Canada's Pensions Testify on Investing in China

Witnesses

From 6:30 p.m. to 8:00 p.m.:

Canada Pension Plan Investment Board• Michel Leduc, Senior Managing Director and Global Head, Public and Corporate AffairsCaisse de dépôt et placement du Québec• Vincent Delisle, Senior Vice-President and Head, Liquid Markets• Philippe Batani, Vice-President, Communications and Public AffairsPublic Sector Pension Investment Board• Eduard van Gelderen, Senior Vice-President and Chief Investment OfficerFrom 8:00 p.m. to 9:30 p.m.

As an individual• Paula Glick, Co-Founder, Honeytree Investment Management Ltd. (by videoconference)• Dr. Ari Van Assche, Full Professor, HEC Montréal (by videoconference)British Columbia Investment Management Corporation• Daniel Garant, Executive Vice-President and Global Head, Public Markets (by videoconference)• Jennifer Coulson, Senior Managing Director and Global Head, Environmental Social and Governance (by videoconference)Ontario Teachers' Pension Plan• Stephen McLennan, Executive Managing Director, Total Fund Management (by videoconference)

Pursuant to the order of reference of Monday, May 16, 2022, the committee resumed its study of the Canada–People’s Republic of China relations.Michel Leduc, Vincent Delisle and Eduard van Gelderen made statements and, with Philipe Batani, answered questions.

At 8:00 p.m., the sitting was suspended.

At 8:10 p.m., the sitting resumed.

Paula Glick, Ari Van Assche, Daniel Garant and Stephen McLennan made statements and answered questions.

At 9:16 p.m., the sitting was suspended.

At 9:19 p.m., the sitting resumed in camera.

You can watch the entire proceedings of this interesting Special Committee in English here and en francais ici.

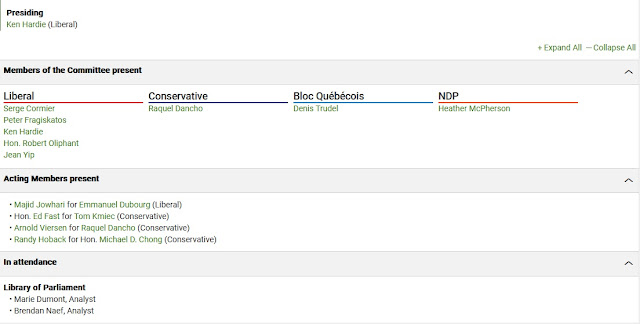

Presiding over the Committee was Ken Hardie (Liberal) and the members are listed below:

Noticeably absent from the Committee was yours truly.

I think they had their fill of me the last time I visited Parliament and testified at the request of Tom Mulcair.

Besides, on the topic of investing in China, I would bring my copy of one of my favorite books, George Orwell's Animal Farm and tell them exactly what I think about investing big money in a communist country, no matter how big it is.

NO BUENO! CAPICHE?

Alright, let me get serious as there were some excellent exchanges here and I'll try to leave my biased capitalist views aside as much as I possibly can.

First, I asked Michel Leduc, Senior Managing Director and Global Head, Public and Corporate Affairs at CPP Investments to share his opening remarks with me which he graciously did:

Let me hone in on the important reason why CPP Investments invests in China:

Canada stands out as one of the very few countries with a solvent national retirement fund.

Our organization was set up to expose the Fund to capital markets to achieve financial returns. Optimal diversification and a long-term focus on growth has helped our organization achieve a level of financial performance few institutional investors worldwide have matched. Recent third-party benchmarkers ranked CPP Investments number one in performance among global peers.

Diversification allows us to capture global growth and withstand periods of market uncertainty. It is a powerful way to enhance returns and prevent concentration risk.

When liabilities extend far into the future (pension obligations beyond 75 years), growth and resilience from diversification are predicated on exposure to emerging markets. These markets are expected to account for more than half the world’s annual GDP within the next ten years.

Exposing the Fund to the Chinese market gives us access to one of the world’s largest and fastest growing economies, in sectors such as consumer discretionary, logistics, and real estate. This demographic opportunity provides an important source of balance to our portfolio.

