The World’s Best and Worst Pensions in 2022

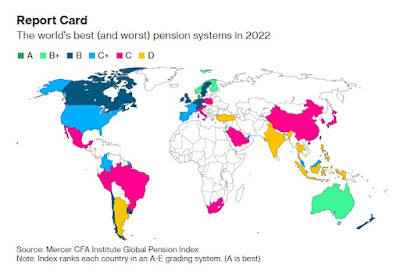

Amy Bainbridge of Bloomberg reports these are the world’s best and worst pensions in 2022:

Workers may have to rethink their retirement plans, warns a survey ranking the world’s pension systems.

Iceland, the Netherlands and Denmark again took the top three rankings in this year’s Mercer CFA Institute Global Pension Index. But the report recommended that retirement ages need to be lifted almost everywhere in the face of mounting threats from aging populations, ballooning government debt and low birth rates.

“What we’re also finding with increased education in many countries, is people are entering the workforce a bit later,” David Knox, senior partner at Mercer and the report’s lead author, said in an interview. “You can’t enter the workforce later, retire at the same age and live longer. Something has to give.”

The current economic environment of reduced wage growth, rising inflation and reduced investment returns in many asset classes is also placing additional financial pressures on retirement income systems, the report found.

The report’s top three countries, while not immune to global economic headwinds, were again found to have sustainable and well-governed systems with a healthy mix of public and private sector pensions and a “high level of integrity.”

The US ranked 20th of the 44 countries surveyed, while newcomer Portugal came in at 24 and mainland China was ranked 36. Mexico, in 29th place, was singled out for improving its score significantly due to pension reforms.

Thailand was ranked lowest, coming in just below the Philippines, Argentina and India. Mercer described those systems as having “some desirable features” but also major weaknesses that needed to be addressed.

As fertility rates decline and people live longer, the United Nations predicts the portion of the world’s population aged 65 or over will rise from 9.7% this year to 16.4% in 2050. Retirement ages among the countries surveyed ranged from 55 to 68, and Knox said that governments needed to encourage people to work “a bit longer.”

The Mercer report recommends promoting higher labor force participation among older people, which will boost their savings while limiting the continued increase in retirement years.

“What we’re really talking about is the living standards of retirees,” said Knox. “It’s much better to tackle this now than wait for that debate to happen in the future.”

Barbara Shecter of the National Post also reports that Canada's pension system holds steady in global ranking as retirement risks rise:

Canada’s pension system received an improved score in a global annual ranking by Mercer and the CFA Institute, but slipped a notch to 13th spot.

The list, released Tuesday, was topped by Iceland, which had an overall index value 84.7, closely followed by the Netherlands at 84.6 and Denmark at 82.

Canada maintained its B-level rating in the 2022 Mercer CFA Institute Global Pension Index with an overall score of 70.6, up from 69.8 in 2021.

Thailand had the lowest index value in the 2022 ranking, at 41.7.

The latest report warned that inflation and rising interest rates are challenging retirees, particularly as employers continue to shift from offering defined-benefit (DB) pension plans to defined-contribution (DC) pension plans. DB plans come with guaranteed payouts, sometimes indexed to keep up with inflation, while payouts on DC plans are based on market performance.

“As DC pension plans continue to make up a greater part of Canadians’ retirement, turbulent markets, soaring inflation and a higher cost of living are all impacting older workers that are transitioning to full or part-time retirement,” said F. Hubert Tremblay, principal and senior wealth adviser with Mercer Canada.

“While Canada’s retirement system continues to rank well globally, there are risks that employers and employees need to manage in the current environment.”

The Mercer-CFA index is derived from a comprehensive study of 44 global pension systems and covers 65 per cent of the world’s population.

It benchmarks retirement income systems around the world, highlighting some shortcomings in each system, and suggests possible areas of reform that would help provide more adequate and sustainable retirement benefits.

Mercer and the CFA Institute released a statement going over the Mercer CFA Institute Global Pension Index 2022 highlights and key challenges of defined contribution plans for retirees:

- Index compares 44 retirement income systems, covering 65 percent of the world’s population

- Index sees Iceland top the list for second year in a row

- As more employers shift from defined benefit to defined contribution plans, retirees will take on greater financial risks

New York, United States – October 11, 2022, 12:01 AM EDT – Today, Mercer and the CFA Institute released its 14th annual Mercer CFA Institute Global Pension Index (MCGPI). Iceland’s retirement income system has once again topped the list, with The Netherlands and Denmark retaining second and third places respectively in the rankings. As more employers have stepped away from defined benefit (DB) plans, the study also investigates the challenges and opportunities with the global shift towards defined contribution (DC) plans where individuals bear increased financial responsibility.

