Americans’ Views of State-Facilitated Retirement Programs

A national survey finds strong support for new state-facilitated retirement programs aimed at helping workers without employer-provided plans save for retirement. The vast majority of Americans (72 percent) agree that state-facilitated retirement savings programs are a good idea, with high support across party and generational lines. Three-quarters of Americans say they would participate in these retirement programs if offered in their state, and most express favorable views of features like portability and low fees.

These findings are contained in a new issue brief from the National Institute on Retirement Security (NIRS), Americans' Views of State-Facilitated Retirement Programs. Download the research here.

"It's encouraging that many states are taking action to help employees save for retirement, and it's equally promising to see strong public support for these new retirement programs," said Dan Doonan, NIRS executive director and report co-author. "At the same time, it's important to note that the state-facilitated programs are a backstop for employees who lack workplace plans like pensions and 401(k) accounts."

"Ideally, the state-facilitated programs will nudge more employers to offer retirement plans to their employees. Employer-sponsored retirement plans have advantages that are not available to state-facilitated plans, including employer contributions. In fact, research indicates that more employers in states like California, Oregon, and Illinois are moving toward plan sponsorship in response to the new state-facilitated programs," Doonan explained.

This research finds:

- The vast majority of Americans (72 percent) agree that state-facilitated retirement programs are a good idea. There is high support across party and generational lines, with support highest among Millennials (78 percent).

- Three-quarters of Americans (75 percent) say they would participate in state-facilitated retirement programs, consistent across party and generational lines.

- Americans view many key features of state-facilitated retirement programs as highly favorable, especially portability (84 percent), higher returns (82 percent), and lower fees (82 percent).

These results come as most working Americans are not on track for a secure retirement. Half of U.S. households will not have enough retirement income to maintain their standard of living in retirement. The causes of the retirement savings crisis are many, including fewer pensions, lower Social Security income, and the rising costs of housing, healthcare, and long-term care.

To help Americans lacking retirement plans at their workplace, many states have taken action, establishing state-facilitated retirement savings programs.

Since 2012, some 46 states have either enacted, studied, or considered legislation that would establish state-facilitated retirement programs, according to Georgetown University's Center for Retirement Initiatives. Currently, 14 states and two cities have enacted these new programs for private sector workers.

While each program is different, the most popular type of program that states are enacting automatically enrolls workers in moderate risk, low-cost retirement savings accounts referred to as auto-IRAs. Typically, the state-facilitated programs require private sector employers lacking retirement plans to provide their employees with access to retirement accounts through payroll deductions. These programs are overseen and administered by the state, while investments are managed by private companies. Workers in states that offer these programs can access these retirement savings accounts when they retire.

Conducted by Greenwald Research, information for this study was collected from interviews conducted between December 4–10, 2020, of 1,203 individuals aged 25 and older. The final data were weighted by age, gender, and income to reflect the demographics of Americans aged 25 and older. Tabulations in some of the charts may not add up to 100 due to rounding.

For the purposes of this research, Millennials include those ages 25 to 43, Generation X includes those ages 44 to 55, Baby Boomers include those ages 56 to 74, and the Silent generation includes those age 75 or older.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @NIRSonline.

You can read more on Americans’ Views of State-Facilitated Retirement Programs on the National Institute of Retirement Security's website:

A national survey finds strong support for new state-facilitated retirement programs aimed at helping workers without employer-provided plans save for retirement.

Americans’ Views of State-Facilitated Retirement Programs finds:

- The vast majority of Americans (72 percent) agree that state-facilitated retirement programs are a good idea. There is high support across party and generational lines, with support highest among Millennials (78 percent).

- Three-quarters of Americans (75 percent) say they would participate in state-facilitated retirement programs, consistent across party and generational lines.

- Americans view many key features of state-facilitated retirement programs as highly favorable, especially portability (84 percent), higher returns (82 percent), and lower fees (82 percent).

These results come as most working Americans are not on track for a secure retirement. Half of U.S. households will not have enough retirement income to maintain their standard of living in retirement. The causes of the retirement savings crisis are many, including fewer pensions, lower Social Security income, and the rising costs of housing, healthcare, and long-term care. To help Americans lacking retirement plans at their workplace, many states have taken action, establishing state- facilitated retirement savings programs.

Conducted by Greenwald Research, information for this study was collected from interviews conducted between December 4–10, 2020, of 1,203 individuals aged 25 and older. The final data were weighted by age, gender, and income to reflect the demographics of Americans aged 25 and older.

Take the the time to download and read the full report here.

It's a very short report and easy to read. Below, I share the important findings:

I find this research fascinating because it shows you a few things:

- Americans across generations are increasingly concerned about retirement security

- They see state-facilitated retirement programs as an easy way to address these concerns

- There is wide support for these state-facilitated retirement programs

- These programs offer many benefits and ensure widespread coverage, especially for employees without workplace retirement programs.

Now, keep in mind, most Americans don't have a 401(k) plan at work, they have very little or no retirement savings, leaving them very exposed as they age and look to eventually retire.

Worse still, the concentration of wealth in the United States has reach epic proportions.

A month ago, Robert Franck of CNBC reported the wealthiest 10% of Americans own a record 89% of all US stocks:

The wealthiest 10% of Americans now own 89% of all U.S. stocks held by households, a record high that highlights the stock market’s role in increasing wealth inequality.

