OMERS CEO and CFO/ CSO on Their Mid-Year Investment Update

The Ontario Municipal Employees Retirement System, or OMERS, said it posted a loss of 0.4 per cent, or about $500-million, in the first six months of 2022 despite the turmoil in stock and bond markets.

Royal Bank of Canada’s RBC I&TS All Plan Universe saw defined benefit pension plan assets – as measured by a typical mix of publicly held stocks and bonds – shrink 14.7 per cent over that period.

Blake Hutcheson, OMERS chief executive, said in an interview that the pension has been moving away from public equities over time to buy more private assets. In rapidly rising markets, pension funds with significant private assets can trail the broader stock indexes. On the downside, however, the pension funds can outperform. “Our strategy has played into our hand in terms of preserving and protecting our portfolio,” Mr. Hutcheson said.

OMERS is the third of three major Canadian pension plans with Dec. 31 fiscal years to report half-year returns in 2022. On Monday, Ontario Teachers’ Pension Plan reported a 1.2-per-cent return for the six months ended June 30. Wednesday, Caisse de dépôt et placement du Québec posted a 7.9-per-cent loss.

OMERS, like the other members of the “Maple Eight” large Canadian pension plans, owns more than stocks and bonds; it has moved into infrastructure, real estate and other private assets.

The funds’ varying returns for the first half of 2022 were driven by differences in their portfolios.

The Caisse had 75 per cent of its assets in equities and fixed income at June 30. By contrast, OMERS had about half of its portfolio in public equities, bonds and credit investments at June 30. Teachers had a little less than half of its assets in equities and fixed income, with roughly 20 per cent of its portfolio in what it calls “inflation sensitive” assets, designed to perform better in inflationary environments.

Jonathan Simmons, OMERS chief financial and strategy officer, said the allocation to private investments, coupled with decisions to favour quality over growth stocks, and short-term credit over long-term bonds, protected OMERS “from the worst six-month period of market losses incurred by investors in more than 50 years.”

OMERS said its public equities – stocks traded on exchanges – lost 13.2 per cent, but the private-equity division returned 7.7 per cent. Together, the two make up about 40 per cent of the OMERS portfolio as of June 30.

Mr. Simmons said in an interview that OMERS is seeing about 10-per-cent year-over-year growth in earnings at the companies in its private-equity portfolio, even before they’ve added to profits by acquiring new businesses.

Infrastructure returned 4.8 per cent, while real estate returned 9.9 per cent. Those two asset classes make up about one-third of the portfolio.

Mr. Hutcheson said in the interview that OMERS’ real-estate arm, Oxford Properties, has been moving away from retail real estate, taking it down to about 10 per cent of the portfolio, and has shifted toward buying industrial, life sciences and multifamily residential properties.

Bonds and credit investments – together, about a quarter of OMERS’s assets – lost 2.5 per cent and 1.8 per cent, respectively.

OMERS reported $119.5-billion in assets at June 30. The 10-year, annualized return through June 30 was 7.5 per cent.

OMERS has more than half a million members, municipal employees from communities across Ontario.

Layan Odeh of Bloomberg News also reports OMERS posts 0.4% loss as equity markets sap PE gains:

The Ontario Municipal Employees Retirement System posted a 0.4% loss for the first six months of 2022 as a decline in public stocks exceeded the pension fund’s private equity gains.

“The geopolitical environment was incredibly, not only unpredictable, but tragic in so many ways,” Omers Chief Executive Officer Blake Hutcheson said in an interview Thursday. “We have inflation that’s today higher than it’s been in 40 years. Central banks are raising rates quicker than they have since any time since 1994.”

The fund’s public stock holdings dropped 13.2% and the bond portfolio slid 2.5%, it said in a statement, while private equity investments gained 7.7%.

Omers is a net-seller so far this year as the firm realized investments in private equity, infrastructure and real estate — including selling its interests in GNL Quintero SA, a liquid natural gas terminal in Chile, and in Sony Center in Berlin. The Toronto-based pension plan has also agreed to sell its interest in the holding company that controls Michigan-based Midland Cogeneration Venture.

“Over the last year, we were actually expecting some downturns and making sure we were armed for the next wave of investment opportunities,” Hutcheson said.

Fear of a recession has weighed on deal-making and initial public offerings, crunching valuations and restricting the ability of private equity firms to exit investments. Omers has a strong war chest available to purchase high quality assets, according to Hutcheson. “We will be able to continue to buy in this cycle but very selectively — very high quality assets, very much on target with strategy.”

