Buffett Baffled by 30-Year Bonds?

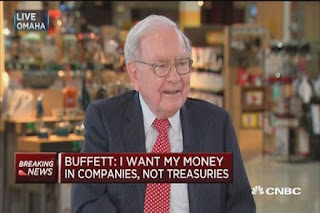

Billionaire investor Warren Buffett told CNBC he can't see any reason for investors to buy 30-year bonds right now.Buffett has a lot to say this time of year. In his widely read annual letter to shareholders of his Berkshire Hathaway holding company, the Oracle of Omaha blasted hedge funds and their high fees and urged average investors to buy regular index funds instead of trying to chase the next hot sector or plow their life savings into high-fee hedge funds:

"It absolutely baffles me who buys a 30-year bond, the chairman and CEO of Berkshire Hathaway said on "Squawk Box" on Monday. "I just don't understand it."

"The idea of committing your money at roughly 3 percent for 30 years ... doesn't make any sense to me," he added.

Buffett said he wants his money in companies, not Treasurys — making the case throughout CNBC's three-hour interview that he sees stocks outperforming fixed income.

"When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients," said Buffett's letter.Buffett is right, the bulk of hedge funds charge high fees and deliver mediocre returns over the long run. And there are plenty of glorified hedge fund asset gathers out there charging alpha fees for low-cost beta returns.

"The problem simply is that the great majority of managers who attempt to overperform will fail. The probability is also very high that the person soliciting your funds will not be the exception who does well," Buffett wrote.

"Both large and small investors should stick with low-cost index funds," he added.

Moreover, in my latest top funds' quarterly activity report, I discussed how Buffett took some of these young hedge fund titans to school and bought Apple shares in the last quarter of 2016 and even more this year, making a lot of money and effectively making him a huge owner of the company.

But what he neglects to say is there are elite hedge funds, some of which are shafting clients on fees, with a long, outstanding track record of consistently delivering great risk-adjusted returns. Some of these elite hedge funds are super quants taking over the world while others are top stock pickers or global macro funds speculating billions on economic trends.

Buffett may not agree with their approach or fee structure -- and some of these elite hedge funds are cutting their fees while others are changing their fee structure to get better alignment of interests -- but they have been around for a long time and institutions looking for the best risk-adjusted returns will keep plowing billions into them.

Interestingly, in his annual letter, Buffett praised Jack Bogle, the founder of the Vanguard Group, for transforming investing forever with the index fund:

"If a statue is ever erected to honor the person who has done the most for American investors, the hands- down choice should be Jack Bogle," Buffett writes, adding:No doubt, Jack Bogle is an investment pioneer. He is not as filthy stinking rich as most mutual fund or hedge fund giants and he doesn't command the respect of a Buffett or Soros, but Jack Bogle is arguably the most important man in investing and I highly recommend you read his books and follow his 4 rules of investing.

"For decades, Jack has urged investors to invest in ultra-low-cost index funds. In his crusade, he amassed only a tiny percentage of the wealth that has typically flowed to managers who have promised their investors large rewards while delivering them nothing – or, as in our bet, less than nothing – of added value.

"In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me."

[Note: Other investing books I highly recommend are William Bernstein's The Four Pillars of Investing and The Intelligent Asset Allocator, Marc Litchenfeld's Get Rich With Dividends and my favorite, Peter Lynch's One Up on Wall Street.]

But what worries me is that too much of a good thing may turn out terribly wrong.

In particular, I openly worry that we have moved from a George Soros hedge fund "alpha" bubble to a Warren Buffett - Jack Bogle "beta" bubble and now we have a bunch of investors, including large hedge funds and robo-advisors, plowing trillions into low-cost index funds erroneously thinking there are diversifying risk when in reality they are taking part and adding to systemic risk.

"Huh? You're losing me. I understand Buffett, Bogle and hedge funds charging high fees for lousy returns but I don't understand all this talk of a beta bubble and systemic risk."

Ok, let me explain. A long time ago, there was a great economist, Paul Samuelson, who fretted the day everyone starts following Burton Malkiel's advice in A Random Walk on Wall Street (another Bogel disciple).

