Top Funds' Activity in Q1 2021

A number of well-known U.S. hedge funds bought value stocks and blank-check acquisition companies, selling some winners from the technology-led stock rally as bond yields rose during the first quarter, filings released on Monday showed.

Special-purpose acquisition companies, known as SPACs, proved popular among hedge fund managers, with funds such as Third Point and Saschem Head adding shares of SPACs, including FinTech Acquisition Corp V and healthcare company Orion Acquisition Corp (OHPA) to their portfolios.

Tiger Global added shares of Revolution Healthcare Acquisition Corp and Soaring Eagle Acquistion Corp and trimmed its position in Facebook Inc.

Activist investor Starboard Value invested in a string of other so-called SPACS that exist to buy private companies and take them public, including Montes Archimedes Acquisition Corp, Altimar Acquisition Corp, Churchill Capital Corp II and Forest Road Acquisition Corp.

Over 400 SPACs have listed their shares since the start of 2021, though the majority are underperforming the broad stock market, a Reuters analysis showed. read more

At the same time, several hedge funds added to financial, energy and consumer companies. Third Point added a new position in Carvana Co (CVNA) and Uber Technologies Inc (UBER), while Epoch Investment Partners added new positions in energy firms such as Exxon Mobil Corp (XOM), Pioneer Natural Resources Co (PXD) and Diamondback Energy Inc (FANG).

Billionaire Ray Dalio's Bridgewater Associates, the largest hedge fund manager in the world, added a new position in General Motors Corp (GM), Ecolab Inc (ECL) and Johnson Controls International PLC (JCI) while selling out of its position in media companies, including the New York Times Co, News Corp and Discovery.

The moves into stocks that benefit from a broadly growing economy came during a quarter in which so-called value stocks - in industries such as financials and materials that rise on economic growth - surged and interest rates rose as investors positioned for a reopening of the global economy after the coronavirus pandemic.

The Russell 1000 Value index, for instance, is up 17% for the year to date, while the Russell 1000 Growth index - which is top-loaded with shares of technology companies like Apple Inc and Amazon.com Inc that surged during the economic lockdowns - is up 3.5% over the same time.

Bond yields, meanwhile, rose to reflect rising inflation expectations, increasing borrowing costs for consumers and companies. Consumer prices rose in April by the largest measure in 12 years, prompting some mutual fund managers to increase their cash positions and turn more defensive. read more

Hedge fund managers' positions were revealed in 13F filings that show what fund managers owned at the end of the quarter. While they are backward-looking, these filings are one of the few public disclosures of hedge fund portfolios and are closely watched for clues on trends and what stocks certain fund managers are favoring.

They do not disclose the date a purchase was made during the quarter.

Some hedge fund managers unloaded shares of companies that performed well over the last year, suggesting they see limited gains ahead. Epoch Investment Partners, for example, liquidated its position in Under Armour Inc, which is up 34% for the year to date, and cut its position in Amazon by roughly 46%.

Third Point, meanwhile, sold out of its position in Alibaba Inc (BABA).

Dan Loeb also exited his Palantir trade, made a big bet in a newly public company, and trimmed big tech stocks in the first quarter of 2021:

Billionaire investor Dan Loeb exited his Palantir trade, made a large bet in a newly public company, and trimmed some of his big-tech holdings in the first quarter of 2021.

Third Point securities filings for the period show that Loeb exited his Palantir (PLTR) position, selling 2,356,991 shares of the big-data company. The company's stock is down nearly 13% year-to-date as investors rotate into stocks that hinge on an economic recovery.

Loeb added 41,500,000 shares of Paysafe, a British payments firm that went public via a special purpose acquisition company during the quarter. The company is his fifth largest holding. His eighth largest holding is a new position in CoStar (CSGP), a commercial real estate company.

The Third Point chief said in a letter to investors earlier this month that his flagship fund gained 11% in the first quarter, outperforming the S&P 500.

Loeb said that one of his best-performing investments last quarter was Upstart. The fund first invested in Upstart at a $145 million valuation about six years ago. It now owns roughly 13.3 million shares for a value of around $1.7 billion following the AI-powered lender's IPO in December. Upstart is the fund's top holding.

Loeb also trimmed back on some of his big tech stocks. He slimmed down his positions in Alphabet, Amazon, and Facebook, but added 300,000 shares of Microsoft.

Loeb also exited his positions in Pinterest, Adobe, Salesforce, Alibaba, Nike, and DoorDash.

