HOOPP Loses 8.6% in 2022, Remains Fully Funded

The Healthcare of Ontario Pension Plan, long a top performer among Canada’s big pension plans, swung to a loss in 2022, its first in 14 years.

HOOPP said Friday it posted a loss of 8.60 per cent on its investment portfolio, cutting its assets to $103.7-billion at year end.

The plan, which serves 435,000 active and retired Ontario health care workers at more than 630 employers, dipped to its lowest level of funding since 2014 – but that funding ratio, which compares its assets with the future benefits it owes members, still stood at 117 per cent, down from 120 per cent at the end of 2021.

In an interview, chief investment officer Michael Wissell said the annual loss, HOOPP’s first since the financial crisis in 2008, was “disappointing” – but unsurprising for a pension plan with its asset mix.

“We have, broadly, a more decent allocation to public stocks and bonds. And when you look at 2022, the area that did the most poorly was public stocks and bonds. So in the near term, that’s given us our first negative return since 2008.”

HOOPP targets having about 40 per cent of its portfolio in bonds and about 25 per cent in public equities, according to its investment policies. It closed 2022 with about 54 per cent in bonds and 13 per cent in public equities.

Its fixed-income, or bond, portfolio lost 17.80 per cent in 2022, and its public equities lost 12.49 per cent.

In contrast, its credit portfolio – specialized lending to businesses – gained 0.95 per cent. Real estate gained 4.01 per cent, and infrastructure returned 9.43 per cent.

Private equity gained 11.04 per cent, buoyed by a number of profitable exits in HOOPP holdings, particularly Edmonton-based Champion Petfoods LP, which HOOPP and its co-owners sold to Mars Petcare US Inc. last year for an undisclosed price.

Mr. Wissell said that despite the overall loss, HOOPP beat its benchmark – what a similar portfolio should have been expected to return – by 4.61 percentage points. And each investment department outperformed its benchmark, “across the board,” he said.

HOOPP’s 10-year annualized return as of the end of 2022 was 8.35 per cent.

“What we say here is, we’re in the pension delivery business. We’re not in the money-management business, so against that backdrop, we’re pleased that we remain fully funded,” Mr. Wissell said.

Compared with its larger Canadian peers, HOOPP has been late to move into private asset classes such as infrastructure, real estate and private equity. HOOPP targets just about 20 per cent of its portfolio to those categories, and closed 2022 with 23 per cent. That asset mix contributed to its lagging performance versus the other members of the “Maple Eight” big Canadian plans with a calendar-year fiscal period.

The Ontario Municipal Employees Retirement System, with $124-billion in assets, reported a gain of 4.2 per cent. Ontario Teachers’ Pension Plan, with $247-billion in assets, reported a 4-per-cent return for 2022. Caisse de dépôt et placement du Québec, with $402-billion in assets, posted a 5.6-per-cent loss. Alberta Investment Management Corp. is expected to release results later this spring.

On average, Canadian defined benefit pension plans performed much worse, with an average annual loss of 10.3 per cent, as measured by a typical mix of publicly held stocks and bonds tracked by Royal Bank of Canada’s RBC I&TS All Plan Universe.

“We have been steadily, here at HOOPP, growing our private assets,” Mr. Wissell said. “We have this very tenacious focus on liquidity, but that doesn’t mean that we don’t have some capacity to own private assets. We only recently got going in the infrastructure area, and it continues to grow.”

Benefits Canada also reports HOOPP returns -8.6% for 2022, citing declines in equities, fixed income:

The Healthcare of Ontario Pension Plan is reporting an annual return of negative 8.6 per cent for 2022, citing declines in equities and fixed income markets.

The HOOPP finished the year with net assets of $103.7 billion and, despite the economic challenges, maintained a funded status of 117 per cent. Its fixed income portfolio generated a 17.8 per cent loss, while equities were down 12.49 per cent for the year.

By contrast, the pension fund reported positive returns in private equity (11.4 per cent), infrastructure (9.43 per cent), real estate (4.01 per cent) and credit (0.95 per cent).

The HOOPP’s liability-driven investing strategy helped weather the volatile economic market, according to Michael Wissell, its chief investment officer. “HOOPP remains committed to LDI and, as always, we take a dynamic approach, evolving our strategies to respond to changing markets,” he said in a press release.

