Will the Clock Strike Twelve Before Christmas?

Stocks slipped from record highs in volatile trading on Friday as lawmakers struggled to bridge differences on additional coronavirus stimulus measures.

The Dow Jones Industrial Average fell about 124.32 points, or 0.4%, to 30,179.05. At its session low, the 30-stock benchmark shed more than 270 points. The S&P 500 dipped 0.4%, or 13.07 points, to 3,709.41, while the Nasdaq Composite lost 0.1%, or 9.11 points, to 12,755.64. All three indexes touched new intraday highs earlier in the day after closing at records in the previous session.

Leaders on Capitol Hill said they are close to an agreement that would provide $900 billion in additional aid. The talks, which have stretched on for months, are up against the wire, with federal funding lapsing at 12:01 a.m. ET on Saturday.

Senate Majority Leader Mitch McConnell, R-Ky., said Friday that the negotiations “remain productive.” “In fact, I am even more optimistic now than I was last night that a bipartisan, bicameral framework for a major rescue package is very close at hand,” he added.

House Majority Leader Steny Hoyer, D-Md., said in the afternoon that the chamber would go into a recess until 5 p.m. while congressional leaders try to get a “clearer picture” of how to move forward. He told representatives to keep Friday night, Saturday and Sunday free.

Last-minute disputes preventing Congress from passing a relief deal include direct payments, small business loans and a boost to unemployment insurance.

Big volume

The stock market experienced massive volume on Friday as Tesla’s historic entry into the S&P 500 will be based on prices at the close. There was a rush of activity into the final bell and the S&P 500 will begin trading with Tesla as a member on Monday.

With a market capitalization of more than $600 billion after a 700% rally this year, the electric carmaker will be joining as the seventh-largest company in the index.

Tesla is being added to the benchmark in one fell swoop, marking the largest rebalancing of the S&P 500 in history. It’s estimated that passive funds tracking the S&P 500 will need to buy more than $85 billion of Tesla, while selling $85 billion of the rest of the index to make room for it.

Shares of Tesla jumped as much as 4% to hit an all-time high on Friday before closing just 0.4% higher. More than 181 million shares of Tesla changed hands, quadrupling the 30-day average volume.

Several major exchange-traded funds like the Invesco QQQ Trust (QQQ), which mirrors the Nasdaq 100, will be rebalanced alongside the S&P 500 Friday.

Meanwhile, the Tesla inclusion coincides with a quarterly event known as quadruple witching, when options and futures on indexes and equities expire. Many expect Friday will be one of the busiest trading days of the year.

Winning week

Major averages eked out gains for the week despite Friday’s weakness. The Dow gained 0.4% for the week. while the S&P 500 advanced 1.3% for its its fourth positive week in five. The tech-heavy Nasdaq outperformed with a 3.1% gain for the week.

Stocks gained earlier this week amid optimism toward a stimulus deal as well as the vaccine rollout. On Thursday evening, Food and Drug Administration advisors overwhelmingly backed Moderna’s Covid vaccine, a key step towards public distribution approval by the FDA. The first inoculations in the U.S. were given Monday with Pfizer and BioNTech’s vaccine.

Investors were betting that a rise in Covid cases as well as disappointing economic data would push lawmakers to cement a new aid package. Jobless claims last week hit their highest level since early September, while retail sales fell more than anticipated in November.

“The bad news this week is that the third wave continues to get worse, and the economic damage from the pandemic continues to mount,” said Brad McMillan, chief investment officer at Commonwealth Financial Network. “The good news is that policy is starting to succeed in containing the virus, and the federal government will likely pass a stimulus bill, mitigating both major risk factors.”

McMillan said investors should expect more volatility in the short term amid developments on the stimulus and vaccine front, before the economy returns to growth in 2021. “With vaccines now available and ramping up, we are at the end of the beginning of the pandemic, and markets recognize that,” he added.

Alright, it's Friday, time to cover markets and once again, there's a lot to cover.

