Top Funds' Activity in Q1 2023

Futures on Friday suggest the S&P 500 may pop its head through the 4,200 level again, looking to decisively break above the 400-point trading range in which it has twitched for nearly seven months.

Easing angst over U.S. regional banks and the government debt-ceiling, combined with calmer conditions in bond markets as traders welcome cooling inflation and a Federal Reserve rate-hike pause, are all underpinning sentiment.

We even have a fresh structural paradigm for bulls to feast on. Hopes for an AI bonanza have helped push the Nasdaq Composite to its highest since August.

Just look how optimistic people are! Nasdaq 100 call option volume has hit its highest since 2014:

But hold on. All this is all happening while people say they are downright miserable about the market. Even those who are active investors reflect sentiment at depressed levels.

That’s fine, because the dichotomy in fact implies further market gain, says George Smith, portfolio strategist at LPL Research.

According to the latest weekly data from the American Association of Individual Investors (AAII) the percentage of individual investors who are bullish about short-term market expectations is 23%, down from 29% last week.

“This marks the lowest level since the end of March and is well below the long-term average of 34%,” says Smith. The percentage of investors who are bearish decreased week-on-week to 40%, but was still well above the long-term average of 32%, he adds. This puts the spread between the bulls and the bears at minus 17%, versus a long-term average of plus 2%.

As the chart below shows, investor sentiment, as measured by the spread between bulls and bears in the AAII data, is more than one standard deviation below its long-term average.

“While the concerns that are feeding into the individual investors’ ‘wall of worry’ [lingering inflation, higher interest rates and recession fears] are valid, the negative sentiment they have built up is, from a contrarian perspective, a potential catalyst for positive forward returns,” says Smith.

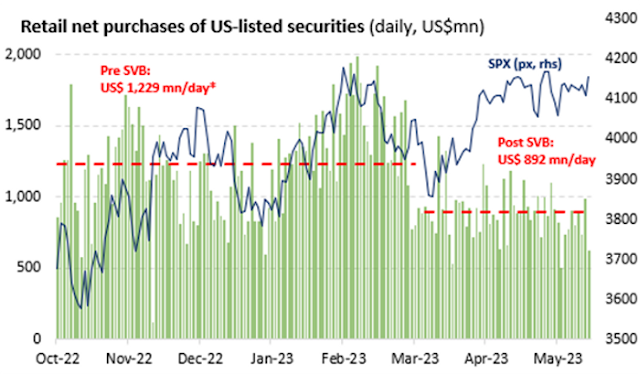

Indeed, this chart from Vanda Research shows how retail investors in particular have reduced stock purchases since SVB went bust.

In other words there is support for stocks, as many potential buyers wait in the wings for current worries to subside, says LPL’s Smith.

“Extremes in pessimism in the AAII data are, on average, bullish for near-term stock market returns (and extreme investor optimism tends to be bearish for the near-term outlook). When the bull-bear spread is around where it is now (between 1 and 2 standard deviations below average), we have seen the strongest S&P 500 returns three months and 12 months out, and the second strongest returns six months out,” says Smith.

Ksenia Galouchko of Bloomberg also reports BofA strategist says sell US stocks as AI seen forming a bubble:

Bank of America Corp. strategist Michael Hartnett reiterated his call to sell US stocks, saying tech and artificial intelligence are forming a bubble and the Federal Reserve’s rate hikes may not be over, with rising bond yields posing a risk.

Hartnett, who correctly predicted last year that recession fears would fuel a stock exodus, recommended selling the S&P 500 at 4,200 — the index’s current level.

If the Fed “mistakenly” pauses rate hikes this year, US bond yields will reflect that by rising above 4%, “and if so we most certainly ain’t seen the last Fed rate hike of the cycle,” strategists led by Hartnett wrote in a note on Friday. The 10-year US Treasury yield traded at about 3.6% on Friday, having surged in the past week amid the debt-ceiling debate.

BofA said AI for now is a “baby bubble,” noting that in the past bubbles always started with “easy money” and ended with rate hikes. They cited the lesson from 1999, when a rally in internet stocks and strong economic data caused the Fed to restart monetary tightening, and the bubble in tech stocks burst nine months later.

The biggest “pain trade” in the next 12 months is the Fed funds rate rising to 6% instead of falling to 3%, given that the market expects rate cuts, according to the strategists.

