A Conversation With CAAT Pension Plan's CFO & CIO Going Over 2022 Results

TORONTO, April 11, 2023 — CAAT Pension Plan (“the Plan”) announced positive future changes to both its modern defined benefit (DB) pension plan designs, DBprime and DBplus, stemming from its healthy funding and long-term investment performance. In its latest valuation report, the Plan reaffirmed a strong funded position of 124% as of January 1, 2023, on a going-concern basis.

Effective January 1, 2025, participating members and employers under DBprime will receive a 1% decrease in contribution rates, while DBplus members will receive a 1% increase in the annual pension factor on future ongoing contributions. As a result, DBprime members will build the same valuable pension with lower contribution rates, and DBplus members will build their pension at a faster pace, while contribution rates remain the same.

With both plan designs, CAAT continues to provide participating employers with a desirable DB pension plan that attracts and retains talent, ultimately helping them win the “Marathon for Talent” in Canada’s highly competitive workforce today.

“Prudent funding management, superior long-term investment performance, and making the Plan accessible across Canada have all contributed to the Plan’s strong funded status, and enabled valuable improvements that benefit both members and employers,” says Derek W. Dobson, CEO and Plan Manager, CAAT Pension Plan. “Members and employers know that they benefit when CAAT performs well. To be able to grant these improvements really reflects the strength of the modern jointly sponsored DB model.”

The Plan also announced that it will grant conditional inflation protection increases through to 2026—maintaining a perfect record of granting these enhancements since they were first introduced in 2007.

CAAT’s team of pension experts remains focused on maintaining long-term benefit security and upholding CAAT’s status as one of Canada’s most sustainable and well-funded pension plans.

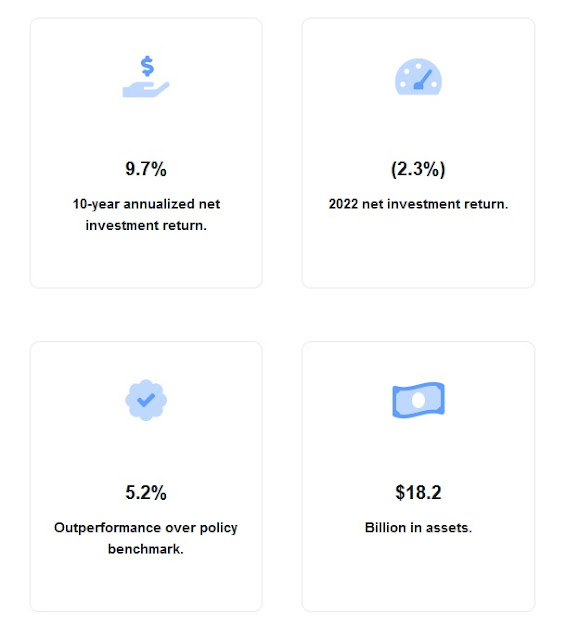

The Plan closed the 2022 fiscal year with assets of $18.2 billion. The Plan’s 2022 investment results will be released with its annual report on April 19, 2023.

About CAAT Pension Plan

Established in 1967, the CAAT Pension Plan is an independent, jointly governed plan that offers two highly desirable designs of a defined benefit pension. CAAT's award-winning DBplus plan design is leading an extraordinary pace of growth for the Plan. Originally created to support the Ontario college system, the CAAT Plan now proudly serves more than 290 participating employers in 15 industries including the for-profit, nonprofit, and broader public sectors. It currently has more than 82,900 active and retired members. The CAAT Plan is respected for its pension and investment management expertise and focus on stability and benefit security. On January 1, 2023, the Plan was 124% funded on a going-concern basis.

The CAAT Pension Plan did release its results in late April, providing a performance overview:

CAAT’s approach to strategic investment and risk management has contributed to making us one of Canada’s most sustainable and secure pension plans. The Plan remains at a healthy funding level of 124%, with $1.24 set aside for every dollar promised in pensions.

CAAT’s 10-year net rate of return is 9.7% per year. CAAT has outperformed its 10-year policy benchmark by 2.5% per year. The Plan remains strong, resilient and focused on securing pensions over the long term.

2022 Highlights

During 2022, the Plan’s assets remained at $18.2 billion, with $4.7 billion in funding reserves. Healthy reserves reinforce benefit security, so members can be confident in the sustainability of the Plan even in challenging investment markets.

Despite inflationary pressures and investment market volatility in 2022, our team performed well. The Plan returned (2.3%) in 2022 net of management fees, exceeding the policy benchmark by 5.2%. CAAT continues to focus on long-term returns, so our members can be confident their retirement savings are backed by a strong track record of prudent management to fulfill every pension dollar promised.

In May, CAAT had a webinar with all its members going over results and more on the Plan, so I waited to cover their results properly (see clips at end of comment which became available).

Earlier today I had a discussion with CAAT's CFO, Michael Dawson and its CIO, Asif Haque.

Before I get to this discussion, I urge my readers to read CAAT's 2022Annual Report here.

As I customarily do, it is worth reading the message from CAAT's Chair, Virginia Di Monte, and Vice-Chair, Dr. Scott Blakey:

I also urge you to read about CAAT Pension Plan's joint governance here.

