Will Wage Inflation Clobber Equities?

Stocks jumped Friday to finish their best week of the year, as continued strength in earnings reports extended the tech-led rebound from the January rout.

The S&P 500 rose 0.5% to 4,500.61, while the and the tech-heavy Nasdaq Composite climbed 1.6% to 14,098.01. The Dow Jones Industrial Average inched lower by 22 points, or 0.06%, to 35,089.15.

For the week, the Nasdaq was up 3%. The Dow and S&P were on pace to end the week 1% and 2% higher, respectively. If these gains hold, they’ll mark the second weekly advances of 2022 for the major averages — which were under pressure last month as worries of higher interest rates dragged down tech names.

Amazon led the market higher as it jumped 15% on strong quarterly earnings and cloud revenue beats. Snap rocketed up around 62% the day after reporting earnings. Pinterest rose about 11%.

“We’re in for a choppy period but tech has been picked on for quite some time, and now, a lot of traders are saying this is the time to be constructive, especially on some of these companies that have proven time and again that they’ve been able to manage different types of environments and are providing optimistic outlooks going forward,” like Amazon, Apple and Alphabet, said Edward Moya, senior market analyst at Oanda.

Traders Friday were also weighing a much stronger-than-expected jobs report and its potential impact on U.S. monetary policy going forward.

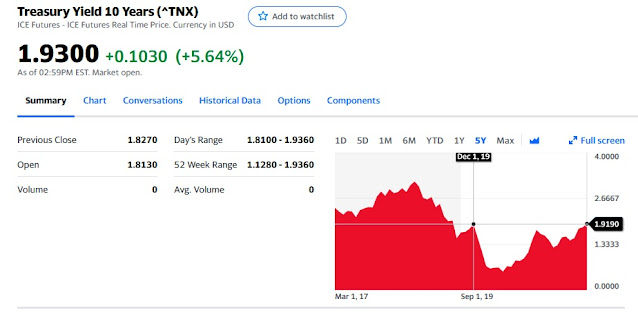

The 10-year Treasury yield jumped above 1.9%, hitting its highest level since December 2019, after the January jobs report showed a 467,000 gain in payrolls. Economists polled by Dow Jones had expected a minor gain of 150,000, and some economists predicted a large decrease. Economists had cautioned before the report it could be noisy because of an omicron wave hitting while the survey was taking place.

“For markets, the jobs report is all about the Fed, and today’s upside surprises in both job creation and wage growth keep the Fed on track to begin raising rates in March and hike four or more times this year,” said Barry Gilbert, asset allocation strategist at LPL Financial.

The benchmark yield has jumped from 1.51% at the end 2021, as the Federal Reserve pivoted to more aggressively fight inflation, signaling it would slow down its bond buying and raise rates several times this year. Higher rates have weighed on stocks, especially tech shares with high valuations. The S&P 500 is down 6% this year.

Wall Street was coming off a horrid session in which a plunge in Meta shares dragged megacap tech stocks lower. Meta shares suffered their worst day ever on Thursday, dropping 26.4% on the back of disappointing quarterly earnings.

The Nasdaq Composite, which is tilted towards tech shares, fell 3.7% on Thursday for its worst daily performance since September 2020. The S&P 500 had its worst day in nearly a year, sliding 2.4%, and the Dow fell 518.17 points.

The sharp drop in Meta Platforms, as well as that of Netflix after its earnings last month, could signal weakness under the surface and have bearish implications for the market, according to Adam Sarhan, CEO of 50 Park Investments.

“Some of the megacap tech stocks are trading almost like penny stocks. That is a massive shift under the surface from an overtly bullish market, to a market that could be topping and or the beginning of a bearish phase on Wall Street,” he said.

“For the first time since Covid, we’re seeing a massive, almost 180-degree shift where even if we have growth and strong numbers, stocks are no longer blindly, wildly going up. Instead, they’re going down.”

Alright, TGIF Friday has arrived and it was another crazy week on Wall Street.