US equities rallied on Thursday as optimism over steps toward resolving Washington’s debt-ceiling standoff outweighed concerns that the Fed may not suspend its rate-hiking campaign next month. The Nasdaq 100 soared to the highest level since April 2022, with its 14-day relative strength index closing in overbought territory for the first time since early February. The tech-heavy gauge is up 26% this year, one of the best performers among global indexes.

Tech stocks had their fifth week of inflows, while financials saw a third week of outflows, and REITs had the largest withdrawals since November 2022, BofA said, citing EPFR Global data.

Overall, equity funds had $7.7 billion outflows in the week through May 17, while bonds have seen inflows in the past eight weeks.

And Filip De Mott of Business Insider reports Carl Icahn lost $9 billion on an ill-timed short trade. Here's what he says are 3 big lessons from the soured bet:

- Carl Icahn admitted a huge bet against the economy was wrong and cost $9 billion over six years.

- "Maybe I made the mistake of not adhering to my own advice in recent years," he told the Financial Times.

- He also attributed the losses to trillions of dollars the Fed injected into the economy amid the pandemic.

Billionaire Carl Icahn conceded that he was wrong to bet on a broad market downturn, a forecast that cost his firm close to $9 billion over six years.

The famed activist investor grew increasingly bearish that the economy would tank in the wake of the global financial crisis and shorted everything from broad market indices to commercial mortgages.

But a Financial Times analysis found that the strategy lost $1.8 billion in 2017 alone and another $7 billion between 2018 and the first quarter of this year.

To be sure, Icahn's portfolio also made about $6 billion from his activist investments even while his short bets were losing $9 billion, according to the FT, resulting in a net loss of nearly $3 billion.

In an interview with the FT, Icahn reflected on his ill-timed short trade. Here are three key lessons:

1. "I've always told people there is nobody who can really pick the market on a short-term or an intermediate-term basis," Icahn said. "Maybe I made the mistake of not adhering to my own advice in recent years."

2. At one point, the value of the securities Icahn had wagered against surpassed $15 billion, an amount that proved especially costly when markets did not go his way. "You never get the perfect hedge, but if I kept the parameters I always believed in … I would have been fine," he said. "But I didn't."

3. At the height of the pandemic, the Federal Reserve's stimulus efforts not only staved off a greater economic downturn, but undermined Icahn's short bets hopes as well. Between 2020 and 2021, Icahn Enterprises reported $4.3 billion in short losses.

"I obviously believed the market was in for great trouble," said Icahn. "[But] the Fed injected trillions of dollars into the market to fight Covid and the old saying is true: 'don't fight the Fed.'"

Amid the losses, Icahn added $4 billion of his own funds into the company. The separate sale of companies held by the firm also resulted in gains of $3.5 billion that were held outside the investment portfolio, the FT said.

Meanwhile, Icahn is fighting claims from activist investor Hindenburg Research, which announced it's shorting Icahn Enterprises and said the firm is run like a Ponzi scheme.

He responded to the Hindenburg claims in a statement last week, saying Hindenburg launches "disinformation campaigns."

Alright, it's Friday and I have a ton of things to cover today going over top funds' activity for Q1 2023.

Before I get into it, a couple of important points:

- First, I am working with two top quants who are actually incubating a strategy using this information properly. They bought the data from the SEC and are incubating and filtering information to improve added value and they are are putting actual money to work on this strategy so this isn't pro forma nonsense (one of them was about to work for Millennium at point, is a data analytics expert who can easily work at a top quant fund but he's too much of a wanker and enjoys the good life!😁).

- Second, markets are at an important inflection point here, so DO NOT GET CARRIED AWAY with what Buffett, Soros and company bought and sold last quarter. Remember this data is lagged by 45-days so it's not representative of what they hold now and many top hedge funds are going to get clobbered when the financial storm hits their portfolio.

Got that? Never mind what Steve Cohen says publicly about investors being too worried and him being bullish because of the AI revolution, that's more rubbish I want you to ignore.

I want you to repeat in your head what the late, great George Carlin kept saying: "It's all bullsh*t and it's bad for you!"

Importantly, this market is on the verge of turning south and when it does, it's going to be really ugly:

I would reiterate to bulls that since 2009 each time small caps had a death cross (50 dma below 200 dma), the S&P 500 imploded.

