Beware of Market Euphoria?

The S&P 500 fell slightly on Friday, retreating from record levels, while the strength in major technology names pushed the Nasdaq Composite to another all-time high.

The broad equity benchmark dipped 0.3% to 3,841.47 after closing at a record in the previous session. The Nasdaq rose 0.1% to another record close of 13,543.06, supported by Big Tech. The Dow Jones Industrial Average slid 179.03 points, or 0.6%, to 30,996.98.

Dow-component IBM dropped 9.9% after the company reported fourth-quarter sales below analysts’ expectations. Revenue fell 6% on an annualized basis, the fourth consecutive quarter of declines. Intel shares retreated 9.3% following a 6% pop on Thursday after it released better-than-expected earnings.

Hopes for a robust earnings season from the largest communications and tech companies sparked a rally in mega-cap stocks during the holiday-shortened week, pushing the broader market higher. The Nasdaq climbed 4.2% this week, while the S&P 500 and the Dow gained 1.9% and 0.6%, respectively.

Apple rose another 1.6% Friday, bringing its weekly gain to 9.4%. Facebook and Microsoft also rallied 9.2% and 6.3%, respectively, this week. These big tech companies are scheduled to report earnings next week.

“Unlike earlier this month, this week’s rally has been led by growth stocks and mega-cap tech names,” Mark Haefele, chief investment officer at UBS, said in a note. Netflix’s “strong results and plans to return cash to shareholders supported a rally in the other FAAMNGs ahead of their forthcoming earnings releases.”

Stimulus watch

Investors reassessed the outlook for President Joe Biden’s ambitious Covid stimulus plan. A growing number of Republicans have expressed doubts over the need for another stimulus bill, especially one with a price tag of $1.9 trillion proposed by Biden. Meanwhile, Democratic Sen. Joe Manchin has criticized the size of the latest round of proposed stimulus checks. Dissent from either party carries weight for Biden, who took office with a slim majority in Congress.

“The political reality of Washington is starting to impact markets, and it’s becoming more unclear when Democrats’ ambitious stimulus goals will become law,” said Tom Essaye, founder of Sevens Report.

Cyclical sectors, or those that would benefit most from additional stimulus, have put pressure on the broader market this week. Energy, financial, and materials were the biggest laggards, losing at least 1% each this week.

Meanwhile, with the S&P 500 up another 2.3% this year, some investors believe the market may be getting ahead of itself as hiccups with the vaccine rollout and economic reopening remain likely going forward.

“The Covid pendulum, which normally emphasizes vaccine optimism over the harsh near-term reality, is swinging back towards the latter (for now) as epicenter stocks get hit hard in Europe,” Adam Crisafulli, founder of Vital Knowledge, said in a note Friday.

Meanwhile, a Senate committee on Friday overwhelmingly supported former Fed Chair Janet Yellen as Biden’s Treasury secretary. If confirmed, she would be the first woman to lead the department.

Alright, it's Friday, let me dive into it.

This week, President Biden was sworn in to office but more importantly, the Senate Finance Committee on Friday unanimously approved Janet Yellen’s nomination as Treasury secretary and she will be confirmed by the full Senate later today.

Yellen is good for risk assets, she's ultra dovish and that spells good news for stocks going forward.

This week, the S&P 500 gained 1.3% led by big gains in Communication Services (XLC) and Technology (XLK):

Of course, the big gains in Communications Services (XLC) this week came from Netflix (NFLX) which soared nearly 20% on Wednesday before tapering off:

But all the FAANG stocks and technology stocks in general performed well this week and I expect this to continue as Big Tech gets ready to report earnings.

In fact, check out this 5-year weekly chart of the QQQs, it clearly shows you technology stocks are on a tear here and momentum is in their favor:

How is this possible? There's simply tons of liquidity, big hedge funds are ramping up all sorts of stocks, including GameStop (GME) which soared nearly 70% today as trading was briefly halted amid epic short squeeze:

And this stock was already on fire prior to today:

I'm telling you, I haven't seen moves likes this since the heyday of 1999!

Hedge funds are having fun trading stocks like Palantir Technologies (PLTR) and Jumia Technologies (JMIA):

Good luck shorting any of these high flyers, you're going to get your head handed to you!

If it feels like there's some herding going on in a few select tech names, it's because there is.

And it's not just tech stocks. Solar stocks like SunPower (SPWR) are melting up this week:

Again, there's definitely herding in some stocks and sectors, and euphoria is settling in.

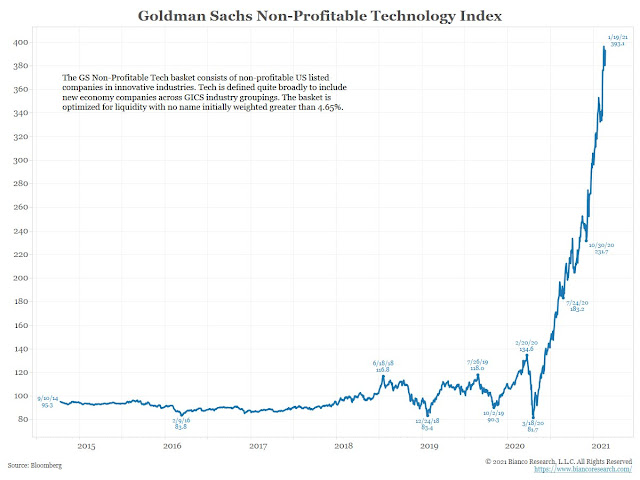

In fact, earlier this week, Jim Bianco tweeted this image of the Goldman Sachs non-profitable tech basket, stating "a chart that says it all about today's market":

But nowhere is the euphoria more palpable than in penny stocks.