The activist investor said that he's bullish on stocks and the US economy in his investor letter, citing ample liquidity in markets, loose monetary and fiscal policy, and a supportive Federal Reserve.

Rupert Hargreaves of Gurufocus also asks, why are hedge funds piling into SPACs?:

As I have been going through hedge fund 13F reports over the past few days, I've noticed one clear trend. Most big-name firms have built up extensive holdings of Special Purpose Acquisition Companies (SPAC) in 2021.

Seth Klarman (Trades, Portfolio)'s Baupost is a great example. According to the hedge fund's 13F for the three months ended March 2021, Baupost owned the following SPACs:

Reinvent Technology Partners Y Units (NASDAQ:RTPYU)

Avanti Acquisition Corp. (NYSE:AVAN)

Reinvent Technology Partners (NYSE:RTP)

Horizon Acquisition Corp. II (NYSE:HZON)

Liberty Media Acquisition Corp. (NASDAQ:LMACA)

Broadstone Acquisition Corp. (NYSE:BSN)

Altimeter Growth Corp. 2 (NYSE:AGCB)

Investindustrial Acquisition Corp. (NYSE:IIAC)

Dragoneer Growth Opportunities Corp. III (NASDAQ:DGNU)

Finch Therapeutics Group Inc. (NASDAQ:FNCH)

SVF Investment Corp. (SVFA)

Dragoneer Growth Opportunities Corp. II (DGNS)

Reinvent Technology Partners Z (RTPZ)

Why are hedge funds piling into SPACs? I don't know, maybe because they realize public markets are insanely overvalued right now, so go hide in SPACs, aka, the poor man's private equity.

All I know is the SPAC market has cooled considerably in recent weeks, with companies that went public by merging with a blank-check entity trading well off their highs, and a growing number of regulatory hurdles emerging for an investment strategy that often dominated financial news headlines in 2020.

Anyway, it's that time of the year again when we get a sneak peek into what top fund managers bought and sold last quarter, with a 45-day lag.

Before I get into the details, please take the time to read my more recent market comments:

- Will stocks crash after entering the valuation Twilight Zone?

- What Does the Big US Jobs Miss Signal For Stocks?

- Market Sells Big Tech's Blowout Earnings

- Sell in May and Go Away?

I am continuously looking at the stock market, every day I go over which stocks registered the biggest advances and declines, I check out which sectors are outperforming, which ETFs are outperforming, I look at the top holdings of top funds, then look at a bunch of daily and weekly charts.

It's a full-time job (what, you think I'm only interested in pensions?) and I realize how tough these markets are getting which is why I tell all my readers to focus on risk management right now.

On that note, take the time to read the latest weekly comment from Trahan Macro Research on managing risk in an usually polarized equity market (download it here).

I note this:

There is little doubt that the economy is gaining strength as the U.S. appears to be quickly transitioning into a post-pandemic recovery. Unfortunately for equity investors this has not been an easy backdrop to manage money.What we have seen this year is a see-saw between leadership of Growth/Stability and Value/Cyclicality, and with the latter has come downward pressure on the S&P 500 Index as a whole. One of the reasons for this behavior is the unusually high proportion of Growth stocks in the Index, which currently exhibits a historically high valuation spread relative to Value.

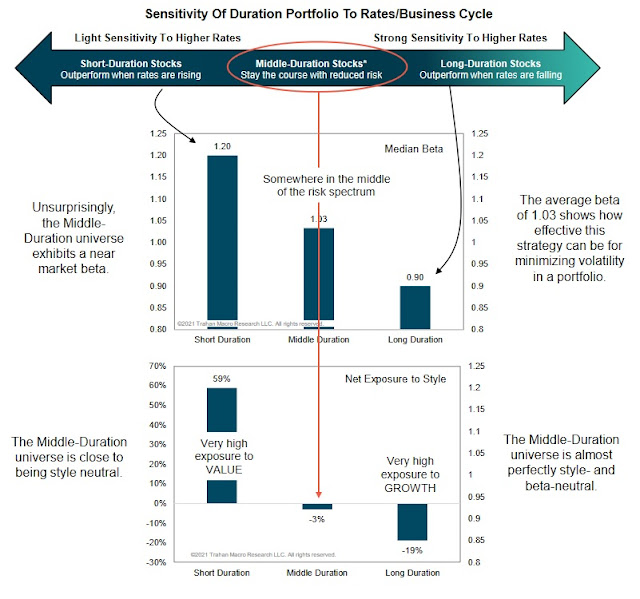

In the report, Francois Trahan explains why valuations matter at extremes and they then develop a way to minimize volatility by focusing on Middle-Duration stocks in the S&P 500:

They even provide a list of stocks based on their All Weather Model and Middle Duration stocks:

As Francois explained to me:

This approach generated 600 basis points of excess performance over the S&P 500 this year while limiting "market leadership" or "rotation" risk. This is the part that clients are really focused on. There is a lot of anxiety about leadership and how to manage it with the ISM near historic highs.