How crazy? Well, consider this:

- Advanced Micro Devices and Alphabet/ Google posted solid reports, sending their shares higher

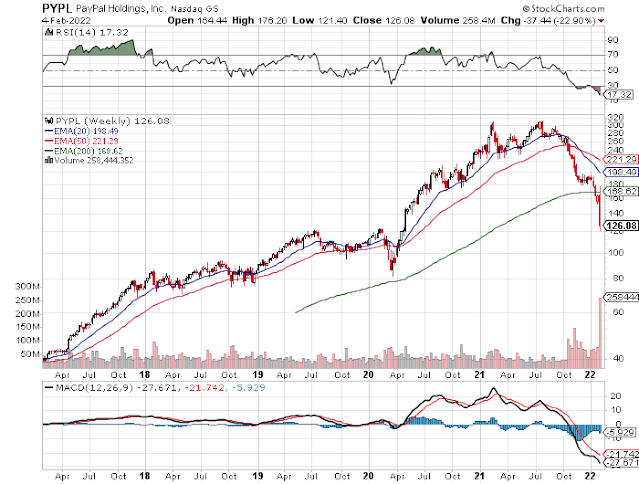

- Then PayPal shares got clobbered mid-week after the company disappointed

- Then on Thursday, Facebook/ Meta Platforms shares got slaughtered, wiping billions off the company's market cap.

- Then after the bell Thursday, Amazon beats sending its shares up 16% and Snap posts its first ever profit, sending its shares up 60%.

- Then this morning we see a huge upside surprise on the US nonfarm payrolls, average hourly earnings are up 5.7% year over year, traders are now pricing in more rate hikes ahead, the 10-year yield climbs to 1.93% but tech stocks still rallied sharply on Amazon's earnings.

It's enough to make any trader suffer severe whiplash so let me take a step back here and share some thoughts.

First, there's no doubt this market is punishing high growth companies -- no matter how big they are -- if they disappoint:

As a rule of thumb, when stocks sink below their 200-week exponential moving average, stick a fork in them, they're done. They can still bounce and post nice counter-trend rallies but the technical damage is so heavy, they rarely recover quickly.

In the case of Facebook/ Meta, it's a big deal because it's a systemically important FAANG stock, so further weakness doesn't portend well for the Nasdaq.

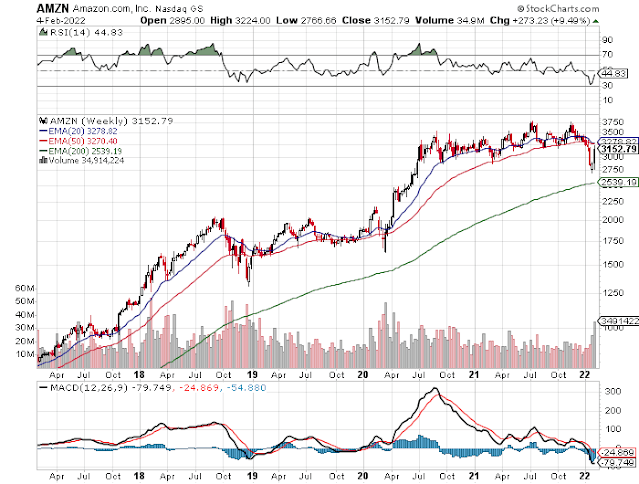

What about Amazon? Well, to be honest, just looking at the weekly chart below, it's still a short even after today's monster rip-your-face-off rally:

In fact, I bet you smart money was shorting it at the close today but that's just my hunch.

Even value investors are scratching their head as they dig deeper into Amazon's "blowout" numbers:

WTF? - $AMZN on 60X PE misses Sales, forward Sales, & suffers blow out in operating costs of 15% => but books $12bn profit on RIVN (just fell 50% since IPO) to boost NPAT & “beat” expectations pic.twitter.com/DTUIlpD5XL

— Douglas Orr, CFA (@EquitOrr) February 4, 2022

By the way, even Snap shares which rocketed up almost 60% today after beating and posting a profit, remain in a downtrend and well off their highs:

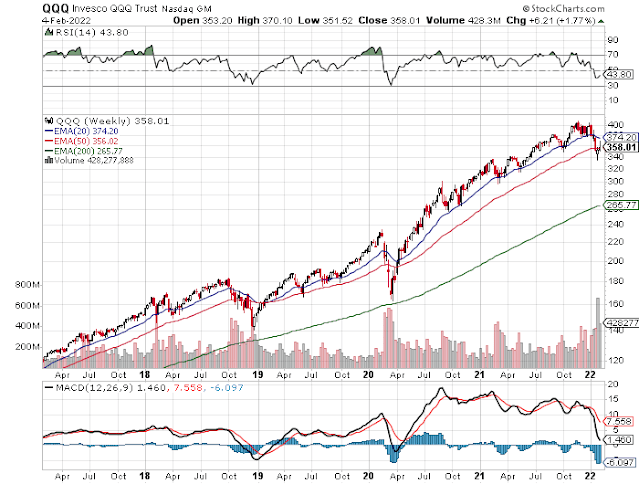

What about the Nasdaq? It too remains weak and needs to reverse course here or else it's headed lower:

I think the bigger worry underlying all this volatility is whether the Fed is about to make the biggest policy mistake since December 2018.

