2008: Year of Reckoning for Pensions?

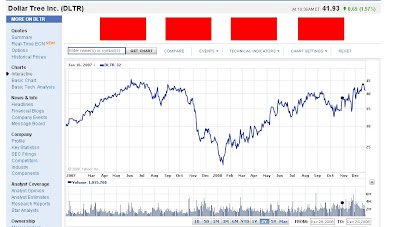

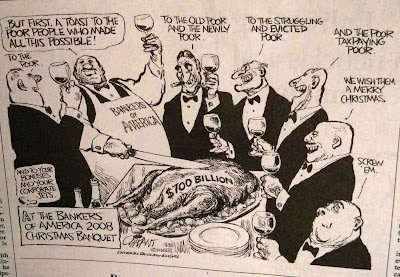

How will you remember 2008? Most investors will remember 2008 as a year of turmoil : The past 12 months will be remembered as a gut-wrenching confluence of unlikely defining trends, almost all unpleasant: a puncturing of the housing bubbles in the U.S. and Western Europe; a paralyzing credit freeze among banks worldwide; an abrupt plunge in commodity and stock prices; global government bailouts of banking, auto and other sectors, and of consumers (through "stimulus packages"); and the re-emergence of unapologetic deficit spending to put an economic Humpty Dumpty back together again. But the year is better understood as one of reckoning, of forced atonement for past sins. The industrialized world has long been living beyond its means, floating everything from unaffordable house purchases to highly leveraged corporate takeovers on a sea credit of unprecedented volume. When the tide of easy money that characterized most of the decade finally went out, crises long in the making ...