OMERS 2022 Virtual Annual Meeting

The full recording of the event below is available here.

I spent the afternoon listening to the OMERS virtual annual meeting after I watched two interesting sessions from the CFA Society Toronto’s 2022 Annual Pension Conference.

Alright, let me dive right into it.

Even though I watched the full two hours, my focus today will be on two presentations, one from Jonathan Simmons, OMERS' CFO and Chief Strategy Officer, and the other from Blake Hutcheson, OMERS' President and CEO.

Let me begin by wishing Blake a happy belated birthday (it was earlier this week) and a speedy recovery from Covid (he is fine but taped his message from home over the weekend and participated live on the Q&A with members).

Before I get to Jonathan's presentation, right after Chair of the Board George Cooke's presentation close to the beginning, there's a great presentation where members discuss what OMERS' pension means to them.

I've said this plenty of times, pensions are first and foremost about people. It's important to remember this because once you lose the focus and purpose, you lose the meaning of working at a pension.

The hardworking members of OMERS, many of whom are frontline workers, deserve to be treated with the utmost respect when it comes to how their pension plan is being managed.

On that last point, I can wholeheartedly assure OMERS members that their pension is solid and being managed in their best interests over the long run.

Jonathan Simmons' Presentation

Jonathan Simmons, OMERS CFO and Chief Strategy Officer, begins his discussion at around minute 11:25.

Jonathan is really sharp and articulate. He provides "the meat" in his presentation which is why I took snapshots to cover it properly (most of it).

OMERS had a very strong year last year, returning 15.7% net, well above its absolute return benchmark of 6.6%. That translates into $16.4 billion of net investment income, well above the $6.5 billion benchmark return.

So where did those returns come from? As shown in the next slide, all segments of the portfolio (public markets and private markets) generated above benchmark returns:

Next, Jonathan broke down the four factors that contributed to the Plan's outperformance vs. the benchmark:

I note that OMERS' Public Equity portfolio which is made up of high-quality global stocks did very well last year as value outperformed growth. Earnings growth and strong investor appetite explain the strong strong private equity returns and growing demand for logistics and warehousing explain the strong performance in real estate. Infrastructure remains a solid portfolio providing stable returns.Next, Jonathan notes: "The youngest member at OMERS is 16 and the oldest member is 106, so we measure success in decades."

As shown above, the 3 and 10-year return is 8% and 5-year is 7.5%, all above the absolute benchmark returns for those time frames.Next, Jonathan looks at expenses (MER) which went up last year from the previous year, mostly owing to strong performance from internal and external managers ("our investment performance really drives the performance rated compensation of internal and external managers":

Next, Jonathan looks at the diversification of the overall portfolio:

The next slide is one of the most important ones, showing the increase in the Plan's funded status over the last ten years and the decrease in the discount rate during that period:

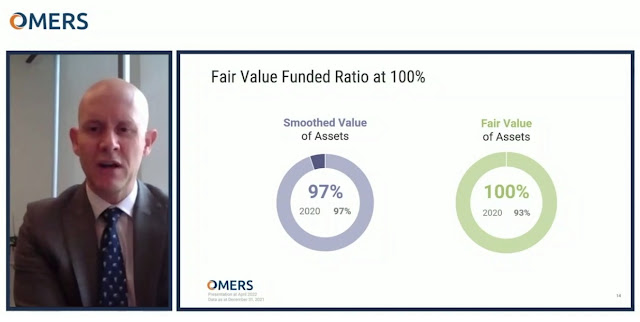

On a smoothed basis, the Plan is 97% funded, significantly higher than where it was 10 years ago. At the same time, the discount rate dropped from 4.25% to 3.75%, adding cushion to the Plan.