I couldn't resist to share my two cents, noting how I read a Bloomberg article on a three-decade bond veteran warning against big bets on inflation:

Lee, who worked in bond sales in the 1990s at UBS Group AG, said yields on 10-year U.S. Treasuries are more likely to fall below 1% than to normalize above 3% for “any lasting time.” That’s because the deflationary pressures that have plagued markets for decades -- increasing automation, aging demographics and falling global productivity -- haven’t gone away.

“It’ll take years to be able to normalize beyond the sort of 2-3% range” that we’re hoping to enter now, said Lee, who holds a doctorate in Mathematics from Oxford University. “Pretty much every country has got a debt burden that corporates or households would struggle to service if yields rose by really quite modest amounts.”

Her strategy? “Sit out taking an active position” when necessary, rather than risk losses. She’s exited most of her overweight positions in inflation-linked bonds.

Why is this important? Well, because after a huge increase in the yield of the 10-year Treasury yield over the last six months, long bond yields seem to be stalling here:

Interestingly, this week, the cyclical sectors (Financials, Energy, Industrials, Materials) registered losses and the more defensive rate sensitive sectors (Real Estate, Utilities) and rate neutral (Healthcare) registered gains while Technology was flat, recovering losses from earlier this week:

If rates continue to creep lower, this is what you'd expect, but I'm not convinced as I see a strong US economic recovery in the second half of the year (you'll likely see it in the May nonfarm payroll data which comes out on the first Friday of June).

There are a lot of macro undercurrents in this market, if you don't get the macro right, you will not pick your stocks correctly.

There is a lot of uncertainty which is why I'm providing you some food for thought before going over top funds' Q1 activity.

Who cares, tell me what Soros et al. bought and sold!

Alright, let's get into what top funds bought and sold last quarter.

Earlier this week, Zero Hedge did a complete 13F summary:

Well, the latest barrage of 13F reports confirms that tech indeed was the bete noir of the first quarter, with some of the most notable hedge funds dumping some or all of their tech exposure, as they rotated into value and reflation sectors such as financials and energy. That and much more is noted in the below summary of the most notable 13F moves of the past quarter, courtesy of Bloomberg:

Philippe Laffont’s Coatue Management slashed many of its tech holdings that have benefited from the pandemic-induced lockdowns, like fitness-equipment maker Peloton Interactive Inc., cyber-security solutions company Crowdstrike Holdings Inc., and Zoom Video Communications Inc. Coatue reduced its exposure to technology stocks by about 8%, data compiled by Bloomberg show. Alex Sacerdote’s Whale Rock Capital Management also decreased its stake in some of those stocks, including Peloton and Crowdstrike.

Financials were a key sector that firms re-allocated to as they broadly trailed other cyclical sectors due in part to low interest rates. Dan Sundheim’s D1 Capital liquidated its stake in JPMorgan Chase & Co., jettisoning a position worth more than $1 billion as of March 31. Viking Global also decreased its JPMorgan stake, but it’s starting a new position in Bank of America. Duquesne took a new position in Citigroup and has a small holding in JPMorgan. Berkshire Hathaway Inc., meanwhile, cut its position in Wells Fargo. ValueAct dumped its remaining stake in Morgan Stanley.

GameStop Corp. was among the companies that skyrocketed during the Reddit-fueled trading frenzy at the beginning of the year. Lee Ainslie’s Maverick Capital exited its stake in the video-game retailer, valued at $88 million at the end of December, when the shares traded at $18.84. GameStop shares hit a record $347.51 on Jan. 27 as Redditors pushed the stock “to the moon.”

Alibaba Group Holding Ltd. seemed to fall out of favor with some hedge funds in the first three months of the year as China’s crackdown on the technology sector weighed on the e-commerce giant. It was a top exit for Third Point and Coatue Management; Soroban Capital Partners trimmed its stake.

