CalPERS' Former CIO on Saving America’s Public Pensions

Much has been written in recent years about the plight of US public pensions. There are growing concerns about underfunded liabilities, rising implicit tax burdens, and broken promises to beneficiaries. These are not groundless fears. Many US public pensions are indeed facing severe financial pressures.

These problems have begun to fuel doubts, among both current and future pensioners, about the reliability of their benefits over time, and thus about their economic security after they retire. But there are still many ways that investment staff, sponsors, and beneficiaries could work together to restore faith in the system. The key is first to understand the challenges facing the US public pension industry. One can then start to map out strategies for putting public pensions on a sound financial footing.

The Pension Puzzle

The main challenge facing the public pension industry is the high assumed rates of returns on pension assets relative to what equities or bonds are likely to deliver.Many US public pension funds expect a rate of return in the neighborhood of 7% per year. But in today’s capital-market environment, achieving that sustainably over the long term has become an increasingly daunting task.In fact, this is not a new problem. As Chart 1 illustrates, the gap between the risk-free and assumed rate of return has been widening for the past four decades. In the1980s, the risk-free rate (as approximated by the yield for ten-year US Treasury bonds) was often far higher than the assumed rate of return, making it relatively easy for pension funds to hit their targets. Today, however, the risk-free rate is more than six percentage points below targeted return.

Closing the gap will require innovation, new skills, and a greater appetite for risk. But investors today face a unique challenge in the form of the “triple low”: a low real interest rate, low inflation, and low economic growth. These conditions imply that future returns will likely lag well behind historical norms.Moreover, public pension funds also face a more idiosyncratic set of challenges,which I have dubbed the “triple high”: high expected returns, high current liabilities, and high underfunded gaps. These conditions are limiting pension funds’ investment flexibility at the same time that the triple low is tightening constraints on expected returns.

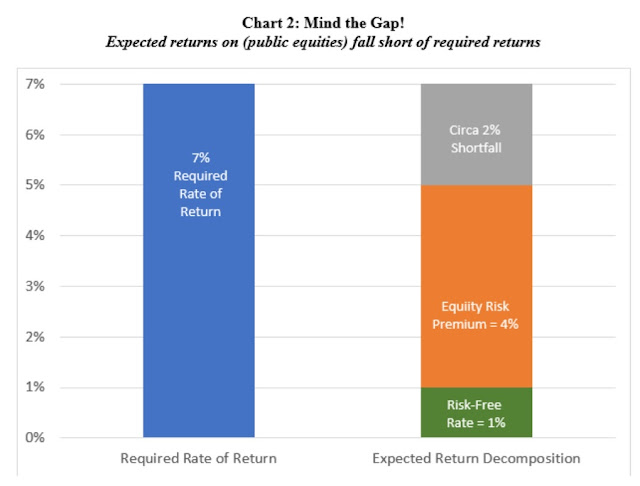

In today’s high-paced financial environment, in which markets tend to focus on quarterly results, it is important to remember that pension funds invest for the long run. A reasonable expectation of long-run equity returns is determined by the sum of the risk-free rate and the sustainable equity risk premium. Whereas the risk-free rate is below 1%, historical experience has shown the sustainable equity risk premium to hover around 4%.

Thus, as Chart 2 illustrates, the most that one can expect from a public-equity-only portfolio in the long run is a return of around 5% – well short of the 7% target.

The key point here is that public equity is the building block for pension plans, because it has the highest expected return among major liquid asset classes. And make no mistake: liquidity matters. Because public pension funds are sensitive to losses, liquidity management is crucial for preventing market drawdowns from spiraling into permanent losses.Liquidity is also needed to ensure that pensions can pay member benefits on time, regardless of market volatility. But the need to preserve prudent levels of liquidity means that public pension funds’ investment options for increasing returns are necessarily more limited than they would be otherwise.

The Missing Link

Another fundamental issue is that many US public pension funds are simply underfunded, with investable assets commonly accounting for around 70% of discounted liabilities. The problem with underfunding, of course, is that it leaves a pension plan vulnerable to market drawdowns. To mitigate the market risk,underfunded pensions must diversify, typically into assets with much lower expected returns, such as bonds. And because mature schemes require more income to pay member benefits, the long-term expected return is pushed down even lower than 5%.

So, how can pensions, especially those that are underfunded, boost returns? One answer is private equity, which is generally expected to deliver returns 1.5-3 percentage points higher than public equity, owing to the illiquidity premiums and additional returns (“alpha”) that private-equity owners can extract through operational control over the businesses in their portfolios. Still, many skeptics argue that boosting returns through private equity is not enough to narrow public pensions’ funding and return gaps. This suggests that the only remaining option is for pension plans to start reducing their unreasonable targets for expected returns.