— Mac10 (@SuburbanDrone) May 19, 2023

No exceptions. pic.twitter.com/8OGjBq7X95

Janet Yellen just warned of more bank failures to come.https://t.co/eRNWyF40LV

— Mac10 (@SuburbanDrone) May 19, 2023

Good thing to learn on a Friday afternoon at the same time that debt ceiling talks are suspended. pic.twitter.com/J1EHKFFZpu

I mentioned below that Bear Stearns blew up the same weekend in 2008 that SVB did in 2023…

— Stephen Geiger (@Stephen_Geiger) May 18, 2023

The market then rallied after the initial bank panic was squashed. That rally ran strong until it ended on May 19, 2008. https://t.co/8tgfMwEsU0

Like Carl Icahn,I can't tell you for sure when this market is going down, but I'm willing to bet it's soon and have written about why recently:

- Will the Market Keep Grinding Up or Implode as Recession Takes Hold?

- The Private Debt and Commercial Real Estate Crash Nobody Sees?

One thing I can tell you for sure is we are heading for a severe and prolonged global economic recession/ depression and by this time next year, everyone will be talking about it.

File this one under "it's never happened before" but this last rate hike was the first time in the history of the SLOOS that Fed tightening policy with lending standards this tight. This year is also the first time the Fed tightens with S&P 500 earnings that are trending lower. pic.twitter.com/TJnzF4PEM5

— Francois Trahan (@FrancoisTrahan) May 19, 2023

We May Be Getting Used to High Inflation, and That’s Bad News @WSJ https://t.co/fbnG2YfGbs

— Mark Wiseman (@MarkDWiseman) May 19, 2023

Global supply chain index is declining but core inflation remains elevated and CPI stubbornly high.

— Daniel Lacalle (@dlacalle_IA) May 19, 2023

Exactly. Inflation is a monetary phenomenon pic.twitter.com/0DzWU2Yx2Y

US Housing Starts were were down 22% over the last year, the 12th consecutive YoY decline (longest down streak since 2009). Tends to be a leading indicator for the economy, recessionary signals continue to build. pic.twitter.com/fU3o5nkx5t

— Charlie Bilello (@charliebilello) May 17, 2023

Realtors are officially quitting.

— Nick Gerli (@nickgerli1) May 19, 2023

The growth rate in Realtors registered with the NAR officially went negative in May 2023.

That's the first contraction in the # of Realtors in America since the 2008 crash.😬 pic.twitter.com/IHQt5MHAha

Clearly the US economy is slowing and we will soon get confirmation when the next nonfarm payrolls report becomes available.

And the rest of the world typically lags the US economy by six months, and they're in even bigger trouble!

Learn to Look at Daily and Weekly Charts!

I'll get to top funds below but before I do, a little lesson in looking at financial charts properly.

Go to stockcharts.com and type in "NVDA" which is the symbol for Nvidia at the top where it says enter symbol or name.

The default settings are daily period and two simple moving averages, the 50-day and 200-day moving average.

For my daily charts, under chart attributes, I change the default settings to period = 1 year and then in overlays section below that I put three exponential moving averages: the 20-day, 50-day and 200-day exponential moving averages.

Your daily NVDA chart should look like this once this is done:

Now, for my weekly NVDA chart, I change the period to weekly under chart attributes and in predefined range, I put that to 5 years instead of one year. I keep the same exponential moving averages except now they will be weekly, not daily.

Once you do this, your weekly NVDA chart should look like this:

Both charts are very bullish (daily and weekly MACD is above zero and rising), Nvidia shares made a new 52-week high yesterday and everyone is touting them because of they are leaders in the "AI revolution".

Notice, however, on the weekly chart, Nvidia is about to do a double-top and roll over?

It's a nice short candidate here which is why I'm looking to short it using the AXS 1.25X NVDA Bear Daily ETF (NVDS) which has a little leverage too magnifying returns.

So what's the problem? The problem is Nvidia shares made a new 52-week high yesterday (see daily list for Nasdaq here and you can see all exchanges there too) and in my experience you should never short stocks making new 52-week highs, you wait for a better moment.

Look at Nvidia shares today:

A bunch of rookie short-sellers got in there early today thinking the stock was going to go down 10% and by 11 a.m., the stock reversed course and is headed back up.

