in Malaysia, alongside BPEA EQT Mid-Market Growth Fund.

- Invested US$50 million in the convertible debt of Netskope. Based in the U.S., Netskope is a leading cloud cybersecurity business within the Secure Access Service Edge market.

- Committed US$300 million to Bain Capital Asia Fund V, the pan-Asia platform of Bain Capital, which will target mid-to-large companies in diversified sectors.

- Committed US$205 million to IndoSpace Logistics Park IV, a real estate vehicle managed by India-based real estate company IndoSpace.

- Invested US$78 million in Shandong Fengxiang Co. Ltd, a fully integrated poultry meat product manufacturer and producer in China, alongside PAG Asia Capital.

- Invested US$50 million in the Series B funding round for Asimov, a U.S.-based synthetic biology company building tools to design and manufacture next-generation therapeutics.

- Completed a secondary purchase of an approximate US$180 million interest in Sequoia Global Growth Fund III, which invests globally across asset classes.

About CPP InvestmentsCanada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At December 31, 2022, the Fund totalled $536 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Alright, after last night’s marathon comment covering Daniel Fournier's appointment to lead Oxford Properties, OMERS' real estate subsidiary, I definitely want to keep it tight tonight.

First, I really couldn't care less what performance CPP Investments delivers in any fiscal quarter because I highlighted all the important passages and "the State of the Fund is strong" over the long run which is what ultimately counts:

In the five-year period up to and including the third quarter of fiscal 2023, CPP Investments has contributed $166 billion in cumulative net income to the Fund, and over a 10-year period, it has contributed $308 billion to the Fund on a net basis.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved five-year and 10-year annualized net returns of 8.1% and 10.0%, respectively. For the quarter, the Fund’s net return was 1.9%.

...

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada (OCA), an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

“The Chief Actuary has concluded through her most recent review that the Canada Pension Plan remains sustainable for the long term at current contribution rates. It is especially important during times of economic uncertainty that contributors and beneficiaries know the CPP Fund will be there to provide a foundation for their retirement income now and for generations to come,” added Mr. Graham. “Notably, the report outlines that due to strong investment performance over the three-year period from 2018 to 2021, investment income was more than $100 billion higher in 2021 than expected in the previous report.”

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Everything you need to know about CPP Investments' long-term performance and its commitment to the Canada Pension Plan is there.

The only useful thing about quarterly results is you can go back a year to impute CPP Investments' calendar year result for 2022 which was -2.6% (not official and probably worse than that as subject to review and private market valuations).

A decline of 2.6% when stocks and bonds got clobbered, especially in the first half, is excellent as most Canadian DB plans were down 10.3% in 2022 according to RBC:

TORONTO, Jan. 31, 2023 - Canadian defined benefit (DB) pension plans posted hard-hitting losses in 2022 despite a positive final quarter, according to the latest survey from RBC Investor & Treasury Services (I&TS).

Within the I&TS All Plan universe, pension assets returned 3.8% over the last three months of the year, bringing the annual median return to -10.3%, the lowest observed since the 2008 financial crisis, which saw an annual median return of -15.9%.

"Pensions gained traction toward the end of 2022 despite the ongoing volatility caused by embedded inflation and subsequent higher interest rates imposed by central banks," said Niki Zaphiratos, Managing Director, Asset Owners, for RBC Investor & Treasury Services. "However, this was not enough to offset the first two quarters of heavy losses."

Foreign equities, the top-performing asset class in Q4, returned 9.7% in the quarter, bringing full-year results to -11.3% – ahead of the MSCI World Index, which returned -12.2%. Over the quarter, a majority of developed markets generated healthy local currency returns. In addition, currency gains outside of the US market further boosted returns for unhedged portfolios (MSCI EAFE Index CAD 15.7% versus MSCI EAFE Local 8.7%). Value stocks outperformed growth stocks in the quarter and finished the year well ahead of their growth counterparts (MSCI World Value 0.3% versus MSCI World Growth -24.1%).

Canadian equities trailed their global counterparts over the quarter and returned 6.3%, versus 5.9% for the TSX Composite Index. Over the year, domestic stocks represented the top performing asset class (returning -3.6% in the All Plan Universe versus -5.8% for the TSX Composite Index), attributable to a large exposure to commodity stocks.

Canadian pensions had their largest annual fixed income decline in more than 30 years, losing 16.8% over the 12-month period, compared to the -11.7% return for the FTSE Canada Bond Index. As central banks enacted restrictive monetary policy to tame surging inflation, yields rapidly rose across the spectrum. The weakness spread across the market, but inflation-sensitive, longer-duration bonds were the most affected. The FTSE Canada Long Overall Bond Index declined 21.8%, while FTSE Canada Short Overall Bonds were down 4.0%.

