Rising Macro Risks Means Fed Will Pause But Risk Assets are Cooked

Stocks rose slightly on Friday but logged a losing week amid renewed worries that the Federal Reserve may raise rates more than previously expected.

The S&P 500 edged up 0.14% to snap a three-day losing streak and finish at 4,457.49. The Dow Jones Industrial Average added 75.86 points, or 0.22%, to close at 34,576.59, while the Nasdaq Composite eked out a 0.09% gain to settle at 13,761.53.

Major averages also capped off a losing week. The S&P and Nasdaq dropped 1.3% and 1.9%, respectively, for their first negative week in three. The Dow finished about 0.8% lower.

Energy stocks rose Friday as oil prices continued their recent rise. The S&P sector increased 1% and posted a 1.4% weekly gain. Major winners included Marathon Petroleum and Phillips 66, both up about 3%. Valero Energy jumped 4%.

Some technology stocks that have struggled in recent sessions found their footing. After two straight losing days, Apple inched up 0.4%. Microsoft and Salesforce rose about 1%. Other names, including Nvidia and Tesla, fell more than 1%. Block shed 5.3% as the payments company grappled with a systems outage.

Investors may have found some comfort in the lack of bad news during Friday’s session following a string of stronger-than-expected economic data points earlier in the week, said Bryce Doty, a senior vice president and portfolio manager at Sit Investment Associates.

“When you think of the economy, it’s a Catch-22 for investors,” he said. “If it looks like we’re going to avoid the hard landing, we get some good economic news, and there’s a sigh of relief quickly followed up by an increased expectation of Fed rate increases.”

Recent economic data, including lower-than-expected initial jobless claims, have reignited rate hike fears and concerns that the Federal Reserve may have more work ahead. As of Friday, traders are pricing in greater than 4 in 10 chances of an increase in November after an anticipated pause in September, according to CME Group’s Fed Watch tool.

These factors, along with signs that companies are faring decently despite rising interest rates, are contributing to the current “tug-of-war” of choppiness in markets, said Yung-Yu Ma, the chief investment strategist at BMO Wealth Management.

“Right now, we’re in that strange phase where good news can be bad news, but I don’t think that lasts too long,” he said, adding that softening consumer spending could flip that narrative. “We’re just not there yet.”

Elsewhere, investors pored over the latest batch of corporate earnings reports. E-signature stock DocuSign lost 3.7% even after the company topped fiscal second-quarter estimates and posted rosy third-quarter guidance. RH dropped 15.6% on soft third-quarter guidance. Both companies reported late Thursday.

And Rich Asplund of Barchart reports stocks post modest gains on hopes for a Fed pause:

The S&P 500 Index ($SPX) (SPY) Friday closed up +0.14%, the Dow Jones Industrials Index ($DOWI) (DIA) closed up +0.22%, and the Nasdaq 100 Index ($IUXX) (QQQ) closed up +0.14%.

Stocks on Friday closed slightly higher. Friday’s strength in crude oil prices boosted energy stocks and the broader market. Stocks also garnered support as expectations improved for a pause in Fed rate hikes on comments late Thursday night from Dallas Fed President Logan, who said, "Another skip in raising interest rates could be appropriate when the FOMC meets later this month.” Stock indexes fell back from their best levels Friday afternoon when T-note yields moved higher after being lower for most of the session.

Friday’s U.S. economic news was negative for stocks after July consumer credit rose +$10.399 billion, weaker than expectations of +$16.000 billion.

Stocks have some negative carryover from a slide in Asian stock markets on Friday. Technology stocks were under early pressure on concern China’s ban on Apple’s iPhones could impact other technology companies that rely on sales and production in China.

A draft from the leaders of G-20 countries meeting in India this weekend warns that “cascading crises” have posed challenges to long-term economic growth and call for coordinated macroeconomic policies to support the world economy. Also, global economic growth is uneven and below the long-term average as uncertainty on the economic outlook remains high, and the balance of risks is tilted to the downside.

The markets are discounting the odds at 7% for a +25 bp rate hike at the September 20 FOMC meeting and 48% for that +25 bp rate hike at the November 1 FOMC meeting.

