Letko and Brosseau Set the Record Straight on Why Pensions Should Invest More in Canada

Before I get to that conversation, AIMCo's CEO Evan Siddall wrote an op-ed for the Globe and Mail stating the federal government government should not be pushing pension funds to invest more in Canada:

The Canadian model of pension investment management is seen around the world as the gold standard in safeguarding retirement savings. Despite defining the standard, Canada’s retirement system is under pressure. We should all be concerned.

Our high ratings have fallen, according to the Mercer CFA Institute Global Pension Index 2023, primarily because of mounting concerns about the ability of plans to operate in the most efficient manner, unfettered by political influence.

Finance Minister Chrystia Freeland’s fall economic statement did not help. It included proposals that would have Canadian plans obfuscate our clear, risk-adjusted return-driven mandate to add a focus on economic development. However, this so-called “dual mandate” would be confusing and would dilute our fiduciary obligation to deliver safe, secure and growing pension investments for the people we serve. Inherently, it asks pensioners to foot the bill for Ottawa’s failure to promote Canadian economic growth and productivity.

Remarkably, this comes at a moment when the business of investing is already tough: Inflation pressures, volatile financial markets and geopolitical tensions make it harder to do our jobs.

The Canadian pension model of long-term investing was built for this: to be resilient in difficult conditions. It rests on three pillars: stand-alone pension investment firms with unambiguous missions; strong, independent governance; and the ability to hire professional resources and highly qualified investing talent. As a result, Canada is the envy of the world and houses some of the best investment firms anywhere.

Ms. Freeland proposes to interfere with two of these three pillars. A dual mandate muddies the waters, the opposite of a “clear mission.” Worse, any hint of political influence over our conduct undermines independent governance, which the World Bank called “the most important element of the Canadian model.”

As the investment manager for several Alberta-based pension plans, AIMCo does not believe we need to increase our investments in Canada. While our public disclosure makes clear we invest nearly half of our clients’ portfolios domestically, AIMCo must be free to seek investment opportunities by achieving the portfolio benefits of global diversification. In short, we will pursue the best investments wherever they exist, consistent with our fiduciary responsibility to maximize risk-adjusted net returns.

Regrettably, the inherent value of diversification is being overlooked by those pressuring Canadian pension funds to increase domestic investments. It is well understood that an investor can reduce risk without reducing returns by avoiding a portfolio of correlated investments whose fortunes rise and fall together, such as having too many assets in any single country – like Canada.

It may seem appealing to encourage pension funds to invest more of our combined funds of over $2-trillion in Canada. Letko Brosseau has launched a lobbying and letter-writing campaign to compel us to buy more of the Canadian equities that they principally invest in. It is not our role to prop up Canadian equity markets. Their self-serving and amateurish critique of Canadian pension plans overlooks our far larger investments in Canadian fixed-income securities, real estate, infrastructure and private debt and equity. Their analysis reflects a profound lack of understanding of investing on behalf of pension funds.

As it is, pension funds are already highly exposed to the Canadian economy, employment levels and wage growth. Rather than doubling down on these risks, AIMCo is unapologetically expanding our global presence in order to increase the potential sources of diversification and higher returns for our pension clients and beneficiaries.

It is wrong to seek to expropriate the savings of hard-working Canadians to achieve policy objectives. Tax measures and economic incentives are more direct means of attracting domestic pension funds’ interest, and other global investors’ attention as well.

Rather than interfering with our clear mandate, there are many levers available to the Canadian federal government to grow our country’s economy. We welcome the potential of lifting the archaic 30-per-cent cap on our ownership of Canadian businesses. A reinstatement of pension-friendly inflation-hedged Real Return Bonds would also result in an immediate increase in our investments in Canada. Making large-scale infrastructure projects currently owned by the Government of Canada available for private investment would be another useful demonstration of Ottawa’s desire to increase pension-fund investments in Canada.

Pressuring pension funds to “make Canada great again” is not the way Canada will grow its economy. Indeed, it will harm the very individuals on whose behalf they are investing. The pension savings of Canadians are not our country’s economic development department.

Canadian plans work on behalf of teachers, nurses, police officers, judges, professors, firefighters and civil servants. Our political leaders owe these hard-working Canadians safe and secure retirement savings. We have already shown the world how: through dedicated pension organizations with clear, undiluted missions and independent governance that is free of any hint of interference.

Evan raises many important points here but the primary ones I want to highlight are the Canadian pension model works because they got the governance right, separating government from pension investment decisions and secondly, we shouldn't view pensions funds as economic development departments.

I've said this many times, the primary purpose of any pension fund is to deliver on its mandate, obtaining the highest risk-adjusted returns over the long run, making sure they have more than enough assets to cover their long dated liabilities.