There are a lot of things they do not teach you in trading books, you need to feel the pain of losing money to become a great money manager.

Capiche? If it was that easy, everyone would be trading, not working for a living!

And there are other risks with NVDS and TSLQ, the non-levered Tesla Bear ETF.

Like what? Like you wake up in the morning and Apple has bought both companies up at a nice premium. BAM! You're toast!

Trading and investing is meant to be very hard, very complex, there are a ton of variables at work each and every day.

I use my weekly charts to determine longer trends and see if it is a good time to go in.

I use daily charts for short-term trends but truthfully, I prefer swing trading than day trading.

LTK Capital Management is up huge this year, close to 300%, trouncing elite hedge funds and money managers.

And as of Thursday morning, it's all cash, marked to market and safe.

Sometimes you need to take a break and let the market come to you, don't chase it!

Plus with all the debt ceiling nonsense, I see more risks than opportunities even if I seriously doubt they're stupid enough to default on their debt (political and economic risks are way too high).

Properly Screening Stocks

Apart from what Soros and company are buying and selling, one of the best ways to properly screen US stocks (and Canadian if you want) is to go to barchart.com and click on stocks at the top of page which will show you this screen:

From there, you can see new high and lows, percent change and a bunch of other updated market information to help you screen stocks.

For example, if I click on new highs & lows it gives me an alphabetical list of stocks for all US exchanges (default setting) making a new high today:

You can also change settings to view large cap or Nasdaq stocks and see new lows too if you're a contrarian investor (good luck there).

Both barchart and stockscharts have premium services which you need to pay for to extract more information but that is up to you, they provide a lot for free but for experts, you should dig deeper.

What I like to do is see stocks making a new 52-week high and then see which hedge funds bought it last quarter.

For example, have a look at the 5-year weekly chart of Palantir (PLTR) shares which have made a new high this week:

There isn't much history because the stock IPOed back in Ocotober 2020 but it popped this week on news that Cathie Wood's Ark Fund bought a ton of shares (Her flagship Ark Innovation ETF has slid 76% from its February 2021 peak, but has rebounded 23% so far this year).

Anyway, then go to Nasdaq.com and at top right-hand corner, type in "PLTR" which is the symbol for Palantir and then click on common shares to get you here:

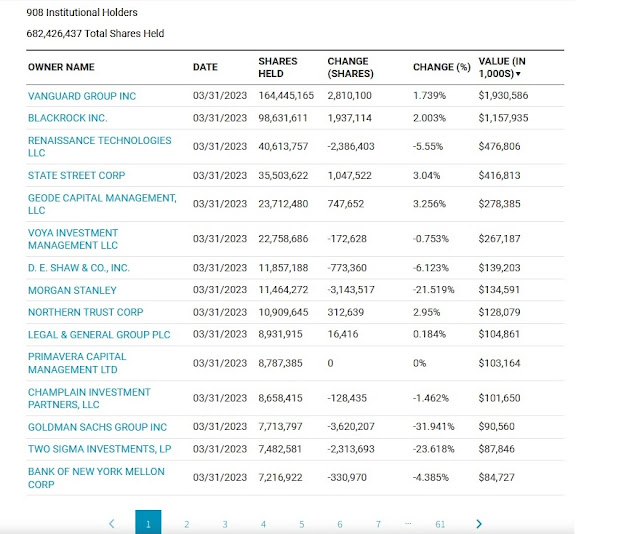

Then click on institutional holdings to see which funds owned it as of the end of March:

You will typically always see the big index funds (Vanguard, Blackrock, Fidelity, State Street) and then you see some top quant funds like Renaissance, DE Shaw and Two Sigma which were shaving their position.

Importantly you can do this analysis on any stock or ETF and see who has been buying it or selling it.