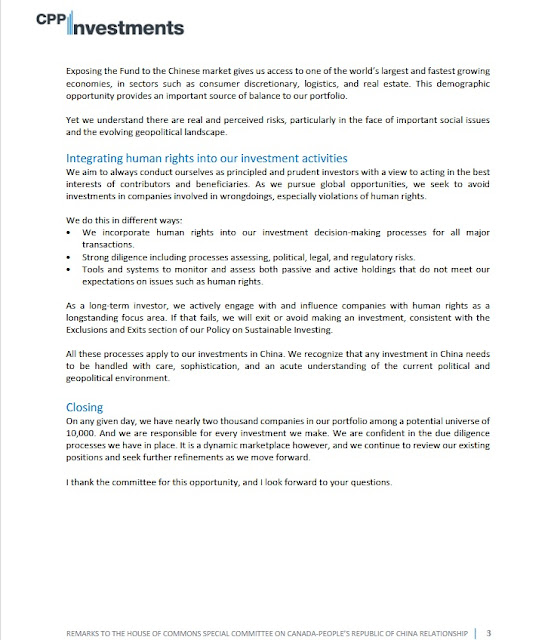

Yet we understand there are real and perceived risks, particularly in the face of important social issues and the evolving geopolitical landscape.

Michel then explains how they incorporate human rights into their investment decision-making processes, although I must admit monitoring human rights in a country like China is challenging (as it apparently is in the US, see my last post on Blackstone’s bombshell).

I'm focusing on CPP Investments because it is the largest pension fund in Canada and invests the most (9.8% of its assets) in China (mostly in liquid public securities).

Now, the majority of Canada's large pensions also invest the bulk of their assets in China in liquid public securities.

Again, there's a reason for this, look at what happened in Russia after Putin waged his war on Ukraine.

These are communist countries or autocracies, there is no rule of law, only rule of Xi and Putin.

But China is a global powerhouse so it's hard to ignore it, just like it's hard to ignore India.

However, India is a social democracy with reasonably good rule of law, so there Canada's large pensions are investing in infrastructure, real estate and private equity with solid partners.

Partnerships are critical when you invest in these countries, especially in China.

The only good thing is to hold on to power, Xi needs growth or else he will have a massive rebellion to reckon with.

So, from that perspective, it's safe investing in China.

Also, China’s demographic crisis continues and this will pose a problem for everyone, especially China.

My own preference is to play China through US stocks like Caterpillar, Deere, Nike, J&J, etc.

But I get it, there is money to be made in active management in China and other emerging markets but there are huge risks too.

Anyway, take the time to watch the two panels here, it is way too long to go over here but well worth listening to both panels and the expert witnesses.

I applaud the Committee members for asking tough questions and raising serious concerns.

Investing in China is necessary but fraught with risks.

God forbid China invades Taiwan, then what are global pensions going to do? Divest? Good luck.

Below,

Canada vs China: Why Both Countries Are Expelling Diplomats | Vantage with Palki Sharma. A major diplomatic row erupted after Canada and China expelled diplomats from their respective countries. This comes after reports of alleged Chinese political interference in Canada. Will tension between the two escalate further? Palki Sharma decodes.

Like I said, investing in China isn't straightforward, especially when geopolitical tensions run high and your own government is embroiled in a diplomatic dispute with this economic powerhouse.

Update: Senator Clément Gignac sent me this after reading this post:

No doubt that big Canadian Pension funds care about ESG principles! Having said that, do they do enough to integrate the National Security concerns from policymakers about investing in non democratic and potential hostile countries with questionable rules of law and human rights protection such China?

I just want that Maple 8 disclose their assets exposure country by country and let Canadians pensioners to decide how comfortable they are to scale down Canadian exposure and finance non friendly countries such China! Food for thought

I explained to Clément that Canada’s large pension funds aren’t a democracy, they are mandated to invest in the best long-term interests of their beneficiaries.

But I also said I don’t agree with everything they do on China where there are legitimate concerns.

He replied:

Exactly. Having said that I found interesting the huge divergence exposure approach between CPPIB exposure in China (about 10% exposure) versus PSP ( 3% exposure) and CDPQ (about 2% exposure). As far as illiquid assets (such real estate, infrastructure and private equity), how do you evaluate assets in China in a stress test scenario with potential western countries sanctions following a potential Taiwan invasion? Just an example! No relevant market price available!

The difference in asset allocation is explained by the different objectives of these large pensions.

As far as stress testing, he’s right and he’s also right that Canada’s Maple Eight need to disclose a lot more detail on their investments by country and where they invest (public vs private and sectors). It should be part of their annual report and easily accessible information.

Read my follow up comment on grilling Canadian pension executives on China investments.

Comments

Post a Comment