First, the good news, the FDA did overwhelmingly back Moderna's Covid vaccine and since it doesn't need to be refrigerated at extremely cold temperatures, I expect this one will be shipped in rural areas all over the United States and ready to be administered starting Monday morning.

The vaccine can't come soon enough as US coronavirus deaths soared to a daily record of 3,580 and hospitalizations rose for the 19th straight day on Wednesday.

Amazingly, some Americans still refuse to wear a mask in public for political reasons. They should listen to former New Jersey Gov. Chris Christie who is urging people to wear a mask, saying he was wrong to remove his during a White House celebration in October.

I am very happy today for this ad to start to run on TV across America. I urge all Americans to learn from my experience and to, please, wear a mask and stay safe. pic.twitter.com/DGmOValDJo

— Governor Christie (@GovChristie) December 16, 2020

"You're twice as likely to get COVID-19 if you don't wear a mask, because if you don't do the right thing, we can all end up on the wrong side of history, please wear a mask."

Apart from wearing a mask in public, physical distancing and washing your hands often, I keep telling people to increase their intake of vitamin D as they wait to be vaccinated (and even after they're vaccinated):

“Vitamin D treatment should be recommended in Covid-19 patients with low levels of vitamin D circulating in the blood since this approach might have beneficial effects in both the musculoskeletal and the immune system,” said the Spanish study’s co-author, José Hernández, PhD, of the University of Cantabria in Spain. Neither study can say for sure that the deficiency causes the negative outcomes or whether other factors are involved — such as people with the deficiency having other underlying health conditions, or lacking health insurance or access to hospitals.

Yet another study actually tested the effects of vitamin D on Covid-19 patients by adding it to the treatment for one group and not another. Among 26 people who didn’t get the vitamin, half ended up in the intensive care unit and two died. Among the 50 people who got the vitamin, one went to ICU and none died. The results require follow-up research to be conclusive, the scientists wrote in the Journal of Steroid Biochemistry and Molecular Biology. Willett calls vitamin D the “most promising” supplement under study for Covid protection.

Dosage: The U.S. Recommended Dietary Allowance (RDA) for adults is 600 IU (international units) daily. But there’s no firm agreement on this. “I think 2,000 to 4,000 IU per day will get most people out of the deficiency zone and is safe,” Willett says.

Now, as far as the stimulus package, Congress is trying to pass a two-day government funding extension as it has only hours to prevent a shutdown.

I can't believe lawmakers are struggling to finalize a $900 billion coronavirus relief package, but leave it up to Congress to leave everything right down to the wire.

I still think they'll pass something this weekend and if they don't, it's simple, markets will tank next week (unless they keep extending talks).

Alright, let's get to markets starting off with everyone's favorite EV play (not mine), Tesla.

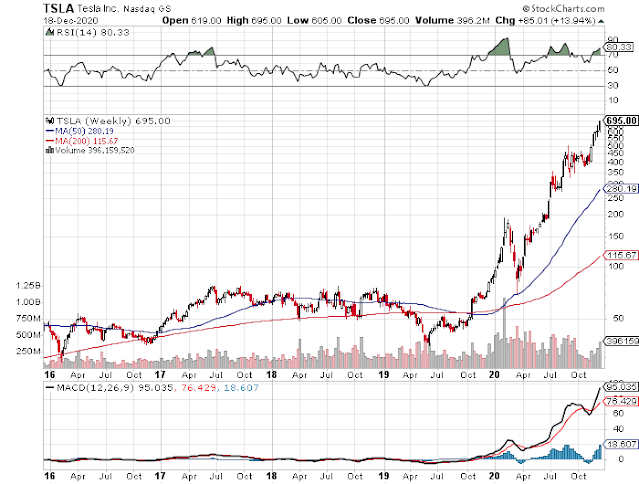

So Tesla made it into the S&P 500 and a bunch of funds that hate it had to buy it today, sending the stock up another 6% on huge volume:

Of course, now that it made it into the S&P, you have to wonder who's left to buy it, a point Anastasios Avgeriou, Chief Equity Strategist at BCA Research, made to me on LinkedIn this afternoon after he posted that he's removing Tesla from the BCA Millennial Basket today:

I tend to agree with him and looking at Tesla's 5-year weekly chart below, I can't help think this is it for this EV juggernaut:

But I must admit, it wouldn't shock me if Tesla hits $1,000 or more in these wacky markets (even Anastasios admits, it can still go up for another two or three months) and a lot of short sellers, including the Big Short's Dr. Burry, are going to feel the pain if this happens (as they did in 2008).