The MCGPI is a comprehensive study of 44 global pension systems, accounting for 65 percent of the world’s population. It benchmarks retirement income systems around the world, highlighting some shortcomings in each system, and suggests possible areas of reform that would help provide more adequate and sustainable retirement benefits.

Senior Partner at Mercer and lead author of the study, Dr. David Knox, highlighted the importance of strong retirement schemes in light of growing external uncertainty.

“Individuals have been assuming more responsibility for their retirement savings for some time; amidst high levels of inflation, rising interest rates and greater uncertainty about economic conditions, they are doing so in an increasingly complex and volatile environment. Despite differences in social, political, historical or economic influences across geographies, many of these challenges are universal. And while the necessary reforms may take time and careful consideration, policymakers must do all they can to ensure retirement schemes are supported, developed and well-regulated,” said Dr. Knox.

CFA Institute President and CEO, Marg Franklin, CFA, underscored the dynamic environment of the investment industry.

“Since the inception of the Mercer CFA Institute Global Pension Index, the investment management and pension industry at large have faced extraordinary challenges. New financial products and strategies will be required to deliver adequate returns for beneficiaries. This past year, we’ve gone from a ‘lower for longer’ interest-rate environment to significant rates of inflation, quadrupling of interest rates in some global markets and a rise in the cost of living for many, all of which have a significant impact on the fixed income of retirees,” said Ms. Franklin.

“At CFA Institute, we believe financial professionals can serve as a force for good in society to support individuals through this complex time. This report provides insights on how retirement plans need to adapt or are adapting to the changing environment, and also makes recommendations for a range of reforms that can be implemented to improve the long-term outcomes from our retirement income systems,” she added.

The shift to defined contribution (DC) increases uncertainty for retirees

As employers continue to step away from the financial security which has been offered in DB plans, individuals bear the risks and opportunities before and after retirement. Unlike DB plans where an individual receives regular income payments for life upon retiring, typically DC plans provide individuals with a lump sum benefit at retirement. Additionally, many governments are considering reducing their level of financial support during retirement to ensure the country’s financial sustainability over the longer term.

The result is that many individuals will no longer be able to rely on significant financial support from their previous employers and/or government during their retirement years. Therefore, it is essential individuals make the best financial decisions at retirement to maximize the value of their available DC pension assets. Just as diversification is a key part to any investment scheme, individuals may also seek to diversify their retirement savings between regular income, appropriate protection and access to capital, as well as different sources of financial support including government, private pensions and individual savings.

“Households will have to consider what the right balance is between receiving a steady income, access to some capital and protection from future risks, given the many uncertainties faced by retirees,” said Dr. Knox.

“It is critical that we understand whether or not the retirement income systems around the world will be able to meet the needs and expectations of their communities for decades to come,” he continued. “There is no single or perfect answer – the best system is the one that helps individuals maintain their previous lifestyles into retirement. Governments, employers, policymakers, and the pension industry should use the full array of products and policies available so individuals can retire with dignity, confidence, and financial security.”

By the numbers

Iceland had the highest overall index value (84.7), closely followed by the Netherlands (84.6) and Denmark (82.0). Thailand had the lowest index value (41.7).

The Index uses the weighted average of the sub-indices of adequacy, sustainability, and integrity. For each sub-index, the systems with the highest values were Iceland for adequacy (85.8) and sustainability (83.8), and Finland for integrity (93.3). The systems with the lowest values across the sub-indices were India for adequacy (37.6), Austria for sustainability (22.7), and the Philippines for integrity (30.0).

In comparison to 2021, Mexico showed the most improvement as a result of pension reform, which improved outcomes for individuals and pension regulation.

About the Mercer CFA Institute Global Pension Index (MCGPI)

The MCGPI benchmarks retirement income systems around the world, highlighting some shortcomings in each system, and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits.

This year, the Global Pension Index compares 44 retirement income systems across the globe and covers 65 percent of the world’s population. The 2022 Global Pension index includes one new retirement income system – Portugal.

The Global Pension Index uses the weighted average of the sub-indices of adequacy, sustainability and integrity to measure each retirement system against more than 50 indicators.

The Global Pension Index is a collaborative research project sponsored by CFA Institute, the global association of investment professionals, in collaboration with the Monash Centre for Financial Studies (MCFS), part of Monash Business School at Monash University, and Mercer, a global leader in redefining the world of work and reshaping retirement and investment outcomes.