The top 1% gained more than $6.5 trillion in corporate equities and mutual fund wealth during the Covid-19 pandemic, while the bottom 90% added $1.2 trillion, according to the latest data from the Federal Reserve. The share of corporate equities and mutual funds owned by the top 10% reached the record high in the second quarter, while the bottom 90% of Americans held about 11% of individually held stocks, down from 12% before the pandemic.

The stock market, which has nearly doubled since the March 2020 drop and is up nearly 40% since January 2020, was the main source of wealth creation in America during the pandemic — as well as the main driver of inequality. The total wealth of the top 1% now tops 32%, a record, according to the Fed data. Nearly 70% of their wealth gains over the past year and a half — one of the fastest wealth booms in recent history — came from stocks.

“The top 1% own a lot of stock, the rest of us own a little,” said Steven Rosenthal, senior fellow, Urban-Brookings Tax Policy Center.

The growing concentration of wealth comes despite millions of new investors coming into the stock market for the first time during the pandemic, leading to what many have labeled “the democratization” of stocks. Robinhood added more than 10 million new accounts over the past two years and now has over 22 million — many of them held by younger, first-time investors.

Yet while the market may be owned more broadly, the gains and wealth it creates are not being more widely distributed. Rosenthal said that while the army of new investors may be numerous, they are also still small, with the average account size at Robinhood at about $4,500. When markets rise, they will have far smaller dollar gains than wealthier investors with hundreds of thousands or even millions in stock holdings.

“Many of the younger investors also bought in at higher prices, compared to bigger investors who have been in the market for years and see larger gains,” Rosenthal said.

Also, many of the new investors have more of a trading mentality — buying and selling stocks rapidly, with leverage, in hopes of quick gains. While the strategy can create big winners, others may see lower returns than those of investors who simply buy and hold for the long term.

The top 10% saw the value of their stocks gain 43% between January 2020 and June of 2021, according to the Fed. The bottom 90% saw stock wealth rise at a lower rate — 33%.

“They might account for a larger share of trading activity, but that’s different from ownership and wealth,” Rosenthal said.

A lot of younger Americans "discovering" trading are in for a rude awakening when this giant bubble bursts, and it's already bursting in many of the high-flying, high-octane growth stocks:

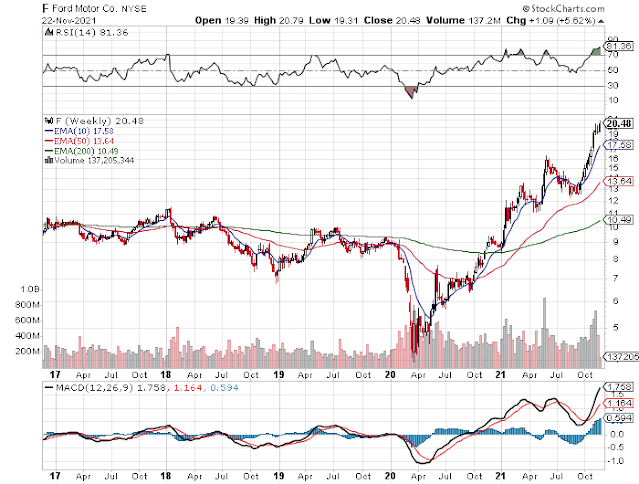

Also, while the younger generation are enamored with Tesla shares, they're probably better off taking profits and sticking with Ford and GM shares going forward:

Or maybe they are better off taking all their profits and sitting on cash over the next year:

BofA Is Bearish on Markets and Sees ‘Rates Shock’ Coming in 2022 https://t.co/jt8yHBsNTy via @Yahoo

— Leo Kolivakis (@PensionPulse) November 22, 2021

Who knows? Nobody knows what the future holds, we are in uncharted territory with unprecedented, some would say obscene amounts of monetary and fiscal stimulus.

The late economist John Kenneth Galbraith used to say: "In a bull market, everyone is a financial genius."

He was spot on, when making money seems easy by taking insane risks, you know there's something way off.

My point in all this is most Americans don't have the luxury to ponder which stocks, hedge funds, private equity funds they're going to invest in, they simply have no workplace retirement programs whatsoever.

They can't relate with the hedge fund gurus I cover every quarter, they're focused on making ends meet.

There is a huge demand for cost-effective, secure workplace retirement programs, something better than 401 (k) plans.

I would urge all US states to study CAAT Pension Plan's DBplus and OPTrust's Select.

Importantly, the future in retirement security lies in bringing back cost-effective, well governed defined benefit plans and these can be managed by large state pension funds.

Don't underestimate the economic benefits of increasing DB pension coverage throughout your population, they're enormous.

Canada's large pensions know all about what's important in retirement. they also know good workplace retirement plans are good for business.

All this to say, I welcome this new research from the National Institute on Retirement Security on Americans' views of state-facilitated retirement programs, but I hope to see it translated into meaningful legislation and better solutions to cover those that need it most.

Below, America's pension shortfall for defined benefit plans alone is estimated to be as high as $7.5 trillion across government and corporate pensions. And the outlook for the alternative of defined contribution plans is equally dire. Only 65% of private-sector workers have access to such plans, and only about half contribute. Given that many experts question the feasibility of pension plans to persistently return 6% to 8%, what can be done to address their shortfalls? What solutions are available for workers not covered by workplace plans? Will new innovative models provide states with a solution? Ultimately, how will the nation save retirement?

Listen to this interesting panel discussion which took place at the Milken Institute two years ago (June 2019).

Comments

Post a Comment