Now, Evan also wrote this in his op-ed:

Letko Brosseau has launched a lobbying and letter-writing campaign to compel us to buy more of the Canadian equities that they principally invest in. It is not our role to prop up Canadian equity markets. Their self-serving and amateurish critique of Canadian pension plans overlooks our far larger investments in Canadian fixed-income securities, real estate, infrastructure and private debt and equity. Their analysis reflects a profound lack of understanding of investing on behalf of pension funds.

That didn't sit particularly well with Peter Letko and he told me so earlier today right before lunch when we spoke along with his partner Daniel Brosseau.

I want to thank both of them for taking the time to talk to me earlier today and let me begin by setting the record straight:

- Letko and Brosseau are not -- I repeat not -- lobbying the government to force Canada's large pension funds to invest more in Canadian equities. They see plenty of opportunities in Canadian equities and told me flat out our most venerable pension funds missed huge run-ups in stocks like Couche Tard and others, but they are not lobbying to increase Canadian equity exposure.

- Letko and Brosseau are not lobbying for a dual mandate at Canada's large pension funds similar to the one at CDPQ. In fact, they explicitly told me they are not looking to change the governance at our large pension funds and they are not telling pension funds where to invest.

- Letko and Brosseau are looking to have a meaningful conversation on where Canadian pension funds invest the savings of Canadians. Here they highlighted long-term structural issues plaguing our economy like the decline in productivity relative to the US and they think it's time to explore ways to improve our economy and they think pension funds that control long-term patient capital need to be part of that conversation.

As far as talking up their book, Peter Letko was resolute: "Our book speaks for itself, we have 15% annualized return over the long run, more than double the TSX, a track record that many compare to Warren Buffett's."

Peter reminded me that he and Daniel came from CN's pension plan and they were the first to invest internationally, as well as in venture capital and private equity.

They were the first to lobby hard to change foreign content rules so that Canada's pensions can invest more abroad.

So why have they been so vocal on this issue now? They both told me they have children and grandchildren and are concerned about their future and the future of Canada and they think we need to have a meaningful conversation as to where our savings are being invested and pensions need to engage in that conversation.

They sent me a brief executive summary going over their thoughts:

The key point is that pension funds account for 36% of Canadian institutional savings and they are ideally placed to invest more in Canada.

They didn't specify where to invest more -- leaving it up to pension fund managers -- but did show data demonstrating how even though Israel's economy is a quarter the size of Canada's, they invest twice as much in start-ups and US pension funds invest 70% of their assets domestically.

Now, I didn't want to be impolite but US pension funds have huge governance issues, too much political interference, which is why their long-term performance isn't good and why most of them are heavily underfunded (unlike our fully funded Canadian pension plans).

Daniel Brosseau did mention that there were plenty of opportunities to invest in Canada before the loosening of the foreign content restrictions and there will be plenty more in the future.

He said just because Canadian equities represent 3% of the MSCI World Index, doesn't mean pensions shouldn't invest more here. "That figure represents world savings, the $2 trillion Canadian savings is meaningful for our economy."

I did mention to both of them that I'm uncomfortable seeing pension funds investing in Chinese equities despite that economy growing fast over the past two decades:

What’s the point of investing in Chinese equities again?

— Michael A. Arouet (@MichaelAArouet) November 21, 2023

Chart @laidler_ben pic.twitter.com/fNF69SkY0V

Basically I have a fundamental problem investing any amount in a communist country or any country governed by an autocratic ruler (there are safer ways to play China's growth).

I also mentioned most of Canada's Maple 8 are scaling back or have scaled back their investments in China ever since Russia invaded Ukraine.

What else? I mentioned I see a major US and global recession on the horizon and I'm very worried about concentration risk in US equities right now:

WARNING: Bank credit is officially contracting

— Game of Trades (@GameofTrades_) November 22, 2023

This has only happened once in the past 50 years

At this rate, something is bound to break pic.twitter.com/7DhTJH74g4

WARNING: M2 money supply has plummeted

— Game of Trades (@GameofTrades_) November 21, 2023

And is contracting at the deepest level. Ever. pic.twitter.com/ujv8MSmSQb

Interest rate on credit card debt has risen to 21.19%

— Game of Trades (@GameofTrades_) November 22, 2023

To put this in perspective, this rate was at 14.56% in early 2022

That’s a 6% + jump in less than 2 years

Current levels have NEVER been seen in over 25 years

This is happening at a time when credit card debt has crossed… pic.twitter.com/ktMs74DyAB

One of the reasons the US is not in recession yet

— Michael A. Arouet (@MichaelAArouet) November 23, 2023

Chart @PkZweifel pic.twitter.com/DWfg2xHIpI

Every generation has its own bubble. Human nature doesn’t change, only the bubbles change. pic.twitter.com/TEGeOMutIW

— Michael A. Arouet (@MichaelAArouet) November 23, 2023

Four blue-chip Tech stocks are leading the Dow this year, with Intel $INTC actually up the most at 69.1%. Salesforce $CRM ranks 2nd at +68.8%, followed by Microsoft $MSFT (58%) and then Apple $AAPL (48%). pic.twitter.com/SS2HDynpQB

— Bespoke (@bespokeinvest) November 24, 2023

Comparing four week % Tech gains to a new 52 week high, going back 20 years.