For example, let's look at the top holders of Take-Two Interactive Software (TTWO) which is another stock that popped big yesterday after it announced great earnings:

You'll notice Tiger Global Management significantly increased its position in Q1 and that proved to be a wise move:

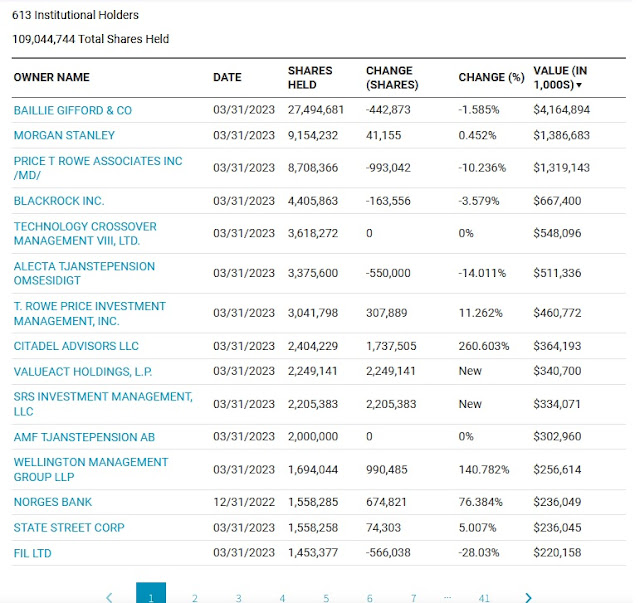

Let's look at another stock that is on fire this year, Spotify (SPOT):

If you look at its top holders, you'll see ValueAct took a big new stake and Citadel significantly increased its position last quarter:

Another tech stock on fire this year is Shopify (SHOP):

Here, among the top holders are again, Baillie Gifford,Canadian and big well known funds along with the Royal Bank:

By the way, on the Nasdaq site, you can click on each fund to view their top holdings as at the end of March. You can also click on column headings too and see which funds significantly increased their stake.

I can go on and on and on!!

There are thousands of stocks and you really need to do your homework when looking at them.

The best stocks are the ones that come from solid companies that are run well.

For example, look at Eli Lilly (LLY) shares over the last 5 years:

Beautiful! It is owned by huge asset managers and this is the type of stock I love, one that does well over the long run.

Also, have a look at the performance of First Solar (FSLR) shares over the last year:

Again, beautiful, which means you don't have to have tech to outperform the market!

Lastly, I am looking at a lot of biotechs these days and can provide you the symbols to see them for yourself:

ACAD, AKRO, BIIB, CRSP, FOLD, FULC, KOD, MRTX, PTGX, RETA, TGTX, VERV, VKTX, XFOR and a few more.

LTK Capital Management made a killing trading some of them very well (MRTX, TGTX, FULC, XFOR) but also missed the boat on others like VKTX whose top holders include elite hedge funds and bitoech funds like Viking Global, Millennium, Point 72 and RTW (Fidelity owns the most, they have a potential treatment for NASH disease) :

I also missed a nice trade on Acadia Pharmaceuticals (ACAD) recently (Baker Brothers and RTW are top holders here):

Biotech is binary and very risky but biotech is where you can make a fortune fast (and lose a fortune faster) which is why I track top biotech funds very carefully (Avora, Perceptive, RTW, etc).

What Top Funds Bought and Sold in Q1

Zero Hedge does a decent job providing a 13F summary for Q1 2023:

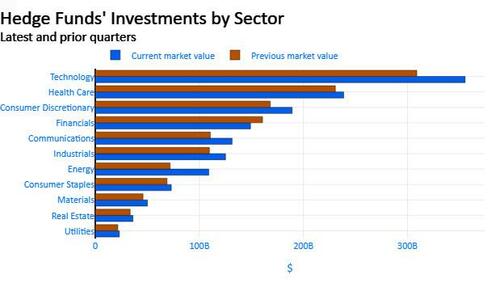

According to 13F data compiled by Bloomberg, hedge funds and other institutional investors bought into the sizzling tech rally - with an emphasis on, you guessed it, AI - in the first quarter while selling financial stocks as the banking sector imploded.

The combined value of institutional investors’ investments in Facebook parent Meta Platforms increased by $8.5 billion in the first three months of the year through March 31, the second largest change by market value, according to Bloomberg’s analysis of data from 13F filings. Occidental Petroleum was the most purchased stock, while AI leader Nvidia, Salesforce and Netflix were also among the names institutional investors bought.

But while everyone bought tech, a handful of billionaire investing titans such as Stanley Druckenmiller and David Tepper loaded up on aggressively on artificial intelligence stocks during the first quarter.