In particular, when everyone starts doing the same thing, they might not realize it, but they're contributing to a trend which taken to its limits, can cause serious systemic failures. The subprime mortgage crisis which led to the 2008 meltdown is an obvious example of this, but some trends are more stealth in nature, take a much longer time to develop, and by the time you realize it, it's too late.

I mention this because there are important cyclical and structural trends going on in the global economy, trends that will forever reshape the global labor market.

Last Monday when I discussed how CPPIB is helping to fix China's pension future, I brought some of these worrying trends up:

[..] bolstering pensions is critically important all over the world, not just China. A friend of mine is in town from San Francisco this long US weekend and we had an interesting discussion on technological disruption going on in Silicon Valley and all over the United States.Well, there is no way President Trump will touch Social Security and Medicare but that comment of mine elicited this response from an informed reader:

My friend, a senior VP at a top software company, knows all about this topic. He told me flat out that in 20 years "there will be over 100 million people unemployed in the US" as computers take over jobs -- including lawyers and doctors -- and make other jobs obsolete at a frightening and alarming rate (Mark Cuban also thinks robots will cause mass unemployment and Bill Gates recently recommended that robots who took over human jobs should pay taxes).

"It's already happening now and for years I've been warning many software engineers to evolve or risk losing their job. Most didn't listen to me and they lost their job" (however, he doesn't buy the "nonsense" of hedge fund quants taking over the world. Told me flat out: "If people only knew the truth about these algorithms and their limitations, they wouldn't be as enamored by them").

He agreed with me that rising inequality is hampering aggregate demand and will ensure deflation for a long time, but he has a more cynical view of things. "Peter Thiel, Trump's tech pal, is pure evil. He wants to cut Social Security and Medicare and have all these people die and just allow highly trained engineers from all over the world come to the US to replace them."

The US and EU are facing the same [pension] problem, and that has much to do with why the global elites are so big on immigration. The Davos crowd know that unless there's a large influx of immigrants to pick up the slack in payroll taxes, the govt. is going to come after the elites because global wealth is overly concentrated among the elites, the vulgar masses haven't got anything to tax.He added:

In the US, the top 20% of the population controls 93% of the wealth. Small wonder the global elites have $30 trillion+ socked away in tax havens. Greed will always be a part of the human condition. If I had their money, I'd probably be doing the same thing, nobody enjoys paying taxes.

Their plan won't work because AI, technology and continued offshoring of jobs are going to put many more millions of people out of work in the coming future.

Buffett and Gates were interviewed in late January by Charlie Rose, and Buffett stated that these people that are displaced by technology, and are 55+ years old (read: too old to be re-educated), they need to be "taken care of". By who? I assume Buffett means the US government because Buffett shuttered the Dexter Shoe Co. plant in Dexter, ME in 2003 putting 1500 employees out of work. The workers were told on a Thursday morning that Friday (the next day) was to be their last day of work. I've heard on good authority (The CEO of another shoe Co. in Dexter, ME, Maine Sole) that only the top 35 employees received any compensation upon being terminated.

Buffett, Gates and their ilk have so much of their wealth socked away in tax free foundations, where is the money going to come from to take care of these displaced workers?

I see in the not too distant future the elites in the US putting excess pressure on Congress to reform entitlements (Medicare and Social Security), because these are unfunded liabilities that if you were to properly account for them like they do the $20 trillion national debt, total US debt would exceed $100 trillion. Let's just say it's a national shit sandwich that only the elites can afford to eat, but obviously don't want to.But even after blasting Buffett, Gates and their ilk, this person admitted to me that Berkshire Hathaway shares (BRK-B) are his largest holdings (good move!).

In terms of Buffett and bonds, this person shared this with me:

Buffett isn't so much a top down Macro investor as he is a bottom up investor.I don't know about a GI Bill but I have long warned people the pension Titanic is sinking and that these six structural factors will ensure a long deflationary period, something Warren Buffeet will likely not experience but Bill Gates will:

Bonds and stocks are one and the same to him, in that his perception of a 10 year US Treasury bond is that it's no different than the stock of a Co. with a 10 year life and a constant earnings yield of 2.5%, which to him means the instrument has a P/E of 40 (1/40 = 2.5% yield). There's no way he's going to pay 40 times earnings for something with zero growth potential when he can buy common stocks with reasonably predictable growing earning streams at much lower multiples, which makes sense.

