Market Betting on the All Elusive Soft Landing Materializing?

The Dow Jones Industrial Average surged Friday for its best day since January as traders cheered a strong jobs report and the passage of a debt ceiling bill that averts a U.S. default.

The 30-stock Dow jumped 701.19 points, or 2.12%, to end at 33,762.76. The S&P 500 climbed 1.45% to close at 4,282.37. The Nasdaq Composite advanced 1.07% to 13,240.77, reaching its highest level since April 2022 during the session.

With Friday’s gains, the S&P 500 and Nasdaq finished the holiday-shortened trading week about 1.8% and 2% higher, respectively. The Dow’s Friday advance pushed it into positive territory for the week, finishing up around 2%. The Nasdaq notched its sixth straight week higher, a streak length not seen for the technology-heavy index since 2020.

Nonfarm payrolls grew much more than expected in May, rising 339,000. Economists polled by Dow Jones expected a relatively modest 190,000 increase. It marked the 29th straight month of positive job growth.

Recently, strong employment data had been pressuring stocks on the notion it would keep the Federal Reserve raising interest rates. But Friday’s data also showed average hourly earnings rose less than economists expected year over year, while the unemployment rate was higher than anticipated.

Both data points have given investors hope that the Fed could pause its interest rate hike campaign at the policy meeting later this month, according to Terry Sandven, chief equity strategist at U.S. Bank Wealth Management.

“The so-called Goldilocks has entered the house,” Sandven said. “Clearly, on the bullish side, there are signs that inflation is starting to wane, speculation that the Fed is going to move into pause mode, increasing the likelihood of a soft landing.”

Easing concerns around the U.S. debt ceiling also helped sentiment. The Senate passed a bill to raise the debt ceiling late Thursday night, sending the bill to President Joe Biden’s desk. That comes after the House passed the Fiscal Responsibility Act on Wednesday, just days before the June 5 deadline set by U.S. Treasury Secretary Janet Yellen.

Lululemon shares popped more than 11% on strong results and a guidance boost, while MongoDB surged 28% on a blowout forecast.

Small-cap stocks post biggest one-day gain since November

The Russell 2000 index of small-cap stocks jumped 3.56% on Friday, the best one-day rally since Nov. 10, 2022, and rising above its 200-day moving average for the first time since March 8, just before Silicon Valley Bank blew up.

Year to date, the Russell has now gained 3.96%, far behind the S&P 500′s advance of 11.5%.

Ari Levy of CNBC also reports tech stocks close out first six-week rally since January 2020:

Tech stocks still haven’t fully rebounded from a miserable 2022, but they’re rewarding investors who saw the sell-off as too extreme.

The Nasdaq Composite gained 2% this week, wrapping up the sixth-straight weekly rally for the tech-heavy index. It’s the longest stretch since January 2020, before the Covid-19 pandemic hit the U.S.

Stocks across the board got a big boost Friday after a strong jobs report for May and the Senate’s passage of a debt ceiling bill Thursday night, which allowed the U.S. to avert default. President Joe Biden still has to sign the bill.

While last week’s gains were spurred by Nvidia’s earnings report and a surge in optimism around demand for technologies powering artificial intelligence workloads, this week didn’t see any notable news in the mega-cap group. But there was continued upward momentum.

Among the most-valuable Nasdaq companies, Tesla led the way, with an 11% increase for the week. Shares of the electric vehicle maker are now up 74% for the year after losing roughly two-thirds of its value in 2022.

Tesla and Nvidia, which has climbed 169% this year, have helped pull the Nasdaq up 27% in 2023, far outpacing the S&P 500 and Dow Jones Industrial Average. After peaking in late 2021, the Nasdaq plummeted 33% last year, its steepest drop since the financial crisis, on concerns surrounding inflation and rising interest rates. The index is still about 18% off its all-time high.

“I’m focusing on mega-cap tech here and semiconductors as well,” said Danielle Shay, vice president of options at Simpler Trading, in an interview on CNBC’s “The Exchange” on Friday. “The AI trade has been absolutely phenomenal.”

