APG Pushing the Limits on Factor Investing?

Wouter Klinj of the Investment Innovation Institute (i3) reports, APG – Pushing the Limits of Factor Investing:

De Zwart obviously knows his stuff and what struck me is the number of factors being investigated using these 500+ alternative data sets to evaluate these factors in real time.

Just consider some of the factors below from State Street Global Advisors (click on image):

The sheer volume of data and number of factors make it a fairly complicated task to "innovate" every year but De Zwart takes a pragmatic approach:

Here, I will refer you to two books, Andrew Ang's Asset Management: A Systematic Approach to Factor Investing and Antti Ilmanen's Expected Returns: An Investor's Guide to Harvesting Market Rewards. There are plenty of other books on factor investing but investors looking to understand this subject should read these books.

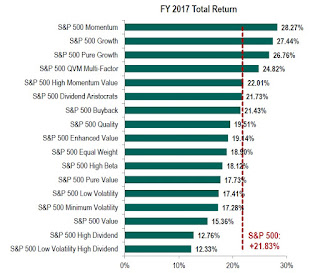

Also, you might want to read Lawrence Hamtil's latest comment, Why Low-Vol Strategies Make Sense Now, where he shows how the S&P 500 low-volatility index failed to outperform all but a handful of the other factor benchmarks, trailing the growth and momentum indices by more than 10% each. Just look at the chart below and read his comment to understand why you should consider low vol strategies going forward (click on image).

As far as external managers APG uses them to help it implement its factor investing. I'm not privy to that information but if I had to guess, I'd say Clifford Asness's AQR is part of the list.

This is just a guess and there are other great quant shops to help them implement this approach. I'd even invite Gerben De Zwart here to Montreal to talk to meet with Nicolas Papageorgiou, Chief Investment Officer, Canadian Division at Fiera Capital. If it's someone who can help him innovate at APG using rigorous quantitative approach to factor investing and more, it's Nicolas (he's a very nice guy who really knows his stuff).

Other services I'd highly recommend are firms that provide outstanding independent macro and market research. In particular, François Trahan's research at Cornerstone Macro (another nice guy who really knows his stuff). He and his team can help clients with sector positioning, factor and style investing, and dynamically allocating based on their reading of macro and market indicators. François helped me write my Outlook 2018 and I have learned a lot reading his material and listening to his insights.

I'm pretty sure APG knows all about Cornerstone Macro but I'm not sure they know about Nicolas Papageorgiou at Fiera Capital. Maybe they do. APG is one of the best pension funds in the world and the managers there are plugged in with a lot of excellent advisors and money managers all over the world.

Actually, the guy that brought the article above to my attention was Dominic Clermont, Senior Consultant - Portfolio Management & Risk Management Analytics at Axioma Inc. Dominic formerly worked at the Caisse managing an internal alpha team that used factor investing to develop long/ short equity strategies. He too really knows his stuff and is very nice.

Lastly, since we are on the subject of factor investing and quantitative investing, one astute investor brought to my attention Hull Tactical in Chicago founded by Blair Hull. Hull Tactical US ETF (HTUS) is a sophisticated actively managed ETF that charges 91 basis points (it's not a lot for what they do). It's not a very liquid ETF because it's not well known but you should definitely take a closer look at it and keep an eye on it to see how it performs in a bear market.

[Note: There are plenty of other active or smart beta ETFs but as always, do your due diligence and really understand the product before investing in it.]

Below, factor investing is increasingly in the spotlight. Financial magazines run features on it, seminars are organized on the subject, and investors consider adopting its approach. Yet you might wonder: is it just a hype? Is the increased interest in factor investing no more than a passing trend? This is the question that Robeco answers below. Take the time to watch this and learn more on Robeco's site here.

Dutch pension behemoth APG, which manages about A$680 billion, has been applying a factor-based approach to investing for two decades.This is an excellent article which discusses how the Dutch pension APG, one of the best pension funds in the world, approaches factor investing internally and with external managers.

But if you suspect they would be a little cynical about the sudden rise in popularity of this approach, your suspicion would be unfounded.

Gerben De Zwart, Head of Quantitative Equity and a member of APG’s Developed Market Equities management team, is excited about the future of this approach.

“Factor investing is on the eve of a very big change and that is due to the digital revolution,” De Zwart says in an interview with [i3] Insights.

“If you look at the past 35 years, then you’d see that scientists have focused on maybe 10 different data sets. They have been looking at these sets and have done smart things with them.