A lot of economists are talking up today's big upside surprise in the US jobs report stating it clears the way for the Fed to hike more aggressively, but others are throwing cold water on it and a healthy dose of skepticism:

What economists are saying about the red-hot January jobs report https://t.co/yw4onwLyZM via @Yahoo

— Leo Kolivakis (@PensionPulse) February 4, 2022

You literally just ignored the chart in the tweet. Job growth isn’t stronger. Its about the same. Job gains were removed from the summer months and spread out the rest of the year. In rate of change terms job growth is actually slowing three-tenths faster than before. Jesus https://t.co/cIe7oNUGBH

— GreekFire23 (@GreekFire23) February 4, 2022

Pro Tip: When hours worked falls average hourly earnings goes up, but you walk home with the same amount of total pay. I guess analyzing economic data everyone has access to is “edge” these days

— GreekFire23 (@GreekFire23) February 4, 2022

Interestingly, even rates traders are pricing in five rate hikes this year, two next year and 50% chance of a rate cut in 2024:No!! Fed idiots always buy into the wrong consensus narratives (so as to not surprise markets) and they will hike and hike a lot. The back-end of the curve will be a fade sometime this year (when it wakes up) and will rip faces off as massive short interest continues to build https://t.co/WZBSQ5FgvJ

— GreekFire23 (@GreekFire23) February 4, 2022

The Fed is priced to CUT RATES in 2024 now.

— Alf (@MacroAlf) February 4, 2022

- Hike 5 times in 2022 + 2 times 2023

- Completely kill the cycle

- 50% of a first rate cut in 2024

Last time markets priced the Fed to be so aggressive in year 1 & 2 such that they need to think about cuts in year 3 was in Q3-18. pic.twitter.com/qTLmQimBGw

The Fed meets in mid-March and will have a chance to digest another jobs report before deciding whether to hike 25 or 50 basis points.

I'm still betting on a 25 basis points hike in March but you never know, central bankers are tilting hawkish as inflation remains a transitory persistent problem:

Traders Ramp Up BOE Bets After Bank Toyed With Half-Point Hike https://t.co/JH7xUEk76t

— Leo Kolivakis (@PensionPulse) February 4, 2022

The move in German 2-year yields is remarkable as Christine Lagarde expresses concern about inflation. pic.twitter.com/iZqQI7UDBb

— Lisa Abramowicz (@lisaabramowicz1) February 3, 2022

Eurozone #inflation expectations (measured by 5y5y swaps) have jumped to the highest since 2014 ahead of ECB meeting. pic.twitter.com/jBksY5xQ5J

— Holger Zschaepitz (@Schuldensuehner) February 3, 2022

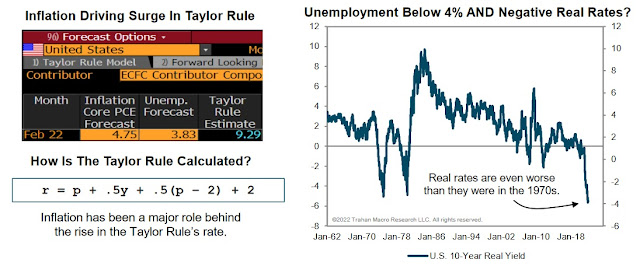

In his latest report, Francois Trahan of Trahan Macro Research calls this a lose-lose situation for the Fed and equities in 2022:

It was just six weeks ago that the Fed finally acknowledged that inflation was a bigger problem than they originally thought. Never mind that it had reached 39-year highs by then, or that they still thought it was all about supply-chain disruptions. That is water under the bridge at this point. Now a short while later, the debate is about whether we get three, or even up to seven, rate hikes this year. Wow.