"It was a challenging year for pension asset managers," noted Zaphiratos. "Both equities and fixed income asset classes, which typically offset each other, experienced losses. However, the rapid rise in bond yields resulted in the lowering of pension liabilities – and most pensions ended the quarter in a better position."

Zaphiratos continued: "In the next few months, plan sponsors will need to be attentive to risk factors such as the economic impact of the central banks' actions, ongoing geopolitical tensions and ongoing efforts to contain the COVID virus outbreak in certain emerging markets."

Historic performance

Period

Median return (%)

Period

Median return (%)

Q4 2022

3.8

Q3 2020

3.0

Q3 2022

0.5

Q2 2020

9.6

Q2 2022

-8.6

Q1 2020

-7.1

Q1 2022

-5.5

Q4 2019

2.0

Q4 2021

4.5

Q3 2019

1.7

Q3 2021

0.6

Q2 2019

2.7

Q2 2021

4.4

Q1 2019

7.2

Q1 2021

-0.2

Q4 2018

-3.5

Q4 2020

5.4

Q3 2018

0.1

About the RBC Investor & Treasury Services All Plan Universe

RBC Investor & Treasury Services has managed one of the industry's largest and most comprehensive universes of Canadian pension plans for more than 30 years. The All Plan Universe, a widely recognized performance benchmark indicator, tracks the performance and asset allocation of a cross-section of assets across Canadian defined benefit pension plans. The All Plan Universe is produced by RBC Investor & Treasury Services' Risk & Investment Analytics service, which delivers independent and cost effective solutions that help institutional investors monitor investment decisions, optimize performance, reduce costs, mitigate risk and enhance governance.About RBC

Royal Bank of Canada is a global financial institution with a purpose-driven, principles-led approach to delivering leading performance. Our success comes from the 95,000+ employees who leverage their imaginations and insights to bring our vision, values and strategy to life so we can help our clients thrive and communities prosper. As Canada's biggest bank and one of the largest in the world, based on market capitalization, we have a diversified business model with a focus on innovation and providing exceptional experiences to our 17 million clients in Canada, the U.S. and 27 other countries. Learn more at rbc.com.

Now to be fair, it's better to compare additional CPP performance with that of the average Canadian DB plan which acts more like a 60/40 portfolio (global equities/ global bonds).

But even there, the additional CPP account achieved a 1.2% net return for the quarter, and an annualized net return of 5.0% since inception in 2019.

The big difference between CPP Investments' portfolio and all of Canada's Maple 8 with that of the typical Canadian DB plan is they have a much higher allocation to private markets and a much better approach, internalizing investment management across public and private markets as much as possible.

This is where most of the active management takes place (not all of it as public markets also contribute).

I will caution however, that even though values of private markets were 'little changed' last fiscal quarter, what happens in public markets ultimately impacts privates as well.

It's only normal, as valuations get hit in stock markets, it impacts the valuations of comparable private companies, especially if bear market lasts a while, and there are less exits so it impacts private equity returns (harder to realize on investments, realize them at lower valuations).

And then there are rates. Higher for longer will also impact private markets.

But what I find interesting is what CPP Investments CEO John Graham stated in a recent Globe and Mail interview where he predicted ‘alpha’ investors will outperform in the next decade:

With 2023 shaping up to be another volatile year for investors, Canada Pension Plan Investment Board chief executive John Graham is in a picky mood.

The CEO of the $529-billion pension asset manager is happy to see 2022 – marked by COVID-19 lockdowns, Russia’s invasion of Ukraine, supply chain upheaval, high inflation and soaring interest rates – in the rear-view mirror.

At its outset, the new year isn’t looking a lot easier. But in an interview at CPPIB’s Toronto office, Mr. Graham predicted 2023 could mark a pivot point to a different investing landscape where the pension plan asset manager can take advantage of its financial heft and global reach.

He’s calling it the beginning of “the decade of alpha” – a period when active investors with the luxury to pick and choose between countries, companies and assets should be able to beat benchmarks and stand out.

For most of the past 20 years, Mr. Graham suggests, investors of all stripes capitalized on a series of tailwinds helping the global economy. Those included cheap borrowing rates, low inflation and what seems in hindsight like a relatively benign political environment. In combination, those factors provided a rising tide for investors, and passive investing strategies gained hugely in popularity.

As each of those factors has inverted, investors are repricing risks, deals are harder to come by and financing isn’t always readily available. Suddenly, investors are taking more varied approaches to allocate their money. And with government bonds offering generous rates of return for the first time in years, “there’s options now,” Mr. Graham said.