The pension fund’s net assets decreased to C$119.5 billion ($92.3 billion).

Montreal-based Caisse de Depot et Placement du Quebec reported a 7.9% loss in the first six months of the year, while Canada Pension Plan Investment Board, the country’s largest pension fund, posted a negative 4.2% return in its fiscal first quarter. Ontario Teachers’ Pension Plan said this week it had a 1.2% net return in the first six months of the year.

OMERS released its mid-year investment update here and it is available in English and French. Just click on the PDF files to read them.

Below, is the release on its website going over the mid-year investment update:

OMERS generated a net investment return of -0.4%, or a loss of $0.5 billion, during the six-month period from January 1 to June 30, 2022. Over the twelve months ended June 30, 2022, the Plan earned a net investment return of 6.0%, or a gain of $6.7 billion, after reporting a net investment return of 15.7% or $16.4 billion for the 2021 calendar year. Net assets as at June 30, 2022 were $119.5 billion.

“As everyone has witnessed, the first half of the year was extraordinarily difficult for investors in an environment characterized by ongoing geopolitical challenges, supply chain issues, recessionary threats, and soaring increases to both inflation and interest rates - more rapid than we have seen in decades. These influences combined to create acute stress in the global economic environment, pushing the returns for leading global investment market indices to decline well into the double digits,” said Blake Hutcheson, OMERS President and CEO. “Against this backdrop, our investment teams and strategy have been extremely effective in protecting the value of our members’ portfolio, by any objective measure.”

“Our significant allocations to private investments, the strategic decisions to favour quality over growth stocks, and short-term credit over long-term bonds, protected OMERS from the worst six month period of market losses incurred by investors in more than 50 years,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “Infrastructure, real estate, and private equity all generated positive investment returns that largely offset the negative performance of public equities and credit investments.”

“OMERS is a long-term investor and over the last 10 years our active investment and asset management strategies have produced $62 billion in value for our members and a 7.5% annualized return. As we look to the future, we remain well-positioned with a portfolio of high-quality investments and ample liquidity to pursue the right growth opportunities for our Plan,” said Mr. Hutcheson. “Across OMERS, our entire team is proud to work in service of over half a million hard-working OMERS members. We remain relentlessly focused on delivering to them a sustainable, affordable and meaningful plan for the generations to come.”

OMERS remains highly rated by four credit rating agencies, including two ‘AAA’ ratings.

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over half a million active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in public markets, private equity, infrastructure and real estate.

Net Assets $ Billions

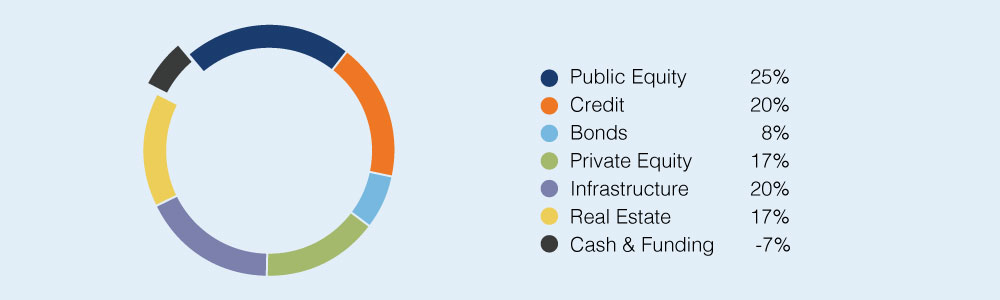

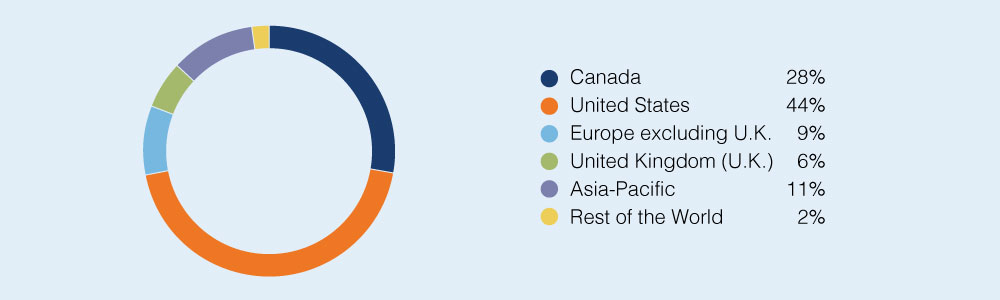

Diversified by Asset Class and Geography

OMERS invests in high-quality assets that are well-diversified by geography and asset type.

