OMERS CIO Satish Rai on Asset Allocation in a Higher Rate Environment

This is an excellent interview which is well worth listening to because Satish Rai rarely gives interviews. He is retiring and Ralph Berg, Head of Capital Markets, was recently appointed the new CIO, effective April 1. I covered this appointment here along with executive appointments at the CDPQ.

I really like this interview because it gives you an idea how a pension plan manages assets, thinking about where they can obtain the best risk-adjusted returns over the long run to cover their long-dated liabilities.

BNN Bloomberg host Amber Kanwar began by stating "there seems to be a sea change in where rates are going" and asked Satish, how he's think about all this as it relates to all the assets they manage:

There is a very large shift taking pace which I don't think society has fully transformed to yet. We have almost 40 years where interest rates were below the rate of inflation and now we are heading in an environment where rates are above the rate of inflation. And what that's meant is for 20 years, anyone who has borrowed money has benefited and anyone who has saved has been hurt. This transition, I believe, impacts consumers, corporations and governments. This transition that has taken place over the last two years will take many years for individuals, corporations and governments to transform.

Amber then asked him if they are preparing for a slower economic environment:

It's hard to imagine if your borrowing costs go up double -- everybody says it's happening -- that you're going to have the same kind of growth. Whatever you anticipated the last ten years, let's say growth of 2% to 3%, it might be 1% to 2%. And that means if you have a business model that's not perfect, you'll have a much harder time going forward.

Amber Kanwar then noted that this is their guiding light -- higher rates, slower growth -- and while the opinion of the market changes, OMERS is a long-term investor which doesn't shift its view often:

For savers like a pension fund, this is a great environment for us because for 20 years we have not been able to run a return in our fixed income book that met our liabilities. Today we can easily meet those returns because sovereign bonds yield 4-5%, corporate bonds 6-7% and that's a really good outcome for us. It means what was a great return in the past, the hurdle has to be higher now. Whether the rate is 4% or 5% doesn't really matter, what matters to us is rates are 4% higher than where they were over the last ten years and that has an enormous positive impact on savers.

Amber then noted that for the longest time, there's was a mantra of there is not alternative to stocks but OMERS shifted a significant portion of its assets into private markets which include infrastructure, private equity, real estate and venture and she asked whther they will retrench from that and park themselves in a nice government bond:

Satish replied:

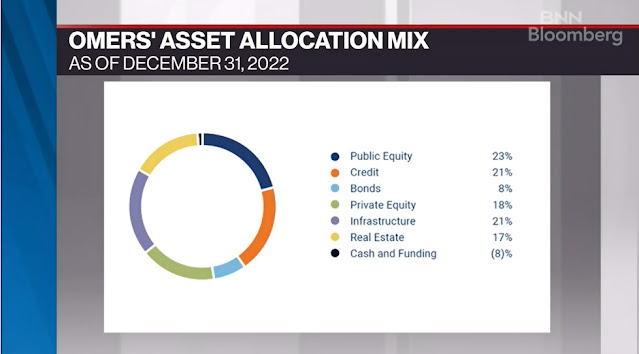

We've got a very long-term discipline so whether rates go up or down a little bit today doesn't really matter. We are approximately 20% in real estate, approximately 20% in infrastructure, approximately 20% in private equity, and approximately 20% in corporate bonds. We've got it very balanced. The most important thing for us is are the assets we're buying -- whether it's real estate, corporate credit or equities -- are they going to stand the test of time? Are they going to provide in a slow growth environment and that's a process we're walking every single day, how do we grow our asset book making sure it meets our liabilities stream, making sure it can pay pensions over 50 years. The challenge most investors will have is you could have reached over the last five to ten years but if you have a business model that isn't EBITDA positive, cash flow positive or very low debt, you're going to have a very hard time.With those five asset classes we have, we feel very comfortable because we're buying the best in class.

He then said on public equities they're looking for who can build up market share in a slow growth environment, who has the strongest balance sheet and business case. he added: "we are not looking for the next three weeks or three months, remember some of our pensioners are 70-years-old, some are 100-years-old, so we are looking for long-term and that's the biggest benefit a pension fund has."

He said despite current challenges. their commitment to venture and growth will remain but in the past, they'd look at 500 deals and invest in 5 or 10, now the "quality of those deals has to go up."

