AIMCo's CEO On Why Fossil Fuel Divestment Is Not Their Strategy

Alberta’s public investment manager is not making a net-zero commitment, and selling off fossil-fuel producers is out of the question. Instead, it will concentrate on investing alongside portfolio companies to decarbonize, its chief executive officer says.

Alberta Investment Management Corp. will unveil a “transition finance” strategy in the coming months that will spell out its plans for investing in a lower-carbon economy on behalf of several pension plans and public accounts in the province. Unlike the case with some institutional investors, divestment from fossil fuels – still Alberta’s dominant industry – won’t be on the agenda.

For Edmonton-based AIMCo, concentrating on a specific net-zero goal would be a distraction from what’s needed to balance energy supply and emission reduction, CEO Evan Siddall said. He believes in the concept but said he can’t make the commitment on behalf of clients if he can’t see a clear path to get there.

“Use of energy is going up, and net zero doesn’t mean zero. The initial reaction of a lot of people in the investment world was to jump on a net-zero bandwagon that was divestment-driven. We think that is ill-advised for a bunch of reasons,” Mr. Siddall said in an interview.

“The world is going to need hydrocarbons. We need to make the ‘net’ big enough to be net zero. It’s not just about eliminating the gross, it’s also about increasing the net. If we don’t attend to the oil and gas industry and help them invest in that decarbonization, we will not get to net zero.”

Divestment of fossil-fuel companies robs them of the ability to make the capital investments needed to cut greenhouse gases and raises the risk that producers will be acquired by buyers with no interest in cleaning up operations or even by “unfriendly regimes,” he said.

Not all major Canadian pension managers share that view. Last year, the Caisse de dépôt et placement du Québec caused a stir when it said it would sell off its remaining oil-producing assets as part of its climate strategy. It also set up a $10-billion fund to decarbonize other high-emitting industrial sectors in which it has holdings. The Ontario Teachers’ Pension Plan and the Canada Pension Plan are employing various strategies for their net-zero ambitions.

But the Public Sector Pension Investment Board is taking an approach similar to AIMCo’s, avoiding a specific emission target and concentrating on decarbonization efforts at portfolio companies.

Environmental advocates have criticized many of Canada’s large pension plans for not setting targets to exclude fossil fuels from their portfolios, arguing that this exposes beneficiaries’ retirement funds to climate-related risks.

With oil and gas shortages causing economic upheaval in Europe and contributing to inflation in North America, the race to drain carbon from the global economy has become increasingly contentious. But Mr. Siddall, who is presiding over the opening of a new AIMCo office in Calgary this week, said transforming the oil and gas industry could be “the investment opportunity of our generation at a place, at a time when there are few of them.”

“So we want to really get our hands dirty. We have the benefit of being Albertan and not being driven to rush into this divestment kind of frenzy. Instead, we can help heavy emitters in the oil and gas business, invest in them and decarbonize,” Mr. Siddall said.

AIMCo, which is owned by the Alberta government, manages $168-billion of assets on behalf of 32 entities, including pension funds for municipal employees, first responders, judges, teachers, university professors and others, as well as government accounts such as the $19-billion Heritage Savings Trust Fund.

In late August, it reported a 4-per-cent investment loss for its second quarter, joining several of its peers in showing how big drops in equity and bond markets hurt results. Still, the results beat similar assets it uses as a benchmark, it said.

Mr. Siddall took the helm in July, 2021, after his tenure as the CEO of the Canada Mortgage and Housing Corp. His entry followed a period of upheaval at AIMCo sparked by a $2.1-billion investment loss at the start of the pandemic on volatility-linked instruments, when markets gyrated wildly. An internal review found that the organization suffered from a poor approach to risk management as well as insufficient oversight.

Today, he said, AIMCo is a transformed organization after what he called its “Tylenol moment,” with new leadership that emphasizes close consultation with its clients on investment strategies – a promise he made a year ago. That includes speaking to the heads of the pension plans “almost every week.”

“I have direct relationships with the CEOs of the clients. I present to their boards. [Chief fiduciary management officer] Amit Prakash runs that part of the organization, and in this respect I work for him. He tells me where I need to go and who I need to speak to,” he said.

