This Week in Pensions & Investments: 10-11-2023

1) CPP Investments ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $576 billion, compared to $575 billion at the end of the previous quarter:

The $1 billion increase in net assets for the quarter consisted of $488 million in net income and $700 million in net transfers from the Canada Pension Plan (CPP).

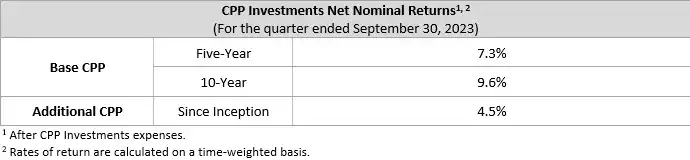

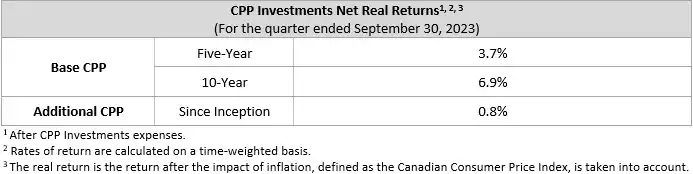

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a 10-year annualized net return of 9.6%. For the quarter, the Fund’s net return was 0.1%. In the 10-year period up to and including the second quarter of fiscal 2024, CPP Investments has contributed $311 billion in cumulative net income to the Fund.

For the six-month fiscal year-to-date period, the Fund increased by $6 billion consisting of a net loss of $4 billion, plus $10 billion in net CPP contributions. For the period, the Fund’s net return was negative 0.7%.

“Our diversified portfolio remains resilient, and while we expect these challenging investing conditions to persist for the near term, we are confident that our active management strategy will continue to deliver positive long-term results for CPP contributors and beneficiaries,” said John Graham, President and CEO, CPP Investments.

The Fund’s quarterly results were driven by positive performance in credit and private equities and gains across U.S. dollar-denominated assets, which benefited from a strengthening U.S. dollar relative to the Canadian dollar. Returns were offset by losses in fixed income due to continued high interest rates and weak performance in public equities as global markets declined.

Performance of the Base and Additional CPP Accounts

The base CPP account ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $546 billion, compared to $547 billion at the end of the previous quarter. The $1 billion decrease in net assets consisted of $1 billion in net income, less $2 billion in net base CPP outflows. The base CPP account’s net return for the quarter was 0.2%, and the five-year annualized net return was 7.3%.

The additional CPP account ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $30 billion, compared to $28 billion at the end of the previous quarter. The $2 billion increase in assets consisted of a net loss of $392 million and $3 billion in net additional CPP contributions. The additional CPP account’s net return for the quarter was negative 1.3%, and the net return since inception in 2019 was 4.5%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Board appointments

- Welcomed the designation of Dean Connor as Chairperson of the Board of Directors, effective October 27, 2023. Mr. Connor succeeded Heather Munroe-Blum, CPP Investments’ Chairperson since 2014, whose final term as Chairperson and Director expired in October. Mr. Connor has served on the Board since August 2021.

- Welcomed Nadir Mohamed to the Board of Directors. Appointed in October 2023, Mr. Mohamed is the retired President and Chief Executive Officer of Rogers Communications Inc. He brings extensive business leadership experience to the Board, as well as expertise in stakeholder management, enterprise risk management and cultivating talent.

- Welcomed the reappointments of Ashleigh Everett, John Montalbano, Mary Phibbs, and Boon Sim as Directors of the Board for three-year terms effective October 2023.

Executive announcements

- Manroop Jhooty was appointed Senior Managing Director & Head of Total Fund Management. In this role, Mr. Jhooty is responsible for the Total Fund Management department where he leads the balancing and financing portfolio, which is invested in global public securities, as well as balance sheet management, tactical positioning, trading and portfolio design. Mr. Jhooty joined CPP Investments in 2019.

Corporate developments

- Published our 2023 Report on Sustainable Investing, which focuses on how we embed sustainable investing across the investment life cycle to create value and progress on our net-zero commitment.

- Published Road to Zero: Decarbonization Investment Approach Progress Report through the CPP Investments Insights Institute, which shares learnings from the Fund’s first year implementing its decarbonization investment approach. The approach involves supporting portfolio companies as they reduce emissions to build value over the long term.