Bill Ackman's Pershing Square added Domino’s Pizza Inc. to its investments and exited Starbucks

Elliott added E2open Parent Holdings Inc. Class A to its investments and exited F5 Networks Inc. in the first quarter. Elliott also added to its holdings in Twitter Inc, Decreased its stake in CorMedix Inc; Dell Technologies Class C was the biggest holding, representing 28% of disclosed assets

David Tepper's Appaloosa added Chesapeake Energy Corp. to its investments and exited Square. Other higlights: it added to its holdings in Energy Select Sector SPDR Fund, and decreased its stake in PG&E Corp; Micron Technology Inc. was the biggest holding, representing 9.2% of disclosed assets.

George Soros’s investment firm was among those that capitalized on the distressed remains of Bill Hwang’s Archegos Capital Management. His Soros Fund Management snapped up shares of ViacomCBS Inc., Discovery Inc. and Baidu Inc. as they were being sold off in massive blocks during the collapse of Archegos at the end of March. Coatue Management also started smaller new positions in three of the names in the quarter: a $148 million stake in Farfetch Ltd., a $147 million position in RLX Technology Inc. and a $77 million holding in ViacomCBS. And D1 Capital Partners added 124,000 shares of Shopify Inc. for a stake valued at $137 million. Elliott Management Corp. disclosed it held a $95 million stake in Discovery Inc.

Stan Druckenmiller’s family office Duquesne took a new position in Citigroup, worth $154.6 million, a $139.4 million stake in data-mining firm Palantir and a small holding of JPMorgan. The investment firm boosted its holding in Starbucks and liquidated its investment in Disney, worth about $124 million, while also exiting cruise liner Carnival.

Starboard Value jumped on a hot Wall Street trend: SPACs. The activist investor, which launched its own blank-check company last year, made relatively small investments in 18 such companies in the quarter, including ones being run by notable investors such as Michael Klein and Alex Rodriguez and private equity firms KKR & Co. and Warburg Pincus. Another activist investor, Keith Meister’s Corvex Management, also snapped up several SPAC names in the quarter.

Berkshire Hathaway exited Synchrony Financial in the first quarter as Warren Buffett’s company continued to trim its bets on financial firms.

Chase Coleman’s Tiger Global kept the majority of its positions static in the first quarter and only sold out of two names. Digital games company Roblox, which made its public debut in the quarter, emerged as a new top holding for Tiger Global, behind JD.com and Microsoft, and was valued at $2.6 billion at the end of March. Tiger Global was among the company’s pre-listing backers, having first invested in Roblox in 2018

Jana Partners built a new position in Vonage Holdings Corp. The hedge fund plans to push for changes at the telecommunications services company, according to people familiar with the matter

Andreas Halvorsen’s Viking Global started a new position in Bank of America, snapping up 31.3 million shares worth $1.2 billion as of March 31. That makes it Viking’s fifth biggest long holding. Shares of Bank of America have been on a tear, rising 28% in the first quarter after gaining 26% in the fourth quarter. Viking also took new stakes in Netflix, solar energy company Sunrun and 25 others companies. Meanwhile it sold out of Disney, ditching shares worth $774 million as of March 31 and getting out of a stake worth $632 million in American Express as of the same date.

A detailed breakdown of the top fund changes follows:

