The Big Bounce Bodes Well For Markets?

Investors got a reprieve from a painful sell-off as the Dow Jones Industrial Average and the S&P 500 rallied to close their best weeks since November 2020.

The Dow jumped 575.77 points, or nearly 1.8%, to 33,212.96. The S&P 500 rose about 2.5% to 4,158.24. The tech-heavy Nasdaq Composite was the outperformer, helped by strong earnings from software companies and a fall in the 10-year Treasury yield. It was ended the day up 3.3% to reach 12,131.13.

All three of the major averages closed the week higher. The Dow finished up 6.2% for the week and snapped its longest losing streak, eight weeks, since 1923. The S&P 500 is 6.5% higher and the Nasdaq is up 6.8% on the week. Both indexes ended seven-week losing streaks. A chunk of the week’s gains came Thursday and Friday, when all three of the averages rallied as strong retail earnings and a slowing inflation report lifted sentiment.

“We’re taking a breather here and making some adjustments in the market to allow for that,” Tom Martin, senior portfolio manager at Globalt Investments, told CNBC. “We have come a long way down pretty fast and if we can stabilize here then the declines we’ve seen might be all that’s needed, or something close to that.”

A report showing inflation slowing a bit helped give stocks a boost on Friday. The core personal consumption expenditures price index rose 4.9% in April, down from the 5.2% pace seen the previous month. This particular report is watched closely by the Federal Reserve when setting policy.

Investors on Friday also continued to parse through retail earnings. Ulta Beauty shares were up nearly 12.5% after the company reported better-than-expected quarterly results, while Gap added 4.3% despite slashing its profit guidance.

“The consumer appears to have a ‘barbell’ approach to spending: low-end necessities and higher-end experiences/luxury items are doing fine, while general merchandise spending is being delayed, i.e., getting one more year out of that worn-down patio furniture is okay,” Wells Fargo’s Christopher Harvey said Friday.

“This week, various retailers started to balance the macro narrative, with the demise of the consumer now appearing to have been greatly exaggerated,” he added.

Tech stocks were among the top gainers Wednesday. Software company Autodesk rose 10.3% after reporting strong earnings for its most recent quarter. Dell Technologies jumped 12.8% on earnings, and chipmaker Marvell advanced 6.7%. Zscaler and Datadog were also higher Friday, up about 12.6% and 9.4%, respectively.

The moves came as investors assessed the sustainability of this week’s rally, and whether it’s a relief bounce or does it mark the bottom of this year’s long sell-off.

Still, the averages are well off their highs, with the Nasdaq Composite still solidly in bear market territory and the S&P 500 having briefly dipped more than 20% below its record last week.

The Nasdaq now sits about 25.2% from its record, while the S&P 500 and Dow are off by 13.7% and 10.1%, respectively.

Jeff Kilburg, chief investment officer of Sanctuary Wealth, said he looks to the Treasury market as a “beacon of light” for the stock market. The 10-year Treasury yield has fallen below 2.75% from a peak that exceeded 3% this year.

“I’m not calling it a bear rally, just a repositioning. A lot of people got too pessimistic,” said Kilburg said. “I go back to interest rates. When you saw Treasurys have that pop above 3%, it wasn’t sustainable. When it came under 2.75% that allowed equities to heal, that was the all-clear short term to come back into equities.”

It's Friday and I haven't done a market comment in a while because it was grim out there.

I didn't even bother covering top funds' activity in Q1 because if you read my Q4 comment, you'll understand I foresaw a lot of pain for top hedge funds that rode the wave up.

Anyway, stocks finally had a solid week led by beaten down tech shares.

The Nasdaq has rallied 10% since last Friday's low of 11,035:

Also, as shown above, the Nasdaq index has now crossed above its 20-day exponential moving average for the first time in weeks and looks like a nice reversal in underway.

But as we head into the Memorial Day long weekend, a lot of investors are wondering if this is just another bear market rally before the index resumes its downtrend.

Here are some things to consider as we head into the long weekend:

- After peaking at 3.17%, the yield on the US 10-year Treasury note now stands at 2.74%. It seems like the long end of the curve is already pricing in a growth slowdown/ recession.

- There are several reasons to believe we are likely at peak inflation or close to it. The core personal consumption expenditures price index, the Fed’s preferred inflation gauge, rose 4.9% from a year ago in April, in line with estimates and a deceleration from March when it came in at a 5.2% y-o-y rate. Lower inflation expectations are already being seen by the New York Fed, especially three to five years out, and this too supports lower long bond yields.

- As the economy slows and long bond yields stop rising, investors are migrating back into tech stalwarts but with Fed policy still hawkish and recession fears looming, it's hard to determine whether this is "the" bottom in tech stocks. It might be an interim bottom, we might see a summer rally and then one more big dip this fall. Nobody really knows but stocks aren't going to go straight up just like they won't go straight down. For me, holding above the 20-day exponential moving average on the Nasdaq will be critical in the coming weeks.

- Corporate bonds also rallied sharply this week, supporting the move in equities.