AIMCo is considering opening new offices in New York and Singapore to bolster its expertise in those major financial centres. Asia and China, specifically, are of keen interest. Besides its headquarters and new Calgary site, it currently has offices in Toronto, London and Luxembourg. “This is something we’re looking at and we’ve not yet decided,” Mr. Siddall said. “It’s a complicated thing. You’ve got to find space. You’ve got to find people – the right people. We ideally will have senior people in each office.”

Mr. Siddall is clear that AIMCo remains committed to maintaining environmental, social and governance (ESG) standards as criticism of the field increases in some political and business spheres. The E portion is represented by the decarbonization strategy, and he sees diversity, equity and inclusion – part of the S category – as being key to the organization’s success.

“We’re a decision-making institution, right? That’s what we do. If people don’t feel comfortable speaking up and challenging decisions, we can’t make good decisions. And when people feel excluded, for whatever reason – their gender, their ethnicity, their education, their age – then we restrict our ability to make the best decisions.”

PIPA News also reports AIMCo CEO rejects divestment of fossil fuels as an investment strategy:

The CEO of Alberta Investment Management Corp. (AIMCo) says that divesting from fossil fuels is the opposite of what pension funds should be doing if they want to help solve the climate crisis.

Evan Siddall — head of what is one of Canada’s largest institutional investors, with $168.3 billion in assets under management late last year — said in an interview that AIMCo aims to be a leader in financing the transition to a low-carbon economy, but it won’t do that by divesting from fossil fuels, as some global pension funds have done.

Instead, Siddall said AIMCo will explore opportunities to invest in oil and gas companies and other heavy industrial issuers.

“We don’t believe in (divestment) as a strategy at all,” Siddall said.

“The energy sector is the sector that invests the most in this area (emission reduction) and has the most to lose. So we think that deserves our support and we are going to invest in that. And we think that’s where the return lies.”

Siddall made the comments Wednesday at a ribbon-cutting event in Calgary to mark the opening of AIMCo’s new office in that city. Until now, AIMCo – which is responsible for pension, equity and government fund investments in Alberta and headquartered in Edmonton – had secondary offices in Toronto, London, the UK and Luxembourg.

Siddall — who has served as CEO of AIMCo for a little over a year and previously served as CEO of the Canada Mortgage and Housing Commission — is also considering opening offices in Asia and possibly New York as it expands into the world over the next few years. want to aim. year.

But he said the importance of Canada’s energy sector right now and moving forward is undeniable as global efforts to decarbonize economies and keep the trajectory of climate change below the dangerous tipping point of 1.5 degrees Celsius of warming accelerate.

“We (AIMCo) have been absent from the Calgary oil and gas and energy hub, probably leaving us less informed than we could be,” Siddall said.

While environmental groups have argued that one of the best ways to make progress on climate change is to urge banks, pension funds and investors to cut funding for the fossil fuel industry, Siddall said it’s misguided.

He said that if Canada is to deliver on its Paris climate accord, it must not only invest in renewable, zero-emission energy, but also help reduce heavy greenhouse gas emissions, or go from ‘grey to green’.

“And that means investing in oil and gas companies. It basically means you have to support them,” Siddall said.

AIMCo has already invested $3.2 billion in no-carbon or low-carbon assets through its infrastructure and renewables portfolio. The company also completed its inaugural “green bond” issuance last year through its AIMCo Realty division.

But Siddall said over the next year AIMCo will explore opportunities for its clients to capitalize on the transition to a low-carbon economy by providing capital to heavy issuers working on their own net-zero plans.

“The first sectors we look at are the energy sector, the energy and utilities sector, industrial issuers in general,” he said.

“We see the potential for strong financial returns. We’re a long-term investor, so unlike public markets that tend to operate quarter-to-quarter with a much shorter horizon, we can look at a move into 2030 and see the way to get a return on decarbonization.

These are excellent interviews with Evan Siddall, AIMCo's CEO, as he explains why they don't believe in divestment from fossil fuels but remain fully committed to responsible investing and ESG despite what critics think.