“We reduced our bond holdings prior to last year’s rising interest rates, which helped mitigate the impact. Further, we continue to balance our portfolio with more capital in private equity, infrastructure and real estate. But the core approach of matching assets to liabilities, with a heavy weighting in fixed income, remains key to our investment strategy.”

Last Friday, HOOPP issued a press release stating it maintains a strong funded status in challenging year: Improves benefits and keeps contribution levels unchanged:

TORONTO, March 17, 2023 (GLOBE NEWSWIRE) -- Despite a very challenging year for the markets, HOOPP maintained a strong funded status of 117%. Funded status is one of the most important indicators of the health of the Plan and its ability to pay pensions to members today and in the future.

2022 was an extremely challenging year for many investors, with some of the worst declines on record in both public equities and fixed-income markets (e.g., the US S&P 500 was down over 18%). It’s very rare for these markets to move in the same direction at the same time, to such a significant degree. In addition, 2022 was marked by the highest inflation rate in 40 years and rising interest rates.

HOOPP was not immune to this challenging combination of factors, posting an annual return of -8.60% and closing out the year with net assets of $103.7 billion. HOOPP’s investment team mitigated the impacts of the challenging market, surpassing the benchmark by 4.61% and generating a value add of over $5 billion.

“While we never want to see negative returns, our focus is always on paying pensions now and over the long term,” said President and CEO Jeff Wendling. “As a pension delivery organization, we invest and plan in terms of decades, not single years. Our focus is on maintaining a healthy funded status and being able to pay pensions; we remain in an excellent position on that front.”

HOOPP has a long history of investment success and significant asset growth. In 2001, net assets were $17 billion. By 2011, they had grown to $40 billion, and they surpassed $100 billion in 2020. This amounts to an increase of more than $83 billion in less than 20 years. HOOPP’s 10-year annualized return as of Dec. 31, 2022 is 8.35%.

The continued strength and health of the Plan allowed HOOPP to deliver a benefit improvement to active members in 2022, the third benefit improvement in five years. HOOPP also provided a cost-of-living adjustment (COLA) to retired and deferred members at 100% the rate of increase of CPI, which we have done every year since 2014. Contribution rates remained stable for the 19th year in a row.

Other highlights from the year include:

- We welcomed 28 new employers to the Plan, including many small healthcare providers.

- HOOPP was selected by Mediacorp Canada Inc. as one of Greater Toronto’s Top Employers for the third year in a row.

HOOPP’s long-term investment success is due, in large part, to Liability Driven Investing (LDI), a strategy for which HOOPP is known as a leader in the global pension landscape. This approach, which aligns the Plan’s assets with its pension liabilities, has enabled HOOPP to consistently maintain a strong funded status. Funded status as of Dec. 31, 2022 is 117%, which means that for every dollar HOOPP owes in pensions, it has $1.17 in assets.

Despite the long-term success of LDI, there will be years when this approach produces a short-term negative return, as it did in 2022. The combination of factors that made the year unusual was particularly impactful on HOOPP’s portfolio, being weighted heavily in fixed income and public equities.

HOOPP Chief Investment Officer Michael Wissell said: “HOOPP remains committed to LDI and, as always, we take a dynamic approach, evolving our strategies to respond to changing markets. We reduced our bond holdings prior to last year’s rising interest rates, which helped mitigate the impact. Further, we continue to balance our portfolio with more capital in private equity, infrastructure and real estate. But the core approach of matching assets to liabilities, with a heavy weighting in fixed income, remains key to our investment strategy.”

He added: “In addition to our healthy funded status, we maintain a strong liquidity position.”

Performance by asset class 2022 % Return Fixed Income -17.80% Equities -12.49% Credit 0.95% Private Equity 11.04% Real Estate 4.01% Infrastructure 9.43% About the Healthcare of Ontario Pension Plan

HOOPP serves Ontario’s hospital and community-based healthcare sector, with more than 630 participating employers. Its membership includes nurses, medical technicians, food services staff, housekeeping staff, and many others who provide valued healthcare services. In total, HOOPP has more than 435,000 active, deferred and retired members.

HOOPP operates as a private independent trust, and is governed by a Board of Trustees with a sole fiduciary duty to deliver on the pension promise. The Board is jointly governed by the Ontario Hospital Association (OHA) and four unions: the Ontario Nurses’ Association (ONA), the Canadian Union of Public Employees (CUPE), the Ontario Public Service Employees' Union (OPSEU), and the Service Employees International Union (SEIU). This governance model provides representation from both management and workers in support of the long-term interests of the Plan.