In the cloud software corner of tech, some earnings reports are still providing a boost. MongoDB, the developer of a cloud-based database, jumped 33% for the week. The company on Thursday reported earnings and revenue that topped analysts’ estimates and raised its guidance for fiscal 2024.

On MongoDB’s earnings call, CEO Dev Ittycheria said his company’s products are seeing increased usage as clients look for efficiencies and cut costs.

“It’s clear customers continue to scrutinize their technology investments and must decide which technologies are a must-have, versus merely nice to have,” he said.

Cybersecurity vendor SentinelOne and software developer PagerDuty experienced the flipside of the equation.

SentinelOne plunged 35% for the week after the company lowered its guidance and announced layoffs. Chief Financial Officer David Bernhardt said on SentinelOne’s earnings call large customers have been using the technology less and, due to the “current macro environment, we expect these lower usage and consumption trends to persist.”

PagerDuty dropped 14% this week. The provider of technology that helps IT departments respond to incidents slashed its forecast for the year “in anticipation of continued pressure” at small- and medium-size businesses, CFO Howard Wilson said on the call.

And Lewis Krauskopf of Reuters also reports Wall St Week Ahead: Surging US megacap stocks leave some wondering when to cash out:

As the U.S. stock market continues its climb, investors holding shares of the massive tech and growth companies leading the charge are debating whether to cash out or stay on for the ride.

A record $8.5 billion flowed into tech stocks in the latest week, data from BofA Global Research showed, as investors piled into a rally that has seen the tech-heavy Nasdaq 100 (NDX) gain 33% in 2023. The benchmark S&P 500 (SPX) has risen 11.5% this year and stands at a 10-month high.

Yet others see reasons for caution. Among them is the narrowness of the market’s rally: the five largest stocks in the S&P 500 have a combined weighting of 24.7% in the index, a record high dating back to 1972, Ned Davis Research said in a recent report. The heavy weightings could mean more significant fallout for broader markets should those names falter.

"We had this big run and the essential question is, do you believe it’s going to continue or do you believe things are going to return to the mean?" said Peter Tuz, president of Chase Investment Counsel.

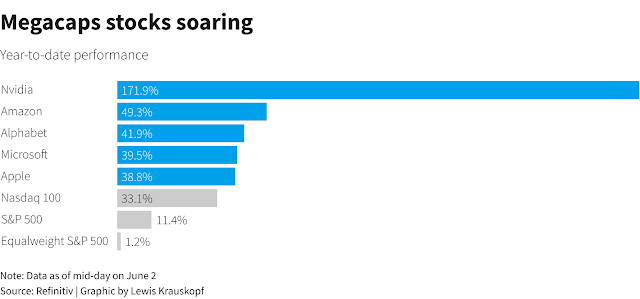

Excitement over advances in artificial intelligence is a key factor fueling gains in megacap stocks. Big movers include shares of Nvidia (NVDA), which are up about 170% this year, while Apple (AAPL) and Microsoft (MSFT), the top two U.S. companies by market value, have both climbed nearly 40%.

Jay Hatfield, CEO of hedge fund InfraCap, believes excitement over AI will keep boosting megacap stocks. He is overweight megacaps, including Nvidia, Microsoft and Google-parent Alphabet (GOOGL).

“We 100% believe in the AI boom,” Hatfield said. “I would be shocked if by the end of the year these stocks are not significantly higher."

Data on Friday showed U.S. job growth accelerating in May, even as a jump in the unemployment rate suggested labor market conditions were easing, boosting investors’ appetite for stocks amid hopes that the Federal Reserve will be able to bring down inflation without badly hurting growth. The S&P 500 rose 1.45%.Megacap stocks led markets for much of the decade after the financial crisis and betting against them has been a perilous strategy in 2023. Investors' allocation to cash is higher than it has been historically, data from BofA showed, which some market observers believe leaves plenty of fuel to push the rally further.