About Mercer

Mercer believes in building brighter futures by redefining the world of work, reshaping retirement and investment outcomes, and unlocking real health and well-being. Mercer’s approximately 25,000 employees are based in 43 countries and the firm operates in 130 countries. Mercer is a business of Marsh McLennan (NYSE: MMC), the world’s leading professional services firm in the areas of risk, strategy and people, with 83,000 colleagues and annual revenue of over $20 billion. Through its market-leading businesses including Marsh, Guy Carpenter and Oliver Wyman, Marsh McLennan helps clients navigate an increasingly dynamic and complex environment. For more information, visit mercer.com. Follow Mercer on LinkedIn and Twitter.

About CFA Institute

CFA Institute is the global association of investment professionals that sets the standard for professional excellence and credentials. The organization is a champion of ethical behavior in investment markets and a respected source of knowledge in the global financial community. Our aim is to create an environment where investors’ interests come first, markets function at their best, and economies grow. There are more than 190,000 CFA® charterholders worldwide in more than 160 markets. CFA Institute has nine offices worldwide, and there are 160 local societies. For more information, visit www.cfainstitute.org or follow us on LinkedIn and Twitter at @CFAInstitute.

About the Monash Centre for Financial Studies (MCFS)

A research centre based within Monash University's Monash Business School, Australia, the MCFS aims to bring academic rigour into researching issues of practical relevance to the financial industry. Additionally, through its engagement programs, it facilitates two-way exchange of knowledge between academics and practitioners. The Centre’s developing research agenda is broad but has a current concentration on issues relevant to the asset management industry, including retirement savings, sustainable finance and technological disruption.

You can view the entire list of countries in the press release here.

You can download the report going over the Mercer CFA Institute Global Pension Index 2022 here.

I note the following:

The results are in: Iceland leads, but only by a margin

The Mercer CFA Institute Global Pension Index benchmarks 44 retirement income systems around the world, highlighting challenges and opportunities within each. This year we have added Portugal to the mix, as well as using updated data from OECD and the UN World Population Prospects 2022.

The index is made up of three sub-indices – adequacy, sustainability and integrity – to measure each retirement income system against more than 50 indicators. This year's feature chapter unpacks the challenging defined contribution (DC) equation of converting a DC lump sum into a good outcome for retirees. Download the reports to learn more about your pension system.

Now, my attention immediately went to how Canada scored in the three pillars of analysis:

You will note Canada scored 70.6 in the overall index, ranking at #12 this year.

Its Adequacy index scored 70.8 (B), its Sustainability Index scored 64.7 (C+) and its Integrity Index scored 78.6 (B+).

On Sustainability, the report notes the following (page 21):

The long-term sustainability of the existing retirement income system is a concern in many countries, particularly in light of the aging population, the increasing old-age dependency ratio, the public expenditure on pensions, substantial government debt and rising inflation. Indeed, the World Bank has noted that “most public pension schemes are not viable financially and cannot keep their promises to younger cohorts that will retire in the future.”

This sub-index therefore brings together several measures that affect the sustainability of current programs. Although some demographic measures, such as the old-age dependency ratio (both now and in the future), are difficult to change, others such as the state pension age, the opportunity for phased retirement and the labor force participation rate among older workers can be influenced, either directly or indirectly, by government policy.

An important feature of sustainability is the level of funding in advance, which is particularly important when the ratio of workers to retirees is declining. Therefore, this sub-index considers contribution rates, the level of pension assets and the coverage of the private pension system. In addition, real economic growth over the long term has a significant impact on the sustainability of pensions as it affects employment, saving rates and investment returns.

Given the growing importance and impact of climate change and other global effects on future investment returns, the sub-index also explores the relevance of economic, social and governance (ESG) factors on the investment policies or strategies adopted within each system.

Finally, given the key role that the provision of a public pension plays in most systems, the level of government debt and public pension expenditure represent important factors affecting a system’s long-term sustainability and the future level of these pensions.

Admittedly, I was a bit surprised reading this because I cover Canada's largest pensions and they're all fully funded or close to it and they are global leaders in responsible investing.

In Canada, we have some incredible people in responsble investing like Barb Zvan and Brian Minns (UPP), Richard Manley (CPP Investments), Jennifer Coulson (BCI), Marc-André Blanchard and Bertrand Millot (CDPQ), Katharine Preston and Michael Kelly (OMERS), Sarah Takaki (HOOPP), Hyewon Kong (IMCO), Alison Loat (OPTrust), Carmen Velasquez and Ben Hawkins (AIMCo), Vincent Felteau (PSP) and Stephen McLennan (OTPP).