But lowering expected returns is not a decision that can be taken lightly. Public pensions are balanced on a three-legged stool of investment return, member benefits, and employer/employee contributions. Lowering expected returns thus would have a significant adverse effect on stakeholders such as employers and employees.

To be sure, over the past decade, policymakers have introduced measures to improve the stability of the public pension system by lowering expected returns, adopting benefit reforms, and demanding higher contributions. California’s 2013 Public Employees’ Pension Reform Act, for example, slowed the rate of benefit accruals and capped payments.

But, because these policies have resulted in meaningful increases in employer and employee contributions, it would be difficult to repeat them anytime soon. Accordingly, the onus has shifted once again to the investment leg of the stool:despite the challenges, there is an acute need to boost returns.

The Public Advantage

Fortunately, unlocking higher returns is possible, given the inherent advantages enjoyed by public pension schemes. For starters, because public pension funds have a long-term investment horizon, and are perpetual by design, they can capture the kind of risk premiums that manifest over time, such as illiquidity and equity-risk premiums.

Moreover, pensions are asset owners, as opposed to asset managers. While asset managers are under pressure to prevent their clients from abandoning them during times of market stress, public pension funds are spared from such concerns, and thus can ride out the storms.

Because asset ownership reinforces one’s ability to pursue long-term investments, private equity – with its long tie-up periods – is an ideal asset class for public pensions. But building a suitable private-equity portfolio is no small matter. Knowing which private-equity managers to pick requires deep, specialized knowledge; and getting allocations from the best managers is often difficult. Moreover, private equity is not cheap. The top managers demand high fees, and their strategies often lack the transparency of public markets.

Nevertheless, the benefits outweigh the costs. For the disciplined and committed long-term investor, the illiquidity and manager-expertise premiums offered by private equity can be treated as durable. That is why private equity is ultimately the“better” asset.

Leveraging for Growth

Beyond investing in “better” assets, public pensions can also try to close the gap between expected and target returns with “more” assets. By using moderate borrowing (leverage), pension funds can increase the volume of total assets under management and thereby boost overall returns.

This option is particularly sensible in light of today’s ultra-low borrowing rates. Unlike investing in ever-riskier assets – an approach that is subject to diminishing returns, because many other investors will pile into the same strategies – borrowing to increase the size of one’s portfolio capitalizes on public pensions’ inherent advantages.

To be sure, leverage presents its own risks, such as duration mismatches between liabilities and the assets acquired, and unexpected increases in borrowing rates. But in a world of low inflation and gradual recovery, most major central banks have made clear their intention to keep borrowing rates lower for longer. Ultimately, leverage will always be a double-edged sword that can enhance returns but also amplify losses during market setbacks. As such, it should be used judiciously and with proper risk management provisions in place.

The final key to closing the gap is to harvest long-term returns. That may sound easy, but it actually runs contrary to human nature. Asset owners are prone to squander their advantage by reacting to short-term market volatility. It is well documented that investors tend to feel the pain of loss more strongly than the pleasure from gain.

Yet unlike Odysseus, it is difficult for a pension fund manager to strap herself to the proverbial mast. Having a plan and the will to stick to it is critical, requiring discipline not just from investment staff but also from those who oversee portfolio performance, such as trustees or boards.

In other words, sustaining higher returns requires courage and a well-formed strategy. It takes courage to be different and to stay the course; and the strategy must align incentives for long-term performance.

Process Makes Perfect

This is not a plea for dogmatism. Because the fundamentals can change, strategic asset allocations may need to adapt. Ultimately, the commitment should be to the process itself. Decision-makers must ask whether a judgment about the investment environment is solidly based. Are the read-throughs to probable returns, risks, and liquidity needs being properly analyzed? Is there a sufficient cushion, above all in liquidity, to meet the plan’s obligations? If these boxes can be ticked, the strategy ought to be maintained in the face of ordinary market setbacks and periodic underperformance.

Remember, during times of crisis, asset owners – unlike asset managers – do not face the threat of investor redemptions. With the ability to buy when others sell, they can rely on an intrinsic source of return enhancement. This was certainly the case for better-prepared funds during the financial market turmoil induced by COVID-19 last spring. And over time, this key advantage can compound and accrue to a plan’s sponsors and beneficiaries.

Closing US public pension funds’ large funding gaps will not be easy, but nor is it a lost cause. The best approaches will be based on these institutions’ intrinsic advantages as large-scale long-term investors. Improving returns is possible through“better” assets, “more” assets, and a serious commitment to long-term thinking.

To succeed, those overseeing pension schemes must recognize that improvements in risk management and in the structure of incentives are essential. Enhancing the rate of return is not possible without embracing risk. Investment staff therefore need to be equipped with the tools to identify, take on, and mitigate risk; and those who reward or constrain the investment staff need to appreciate the inherent advantages and challenges that come with being a long-term investor.