“But if you look at where we are today, then you actually see that we are talking to parties that offer more than 500 different data sets, all of which are new. So we’re getting access to completely new data sets over a very short time frame.

“The question for factor investors is: How do you deal with that? Doing nothing is not an option and APG’s vision is that we are firmly committed to innovation. We do this not only for quantitative strategies, but also for fundamental investments and for the pension fund in general.

“If you have 500 different data sets, where do you start? Well, we do this in two different ways: we have external managers who already invest for more than 60 per cent on the basis of alternative data sets and innovative techniques.

“At the same time, on the internal side we focus on the existing styles that we are going to measure in a smarter way with alternative data sets.”

De Zwart uses the term ‘now casting’, where through the use of these alternative data sets the present is predicted.

For example, this method is used by central banks to predict the state of the economy in real time. Many economic indicators, including gross domestic product, are published with a significant lag. But now casting aims to monitor these variables as they occur.

You can apply this method to investing as well, De Zwart says.

“For example, many people do value investing, but now you may be able to determine the value with alternative data sets more real-time. So you can search in these alternative data sets for information that has the highest added value to your investment philosophy,” he says.

“The danger, of course, is that you have so much data that it will take you 10 years to investigate all of that and you don’t implement any innovation in your investment process.

“At APG, we have the philosophy that we need to add innovations in our investment strategy every year. The question is: Where can we best use our resources, so that is money and people, to create the highest possible marginal benefit?

“What I think is that other investors will have the same problem, but might approach it differently and I think that is going to create a lot of divergence in the returns of factor investors in the coming years because people are going to make different choices.

“In fact, I think from now on quantitative investing will only become more fun.”

Factors, Signals or Styles?

One of the ongoing discussions in the investment industry centres on the question of how many persistent factors there really are that can be exploited.

Some academic literature indicates there are over 300 factors, while others say there are no more than half a dozen.

De Zwart takes a pragmatic approach that sits somewhere in between.

“We make a clear distinction between styles and factors. There are studies that talk about more than 500 factors, but we think that there are actually only a limited number of styles and the point is how do you fill in such a style?

“That happens more and more sophisticatedly. You have value, quality, size, low volatility and then something that we call ‘sentiment’, so there is more in there than just momentum.

“We believe in active factor investing and what that means is that we take responsibility for the returns of the investments and not just for offering exposures to certain styles.

“That is why we work with active external managers and also do a lot of research on factors.

“These factors often have an underlying explanation and we can use very advanced methodologies that measure that theme in a smarter way. But in principle, the essence of such a factor is still sentiment or value.”

“We actually invest in more than 200 of those underlying factors, but then it is mainly about measuring things smarter.”

Another controversial point in factor investing is whether or not you can actually time factors dynamically in order to generate higher returns or whether a broadly diversified multi-factor approach is best.

De Zwart doesn’t dismiss factor timing outright.

“Internally, we look for better factors, but our external managers also look to add value by timing factors. But the timing of factors is extremely difficult and that creates many challenges, so if you look at the total portfolio, we actually have a fairly stable allocation,” he says.

Combining Quant and Fundamental Strategies

APG’s choice of factor investing is not so much a philosophical one as it is a practical one. The pension fund’s factor investments amount to about 80 billion euros, or A$124 billion, and it would be difficult to invest such a large portfolio completely with active, fundamentally focused managers.

A factor approach allows APG to produce above index returns, while at the same time ensuring liquidity.

But it also has a fundamentally driven program.

“A large part of the portfolio is also equipped with fundamental strategies that are highly concentrated. We have a portfolio with 5 to 10 per cent interests, where we also have active ownership, and where we know the company well, we know the board of directors well, but you also see that these portfolios are not liquid,” De Zwart says.

“So half is quantitatively invested and the other half is invested fundamentally and what we see is that the return flows diversify very well. In the year that factor investing is doing well, fundamental is lagging behind and vice versa, which means that the total return on shares is very stable.”

Sustainable Factor Investing

APG takes pride in its approach to governance and sustainability and it requires its external managers to meet the same requirements.

“The responsible investment policy we are implementing for our clients is very progressive, so for example there are ambitions to reduce CO2 emissions by 25 per cent by 2020. We also impose this target on external managers.,” De Zwart says.

Much of the research into responsible investing is quantitative as well, he says.

“Once you know the CO2 footprint of a company, and you have all the data that goes with that measurement, then you can steer it towards the target,” he says.

“We share this methodology with our managers. In this way, we are talking about exactly the same data and methodology and they can measure it consistently.”