According to Bloomberg, Druckenmiller’s Duquesne Family Office increased its stake in Nvidia, which more than doubled this year, making it one of the top performers in the S&P 500 Index. The fund added more than 208,000 shares of Nvidia during the first quarter, increasing the market value of the firm’s holding in the chipmaker to about $220 million.

“AI is very, very real and could be every bit as impactful as the internet,” Druckenmiller said at the 2023 Sohn Investment Conference last week.

Duquesne Family Office added a large new position in Microsoft which now makes up 9% of the firm’s roughly $2.3 billion US equities portfolio. Microsoft has a $10 billion investment in OpenAI, whose ChatGPT tool has lit up the internet. Druckenmiller’s firm also added a new position in Iqvia Holdings, a health-care technology company that says on its website it has “transformative AI capabilities” to help with its research and commercial efforts. Duquesne bought about 474,500 shares of the company during the first quarter with a market value of $94 million.

Meanwhile, Tepper’s Appaloosa Management also added a new position in Nvidia, buying 150,000 shares with a market value of about $41.7 million. The firm also bought 500,000 new shares of Cathie Wood’s ARK Innovation ETF, which invests in companies that create disruptive technologies. While the fund has lost three-quarters of its value since its high in early 2021, it has gained 23% this year.

While they were buying tech, and/or AI, institutional investors were also reducing the value of their investments in financial shares by the most for any industry, unloading $1 billion of SVB Financial Group as its Silicon Valley Bank collapsed. Meanwhile, as we reported last night, Berkshire Hathaway eliminated US Bancorp and Bank of New York Mellon from its holdings.

Curiously, the SPDR S&P Regional Banking ETF, the KRE, was a top buy among hedge funds last quarter as the fund fell 25%. Among the investor group trying to catch the falling knife, 16 cut or exited positions, while 50 added shares. The buy ratio was among the highest for securities that had at least 50 position changes, according to Bloomberg’s analysis of 13F filings by 1,099 hedge funds.

- Hedge funds added a net 13.47 million KRE ETF shares, increasing their combined holding to 17.97 million shares; Pentwater Capital Management LP, with 2.31 million shares, and Parallax Volatility Advisers LP, with 1.94 million shares, were the biggest buyers

- Marshall Wace LLP was the biggest bear on the stock among the investor group, selling 855,178 shares; Two Sigma Investments LP sold 401,600 shares

Bloomberg analyzed 13F filings by 1,056 hedge funds and other institutional investors. Their combined holdings amounted to roughly $1.5 trillion, compared with $1.4 trillion held by the same funds three months earlier. Here are some of more notable findings:

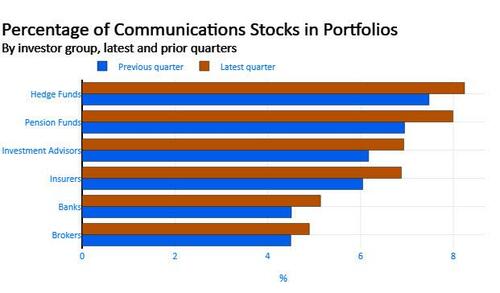

- Hedge funds had 8.2% in Communications at the end of the March 31 quarter, the biggest weighting among six major investor types, according to Bloomberg’s analysis of 13F filings. Brokers had the lowest exposure, at 4.9% of portfolios. Hedge funds held $151.5 billion of Communications stocks, up from $128.82 billion at the end of the previous quarter. iQIYI Inc Adr-Class A, Lumen Technologies Inc and AT&T Inc were among the top position increases in Communications by hedge funds.

- Hedge Funds bought 37.54 million Nikola Corp shares in the March 31 quarter as the stock fell 44%, the biggest position increase among their investments, according to Bloomberg’s preliminary analysis of 13F filings. Among the group, seven increased their Nikola positions, while five reported a decrease.

- Hedge Funds sold 20.89 million shares in Clarivate PLC as the stock rose 13%, the biggest selloff, the analysis shows. Twenty investors reduced or exited a stake, while 15 reported an increase.

- Meta Platforms Class A provided the biggest increase by market value for a single investment, at $4.64 billion. The value of the group’s combined investment in Charles Schwab Corp. dropped $1.15 billion, the biggest decrease by market value.

- Iconiq Capital continued to slash its stake in cloud-computing company Snowflake in the first quarter, selling 4.85 million shares. The market value of its holding totaled about $1 billion, down $625 million from the prior quarter. The San Francisco-based firm only made two new buys in the first quarter, adding small positions in game companies Roblox and Take-Two Interactive Software worth less than $1 million.