By the way, what happened to short sellers? I told you, the Fed infected them with monetary coronavirus months ago and there's no vaccine to treat that, you just have to wait for the collective madness of crowds to play out.

And let me tell you, pockets of this market are in a full fledged mania.

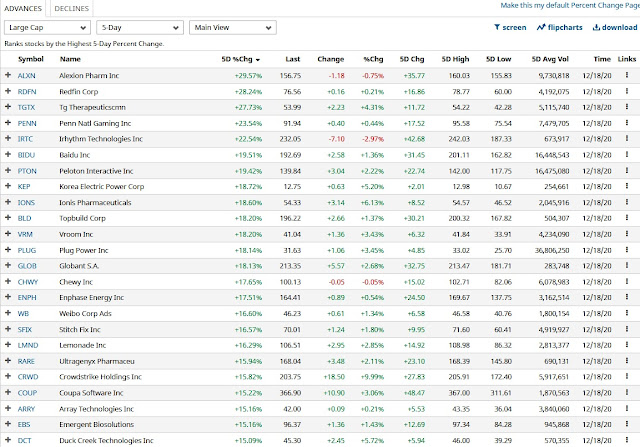

Check out the red hot solar stocks below:

There's no ESG bubble? It's all rational behavior? Save it!

"Ah, come on Leo, don't be such a Debbie Downer, you used to love solar stocks!".

Yes, I did, until I got scorched badly as will a whole new legion of neophyte investors who buy stocks that make them feel good because they're ESG compliant and "only go up, up and away."

I'm not saying all solar stocks are bad (stick with FSLR and SPWR) but there's definitely way too much optimism here and I suspect the minute Joe Biden gets sworn in as the 46th President of the United States, a lot of investors will be taking their profits on these red hot solar shares (it might even be happening now).

I tell all traders/ investors, any time you see a parabolic move like that, book your profits, don't be shy to sweep the table after such monster moves.

What else is going on this week? Hedge funds are buying more Crowdstrike (CRWD), Fireye (FEYE) off the SolarWinds Russia hack and Jumia Technologies (JMIA):

Hedge funds are so predictable, the minute the Fed came out this week and reinstated it's keeping rates low and maintaining its bond purchase program, it's giving a green light to speculators to keep buying high beta growth stocks.

Like David Tepper said, "these are stocks you rent, not own" and a bunch of hedge funds are renting them, big time!

When will this market frenzy end? It's tough to say in these TINA/ FOMO markets dominated by large quant funds, but nobody rings a bell at the top or the bottom, that much I do know.

In the meantime, we all await Congress to pass the bloody stimulus package already.

They will or else Republicans will lose the Senate runoff elections in Georgia early next month and they simply can't afford to lose those elections.

But you never know, the dysfunctional behavior in Washington has reached epic proportions.

Anyway, let me wrap it up here with this week's sector performance, and the best performing large cap and small cal stocks:

Below, Short Hills Advisors' Steve Weiss and the rest of the Halftime Report traders discuss the markets and where they see things headed from here. With Shannon Saccocia, Boston Private Wealth Management.

And Andy Blocker of Invesco discusses the odds a deal on a new stimulus package will be reached, and what's ahead for Congress and other leaders in Washington in 2021.

I think they will strike a deal right on time for Christmas and for Republicans to stand a chance to win the Georgia runoff elections, but you never know with these dysfunctional politicians in Washington.

Update: As predicted, Congress passed the $900 billion stimulus bill on Sunday early evening. Merry Christmas Wall Street and a few crumbs for Main Street. So far Monday morning, traders sold news, with the red hot Nasdaq bearing the brunt of the selling pressure.

Comments

Post a Comment