The key point is this:

As a member of the CAAT Pension Plan, you can be certain that your interests are well-represented, because both members and employers share equally in making the decisions that affect your benefit security.

Next, you should read the message from CAAT's CEO and Plan Manager, Derek Dobson:

I note the following:

The results of CAAT’s January 1, 2023 actuarial valuation confirm that the Plan remains at a healthy funding level of 124% on a going-concern basis, with $1.24 set aside for every dollar promised in pensions. As one of Canada’s most sustainable, highest performing pension plans, CAAT holds $18.2 billion in market value of assets and $4.7 billion in funding reserves. Healthy reserves reinforce benefit security, so members can be confident that the Plan will continue granting enhancements like conditional inflation increases, as it has done every year since the feature was introduced in 2007.

With CAAT, members don’t have to worry about every market dip and blip. Their retirement savings are backed by a strong track record of prudent management to fulfill every pension dollar promised, no matter the circumstances. As Canadians anticipate rising living costs, granted inflation enhancements are more valuable than ever.

Marking a milestone in its 55-year history, the Plan proudly achieved coast-to-coast-to-coast coverage and welcomed its first employers from the Yukon and Northwest Territories. Groups from Jamieson Laboratories, McInnes Cooper, Rio Tinto Alcan and Angus Consulting Management were among the 80 new employers to join DBplus in 2022.

And before I get to my discussion, it is worth looking at CAAT's well-diversified portfolio and its strong long-term investment performance:

Also, Keith Ambachtsheer, a thought leader in the pension industry and president of KPA Advisory Services, recently penned an op-ed to the Globe & Mail, Canadian civil servants have a great pension system – why can’t that be expanded to us all?.Read the full op-ed in the Globe & Mail here and the full policy paper on KPA Advisory Services here.

Discussion with CAAT CFO Michael Dawson and CIO Asif Haque

Alright, earlier today I had a chance to speak with CAAT's CFO Michael Dawson and CIO Asif Haque.

I want to begin by thanking both of them for taking some time to talk to me.

I also want to thank Vicki Lam for organizing this discussion and for sending me relevant material and clips to embed below.

I began by asking Michael to give me an overview of last year's performance and key milestones and strategic initiatives:

The 2022 performance, the Fund declined by 2.3%, outperforming the policy benchmark by 5.2%. But really we try to focus on the long run. Over the last 10 years, we've had a 9.7% annualized return which represents 2.5% annualized of outperformance.

Something that really matters for us is membership growth. We want to grow the membership base which is very much tied to our Plan stability strategy. We ended the year with 82,000 members which is 7400 increase from 2021.

I pressed Michael to explain why the growth in membership is tied to the Plan's stability:

One of the the core things about the strategy is price stability, growing our membership base, growing our active contributions, expanding out the demographics of the membership pool. Our big focus is being ready for that growth, growing operationally and being prepared for it.

I told Michael I met up with Sabeen Purewall, Director Pension Solutions & Partnerships when he was in Montreal last summer and we had a great discussion on what he does to attract new members by going ot pension conferences all over the country.

However, Sabeen also explained to me there is some reluctance from some members who are not aware of the advantages CAAT's DB solutions offer. Michael confirmed this:

There is a lot of excitement about these products but there is certainly some reservations from some companies about having a DB plan. So part of our strategy is product innovation. What can we do to offer that product that has that pension like return. That is the feedback we heard from industry. That was one of the benefits of doing DBplus, they can treat it like a DC plan and it's that kind of innovation we are continuing to look at.

I told him through my discussions with Sabeen, there are a lot of prospective employers/ members who are stuck with a DC mindset thinking it's a lot cheaper and Michael responded:

It's a factor, it is one of the things about how these things are perceived so part of our strategy is on the communication side, so how do we get ahead of those messages, that's always a struggle for us.

Asif then added something pertinent:

One of the benefits of DBplus is it provides cost certainty. An employer committed to the pension plan is limited to the contributions and those contributions are fixed. So, it really does provide the benefits of a DC plan for employers but still providing that guaranteed benefit to employees for life so it really is the best of both worlds. And just getting that message across when people think it's a binary choice between DC and DB, we are trying to change that conversation, but it takes times.As CAAT Pension Plan CEO and Plan Manager Derek Dobson said, there are also added benefits to employers in terms of employee retention and higher productivity.

Michael Dawson told me there are a number of initiatives to get the word out, they are focusing on being across Canada and also focusing on getting their brand out. They are trying a number of different things, getting feedback and trying to see what is working and not working.

He added they are trying to keep the message simple, keep the value propositions simple and they are not trying to over-communicate the complexities of the products.

Lastly, he told me while it is scalable, they made enormous investments in their IT platform to support the administration of the Plan as they garner new members.

And I asked if conditional inflation protection is for all members and Michael and Asif confirmed that it was.