Asset Diversification

As at June 30, 2022

On March 1, 2022, OMERS updated asset class definitions in connection with our updated Statement of Investment Policies & Procedures; the asset mix above reflects these updated definitions.Geographic Diversification

As at June 30, 2022

Asset Class Investment Performance

Investment Performance highlights

Over the first six months, ended June 30, 2022:

Our bond and credit portfolios generated narrow losses despite a sharp rise in bond yields and credit spreads. The short-term duration of our portfolio sheltered it from more significant declines following the rise in rates.

Our public equities portfolio was heavily impacted by the widespread and significant drawdowns in global stock markets. Our strategic focus on high-quality investments; exposure to Canadian equities; and lower exposure to growth stocks, including consumer discretionary and information technology; all helped to dampen the impact of market losses.

Our private equity return was driven by strong operational performance as businesses in our portfolio grew their earnings organically and through acquisitions.

Our infrastructure investments continued their long track record of steady performance with stable operating income, and higher valuations from accretive refinancing and transaction activity.

Our real estate assets outperformed expectations, as a result of higher valuations and development profits from our North American industrial portfolio, and operating income.

Our portfolio’s investment returns have also broadly benefited from locking in fixed-rate, fixed-term financing in prior years, when borrowing rates were lower than in the current environment.

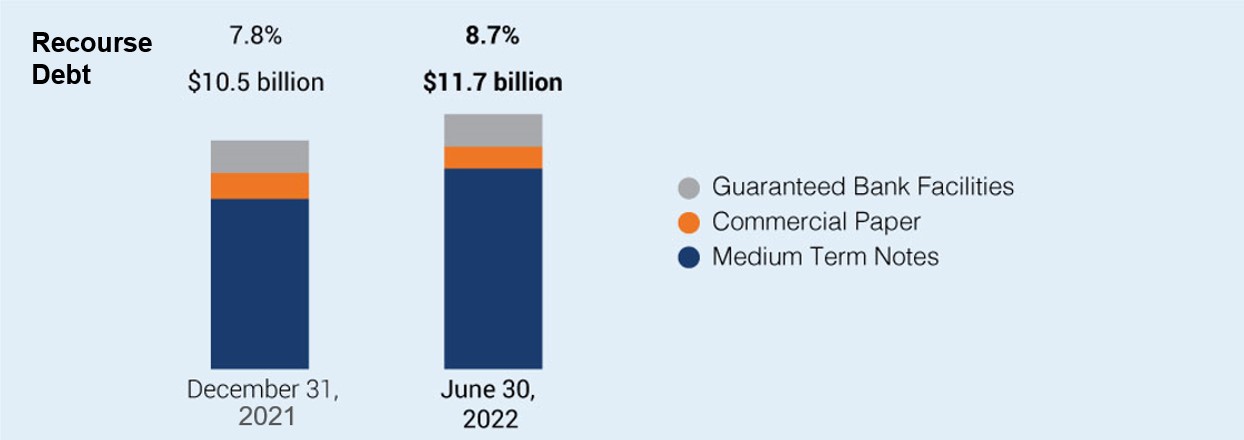

Recourse Debt

We continue to use debt prudently to enhance our investment returns. At June 30, 2022, we had $11.7 billion of recourse debt outstanding, equating to a recourse debt ratio of 8.7% of net assets, up from 7.8% at December 31, 2021. This change was driven by the issuance of our first sustainable bonds, for 10- and 30-year terms, totaling US$1.1 billion.

In addition to this low leverage, we continue to maintain ample liquidity. At June 30, 2022, OMERS had $25.4 billion of liquid assets to pay pension benefits, to fund investment opportunities, to satisfy potential collateral demands related to our use of derivatives, and to fund expenses.

Long-Term Issuer Credit Ratings

This Investment Update presents certain non-GAAP measures. These measures are calculated on the same basis as those calculated and presented in our 2021 Annual Report. This Investment Update and the Condensed Interim Consolidated Financial Statements (the “Interim Financial Statements”) are unaudited. OMERS Administration Corporation’s financial performance set out in this Investment Update is only for the period ended June 30, 2022. Past performance may not indicate future performance because a broad range of uncertainties (including without limitation the future course of the global pandemic) could have an impact on the performance of various asset classes. The financial information included in this Investment Update should be read in conjunction with the Interim Financial Statements.