Strong momentum can also continue to propel stocks higher.

Michael Purves, CEO of Tallbacken Capital Advisors, wrote earlier this week that technical analysis showed the Nasdaq 100 is overbought, a condition that can make an asset more vulnerable to sharp declines. However, the index managed to rally another 10% over three months when it reached the same condition two years ago, according to Purves.

The recent surge in Nvidia showed how a stock can keep climbing even after posting hefty gains. Shares were already up 109% heading into its May 24 earnings report, but rose another 30% in the past week after the chipmaker's surprisingly upbeat sales forecast.

Kevin Mahn, chief investment officer at Hennion & Walsh Asset Management, said shares of Nvidia, which now trade at 44 times forward earnings estimates, according to Refinitiv Datastream, have become "a little rich."

“I still like the technology sector over the next two years, but I now have to be a lot more focused on valuation given the run up in a lot of these megacap stocks,” said Mahn, who says Microsoft shares remain attractive due in part to the company's impressive cash flow and healthy dividend yield.

Others are growing wary, citing factors such as rising valuations and signs that the rest of the market is languishing while a small cluster of stocks soars.

The performance of just seven stocks, Apple, Microsoft, Alphabet, Amazon (AMZN), Nvdia, Meta Platforms (META) and Tesla (TSLA), accounted for all of the S&P 500’s 2023 total return through May, according to S&P Dow Jones Indices.

At the same time, only 20.3% of S&P 500 stocks have outperformed the index on a rolling three-month basis, a record low dating back five decades, according to Ned Davis. Levels below 30% have preceded weaker performance for the broader market, with the S&P 500 rising 4.4% over the next year versus an average of 8.2% for all one year periods, the firm’s research showed. David Kotok, chief investment officer at Cumberland Advisors, in recent days pared back holdings of the iShares semiconductor ETF (SOXX) following the latest spike in shares of Nvidia.

Kotok views narrowing breadth as an ominous sign for the broader stock market, saying that equities also look less favorable in certain asset valuation metrics.

In one commonly used valuation metric, the S&P 500 is trading at 18.5 times forward earnings estimates compared to its historic average of 15.6 times, according to Refinitiv Datastream.

"You can have (market) concentration and it can go on for a while," he said. But, he said, “for me, the narrowing is a warning.”

Alright, it's Friday, everyone is already in weekend mode but I wanted to go over a few things, starting with today's red hot US jobs report.

Here are the key numbers from the report compared to estimates from Bloomberg:

Nonfarm payrolls: +339,000 vs. +195,000

Unemployment rate: 3.7% vs. 3.5%

Average hourly earnings, month-on-month: +0.3% vs. +0.3%

Average hourly earnings, year-on-year: +4.3% vs. +4.4%

Average weekly hours worked: 34.3 vs. 34.4

Employment gains for the last two months were revised higher. Updated data revealed 294,000 jobs were created during April, 41,000 more than previously reported. March's job gains were also revised higher — to 217,000 from 165,000 — making job growth over that two month stretch higher than previously reported by 93,000.

By industry, the largest increases in Friday's data were seen in business and services which added 64,000 jobs.

In Government, 56,000 jobs were added last month. Health care also drove labor gains with 52,000 job additions in May. Leisure and hospitality added 48,000 jobs, with 33,000 of those roles coming in the food services and drinking places category.

Construction added 25,000 jobs in May, a 7,000 role increase from its 12-month average.

In a statement, President Biden said, "Today is a good day for the American economy and American workers."

Any way you slice it, it was another very strong jobs report:

Payrolls rose 339,000 in May, much better than expected in resilient labor market https://t.co/qNWtunxtI0

— Leo Kolivakis (@PensionPulse) June 2, 2023

Jobs report: US economy adds 339,000 jobs in May, crushing expectations https://t.co/iYHJDcAYvA via @YahooFinance

— Leo Kolivakis (@PensionPulse) June 2, 2023

How many times does a report have to come in better than expected before you adjust your models? pic.twitter.com/4S7Yb8dD2Q

— Bespoke (@bespokeinvest) June 2, 2023

Another very strong headline jobs number of 339,000 in May. Bringing total jobs to 1.3 million above CBO's pre-pandemic forecast.