It is one of the areas where APG is able to work in partnership with its external managers.

“We work with managers where possible and where they feel comfortable and often it is not so in the area of alpha or factors, but there are many other areas that work well together, such as trading cost models, risks, insights into the market,” De Zwart says.

“Conversely, we also offer the managers something because the responsible investment policy we implement for our clients is very progressive, so the external managers can first work with us to implement the policy and then perhaps also understand better how many European investors view responsible investing.”

This mix of internal and external asset management is what enables APG to pick the right strategy for the right situation, he says.

“In terms of costs, an internal portfolio is very attractive, so our philosophy is that whatever we can do with our people, our intellectual capacities and systems we do internally,” he says.

“That is why externally we look for managers who are complementary to our internal portfolio and who are willing to work together. For some managers that feels very threatening, but at the same time we have relationships with managers that span more than 20 years.”

De Zwart obviously knows his stuff and what struck me is the number of factors being investigated using these 500+ alternative data sets to evaluate these factors in real time.

Just consider some of the factors below from State Street Global Advisors (click on image):

The sheer volume of data and number of factors make it a fairly complicated task to "innovate" every year but De Zwart takes a pragmatic approach:

“We make a clear distinction between styles and factors. There are studies that talk about more than 500 factors, but we think that there are actually only a limited number of styles and the point is how do you fill in such a style?What is also hard is not just focusing on the right factors and alternative data sets, but using this information dynamically to add on expected return.

“That happens more and more sophisticatedly. You have value, quality, size, low volatility and then something that we call ‘sentiment’, so there is more in there than just momentum.

Here, I will refer you to two books, Andrew Ang's Asset Management: A Systematic Approach to Factor Investing and Antti Ilmanen's Expected Returns: An Investor's Guide to Harvesting Market Rewards. There are plenty of other books on factor investing but investors looking to understand this subject should read these books.

Also, you might want to read Lawrence Hamtil's latest comment, Why Low-Vol Strategies Make Sense Now, where he shows how the S&P 500 low-volatility index failed to outperform all but a handful of the other factor benchmarks, trailing the growth and momentum indices by more than 10% each. Just look at the chart below and read his comment to understand why you should consider low vol strategies going forward (click on image).

As far as external managers APG uses them to help it implement its factor investing. I'm not privy to that information but if I had to guess, I'd say Clifford Asness's AQR is part of the list.

This is just a guess and there are other great quant shops to help them implement this approach. I'd even invite Gerben De Zwart here to Montreal to talk to meet with Nicolas Papageorgiou, Chief Investment Officer, Canadian Division at Fiera Capital. If it's someone who can help him innovate at APG using rigorous quantitative approach to factor investing and more, it's Nicolas (he's a very nice guy who really knows his stuff).

Other services I'd highly recommend are firms that provide outstanding independent macro and market research. In particular, François Trahan's research at Cornerstone Macro (another nice guy who really knows his stuff). He and his team can help clients with sector positioning, factor and style investing, and dynamically allocating based on their reading of macro and market indicators. François helped me write my Outlook 2018 and I have learned a lot reading his material and listening to his insights.

I'm pretty sure APG knows all about Cornerstone Macro but I'm not sure they know about Nicolas Papageorgiou at Fiera Capital. Maybe they do. APG is one of the best pension funds in the world and the managers there are plugged in with a lot of excellent advisors and money managers all over the world.

Actually, the guy that brought the article above to my attention was Dominic Clermont, Senior Consultant - Portfolio Management & Risk Management Analytics at Axioma Inc. Dominic formerly worked at the Caisse managing an internal alpha team that used factor investing to develop long/ short equity strategies. He too really knows his stuff and is very nice.

Lastly, since we are on the subject of factor investing and quantitative investing, one astute investor brought to my attention Hull Tactical in Chicago founded by Blair Hull. Hull Tactical US ETF (HTUS) is a sophisticated actively managed ETF that charges 91 basis points (it's not a lot for what they do). It's not a very liquid ETF because it's not well known but you should definitely take a closer look at it and keep an eye on it to see how it performs in a bear market.

[Note: There are plenty of other active or smart beta ETFs but as always, do your due diligence and really understand the product before investing in it.]

Below, factor investing is increasingly in the spotlight. Financial magazines run features on it, seminars are organized on the subject, and investors consider adopting its approach. Yet you might wonder: is it just a hype? Is the increased interest in factor investing no more than a passing trend? This is the question that Robeco answers below. Take the time to watch this and learn more on Robeco's site here.

Comments

Post a Comment