Second-Quarter Investment Highlights

Credit Investments

- Invested €20 million into a syndicated credit-linked note with Banco Santander, a leading Spanish financial institution, for a diversified portfolio of small and medium-sized enterprise loans.

- Invested €60 million into a syndicated credit-linked note with a leading global bank headquartered in Europe for a diversified portfolio of corporate loans.

- Completed a multi-year forward flow agreement with Exeter Finance LLC, a U.S. indirect auto finance company, to acquire up to US$200 million per year in residual certificates of auto loan receivables securitizations.

- Invested US$150 million in Cornerstone OnDemand’s incremental first-lien term loan. Based in the U.S., Cornerstone OnDemand is a global leader in learning and talent management software-as-a-service solutions.

- Invested £93 million in a debt facility to Vårgrønn, owner of a 20% stake in Dogger Bank Wind Farm, which is an offshore wind farm currently under construction, located off the coast of the U.K.

- Received net proceeds of US$581 million from the sales of U.S. oil and natural gas mineral and royalty interests owned by LongPoint Minerals, LLC and LongPoint Minerals II, LLC, which CPP Investments owns stakes of 72% and 44%, respectively. LongPoint Minerals, LLC and LongPoint Minerals II, LLC acquired their assets between 2016-2021.

Private Equity

- Invested US$206 million to acquire positions in two fund-of-fund vehicles that are invested in buyout, growth buyout and venture funds across a wide range of industries, primarily in the U.S.

- Completed the secondary purchase of a US$100 million commitment to Oak Hill Capital Partners V, which focuses on investing across the industrials, media & communications and business services in the U.S.

- Committed C$200 million to the Canadian private equity market through an evergreen Canadian mid-market mandate managed by Northleaf Capital Partners, a Toronto-headquartered global private markets investment firm. The mandate will target investments in Canadian buyout and growth funds, secondary investments and direct co-investments.

- Invested US$40 million in Redwood Materials Inc., a U.S. company developing a closed-loop supply chain for lithium-ion batteries, through an equity funding round. This is our third investment in the company for a total of US$150 million.

- Invested US$50 million in ServiceTitan, Inc. through an equity financing round and a secondary transaction. Headquartered in the U.S., ServiceTitan is a cloud-based software platform built to power trades businesses.

- Invested US$19 million in Works Human Intelligence, a leading human capital management software provider in Japan, alongside Bain Capital Asia.

- Committed €500 million to CVC Capital Partners IX, L.P., which focuses on control and shared-control buyouts across industries primarily in Europe and the Americas.

- Committed US$150 million to American Industrial Partners Capital Fund VIII, which will primarily target value-oriented, control investments in the North American industrials sector.

- Committed US$150 million to Hellman & Friedman Capital Partners XI, which focuses on leveraged buyouts and growth capital opportunities in North America and Europe, primarily in the technology & software, healthcare, financials and consumer & retail sectors.

- Exited our 2016 commitment to STAR Capital Partners III through a secondary transaction, generating net proceeds of €96 million. STAR Capital is a mid-market, U.K.-based private equity firm focused on buyout and growth opportunities.

- Exited our co-investment in Vistra, a leading provider of trust, fund and corporate services based in Hong Kong with a resilient, scalable, and enterprise-wide technology platform. Net proceeds from the sale were approximately C$155 million. Our original investment was made in 2015 alongside BPEA EQT.

- Exited our co-investment in Coforge, a leading technology services provider in India. Net proceeds from the sale were approximately C$145 million. Our original investment was made in 2019 alongside BPEA EQT.

- Completed a structured liquidity transaction, partially divesting 12 North American energy funds, generating gross proceeds of approximately US$860 million with the opportunity for further distributions.

Real Assets

- Invested US$500,000 in Mombak, a Brazil-based venture-backed carbon removal startup investment manager focused on reforesting the Amazon, and committed up to US$30 million to The Amazon Restoration Fund.

- Announced a new partnership with Amsterdam-based Power2X, in which we will invest an initial €130 million to accelerate the growth of Power2X as a development platform and fund green molecule projects. Power2X is a leading European green molecule developer and advisor focused on the decarbonization of industrial value chains.

- Sold our 45% stake in a portfolio of medical office buildings in Southern California. Net proceeds from the sale were approximately US$100 million. Our original investments were made between 2015-2017.