— Mac10 (@SuburbanDrone) November 23, 2023

Bearing in mind, this current week is only through Wednesday. pic.twitter.com/6fGSMl0erv

I can go on and on but basically we are at a point where US stocks are heavily concentrated in the "Magnificent 7" and beta risks are extremely high (when this AI bubble bursts, pain will be felt everywhere).

What else? Peter Letko noted that roughly 45% of Canadian pension assets are in private markets right now and and appraisers "massage the true valuations".

I told him that may be the case, especially in real estate where REITs have been slaughtered over the past couple of years, but they cannot screw around with valuations for long, it's in their interest to mark these assets down heavily to reflect what is truly going on.

I also told him in private equity, they're shoring up liquidity through sales in the secondary market, diversifying vintage year risk, and they make most of their money there via co-investments with top funds where they pay no fees (to gain access to those co-investments, they invest in funds but their long-term track record is pitiful after accounting for fees).

In infrastructure, they told me they invest all over the world like Reliant in India but through public markets. "Some Canadian pension funds invested in them after us and paid twice as much in a private deal."

Lastly, Peter Letko told me he has sent an article to the Globe and Mail and is waiting for them to publish it.

Once they do, I will publish it here and if they refuse to, I will still publish it here in an update.

I thank Peter Letko and Daniel Brosseau for setting the record straight and their wise insights.

My old friend, professor Tom Naylor, has been an investor with them for decades and he always liked them and I see why.

They're humble, intelligent and hard working and they have a lot of experience.

Peter Letko wants the world to know something else: LetkoBrosseau isn't for sale. "Those rumors have been swirling since we set up shop years ago."

I told him I was happy to hear this, Jarislowsky Fraser was never the same after being sold.

I also told him my favorite LetkoBrosseau trade of all time was back in 2008 when the Caisse was dumping shares of Teck Resources at $2 fearing the company would go bankrupt and LetkoBrosseau was on the other side of that trade scooping them up.

"Oh, I remember, we made great returns on that investment," Letko told me.

Anyways, great conversation with two titans of the Canadian asset management industry.

I told them that I will personally reach out to each CEO at the Maple 8 to try to arrange a discussion with them here in Montreal on the issues they're raising.

As Daniel Brosseau told me: "Don't walk away from the table, we can't ignore this issue and we need to discuss it openly."

Alright, let me wrap it up there and remind all my readers that this blog requires a lot of my time and work -- time away from my baby and time away from trading markets.

Please do support my efforts in bringing you the very best insights on pensions and investments, your kind words are appreciated but your dollars are ultimately what helps this blog so please contribute using the PayPal options on the top left-hand side (suggested minimum of $500 for institutional investors, but if you ask my honest opinion, it should be ten times that amount).

Below, Cameron Dawson, NewEdge Wealth CIO, joins 'Squawk Box' to discuss the latest market trends, the Fed's rate hike campaign, and more.

And Jack Caffrey, equity portfolio manager at JPMorgan Asset Management, says “November has been a really good year,” as he examines the market’s ability to move higher and what it will take for gains to broaden out from the tech sector.

Happy US Thanksgiving to all my American readers.

Update: Peter Letko and Daniel Brosseau of LetkoBrosseau Global Investment Management wrote a comment for the Globe and Mail on why pension funds need to seek out more investments in Canada:

Pension funds need to seek out more investments in Canada, and Ottawa’s push for that in last week’s fall economic statement is a step in the right direction.

Canadian pensions are generally well managed in accordance with sound financial principles and the system is secure. They should be allowed to continue to explore the globe for investment opportunities and to do so without political interference. There is no reason to doubt that this will continue to be the case.

But this does not mean everything is perfect in pension land. Contrary to the household financial assets held in banks and insurance companies, those deposited in pension funds are not limited to safe, fixed-income assets but can take patient, long-term risk. These are the type of investments that should be used to build Canada’s future.