— Jason Furman (@jasonfurman) June 2, 2023

But the unemployment rate rose from 3.4% to 3.7% which is the 94th percentile of historical one-month changes. pic.twitter.com/2xZ9gxDOK0

The economy added 339,000 jobs in May, and revisions for March-April showed employment was 93,000 higher than previously reported.

— Nick Timiraos (@NickTimiraos) June 2, 2023

The unemployment rate rose to 3.7% in May from 3.4 % in April https://t.co/6w20v3GVDV pic.twitter.com/bnqKjApvfY

Yes - people want to work. Labor force participation for prime age workers rises sharply. pic.twitter.com/ivfqT5Ryy3

— Kathy Jones (@KathyJones) June 2, 2023

Participation rate for women has jumped to a new high. pic.twitter.com/qLkgWBHxyd

— Kathy Jones (@KathyJones) June 2, 2023

Still a major bright spot: prime-age labor force participation rate rose again in May; now at highest since January 2007 pic.twitter.com/82owu19tRF

— Liz Ann Sonders (@LizAnnSonders) June 2, 2023

But not everyone is convinced that the US labor market is roaring or will continue to roar in second half of the year. Moreover, there are some inconsistencies in data:

Investors don’t seem to realize that after accounting for the drop in hours worked, it’s as if the economy lost 140k jobs in May. In the Jan-May period, the index of aggregate hours worked is negative and that is a sure-fire recession signal.

— David Rosenberg (@EconguyRosie) June 2, 2023

Job growth over the past 6 months (red line) is about what one would have expected back in November (blue line).

— John P. Hussman, Ph.D. (@hussmanjp) June 2, 2023

It will be a surprise, though, if job growth doesn't go flat or negative during the second half of 2023. pic.twitter.com/zgXQylzlHb

Interesting: The household survey showed a 310K drop in employment - the largest monthly decline since April 2022. It's not unusual to see these disparities but suggests there is some "noise" in the data. pic.twitter.com/kTR2iVheTq

— Kathy Jones (@KathyJones) June 2, 2023

WTF: Is it +339k or -310k? US jobs report was blow-out on Establishment survey w/339k additions, far ahead of 195k forecast. BUT acc to separate Household survey, number of employed fell by 310k, which drove unemployment rate to 3.7% from 3.4% vs 3.5% exp. (via @knowledge_vital) pic.twitter.com/uDjezLatYb

— Holger Zschaepitz (@Schuldensuehner) June 2, 2023

May jobs report shocks Wall Street economists: 'The strangest employment report for some time' https://t.co/BIKpXKpONL

— Leo Kolivakis (@PensionPulse) June 3, 2023

And here is the AI revolution in action:

AI is taking our jobs.

— Genevieve Roch-Decter, CFA (@GRDecter) June 2, 2023

3,900 people laid off in May lost their jobs because of AI.

First time AI has been listed as a reason in the monthly report.

Uh-oh. pic.twitter.com/HSgB1Jvcqh

As i have stated many times, technological revolutions whether they're AI or whatever are deflationary.

That brings me to my next point.

The yield on the 10-year Treasury note bumped up by 8 basis points to 3.69% but was down for the week and the US dollar continued to rally on the news as markets priced in another 25 basis point Fed rate hike at its June meeting:

And the stock market was on fire led by small cap stocks (IWM) which were up 3.56%, followed by the Dow (+2.12%), S&P 500 (+1.45%) and then Nasdaq (+1.07%).