In fact, Martin Roberge of Canaccord Genuity notes this in his weekly comment, Is Euphoria Here?:

This week was quite unusual in the sense that we have seen many low-priced stocks exploding higher. Interestingly, our Chart of the Week shows that stocks whose price is below $1 are the top performing stocks YTD with an average return of 16%. In fact, our chart shows that the lower the stock price, the stronger the YTD performance. Undoubtedly, there are signs of speculative mindset in the market. This is what could be called the stage of euphoria in the cycle of investor emotions. Russel Investments defines this stage as the following: “As markets reach the top of the cycle, investors may experience euphoria. We start to think that we made a smart move to invest when we did, and we believe that the good times will continue unchecked. We may even fool ourselves into believing we can tolerate higher levels of risk—and may begin to trade more frequently or invest in riskier asset classes”. Now the 64K question: are we early, at the mid point or late in the euphoria stage? Hard to tell but looking at the strong performance of many hyper-growth stocks today, we may not be in the late stage yet.

Did you get this part: "Now the 64K question: are we early, at the mid point or late in the euphoria stage? Hard to tell but looking at the strong performance of many hyper-growth stocks today, we may not be in the late stage yet."

You already know my thoughts, central banks are backstopping madness, promoting excessive risk-taking, we shouldn't be surprised to see this market euphoria.

Of course, some well known money managers are sounding the alarm:

"The biggest problem with these unprecedented and sustained government and central bank interventions is that risks to capital become masked even as they mount." https://t.co/pHD4GWO9mm

— Jesse Felder (@jessefelder) January 21, 2021

Truth is Seth Klarman, Jeremy Grantham, Leon Cooperman and many other skeptics will eventually be right but this nonsense can go on for a lot longer than anyone thinks.

So what will bring this euphoria to an end? I personally think the Fed is going to start tapering and raising rates a lot sooner than the market currently expects.

To wit, ECRI’s US Weekly Leading Index (WLI) increased to 150.4. The growth rate rose to 17.7%, a 571-week high!

Maybe the US economy will come roaring back forcing the Fed's hand, but by then, market euphoria will be a lot worse.

Still, the chart above is why rates will back up a little more, the US dollar will come roaring back, and stocks will taper off a bit after running up more.

Don't forget, next week is month end, big funds will rebalance, euphoria in penny stocks will continue but I expect there will be some profit taking in big tech over the next two weeks. We shall see.

Let me wrap it up with my stocks of the week, General Motors (GM) and Ford (F) (last week it was BlackBerry (BB) which soared this week):

I think this year will be revenge of traditional automakers. There's no way they're going to sit idly by and let Tesla gain all the EV market share.

Lastly, here are this week's top performing stocks:

The full list is available here.

Alright, let me end it there. I remind all of you that this blog runs on donations, so I do appreciate those of you who take the time to donate.

Below, the stock market may avoid a major near-term correction, according to economic forecaster Lakshman Achuthan.

Achuthan, co-founder of the Economic Cycle Research Institute, told CNBC’s “Trading Nation” on Thursday that the risk a pullback of at least 10% is “really low” because the U.S. is in expansion mode.

“The

cycle is on the side of the bulls for the time being,” he said. “At

some point, our forward-looking indictors, which have nailed this

upturn, will peak and turn down. Today, they haven’t done that. They are

still heading to the upside.”

Let's hope he's right but if you continue seeing too much euphoria, you'd better hedge your risk.

Also, Jeremy Grantham, co-founder and chief investment strategist of Boston’s GMO, believes U.S. stocks have become an epic bubble and will burst in a collapse rivaling the crashes of 1929 and 2000. In this interview, he explains why, discusses the futility of Federal Reserve policy, criticizes the state of American capitalism, and shares his thoughts on gold, Bitcoin, emerging markets and climate change. He spoke exclusively to Erik Schatzker on Bloomberg’s “Front Row.”

Great interview. Here's where I think Grantham is wrong, the Fed will go all BoJ if stocks crash and start buying stock ETFs to resuscitate and support stocks.

Lastly, in this excerpt from episode 187 of the Animal Spirits podcast, Michael Batnick and Ben Carlson discuss why index funds will never cause a bubble, how day traders are evolving, the best-performing stocks of 2020, penny stock madness, and more!

By the way, I don't give day traders including Wall Street Bets/ Redddit as much power as these guys. Big hedge funds are squeezing the shorts and causing mini manias, everyone else is on board for the ride!

And if you're wondering about the picture above, it's just Bernie being Bernie during Inauguration Day, and the pic went viral. I wonder what he thinks of the euphoria in the stock market!

Comments

Post a Comment