Governments Robbing Pension Plans?

Institutional Investor reports on how the government is robbing pension plans (h/t, Yves):

Institutional Investor reports on how the government is robbing pension plans (h/t, Yves):Financial repression arrives not with a bang but with a whisper. “It is a very stealthy tax,” says economist Carmen Reinhart of the Peterson Institute for International Economics.

Reinhart is the toast of economic circles these days for speaking out about the newest way Western governments are using financial repression to liquidate their debts, particularly after a financial crisis. They’re doing this on the backs of savers, including pension funds, according to economists.

In practice, financial repression can lead to “the rape and plunder of pension funds,” Reinhart tells Institutional Investor. Financial repression consists of very low nominal interest rates combined with captive lending by large banks or pension funds to a government. The low, stable interest rate facilitates the servicing costs of large public debts. Sometimes modest inflation is added to the mix. This results in zero to negative real interest rates that reduce government debt. Hence, broadly defined, financial repression is a wealth transfer from savers to debtors using negative real interest rates — with the government as one of the key debtors.

“Financial repression is manifesting itself right now,” says Reinhart, who works at the nonpartisan Washington-based research institute chaired by Pete Peterson, co-founder of Blackstone Group.

Low interest rates are a fact of post-crash economic life, designed to kick-start greater borrowing. However, these rates tend to be combined with regulatory measures that give preferential treatment to holders of government debt.

Reinhart outlined examples in her recent paper “Financial Repression Redux,” written with Peterson Institute colleagues Jacob Kirkegaard and M. Belen Sbrancia. The authors assert that governments — in France, Ireland, Japan, Portugal, Spain and the U.S. — are taking steps to create captive markets for their debt. The subtle, perhaps unnoticed result is a new form of taxation: financial repression.

Interestingly, Reinhart does not denounce this new tax. “Financial repression is an expedient way of reducing debt,” she says. For banks as well as the government, debt overhang is a major economic problem. But every tax has costs, including distortionary effects.

Because financial repression punishes savers, it’s unknown to what degree it inhibits savings. What is clear is that all the elements are in place for more financial repression in the U.S. In the wake of Dodd-Frank, public sentiment is moving against laissez-faire capitalism. Reinhart’s advice for pension funds facing this potential onslaught is simple: “I think awareness is the first step to being able to do something about it.”

I've already written on the hidden burden of ultra-low interests rates. Savers are getting pummeled in this environment, earning nothing in their savings accounts or worse still, forced to speculate in this wolf market dominated by high frequency trading platforms run by large hedge funds and big banks.

And in New York, to top up the pension plan, cities borrow from it first (h/t, Diane):

When New York State officials agreed to allow local governments to use an unusual borrowing plan to put off a portion of their pension obligations, fiscal watchdogs scoffed at the arrangement, calling it irresponsible and unwise.

And now, their fears are being realized: cities throughout the state, wealthy towns such as Southampton and East Hampton, counties like Nassau and Suffolk, and other public employers like the Westchester Medical Center and the New York Public Library are all managing their rising pension bills by borrowing from the very same $140 billion pension fund to which they owe money.

Across New York, state and local governments are borrowing $750 million this year to finance their contributions to the state pension system, and are likely to borrow at least $1 billion more over the next year. The number of municipalities and public institutions using this new borrowing mechanism to pay off their annual pension bills has tripled in a year.

The eagerness to borrow demonstrates that many major municipalities are struggling to meet their pension obligations, which have risen partly because of generous retirement packages for public employees, and partly because turbulence in the stock market has slowed the pension fund’s growth.

The state’s borrowing plan allows public employers to reduce their pension contributions in the short term in exchange for higher payments over the long term. Public pension funds around the country assume a certain rate of return every year and, despite the market gains over the last few years, are still straining to make up for steep investment losses incurred in the 2008 financial crisis, requiring governments to contribute more to keep pension systems afloat.

Supporters argue that the borrowing plan makes it possible for governments in New York to “smooth” their annual pension contributions to get through this prolonged period of market volatility.

Critics say it is a budgetary sleight-of-hand that simply kicks pension costs down the road.

“You’re undermining the long-term solvency of these funds and making the pension fund even more of a gamble than it already is,” said Josh Barro, a senior fellow and pension expert at the Manhattan Institute, a conservative research organization. The state, he said, is betting that the performance of the financial markets will improve over the next decade and bail the system out.

“If performance continues to be weak, then contribution rates will be even higher than the rates we’re trying to avoid now, and you’ll produce even more fiscal pain down the road,” he said.

Nationwide, the cost of public retiree benefits has soared in recent years, and states including California, Connecticut and Illinois have been borrowing to pay, or even deferring, their pension bills. Many states are worse off than New York. New Jersey is still paying off bonds issued in 1997 to close a hole in its pension system.

And governors and lawmakers across the country have been trying to take steps to reduce future pension costs, with limited success.