There are more highlights on 2022's results HOOPP's website here including a message from Jeff Wendling, its President and CEO:

The ongoing effects of the COVID pandemic, rising prices and higher interest rates, continue to have a significant impact on our daily lives. For investors, 2022 was especially turbulent, with soaring inflation and historic declines in both public equity and fixed-income markets.

HOOPP was impacted by these market challenges, and posted a negative investment return for the year. While we don’t like to see this kind of result, it does not affect your pension. That’s because your pension is based on a formula, not annual investment returns.

As a pension provider, we stay focused on our mission to pay pensions over the long term. And we remain in an excellent position to do that. Despite the challenging markets and economic environment over the last few years, we’ve kept the Plan strong with a funded status of 117% as at Dec. 31, 2022. In other words, the Plan has $1.17 for every $1 that is owed in pensions. This is one of the most important indicators of the Plan’s overall health and ability to pay pensions, today and in the future.

The Plan’s continued strength was a key factor in giving our Board the flexibility to approve benefit improvements effective Jan. 1, 2023, which helps increase retirement security for active members. Read on to learn more about this and other progress we made to further strengthen the Plan. I hope this information gives you peace of mind that your pension is secure.

On behalf of HOOPP, I want to thank you for everything you continue to do for our communities. We are proud to serve you.

Regards,

Jeff Wendling

President & Chief Executive Officer

Alright, let me get right to covering HOOPP's 2022 results.

I actually didn't see them till today and wasn't even aware they were published on Friday.

I did reach out to HOOPP's CIO Michael Wissell and was able to have a brief chat with him.

Before I get to this discussion, a couple of more things on the Plan's performance last year:

In 2022, we faced a unique environment with historic declines in fixed-income and public equity markets. This had a significant impact on our portfolios, particularly our bond holdings, and led to our first negative annual return since 2008.

While it was a challenging year, our Liability Driven Investing (LDI) approach has served our members very well for many years and we believe it will continue to do so. Our LDI approach is a long-term strategy that focuses on Plan assets in relation to liabilities (in other words, the pensions owed to members). This approach focuses on ensuring that the long-term growth of our investment portfolio meets or exceeds the growth in our pension obligation to members.

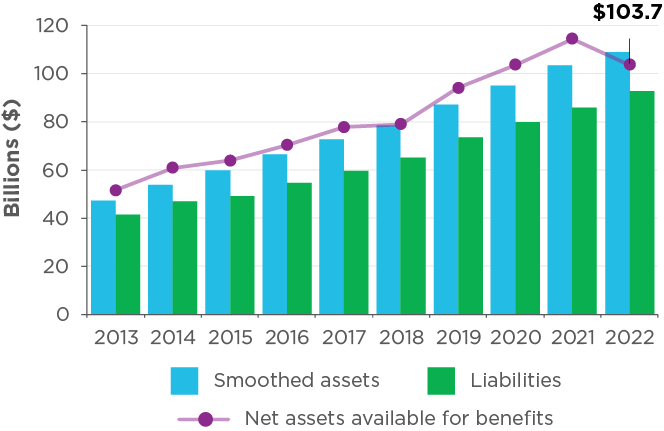

Assets have consistently exceeded liabilities

We continue to take a dynamic approach to LDI, adapting our investment activities based on our outlook and shifting economic environment.

Sustainable investing

We remain firmly committed to our sustainable investing strategy, including our pledge to achieve net-zero carbon emissions in our portfolio by 2050. In 2023, we released our climate change plan, which sets out interim targets to reach this commitment while continuing to deliver on our pension promise. These targets:

- encourage companies to adopt transition plans to reduce greenhouse gases

- increase the capital available for green investments

- prioritize real-world emissions reductions rather than selling assets to reduce our portfolio carbon footprint

You can learn more about how HOOPP is managing climate risk and investing in climate opportunities by reading our climate change strategy, available on hoopp.com.

I would also invite my readers to download and read HOOPP's 2022 Annual Report here.

It is critically important to understand HOOPP's plan maturity:

Relative to OTPP and OMERS, HOOPP is still a younger plan, so its asset mix is different (less geared toward private markets) which explains why it underperformed both these plans last year (they delivered 4% gain mostly owing to infrastructure and commodities in the case of OTPP, real estate for OMERS).

