Alberta Releases Insane Report Peddling an Alberta Pension Plan

The Alberta government released a long-awaited report Thursday on the possibility of establishing an Alberta-only pension plan, claiming the province is entitled to a staggering $334-billion asset transfer from the Canada Pension Plan in 2027.

That's more than half of the fund's estimated total net assets. The third-party report, compiled by consultant LifeWorks, attributes the figure to Alberta's high employment rates, young population, and higher pensionable earnings, which it claims has meant the province has sent billions more into the CPP compared to what it has received.

Withdrawing from the CPP could potentially mean the rest of the country would end up paying more for their pension contributions (though Trevor Tombe, an associate professor of economics at the University of Calgary, said it's not mechanically guaranteed). Quebec would not be affected, as it has operated its own pension plan for decades.

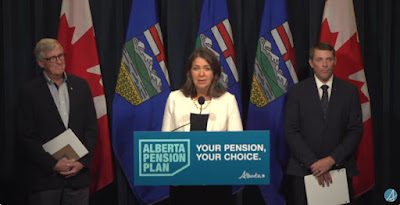

"I believe that an Alberta pension plan would be fairer and could make life more affordable for all Albertans," Alberta Premier Danielle Smith said during a press conference. The report estimates the move would save $5 billion in the first year.

To withdraw from the CPP, Alberta would need to provide written notice that it planned to do so and draft legislation to establish an Alberta pension plan. It would need to accept contributions beginning in the third year following the year in which it gives notice, and then provide comparable benefits to the CPP.

The government is quick to note that such a plan to withdraw from the CPP is still in the early, hypothetical stages. Now that it's been released, the next few months will see former Progressive Conservative finance minister Jim Dinning head up a panel that will consult with Albertans on the idea over the fall and into spring 2024. If those go well, the government says it could then hold a referendum.

During an unrelated press conference on Thursday, federal Finance Minister Chrystia Freeland was asked about Alberta's announcement. Freeland said she had yet to read the details of the announcement and would refrain from commenting directly, but did defend the CPP.

"The CPP, I think, is one of the crown jewels of Canada. The CPP ensures that our parents and all of us can have a safe and dignified retirement. It is a source of a huge amount of security for every single Canadian," Freeland said.

Disagreements over interpretation

Over the coming days and weeks, expect questions about the report's assumptions around how much Alberta would be entitled to, which it states is based on how much Albertans have contributed to the CPP, minus what they've received in benefits since the start of the CPP in 1966, plus investment earnings on that amount. The government expects those questions, along with others, will be hotly debated over the coming weeks and months.

Michel Leduc, senior managing director at CPP Investments, which invests on behalf of the CPP, said the Alberta asset-transfer estimates, as outlined, are not feasible on a number of fronts.

"It's basically invented, and then you end up with this very, very large figure that would not work," Leduc said.

Dinning himself noted in a news release Thursday that he expects that conversations around the plan could get "fiery" at times. Polling has suggested that the majority of Albertans aren't on board with the idea.

Tombe, at the University of Calgary, said that what the government released in its report today was a "very problematic" interpretation of the act.

"[It] basically puts Alberta into the position that it would have been in had it never joined in the first place. But that's not a reasonable read," said Tombe.

"What we need to do is divide the existing assets, not construct a hypothetical amount of assets that we could have had if the world had been different from the 1960s onwards. So that's hugely important."

Tombe said a more reasonable interpretation lands not at over half of CPP assets, but somewhere potentially around 20 per cent of CPP assets, or at the highest, 25 per cent.

Asked about that on Thursday, Alberta Finance Minister Nate Horner, who joined Premier Smith at the press conference, stood by the report.

"We're using the best information we have. That's what LifeWorks has used and we stand by the validity of ... their interpretation and methodology," Horner said.

Tombe also released an analysis on the possibility of an Alberta pension plan on Thursday.

"There is also a practical problem to consider. If British Columbia, Alberta, and Ontario each withdrew from the CPP, for example, I estimate 128 per cent of assets would need to be paid," Tombe writes.

Tombe expanded on that in an email to CBC News, writing that his view is that LifeWorks' interpretation of the formula that is laid out in the act is not a reasonable one.