But New York appears to be unusual in allowing public employers to borrow from the state’s pension system to finance their annual contributions to that system.

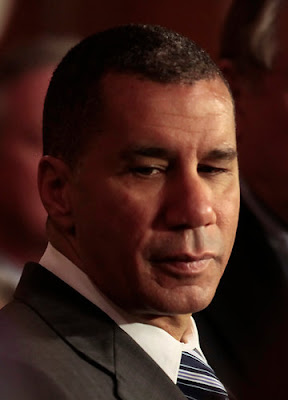

The state’s borrowing mechanism, approved in 2010 under Gov. David A. Paterson, was backed by public sector unions and by the state comptroller’s office, which oversees the pension fund and prefers to call the borrowing a form of amortization, or paying a debt gradually, with interest. The public employers that borrow from the pension system essentially contribute less than they owe in a given year, and agree to repay the difference, with interest, over a decade.

Contributions to the pension system, which covers more than one million members, retirees and beneficiaries, are due annually from the state and municipal governments. As they struggle to pay their obligations under the current system, municipalities are borrowing $200 million this year, up from $45 million last year, the first year the borrowing plan was available, according to the state comptroller’s office.

“I don’t think any financial manager likes to see the can kicked down the road, and would prefer to see all costs paid for in the years that they are incurred,” said Tamara Wright, the comptroller of Southampton. Southampton, on the East End of Long Island, recently borrowed a fifth of its pension bill — $1.2 million of $6 million — by decision of the town board.

“I certainly am sensitive to the board’s concerns about the current economic times,” she said.

The state is borrowing too — $575 million in the current fiscal year, and $782 million in the next, under a budget proposed by Gov. Andrew M. Cuomo.

The state’s comptroller, Thomas P. DiNapoli, said in a statement, “While the state’s pension fund is one of the strongest performers in the country, costs have increased due to the Wall Street meltdown.” He added that “amortizing pension costs is an option for some local governments to manage cash flow and to budget for long-term pension costs in good and bad times.”

The comptroller’s office noted that only a part of the overall pension contributions owed by the state and municipalities was being borrowed. And it said the number of borrowers had risen partly because the borrowing plan only recently became available.

“It would not be fair to draw a characterization about statewide municipal finances from these numbers,” said Kevin Murray, an executive deputy in the comptroller’s office.

But it is clear that a number of major public employers are having trouble affording the state’s current pension system.

“Sharp increases in pension costs are unsustainable and are devastating state and local governments,” Robert Megna, Governor Cuomo’s budget director, said in a statement.

Mr. Cuomo, a Democrat, is proposing changes that would require future state employees to share a greater portion of their pension costs, and would allow them to opt into a 401(k)-style retirement plan. The proposal is known as Tier VI because it would be added to five existing pension benefit categories.

The governor’s proposal has been met coldly by labor unions, as well as by many state lawmakers and Mr. DiNapoli, also a Democrat and an ally of the labor movement. The proposal is supported by Mayor Michael R. Bloomberg of New York as well as other municipal leaders, and by business groups.

“It’s the most significant rising cost that we have,” Scott Adair, the chief financial officer of Monroe County, said of pensions.

In Poughkeepsie, which is contributing $3.6 million into the state pension system this year and borrowing nearly $800,000, Mayor John C. Tkazyik, a Republican, said rising pension costs and new federal accounting requirements for retiree health coverage could have dire consequences.

“It could bankrupt the city,” Mr. Tkazyik said, adding that the city had cut its work force, to 367 from 418 employees, in four years as it struggled to compensate.

The New York Public Library is borrowing nearly $2.9 million of a $14.7 million pension bill this year. A library spokeswoman said the decision to borrow came at the urging of the city, which finances a majority of the library’s budget. The city has its own pension system, separate from the state, which has undergone its own fiscal stresses because of sharp contribution increases.

“After a strong recommendation from the city, the library decided to amortize its pension payments because of the cost savings to both the library and the city, which reimburses more than half of our pension costs,” said Angela Montefinise, the library spokeswoman.

But the Bloomberg administration played down its role.

“The library system decides how to manage their finances,” said Marc LaVorgna, a Bloomberg spokesman, adding, “The decision was made by the libraries.”

What is happening in New York is happening across all states where cash-strapped cities are having a tough time honoring their pension obligations. I am afraid that it's only going to get worse from here.

Finally, a buddy of mine who is a portfolio manager sent me this comment:

One of the first things Tony Blaire did when he entered Number 10 was to put a massive windfall tax on UK utilities that effectively stripped pension funds of billions of dividend income.

Below, Michael A. Gayed, the chief investment strategist at Pension Partners LLC, talks about the possible impact of the rise on oil prices on financial markets. He speaks with Matt Miller on Bloomberg Television's "Street Smart."

Comments

Post a Comment