CPP Investments and Blue Owl Provide $1.25B of Capital To BridgeBio Pharma

BridgeBio Pharma has secured up to $1.25 billion in new financing, as the biopharmaceutical company gears up for the launch of its acoramidis heart-disease drug candidate.

BridgeBio on Thursday said it will receive $500 million in cash from Blue Owl Capital and Canada Pension Plan Investment Board upon U.S. Food and Drug Administration approval of acoramidis in exchange for a 5% royalty on global sales of the drug.

The Palo Alto, Calif., company last month filed for FDA approval of acoramidis for the heart disease transthyretin amyloid cardiomyopathy, or ATTR-CM.

BridgeBio said it also inked a refinancing deal with Blue Owl that includes $450 million of committed capital to refinance its senior credit facility, extending the maturity to 2029 from 2026.

The agreement also provides for additional facilities of up to $300 million of credit to support strategic pipeline expansion and acceleration, BridgeBio said.

The company said the new financing leaves it well capitalized to launch acoramidis and continue to accelerate its genetic-medicine research-and-development efforts.

Nick Paul Taylor of Fierce Biotech also reports that BridgeBio taps investors for $1.25B to fund showdown with Pfizer:

BridgeBio Pharma is building a war chest for its showdown with Pfizer. Facing a deep-pocketed rival, the biotech has struck a set of financing deals worth up to $1.25 billion to support an anticipated launch and a schedule of phase 3 readouts for other assets.

Last year, BridgeBio raised $250 million by selling stock, enabling it to exit the third quarter with more than $500 million in the bank. But with winning heart disease market share from Pfizer high on its to-do list—and the roadmap for the coming years featuring multiple late-stage readouts—the biotech has decided it needs to stockpile more cash.

Blue Owl Capital and Canada Pension Plan Investment Board have met that need. BridgeBio is set to get $500 million, in total, from the two companies upon FDA approval of acoramidis. In return, the investors will receive 5% royalties on worldwide net sales of the molecule and stand to pocket up to $950 million, a 1.9-time return on their investment. The deal features a provision for if BridgeBio is acquired.

BridgeBio also refinanced its existing senior credit facility. The agreement with Blue Owl will give the biotech $450 million, extend the maturity of its loan from 2026 to 2029 and grant it access to a further $300 million “to support strategic corporate development activities.”

The first priority is to bring acoramidis to market in transthyretin amyloid cardiomyopathy (ATTR-CM), an indication currently served by Pfizer’s tafamidis products. BridgeBio filed for FDA approval in November, putting it on course to bring the product to the U.S. market in the second half of 2024. Submissions for approval in other markets are also planned (PDF) for this year.

While analysts have warned Pfizer is “quite entrenched” and “might be difficult to displace,” ATTR-CM is a large, growing market and BridgeBio foresees “billions of peak year sales” for acoramidis. The revenue, plus the biotech’s existing cash, will support the development of a clutch of other candidates. BridgeBio is running phase 3 trials in achondroplasia, a form of muscular dystrophy and the calcium disorder ADH1.

Earlier today, BridgeBio Pharma issued a press release stating it has secured up to $1.25 billion of capital from Blue Owl and CPP Investments to accelerate the development and launch of genetic medicines:

The raise includes $500 million in cash from Blue Owl and CPP Investments in exchange for a 5% royalty on future global net sales of acoramidis

- The raise also includes a $450 million credit facility from Blue Owl that refinances existing senior secured credit, extending maturity from 2026 to 2029 subject to certain conditions

- Additionally, the agreement with Blue Owl provides for the possibility of additional incremental facilities of up to $300 million of credit to support strategic pipeline expansion and acceleration

- With this financing BridgeBio enters 2024 well capitalized to launch acoramidis and continue to accelerate its industry-leading genetic medicine R&D engine

PALO ALTO, Calif., Jan. 18, 2024 (GLOBE NEWSWIRE) -- BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a commercial-stage biopharmaceutical company focused on genetic diseases and cancers, today announced strategic financing from Blue Owl Capital (Blue Owl) and Canada Pension Plan Investment Board (CPP Investments), through a wholly owned subsidiary (CPPIB Credit) of CPPIB Credit Investments Inc., bringing in capital of up to $1.25 billion.

