BCI, CPPIB, IMCO and PSP Join ESG Data Convergence Project

More than 100 global institutional investors and asset managers are committing to a project that seeks to standardize environmental, social and governance metrics to provide a mechanism for comparative reporting in the private equity industry.

The ESG Data Convergence Project, which was launched in September 2021, now includes commitments from the British Columbia Investment Management Corp., the California Public Employees’ Retirement System, the Canada Pension Plan Investment Board, the Investment Management Corp. of Ontario, the Public Sector Pension Investment Board, the San Francisco Employees’ Retirement System and the Universities Superannuation Scheme.

The collaboration now represents US$8.7 trillion in assets under management and more than 1,400 underlying portfolio companies. The group is working to streamline the industry’s historically fragmented approach to collecting and reporting ESG data, enabling greater transparency and more comparable portfolio information, according to a press release.

In spring 2022, the project’s inaugural data will be aggregated into a benchmark by the Boston Consulting Group. The initial data will cover six categories: greenhouse gas emissions, renewable energy, board diversity, work-related injuries, net new hires and employee engagement.

The press release noted the group will meet annually to review and assess the previous year’s data and to build upon and add to the initial metrics. As part of these efforts, the group is also working to expand more broadly in private markets to include asset classes such as private credit.

I've already discussed CalPERS and Carlyle's ESG Data Convergence Project, an attempt to measure environmental, social, and governance (ESG) milestones within private equity here.

Reuters first reported on this project in late September here and the original press release was also released at that time:

Leading global general partners (GPs) and limited partners (LPs) today announced the creation of the ESG Data Convergence Project to advance an initial standardized set of ESG metrics and mechanism for comparative reporting.

The California Public Employees’ Retirement System (CalPERS) and global investment firm Carlyle (NASDAQ: CG) led the collaboration which includes GPs and LPs representing more than $4 trillion in AUM. The group includes LPs: AlpInvest Partners, APG, CalPERS, CPP Investments, Employees’ Retirement System of Rhode Island, PGGM, PSP Investments, The Pictet Group, Wellcome Trust; and GPs: Blackstone, Bridgepoint Group Plc, Carlyle, CVC, EQT AB, Permira, and TowerBrook.

The group’s objective is to streamline the private equity industry’s historically fragmented approach to collecting and reporting ESG data in order to create a critical mass of material, performance-based, comparable ESG data from portfolio companies. This will allow GPs and portfolio companies to benchmark their current position and accelerate progress toward ESG improvements, which the group believes drives better financial outcomes. This will also enable greater transparency and provide more comparable portfolio information for LPs.

GPs will track and report six metrics from their underlying portfolio companies, beginning with calendar year 2021. The data will be shared directly with invested LPs by GPs and aggregated into an anonymized benchmark by Boston Consulting Group (BCG) for this first cycle. The initial six metrics are: Scopes 1 and 2 greenhouse gas emissions, renewable energy, board diversity, work-related injuries, net new hires, and employee engagement.

The group plans to meet annually to assess the prior year’s data, and to refine and build on these initial metrics, prioritizing materiality. This collaboration is intended to be a long-term mechanism to increase the quality, availability, and comparability of ESG data in private markets.

Marcie Frost, CalPERS CEO, said, “Sustainability is a cornerstone of the CalPERS investment program. And yet, we have found it challenging to effectively measure impact in our private equity portfolio because of the multitude of frameworks and definitions used by GPs and LPs. This initiative simplifies sustainability reporting by using comparable metrics which allow us to gain insight into the investment risks and opportunities in our private markets portfolio. Managing these risks and opportunities is essential to fulfilling our fiduciary duty to provide retirement security to our 2 million members. Collaboration between the GP and LP community is the foundation, and we look forward to building out this important work.”

Peter Branner, Chief Investment Officer at APG Asset Management, said, “On behalf of clients, APG has long been driving ESG transparency in private equity as a way to secure accountability for responsible investment performance in the asset class. Through this collaboration, we expect to push towards comparable ESG performance measurement and wider adoption of ESG as an integrated objective of PE investments. APG will use the metrics in its engagement with managers. While APG's ambition goes beyond the six metrics identified by the ESG Data Convergence Project, we are excited by the momentum generated, with data collection by PE managers already underway.“

Eric-Jan Vink, Head of Private Equity at PGGM, said, “Since 2020, PGGM has actively collected portfolio company GHG emissions data, enabling us to report Scope 1 emissions data on 27% of the companies in our private equity portfolio. By supporting the ESG Data Convergence Project, we are committed to achieving full ESG transparency. The current set of six metrics is a great starting point, and we expect more as the field develops. In Europe, we see that additional ESG disclosures are required under the Sustainable Finance Disclosure Regulation already. PGGM, as a member of the ESG Metrics Steering Group, will play a role in driving the private equity market towards making more and better ESG disclosures.”