“We see the next decade as being the decade of value-added, the decade of alpha,” he said. “Just harvesting market returns has been a very successful strategy over the past 20 years because of these tailwinds. And right now, it is about picking your spots. It’s about picking the right geographies, the right asset classes and the right securities.”

Over the longer term, he added, “it actually is providing the opportunity for, in some ways, more interesting portfolio construction.”

CPP manages money for the Canada Pension Plan, the primary national retirement program for working Canadians, with about 21 million contributors and beneficiaries. Since it was created in 1997, CPPIB has increasingly embraced active management, shifting a greater share of its investments into assets such as real estate, infrastructure and private equity, in addition to public stocks and bonds.

The first six months of CPPIB’s fiscal year were challenging, with assets down 4 per cent as of Sep. 30 to $529-billion. That was a better result than some relevant benchmarks, as selloffs pushed some equity markets down by double-digit percentages

Over the past 10 years, CPPIB has returned 10.1 per cent annually, on average.

Before he was named CEO in 2021, Mr. Graham led CPPIB’s credit business, which includes private credit investments in businesses that are starting to feel the pinch of rising interest rates. Much has been made of the valuation gap between publicly traded assets, which have fallen sharply in many cases, and private assets that have been slower to adjust. But Mr. Graham said CPPIB has been “quite disciplined” about marking its portfolios to markets, and doesn’t expect big markdowns to come “based on what I’m seeing now.”

He also said many businesses are coping well with the higher borrowing costs that come with higher interest rates so far. “To date, we haven’t seen a lot of stress, to be frank. A lot of companies are doing well.”

In spite of the many challenges roiling markets, he also enumerated some positive signals that are buoying investor sentiment: A reopening in China after draconian COVID-19 lockdowns, inflation starting to come down, a comparatively warm winter in Europe easing pressure on energy supply and a decent start to the year in equity markets.

Yet Mr. Graham said the economic dynamics that shape the global investment landscape are more complicated than they were in recent years. “Now there’s a national-security lens, a domestic-interest lens that’s applied to economic policy and industrial policy. It’s not just a profit maximization. There are other factors at play,” Mr. Graham said.

In that context, he said, it will be especially important to be “somewhat surgical” about choosing which countries to emphasize and how to invest in them, including which sectors to prioritize. CPPIB has eight offices outside Toronto, from New York and London to Hong Kong and Mumbai.

“Our appetite for any given country will ebb and flow based on what opportunities we see at the time,” Mr. Graham said. “Right now, we’re quite comfortable with our exposure to emerging markets.”

I don't know what the next decade holds but I'm very anxious about the next three years, there will be huge dislocations in markets and global economies and that will present risks and opportunities for a fund like CPP Investments.

One thing is for sure, CPP Investments and all of Canada's Maple 8 will not escape the carnage ahead, which is why we need to track their long-term performance.

Lastly, Bloomberg reports Denmark’s biggest pension fund lost a record $8.2 billion as bonds, stocks sank last year:

ATP, Denmark’s biggest pension fund, lost the most money on record last year as the value of its bonds and stocks sank.

The investor had a net loss of 56.8 billion kroner ($8.2 billion) compared with a net profit of 13.5 billion kroner in 2021, ATP, which is based north of Copenhagen, said on Thursday. Its total assets declined 28% to 678 billion kroner.

“ATP has had a very difficult year where we lost a lot of money in our investment portfolio,” Chief Executive Officer Martin Praestegaard said in a separate statement. “ATP was hit by losses in both equities and particularly bonds, which constitutes a large share of the investment portfolio.”

ATP lost 64.4 billion kroner on its investments last year, equal to a negative return of 41% of its bonus potential, after expenses, it said. The state-controlled fund, which all Danes are required to contribute to by law, has been criticized in local media in the past year for taking on excessive risks with its investments.

ATP has “the right long-term strategy, and a 2022 that disappointed in terms of results does not change this,” the CEO said in Thursday’s statement.

ATP is an excellent pension plan, there are a lot of reasons why they lost so much, including leveraging bonds as a form of risk parity, but it will bounce back over the long run.

I'm just showing you that even the best pension pans can get hit in any given year.

Alright, that's it from me.

Below, listen to the December 2022 State of the Fund message from John

Graham, CPP Investments’ President and CEO. John shares his views on how

their clear purpose, active management strategy and sustainable investing

leadership helped them navigate last year’s challenges, and why they remain

cautiously optimistic about the year ahead.

Comments

Post a Comment