Global bond yields on Friday were mixed. The 10-year T-note yield rose +1.2 bp to 4.256%. The 10-year German bund yield fell -0.4 bp to 2.610%. The 10-year UK gilt yield fell -3.0 bp to 4.423%.

Overseas stock markets Friday settled mixed. The Euro Stoxx 50 closed up +0.38%. China’s Shanghai Composite Index closed down -0.18%. Japan’s Nikkei Stock Index closed down -1.16%.

Today’s stock movers…

Strength in crude prices Friday lifted energy stocks. Valero Energy (VLO) closed up more than +4%. Also, Philips 66 (PSX), Marathon Petroleum (MPC), and Marathon Oil (MRO) closed up more than +2%. In addition, Hess Corp (HES), Exxon Mobil (XOM), and Occidental Petroleum (OXY) closed up more than +1%.

Regional bank stocks moved higher and lent support to the overall market. Lincoln National (LNC), KeyCorp (KEY), and Zions Bancorp (ZION) closed up more than +3%. Also, Comerica (CMA) and M&T Bank (MTB) closed up more than +2%. In addition, Huntington Bancshares (HBAN), Citizens Financial Group (CFG), Truist Financial (TFC), Northern Trust (NTRS), and US Bancorp (USB) closed up more than +1%.

Kroger (KR) closed up more than +3% after it announced it would sell 413 stores to C&S Wholesale Grocers in a bid to help win antitrust approval for its $24.6 billion deal to merge with Albertsons.

Gilead Sciences (GILD) closed up more than +2% after Bank of America Global Research upgraded the stock to buy from neutral with a price target of $95.

Smith & Wesson Brands (SWBI) closed up more than +10% after reporting Q1 net sales of $114.2 million, stronger than the consensus of $100.8 million.

Smartsheet (SMAR) closed up more than +6% after reporting Q2 adjusted EPS of 16 cents, double the consensus of 8 cents, and raising its 2024 EPS forecast to 53 cents-57 cents from a prior estimate of 37 cents-44 cents, stronger than the consensus of 42 cents.

Snowflake (SNOW) closed up more than +3% after D.A. Davidson initiated coverage of the stock with a recommendation of buy with a price target of $200.

Westrock (WRK) closed up more than +4% and extended Thursday’s +3% advance after the Wall Street Journal reported the company is nearing a deal to merge with Smurfit Kappa.

Insulet (PODD) closed down more than -4% Friday to lead losers in the S&P 500, adding to Thursday’s -7% plunge after a New England Journal of Medicine article said the use of semaglutides shots like Ozempic and Wegovy in patients with type 1 diabetes reduces the need for insulin injections.

Boeing (BA) closed down more than -2% to lead losers in the Dow Jones Industrials after it warned that deliveries of its 737 jetliner will come in at the low end of its targeted range this year due to recently discovered manufacturing defects.

Lab tool makers exposed to China retreated on concerns about the impact of China’s anti-corruption crackdown in the healthcare sector. As a result, Revvity (RVTY) closed down more than -3%. Also, Bio-Techne (TECH), Danaher (DHR), Bio-Rad Laboratories (BIO), Thermo Fisher Scientific (TMO), and Waters Corp (WAT) closed down more than -2%.

RH (RH) closed down more than -15% after forecasting Q3 revenue of $740 million-$760 million, weaker than the consensus of $774 million.

Hudson Pacific Properties (HPP) closed down more than -2% after it suspended its quarterly dividend on its common stock, citing current market conditions.

Essex Property Trust (ESS) closed down more than -2% after Citigroup downgraded the stock to neutral from buy.

PDD Holdings (PDD) closed down more than -1% after Grizzly Research said PDD is a dying fraudulent company and its shopping app TEMU is cleverly hidden spyware that poses an urgent security threat to U.S. national interests.

Across the markets…

December 10-year T-notes (ZNZ23) on Friday closed down -2 ticks, and the 10-year T-note yield rose +1.2 bp to 4.256%. Dec T-notes Friday gave up an early advance and closed slightly lower. An increase in inflation expectations weighed on T-note prices after the 10-year inflation breakeven rate rose to a 2-week high Friday at 2.339%. T-note priced Friday initially moved higher on comments from Dallas Fed President Logan late Thursday night that bolstered expectations for a pause in Fed rate hikes when she said, "Another skip in raising interest rates could be appropriate when the FOMC meets later this month.”