Steve Nelson, ILPA CEO, said, “ESG has become a core consideration for many LPs when evaluating private market commitments both because of the need to align organizational priorities and from an investment resiliency and return perspective, but to date LPs have lacked a standard set of metrics for assessing their ESG objectives. ILPA believes such convergence is a necessary ingredient for industry-wide progress and supports initiatives aimed at streamlining existing frameworks that are fit-for-purpose and flexible enough to adapt as the market and investor needs evolve. In service of these objectives, we are proud to include these resources as a part of our ESG Roadmap, which is comprised of a variety of helpful ESG-related resources for the private equity industry."

The partnership is open to any GPs and LPs that wish to join and agree to support the principles of the work. The effort encourages private equity industry stakeholders to work together to gather better, decision-useful ESG data in order to generate deeper insight into ESG factors and their relationship to financial outcomes, and, ultimately, to drive greater progress on critical ESG issues.

So, it's important to note CPP Investments and PSP Investments were part of the founding members of this project, which doesn't come out clearly in the Benefits Canada article (I thank CPP Investments' Frank Switzer for clearing that up for me).

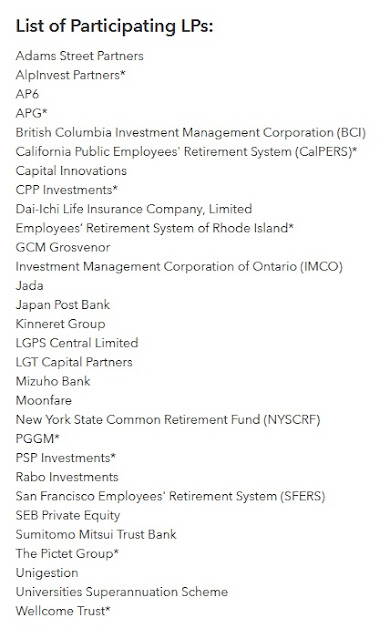

Anyway, as shown here, the list of participating limited partners (LPs) is growing:

Now, I'm not sure why AIMCo, CDPQ, OTPP, OMERS, HOOPP, OPTrust and other large Canadian pensions haven't joined yet but I suspect it's only a matter of time.

Importantly, as assets shift more into private markets, there needs to be some standardization of ESG data in private equity,

Recall, despite what some critics think, Canada's large pensions are among the most responsible asset allocators in the world.

In order to solidify their leadership in responsible investing, they need to take initiative and make sure they're ahead of the curve when it comes to measuring ESG data in private equity.

This is why I support this project and recommend all LPs and GPs join to work toward a common goal of standardizing ESG data in private equity.

In related news, Matt O'Grady of BC Business reports institutional investors—including B.C. players—put sustainability at the fore of financial decision-making:

British Columbia Investment Management Corp. has made environmental, social and governance issues a priority, with an emphasis on climate-conscious investment tools

Going into the UN Climate Change Conference in Glasgow this November (also known as COP 26), there were high expectations about what the world’s leading economies could accomplish. First and foremost, countries were asked to come prepared with “ambitious 2030 emissions reductions targets”—with the goal of getting to net-zero emissions by mid-century, and thus keeping global temperature rises to under 1.5 C. After one of the wildest weather years on record—including a heat dome that brought unprecedented temperatures and death to the Pacific Northwest—the call for climate action grew even louder.

But high on the list of the Glasgow goals—third of four listed priorities—was the need to mobilize “at least $100 billion in climate finance” each year, both in public finance (to develop greener infrastructure) and private finance (to fund green technology and innovation). “To achieve our climate goals,” said the conference organizers, “every company, every financial firm, every bank, insurer and investor will need to change.”

The push to hit that target is being felt across the financial industry and in all corners of the world. British Columbia Investment Management Corp. (BCI), based in Victoria, is the provider of investment management services for B.C.’s public sector and one of the largest asset managers in Canada, with about $200 billion under its care. Like a lot of institutional investors, it has made ESG (environmental, social and governance issues)—and, particularly, climate-conscious investment tools—a priority in recent years.