ADAGE CAPITAL PARTNERS

Top new buys: PRAH, AEVA, F, PNTM, PAX, APTV, VRT, MIT, EPIX, PTC

Top exits: MMM, CEO, IMVT, KMB, SRPT, STEM, SAIC, NVAX, VALE, NVT

Boosted stakes in: FTV, ALXN, MRK, HON, JNJ, MSFT, BAC, GOOG, GOOGL, W

Cut stakes in: RPRX, AAPL, BURL, EYE, XOM, DOV, UAA, AMZN, DLTR, EIX

APPALOOSA

Top new buys: CHK, PSFE, DHI, MOS, AR, IQ, APA, ETWO, BP, DISCA

Top exits: SQ, WFC, MMP, TEN, KMI, ENBL

Boosted stakes in: XLE, OXY, XOP, UNH, GT, FCX, ADS, QCOM

Cut stakes in: PCG, BABA, TMUS, TWTR, PYPL, DIS, MA, AMZN, V, CRM

BALYASNY ASSET MANAGEMENT

Top new buys: WFC, COHR, INTC, ISRG, SCHW, HIG, PHM, FDX, HON, MTD

Top exits: PYPL, NVDA, XOM, RTX, JBHT, AAPL, STLA, SBUX, PG, KR

Boosted stakes in: TGT, BK, ZTS, AMZN, MS, MA, ALGN, CNI, ATVI, INFO

Cut stakes in: GOOGL, BABA, DIS, NFLX, MSFT, TEAM, TSCO, V, BAC, PANW

BAUPOST GROUP

Top new buys: WLTW, IFF, NUVB, CGEM, AJAX, TBA, AVAN, HZON, RTP, LMACA

Top exits: MPC, RBAC, RADI, VIST

Boosted stakes in: INTC, GOOG, QRVO, FB, MU, VRNT, PEAK, SSNC

Cut stakes in: EBAY, FOXA, ATRA, FNF

BERKSHIRE HATHAWAY

Top new buys: AON

Top exits: SYF, SU

Boosted stakes in: KR, VZ, RH, MMC

Cut stakes in: CVX, WFC, MRK, STNE, LBTYA, ABBV, AXTA, BMY, SIRI, GM

BRIDGEWATER ASSOCIATES

Top new buys: LOW, HD, JCI, LULU, DD, SHW, ECL, TSLA, KMX, F

Top exits: NOW, ADBE, SCCO, NVDA, APD, ATVI, ADSK, DE, AMAT, LRCX

Boosted stakes in: PG, KO, JNJ, MCD, WMT, TT, EL, APTV, PEP, WFC

Cut stakes in: GLD, EEM, IAU, SPY, IVV, VEA, PDD, EFA, IEFA, IEMG

COATUE MANAGEMENT

Top new buys: OSCR, MRNA, FTCH, RLX, TWLO, AI, LMND, BNTX, QS, DDD

Top exits: LRCX, JD, AYX, NVDA, DT, BABA, CREE, EXPE, GPS, MU

Boosted stakes in: LI, GH, XPEV, AMZN, NKLA, SE, SNOW, LSPD, COUP, VLDR

Cut stakes in: PYPL, DIS, PTON, CRWD, ZM, GPN, SQ, TSLA, UBER, PLAN

CORVEX MANAGEMENT

Top new buys: MSFT, EXPE, BLMN, AJAX, CAP, HZON, TWND, AACQ, HEC, FIII

Top exits: WDAY, ADBE, AEO, ZEN, HCA, HUM, EVRG, CNP, STEM

Boosted stakes in: EXC, GOOGL, TMUS, CCEP, AMZN, JPM, ATUS

Cut stakes in: MGM, FE, ATVI, GLD, NFLX

D1 CAPITAL PARTNERS

Top new buys: BKNG, DDOG, AMZN, DECK, MRVI, BAX, DRI, TEAM, BX, EDU

Top exits: IR, PNC, CLVT, DT, MSGS, MU, SMAR, KRC, BABA, ESS

Boosted stakes in: MSFT, EXPE, NFLX, FB, GOOGL, DIS, RH, JPM, DHR, TGT

Cut stakes in: LYV, CVNA, AVB, ORLY, HPP, BLL, LVS, DEI, AAP, RACE

DUQUESNE FAMILY OFFICE

Top new buys: C, PLTR, ON, BKNG, INTU, BLDR, FB, TSM, JPM, CAT

Top exits: DIS, NEE, CCL, IQV, ADI, WDAY, SMAR, SMH, NYT, ELAN

Boosted stakes in: EXPE, SBUX, CMI, UBER, GOOGL, USFD, TECK, FLEX, VALE, LIN

Cut stakes in: TMUS, NUAN, MSFT, CVNA, NET, MELI, PENN, AMZN, PANW, SE

ELLIOTT MANAGEMENT

Top new buys: ETWO, DISCK, TTD, RYAAY, FB, PFG

Top exits: FFIV, FNV, XOP

Boosted stakes in: TWTR, MPC, PINS, SNAP

Cut stakes in: CRMD

EMINENCE CAPITAL

Top new buys: AAP, NICE, ETWO, WBA, LIVN, NSTG, CHTR, CCK, SNRH, PFGC

Top exits: DD, CHNG, FISV, WWE, OUT, CNC, AVTR, WELL, VRT, VVV

Boosted stakes in: DNB, AMZN, EXPE, WSC, RRR, GOOG, AON, PSTG, PEGA, ABG

Cut stakes in: USFD, MIC, RHP, DFS, PLAY, NUAN, BERY, NEWR, CNNE, COF