It's Friday, it was another choppy week in markets and people are starting to get nervous about the lagged effects of rate hikes.

As I stated last Friday, the US slowdown has begun and risk assets are vulnerable as recession clouds gather.

And let there be no mistake, a hard landing awaits the US economy, it will be a deep and prolonged recession and this time isn't different.

100 percent accuracy rate to predict each recession in last 80 years 👇 Did someone say higher for longer? pic.twitter.com/HNpvbALo7N

— Michael A. Arouet (@MichaelAArouet) September 8, 2023

Every time this metric spiked, it led to a recession

— Game of Trades (@GameofTrades_) September 8, 2023

Permanent job losses have been accelerating rapidly pic.twitter.com/lGorDvfiuU

Mortgage demand has fallen to Dec 1996 levels

— Game of Trades (@GameofTrades_) September 8, 2023

With mortgage rates skyrocketing

And the Fed still keeping rates high

The housing market is in a tough spot pic.twitter.com/xMkvpihWOJ

BREAKING: Mortgage demand falls 28% over the last year to its lowest since 1996, according to CNBC.

— The Kobeissi Letter (@KobeissiLetter) September 7, 2023

Meanwhile, refinance applications are down 30% over the last year.

90% of mortgage rates are currently at 5% or lower.

Why sell your home if your mortgage rate will skyrocket?

Will it be really different this time? pic.twitter.com/HRFUwxpty6

— Michael A. Arouet (@MichaelAArouet) September 8, 2023

Question, what did 2001, 2008, 2020 and 2023 have in common? pic.twitter.com/Cm1AzRJDOc

— Michael A. Arouet (@MichaelAArouet) September 7, 2023

Meanwhile oil prices keep climbing and the US faces its lowest total crude inventories in 38 years:

Is Crude Oil on its way to $100+ per barrel?https://t.co/POYMN39MDE

— Barchart News (@BarchartNews) September 8, 2023

The U.S. is facing its lowest total crude inventories in 38 years via data from Bloomberg and ZeroHedge pic.twitter.com/HtEmtmaYv8

— Barchart (@Barchart) September 8, 2023

The US Strategic Petroleum Reserves (SPR) now stand at their lowest since 1983.

— The Kobeissi Letter (@KobeissiLetter) September 8, 2023

However, the SPR now holds just 46 days of supply, by far the lowest on record.

In May 2020, before the SPR depletion began, it held a record 92 days of supply.

The historical average is 65 days of… pic.twitter.com/9YF4So3igb

As far as risk assets, if you're paying close attention, macro risks are flashing yellow all over:

The ratio of Mega Cap Tech Stocks to Small Caps is at a level not seen since the peak of the Dot Com bubble pic.twitter.com/6MKYCeb2Zo

— Barchart (@Barchart) September 6, 2023

U.S. Dollar Index $DXY 🇺🇸 will put in its 8th consecutive green week, its longest winning streak in 9 years! How about those BRICS? pic.twitter.com/yeghowO76h

— Barchart (@Barchart) September 8, 2023

BREAKING: The Chinese Yuan

— Barchart (@Barchart) September 8, 2023

Chinese Yuan falls to ANOTHER 16-year low against the U.S. Dollar. Complete collapse mode! pic.twitter.com/CgA6IDg0YE

The Japanese Yen may fall to 170 per U.S. Dollar, warns Suntory CEO Takeshi Niinami. Would the BOJ allow the yen to fall that low? pic.twitter.com/qTebNHzGyc

— Barchart (@Barchart) September 8, 2023

Given the heightened risks of a macro event, even if CPI inflation comes in stronger than expected this week, I still see the Fed pausing later this month.

This week, the Bank of Canada hit the pause button:

Canada’s cooling economy prompted country’s central bank to hold interest rates at five per cent this week, and economists say rate cuts could be possible in first few months of 2024. https://t.co/wTdD1qgPAG

— BNN Bloomberg (@BNNBloomberg) September 7, 2023

It is my contention that all major central banks now want to wait before doing anything because the lagged effects of all those rate hikes are starting to kick in.