With these transactions, BridgeBio obtains financing from experienced healthcare investors who share the Company’s confidence in the anticipated launch of acoramidis as the potential backbone of therapy for transthyretin amyloid cardiomyopathy (ATTR-CM).

“We are excited to be working with a distinguished group of life sciences investors who are aligned with our view of acoramidis’ blockbuster market opportunity,” said Brian Stephenson, Ph.D., CFA, Chief Financial Officer of BridgeBio. “Our newly strengthened balance sheet will enable us to serve ATTR-CM patients with a well-resourced launch of acoramidis, as well as patients with genetic diseases more broadly with multiple Phase 3 readouts for blockbuster indications anticipated over the next few years. Our increasing patient impact should allow us to diversify drivers of top line revenue in the near term and enable reinvestment into R&D paired with opportunistic business development.”

The overall collaboration includes the following key features:

- A royalty agreement with Blue Owl and CPPIB Credit:

- $500 million cash payment upon FDA approval of acoramidis to help support the Company’s commercial launch in exchange for future royalties of 5% of worldwide net sales of acoramidis, both of which are subject to various conditions. This consists of $300 million from Blue Owl and $200 million from CPPIB Credit

- Total royalty payments are capped at 1.9 times the invested capital, and the royalty agreement includes investment features (such as change of control provisions that apply prior to FDA approval) intended to provide broad strategic flexibility for BridgeBio going forward

- A refinancing with Blue Owl of BridgeBio’s existing senior credit facility:

- $450 million of committed capital funded at close to refinance BridgeBio’s existing senior credit facility, extending maturity from 2026 to 2029 and providing the Company with considerable operational flexibility

- An additional tranche of up to $300 million, funded at the Company and Blue Owl’s mutual consent to support strategic corporate development activities

“Blue Owl is well-positioned to provide bespoke and scaled financing solutions to the most consequential companies in the life sciences sector,” said Sandip Agarwala, Managing Director at Blue Owl Capital. “Acoramidis has demonstrated an impressive and differentiated clinical profile, and we believe it will be an important advancement in the treatment of ATTR-CM. Further, BridgeBio’s promising pipeline of late-stage targeted rare disease therapies address critical unmet needs in these underserved populations. We are pleased to support BridgeBio in its mission of bringing breakthrough medicines to patients.”

“This investment in BridgeBio represents an opportunity to provide structured capital solutions to an innovative company in the healthcare space and leverage CPP Investments’ deep capabilities in life sciences,” said David Colla, Managing Director and Head of Capital Solutions, CPP Investments. “Investments in leading therapies also help to diversify our capital allocations to income streams that are typically uncorrelated to the broader capital markets.”

Morgan Stanley & Co. LLC acted as sole structuring agent on the transactions. Latham & Watkins served as legal advisor to BridgeBio and Cooley LLP advised Blue Owl.

About BridgeBio Pharma, Inc.

BridgeBio Pharma, Inc. (BridgeBio) is a commercial-stage biopharmaceutical company founded to discover, create, test, and deliver transformative medicines to treat patients who suffer from genetic diseases and cancers with clear genetic drivers. BridgeBio’s pipeline of development programs ranges from early science to advanced clinical trials. BridgeBio was founded in 2015 and its team of experienced drug discoverers, developers and innovators are committed to applying advances in genetic medicine to help patients as quickly as possible.About Blue Owl Capital

Blue Owl (NYSE: OWL) is a leading asset manager that is redefining alternatives. With $157 billion in assets under management1, we invest across three multi-strategy platforms: Credit, GP Strategic Capital, and Real Estate. Anchored by a strong permanent capital base, we provide businesses with private capital solutions to drive long-term growth and offer institutional and individual investors differentiated alternative investment opportunities that aim to deliver strong performance, risk-adjusted returns, and capital preservation. Together with over 650 experienced professionals in more than 10 offices globally, Blue Owl brings the vision and discipline to create the exceptional. To learn more, visit www.blueowl.com.1 As of September 30, 2023

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2023, the Fund totalled C$576 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Well, kudos to David Colla (featured above) and the Capital Solutions team over at CPP Investments for working alongside Blue Owl to secure this royalty deal.

According to Fierce Biotech, BridgeBio filed for FDA approval for acoramidis in November, putting it on course to bring the product to the US market in the second half of 2024.