- After seven down weeks, we were due for a big relief rally and got it on a week where Fed minutes and PCE were released. Next week, more economic data will come in likely confirming a slowdown is happening.

- Traders I talk to think the Fed will raise rates by 50 basis points two more times and maybe in September and then pause before midterm elections. This makes a lot of sense because if Republicans sweep, fiscal retrenchment lies ahead and typically a Republican House bodes well for the stock market (not always the case).

The big wild card in all this is Fed policy and whether it will commit a policy error and raise rates too much. So far, the market doesn't think so but this can change as we enter the second half of the year depending on how elevated inflation remains.

Former Treasury Secretary Lawrence Summers voiced some support for the Federal Reserve’s latest policy stance, after having long criticized the central bank for being slow to take up the fight against decades-high inflation.

“I thought the Fed’s posture at last was broadly appropriate,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “Now the question’s going to involve carrying through.”

Fed policy makers backed raising interest rates by half a percentage point at the June and July meetings after a hike of that magnitude on May 4, minutes of this month’s gathering showed on Wednesday. “Many” officials thought they’d then be well positioned to “assess the effects” of their actions and the extent to which policy adjustments were needed, the minutes indicated.

Summers, a Harvard University professor and paid contributor to Bloomberg Television, suggested that the tightening in US financial conditions could shape how high the Fed needs to take interest rates.

“I’ve been uncertain as to where interest rates will have to go to achieve” an economic downturn that sends unemployment higher -- a necessary condition for pulling down inflation. “Particularly all that’s happening that’s been adverse for financial conditions, in the stock market and in credit markets.”

Like I said, if you look at the high yield bond ETF, it rallied like crazy this week, supporting stocks:

Was this just short covering? It sure looks like it as that is a hell of a spike up when fundamentals are deteriorating and rates haven't come down enough to justify such an explosive move.

Anyway, the good news is most Americans will be celebrating Memorial Day and not worrying as much about the stock market and maybe, just maybe, we are heading for a nice summer rally:

But I wouldn't bet on it, these type of explosive rallies typically fizzle out fast and we will likely see some consolidation before the next leg up or down.

The 5-year weekly chart on the S&P 500 ETF tells me short sellers are just taking a small vacation here, they will be back:

However, the 5-year weekly chart on the Nasdaq looks a little more encouraging, at least it avoided falling below its 200-week exponential moving average and bounced nicely off it:

So maybe tech stocks continue to melt up here as the economy slows, we shall see.

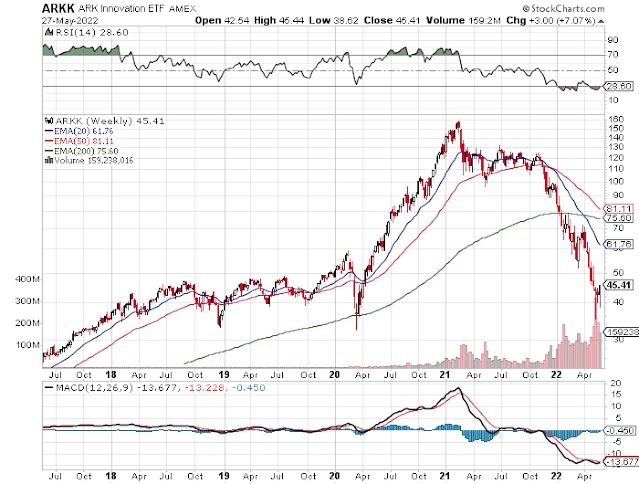

One thing I can tell you is any big bounce in the ARK Innovation ETF (ARKK) should be shorted as a lot of the stocks in this ETF are still in La-La Land:

The only good news is there is so much pessimism and skepticism out there and markets tend to climb the wall of worry but with the Fed still in hawk mode, investors need to be careful and hedge their risk.

Below, the committee debates whether the market has hit bottom yet. With CNBC's Scott Wapner and the 'Halftime Report' investment committee, Brenda Vingiello, Richard Saperstein, Steve Weiss, Jon Najarian and Jim Lebenthal.

Update: Barron's reports the stock market had a winning week and why it might not last:

Deutsche Bank strategist Alan Ruskin says investors have to decide if the 10-year Treasury yield at 2.75% and the S&P 500 near current levels are enough to get inflation heading back toward 2%. “If the answer is YES (presumably supply improvements dominate any push toward lower inflation), then risky assets are secure,” Ruskin writes. “If the answer is NO, then the Fed will have to do more heavy lifting in raising [short term] rates over and above what is priced, driving a greater tightening in financial conditions. In case you had not guessed, my personal view is: NO.”

And even some of the bulls acknowledge that the risks have risen, even with the stock market rally. Yardeni Research’s Ed Yardeni notes that the Fed’s focus on inflation has caused the market’s latest panic attack. “But this one won’t end until inflation moderates significantly all by itself or with the help of a Fed-induced recession, either by design or by accident,” he writes. “We think that can happen without a recession. Nevertheless, we now are raising the odds of a recession from 30% to 40%.”

Bottom line, keep your eyes peeled on inflation and the Fed as we move into second half of the year.

Comments

Post a Comment