Boxing Day Specials?

I must admit that I hate Boxing Day. People lose perspective and rush out to buy whatever they can as retailers slash prices. I prefer waiting until the mad rush is over before I venture off into any shopping mall.

Then again, I always hated shopping and with MS, I have to plan my trips carefully so I do not waste time and energy browsing. I know what I want ahead of time and I call in advance to make sure they set it aside for me.

But today is a day for that all-American past time - now global past time - of shopping for deals to spend whatever they can after Christmas. I joke with my buddies telling them "Thank God for women or else we'd be in a Depression by now."

At the time of writing this commentary (mid day), stocks rose modestly in light post-holiday trading after the GMAC lifeline, but investors are still cautious about embarking on a year-end rally following dreary preliminary readings on holiday spending:

Not surprisingly, Americans spent much less on gifts this season than they did last year, according to SpendingPulse, a division of MasterCard Advisors. Retail sales dropped between 5.5 percent and 8 percent compared with last year, the data showed, or between 2 percent and 4 percent after stripping out auto and gas sales.

Personal consumption is a huge part of U.S. economic activity -- comprising more than two-thirds of gross domestic product -- so Wall Street is nervous that a more frugal consumer could keep the economy weak in 2009.Investors did get a some good news on Christmas Eve, when the Federal Reserve allowed GMAC Financial Services -- the finance arm of struggling Detroit automaker General Motors Corp. -- to become a bank holding company and thus qualify for the government's $700 billion rescue fund. Analysts had said that without financial help, GMAC might have had to file for bankruptcy protection or shut down.

But so far, with just four trading days left in the year, no news has been upbeat enough to spark a year-end rally on Wall Street. December is usually a strong month for the stock market, with a flurry of trading known as a "Santa Claus rally" often seen in the month's final week.

In early trading, the Dow Jones industrial average rose 40.54, or 0.48 percent, to 8,509.02.

Broader stock indicators also advanced. The Standard & Poor's 500 index rose 4.18, or 0.48 percent, to 872.33, and the Nasdaq composite index rose 3.98, or 0.26 percent, to 1,528.88.

Trading volumes are expected to be extremely low on Friday as they were earlier this week. When trading is light, stock movements are often not indicative of broader market sentiment. Friday is also likely to be a quiet day of trading because there are no major economic or corporate reports scheduled.

Some retailers did report strong sales. Amazon.com Inc. (AMZN) said Friday that the 2008 holiday season was the online retailer's "best ever," with more than 6.3 million items ordered and 5.6 million units shipped during its peak day on Dec. 15.

This brings me to today's subject. The #1 question I always get is "Leo what should I buy?". I hate that question for the simple reason that nobody can forecast the movements of stocks so what I tell them is to forget the analysts and the cheerleaders on Wall Street and look at what the experts are buying, bearing in mind that even they have suffered huge losses this year.

Importantly, if my macroeconomic forecast of a decade of debt deflation becomes a reality, then your best bet is to keep buying long-term bonds - even at low yields - and forget about the stock market altogether.

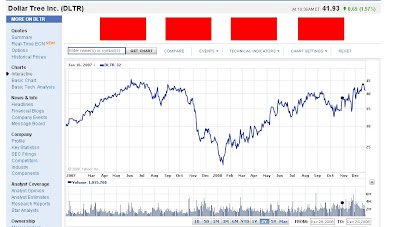

But bonds are boring (just ask pension funds!) and people want yield - lots and lots of yield - so let's look at some stocks out there and try to find some bargains. I included a two year chart of Dollar Tree (DLTR) above (click on first image to enlarge), to prove a point that even in the worst environments, there are individuals companies that do well.

The trick of course, is finding which ones and having the conviction to buy their shares at the appropriate time. If you look at Dollar Tree's two-year chart, you'll see the stock tanked from low forties in mid-October 2007 to the low twenties in mid-January 2008 and then slowly climbed higher to reach the low forties again.

I like this chart because it shows you two things. First never buy after a major decline because in all likelihood, it will go lower, especially as you approach year-end where mutual funds sell their losers to window dress their books.

Second, after the second down-leg, good companies will rise in the first quarter of the year as investors snap up deals. You will notice that the shares kept making new highs after March 2008 and that was the breakout to buy (go back to read Boy Plunger's Pivotal Point Theory).

Dollar Tree, through its subsidiaries, operates discount variety stores that offer merchandise at the fixed price of $1.00 in the United States. In a bad economy, these discount stores do very well, so we shouldn't be surprised to see their shares rise.