ENGAGED CAPITAL

Top new buys: CORE

Top exits: MGLN

Boosted stakes in: NCR

Cut stakes in: QUOT, IWM

FIR TREE

Top new buys: CIT, EXC, NAAC, PCPC, MSFT, EAC, FPAC, CTAQ, PNTM, TACA

Top exits: EXPE, MSGE, CTXS, HHC, AACQ, DIS, WPF, THCB, ASPL, BOWX

Boosted stakes in: OUT, ENPC, ABBV, MLAC, STWO, GLEO, SCVX, GOAC, CRHC, CONX

Cut stakes in: SLM, LAMR, FE, SPR, GRSV, BSX, DELL, TMUS, HEC, THCA

GREENLIGHT CAPITAL

Top new buys: FSRV, WPF, SPNV, GPRO, XOG, CPRI, GANX, RTP, DGNR, NGAC

Top exits: NCR, GDX, CCK, DDS, UHAL, ICPT, MNOV

Boosted stakes in: DNMR, CNXC, APG, SATS, ADT, JACK

Cut stakes in: GRBK, AER, GLD, FUBO, REZI, CNX, CHNG, TECK, AAWW, CC

ICAHN

Top new buys: FE

Boosted stakes in: BHC, DAN, XRX, TEN

Cut stakes in: HLF, OXY

IMPALA ASSET MANAGEMENT

Top new buys: WFG, PXD, LYB, ZIM, AGCO, ASTE, OSK, WDC, TFII, SONY

Top exits: FCX, THO, CMI, SIX, EOG, KBH, LEA, CLR, GBX, F

Boosted stakes in: DAC, UAL, HES, DVN, TROX, ADNT, CENX, LAD, CNK, TECK

Cut stakes in: KNX, HOG, NVR, RIO, DOOR, SLB, COP, HGV, SBSW, MU

JANA PARTNERS

Top new buys: VG, CONE

Top exits: BLMN, TGNA, NEWR, GRA

Boosted stakes in: THS, LH

Cut stakes in: EHC, SPY

LAKEWOOD CAPITAL MANAGEMENT

Top new buys: AEL, GDDY, GPI, CDW, FAII, SYNH, HEC, TSCO, DNMR, UWMC

Top exits: TMUS, LBRDK, AGNC, GS, UE, SCHW, GLD, CWH, CROX

Boosted stakes in: FB, ATH, BABA, MIME, GOOGL, FAF, AXTA, SAIC, ANTM, WRK

Cut stakes in: CIT, DELL, HCA, APO, MCD, COF, ALLY, ABG, MA, SKX

LANSDOWNE

Top new buys: IEUR, BLBD, AER, CDE, PAAS, RBLX, SSO, USO

Top exits: C, UNP, NSC, PSX, IDA, AG, HTOO, EEM, GLD

Boosted stakes in: RYAAY, ETN, GE, CARR, ENIA, VXX, REGI, UVXY, EGO

Cut stakes in: OTIS, TSM, VMC, TMUS, AES, ED, BKNG, LUV, BLDP, DAR

LONG POND

Top new buys: INVH, GDS, FMX, EXPE, QTS, DIA, HLT, CONE, AIV, MLCO

Top exits: AIRC, GLPI, ESS, UDR, DEI, ABNB, LSI, MGP, EXP, RADI

Boosted stakes in: AMH, FR, SUI, CPT, WH, LVS, HGV, MSGS, ELS

Cut stakes in: EQR, AVB, PHM, JBGS, NNN, MAA, SRC, FPH

MAGNETAR FINANCIAL

Top new buys: PRAH, KSU, COHR, SJR, MGLN, PBCT, CCIV, CATM, CTB, FRTA

Top exits: CCX, NOVA, VIEW

Boosted stakes in: CHNG, FLIR, ATH, RTP, TCF, BDX, AZN, MDT, AJRD, AVTR

Cut stakes in: OPEN, BSX, ARVL, IPOF, LH, THBR, VGAC, FUSE, ATAC, FIII

MAVERICK CAPITAL

Top new buys: CPNG, TMUS, IFF, MELI, AJAX, TBA, SUM, DRNA, TSM, SPFR

Top exits: GME, GTLS, WYNN, IBP, CPB, CROX, JACK, VFC, CMLF, MKC

Boosted stakes in: LPLA, AMZN, AON, FIS, UBER, NFLX, XP, ELAN, LB, LVS

Cut stakes in: DD, FB, BABA, AXP, FLT, LRCX, MGM, AMAT, ADBE, NKE

MELVIN CAPITAL MANAGEMENT

Top new buys: SNOW, UBER, ADSK, SBUX, USFD, NTES, BILL, MU, SIG, SEAS

Top exits: FISV, AMD, ADBE, MELI, JD, MSFT, AZO, BABA, MSCI, SPGI

Boosted stakes in: LH, NFLX, AMZN, RACE, PAGS, FICO, CRWD, DECK, IAA, CBRL

Cut stakes in: FB, EXPE, BKNG, MA, COUP, NKE, LVS, PINS, LB, NOW

OAKTREE CAPITAL MANAGEMENT

Top new buys: CHK, SHLS, KRC, HIMS, FTAI, XOG, SRNE

Top exits: VALE, IBN, BBD, PBR, AU, AZUL, AFYA, TSM, AMX, LU

Boosted stakes in: STKL, EQR, IEA

Cut stakes in: ITUB, VST, CX, CRC, VEON, TV, NMIH, MTG, LBTYK, ALLY