There is competition from Pfizer’s tafamidis but if BridgeBio receives FDA approval and starts selling this drug, CPP Investments and Blue Owl will receive a royalty payments which are capped at 1.9 times the invested capital:

A royalty agreement with Blue Owl and CPPIB Credit:

- $500 million cash payment upon FDA approval of acoramidis to help support the Company’s commercial launch in exchange for future royalties of 5% of worldwide net sales of acoramidis, both of which are subject to various conditions. This consists of $300 million from Blue Owl and $200 million from CPPIB Credit

- Total royalty payments are capped at 1.9 times the invested capital, and the royalty agreement includes investment features (such as change of control provisions that apply prior to FDA approval) intended to provide broad strategic flexibility for BridgeBio going forward

So, if the FDA approves acoramidis, that $500 million cash payment ($200M of which is from CPP Credit) to BridgeBio immediately goes into effect and then both Blue Owl and CPP Investments start getting 5% royalty payments up to 1.9 times the invested capital.

Ever watch Shark Tank when Mr. Wonderful (Kevin O'Leary) extracts a pound of flesh through his royalty deals?

Well, CPP Credit and Blue Owl aren't extracting a pound of flesh but they are thinking wisely about structuring the right deal to maximize risk-adjusted returns.

A quick look at BridgeBio Pharma stock, it has more than tripled since last year:

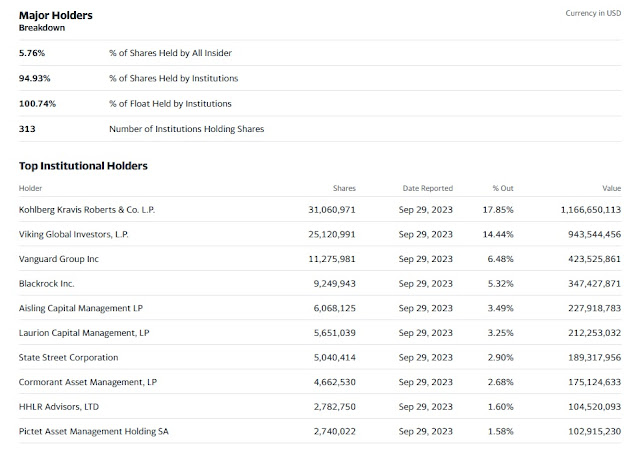

Among its top holders, you'll find power equity powerhouse KKR which owns 18% of the shares and elite hedge fund Viking Global which owns 14% of the shares:

So why doesn't CPP Investments buy shares of BridgeBio then?

Several reasons, first of all, investing in biotech shares is risky business. I know that well as I almost exclusively trade biotech and can tell you even top funds get clobbered once in a while.

Second, if FDA approves, share price might go up, or traders might sell the news, and it will be volatile.

By structuring a credit deal, both Blue Owl and CPP Credit are not betting on FDA approval and they're receiving guaranteed royalty payments up to 1.9 times invested capital.

In other words, that's a hell of a smart risk-adjusted trade with a great payoff which is secured (there are provisions if BridgeBio gets bought out).

By the way, CPP Investments has done a few of these drug royalty deals including when it acquired a portion of LifeArc’s royalty interests on worldwide sales of Merck's Keytruda®* (pembrolizumab) for approximately US$1.3 billion back in 2019 (see details here).

Alright, let me end it there and once again congratulate David Colla and his Capital Solutions team for structuring this deal alongside Blue Owl Capital.

Below, back in March of last year, CNBC's Meg Tirrell joined 'Power Lunch' to report on Bridgebio's stock surge on buyout rumors.

All I can tell you if the company gets FDA approval for acoramidis, a potential bidder is going to pay much higher multiples to acquire it.

In the meantime, Blue Owl and CPP Credit can enjoy nice royalty streams.

Also, disheartening cardiovascular disorder, ATTR-CM is a progressive, underdiagnosed, potentially fatal disease in which amyloid protein fibrils deposit in, and stiffen, the walls of the heart’s left ventricle.

But a (then new) agent to prevent misfolding of the deposited protein is showing a significantly reduced risk of death. Following Fast-Track and Breakthrough designations in 2017 and 2018, 2019 marked the FDA approval of Pfizer's tafamidis, the first-ever medication for treatment of this increasingly recognized condition.

Learn more about this condition watching the second Cleveland Clinic clip below (from four years ago).

Comments

Post a Comment