Transaction Highlights Following the Quarter

- Committed US$240 million to TPG Partners IX, L.P., which focuses primarily on healthcare, software and digital media & communications, and US$60 million to TPG Healthcare Partners II, L.P., which focuses solely on healthcare. The funds target upper middle-market and large growth buyouts in North America and Western Europe.

- Committed up to US$90 million in junior financing to fund up to US$820 million of loans originated by Service Finance Company, a U.S. home improvement financial services company.

Read the press release here and see highlights here.

2) OMERS to invest US$400 Million for an indirect 5% stake in Maple Leaf Sports & Entertainment (MLSE):

Toronto, [November 6, 2023] – OMERS, one of Canada’s largest defined benefit pension plans, is acquiring a 5% indirect stake in Maple Leaf Sports & Entertainment (“MLSE”) for US$400 million (~C$546.8 million) through a 20% direct stake in Kilmer Sports Inc. (“KSI”), owned by MLSE Chair Larry Tanenbaum.

“As an owner of MLSE, I’ve always seen myself as a steward of a public trust, working in service to the fans and the public to build Canada’s most iconic sports teams and win championships,” said Larry Tanenbaum, Chair of MLSE. “Now with this investment by OMERS, I’m thrilled to be sharing this public trust with over 600,000 hard-working Ontarians. Today is a good day for the future of MLSE.”

KSI currently owns 25% of MLSE. KSI is owned by Larry Tanenbaum who is also Chairman and CEO of Kilmer Group. In 1998, Tanenbaum was instrumental in the formation of MLSE, the pre-eminent leader in delivering top quality sports and entertainment experiences. It is the parent company of sports teams including the National Hockey League’s Toronto Maple Leafs, the National Basketball Association’s Toronto Raptors, Major League Soccer’s Toronto FC, and the Canadian Football League’s Toronto Argonauts and a number of development teams.

Blake Hutcheson, President and CEO of OMERS, said “This is an exciting and unique opportunity for OMERS members in Ontario communities to be connected to these iconic sports teams in their own backyard. As an investor on their behalf, we actively seek out investment opportunities of the highest quality, that are fortified by trusted partnerships and that offer the potential of significant long-term upside. This one happens to be here in Canada and Ontario which is also really important, and meaningful to OMERS.”

Upon closing, Tanenbaum will retain an 80% stake in KSI and KSI maintains its 25% stake in MLSE. Tanenbaum will remain Chair of MLSE, Governor and member of the Executive Committee of the National Hockey League and Major League Soccer, and Chairman of the Board of the National Basketball Association. OMERS will be a financial investor and will not participate in operational decisions of MLSE or any of its teams.

About Kilmer Group

Kilmer Group is a multi-generational platform with a long history in business development and investment focused on three verticals: Infrastructure & Real Estate, Sports & Media, and Private Equity, which includes a majority ownership in Coca-Cola Canada Bottling Limited.

About OMERS

Founded in 1962, OMERS is one of Canada’s largest defined benefit pension plans, with C$127.4 billion in net assets as at June 30, 2023. OMERS is a jointly-sponsored pension plan, with 1,000 participating employers ranging from large cities to local agencies, and 600,000 active, deferred, and retired members. OMERS members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. Contributions to the Plan are funded equally by members and employers. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers and originating and managing a diversified portfolio of high-quality investments in public markets, private equity, infrastructure, and real estate.

Read the press release here.

Ana Pereira of the Toronto Star notes the deal puts the overall value of MLSE at $8 billion — a significant increase from when BCE and Rogers bought a stake in the company for 1.32 billion in 2012:

The deal puts the overall value of MLSE at $8 billion — a significant increase from when Bell Canada and Rogers Communications bought a 75 per cent stake in the company from the Ontario Teachers Pension Plan for $1.32 billion in 2012.

That’s partly because, over the last decade, professional sports franchises saw a spike in value on the heels of growing billionaire interest in a finite pool of teams.

MLSE’s success is a result of growing sales, merchandising, and breeding championship contending teams like the Raptors, which captured the NBA Championship in 2019, says Richard Powers, professor at the Rotman School of Management who specializes in sports marketing.

“They know the business,” said Powers “and they’ve had excellent leadership over the years.”

The Raptors alone are valued at $4.1 billion, 10th in a list of NBA teams for 2023, according to Forbes, while the Leafs came in second in Forbes rankings of most valuable NHL teams in 2022 at $2 billion.