Now, it's important to note that apart from CDPQ which is pursuing its climate strategy and has exited out of oil & gas, all of its large Canadian peers are not divesting out of this sector, preferring engagement and looking to work with these companies to lower their GHG emissions.

The oil & gas sector typically represents a very small portion of their overall portfolio but they still engage with these companies instead of divesting from them.

I am not going to get into a debate about divesting from oil & gas but it is important to read some material on decarbonizing this industry:

- McKinsey: The future is now: How oil and gas companies can decarbonize

- Pembina Institute: Decarbonizing Canada’s oil and gas supply

From the Pembina Institute:

As Canada’s single largest source of emissions, the oil and gas sector has the potential to make or break the country’s climate commitments. Despite successful efforts to reduce emissions intensity per barrel in the last decade, Canadian crude oil remains some of the most carbon intensive in the world, and the industry’s emissions have continued to increase at a time when greenhouse gases from other sectors have declined.

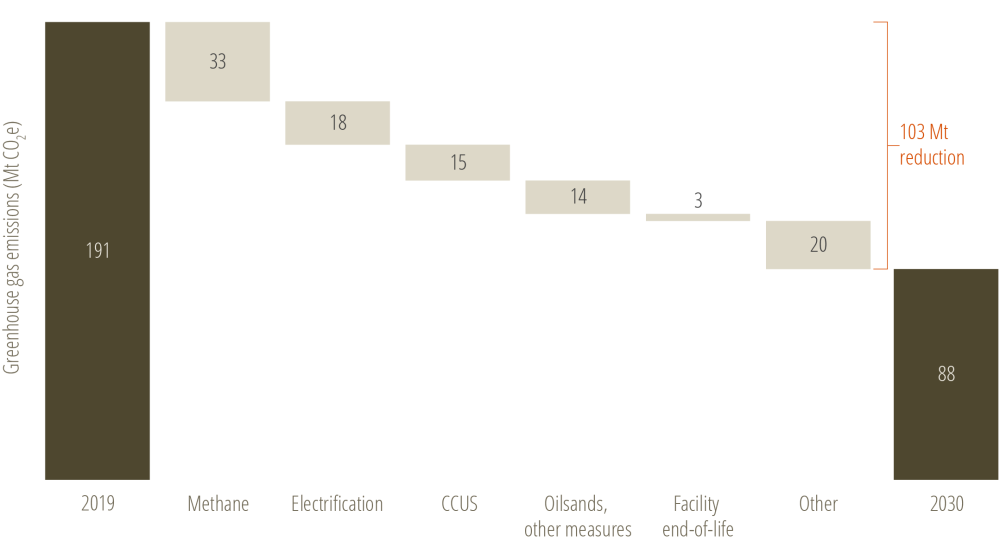

If Canada is to achieve its economy-wide goals of 40-45% reduction by 2030, and net-zero by 2050, the Pembina Institute holds the view that the oil and gas industry’s emission reduction target for 2030 must be at least 45%. Our calculations show that this would mean an annual reduction of 103 million tonnes (megatonnes; Mt) from 2019 levels (which is the most recent year that data for emissions is available).

We also outline the six areas where we assess that the sector can make these reductions, using technology and funds already at its disposal.

Potential to reduce GHG emissions from oil and gas sector by 2030

In addition, these emissions reductions are now crucial for the sector to remain competitive in an evolving global marketplace in which investors are placing increasing value on climate credentials. The war in Ukraine has added to this pressure, as it is reasonable to expect countries will respond to the crisis by expediting their moves away from fossil fuels. Even prior to the war, credible agencies – including from within the oil and gas industry – were suggesting that global demand for oil and gas will start to decline before 2030.

I cannot confirm any of their figures, I am just bringing to your attention why the oil & gas industry must be part of the effort to decarbonize and why many large Canadian pension investment managers are looking to engage with these companies rather than divest from them.

Back to AIMCo, Evan Siddall says he believes in the concept of net zero but said he can’t make the commitment on behalf of clients if he can’t see a clear path to get there.

