Fully Funded CAAT Pension Plan Gains 15.8% in 2021

CAAT Pension Plan released its 2021 Year in Review:

Canada’s workplaces are changing. We’re innovating to help them evolve.

Now more than ever, Canadians are looking for flexible workplaces that provide valuable, predictable, secure, lifetime retirement income from an organization they can trust.

Employers are adapting for the future and investing in employee wellness to win the race for talent.

At CAAT, we’re reimagining what’s possible to develop innovative, impactful solutions for employers and employees alike.

There’s a reason we’re one of Canada’s most sustainable and secure pension plans.

The CAAT Pension Plan offers innovative pension designs to meet the needs of employers, our members, and the evolving market. Canadians want and deserve secure, reliable retirement income paid for life. They are ready for the future, and so are we.

5 ways we are helping workplaces reimagine retirement security for employees:

- Providing the lifetime pension that Canadians want and need

- Staying strong in extraordinary times

- The flexibility and choice employers and employees need

- Living our purpose through joint governance

- Expanding pension coverage to help Canada thrive

I want to thank Vicki Lam, Senior Communications Officer, for sharing this information with me earlier today and also sharing the 2021 annual report which you can download at the bottom of the page here.

Please take the time to download CAAT Pension Plan's annual report, it's excellent and extremely well written.

Let me give you the overall highlights before delving into the report:

How good are those overall results? They're excellent, in line with the best results among larger peers in Canada.

Just to give you an idea, HOOPP gained 11.28% last year, achieved a funded status of 120% and registered a 10-year annualized rate of return of 11.06%.

Admittedly, these are two different plans with different asset allocations and liabilities (HOOPP is bigger and has more assets in private markets) but they share a couple of common themes:

- A relentless focus on measuring success through their funded status, making sure they have enough assets to cover long dated liabilities

- Both CAAT and HOOPP are ardent defenders of the defined benefit model and they both do extraordinary work in highlighting the need to improve workplace pensions in Canada and elsewhere (I would include OPTrust in there too).

Achieving a 124% funded status is truly remarkable given that at 125% or more, the Canada Revenue Agency will not allow you to accept contributions.

So, in terms of funded status, CAAT is really doing great and CAAT explains in detail its funding in the annual report:

The key point is this, when members look at their pension plan, they should immediately ask whether it's sustainable and whether there are enough assets to cover long dated liabilities.

That's what pensions are really all about, matching assets with (long dated) liabilities.

And here I will give credit to CAAT Pension Plan's CEO, Derek Dobson, who is always thinking about plan design and how to make CAAT Pension Plan stronger, more sustainable over the long run, all while making it flexible and attractive to workplaces looking to offer their employees a better retirement solution.

In his message to members in the annual report, Derek states this:

As one of the most sustainable and fastest growing pension plans in Canada, the CAAT Pension Plan remains committed to providing Canadians with a secure lifetime pension.

Strength, sustainability, and resilience are cornerstones of the Plan. We are happy to share that for the 11th straight year, the Plan’s funding health has improved.

The results of CAAT’s January 1, 2022 actuarial valuation place the Plan in a healthy funding position, yielding year-over-year increases across all vital metrics. The Plan is 124% funded on a going-concern basis – in other words, the Plan now has $1.24 set aside for every dollar promised in pensions. The Plan’s net assets have a market value of $18.2 billion and funding reserves totaling $4.4 billion. Building large funding reserves provides a buffer against unexpected economic or demographic shocks and aligns with the Plan’s focus on benefit security and stability.

The Plan has filed the January 1, 2022 valuation with the regulators, which means that conditional benefits are granted until 2025, including conditional inflation protection enhancements in retirement. Furthermore, we project that the Plan will remain strong and resilient well into the future.

Funding position improvements are due primarily to gains from 2021 investment performance. That is a testament to our dedicated team of experts, who remain focused on maintaining our status of being one of Canada’s most sustainable and well-funded pension plans.

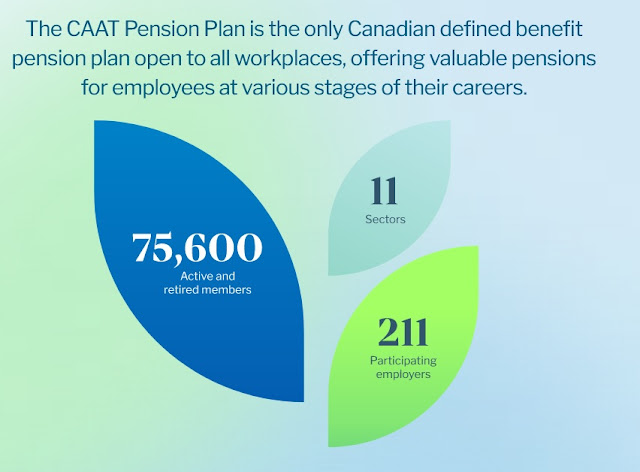

Last year, CAAT welcomed 100 new employers to DBplus and attracted interest from many others. We now have member participation across 11 industries and the support of 17 unions and associations, with many more exploring our valuable and unique solution.