"It isn't completely insane, to be clear, and was a reasonable interpretation shared by some in 1965 when the act was passed," Tombe wrote.

"But in the modern CPP it is no longer a practical interpretation … the problem is that the language is vague. It is not at all clear which of several potential interpretations is the correct one. My own analysis suggests 20 to 25 per cent of the CPP assets reflects a reasonable interpretation. Ultimately, the Supreme Court will need to decide. Claims that there is a simple formula that just needs to be applied are false, in my view."

Leduc with CPP Investments said Tombe had come to the same conclusions his asset management company had reached, albeit a little higher than what they calculated, but much lower than what is in the report.

Barbara Shecter of the National Post also reports that it's 'impossible' for Alberta to exit with half of CPP assets, pension fund official says:

The prospect of Alberta pulling out of the Canada Pension Plan in favour of its own pension scheme is back in the spotlight with an independent report — three years in the making — claiming the oil-rich province is entitled to more than half of the assets in the CPP Fund.

The total entitlement of up to $334 billion of the fund’s projected assets by 2027 is contained in a report by Lifeworks, a unit of Telus Health, and is based on calculations of what the contributions of Albertans would be worth had the province never joined the national pension scheme, which was launched in the 1960s.

No official timeline has been given by the Alberta government that commissioned the report. However, the province’s finance minister, Nate Horner, said during a Sept. 21 news conference that pension protection legislation will be introduced this fall to ensure Albertans have a say on whether to leave the Canada Pension Plan and to ensure that an Alberta Pension Plan, if pursued, would offer the same or better benefits and the same or lower contribution rates as the existing CPP.

The Lifeworks report concludes that Alberta, as a province with a younger population with higher employment rates and well-paying jobs, has contributed more than its share to the fund and would therefore be responsible for and entitled to a greater portion of the returns.

But Michel Leduc, senior managing director and global head of public affairs at CPP Investments, the pension management organization that invests on behalf of the CPP Fund, said that while he respects the rights of provinces to create their own pension plans, the transfer formula contemplated in the Lifeworks report is “impossible” given the composition of the national pension scheme.

“A province that accounts for only 16 per cent of total contributions can’t legally or realistically be allowed to claim more than half the assets,” Leduc said, adding that if Ontario were to pursue a transfer based on contributions from Canada’s most populous province using the same formula, the entire fund would be drained and remaining provinces would owe money to the two provinces withdrawing.

“If they (Ontario) were to go, there wouldn’t be enough money in the CPP Fund to fulfill Alberta’s claim,” he said.

Leduc added that the lion’s share of the CPP Fund’s total assets of $570 billion at the end of fiscal 2023 came from investment returns, which were only possible because of the national fund’s size and scale.

Given the stakes, it is anticipated that any withdrawal from CPP will be challenged and subject to negotiation, with observers suggesting the matter could go to court. Lifeworks, however, concluded that other provinces don’t have a legal say in whether Alberta withdraws from CPP because, under the federal Canada Pension Plan Act, a province is required only to provide written notice to the government and meet certain conditions. These include providing benefits which are at least as good as the benefits provided by the CPP and assuming all obligations and liabilities for CPP members in the province.

In addition, a replacement provincial pension must be ready to go on its own at the start of the third year after notifying the government of the intention to withdraw from the national pension scheme.

Quebec operates a separate pension plan, but the province never joined the national pension scheme. In addition, Canadians can move between provinces, contribute to both the Quebec Pension Plan and the Canada Pension Plan, and collect harmonized benefits on retirement depending on where they live.

Alberta Premier Danielle Smith, like her predecessor, Jason Kenney, whose government started the ball rolling on the Lifeworks report, has portrayed pulling out of CPP as a way for Alberta to take control of how the money is invested, with an eye to bolstering the province’s oil and gas sector.

Alberta officials have previously suggested the province will not pull out of CPP without taking the views of Albertans into consideration, including a possible referendum on the issue.

Malcolm Hamilton, a pension expert who was instrumental in a 1995 Canadian Institute of Actuaries report that helped lead to legislation in 1998 that increased funding for the Canada Pension Plan, said this is not the first time Alberta has examined the possibility of withdrawing from the CPP and the issue has always been how a separate provincial pension plan would be able to manage the liabilities.