How does he handle the specter of deflation? I suppose he looks at it as a constant battle between deflation and inflation. To protect himself against inflation, he buys hard assets like his railroad and the utilities. For deflation, he's always sitting on a ton of cash (currently $85 billion), so if the market takes a hit, he's got the cash to take advantage of crazy deflated prices. It's the best of both worlds. Carnegie and Frick ran Bethlehem Steel in a similar fashion. They always bought state-of-the-art technology to ensure they were always the low cost commodity producer, and they made sure they were always cash rich because they knew downturns were inevitable and they would always have the cash on hand to buy up a competitor on the cheap.

Your friend's estimate that there will be 100 million people unemployed in the US in 20 years. By my back-of-the-envelope calculations, we could easily be close to that today. The US is in dire need of some sort of GI Bill like there was post-WW2 and Korea. When it was announced in 1944, it wasn't meant to be some sort of perk/reward for returning vets. It wasn't from the goodness of his heart that FDR created the GI Bill, it was because there was a great fear that the economy would slip back into a depression given that the war economy would shut down and you suddenly had an influx of returning vets into an already crowded labor pool. The GI Bill was to reduce competition in the labor force by keep these men off the market; you could almost describe it as a form of "hidden unemployment".

That said, the GI Bill turned out to be a blessing because it was an agent of meritocracy for these returning vets who took advantage of it. Both my father and a brother became doctors courtesy of the Canadian GI Bill, while another brother became a Chemical Engineer (MIT) courtesy of the US GI Bill (Korea). If the US could re-create a modern day version of the GI Bill to give people in need of employment some marketable skills for today's economy, I have no doubt it would be a blessing that would pay huge dividends to the economy going forward.

This brings me to an important point, the question Warren Buffett asked at the top of this comment, who in their right mind would buy a 30-year bond?

- The global jobs crisis: Jobs are vanishing all around the world at an alarming rate. Worse still, full-time jobs with good wages and benefits are being replaced with part-time jobs with low wages and no benefits.

- Demographics: The aging of the population isn't pro-growth. As people get older, they live on a fixed income, consume less, and are generally more careful with their meager savings. The fact that the unemployment rate is soaring for younger workers just adds more fuel to the fire. Without a decent job, young people cannot afford to get married, buy a house and have children.

- The global pension crisis: A common theme of this blog is how pension poverty is wreaking havoc on our economy. It's not just the demographic shift, as people retire with little or no savings, they consume less, governments collect less sales taxes and they pay out more in social welfare costs. This is why I'm such a stickler for enhanced CPP and Social Security, a universal pension which covers everyone (provided governments get the governance and risk-sharing right).

- Rising inequality: Rising inequality is threatening the global recovery. As Warren Buffett once noted, the marginal utility of an extra billion to the ultra wealthy isn't as useful as it can be to millions of others struggling under crushing poverty. But while Buffett and Gates talk up "The Giving Pledge", the truth is philanthropy won't make a dent in the trend of rising inequality which is extremely deflationary because it concentrates wealth in the hands of a few and does nothing to stimulate widespread consumption.

- High and unsustainable debt in the developed world: Government and household debt levels are high and unsustainable in many developed nations. This too constrains government and personal spending and is very deflationary.

- Technology: Everyone loves shopping on-line to hunt for bargains. Technology is great in terms of keeping productivity high and prices low, but viewed over a very long period, great shifts in technology are disinflationary and some say deflationary (think Amazon, Uber, etc.).

Well, in turns out a lot of pensions and insurance companies managing assets and liabilities are buying these long bonds. And if the US Treasury starts issuing 50 or 100-year bonds, I suspect many pensions will snap those up too, just like they did in Canada.