More than ever before, employers and workers are realizing the superior value of a secure defined benefit pension plan. Members should feel proud that the Plan continues to offer valuable lifetime pensions to more Canadians, so that more workers can save and retire with confidence. As we grow and diversify across Canada, our pension plan will be even stronger.

Our focus on long-term growth and security means that members can count on our pension promise – that a lifetime pension will be ready when they are.

In his message, Derek rightly praises the exceptional investment returns which helped CAAT achieve strong funding position.

Here I will credit CAAT's former CIO, Julie Cays, and the current CIO, Asif Haque and his entire investment team for delivering outstanding results.

I had a conversation with Asif last March which you can review here. Last week, I enjoyed listening to him and Aaron Bennett, CIO of the University Pension Plan Ontario (UPP) at the CFA Society Toronto Annual Spring Pension Conference talking about the current market conditions and how they're navigating them.

That last session was fantastic and I am still waiting for links to replays but I remember Asif giving credit to his predecessor and also stating: "Julie's timing to retire was, as usual, excellent."

That made me laugh because so far, 2022 is a lot tougher than anything we experienced in over a decade, with stocks and bonds getting hit hard and the traditional 60/40 portfolio down this year, having its worst run since 2008.

Asif mentioned they are currently going through their triennial asset-liability modelling study and looking hard at how persistent inflation pressures will be and what that means in terms of their asset allocation going forward.

We did a similar exercise back in 2004 when we worked together at PSP Investments.

It's not easy to forecast the future, it's next to impossible and you don't want to get caught up in recent trends. I can honestly make the case for stagflation and debt deflation right now and if I were working at a large pension, I'd be sitting down with folks at Brdgewater, Rokos Capital, Brevan Howard, etc., bombarding them with macro questions.

As an aside, macro funds are doing great this year, it's the equity hedge funds that are finding it rough out there, especially those betting on tech stocks like Netflix:

That's when you know you're in a bear market, when macro funds are cleaning up and beta chasers are struggling (wait till this fall, that's when the fun begins!).

Alright, back to CAAT's investments and understanding why they're doing so well.

Two things stand out. First, they have a well diversified asset mix designed to weather all economic environments:

As shown above, CAAT invests in Real Assets (Infrastructure and Real Estate; 16%), Private Equity (19%), Global Diversified Equities (25%), Emerging Market Equity (10%) Commodities (5%), Nominal Long Bonds (15%), Nominal Universe Bonds (5%) and Real-Return Bonds (5%).In total, 20% of the portfolio is in interest rate sensitive assets, 26% in inflation sensitive and 54% in return enhancing assets.

This is a well diversified portfolio and when you look at returns by asset class, you see where returns came in last year, namely, Commodities (38%), Private Equity (42%), Global Developed Equities (24%) and Real Assets (15%):

Private Equity in particular had a stellar year, delivering 21% above its benchmark which isn't easy to beat. Last week, Asif did state that they are looking to diversify their strategies there from buyouts to more direct lending and other PE strategies. They also do a lot of co-investments to lower fee drag.Secondly, CAAT Pension Plan has formed great partnerships across public and private markets and leverages those partnerships properly.

This too is a critical element of success.

And again, CAAT, HOOPP and OPTrust measure success through their funded status but long-term investment returns matter and they're terrific:

Think about it this way, working at CAAT Pension Plan, you're working at a great place where diversity & inclusion are taken seriously and making a difference in the lives of old and new members looking to retire in dignity with a secure pension they can count on.

In February, I spoke to Derek Dobson on saving Canada's retirement system and he brings the same passion and commitment to this public policy issue as he does in running CAAT Pension Plan.

I look forward to seeing Derek and Asif when they hold a webinar going over 2021 results and more but for now, take the time to listen to his Contributors podcast on the power of pensions here.

Below, I share a small clip of that conversation. Take the time to listen to the full podcast here, it really is excellent and worth listening to.

Update: Vicki Lam, Senior Communications Officer at CAAT, shared this with me after reading my comment:

We are also inviting anyone who is interested in learning more about the Plan and our mission to expand retirement security in Canada. If you think that would be of interest to your readership, please feel free to include the registration link: https://www.caatpension.ca/2022-annual-webinar/registration-interested

I thank Vicki for sharing this with my readers.

Comments

Post a Comment