OMEGA ADVISORS

Top new buys: BABA, IFF, NRG, PSFE, FOA, PNTM, JWSM, APSG

Top exits: AMCX, MNRL, BGS, NBR, AC, GBL

Boosted stakes in: ATH, ET, WSC, STKL, SMTS, C, VRT, FLMN, BBDC, ORCC

Cut stakes in: TRN, COOP, AMZN, OCN, SRGA, SNR, FCRD, ABR, MGY, NAVI

PERSHING SQUARE

Top new buys: DPZ

Top exits: SBUX

Boosted stakes in: HHC

Cut stakes in: CMG, QSR, A, HLT, LOW

SOROBAN CAPITAL

Top new buys: DPZ, INFO, V, MA, SPGI, WPF, NSTB, FUSE, FTOC, CAP

Top exits: YUM, MAR, FB, FISV, PSTH, HLT, ARMK, SONY, PLNT

Boosted stakes in: LOW, FIS, GWRE, AMZN

Cut stakes in: BABA, ADI, CMCSA, RTX, GOOGL, MSFT

SOROS FUND MANAGEMENT

Top new buys: BIDU, VIPS, TME, IFF, OPEN, DISCK, MU, ASHR, WAL, DISCA

Top exits: PLTR, EEM, SLQT, NLOK, DRI, PFSI, SE, XLNX, AGNC, FTAI

Boosted stakes in: AMZN, DHI, GOOGL, TXN, ADI, DEN, GM, IQ, VICI, ATVI

Cut stakes in: LBRDK, ALC, CLVT, HAIN, OTIS, UBER, MT, APTV, NOW, NKE

STARBOARD

Top new buys: ELAN, EHTH, MAAC, CCX, KVSC, PRPB, KVSA, TWCT, LNFA, DGNU

Top exits: AAP

Boosted stakes in: ACM, BOX, NLOK, IWM, SCOR, GDOT

Cut stakes in: ACIW, CERN, IWR, MMSI, CTVA, CVLT, ON

TEMASEK HOLDINGS

Top new buys: RBLX, XLF, INDA, GOVT, GRCL, PDD, AFRM, KRTX, PCVX, LMND

Top exits: AQUA, XLI, XLY, ABNB, SYK, MDT, ZBH, FTSI, BSX

Boosted stakes in: BGNE, KDP, MA, AMZN, VIR, V, EWY, IWM, SNOW, ADBE

Cut stakes in: DASH, BABA, VIRT, FTCH, EWZ, VNET, MSFT, DDOG, SE

THIRD POINT

Top new buys: CSGP, UBER, DD, DELL, SHOP, SU, CVNA, NYT, AES, SLV

Top exits: BABA, FIS, ADBE, CRM, PLNT, EXPE, SWK, NKE, PINS, PLTR

Boosted stakes in: PSFE, EL, UNH, MSFT, INTU, Z, SPGI, RH, LESL, APTV

Cut stakes in: IAA, AMZN, CHTR, DIS, PCG, JWS, RACE, ETRN, BKI, GOOGL

TIGER GLOBAL

Top new buys: RBLX, FUTU, CPNG, PLTK, OSCR, ONTF, DOCN, BMBL, XM, TBA

Top exits: GOTU, YALA

Boosted stakes in: DOCU, MSFT, DASH, SHOP, ZM, SE, ADBE, NOW, COUP, ONEM

Cut stakes in: UBER, SPOT, RUN, GDS, FB, STNE, DESP, INTU

TUDOR INVESTMENT

Top new buys: XLI, SMH, INFO, XLE, INTC, CLGX, DOCN, PRAH, WPC, FXI

Top exits: WLTW, EWZ, DD, PG, ZTS, VICI, IBM, LH, DELL, IRM

Boosted stakes in: SPY, NAV, ZM, XLNX, ALXN, LSPD, HIG, WMT, PANW, HQY

Cut stakes in: WORK, MXIM, ICLN, RSG, AAPL, MDLZ, EQIX, HEC, LOW, ELAN

VIKING GLOBAL INVESTORS

Top new buys: BAC, ORLY, COUP, NFLX, RUN, DE, AMP, XPEV, CRL, LAD

Top exits: DIS, AXP, TSM, HLT, BKNG, AMD, EHC, MU, AVB, APD

Boosted stakes in: GE, FB, TMO, LH, CB, FTV, BMY, UNH, PODD, PANW

Cut stakes in: JPM, MSFT, MELI, BSX, FIS, CI, NUAN, HIG, PH, VRSN

WHALE ROCK CAPITAL MANAGEMENT

Top new buys: GOOGL, W, AMAT, WDAY, ORCL, TWTR, ASML, MSFT, NCNO, CPNG

Top exits: SQ, NXPI, ZM, UBER, ZS, CRUS, EXPE, FTCH, NVDA, JD

Boosted stakes in: FB, BEKE, TRIP, AMZN, ZEN, TWLO, BILL, BILI, SMAR, SNOW

Cut stakes in: TSLA, CRWD, TSM, PTON, SE, PENN, CREE, FIVN, DIS, MDB

Source: Bloomberg

The links below take you straight to their top holdings and then click to see where they increased and decreased their holdings (see column headings).

Top multi-strategy and event driven hedge funds