Transaction Overview

INVESTING FOR TOMORROW

To create value for our members over the long term, OMERS remains focused on strengthening our portfolio and deploying capital towards our target asset mix. We remain disciplined as we invest in diverse, high-quality assets that meet the Plan’s risk and return requirements.HEALTHCARE AND LIFE SCIENCES

We believe that investments centred around life sciences and health care make a meaningful difference today, as they support and advance innovative solutions for tomorrow’s medical needs. In this space, we:

- Announced a series of life sciences opportunities, including: a partnership with Novaxia to invest in and develop life sciences properties in France; our selection as the preferred development partner of Snowsfields Quarter in central London, UK, a life sciences hub with world-class lab facilities in a prime health innovation cluster; a strategic partnership for the Navy Yard in Philadelphia (US) which will, over time, own and develop up to 3 million square feet of life science properties; and the acquisition of a nine-asset, 13-building life sciences portfolio in San Diego’s Sorrento Mesa and Sorrento Valley (US).

- Took a minority stake in US-based Medical Knowledge Group, a leading commercialization services platform serving pharmaceutical and biotechnology companies.

- Announced a funding round to help Aledade continue scaling its practice management solutions, serving more than 11,000 physicians in 36 US states and the District of Columbia.

- Invested in Birdie, a UK-based home healthcare technology that aims to reinvent care at home and radically improve the lives of millions of older adults.

In the weeks since June 30, 2022, we:

- Announced an investment in Ultragenyx Pharmaceutical Inc., which will earn royalties from the future sales of Crysvita®, a drug that is improving the lives of pediatric and adult patients with two rare diseases.

- Completed the conversion of the Boren Labs office building to a fully dedicated life sciences facility in downtown Seattle, Washington (US).

- Announced our investment in Caraway, a hybrid 24-hour healthcare platform focused on women’s health.

LOGISTICS AND TRANSPORTATION

We expect the global growth of e-commerce and demand for expedited supply chains to result in strong long-term demand for logistics and transportation assets. In the first half of 2022, we:

- Partnered to acquire Direct ChassisLink, Inc., one of the largest chassis lessors in the US, with over 151,000 marine and 100,000 domestic chassis in its fleet.

- Announced that existing portfolio investment IndInfravit, which owns a series of toll highways in India, would add additional roads across four states in the country.

- Grew our investment in global logistics, including the purchase of a portfolio of seven high quality UK logistics assets.

SUSTAINABLE INVESTING AND RENEWABLES

We have made several investments in assets that address key sustainability issues and which reflect the growing investor confidence in renewables, while supporting our commitment to achieve our goal of net-zero greenhouse gas emissions by 2050. In the first six months of 2022, these include:

- A partnership to purchase Groendus, a Dutch energy transition firm active in rooftop solar, metering and energy services.

- Joining other institutional investors in funding Group14 Technologies, an innovative electric battery materials manufacturer.

- Leading a funding round for 99 Counties, a US-based platform that supports regenerative farming that brings sustainable products to market and offers healthy, nutrient-dense foods to consumers.

In the weeks since June 30, 2022, we:

- Announced a minority investment in NovaSource Power Services, the world’s largest independent solar operations and maintenance provider for utility-scale, commercial, industrial, and residential solar assets.

TECH-FORWARD INNOVATION

We are investing in businesses doing interesting work to innovate, harnessing the power of technology to do so. From January to June of this year, we:

- Partnered to provide a term loan to AGP, a highly specialized glass manufacturer with advanced technology for autonomous vehicles and producer of specialty automotive glazing components, to support its global expansion plans.

- Made a convertible preferred investment in Precisely, a data management firm, providing accuracy, consistency, and context in data for customers in more than 100 countries.

- Made a minority investment in US-based real-time analytics company Imply.

- Led the funding rounds in exciting businesses including Moves, an all-in-one banking app for gig workers; and Next Matter, an automation platform that centralizes and automates operational processes.

In the weeks since June 30, 2022, we:

- Acquired Bionic a UK-based tech-enabled platform that matches SME business owners with energy, insurance, connectivity, telecoms and commercial finance solutions.