- The Saudi sovereign wealth fund bought almost 8.8 million shares of Electronic Arts during the first quarter, when the stock slumped following a disappointing earnings outlook. The Saudis held about 16 million shares prior to the first quarter, and held 24.8 million, with a market value of $2.99 billion, as of March 31. That makes them the largest outside stockholder in EA.

- George Soros’s investment firm cut holdings in electric-vehicle makers, slashing a stake in Rivian Automotive Inc. after a 90% share decline. Soros Fund Management also sold off its entire $16 million position in Tesla which it acquired during a big tech push in the second quarter of 2022. It trimmed other tech-related bets, including stakes in Alphabet Inc., Amazon.com Inc., Salesforce Inc. and Intuit Inc.

- The investment firm that manages the Walton family’s fortune bought more shares of the nearly $38 billion Vanguard Short-Term Bond ETF. WIT LLC also added a new position in the SPDR Bloomberg 1-3 Month T-Bill ETF with a market value of roughly $10 million.

- Adage Capital Partners GP LLC sold 746,202 shares in SVB Financial Group, the biggest reduction by the investor group; Renaissance Technologies LLC sold 719,930 shares

- TCI Fund Management Ltd sold 31.01 million shares in Alphabet Class C, the biggest reduction by the investor group; Egerton Capital UK LLP sold 5.36 million shares

- Mason Capital Management LLC added 674.6 million shares in Occidental Petroleum, the largest increase; ExodusPoint Capital Management LP added 1.01 million shares

- Egerton Capital UK LLP sold 9.5 million shares in Charles Schwab, the biggest reduction by the investor group; Echo Street Capital Management LLC sold 2.2 million shares

- Farallon Capital Management LLC sold 15.18 million shares in Clarivate PLC, the biggest reduction by the investor group; Rivulet Capital LLC sold 6.93 million shares

- Coatue Management LLC added 4.29 million shares in Meta Platforms Class A, the largest increase; Alkeon Capital Management LLC added 1.98 million shares

- Antara Capital LP added 36.81 million shares in Nikola, the largest increase; Coatue Management LLC added 1.52 million shares

- Microsoft was cut or reduced by 185 investors, the biggest such number; Microsoft was also increased or initiated by 180 investors, the biggest tally. Occidental Petroleum was the most valuable overall holding at $43.28 billion. Microsoft remains the most valuable overall holding at $20.16 billion

Alright, I've rambled on enough, time to wrap it up.Please remember to donate any amount under

my picture on the top left-hand side of my blog via PayPal options. The blog is free but the information I provide is priceless.

Have fun looking into the portfolios of the world's most famous money managers.

The links below take you straight to their top holdings and then click to see where they increased and decreased their holdings (see column headings).

Top multi-strategy, event driven hedge funds and large hedge fund managers

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Peak6 Investments

6) Kingdon Capital Management

7) Millennium Management

8) Farallon Capital Management

9) HBK Investments

10) Highbridge Capital Management

11) Highland Capital Management

12) Hudson Bay Capital Management

13) Pentwater Capital Management

14) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

15) ExodusPoint Capital Management

16) Carlson Capital Management

17) Magnetar Capital

18) Whitebox Advisors

19) QVT Financial

20) Paloma Partners

21) Weiss Multi-Strategy Advisors

22) York Capital Management

23) Man Group

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Rokos Capital Management

12) Element Capital

13) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Numeric Investors now part of Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Growth at a Reasonable Price, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Investment Management (Paul Singer)

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

51) Fayez Sarofim & Co

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) RTW Investments

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Sectoral Asset Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) Casdin Capital

18) Bridger Capital Management

19) Boxer Capital

20) Omega Fund Management

21) Bridgeway Capital Management

22) Cohen & Steers

23) Cardinal Capital Management

24) Munder Capital Management

25) Diamondhill Capital Management

26) Cortina Asset Management

27) Geneva Capital Management

28) Criterion Capital Management

29) Daruma Capital Management

30) 12 West Capital Management

31) RA Capital Management

32) Sarissa Capital Management

33) Rock Springs Capital Management

34) Senzar Asset Management

35) Southeastern Asset Management

36) Sphera Funds

37) Tang Capital Management

38) Thomson Horstmann & Bryant

39) Ecor1 Capital

40) Opaleye Management

41) NEA Management Company

42) Great Point Partners

43) Tekla Capital Management

44) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis Allan Gray

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Plan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

Below, billionaire investors Stanley Druckenmiller and David Tepper loaded up on stocks benefiting from the artificial intelligence boom during the first quarter, according to 13F filings for their respective firms released on Monday. Valerie Tytel reports on Bloomberg Television.