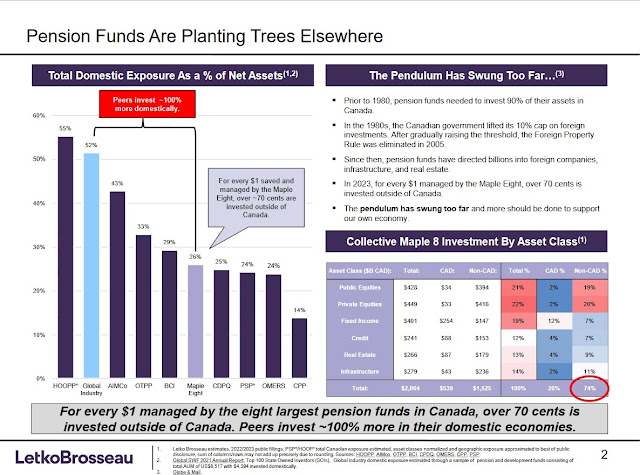

Yet Canadian pension funds invest only 33 per cent in the domestic economy and twice as much abroad. This is down from 90 per cent in Canada 30 years ago. Our peers – in terms of the top 100 state-owned funds reported by Global SWF – invest 60-per-cent more domestically, and the U.S. does so more than twice as much.

We do not know how this 33 per cent is invested by asset class because there is insufficient disclosure. However, based on sources such as financial reports, we can estimate the allocations of the Maple 8: the eight largest funds in Canada. Over all, they invest 25 per cent in Canada, lower than the 33-per-cent industry average. Healthcare of Ontario Pension Plan and Alberta Investment Management Corporation having the highest exposure, and Canada Pension Plan and Public Sector Pension Investment the lowest.

If we exclude fixed income, which is principally invested in government debt, the Maple 8 ratio falls to 15 per cent. This means that 85 per cent of their public and private equities, real-estate, and infrastructure investments put together are not Canadian but foreign. This high level of foreign investment is not limited to public equities.

The flight from Canada could be justified if returns were higher abroad. However, that is not the case. Returns in Canada have been better than practically everywhere in the world over the last 20 to 30 years apart from the U.S. And even for the U.S., there have been decades where Canada has led and others where it has lagged.

But Canada has done better than Europe, Asia and the emerging markets by a significant margin. Funds such as the Caisse de dépot et placement du Québec and the Fonds de solidarité FTQ have proven that it is possible to prioritize Canadian investments without compromising returns.

Pension managers have been focused on their portfolios, as they should, and see little difference between domestic and foreign investments. They cannot compute the full macroeconomic effect their investments will have on their member’s incomes, on their contributions.

This is the missing link. Properly deployed, domestic investment not only generates returns but also creates domestic jobs, increases incomes and raises gross domestic product. Foreign investment benefits are mainly limited to returns.

It’s not as if Canada does not need investment. The U.S invests more than twice as much in non-residential investments per worker than Canada does. Canada invests 25-per-cent less than the G7 average in research and development. For every $1 Canada invest in startups, Israel invests $2 despite being an economy a quarter the size. The US invests $39.

Less investment in Canadian businesses increases their cost of capital, discounts their value, reduces their ability to grow and makes this country less attractive. Over the last 40 years, Canada’s gross domestic product per capita has fallen from 95 per cent of the U.S. to 75 per cent.

For pension funds to seek out more investments in Canada surely requires more work and more personnel. But our personal experience, having successfully managed pension savings for more than 50 years, tells us we can do it.

In the 1970s and 1980s, we worked at the CN Investment Division, investing the railway’s pension fund. During that period, CN essentially created Canada’s pension model.

Just as we were able 30 years ago to very profitably manage portfolios that were 90-per-cent Canadian, we have no doubt that today’s managers can build portfolios that have Canadian content comparable with our peers without compromising on the returns and risks.

Domestic and foreign investments are not the same. The former trigger a feedback loop with very positive effects on the domestic economy that cannot be ignored. Canada is rich in opportunity, and it needs people that believe in its future and do not walk away.

There's lots of food for thought here, some of which needs to be discussed openly, especially the part of investing in Canada creating jobs and whether that's worth looking into.

Also, Daniel Brosseau sent me this after reading my post on reinstating foreign content limits:

The Banks and Insurance companies are subject to regulations that discourage foreign investment but do not proscribe it. We do not think that we need to go back to the 10, 20 and 30% ITA limits. A regulation of pension funds inspired by Bank and Insurance company regulations could suffice. But in any event, all this needs to be discussed. What cannot be accepted is disregard of the feedback loop that domestic investments trigger. Everything must be done purposefully and not haphazardly.

I thank Daniel and Peter for sharing his thoughts and agree with them that everything needs to be discussed openly to clearly understand the consequences of investing or not investing more in Canada.

Comments

Post a Comment