It was about time small cap stocks rallied, they have been severely underperforming large cap growth stocks this year:

This time it’s different in one chart 👇 (BBG) pic.twitter.com/luEYUEpLzC

— Michael A. Arouet (@MichaelAArouet) June 2, 2023

And market internals do not look good this year and there's a real risk when the "Magnificent Seven" tech stocks turn south, this market is in real trouble:

Just FYI. I know you don't care. https://t.co/SdQJXjNVQK

— John P. Hussman, Ph.D. (@hussmanjp) June 2, 2023

Overbought? pic.twitter.com/XEQpC9eyMU

— Kay Kim (@2kaykim) June 2, 2023

Not sure there is much to say, but this is the picture after the rebound in equities of the past week. A mere two stocks now account for 15% of the S&P 500's market cap. Here I thought 2000 was a big deal ... I love seeing things for the first time but this is a bit overdone no? pic.twitter.com/kwlelCpmcG

— Francois Trahan (@FrancoisTrahan) June 3, 2023

We don’t have a fab, totally dependent on geopolitical tranquility in the South China Sea. But at 37x sales, have no fear, are good at “meta” chips, “crypto” chips, and “AI” chips. Hilarious, bs-athon… pic.twitter.com/kfSHbxqnbU

— Lawrence McDonald (@Convertbond) June 3, 2023

The chart of the week:

— Mac10 (@SuburbanDrone) June 2, 2023

S&P Tech with the ISEE call/put index:https://t.co/zlMsxl36fz

Getting out, there will be no one on the other side of the trade. pic.twitter.com/rHyXwFz3oe

That's the week. pic.twitter.com/bL1BSrJ2wu

— Mac10 (@SuburbanDrone) June 2, 2023

In the first Tech overweight melt-up, Tech lost -15%. In the second melt-up Tech lost -35%.

— Mac10 (@SuburbanDrone) June 3, 2023

Bulls believe this will be the easy one.

Nothing could be further from the truth. pic.twitter.com/MqDrxZVTp4

But what if there's something else explaining the dynamics of this market?

What if the market truly believes the Fed is able to engineer a soft landing?

And what if we see mega cap tech stocks go sideways and the rest of the market finally catches a bid?

Massive divergence between growth-oriented Tech (orange) and cyclical-oriented Materials (blue) sectors when measured relative to S&P 500 ... former has soared while latter is plumbing multi-year low

— Liz Ann Sonders (@LizAnnSonders) June 1, 2023

[Past performance is no guarantee of future results] pic.twitter.com/QrnDaF5Z0X

Average performance in May:

— Bespoke (@bespokeinvest) June 1, 2023

10 largest S&P 500 stocks: +8.9%

490 smallest S&P 500 stocks: -4.3%

Of course, this is possible but I just do not believe the Fed can engineer a soft landing and the real risk I see is when the absolutely insane (AI) market hits a brick wall, it's gong to drag the rest of market a lot lower:

Don't get me wrong, there's no doubt the US economy is firing on all cylinders but if you look at leading indicators like New Orders, this isn't gong to last long and I suspect the second half of the year will be telling.The VIX is tracking Apple which has been consistently overbought all of 2023 (top pane).

— Mac10 (@SuburbanDrone) June 1, 2023

Back at the all time high. pic.twitter.com/8YnEmHnO7l

But if employment gains keep soaring and inflation expectations keep dropping, you never know, the Fed might pull off the elusive soft landing.

Next, Bryn Talkington, Jason Snipe, Steve Weiss, and Jim Lebenthal join 'Halftime Report' to discuss major averages moving higher, what a soft landing could look like, and today's job report.

Third, Jan Hatzius, chief economist and head of global investment research at Goldman Sachs, joins ‘Squawk on the Street’ to discuss what the new job reports suggest about the economy, his expectation from Fed's next meeting, and more.

Fourth, David Kelly, JP Morgan Asset Management chief global strategist, and Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America Securities, join ‘Squawk on the Street’ to discuss what the latest strong job reports suggest, the odds of a recession, and more.

Lastly, a great interview with David Rosenberg who warns us not to believe the hype, this economy is "a dead man walking."

It sure doesn't look like it today but by the end of the year, and probably a lot sooner, I bet you Rosie is right!

Comments

Post a Comment