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Peak6 Investments

6) Kingdon Capital Management

7) Millennium Management

8) Farallon Capital Management

9) HBK Investments

10) Highbridge Capital Management

11) Highland Capital Management

12) Hudson Bay Capital Management

13) Pentwater Capital Management

14) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

15) ExodusPoint Capital Management

16) Carlson Capital Management

17) Magnetar Capital

18) Whitebox Advisors

19) QVT Financial

20) Paloma Partners

21) Weiss Multi-Strategy Advisors

22) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Element Capital

12) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Numeric Investors now part of Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Investment Management (Paul Singer)

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) Broadfin Capital

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Sectoral Asset Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) RTW Investments

18) Bridger Capital Management

19) Boxer Capital

20) Bridgeway Capital Management

21) Cohen & Steers

22) Cardinal Capital Management

23) Munder Capital Management

24) Diamondhill Capital Management

25) Cortina Asset Management

26) Geneva Capital Management

27) Criterion Capital Management

28) Daruma Capital Management

29) 12 West Capital Management

30) RA Capital Management

31) Sarissa Capital Management

32) Rock Springs Capital Management

33) Senzar Asset Management

34) Southeastern Asset Management

35) Sphera Funds

36) Tang Capital Management

37) Thomson Horstmann & Bryant

38) Ecor1 Capital

39) Opaleye Management

40) NEA Management Company

41) Great Point Partners

42) Tekla Capital Management

43) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Pan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

Below, CNBC's "Halftime Report" team discusses their view on monetary policy, economy and investment strategy. They also discusses stock market volatility, particularly tech stocks.

Third, investor Michael Burry and his firm Scion Asset Management placed a sizeable bet against Elon Musk and Tesla Inc. that was revealed in the latest 13F regulatory filing. Bloomberg’s Dani Burger reports on "Bloomberg Surveillance: Early Edition."

Fourth, Cathie Wood, chief executive officer and chief investment officer at Ark Investment Management, says the correction in commodities prices is one sign that the U.S. economy is poised for a "massive" period of deflation. She speaks with Bloomberg's Carol Massar at The Bloomberg Businessweek event. Wood also said Bitcoin is "on sale" right now, although it is not necessarily at a bottom (agree with her deflation call, not so much on bitcoin).

Lastly, watch Stanley Druckenmiller, CEO of Duquesne Family Office, share his great insights in a couple of great clips. The first one is embedded below, the second one is his 2021 keynote speech on COVID’s macro consequences for the USC Marshall Center for Investment Studies which you can watch here. Take the time to watch both these clips.

'p"

Comments

Post a Comment