Last year, the Alberta Union of Provincial Employees called on AIMCo to “quantify the climate risks of its investments and adopt a path to net zero”:

In an emailed statement to Benefits Canada, the AIMCo said it acknowledges that climate change is an urgent and compelling matter requiring immediate action from all players. “As Alberta’s investment manager, we recognize the business imperative of integrating climate change into our investment processes, to both enhance and protect our clients’ risk-adjusted investment returns over an extended time horizon.

“We believe that large-scale, long-term investors like AIMCo have an essential role to play in the coming energy transition. AIMCo has been measuring its carbon footprint since 2016, a process that has since advanced to include a portion of all major asset classes and is committed to engaging with our clients to determine a climate action plan and go-forward strategy that most closely aligns with their objectives.”

The statement also pointed to the AIMCo’s recent responsible investing report, in which the government-owned pension investment manager outlined plans to address a range of environmental, social and governance issues, from integrating climate risk to building a more diverse workforce to advancing its risk governance. “We strive to adopt best-in-class ESG-integration strategies across asset classes and investment processes to better identify our ongoing assessment of risk and value,” read the statement.

Additionally, the AIMCo said it’s consulting with its pension fund clients, including the Alberta Public Service Pension Plan and the Local Authorities Pension Plan to arrive at a climate action plan and go-forward strategy. Plan members of the Alberta PSPP and the LAPP are members of the AUPE.

“LAPP Corporation has an ongoing, almost daily dialogue with AIMCo on responsible investing, with climate change and environmental risk factors high on the list of investment considerations,” said Chris Brown, president and chief executive officer of the LAPP Corp., in an emailed statement to Benefits Canada. “While AIMCo works continuously to update and integrate its oversight of ESG factors, our corporation and our sponsor board are refining our policies and processes as well, to ensure we are providing direction to AIMCo that reflects the expectations of our sponsors.”

The AUPE has a seat on the LAPP’s sponsor board, which has identified climate change as a “primary risk” in the plan’s long-term funding policy, said Brown. For its part, the LAPP Corp.’s board of directors is currently working to develop the terms of an updated responsible investment policy for the LAPP’s funds, which will review best practices around climate risk measures and carbon capture metrics.

“AIMCo has announced it will consider viable options to decrease the portfolio’s emissions trajectory over time,” said Brown. “After consulting with its clients, it expects to update its plan regarding implementation of climate-related targets early next year.”

Other resolutions adopted by the union include a just transition toward net zero for workers and a proposal for a green, new deal that includes providing union jobs through an expanded public sector; modernizing public infrastructure to adapt to climate change; recognizing Indigenous rights and treaties; and building a society that is ecologically sustainable and socially fair.

The AUPE’s vote comes on the heels of the 2021 United Nations Climate Change Conference, or COP26, in Glasgow last month, where world leaders came together to map out a coordinated response to the global climate crisis.

These discussions with clients are important and still ongoing and Evan Siddall has made it his priority to be fully engaged with AIMCo's clients regularly informing them of their activities.

I agree with Evan, if Canada is to deliver on its Paris climate accord, it must not only invest in renewable, zero-emission energy, but also help reduce heavy greenhouse gas emissions, or go from ‘grey to green’.

This is what OTPP, CPP Investments, CDPQ and others are doing, looking to target companies that want to reduce their heavy greenhouse gas emissions (CDPQ is not doing this in oil & gas but other industries).

AIMCo needs to figure out its path to net zero and it seems to be on its way there.

I look forward to seeing its "transition finance" strategy once it is unveiled and Evan is already giving us a preview:

AIMCo has already invested $3.2 billion in no-carbon or low-carbon assets through its infrastructure and renewables portfolio. The company also completed its inaugural “green bond” issuance last year through its AIMCo Realty division.

But Siddall said over the next year AIMCo will explore opportunities for its clients to capitalize on the transition to a low-carbon economy by providing capital to heavy issuers working on their own net-zero plans.

“The first sectors we look at are the energy sector, the energy and utilities sector, industrial issuers in general,” he said.

“We see the potential for strong financial returns. We’re a long-term investor, so unlike public markets that tend to operate quarter-to-quarter with a much shorter horizon, we can look at a move into 2030 and see the way to get a return on decarbonization.