COMMUNICATIONS INFRASTRUCTURE AND BUSINESS SERVICES

We invest in companies that deliver services and support to communities, individuals and businesses, providing communications infrastructure that keeps people connected, and helping to ensure that utilities and related services are available when needed.

- In the first months of 2022, we announced agreements to purchase TPG Telecom's mobile towers and rooftop portfolio, located across Australia; and Stilmark, an independent developer, owner and operator of Australian mobile tower assets.

In the weeks since June 30, 2022, we:

- Acquired Network Plus, a leading utility and infrastructure repair and maintenance service provider in the UK, that maintains and delivers essential services – including water, electricity, gas and telecoms – to homes, businesses, and industry; and announced the acquisition of Pueblo Mechanical & Controls, a leading mechanical services company providing HVAC and plumbing installation, retrofit and repair services to commercial clients, based in Arizona (US).

DEPLOYING INTO PRIVATE CREDIT

For a number of years, we have been steadily building out our private credit investing expertise, platform and relationships. During the first six months of 2022, we deployed strategically into these private credit assets, pleased to see that the risk-adjusted returns on high-quality, short-term loans have made this space even more compelling.REALIZATIONS

We rotate capital out of assets with the same level of discipline with which we invest. At the half year mark, our total realizations exceed our acquisitions so far in the year. This activity generated capital, which we plan to deploy into future investment opportunities.

During the first six months of 2022 we agreed to sell interests in several investments, including:

- Straight Crossing Development Inc., which operates the Confederation Bridge, a Canadian landmark connecting the provinces of New Brunswick and Prince Edward Island;

- GNL Quintero S.A., a liquid natural gas terminal in Chile;

- Forefront Dermatology, a consolidated dermatology clinic business;

- A 50% interest in the Sony Centre, an office-led mixed-use landmark property in Berlin; and

- Royal Bank Plaza in Toronto’s financial district and St. John’s Terminal in Manhattan; each representing one of the largest office transactions of the year in their respective markets.

In the weeks since June 30, 2022:

- We announced an agreement to sell the Plan’s interest in the holding company that controls the Michigan-based Midland Cogeneration Venture (MCV), a gas-fired cogeneration facility.

Let me begin by stating OMERS's performance in the first half of the year is exceptional, remaining relatively flat when most Canadian pension plans lost 15% during that time.

The entire leadership team and all employees should be very proud of these results.

Moreover, when you look at the transactions that took place, they've been very active buying and selling assets in private markets, and this is only during the first half of the year.

Real Estate (9.9%), Private Equity (7.7%) and Infrastructure (4.8%) led the gains while in public markets, Public Equity (-13.2%), Bonds (-2.5) and Credit (-1.2%) registered losses but these losses were actually not that bad at all on a relative basis given their positioning.

Overall, OMERS now has a total of 54% in private markets, split between Real Estate and Private Equity (17% each) and Infrastructure (20%) which is in expansion mode.

The large weighting in private markets along with the diversification and active management strategy across private and public markets helps explain the relatively strong performance.

Discussion With Blake Hutcheson and Jonathan Simmons

I had a chance to briefly chat with OMERS' CEO Blake Hutcheson and their CFO/ CSO Jonathan Simmons yesterday to go over these results.

Let me begin by thanking them both as well as Ann DeRabbie, Vice President Corporate Communications and Neil Hrab, Manager of Media Relations, for sending me information and some follow up material.

Blake began by telling me as long-term investors they are not celebrating these mid-year results but are obviously pleased that things are going well.

He then set the backdrop and got into some details:

Inflation is at the highest level in 40 years, mortgage rates are back to 2008 levels, rate hikes the highest since 1994, the S&P had its worst six months since 1970 and the NASDAQ worst ever and there’s geopolitical concern. In too many countries in the world, there is a lot of uncertainty and it's not easy.

In that context, we put a strategy in place that doesn’t capture lightning in a bottle when the equity markets rally, but we jealously protect and defend our pension dollars when they have this sort of uncertainty, so the design of our strategy has worked during a very difficult period.

As we look forward, because we have a high percentage of our book in real estate, infrastructure and private equity, they all fared well for six months. They are all on target for a positive last half of the year.

We have not been heavy investors in long-dated bonds, leery that rates would go up and that it would have a substantial impact, so we have been more focused on private credits which proved prescient from a credit standpoint

The volatility was largely in respect to our public equity portfolio – approximately 25% of the portfolio - and we were not immune to the difficulty out there that everyone experienced.

