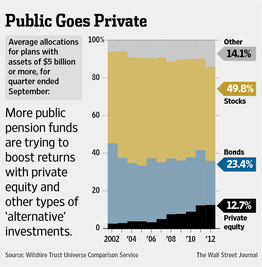

Pensions Taking On Too Much Illiquidity Risk?

My last comment on the Caisse focusing on illiquid asset classes generated a few excellent responses, so I decided to follow-up on this topic. Let me begin with what a former pension fund manager shared with me after reading my comment: Excellent article. I am always impressed to see that some investors still think that illiquid assets are less volatile. Most investors know that illiquid assets have their traditional risk measures (standard deviation, covariance, correlation and beta) underestimated due to stale pricing and infrequent “third-party” valuations. Of course, one can use relatively simple statistical adjustments to estimate the true underlying risk but many investors still prefer to stick with the underestimated risk measures. Private equities generally use more leverage than the average public market investment . It is therefore not surprising to observe a statistically adjusted Beta higher than one. A leading edge Canadian investment organization as...