[Note: One president of a large Canadian pension plan told me they would buy 50-year US bonds, not the 100-year ones because their liability stream doesn't go out that far.]

In my outlook 2017 earlier this year, I warned my readers to ignore the reflation chimera and prepare for some fireworks later this year. I just don't buy that it's the beginning of the end for bonds, not by a long shot.

I also agree with François Trahan of Cornerstone Macro, investors better prepare for a bear market ahead, but I think his timing is a bit off as there is still plenty of liquidity to drive risk assets higher.

Interestingly, hedge fund titan David Tepper agrees with Buffett, he's still long stocks and still short bonds:

Billionaire hedge fund manager David Tepper told CNBC on Monday he remains bullish on the stock market rally.All these billionaires bashing bonds should read my comments more often because if Buffett feels like he got his head handed to him on Walmart, he will really be kicking himself next year for not buying the 30-year bond at these levels.

"Still long stocks. Still short bonds," Tepper told CNBC's Scott Wapner.

The founder of Appaloosa Management said: "Why are stocks and bonds acting differently? It's as if they're reacting to two different economies."

Since the election, bond prices have been falling, and bond yields have been rising. Stock prices, meanwhile, have been hitting new highs.

But more recently, as of mid-February, bond prices and stock prices have been moving higher together again.

Tepper also asked: "Could be there's too much monetary policy still around the globe? Reaction in markets suggests it's affecting the bond market more."

After Friday's late comeback, the Dow Jones industrial average was riding an 11-day win streak for the first time since 1992, with 11 record closes in a row for the first time since 1987.

Tepper's comments come on the same day as another billionaire investor, Warren Buffett, talked up stocks and bashed bonds.

U.S. stock prices are "on the cheap side" with interest rates at current levels, Buffett told CNBC's "Squawk Box" on Monday morning.

The Berkshire Hathaway chief also said: "It absolutely baffles me who buys a 30-year bond. I just don't understand it."

Given my views on the reflation chimera and US dollar crisis, I would be actively shorting emerging markets (EEM), Chinese (FXI), Industrials (XLI), Metal & Mining (XME), Energy (XLE) and Financial (XLF) shares on any strength here (book your profits while you still can). The only sector I like and trade now, and it's very volatile, is biotech (XBI) and technology (XLK) is doing well, for now. If you want to sleep well, buy US long bonds (TLT) and thank me later this year.

On biotech, some of the stocks I told you are on my watch list when I went over top funds' Q4 activity are soaring since I wrote that comment (shares of La Jolla Pharmaceutical surged over 80% on Monday and shares of Kite Pharma are flying today, up 24%).

Simply put, I feel like the Rodney Dangerfield of pensions and investments, I get no respect and certainly don't get paid enough to share my wisdom but then again, I don't have Buffett, Soros, Tepper and Dalio's track record or their deep pockets.

Hope you enjoyed this comment, please remember to show your support by donating or subscribing to this blog at the top right-hand side under my picture via PayPal. I thank all of you who support my efforts and if you need to reach me, feel free to email me at LKolivakis@gmail.com.

Below, Warren Buffett told CNBC he can't see any reason for investors to buy 30-year bonds right now. "It absolutely baffles me who buys a 30-year bond, the chairman and CEO of Berkshire Hathaway said on "Squawk Box" on Monday. "I just don't understand it."

Buffett also said stocks could ‘go down 20% tomorrow,’ but we are not in ‘bubble territory’. I certainly hope he's right but as long as the passive (index) beta bubble winds keep blowing, it will get worse down the road. And if deflation strikes America, it's game over for a long, long time.

Also, billionaire hedge fund manager David Tepper told CNBC on Monday he remains bullish on the stock market rally. "Still long stocks. Still short bonds," Tepper told CNBC's Scott Wapner.

All these billionaires bashing bonds, hmm, where have I heard that before? Buffett and Tepper should stick to stocks and leave the bond calls to Gundlach, Gross, Dalio, Soros and me (lol).

Actually, we should all be listening to the bond market, because at the end of the day, nobody trumps the bond market and the move in Treasury yields signals something is about to give.

Comments

Post a Comment