Note this part on HOOPP's plan maturity however:

The chart (above) on the next page reflects the ongoing maturation of the Plan: total benefits paid have exceeded total contributions since 2018, producing a negative cash flow on this basis. While this trend is likely to continue, it does not mean that HOOPP is unable to pay its promised benefits. The Plan remains fully funded, which means it is projected to have sufficient assets to pay the promised benefits. However, it is an aspect of plan maturity we must monitor and manage over time.

The four most important takeaways from HOOPP's 2022 results:

- Despite the -8.6% return for 2022, the Plan remains fully funded at 117%. As Jeff said: "In other words, the Plan has $1.17 for every $1 that is owed in pensions. This is one of the most important indicators of the Plan’s overall health and ability to pay pensions, today and in the future."

- HOOPP’s 10-year annualized return as of Dec. 31, 2022 is 8.35%.

- Despite the negative performance, HOOPP’s investment team mitigated the impacts of the challenging market, surpassing the benchmark by 4.61% and generating a value add of over $5 billion.

- The continued strength and health of the Plan allowed HOOPP to deliver a benefit improvement to active members in 2022, the third benefit improvement in five years. HOOPP also provided a cost-of-living adjustment (COLA) to retired and deferred members at 100% the rate of increase of CPI, which they have done every year since 2014. Contribution rates remained stable for the 19th year in a row.

When you just look at the -8.6% for 2022, you realize its not indicative of the health of the Plan.

Those four critical takeaways I just cited are why HOOPP's members continue to be extremely lucky and well served. Any underfunded US public pension plan can only wish it had HOOPP's funded status.

Now, in terms of performance and where they got hit last year, David Milstead of the Globe notes:

HOOPP targets having about 40 per cent of its portfolio in bonds and about 25 per cent in public equities, according to its investment policies. It closed 2022 with about 54 per cent in bonds and 13 per cent in public equities.

Its fixed-income, or bond, portfolio lost 17.80 per cent in 2022, and its public equities lost 12.49 per cent.

With inflation hitting a 40-year high last year, it impacted both stocks and long bonds which HOOPP uses to match assets with liabilities.

As rates moved up throughout the year last year, they kept buying long duration bonds seeing value in these long duration bonds.

It closed 2022 with about 54 per cent in bonds and 13 per cent in public equities.

This actually leaves the Plan in an excellent liquidity and investment position as we head into what I see as a deep and protracted economic recession and a massive earnings recession ahead.

David Milstead also wrongly notes the following:

Compared with its larger Canadian peers, HOOPP has been late to move into private asset classes such as infrastructure, real estate and private equity. HOOPP targets just about 20 per cent of its portfolio to those categories, and closed 2022 with 23 per cent. That asset mix contributed to its lagging performance versus the other members of the “Maple Eight” big Canadian plans with a calendar-year fiscal period.

He's wrong because HOOPP has been in Real Estate and Private Equity for a very long time, it's actually a leader in Real Estate having diversified its portfolio in terms of sectors (getting into industrial early on) and geography:

The only place HOOPP is lagging its larger peers is in Infrastructure where it is growing its portfolio nicely through co-investments with funds and peers and it will continue to grow this portfolio carefully.

Discussion With Michael Wissell, HOOPP's CIO

Earlier today, I called Michael Wissell to go over HOOPP's results.

I want to thank Michael for taking some time while he's away on vacation to talk to me.

Clearly, with inflation at a 40 year high, their LDI portfolio hit them hard last year as they came into the year with 40% bonds and added to them as rates moved up.

Michael told me that they aren't an asset manager, they're in the "pension delivery service" and are always squarely focused on their funded status which remains very strong.

More importantly, he told me they're in great shape this year to capitalize on dislocations in the market, first in public markets and then add in private markets as opportunities arise.

Michael said that HOOPP's Canadian peers are all in good shape to capitalize on dislocations as they occur and at HOOPP they will add risk marginally "wherever the best opportunities present themselves".

From a liquidity standpoint, the Plan is in excellent shape.

I asked him if he sees great opportunities now, specifically referring to US regional banks and even though he didn't state anything specific, he told me they think over the next three to six months, there will be many good opportunities to invest in holding over a cycle.

What else? With credit conditions tightening, Michael sees more opportunities in Credit, not just public credit but private credit too as private companies look for funds to grow their operations.