Next, I moved over to Asif, CAAT's CIO, and asked him if he can give me an overview of the Plan's performance in 2022 and what his strategic initiatives are over the next three years:

I saw your great discussion with UPP's CIO Aaron Bennett earlier this week. Obviously, we were all facing the same market challenges in 2022 with inflation coming back for the first time in a lot of people's careers frankly. You and I used to talk about this when we were working together (at PSP) but nobody working now remembers the inflation of the 1970s.

We got a little taste of it last year. It was out first experience of stocks and bonds struggling at the same time. It really brought out the advantages of two things: 1) the advantages of being a long-term investor and being able to look through short-term market dislocations and focus your investment and pension on longer term ideas. When you add that long term focus it really helps you get through a year like 2022. The other thing that really helped is the focus on active management and the focus on working with really great partners that can help you navigate through those challenges.

Mike talked to you about the fact that while we were down 2.3% last year, we outperformed our policy benchmark quite significantly. Some of that was due to small tactical decisions around the margins the internal team took but much of it is great active management decisions from our external partners that added up little by little over the year. And that has really been the case over a the 10-year period as well.

We measure success by keeping the focus on the overall funded status of the plan and by looking at the long-term results of the Plan on the investment side.

I asked him to give me some more details on performance of public vs private markets and asked him if private markets are at 30% or more:

A little closer to 40% in private markets by the end of 2022 and that includes private equity, real estate, infrastructure and a tiny bit in agriculture. Public and Private Equities made up close to 55% of the portfolio by the end of 2022 and the res tin inflation sensitive and interest rate sensitive assets (see asset mix above), more heavily weighted to the inflation-sensitive than interest rate- sensitive which is something that helped us out in 2022 as well.

So that's the asset mix. On the active management side, we outperformed benchmarks. Our Public Equity program performed quite well, we outperformed significantly there. Our Private Equity program had a strong year relative to a public market composite benchmark and our Real Assets portfolio kept up with its benchmark.

I interjected: “So what are you doing right in public markets where many struggled last year?".

Asif responded:

A couple of things explain it. Some of that outperformance are hedge funds that are ported on top of the S&P 500 through a portable alpha strategy and our hedge funds had a really strong year, I think Aaron talked to you about that on the UPP side, but also the more traditional long only public equity, we did well there too. A couple of things there. We built in a more value bias toward the end of 2021 and that really helped up in 2022 when value outperformed growth and then security selection decisions from our managers. A little bit of everything, no one big win.

I asked him about Private Equity and Real Estate which has been challenging for some investors:

Private Equity, really strong year, a combination of really nice performance in our funds area but also we have a meaningful co-investment program as well on the private market side and our individual investments there were really big. The valuations were strong, but the underlying company performance when we look past the valuations, we are seeing a lot of strength there. And again, you know this, we don't judge the success of a private markets program on a one-year performance metric. It was a nice year but what we care about is the long term and our Private Equity program has done over 20% a year for the last ten years. That's the much bigger measure of success.As far as Real Estate, I asked him if they're also being challenged by weakness in Offices and Retail:

A couple of things there. Real Assets which is a combination of Real Estate, Infrastructure and a little bit of Agriculture, got up to 19-20% of the Total Plan last year. Call it 60/40 indie of that between Infrastructure (60%) and Real Estate (40%). Did we have challenges? We are relatively less exposed to Office and Retail than the market would be. We are more focused on industrial/ logistics and areas like that and less focused on Office and Retail and that was helpful in 2021 and 2022.I ended off by asking him what are his strategic plans for the next few years and how he is navigating this challenging year given that a handful of mega cap tech stocks are leading the market higher:

A few things. We do asset liability studies every three years. We did one last year and as a result we will be making some small tweaks to the portfolio over the next couple of years. We will be adding exposure to Credit area (private debt) -- I know that's an area you talk quite a bit about in your blog. We are starting from a low base so adding a little bit from where we are now is a good thing from a portfolio diversification and resilience perspective. Some small geographic changes in Public Equities that aren't major and at the margin, we will be adding exposure to Real Assets mostly in Infrastructure and Real Estate (Agriculture only on an opportunistic basis).

I told Asif that later this afternoon, I was going to speak with Andrew Edgell, Senior Managing Director & Global Head of Credit Investments at CPP Investments and really dig deep into Credit and what are the opportunities and challenges he sees in that market.

That too was a fantastic discussion but you will have to wait till Monday to read it as we covered a lot.

By the way, a friendly reminder. I wake up at 5:30 a.m. now, read a lot on markets, trade when I see opportunities and then sit down three to four hours after markets close to write my blog.

It's a lot of work and I have other things going on too. Please do not contact me for capital introduction or meetings as I used to sit at pensions investing in funds and I am ruthless.

If you want me to go over your material, minimum donation of $1,000 is required for an hour of my time and chances are I will not pass it along to my pension contacts as I don't want to burn my bridges with them peddling funds they couldn't care less about.

As far as this blog, however, the content is original and I do appreciate those who take the time to donate via PayPal on the top left-hand side under my picture to support my efforts. Thank you!

Below, I embedded some fireside chats with CAAT Pension Plan's CEO, CFO and CIO. Take the time to watch Derek, Michael and Asif discuss the benefits of being a CAAT member and a lot more.

Comments

Post a Comment