The good folks at the Fed have painted themselves into a corner. The August 2020 decision to downplay inflation in order to promote employment was the first of many mistakes they made during the pandemic. At this point, it's a lose-lose for the Fed as the two main components of their mandate are in direct conflict with each other. They can raise rates to tackle inflation, which is bad for employment, OR they can keep stimulating the job market, which puts upward pressure on wages and ends up lifting inflation even more.

This week we try to answer the question of what happens to inflation this year. Since core inflation is made up of lagging indicators it is actually not that difficult to forecast. Note that this is just a summary of a broader project that we will cover in a conference call next Wednesday February 9th at 10:30 am EDT (click here to register). The short story is that the odds are extremely low that core inflation dips back below 3% by the end of 2022.

According to Francois, real rates are even lower than they were in the 1970s and the Taylor Rule argues the fed funds rate should already be above 9%, "having been pushed higher by exceptional inflation and unemployment conditions":

Now, I don't need to tell you a fed funds rate above 9% will kill risk assets, the housing market and the economy but Francois's point is many are not pricing in the continued effects of inflation and this will impact margins and earnings.

Interestingly, the world's largest sovereign wealth fund is warning that "permanent inflation" will hit returns:

World’s largest wealth fund warns ‘permanent’ inflation will hit returns https://t.co/Q6d65gC3FW

— Leo Kolivakis (@PensionPulse) February 3, 2022

And the world's largest hedge fund, Bridgewater Associates, shares this in its latest 2022 Outlook:

Monetary Policy 3 (coordinated monetary and fiscal policy) policies have worked, transitioning economies from collapse, to liftoff, to self-sustaining growth. The outcome has been fueled by a massive adrenaline shot of money and credit that is now producing a self-reinforcing cycle of high nominal spending and income growth that is outpacing supply, producing inflation. The policies have also produced a layer of excess liquidity that has driven asset prices higher and left a store of liquidity in the hands of people and the financial system that will continue to have impacts as it recirculates through the system.

As a result of these policies and their effects, policy makers—and particularly the Fed—will increasingly be confronted with a set of choices that will be as challenging as any since the 1970s. Because economies are now experiencing self-reinforcing growth, the natural workings of the economic machine will continue to sustain a high level of nominal growth that is likely to produce a level of inflation that is well in excess of policy targets. For central banks, asymmetric policy alternatives leave an unlimited ability to tighten and a limited ability to ease on their own, which encourages delay and falling further behind, which is likely to make it increasingly difficult to balance economic growth and inflation. Given the inertia in the system, it is unlikely that the current level of nominal spending growth and its impacts on inflation can be contained without aggressive monetary tightening in the very near term.

In contrast to this unfolding story, the markets are discounting a smooth reversion to the prior decades’ low level of inflation, without the need for aggressive policy action—that it will mostly just naturally happen on its own. We see a coming clash between what is about to transpire and what is now being discounted. The inevitability of this clash is due to the mechanical influence of MP3 policies on nominal incomes, spending, asset prices, and inflation, as we describe below.

Take the time to read its 2022 Outlook here.

What does all this mean? It means the Fed has a tough balancing act ahead and equities a very tough slug ahead:

Kaylee showed off her strength on the gymnastics mat. She hopes to go to the 2024 Olympics – and it looks like she can get there. pic.twitter.com/dgraIxuegv

— CBS News (@CBSNews) February 4, 2022

Both deflation trades (Tech) and reflation trades (cyclicals) have the same wave form.

— Mac10 (@SuburbanDrone) February 4, 2022

Two lower highs since the November top. pic.twitter.com/uqQXf8Ii22

And God forbid Russia invades the Ukraine and oil soars to $200 a barrel, then all hell will break loose!

Still, if you ask me, the Fed totally missed its window and hiking rates aggressively now in a slowing US economy will only ensure a painful recession ahead:

The genie is out of the bottle.

— Alf (@MacroAlf) February 4, 2022

- Growth impulse slowing

- Real yields on the rise

And now on top

- Credit spreads widening

The private sector is under strong pressure.

Either they tell markets where the Fed put is, or markets are going to keep pushing to find out. pic.twitter.com/DtaAUe5sPK

So, pay attention to rates but don't be surprised if all those people shorting Treasuries get their face ripped off at one point this year.

If you ask me, the backup in the 10-year Treasury note yield is already overdone here but as is typically the case, if it crosses above 2%, then a new uptrend is established and yields might keep going higher as CTAs and trend followers jump on the trend:

Comments

Post a Comment