“Who will be responsible for all the pensions owed to retired and working Albertans and former Albertans for contributions they have already made?” Hamilton said, noting that if the CPP fund were to hand over a share of the assets it would also “offload” a big chunk of its obligations.

“You don’t get (or deserve) the assets without accepting the corresponding obligations,” Hamilton said in an email.

Detractors of a go-it-alone Alberta pension plan have also pointed to the hefty administration costs of running such a fund. Alberta officials said during the Sept. 21 news conference that an Alberta Pension Plan (APP) could cost up to $2.2 billion to set up.

Kenney had floated the idea for a standalone Alberta Pension Plan to be managed by Alberta Investment Management Corp. (AIMCo), which already manages $158 billion in pension and endowment assets in the province.

But when Alberta’s withdrawal from the Canada Pension Plan was widely discussed in 2019, Alexander Dyck, a professor of finance and policy at the Rotman School of Management who has researched large pension fund performance, said a large influx of money would be difficult for AIMCo to manage.

“If I give you twice as much money as you had yesterday, you’re not going to be able to deploy that money and mimic the returns that you had yesterday,” he said at the time, adding that investing in private equity, infrastructure and real estate does not necessarily scale as easily as investing in stocks.

Carrie Tate and Alanna Smith of the Globe and Mail also report Premier Danielle Smith to move ahead with plans to leave CPP, set up Alberta pension plan:

Alberta will pursue plans to leave the Canada Pension Plan this fall after the provincial government on Thursday released a report that said it is entitled to over half of the assets in the national program, a proposal that would decimate the country’s retirement safety net.

The province, citing a report it commissioned from Telus Health, said it is entitled to $334-billion from CPP and transferring the assets to Alberta would translate into larger paycheques and retirement benefits for its citizens.

Alberta Premier Danielle Smith has made challenging Ottawa central to her political strategy, often with support from other conservative leaders, such as Saskatchewan Premier Scott Moe and Ontario Premier Doug Ford. But Canada’s other premiers will almost certainly dispute Alberta’s math given that the national system would crumble if CPP transferred over half its assets to the third-most populous province participating in its program.

Ms. Smith, who made a point of not campaigning on the possibility of an Alberta Pension Plan during the election race this spring, touted the benefits of a homegrown retirement program.

“I believe that an Alberta pension plan would be fairer and could make life more affordable for all Albertans. It could bring more benefits for seniors, higher take home pay for workers and strengthen the Alberta advantage to attract business. I believe it’s the right decision for our province,” she said during a press conference on Thursday morning.

Alberta on Thursday said it will introduce legislation this fall that would require a referendum before the province could withdraw assets from the CPP to establish an Alberta equivalent. Ms. Smith said it would guarantee the same or lower contributions and the same or better benefits for seniors, but she did not indicate how the government would underwrite such a pledge.

This fall and into spring, an engagement panel chaired by former provincial treasurer, Jim Dinning, will gather feedback from Albertans which will be compiled into a report. Mr. Dinning, at the press conference, said he views an Alberta pension as a potential “game-changer” for the province’s financial sector.

“I find the idea of an Alberta pension plan an intriguing opportunity for Albertans and I know a decision on a public policy issue of this magnitude should only be made after plenty of rinsing, soaking and discussion and debate among Albertans,” he said.

“A big issue like this never is simple. We expect our conversations will be complex, and at times perhaps a little heated and most assuredly fiery. But people engaged in debate remind all of us how important sound public policy is for our society and for our prosperity.”

The report, first commissioned three years ago under former premier Jason Kenney, calculates employees and employers in Alberta would save $5-billion in the first year alone owing to lower contributions. This, the provincial government said, could be used to increase monthly benefits or provide a “bonus payment” of between $5,000 and $10,000 at retirement.

The report itself highlights how there is room for interpretation when it comes to the rules governing how CPP would be divvied up if a province decided to pull out. The report said a “literal reading of the legislation” would give Alberta an “unrealistically large” asset transfer of $637-billion as of Dec. 31, 2021, which exceeds CPP’s total base assets of $575-billion. The report noted Alberta’s share, under the literal interpretation, would grow to $747-billion by Jan. 1, 2027.