Above all, for pension plans to achieve their investment aims, they must be willing to innovate, to consider alternative assets and approaches to boosting returns, and to endure rough passages with an eye on the horizon, rather than on the obstacles immediately in front of them.

What a brilliant comment from Ben Meng, CalPERS' former CIO.

Let me first thank Gordon Fyfe, BCI's President and CEO, for bringing Ben's comment to my attention over the weekend.

Gordon thinks very highly of Ben Meng and so do I. I've had the pleasure of talking with him a few times since he was appointed CIO at CalPERS and not only is he brilliant, he was always very nice and generous with his time.

The last time I spoke with Ben was in the summer via a webcast where he explained that CalPERS is not leveraging its portfolio by $80 billion. We spoke about a few things and I recommend you read my comment here to gain an appreciation of everything he was tying to do at CalPERS.

That was before his crucifixion In August where he was forced to resign.

I'm on record stating the way Ben Meng was treated was absolutely shameful and disgusting.

I don't need to expand on this, suffice it to say CalPERS lost one of the best CIOs in the world and they still haven't replaced him.

The comment Ben wrote above is spot on, he touches on a lot of points:

- The pension rate-of-return fantasy which has plagued US public pensions for over a decade. Ten years ago, I wrote a comment on what if 8% turns out to be 0% and that's pretty much where we are now with long bond yields around the world in negative territory and zero bound.

- Ben discusses how closing the gap will require innovation, new skills, and a greater appetite for risk, but with rates at record low levels and meager growth, future returns will not be anywhere near what they have been over the last 20 years.

- He also discusses how lowering the discount rate (projected return assumption) isn't easy because it would impact many stakeholders who would need to contribute more.

- Moreover, he discusses liquidity management and how US public pensions are underfunded -- and many are chronically underfunded with 50% or less of assets to match future liabilities -- so it's not easy to increase risk. As I've stated many times, pension deficits are path dependent (actually Jim Leech, OTPP's former CEO, taught me that), so your starting point matters.

- Ben's solution is more private equity, moderate leverage and using the "intrinsic advantages" of asset owners with a long investment horizon to capitalize on opportunities across public and private markets and wait to harvest returns at the right time.

- Lastly, he talks about prioritizing risk management and the need to innovate and endure difficult passages.

I must say, after a year like 2020, i find a lot of people, especially young neophyte investors investing in Tesla, Nio, etc., have very skewed expected return projections for the overall market and their own portfolios.

As I explained in my Outlook 2021, last year was a liquidity driven anomaly, the unARKing of the market lies ahead, and we might be in for some very rough passages.

Yes, Janet Yellen will be confirmed as the new Secretary of the Treasury, she's ultra dovish, that's generally good for markets as she wants to pass massive stimulus packages.

But it doesn't mean that risk assets won't experience more than a few hiccups along the way, and some very big ones at that.

All this to say, temper your enthusiasm, even on private equity, it won't be easy over the next decade.

Ben Meng knows all this. Again, he wrote a brilliant comment and the only thing I'd add is that US public pensions need to adopt the governance and compensation that Canada's large pensions have adopted to manage more private assets internally and do a lot more co-investments with their general partners to lower fee drag and maintain a healthy allocation to PE.

And yes, with rates so low, moderate and intelligent use of leverage is also a critical part of the equation going forward. Leverage has been a critical component of the success at Canada's large pensions, but again, you need to hire and pay highly qualified staff to employ leverage or else it might lead to disasters.

A long time ago, I wrote a comment for the New York Times on how US public pensions need a qualified, independent board of directors to oversee their public pensions.

I still stand by that comment but know a lot more now.

Ben Meng adds a lot more insights to this issue as does the study from Clive Lipshitz and Ingo Walter and the paper from Sebastien Betermier and

Quentin Spehner.

Canada is blessed with the world's best public pensions and the US needs to understand why and how they can incorporate elements of success.

Alright, I've rambled on too much, let me end it there and wish Ben Meng all the best for the new year.

Below, CalPERS CIO Ben Meng discusses how private equity has been the highest returning asset class for the California pension, helping them achieve their target return.

No doubt, private equity is a critical asset class but the approach is what counts the most and the best way to meet your return requirements is to partner up with top GPs and make sure you gain access to large co-investments. This requires a strong staff which you need to compensate properly.