Amber Kanwar then asked him what type of environment are we today and what keeps him up at night:

There are two types of crises, one is what happened in 2008 and the other is what happened in 2020. Those were big shocks and the Fed comes in running. We don't think we are in that environment today. We think there's a slow reset going on where central banks are removing liquidity by raising rates and by selling bonds. So this from our point of view is a very slow grind and resetting, and that plays out exceptionally well if you're a saver. I want to emphasize this, for 20 years we were transferring money from savers to borrowers and it may feel painful for borrowers but for savers, it's about time they're getting decent returns.

Kanwar then asked him whether he expects the tightness in the labor market and wage growth to persist:

If you look at the labor market, there are two types of transitions taking place. The job losses are occurring in places where we saw exceptional growth. In Silicon Valley is actually the poster child for that. We've seen Facebook let go of people, startups let go of people, so you see job losses in that space. You're not seeing job losses in the service sector and those people deserve higher wages because they've been hurt over the last five to ten years. You should expect wages in service sector to go higher because of the growth and you should expect wages in higher growth businesses to slow down.He said they don't expect central banks will allow inflation to stay at 4%, they will want to bring it down to 3% or 2% because "inflation is a tax on society".

Kanwar asked him if they need to add risk in a 4% inflation environment to "juice those returns":

I'm not sure we should ask risk at all but you should expect higher returns because the base rates have gone up. If you think about history, stock markets returned 4-5% above the risk-free rate of 1%, so people expected to achieve 5,6,7,8 to 10% but now if your base rate is over 5%, your starting point is higher, so I don't think it's about taking no risk, it's about getting the right return.given the current environment of where we are today.

On stocks vs bonds: "On the bond side, we can achieve 6.7.8% so if we are buying stocks, we should expect 10% or more to meet our hurdle."

Kanwar then said when it comes to a rising rate environment, cracks are appearing in commercial real estate and she asked him if this is an area of concern:

At Oxford, we would have had a high exposure to commercial real estate 15 years ago. Our portfolio has Retail Industrial, Cold Storage, Residential and Office. For us, we have to focus we have good tenants, cap rates have gone up so to achieve those high returns in real estate is difficult but if you have good tenants and low leverage, you can work through this.The big thing in real estate is the multiple of cap rate compression is behind us, so now it's about great income, great rent and doing great things around the assets.

Kanwar asked him if Oxford is still going to be behind residential or office real estate and he sad "yes but if our borrowing costs are 5% we need to gt 10% on our equity, the hurdle goes up."

The hurdle rate is going up for everyone, including external hedge funds which typically have a hurdle of T-bills + 300 basis points.Their hurdle rate just jumped to 8%.

I would have loved if Amber Kanwar asked him what he thought about the duration and depth of the next recession.

Why? because if I'm right and we're heading into a deep and prolonged recession, it will impact both public and private assets for a longer period at OMERS and other large Canadian pensions funds.

Lastly, today we read why First Citizens got a $16.5 billion discount for taking over Silicon Valley Bank:

Stocks of regional banks surged Monday after regulators announced a sale of Silicon Valley Bank's deposits and loans, an agreement that demonstrated how much government assistance will be required to stoke new deal making during this banking crisis.

The buyer, First Citizens Bancshares (FCNCA), ended the day up 54%. The stock of another troubled regional lender, First Republic (FRC), was 12% higher as that San Francisco lender considers a number of options to stabilize its situation. The stocks of PacWest Bancorp (PACW) and Western Alliance Bancorp (WAL), two other California lenders that came under investor pressure following Silicon Valley Bank's failure, also rose.

The failures of Silicon Valley Bank and New York's Signature Bank earlier this month will be examined publicly Tuesday during a Senate Banking Committee hearing in Washington. Witnesses include Federal Deposit Insurance Corporation Chair Martin Gruenberg.

The chairman may face questions about how his agency handled the Silicon Valley Bank auction. It took Mr. Gruenberg's agency roughly two weeks to find a buyer for parts of the bank, and FDIC agreed to sell Raleigh, N.C.-based First Citizens $72 billion in loans at a discount of $16.5 billion while pledging to share any losses (or gains) on those loans in the future.