“An alternate and reasonable interpretation is to apply investment returns to the net cash flows of contributions less benefit payments and CPP administration costs,” the report said, indicating that is how it calculated Alberta’s $334-billion slice.

The Alberta Federation of Labour dismissed the United Conservative Party’s plan to pursue an Alberta pension plan.

“It is clear now that the UCP is using the threat of taking Alberta out of CPP as a tool in its ongoing war with the rest of Canada,” Gil McGowan, AFL’s president, said in a statement. “But that’s not what pensions are for – they exist to provide security for Albertans in retirement. Our message is simple: stop playing politics with our pensions and our retirement security.”

Fourth, Don Braid of the Calgary Herald writes Canada Pension Plan says flat 'NO!' to Alberta claim on half of CPP assets:

Without a gun, a mask and a note to the teller, there’s no way one province can demand half the national pension fund and hope to escape with the loot.

The report on an Alberta pension plan says the province is entitled to $334 billion from the Canada Pension Plan. That is 53 per cent of all the funds held by the Canada Pension Plan Investment Board.

The money would simply be transferred to a new Alberta pension authority, at least in the dreams of Premier Danielle Smith and her government.

The flat “no” came quickly from Michel Leduc, senior global communication director for CPP Investments, the governing board.

“We respect the right of Albertans to consider withdrawing from the Canada Pension Plan, however, the amount the report says could be extracted from the CPP is impossible and based on an invented formula.

“References to how much a province might claim from the CPP Fund should be regarded with caution and a high degree of skepticism until many issues are resolved between federal and provincial governments.

“Any idea of a withdrawal from the CPP would be complex, fiercely disputed, involve political posturing and would result in risk for Albertans for years to come. The best way to protect the financial security of Albertans during one of the most vulnerable times of their lives is to preserve a national fund.”

There’s no wiggle room in that statement, no suggestion that maybe we can talk, let’s see a lower offer. And it carries the charge that Alberta’s whole claim is bogus (“based on an invented formula”).

Even though the CPP is an independent entity, you can bet the federal government will back the sentiment. Even a Conservative national government would be unlikely to back this idea as it stands.

The Alberta plan is all preliminary pending a wide consultation possibly ending with a provincial referendum. But Smith is already sold on it — she said so Thursday. Her ideas have a dogged way of moving ahead.

There’s lots of talk in the report about the benefits to Albertans — lower pension premiums, the same or higher benefits at retirement — but scant analysis of what would happen outside Alberta.

And the impact makes this a complete political impossibility for any federal government.

If Alberta by some miracle extracts one-third of a trillion dollars, Canadians elsewhere would have to pay more to sustain their severely truncated pension account.

Smith says that would amount to about $175 per contributor per year. That estimate could well be very low.

Albertans, by contrast, would each pay $1,425 less per year.

In Vancouver or Winnipeg or Toronto, it will be noted that Alberta is roughly 10 per cent of Canada — one of 10 provinces, with just over 10 per cent of the national population.

And now, the province wants 53 per cent of all the national pension money.

The Alberta response is that provincial contributors have historically paid far more into the CPP than any other Canadians. Based on a formula in federal law — now disputed by the CPP board — that can be seen as $334 billion.

Former treasurer Jim Dinning, who will lead the review panel, articulates the key part of the dream. He says a provincial fund of such magnitude would turn Alberta into a genuine financial powerhouse with great capacity to foster growth and attract more capital.

Dinning once opposed the pension idea but now says, “the ability to change your mind shows you have one.”

He also said years ago, referring to a policy matter, “that dog won’t hunt.”

Now, Dinning is going to walk this dog around the province. Albertans may give it a friendly scratch behind the ear, but it’s no hunter.

Lastly, Jack Mintz wrote an op-ed in the National Post stating an Alberta Pension Plan would be entitled to half of CPP assets:

On Thursday the Alberta government plans to release an updated Lifeworks report on the Alberta Pension Plan — Lifeworks being the former Morneau Shepell, now part of Telus Health. The results are dramatic. Assuming the same pension benefits paid to Alberta retirees as under the Canada Pension Plan, Alberta employers, employees and self-employed workers would pay $5 billion less in payroll contributions in the first year.