I would encourage my readers to read more about AIMCo's approach to responsible investing here.

In other related news, AIMCo's CEO didn't mince words last Wednesday when speaking about the recent push by some corporate leaders to order employees back to the office full-time:

"I’m amazed at, frankly, how many tone-deaf, white male CEOs are saying, 'you must come back to the office.' I think they’re asking for fights with their employees," said Evan Siddall, head of the Alberta Investment Management Corp. (AIMCo) and a former CEO of the Canada Mortgage and Housing Corporation.

"I think there's been a relatively permanent shift."

Siddall made the comments Wednesday during an interview in Calgary, where he was attending the grand opening of AIMCo's new office in that city.

AIMCo — which is responsible for the investments of pension, endowment and government funds in Alberta, with $163.8 billion of assets under management as of the end of last year — has approximately 600 employees spread across offices in Edmonton, Calgary, Toronto, London, U.K., and Luxembourg.

Since the lifting of COVID-19 pandemic restrictions, those employees have been able to decide within their individual teams how often they want to come into the physical office — with the company suggesting that two days a week be the "starting place" for that conversation, but no firm rules to that effect.

“Our philosophy at AIMCo is we’re all adults," Siddall said. "Where you do this work doesn’t matter. There’s some orthodoxies around culture, where people say, ‘you can only preserve a culture if people are in the office full-time.' I just don’t agree with that.”

For Canada's white-collar workers and employers, the pandemic was a years-long experiment in flexible, remote work.

This September has pitted some bosses and workers against each other with a renewed push by some companies to get employees back into office buildings.

And instead of the voluntary return-to-office guidelines that were a feature of earlier points in the pandemic, many employers are now mandating office attendance through corporate policies.

Those policies don't make sense at a time when companies are still struggling with ongoing labour shortages, high turnover rates and the much-talked-about "quiet quitting" phenomenon, Siddall said.

"Incidentally, our turnover – it’s higher than it’s been because of COVID — but we’re outperforming our peers because we’ve got a different offering for employees. And so they’re staying,” he said.

“We think it’s made us an employer of choice actually, and it’s enabled us to recruit some terrific people that we wouldn’t otherwise have been able to recruit.”

Siddall said he's keenly aware that different demographics have different needs and preferences about where they do their work. Immigrant and culturally diverse populations, for example, have a greater tendency to have elderly family members aging in place within their homes, while young families face particular challenges related to child care.

"Large family units, or if you’ve got aging parents, or young children ... it’s a different kind of lifestyle, and now we can welcome those people and expand our talent pool,” he said.

One thing about Evan, he certainly doesn't mince his words and clearly communicates his thoughts.

He also welcomes diversity of thought and encourages all his senior leaders to foster an inclusive and safe workplace where employees can freely express their thoughts:

"We win together; we lose together" is the right motto to have in this environment.

Below, Bjørn Otto Sverdrup leads the Oil and Gas Climate Initiative (OCGI), which gathers the CEOs of twelve of the world's largest oil and gas companies around an ambitious goal: to get one of the leading contributors to climate change to drastically lower their own carbon emissions. He describes a possible path for the industry to pivot to net-zero operations, reimagining the role it could play in helping decarbonize the economy and igniting changes in how we consume energy.

By the way, Aramco's President and CEO, Amin H. Nasser, addressed the Schlumberger Digital Forum 2022 in Switzerland last week and I would invite you to carefully read his remarks here to appreciate the complexities of this energy transition and why policymakers need to get it right.

There is no easy path to net zero, Canada's large pension investment managers know this. They are all doing their best to navigate this environment, looking at the long-term risks and opportunities of climate change, and they are doing this carefully to make sure their beneficiaries and contributors benefit over the long run.

There are plenty of critics from all sides but I can tell you our large pension investment managers are doing outstanding work in this area and it's impossible to appease everyone.

One thing is for sure, they are all committed to responsible investing and that will continue regardless of where they stand on divesting out of oil & gas. It's the right thing to do and the right approach over the long run.

Comments

Post a Comment