“When I first started at BCI 10 years ago, we were largely a manager of managers,” says Jennifer Coulson, senior managing director of ESG. “We had retained our proxy voting rights, we did engagement, but in terms of integrating ESG into actual investment processes? There just wasn’t that opportunity when you’re relying on external managers.” In 2014, the organization decided to become an active asset manager and develop a specific ESG strategy—engaging with the companies it invests in to achieve more sustainable results.

One of the ways BCI has done this is by purchasing so-called green bonds. In February, the asset manager announced its commitment to buy $5 billion in sustainability bonds (based on initial participation values) by 2025, with the funds raised specifically earmarked for environmentally sound projects. BCI has also become involved in a global initiative called Climate Action 100+—an investor-led engagement project that brings together 545 signatories in 32 countries to ensure the world’s largest greenhouse gas emitters are taking action on climate change.

As one of those signatories, BCI leads or co-leads engagement with four North American companies, including Vancouver-based mining giant Teck Resources. “They’re very constructive conversations,” Coulson says. “We’re not interested in making demands and pounding our fists on the table. We all need to play our part.”

One climate action strategy that BCI has not pursued is divesting from fossil fuels—which has become popular with some large institutional investors, including the Caisse de dépôt et placement du Québec. “We’re very public about the fact that we don’t believe that divestment actually is going to make an impact,” Coulson says. “It’s not a great way to manage risk in a portfolio—but also, it doesn’t actually impact greenhouse gas emissions, if that’s your ultimate goal. We can sell a company, but somebody else is going to buy it.”

For Coulson, who first pursued environmental studies (at Western University) in the early 1990s, it’s been a transformative three decades in the ESG space. She’s seen many UN Conferences come and go, and governance fads fade into the distance. But she’s optimistic about where things are heading in 2022.

“When I first started, ESG was not an acronym that we even used. It was very challenging to get executives’ attention,” she says. Now, with capital flowing into ESG funds and ESG issues being raised in mainstream earnings calls, the field is suddenly on everyone’s radar. “And hopefully, that change will lead to climate action.”

Global Financiers Unite!

Bringing together 250+ financial firms responsible for $88 trillion+ in assets, the Glasgow Financial Alliance for Net Zero (GFANZ) aims to accelerate the transition to net-zero emissions by 2050

The world will need significant infrastructure investment over the next 15 years—about $90 trillion by 2030, according to 2019 data from the World Bank

But shifting to a green economy can unlock new economic opportunities and jobs, the World Bank found. On average, a $1 investment yields $4 in benefits

Compared with business as usual, bold climate action could yield a direct economic gain of $26 trillion through 2030, the New Climate Economy report conservatively estimated in 2018

Source: United Nations. All dollar figures in USD

What else? Today, CPP Investments put out a report on social licence and the infrastructure investor:

Perhaps no asset class exemplifies what it means to be a long-term investor as well as infrastructure. Investing in companies that operate and maintain infrastructure provides institutional investors with indirect access to income from an asset that can be in place for decades.

Operators of and investors in infrastructure assets depend on social licence to create and maintain conducive operating environments.

At CPP Investments, part of maximizing investment returns and fulfilling our mandate is ensuring, through our engagement, voting and capital allocation decisions, that operators and management are appropriately prioritizing their social licence.

We strive to be an expert long-term capital partner in our infrastructure investments, which now span five continents. Expert long-term capital partners bring more than just funds to a partnership. They bring experience, greater understanding of factors, including environmental, social and governance issues, and a sense of purpose.

Alongside our partners, we work to ensure our investments provide an excellent and safe service, bolstering their social licence. In this way, we obtain and sustain local support to earn a reasonable return far into the future, adding resilience to our overall portfolio while creating value in the communities we operate in worldwide.

I recommend you take the time to read this report here.

Below, professor Ioannis Ioannou of London Business School discusses ESG and impact investing in private equity.

I also embedded a webinar which included an overview of the emerging trends, global reporting frameworks (GRI, SASB, SDGs, TCFD, CDP), and the key elements of a good report and is suitable if your company is considering reporting non-financial information.

Lastly, a Reuters webinar featuring leading experts discussing ESG standards and frameworks.

Update: On February 7th, University Pension Plan Ontario (UPP) announced it was joining the ESG Data Convergence Project.

Comments

Post a Comment