The FDIC said that such a loss-sharing agreement—a tactic that also used frequently during the 2008 financial crisis when trying to find buyers for failed banks—will maximize recoveries on the assets by keeping them in the private sector.

First Citizens also decided not to take an additional $90 billion in securities that the FDIC will now have to sell on its own. Silicon Valley Bank loaded up on bonds that are now worth much less as the Federal Reserve raises interest rates. One big question during the sale process was whether the bank's investment portfolio would go for "pennies on the dollar or if it's unsaleable,” said a person familiar with the process.

The total hit to the FDIC's deposit insurance fund, the backstop for protected depositors at all banks, will be $20 billion. The FDIC is also providing a line of credit to First Citizens for "contingent liquidity purposes," the bank said. FDIC gets shares of First Citizens valued up to $500 million.

FDIC made some similar concessions on March 19 when it found a buyer for parts of New York's Signature Bank, which went down on March 12. It gave the new owner, Flagstar Bank, a discount of $12.7 billion on its purchase of $12.9 billion in loans and kept another $60 billion in loans Flagstar didn't want.

The deal making by regulators is the latest example of how much government intervention has been required thus far to get the current banking crisis under control. Federal officials initially agreed to cover all depositors at Silicon Valley Bank and New York's Signature Bank and free up more liquidity at the Federal Reserve so that banks could tap new financing if needed. Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell have agreed to consider additional steps if needed.

Their goal was to calm any panic and slow a withdrawal of deposits from vulnerable regional banks. During the week ending March 15, small banks lost $120 billion in deposits, according to new data from the Federal Reserve. The 25 biggest banks gained $67 billion in deposits during the same period. Powell said last week that deposit flows had stabilized.

First Republic, which caters to wealthy customers on both coasts of the U.S., was among the banks that lost deposits during the initial tumult. In fact, 11 of the nation's biggest banks decided to inject $30 billion in uninsured deposits to take that situation around. There have been discussions about government backing to make the lender more attractive to a buyer or potential investor, Bloomberg has reported.

One of the reasons that deposits are getting hit is because people realize they can get 4-5% in money markets:

The @FT on

— Mohamed A. El-Erian (@elerianm) March 27, 2023

"Money market funds swell by more than $286bn as #investors pull deposits from #banks."https://t.co/mN5uXconwV#economy #markets pic.twitter.com/sjGCLldjP6

It’s really a mystery why people are moving money from bank deposits. Chart @CarstenVal pic.twitter.com/ZZd7PYLpfY

— Michael A. Arouet (@MichaelAArouet) March 26, 2023

And here are some other tweets worth keeping in mind:

EVERYONE should read this one. Friendly reminder that Fed tightening cycles lead to economic slowdowns and those weight on earnings and often lead to financial distress. This paper examines the relationship between earnings and Credit Default Swaps.https://t.co/RTsFph8yqk pic.twitter.com/wsDrIkolrb

— Francois Trahan (@FrancoisTrahan) March 27, 2023

Try to focus on the difference between today and 2007 and try to sleep well knowing the Fed has tightened policy aggressively and other central banks are doing the same. None of this guarantees problems, but it does raise the likelihood of problems during the economic downturn. pic.twitter.com/Hpj0Rtt04R

— Francois Trahan (@FrancoisTrahan) March 27, 2023

I realize this is mid-month data, but nothing in used vehicle pricing argues that goods inflation is moving lower in March. If you want to complicate this story then imagine a world where inflation rebounds. Picture how uncomfortable those Fed Q&A sessions with Powell would be! pic.twitter.com/n0IA7c95v1

— Francois Trahan (@FrancoisTrahan) March 27, 2023

I realize there is no need to panic just yet BUT as someone currently shopping for office space I have noticed there is a LOT to choose from. This, as the economy heads into a sustained downturn that will only make conditions worse for commercial real estate. pic.twitter.com/aCKInjAIlQ

— Francois Trahan (@FrancoisTrahan) March 25, 2023

Alright, take the time to watch this excellent interview with OMERS retiring CIO Satish Rai.

And also take the time to watch CNBC’s Diana Olick report on news from the commercial real estate sector. there is a massive shakeout going on, especially in office REITs.

Comments

Post a Comment