CAAT Pension's CEO on Saving Canada's Retirement System

The CAAT Pension Plan continues to enhance workplace pensions in Canada with a Modern defined benefit (DB) plan design that adapts to a variety of workplace needs. Its most recent innovation, DBplus with Contribution Choice launches January 1, 2022. In addition to filling the need for a simple, value-driven workplace pension plan that improves attraction, retention, and lowers stress, Contribution Choice responds to industry requests for additional contribution flexibility — typically only available in defined contribution (DC) or group RRSP programs.

In 2019, CAAT’s DBplus revolutionized the workplace retirement space in Canada by bringing the best of DB and DC together. The award winning DBplus provides lifetime retirement income to members at a fixed and affordable cost for employers. Like DC or group RRSPs, there are no balance sheet risks and employers are only responsible for making their required contributions.

Contribution Choice provides even more options to employers and employees. Employers select the fixed contribution rates, and associated employer match, that they want to offer (subject to certain limitations). Employees choose which of those rates meets their changing needs and financial goals.

Organizations can seamlessly transition to an efficient, low-risk Modern DB pension plan. The Contribution Choice enhancement further supports pension uptake among members, while delivering the recruitment, engagement, and competitive advantages that employers value.

The new features continue to enhance the flexibility of DBplus that is common to DC plans and group RRSPs, while providing the stable benefit security of a Modern DB plan. DBplus with Contribution Choice joins a suite of tailored solutions offered by the CAAT Pension Plan to accommodate a wider range of culture, change management and labour needs, including rate differentiation by employee class and easy transitions from their current arrangements.

The Plan is open to all sectors and equipped to accommodate workplaces of all types, including those that currently offer DB plans, DC plans, group RRSPs, or no workplace retirement savings plans at all. CAAT encourages employers and union representatives to contact the CAAT team for a tailored pension solution that meets their objectives.

Since its launch in 2019, DBplus now has over 200 participating employers. CAAT has members across Canada from 11 industries and has support and participation from 16 unions and member associations. Notable employers include Brink's Canada, Sanofi Pasteur, Greater Toronto Airport Authority, Conference Board of Canada, United Way of Greater Toronto and Lawyers Financial.

DBplus with Contribution Choice will be available to Canadian employers on January 1, 2022.

Quotes:

“Our aim is to provide pension solutions that meet the dynamic needs of Canadian workplaces, and the peace of mind from having dependable, lifetime income in retirement. Employees overwhelmingly want secure predictable lifetime retirement income that comes from a leading not-for-profit pension leader. With the race for talent gaining momentum, CAAT ensures that a no risk Modern DB plan is a great option for employers, regardless of previous pension arrangements, type of industry, size, or sector. Contribution Choice is one of many ways CAAT plans to adapt to what Canadians need from their pension to hold strong to being “Canada’s Workplace Pension of Choice.”

- Derek W. Dobson, CEO, CAAT Pension Plan

About CAAT Pension Plan:

Established in 1967, the CAAT Pension Plan is an independent, jointly governed plan that offers two designs of a defined benefit pension. CAAT's award-winning DBplus plan is leading an extraordinary pace of growth for the Plan. Originally created to support the Ontario college system, the CAAT Plan now proudly serves more than 200 participating employers from various sectors including the for-profit, nonprofit, and broader public sectors. Currently, it has over 74,000 active and retired members. The CAAT Plan is respected for its pension and investment management expertise and focus on stability and benefit security. At January 1, 2021, the Plan was 119% funded on a going-concern basis. Learn more at: www.caatpension.ca.

About DBplus with Contribution Choice

- CAAT continues to evolve the pension landscape and provide innovative solutions by offering DBplus with Contribution Choice.

- DBplus with Contribution Choice combines the flexible contribution rates common to DC plans and group RRSPs with the advantages and security of a DB plan.

- CAAT’s growth and innovation benefits all Canadians and is another way CAAT adds value and furthers benefit security for its current and future members.

CAAT Pension Plan is in the pension solutions business and DBplus with Contribution Choice is just their latest offering making it that much easier for employers to offer their employees safe, secure and affordable retirement income for life.

Late last week, I had a chance to talk to Derek Dobson, CAAT Pension Plan's CEO and Plan Manager.

Let me first thank him for taking some time to talk with me and also thank Vicki Lam, Senior Communications Advisor, for setting up the call and sending me material to review.

Derek began by telling me the CAAT Pension Plan just had "one of its best years ever in 2021" and that it still ranks #1 in a BNY Mellon trust universe of plans in terms of 5 and 10-year returns (the official results aren't out yet).

More importantly, he shared that the "funding ratio has gone up 40% in the last 11 years," a true measure of a plan's success and long-term sustainability.

The CAAT Pension Plan stands 119% funded on a going-concern basis, with a funding reserve of $3.3 billion, based on its latest actuarial valuation as at January 1, 2021. A new valuation is underway to account for the Plan’s 2021 performance and will be published on CAAT’s website in spring.