Commissioned in 2020 by the United Conservative government to explore the feasibility of a provincial plan, the report estimates that APP contribution rates for basic CPP benefits would fall from 9.9 to 5.91 per cent, split between employers and employees. That amounts to yearly savings of $1,425 for each Alberta employer and employee and $2,850 for the self-employed.

The report makes clear that an APP could be a huge win for Alberta, contrary to repeated claims by the NDP in last June’s provincial election. By cutting payroll taxes with no reduction in pension benefits, Alberta could both attract more investment and make life more affordable for working people. What makes all this possible, of course, is Alberta’s favourable age structure, with its younger population and higher employment rate than in the rest of the country. This also translates into a large asset transfer when the APP starts up as explained below.

But that makes the APP a ticking time bomb for the rest of Canada, which is already facing decades of low per capita economic growth even without more growth-killing taxation. Except for Quebec, which already has its own pension plan would therefore be unaffected, Canadians in the other eight provinces would have to pay higher CPP contributions to make up for Alberta’s withdrawal from their national plan. As for Alberta, if leaving the CPP works out well, the province and others may seek further control over their destinies under “Fair Deals,” leaving Ottawa less able to manage federal-provincial relations and thus ultimately undermining Canadian economic prospects further.

The primary source of Alberta’s gain would be a $334-billion asset transfer when the APP takes over CPP liabilities owing to Albertans. Under current CPP rules for a province’s withdrawal, Alberta would be entitled to a net transfer calculated on the assumption it had never joined the CPP, which began in 1966. That amount would equal its past CPP contributions, net of benefits paid to Albertans and administrative costs, plus associated investment returns. Lifeworks figures the total asset transfer due is about half of CPP’s current net assets.

Given Alberta’s younger population, higher income and lower unemployment rates, it is not surprising the province has been a huge net contributor to the CPP for the last 57 years. If anything, Lifeworks takes a conservative approach in assuming Alberta’s age dependency would catch up to the rest of Canada’s, so that by the second half of this century it would have contribution rates roughly similar to the CPP. On the other hand, if Alberta continues with higher incomes, less unemployment and a younger population than the rest of Canada, APP contribution rates would be even lower than those estimated in the report.

But life is uncertain. Investment performance in a turbulent world may be lower in coming decades, or the energy transition may slow Alberta’s growth. Even then, however, Lifeworks estimates the APP contribution rate would remain well below the CPP’s 9.9 per cent — still a good deal.

The release of the Lifeworks report is only the first stage of a process that needs to answer a host of questions. Should the APP be a prudent investor that only maximizes investment returns or should it take a riskier approach and support provincial economic development as Quebec has done, even if this compromises financial performance? Should Alberta choose a single investment manager or several, including Alberta Investment Management and CPP Investments? Should some of the APP surplus be used to raise pension benefits, not just reduce contributions?

The granddaddy of unknowns is the federal reaction to an APP. The federal government could unilaterally change the formula used to determine the $344-billion asset transfer, especially if it has support from provinces unhappy with the prospect of higher CPP payroll taxes. If the split of CPP net assets were based on population rather than the value of past net contributions, Alberta would net about $85 billion to cover liabilities owing to existing retirees. The APP could still be worth it but a major reduction in payroll taxes at the outset would not be feasible.

Ottawa changing the rules of the game would further inflame a province already unhappy with its outsized but unappreciated contribution to the rest of country. Robert Mansell of the School of Policy Studies at the University of Calgary has calculated that the transfer of wealth from Alberta to other provinces from 1960 to 2021 has been $645 billion (in 2021 dollars). By 2027 the cumulative contribution should be close to $750 billion. The APP asset transfer of $344 billion would be a rebate of less than half that.

After eight years of confrontation over energy regulation and climate policies, Ottawa-Alberta relations are at rock bottom. If the Trudeau government wants to avoid the further fracturing of national arrangements like the CPP, it could try reducing tensions rather than stoking them. A good start would be bilateral agreement to negotiate a realistic path to reducing emissions without the unilateral federal regulation that is squandering Canada’s resource wealth despite our allies’ obvious need for secure energy.