Private credit is a relatively new asset class at HOOPP, much like it is at OTPP, but Michael agreed with me that they need to be careful with underwriting these loans and making sure they get properly rewarded for the risks they take (I told him the asset class makes me nervous, especially all the Johnny come lately funds with junior loans on their books they're passing off for senior loans).

Michael told me its sale of Champion Petfoods to Mars Petcare, a division of Mars Incorporated, produced nice distributions in private equity:

HOOPP is pleased to announce the closing of its sale of Champion Petfoods to Mars Petcare, a division of Mars Incorporated. HOOPP held a majority stake in Champion since our initial investment in 2009, alongside Bedford Capital and Kensington Capital.

Champion Petfoods has been operating for more than 35 years and has grown into a leading global pet food maker with its two premier brands, ORIJEN and ACANA. The company has a strong and trusted reputation, growing rapidly as pet owners increasingly seek out nutrient-rich pet food.

HOOPP is proud to have been an investor in Champion Petfoods, supporting the company with strategic advice and expansion capital through a period of outstanding growth and financial performance. During HOOPP’s 13-year investment period, the company grew from a regional player in Canada with some limited international sales to a globally recognized brand with a presence in more than 90 countries.

The collaboration between our investment partners, HOOPP and Champion has benefited Champion’s customers and delivered important value to our members, generating a market-leading 13-year Internal Rate of Return of over 50%.

HOOPP’s approach to private equity investments like Champion is to be an active value-add partner, supporting companies to grow to their full potential through our role as directors on the board and by sharing our deep networks and business expertise. We take a long-term view, and our investment mandate provides flexibility for the types of securities we can invest in, the structure of investments, time horizon and more.

With the recent closing of this transaction, we are pleased to see Champion Petfoods joining the Mars Petcare family where we are confident it will continue to deliver high quality pet nutrition to pet lovers around the world.

Although financial details aren't available, clearly this investment was a winner for HOOPP and its members.

What else did Michael share? They weren't happy about delivering a negative return for the first time since the GFC but despite the negative performance, HOOPP’s investment team mitigated the impacts of the challenging market, surpassing the benchmark by 4.61% and generating a value add of over $5 billion.

Again, I think it's far more important to understand HOOPP's funded status, its LDI approach, it's enviable liquidity and how it will seize opportunities as they arise in both public and private markets.

I thank Michael Wissell for taking the time to chat and offering me some wise advice on my ongoing back issues, I really appreciate it.

One thing he kept telling me which I agree with, is the rapid upward adjustment of the "cost of capital" will have all sorts of implications for markets and entities which weren't properly matching duration (like SVB):

From The Wall Street Journal:

— Mohamed A. El-Erian (@elerianm) March 22, 2023

Some historical context for this afternoon’s Fed policy announcement. #economy #markets #federalreserve #centralbanks @WSJ pic.twitter.com/3EuI6pIQhL

I keep warning my readers that the full effects of the sharp rise in interest rates are only now filtering into the economy and this is why you need to prepare for a deep and protracted recession unlike we have seen since the 70s and 80s and a massive earnings recession which will clobber global stock markets.

From a risk-adjusted point of view, I now favor long bonds (TLT) over high yield bonds (HYG) and stocks (SPY) and I remain long US dollars (UUP).

There will be more negative surprises in markets, we are just seeing the tip of the iceberg lately with US regional banks which didn't match duration properly.

Below, CNBC’s Bob Pisani, Rick Santelli, Steve Liesman, David Kelly, JPMorgan Asset Management chief global strategist, Katie Nixon, executive vice president and chief investment officer for the wealth management business at Northern Trust, John Bellows, Western Asset portfolio manager, join ‘Power Lunch’ to discuss the Fed announcement of a 25 basis point hike.

And Fed Chair Jerome Powell delivers remarks and takes questions after the Federal Reserve announced it would be raising rates by 25 bps. Powell said "inflation remains too high, and the labor market remains very tight."

Powell also said activity in housing remains weak and service sector CPI remains stubbornly high.

Lastly, Odeon Capital Group Financial Strategist Dick Bove breaks down the implications the Fed’s latest rate hike may have on global banking systems with Yahoo Finance's Seana Smith and Dave Briggs. Great discussion,

Bove pointed the finger at the Fed, the FDIC, and those managing the country's currency: 'If they did their job, which they did not do, we wouldn't need regulation.'

He then took things a step further, saying, 'We're going to see a whack at the banks here which is going to drive us into a recession.'

Comments

Post a Comment