They continue to lower the discount rate -- it now stands at 4.95% -- and bolster the plan for a few reasons:

- Provides an extra cushion to mitigate against bad investment outcomes

- Makes the plan more sustainable over the long run by providing a cushion from demographic changes

The one thing about Derek, he's a pension expert and just like Dani Goraichy, Chief Risk Officer and Senior Vice President, Actuarial Services and Plan Policy at OPTrust, he really understands plan design extremely well.

And along with Dani, Peter Lindley, CEO of OPTrust and others, Derek is very passionate about reducing barriers to retirement savings and security that many Canadians face using a hybrid DB-DC model which is affordable and makes long term economic sense.

We obviously talked about DBplus with Contribution Choice.

Basically, the way I understand it is DBplus with Contribution Choice appeals to larger employers who want more flexibility when it comes to how much they and their employees contribute to their plan.

"With the cost of real estate and other expenses going up, some of the larger employers wanted more flexibility so we are offering it to them."

Employers can learn more about CAAT Pension Plan's flexible and tailored solutions here and more about DBplus with Contribution Choice here.

Below, I provide two examples on DBplus with Contribution Choice from CAAT's website:

Example 1:

Example 2:

Again, the name of the game is offering more flexibility but if you ask my professional opinion, employers and employees are better off just sticking with DBplus for everyone but I get it, larger companies are more complex and need the added flexibility.

The more important case Derek made in our discussion is this is a "win, win, win" for employees, employers and the country.

He cited the HOOPP/ Common Wealth survey showing why retirement plans are good for business.

"There is strong evidence linking retirement security to improved talent attraction and retention and great employee productivity through reduced financial stress."

Here I got a sense of how passionately he believes in offering all employees a secure retirement income for life.

"When you have health or other problems, financial insecurity only magnifies those problems. Here is where we can make a real difference by getting the word out that there is a low cost way of offering your employees a safe, affordable and secure retirement income stream for life."

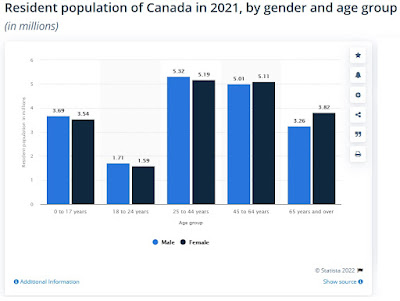

Derek also mentioned there is a demographic shift going on in this country with millions of Canadians between the ages of 25-44 years old which will reach the age of 90 years old or over:

Again, for Derek, just like for me and others, it's all about outcomes and what is in the best interests of Canadians and the country as a whole.

We also talked about the inherent risks in markets and how there will be another storm which will hit and why a well governed and well managed pension can weather that storm better than individuals.

You know the reasons, pensions pool investment and longevity risks but the secret to CAAT's success boils down to three things:

- Getting the asset mix right

- Getting the reserve funding right

- Sharing risks of the plan (jointly sponsored pension plan)

Lastly, we talked about pension policy and how we need more initiatives like CAAT DBplus and OPTrust Select to cover the retirement needs of more Canadians without a defined-benefit plan, particularly in the private and non-for-profit sectors.

Derek feels very strongly that there is a solution to this, a cost effective one, and that we need to get the word out that it's in everyone's best interest to cover more Canadians adequately during their golden years.

Below, in the latest Contributors podcast, Russell Evans, VP Communications, sits down with Derek W.

Dobson, the CEO and Plan Manager at the CAAT Pension Plan to discuss the challenges and impacts of retirement insecurity in Canada.

Derek W. Dobson provides insightful commentary about how DB pension plans are integral to Canada’s retirement ecosystem and why access to a secure pension plan in the workplace is a significant priority for Canadian employees today. Derek helps to debunk common misconceptions about pension plans, offering a new way to approach lifetime retirement income.

After this episode, you’ll learn:

- The looming challenge of retirement savings in Canada – and the opportunity for our economy;

- Three ways employers are improving their business by joining a defined benefit pension plan;

- How organizations, like CAAT, are transforming and innovating pensions;

- Derek’s “secret sauce” behind creating a new category in the retirement savings space.

“In a nutshell, we're listening. Traditional defined benefit plans worked really well for somebody who joined with the same employer for 35 years and retired. That is not the state of most employees today and most employers today. There's a lot of disruption that can happen, a lot of workforce mobility. So we've done a lot of listening less to the groups who have actually joined the plan because clearly our product and our story and the value proposition appealed to them.” - Derek W. Dobson in ‘Retirement Insecurity in Canada

Derek explains why we have a once-in-a-generation opportunity to solve this issue.

I embedded some clips from the podcast below but take the time to view the full podcast here.

I listened to it twice because he covers a lot of important material in a very cogent way and makes a persuasive case to improve our retirement system.

What strikes me listening to Derek talk is his humility, intelligence and passion for finding a real cost effective solution to address retirement insecurity in Canada.

He's an exceptional communicator and leader and he really believes strongly that we can do a lot better to improve retirement security and improve long term economic growth.

In fact, if Canada had a Pensions Minister, I'd recommend him to represent us on this important file (Jim Keohane also comes to mind).

Anyway, please take the time to view the full podcast here, it really is excellent and worth listening to.

Comments

Post a Comment