For Alberta, the APP is a no-brainer. For the rest of Canada (except Quebec), it will be a headache. As Pierre Trudeau said in 1972, no doubt the universe is unfolding as it should. That doesn’t mean non-Albertans are going to like it.

With all due respect to Jack Mintz, he doesn't have a clue of what he's talking about here and the fact that he supports the creation of the Alberta Pension Plan tells me "Big Oil" is behind this bonehead report.

Now, I have nothing against Alberta's oil industry and agree with Mintz that divesting out of oil & gas is a terrible idea for pension funds, but he clearly doesn't understand the benefits of CPP and why an Alberta Pension Plan (APP) would end up costing Alberta and the rest of Canada a lot more over the long run.

Not to mention, if Alberta exits the CPP, why wouldn't Ontario, British Columbia and other provinces follow?

Hell, why do we live in Canada? Let's break up the country into provinces and territories and call it a day!

In the Fantasy Land Jack Mintz and this report are portraying, exiting out of the CPP would be a huge win for Alberta.

Let's first drop the insane notion that Alberta is entitled to $334 billion of the Canada Pension Plan assets, or 53% of its assets.

This claim is beyond ridiculous and the feds and other provinces will never let it happen.

Second, let's say Alberta walks away with $85 billion, who will be administering this new plan and what are the costs over the long run?

Jack Mintz omits that part in his heavily biased analysis but let me tell you firsthand, the Quebec Pension Plan which was created years ago has cost Quebecers in terms of administration.

In terms of asset management, the Alberta Investment Management Corporation (AIMCo) will be in charge of managing the assets, just like CDPQ is in charge of managing the assets of the Quebec Pension Plan.

But there too there is a cost because CPP Investments is the largest, most sophisticated pension fund in the country and neither AIMCo nor CDPQ nor anyone else will match its results over the long run.

Don't get me wrong, they're run well and are great asset managers but if I had a choice, hands down I'd want CPP Investments to be managing my retirement money (I live in Quebec, no choice, CDPQ is managing my retirement security and I'm fine with it even if it's not my first choice).

My message to young Albertans who have the most to lose if this bonehead report actually convinces Albertans to walk away from the CPP is don't fall for the messaging here, it's total nonsense!

Young Albertans paying into enhanced CPP are way, WAY better off with the Canada Pension Plan and having CPP Investments manage their federal retirement security.

I do not know what Danielle Smith, Jack Mintz and others are smoking, but I am a real pension expert and I'm telling you an Alberta Pension Plan is the dumbest idea ever.

And I am a conservative in my political views, but I realize just like I detest the Trudeau Liberals, I detest some conservatives in this country even more.

Wake the hell up! If you really care about this country, focus on jobs, healthcare and education, focus on adopting the right long-term policies that will benefit future generations of Canadians.

This Alberta Pension Plan report is just plain silly and the political and corporate hacks behind it should be ashamed for peddling this nonsense to Albertans.

Alright, if I sound irritated, it's because I spent two hours doing a hip, SI joint and lumbar MRI at a private clinic which costed me $1500 dollars.

Yes, healthcare is free, but I don't have six months to wait to get an appointment for three different MRIs so I paid and did it all in one shot (holding still in an MRI machine for over two hours which is no picnic).

Next up, I'll pay my physiatrist to see me as soon as possible in his private clinic to do a cortisone shot in my left SI joint which is acting up recently and causing me severe pain (rest of my back is fine after decompression surgery in late April).

I'm not impressed with our leaders in Canada, really not impressed.

We get what we deserve but I wish competent leaders were running because we Canadians are getting the short end of the stick here.

And that unfortunately crosses all political divides.

Below, Premier Danielle Smith and President of Treasury Board and Minister of Finance Nate Horner released an independent report on a potential Alberta Pension Plan. Learn more at: https://www.albertapensionplan.ca/.

Everything Premier Smith is peddling here is total nonsense, I was shocked that her speech wasn't properly vetted before she stated these silly claims.

I seriously doubt Albertans will be bamboozled into voting for the Alberta Pension Plan because if they do, they will end up regretting it and weaken the retirement security of the entire country in the process.

That's not good for Alberta and definitely not good for Canada.

Comments

Post a Comment