So should you buy Dollar Tree now? I would say the upside is capped so you are better off focusing on other good companies whose shares got slaughtered in 2008 and who you think will do relatively well in a tough economic environment.

A small caveat, however, before I proceed. I believe that the financial services industry is heading towards a long-term structural bear market. The great bull market that was built on years of deregulation, excess leverage and speculative frenzy will give way to a long-term bear market in that sector that is based on a new era of regulation, cuts in leverage and a lot less speculation.

I mention this because some of my work colleagues think now is the time to buy Citigroup Inc. (C) and other banks that were mired in toxic debt. Why not? They are going to benefit from the government bailouts and even the world's super wealthy - like the Mexican tycoon Carlos Slim, the world's second-richest person - are placing big bets following the credit debacle:

Mexican tycoon Carlos Slim has taken advantage of market turmoil caused by the global credit debacle to place heavy bets on hard-hit companies, an old strategy that has made him one of the world's richest men.

Slim, whose main asset is Latin American cell phone giant America Movil (AMXL.MX) (AMX.N), recently increased his stake in U.S. luxury retailer Saks (SKS.N) to 18 percent, making him the company's biggest investor.

Last week, Slim's Inbursa brokerage in Mexico bought at least $150 million worth of Citigroup (C.N)(C.MX) shares as they sank to lows not seen since 1992.

It was unclear whether Inbursa bought the Citi stake on behalf of Slim, 68, or for other clients.

"He's taking advantage of prices," said Rogelio Gallegos, a portfolio manager at Actinver in Mexico City. "It's the best moment in the last five years to take stock market positions."

Building positions in Saks and Citigroup, both hammered recently by the U.S. credit debacle, would be true to Slim's "Midas" touch history of acquiring struggling, cheap businesses and turning them into profitable cash-cows.

"He tends to be a value investor, a contrarian investor as well," said Merrill Lynch analyst Carlos Peyrelongue. "He was fairly underinvested during this down cycle."

The son of a Lebanese immigrant, Slim is one of the world's three wealthiest men, according to Forbes magazine.

While I agree with some of his choices, I believe there are "slim pickings" (no pun intended) in the financial world. You are better off focusing on banks with little or no expsore to toxic debts who are growing their earnings in a weak economy (I do not know of any).

So what are the other sectors worth looking at now? Back in October, I wrote a piece on looking beyond the 2008 stock market crash where I tried to give you a sense on how I approach that difficult game of stock picking.

I like to look at what some of the top hedge funds and mutual funds are buying and I keep in mind the big themes that will likely play an important part of our future. Themes like deflation (focus on discount retailers like Costco [COST] and on-line discounters like Priceline [PCLN]); alternative energy (read my comment questioning the death of solar stocks); to biotech and medical devices (read my comment on the age of biotech); to infrastructure where there are plenty of heavy construction stocks to watch for in 2009 as well as ETFs to play the sector (I also like KBR Inc. [KBR] in this space).

There are many other companies worth tracking on your radar screen, including conglomerates like Textron (TXT) whose shares got clobbered recently and 3M Co. (MMM) who might also rebound before the global economy bottoms (3M's shares are forming a double-bottom at their two-year lows).

Keep in mind that stock markets will likely spend many years of range trading which is why many feel that the old buy & hold strategy will not work like it did in the past.

But others disagree, believing that buy & hold is the safest way to invest in stocks:

Lee Brodie calls the death of Buy-and-Hold based on the comments of Jeff Macke (Hattip Barry):

2008 is the year that will go down in history as the year that long term investment died as a thesis.

Jeff Macke may not be a fan, but calling the long term investment model a dead duck is absurd.

Lee suggests diversification as a solution, but diversification dilutes gains and brings you towards ETFism, then index funds, which invariably means a buy-and-hold strategy. It's not diversification or time frame that matters, it's risk management that's key. Taking money off the table is fine and dandy if your position heads into profit, but it doesn't protect you when things go against you (and frequently as was the case for many this year). It doesn't matter if you hold for minutes, hours, days, weeks, months or years - the principle for (re)action is the same.

For starters, Buy-and-Hold is not a returnless system; stocks falling under the buy-and-hold umbrella tend to be dividend payers with a history of dividend growth; growth which can produce stellar returns relative to the initial investment. The loss of a Buy-and-Hold limb (financials) was probably viewed by the good doctors to pronounce the patient dead, but the patient is still very much alive and well.