There are plenty more, I am just giving you some names of people working hard to improve sustainable investing in Canada and abroad.

Also, Sebastien Betermier and his co-authors published a paper recently, Green Urban Development: The Impact Investment Strategy of Canadian Pension Funds, where they find the following:

This paper investigates the investment strategy that large Canadian pension funds implement in the private real estate market. Even though they manage just 6% of global pension assets in our data, Canadian pension funds are responsible for 60% of the total value of private real estate deals that directly involve a pension fund. A key component of their strategy consists of internally developing and greening urban properties in core downtown areas. Using a common benchmarking methodology across funds, we show that this impact strategy delivers superior performance net of fees and drives the green development of major city centers.

Anyways, from the large Canadian pensions I cover, there are NO sustainability issues, they have more than enough assets to pay out long-dated liabilities and they are global leaders in sustainable investing.

But I realize the report looks at private and public pensions and I don't know the health of every pension plan in Canada.

I've said this before and I'll say it again, Canada's large pension investment managers are known to be among the very best in the world but the biggest problem we have in this country is lack of coverage.

If every Canadian had access to a well-governed defined-benefit plan, then we would consistently rank at the top spot along with Iceland, Netherlands and Denmark.

This is why we introduced an enhancement to the CPP where assets are well managed at CPP Investments but it's not enough for older workers.

I recently read an article on how as costs spiral, many low-income seniors are doing without in British Columbia:

In B.C., most seniors 65 and older received Old Age Security, which maxes out at $8,000 annually, as well as Canada Pension Plan benefits with a maximum of about $15,000 annually. About one in four in B.C. received the Guaranteed Income Supplement, which maxes out at $11,952 a year for low-income seniors earning less than $20,208 a year. The three combined typically amount to $22,649 annually.

B.C. tops up the pensions of the lowest-income seniors by $99 a month — but fewer than 10 per cent receive that, and the amount the fourth lowest amount in the country. The supplements in other provinces and territories range from $33.33 a month in New Brunswick to $300 in Nunavut; Nova Scotia and Quebec do not offer a top-up.

This is a widespread problem throughout Canada, not just B.C., and it's another form of pension poverty.

Of course, CPP benefits exist to replace a small portion of your wages, most Canadians also save if they can (RRSPs and TFSAs) and many homeowners are banking that their homes will offer them a decent retirement once they are ready to downsize.

The biggest problem with all these savings plans and defined-contribution plans is retirement risk keeps being placed on workers and the outcomes aren't good because many risk outliving their savings, something which doesn't happen in a well-governed defined-benefit plan which pools investment and longevity risk.

Back in June, I covered HOOPP and Abacus Data's 2022 Canadian Retirement Survey, highlighting many challenges Canadians face and stated this:

Here is the big irony in Canada, we literally have some of the best defined-benefit pensions in the world, if not THE best, but sadly we are not covering enough Canadians so our retirement system doesn't score among the best in the world because of our lack of coverage.

No doubt, there are incremental changes happening, enhanced CPP being an important one for future generations, but it's not enough and it won't help older workers.

There are also great initiatives like CAAT DBplus and OPTrust Select, offering cost-effective retirement solutions for employers-employees all over the country (CAAT DBplus) or in Ontario's non-profit sector (OPTrust Select).

They are incredible retirement solution programs which are growing their membership but the reality is we need to accelerate and replicate their success to cover a lot more Canadians desperately looking for a safe pension they can count on.

The world is changing fast, as bubbles in tech and other risk assets pop, it's the younger generation that risks falling further and further behind.

But this report also highlights another big problem, namely, how far too many Canadians have relied on increasing housing prices as their de facto retirement savings program.

As inflation concerns become more ingrained and mortgage rates rise, it introduces a lot more uncertainty in this retirement strategy.

One CEO of a major Canadian pension fund told me recently he's very worried about the lack of diversification in the retirement savings of Canadians and told me flat out: "If we see a protracted downturn in housing, a lot of Canadians which are way overexposed are going to be in big trouble."

That CEO was in Montreal and was kind enough to meet me. He knew what he's talking about and the world has changed dramatically since then (not for the better).

The macro backdrop is horrific, we can still see bear market rallies, but this has to be one of the toughest environments for all investors, especially retail investors.