Our tilt towards value assets, high quality securities and equities, highly diversified globally served us very well versus being highly exposed to technology, which didn’t work for us in 2020, but it has proven to be the right strategy when you reflect on the nearly 16% (overall) return last year.

I asked Blake how they managed to post a 7.7% return in Private Equity during the first six months of the year when their large peers registered marginal losses:

We have approximately 25 businesses we invested in and they (peers) may have a different set. We track our earnings, we track our roll-ups in our businesses, we value them every quarter and vast majority of our businesses are doing really well in the post-COVID environment.

And we aren’t fund investors like many in the private equity space, we are direct drive investors, we have a real line of sight to real operating companies as opposed to a proxy for the industry.

These are real companies that we own or control, with value-add strategies that we have been consistently moving up the EBITDA through roll-ups and acquisitions. Our line of sight is very direct and very real time and that helps explain buoyancy during these times. It's not a proxy for the industry, it’s one by one, enterprises we understand, valued at every quarter.

He told me they are "very comfortable" with their valuations in the PE portfolio. I must say, OMERS Private Equity is doing very well again this year, so kudos to Michael Graham, Jonathan Mussellwhite and the rest of the senior team and employees there.

In the first article above, Jonathan Simmons, OMERS' CFO and CSO, stated they are seeing about 10% year-over-year growth in earnings at the companies in their PE portfolio, even before they’ve added to profits by acquiring new businesses (organic growth).

He also explained their credit returns to me:

Our credit book is an area where we see some opportunity. Spreads and curves are more attractive than they have been in a very long time. Investment grade credit, bank preferred shares and private credit deals are all attractive. There has been a significant change in the opportunity set compared to six months ago.

Blake added in private credit if you can get high single digit, low double-digit returns, then that's excellent and in the credit space, they are seeing real opportunities there. "There's mark to market that dumbs down returns on a quarterly basis but they are cash-paying, significant yielding instruments that we are very focused on."

I asked them why they don't publish their benchmarks in their mid-year results, and Jonathan said this:

We follow an absolute return benchmark strategy. Many of our peers are relative return. Benchmarks are approved by the Board at the beginning of the year and we don’t get into it in our mid-year reports.

Blake added:

It's an annual benchmark based on our operating plans and liability streams and where we have to be. To take an example, there is no real estate proxy that can capture what Oxford Properties is, its global reach, multiple assets, $70 billion of AUM, so we give them an absolute return benchmark to chase based on that book, that portfolio and our liabilities and it's an annual number.He added:

We know what our liabilities are, we know where we are headed, have a management team with their hands on the wheel, strategies in place and going to continue to drive forward with optimism.

Lastly, I asked them if there are things they are concerned about and Blake said:

The one wildcard is our public equity portfolio. We watch that, there is risk given the volatility we experienced during the first six months. A small percentage of our book has some risk in our technology investments but there is not enough data to know where values come home. It's some venture growth, public and private technology investments. Those are areas we are watching.I thank Blake and Jonathan for taking the time to talk to me and also thank Ann DeRabbie for following up with me.

It has been a very busy week covering mid-year results so in closing, I'd like to just state that the performance at all these large pensions proves to me that diversification into private markets and across geographies, sectors and assets is the winning strategy. Also, there's no doubt active management works but you need to hire the right talent to deliver these results over the long run.

OMERS is delivering the results, they are actively buying and selling assets, locking in gains, being very selective when buying and preserving and protecting the pensions of their members.

Whether it's Oxford Properties, OMERS Infrastructure, OMERS Private Equity or even their public market portfolios, they are delivering on all fronts during a very difficult and volatile period.

That proves their strategy of diversifying more assets into private markets and having more direct ownership of these assets is working, especially in turbulent times.

Once again, take the time to read the press release on OMERS 2022 mid-year investment update here and download the PDF files in English and French here.

I told Blake and Jonathan that their over half a million active, deferred and retired members should be very pleased with these results and more importantly, with the strategy in place to ensure their pensions are safeguarded during volatile times.

Below, listen to Blake Hutcheson’s conversation with Goldy Hyder which occurred at the beginning of the year. He said it best: “If you focus on your people, if you focus on your culture, if you focus on your brand and if you are forward-looking, results come.”

Take the time to listen to this interview, he shares a lot of great advice and wisdom for all leaders.

Comments

Post a Comment