The last slide Jonathan showed is how OMERS is now paying more in benefits than it gets in contributions but those benefits have a positive impact on the wider economy in Ontario:

OMERS supports more than 118, 000 jobs and $11.9 billion in economic activity in Ontario

People with a pension plan are almost 50% more likely to report higher satisfaction with life than people who do not participate in one

90% of OMERS retired members attribute higher life satisfaction with being part of a defined benefit pension plan

- They have built a powerful and diverse team of 15 experienced senior executives that Blake would "put against the very best in the world" at what they do.

- The teams at OMERS and Oxford operate across ten global offices and work across 14 different time zones, contributing to OMERS' outstanding international reputation "and it is outstanding".

- Blake compared the $16.4 billion net investment income they generated last year to the Royal Bank's $16.1 billion profit last year which was a record. "Very different industry but it helps you understand the size and complexity of OMERS."

- Most importantly, 3 and 10-year returns are back at 8% and they are now 97% funded on a smoothed basis and 100% on a fair value basis.

- A few highlights, within Private Equity, their team completed $5 billion of transactions, generated income in excess of $3 billion. "This platform was created from scratch in 1995 with one employee and this was its best year yet."

- Blake also said the Ventures platform with $2 billion in capital experienced its best year ever and so did the Growth Equity platform.

- The Infrastructure team generated solid return of over 10% on a 5-year average, "once again demonstrating its stability and global strength."

- OMERS' real estate subsidiary, Oxford Properties, completed over 100 transactions representing $20 billion in buying and selling activity. "Oxford today is a true global powerhouse" and a recognized leader for its ESG practices.

- Lastly, the Capital Markets team with over 50% of assets posted one of its best years ever.

Reflecting on the results, Blake notes two important points:

- Every investment team across OMERS contributed in a major way to the solid 2021 performance. "It speaks to the strength of the diversification strategy we have had in place for several years."

- It's important to focus on the long-term and rotate assets into their private market platforms as opportunities arise, always focusing on high-quality assets.

Blake noted "it feels empowering to take OMERS to the next level of competitiveness from this position of strength."

Their teams are all committed, fiercely competitive but always remain humble and focused on the long term results.

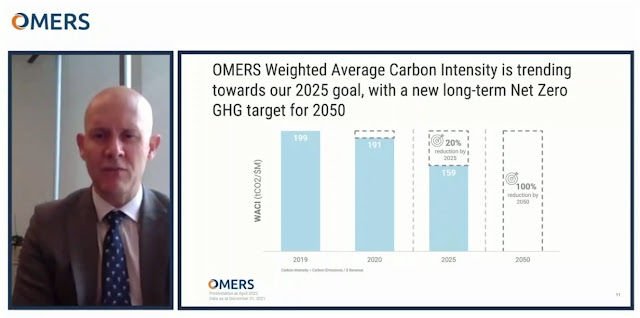

He also stated climate change remains one of the most pressing issues of our time and OMERS remains committed to lowering its carbon intensity by 2050, taking the necessary steps to analyze its carbon footprint across all its portfolios (watch Katharine Preston's presentation on sustainable investing after Blake's presentation around minute 58).

Lastly, around minute 49, he talks about the "how" on achieving long-term success, focusing on their "people, brand, culture and leadership."

Alright, let me wrap it up there, please take the time to watch Blake's presentation and all of the 2022 Virtual Annual Meeting which took place earlier this week here.

OMERS was named one of GTA's best employers and the reason is it has a great leader and great senior executive team, committed to strengthening the Plan over the long run.

Let me once again wish Blake a happy belated birthday and a speedy recovery so he can play Lacrosse in Hunstville with some OMERS members.

I wish I could embed the entire presentation below but OMERS only posts it online here, not on YouTube.

Below, John Ruffolo, founder and managing partner at Maverix Private Equity,

and former CEO of OMERS Ventures, joins BNN Bloomberg to discuss the

multi-million-dollar investment in Viral Nation and what he believes

lies ahead for economic growth. Great interview, take the time to watch it.

<

Comments

Post a Comment