No doubt, rising oil prices are not going to help bring inflation down but I think they will all hit the pause button and wait to see what happens next.

If signs of a recession gain momentum, they will wait longer but there are risks to pausing, especially if wage inflation picks up forcing the Fed to resume rate hikes down the road.

One thing I can tell you, if the Fed pauses, stocks might still creep up but if it cuts, watch out below:

If the Fed cuts rates next year, is that a good thing? pic.twitter.com/hpOqTPoNhE

— Jeff Weniger (@JeffWeniger) September 7, 2023

Jeremy Grantham sounds the alarm on stocks, recession, inflation, and interest rates in a new interview. Here are his 8 best quotes. https://t.co/Z8rUn4mVZ4 via @YahooFinance

— Leo Kolivakis (@PensionPulse) September 7, 2023

This ratio hit levels comparable to the Dot Com bubble

— Game of Trades (@GameofTrades_) September 5, 2023

We all know how it ended back then… pic.twitter.com/gb9Uzm7MPj

Nvidia is a stock bubble and its popping could trigger a broader market crash, investing legend Rob Arnott says https://t.co/vX6ACcjGDw

— Leo Kolivakis (@PensionPulse) September 7, 2023

Hedge Fund investor Dan Niles says Apple $AAPL is his single largest short position pic.twitter.com/TERXiXjd1d

— Barchart (@Barchart) September 8, 2023

Howard Marks warns more companies will default as they feel the full force of the Fed's inflation fight https://t.co/CzDX0tigfU via @YahooFinance

— Leo Kolivakis (@PensionPulse) September 7, 2023

In any case, I expect the magnificent rotation out of mega cap tech stocks to continue but I do worry about a credit event blowing up the market as rates creep higher and stay higher for longer:

Usage of the Fed's emergency bank funding facility jumped by $328 million last week.

— The Kobeissi Letter (@KobeissiLetter) September 8, 2023

It now stands at a new record high of $108 billion, even as the regional bank crisis is "over."

The current rate banks are paying the Fed on these loans?

An alarming ~5.5%.

The banks that… pic.twitter.com/6lWAavqC1b

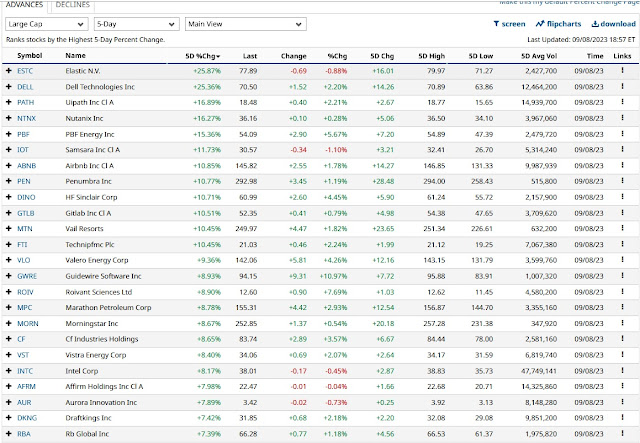

Alright, let me wrap it up with this week's US large cap gainers and decliners (full list available here):

Below, the slow-moving influence of rising interest rates will end up torpedoing the economy, dashing Federal Reserve expectations that a recession can be avoided, according to renowned Wall Street curmudgeon Jeremy Grantham. This interview for "Bloomberg Wealth with David Rubenstein" was recorded August 17th in Boston.

Next, Leon Cooperman, Omega Family Office chairman and CEO, joins 'Squawk Box' to discuss the S&P's performance in the last year, his thoughts on an upcoming recession, and how the major averages perform in the year's second half.

Third, Jonathan Krinsky, BTIG chief market technician, joins 'Halftime Report' to explain why he believes a significant market downside will be ahead.

Lastly, Bryn Talkington, Steve Weiss, Shannon Saccocia and Jason Snipe join 'Halftime Report' to discuss the seasonally weak month of September and the Fed's next move.

Comments

Post a Comment