In a recent comment of mine going over three bearish billionaires and a glimmer of hope, I stated this:

There will be no soft landing, that is impossible given what is happening and what central banks are trying to do.

I agree with those who see a hard landing ahead as recession odds skyrocket.

The big problem right now is whether central banks are making a policy mistake and risk tightening well into a recession.

It remains to be seen where the Fed's terminal rate will be but if core inflation remains sticky, it might be 5% or more and more quantitative tightening might be required (so far QT is negligible).

What does all this mean for stocks and bonds?

It means investors have to reprice risk and that process is still underway.

It means the old 60/40 portfolio will not generate anywhere close to the returns of the past 20 or 10 years and alternatives will need to kick in to make incremental gains.

Large, well capitalized institutional investors with a diverse portfolio across public and private markets all over the world -- like Canada's large public pension investment managers -- will be able to weather the storm as they have a long investment horizon and the right active management approach but even they will be hit if the recession is severe and drags on for a lot longer than usual.

But they have been bracing for tough times and will pounce on opportunities and deliver great returns over the long run.

It will be a lot tougher for individual investors to navigate this environment.

All this to say I'm very worried that many people without a well-governed defined-benefit plan will fall through the cracks.

So, while CPP Investments is easily one of the best pension funds in the world, as are many of its large Canadian peers, there are cracks forming in Canada's retirement system.

But my message to policymakers is focus on outcomes and what works and introduce policies that bolster the retirement security of all Canadians, not just those who are lucky enough to have access to a well-governed DB plan.

Three fundamental pillars we need to make our society better are a great education system, a great healthcare system and a great pension system.

The first two are decent but far from perfect. Healthcare expenses are only rising as the population ages and we should have had funds similar to CPP Investments to adequately plan for rising costs (the pay-as-you-go system is terrible).

The third pillar -- our pension system -- is decent once you account for OAS and GIS but it can be significantly improved if we improve coverage so all Canadians have access to a well-governed defined-benefit plan.

And it can be done in an efficient and inexpensive manner which promotes workplace retention, something CAAT Pension Plan CEO and Plan Manager Derek Dobson keeps hammering when discussing the benefits of CAAT's DBplus for workers and employers:

Defined benefit pensions today can come at a fixed DC-like cost with less risk, since contributions across participating employers are pooled, along with the longevity and investment risks, and managed by investment and pension experts.

“DB pensions are an incredibly efficient way for Canadians to save while they work,” says Dobson. “They can yield three times the retirement benefits per dollar saved than the average individual method of saving through RRSPs, without the employee needing to make sophisticated investment decisions over years, even decades.”

The looming retirement income security crisis in Canada can only intensify as demographics continue to shift. Baby boomers are retiring and Canadians are living longer. With this comes widespread concern among experts about whether Canadians are adequately prepared for retirement, and associated concerns about the impact aging Canadians without sufficient retirement savings will have on the health care system, social security programs such as OAS and CPP, and the overall health and well-being of Canadian families.

Up until the late 1970s, defined benefit plans were one of the most common types of workplace retirement plans Canadian employees could rely on. This means that the average baby boomer has witnessed a drastic decline in defined benefit pensions over the span of their career when, ideally, they should be seeing increased support.

“As the fastest growing DB plan that is open to private, non-profit, and the broader public sectors in Canada, our purpose is to improve retirement income security for Canadians,” says Dobson, who notes pensions also promote social equity by helping workers achieve retirement income security regardless of gender, education, or profession.

More than three-quarters (77 per cent) of Canadians say that employers have a responsibility to offer a pension plan so that employees can have adequate retirement income, according to data from the Healthcare of Ontario Pension Plan. Eighty per cent believe that without good pensions at work, Canadian seniors will experience poverty.

Learn how you can stand out among your competitors with DB plans that demonstrate a commitment to your employees’ long-term professional and financial growth. Register for the The Marathon for Talent: How to attract and retain talent through a long-term lens webinar now, and start planning for the future.

Lastly, it's Mental Illness Awareness Week and I join many unions and disability rights and disability justice movements across Canada urging MPs from all parties to come together in support of Bill C-22, the Canada Disability Benefits Bill which will help many people with mental and physical disabilities:

This week marks Mental Illness Awareness Week, which is aimed at raising awareness and increasing action in support of Canadians living with mental illness. More than two million Canadians have a mental health related disability and one in three Canadians will be impacted by mental illness in their lifetime.