Update: Clive Lipshitz who co-authored an excellent paper with Ingo Walter on what lessons US pensions can learn from Canadian pensions, sent me these insights after reading this comment:

A very good piece. Ben Meng is obviously correct that with a "long-term investment horizon," pensions should “capture… risk premi[a from]... illiquidity and equity-risk.” But premia will dissipate as capital flows the last few areas of market inefficiency. No investor can routinely, always, choose the best investments; as a group some of them by definition will be in mediocre or poor investments. His point about liquidity is one that Mihail makes in his TFM lectures and you do too, i.e. that cash flows are path dependent. The point about benefiting from these "institutions’ intrinsic advantages as large-scale long-term investors” suggests a more strategic relationship between asset owner and asset manager, or a model in which groups of pensions invest together.But the primary point of his opinion piece is one he seems to gloss over as a symptom, not a solution, i.e. pension funding status necessitates “meaningful increases in employer and employee contributions.” There is no math that will close pension funding gaps from the portfolio alone.

I thank Clive and of course, I completely agree with his main point, namely, the funding plan of any pension is what can close the gap between assets and unfunded liabilities. A good funding plan has a shared risk model embedded in it, typically in the form of conditional inflation protection, but also raises contributions when necessary.

I think Ben Meng knows all this as we have had private discussions about it but his insights are more focused on given the constraints US public pensions face and that a shared risk model looks unlikely, what can these pensions do to close the funding gap.

But I agree with Clive, the best investment officers in the world can't close these funding gaps, they need to revamp their funding plans to introduce a shared risk model.

Mihail Garchev, former VP and Head of Total Fund Management at BCI, also sent me his thoughts after reading this comment:

This is a great and much-needed continuation of the topic on pension fund investment management, and I could offer a few additional aspects to consider.

Liquidity premium and private assets: I believe the notion that private assets always deliver an extra return over public assets is not entirely true. It is not necessarily the same as the notion that stocks deliver a risk premium over bonds. If it were, then as long as one invests in something that is called "private equity' it will always deliver a higher return (liquidity premium). A genuine liquidity premium could only be observed in complete markets. Ironically, it is best observed in the listed stock markets. Private assets are incomplete markets where there are other drivers. For infrastructure, for example, many of the transactions were closed at 40-60% discount to the regulatory cost of capital. This means that there wasn't any liquidity premium, but the opposite. Investors paid more, not less. In private equity, much of what manifests as liquidity premium (outperformance of private versus public assets) is not some inherent risk premium but managers' ability to deliver economic value added. In part, the conclusions come from using these universes of private equity funds, but there is, first, significant survivorship bias and significant dispersion of returns. The average private equity fund does not deliver higher returns when properly adjusted for comparison. Again, what manifests as a risk premium (some decide to call it a "liquidity premium") is mostly economic value added from corporate activities in the companies (cutting costs, changing management, synergies, etc.).

This is why it is essential not only to invest in private assets but also "how" to invest in them. This opens up the question of costs, efficiency, and effectiveness. A significant portion of the TFM series was about these, so I won't repeat it. What is essential is to understand that there might de a significant return lost due to inefficiencies. A straightforward example is an investment via funds versus direct and co-investments. Although one still invests in private equity, the outcomes could be quite different as many of the returns "leak" into fees and other costs. This is why a transformation of the entire investment process and implementation is necessary. The direct fees and costs are just the iceberg and are visible, at least approximately. What is not visible are all the other layers of inefficiencies that we uncovered discussed in the TFM series. If one combines all these, one might be surprised at the magnitude of it. I would say that what is needed is a restructuring to unlock what I would call a "structural and efficiency premium." There is also this discussion of what exactly long-term means – we discussed this extensively in episode 2 of the TFM, "What nobody told you about long-term investing." This is what TFM brings to the table, both as a process and as a structure (what we described as the Canadian model 2.0).

Private assets and liquidity: Liquidity is what enables the investment in private assets. There is a natural limit to how much one could invest in private assets. Given the US pension funds situation, cash flows are a big problem, and Clive Lipshitz very well illustrates this in the paper. Leverage is beneficial when used in a path-dependent manner and is also a part of the solution. Market conditions have been beneficial for the use of leverage as one needs to have asset returns higher than the cost of leverage. The market corrections have been short-lived and V-shaped, so they did not do much damage to levered assets. We have been borrowing returns from the future, so if there are lower or negative returns for a prolonged period of time (Japan would be a good example), leverage might not work anymore. Leverage also requires liquidity, so "private assets plus leverage" requires even more liquidity.

On a final note, the US pension fund challenge must be approached from the bottom up, addressing all possible sources of return (what Ben calls "better assets," "more assets," but also "better and more efficient process and structure"). There would also be a need for top-down political reforms. Unfortunately, these might not come easy, certainly not soon. That said, one starts with the organizational and investment strategy design within what one can control, at least in the beginning, and create a critical mass (voice, advocacy, consortium) and then move to the second-order impacts (top-down).

I thank Mihail for his very wise insights and invite my readers to go back to read Part 6 and Part 7 of the TFM series we produced last year for more information.

Comments

Post a Comment