Here is what I think of Nvidia (aka, hedge funds' favorite beta beast) and the whole AI hype:

I am waiting for the right time to pounce and short it like crazy (not yet).

Also, Michael Burry, the money manager made famous in The Big Short, boosted his bullish bets on e-commerce giants JD.com Inc. and Alibaba Group Holding Ltd., shown in a 13F filing released on Monday. Valerie Tytel reports on Bloomberg Television. Not impressed with either of these positions and apparently the good doctor also loaded up on regional banks and got crushed there (time to stop trading or investing).

third, once more, at the 2023 Sohn Investment Conference on May 9, 2023, 13D Research & Strategy Founder Kiril Sokoloff spoke with Duquesne Family Office CEO Stanley Druckenmiller about the future of investing.

Stan is the man! Just don't follow him blindly into AI hype stocks!

Lastly, a couple of great movie scenes.

First, my favorite scene from the movie Margin Call. When the full impact of the private debt and commercial real estate crash hits regional and big banks later this year, you'll remember this comment!

And second, since legendary NFL Hall of Fame running back Jim Brown died on Thursday at the age of 87, my favorite motivational scene from Oliver Stone's "Any Given Sunday". Pacino's powerful speech is impressive but Jim Brown's presence in the background is priceless, makes it all the more powerful.

Life is a game of inches, so is trading and managing money for a living! It looks easy and fun until you get deep in the trenches, get whacked hard and claw your way back to fight for every basis point.

I wish all Canadians a nice long Victoria Day weekend.

Update: Some more tweets on Monday for you to consider as we await the debt ceiling deliberations:

Large speculators/hedge funds have boosted net short S&P 500 futures positions even more, surpassing 2011 extreme and moving to 2007 territory pic.twitter.com/ECQj6yuRqO

— Liz Ann Sonders (@LizAnnSonders) May 22, 2023

Most new highs since the all time high.

— Mac10 (@SuburbanDrone) May 22, 2023

Since the top - each surge in new highs the Nasdaq has imploded. pic.twitter.com/YzqeC3pupS

It's hard to argue that a VIX at the lowest level in 18 months has priced in the worst case scenario.

— Mac10 (@SuburbanDrone) May 22, 2023

But bulls still do it all day every day. pic.twitter.com/m3ixDvpahR

Fed’s Bullard Sees Two More Interest-Rate Hikes Needed in 2023 to Cool Prices https://t.co/34n1VcvdZ0 via @YahooFinance

— Leo Kolivakis (@PensionPulse) May 22, 2023

St. Louis Fed President Jim Bullard says he expects two more rate hikes this year, says US recession odds are probably overstated. Yields on 2-year Treasuries tick up. pic.twitter.com/LwzuQQ939G

— Lisa Abramowicz (@lisaabramowicz1) May 22, 2023

On a positive note, Pfizer shares (PFE) rose after a study showed its experimental diabetes treatment was effective in reducing patients' weight. The drug provided similar weight loss to that of Ozempic, but in less time. Pfizer shares gained over 5% on Monday. See details here.

Also, AI stocks like C3 AI (AI) and Upstart Holdings (UPST) popped on Monday as more hype about AI is spreading out there.

Interestingly, Philippe Laffont's Coatue Management took a big position in Upstart in Q1 and is a top holder of the stock:

Don't get carried away here but pay attention as the stock has been decimated over the last two years and was due for a pop. Maybe Coatue is playing the long game, maybe not, just watch it.

Update 2: A week after publishing this comment, we hit peak AI frenzy. Read my comment on the absolutely insane (AI) market reaching new levels of delusions.

Just remember, if you're going to follow Steve Cohen into AI stocks and chase them higher, be ready for the "Steve Cohen Special," you'll know when it hits you! 😁

Comments

Post a Comment