One only has to look at certain buy-and-hold favourites like Johnson and Johnson (JNJ) to see 2008 was no better or worse than prior years and this excludes the compounding dividend retur.

Buy-and-Hold is the safest way to own stock because it removes the whims of emotions; yes - many 401Ks were badly damaged this year, but would a more actively managed portfolio have performed better? Hmmmm.... those 'smart money' Hedge Funds are having a great 2008?The Fast Money talking heads spout nonsense and fail to see the opportunity presented to them - the old 'can't see the forest for the trees'.

One only has to look at past market collapses to see the golden opportunity it provided for buyers. The key is not to put your eggs into one basket and try and time the market; it's about applying basic strategy.

The same sentiment was discussed by David Altig, senior vice president and research director of the Federal Reserve bank of Atlanta back in mid October:

I trust you will not judge me guilty of overstatement if I say that good news from equity markets has been hard to come by of late. So rough has been the ride that at least one (quite) famous pundit-analyst has taken measure of the landscape and concluded that the time has come to abandon the venerable “buy and hold” investment advice generally offered ordinary savers:

"It's time to unlearn a common myth about investing," Jim Cramer told viewers on Monday. "The best way to invest is not to buy a bunch of stocks and just sit on them."

As is usual in such cases, it is useful to have a look at the record. Though it’s not entirely clear what quantity constitutes “a bunch of stocks,” one reasonable definition would be a broad stock index. With that in mind, here is a look at the annualized three- and five-year rates of change in the S&P 500 index going back to 1941 (click on second chart above to enlarge).

This is not the return on an investment in the index, of course, as holding the portfolio of equities in the index would also generate dividends over the holding period. But it does give some sense of how the recent past compares with the more distant past. While it is true that things look bleak at the moment, this is hardly an unprecedented circumstance. If the buy-and-hold strategy had merit before, it really isn’t that clear things had changed that much through this past September.

You might reasonably argue that buy-and-hold really applies to horizons that extend beyond five years. Here, then, is the same sort of chart as above with index growth for 10-, 15-, and 20-year holding periods (click on third chart above to enlarge).

True enough, the past 10 years have been a little ragged, though again not really unprecedented. And if you were lucky enough to be a long-term saver—that is, held the index for the past 15 to 20 years—good for you. (And note that returns over these horizons are, not surprisingly, substantially less volatile than over the shorter periods.)

Ok, I hear you. Why did I conveniently stop just short of the dramatic decline in the stock market since September. Sure enough, things look substantially worse when the stock market loses over a quarter of its value in a month. For the sake of argument, let’s assume that the S&P average for October ends up at 900, or near the low so far this month. Redoing the three-, five-, 10-, 15-, and 20-year growth calculations would yield annualized rates of –8.9 percent, –2.8 percent, –1.4 percent, 4.5 percent, and 6.1 percent, respectively. Even with the major reversal of the last month, the implied returns on the 15- and 20-year holding periods look pretty good.

Of course, the “buy-and-hold is dead” idea relies on the presumption that the next 10 years are going to look a lot like the last 10 years. Only time will tell if the current growth rate on the three- to10-year holding periods is a trend, or just evidence that you won’t do so well when you get out of the market at exactly the wrong time.

I don’t know what the answer is—and I don’t offer investment advice—but the verdict of history is pretty clear.

Finally, read the following article from Jeff Saut, Chief investment Strategist at Raymond James which was reproduced on Minyanville. Mr. Saut concludes that:

Whatever the outcome, my firm has treated, and continues to treat, the October 10th “capitulation lows” as a bottom for the short-to-intermediate term, until proven wrong.

Still, this is the most difficult market we've seen since the 1970s, which is why we're employing a hedging strategy and continue to emphasize clean balance sheets, decent fundamentals, and dividends.

I couldn't agree more; this is the most challenging environment ever for retail and institutional investors.

I tell people to prepare for the worst, investing in bonds and particular segments of the stock market using market and sector ETFs. If you buy individual stocks, do your homework and make sure they are companies with solid balance sheets and good long-term prospects.

The reality is that the next ten years will be nothing like the past ten years, but this does not mean you have to be caught like a deer in headlights.

Remember to prepare for the worst and hope for the best. Difficult times require financial prudence, some foresight and some conviction that the world will eventually overcome this global financial debacle.

Comments

Post a Comment