According to a recent poll, 40 percent of Canadians reported feeling like they were at a mental health breaking point, while almost 60 percent said someone in their immediate circle of close friends, co-workers and family members has suffered a mental health crisis.

“People living with a mental illness must have access to social safety nets that will help them live in dignity and pursue decent work. Unions welcome the new disability benefits bill because we believe it is part of the solution to pull back the barriers that work against people with mental illness in our society,” said Bea Bruske, President of the Canadian Labour Congress (CLC).

People with mental illness are disproportionately unemployed when compared to their counterparts in the labour market, and consequently, they are more susceptible to living below the poverty line. Even when they are employed, they are more likely to receive wages that are either at or below minimum wage. The Mental Health Commission of Canada found that up to 90 percent of people living with a serious mental illness are unemployed.

The Commission also found that a rising number of people with mental illness are transitioning to various federal, provincial, territorial and private income supports, a situation that has only gotten worse since the COVID-19 pandemic began. What’s worse: these income support programs have already been proven to provide insufficient and inconsistent financial resources that often deepen the economic disparities faced by people with disabilities in Canada compared to the general population.

“Unions across Canada will stand in solidarity with our coalition partners in the disability rights and disability justice movements demanding that this government live up to its promise to build a Canada without barriers. Fast tracking the disability benefits bill is a critical part of fulfilling that promise,” said Lily Chang, CLC Secretary-Treasurer. “Reducing disability poverty through the adoption of Bill C-22 is the right thing to do.”

The Canada Disability Benefit bill was first introduced in the throne speech of fall 2020. It was then reaffirmed in the 2021 mandate letter for Minister of Employment, Workforce Development and Disability Inclusion, Carla Qualtrough. Learn more about advocacy efforts to fast track the benefits bill from the National Disability Without Poverty Network.

And it's not just a mental illness problem.

Disability impacts many families. This summer the Ottawa Citizen published this heartbreaking story about a retired nurse in Ontario, Una Ferguson, and her disabled son, Scott, both terrified about his future as inflation erodes his paltry disability benefits:

Una is worried about what will happen if they are forced to look for new apartments. She has no idea what will happen when she won’t be there to fill the gaps.

“It boggles the mind to think about getting an apartment for $497,” she said.

Inflation has hit most people hard, but it has been even tougher for people living on ODSP.

“It is well known that the social and environmental determinants of health cost human lives. People on ODSP are living in poverty and are living undignified lives. Nurses see that every day,” said Doris Grinspun, CEO of the Registered Nurses’ Association of Ontario, which this week launched a campaign urging the provincial government to double ODSP payments immediately and to index future increases to inflation.

According to the province, the purpose of ODSP is to allow individuals to live as independently as possible and to lead dignified and productive lives. The program includes income support as well as health and personal-needs allowances.

But the province’s support program is out of step with today’s costs and does nothing to give disabled people dignified lives, Grinspun said. According to RNAO calculations, since the Ford government came to power in 2018, the real value of ODSP has further declined by 10 per cent, with an overall decline of almost 32 per cent since 1992.

“We can afford to help them in a way that keeps them out of utter poverty,” she said. “We pay. And they pay. Quite dearly.”

They do pay quite dearly. The only good thing is her pension is guaranteed and well managed by HOOPP so she can rest assured she can help her son while she still can. Others aren't able to do so.

As I keep saying, behind every pension, there's a person with a story.

It's mind-boggling that during the pandemic, the federal government (rightly) gave millions of Canadians who needed income support $2,000 a month in CERB payments when inflation was low and two years later, our society's most vulnerable are left to fend for themselves with half that amount in a high inflationary environment. It's actually scandalous and really unjust when you think about it.

Enough ranting from me, just pointing out that Canada is a great country but we can improve it and that will require MPs from all parties compromise on important issues and do the right thing, especially on some issues which have been neglected for far too long.

Below, everything you need to know about CPP, OAS and GIS. One question I get is when are inflation adjustments made to CPP benefits and the answer is once a year in January, calculated as follows here.

And Employment Minister Carla Qualtrough says a bill reintroduced in Parliament will create a Canada Disability Benefit but there remains a lot of work to be done to determine how much the benefit will pay and who will be eligible. She says there are federal benefits for children with disabilities and for seniors but people with disabilities of working age are left out and this benefit intends to close that gap.

This could potentially be the most significant income security reform and advance for Canadians with disabilities since the 1960s.

Lastly, learn a little about how Iceland's pension system works, very interesting presentation which covers the basics and more.

Comments

Post a Comment