For Tanenbaum, the move might reflect a desire to reap some of that gain, said Michael Goldberg, senior vice president of sports financing at DBRS Morningstar.

“If he has an asset that has gone up by a factor of eight times in the last ten or so years, it’s probably a significant portion of his net worth,” said Goldberg.

Read the full article here.

3) Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers' Pension Plan, invests USD 80 million in Xpressbees

Pune, November 7, 2023 – Xpressbees, one of India’s market-leading and fastest growing third-party end-to-end logistics platforms, announced today that Teachers’ Venture Growth (TVG), the late-stage venture and growth investment arm of the C$249 billion Ontario Teachers’ Pension Plan has made a US$ 80 million investment in Xpressbees. This investment will be used to help drive further growth for the Xpressbees platform and support the company’s strong management team with their future ambitions. This marks Ontario Teachers’ first investment in India from the TVG platform. TVG joins a marquee set of investors in the company including Blackstone Growth, TPG Growth, ChrysCapital, Khazanah Nasional Berhard, Alibaba Group, Elevation Capital, Investcorp, Norwest Venture Partners and Gaja Capital.

Xpressbees has been at the forefront of tech-led disruption in the logistics industry with its unique asset light model tailormade for India and has executed this in a highly capital efficient format. Xpressbees has gained significant market share from incumbents while maintaining its best-in-class SLAs through multiple tech interventions. It has helped scale multiple e-commerce platforms by providing an extremely efficient logistics solution and delivering happiness to their customers’ doorstep. With express logistics being the need of the hour for multiple industries, it has expanded focus across Pharma, Healthcare, Manufacturing and many other segments.

Through its subsidiary NimbusPost, Xpressbees is providing a SaaS based shipping aggregation platform for SME & D2C brands. It’s easy and reliable plug and play cost effective tech solution has resulted in NimbusPost being the second largest shipping aggregator platform. Today, it has 60,000+ clients and ships through 27 local and national courier partners. The company further intends to expand its suite of service offerings through selective inorganic acquisitions. It recently acquired TrackOn to enter SME/C2C courier services.

Speaking on the transaction, Amitava Saha, Founder & CEO Xpressbees said, “We believe the logistics sector is at the cusp of technological disruption and this is the right time to expand service offerings to address the growing needs of businesses and consumers. We are elated to partner with the TVG team who bring rich experience and a vast global network which will help as we scale our end-to-end platform to cater to the next level.”

Deepak Dara, Senior Managing Director and Head of India at Ontario Teachers’ said, “We are excited about the market opportunity for end-to-end logistics and supply chain solutions that can meet the needs of a diversified customer base across industries, including e-commerce in India. Led by a strong team, Xpressbees has established a highly scalable and efficient asset-light model with proven execution capabilities. We are delighted to partner with Amitava and the Xpressbess team in executing their vision to build an industry-leading business.”

Kelvin Yu, Senior Managing Director, Teachers’ Venture Growth said “Xpressbees aligns with our TVG thesis for Asia, of partnering with exceptional management teams looking to leverage technology to accelerate growth in an attractive end market that has a long runway for innovation and development. India is a critical market for our TVG Asia strategy, where we look to lead or co-lead rounds, and Xpressbees is a culmination of one such proprietary opportunity. We are excited to partner with Amitava and leverage our global network and playbook to drive long-term value creation for the business”

Avendus Capital was the exclusive financial advisor on this transaction

About Xpressbees

Xpressbees is one of the fastest growing end-to-end logistics companies in India. Xpressbees has established itself as a full-service logistics organization across B2C Express, B2B Express, 3PL, Cross-border operations, Shipping aggregator and SME courier services. The company today is present across over 5,000 cities and towns, serving over 20,000 pin codes, and delivers over 1.5 million packages per day. Xpressbees now has over 100 hubs across India, more than 3 million sq. ft. of warehouse capacity, and operates across 52 airports in the country.

About Teachers’ Venture Growth

Teachers’ Venture Growth (TVG) focuses on late-stage venture and growth equity investments in cutting-edge technology companies worldwide. We partner with founders with bold missions, looking to expand their product offering, scale geographically, and become the leaders in their markets. We bring long-term thinking and active investing to help build better businesses and a better world. We think globally and act locally through our direct office presence around the world.

Read the press release here.

3) CDPQ announced a minority investment in AVENIR GLOBAL, a Montreal-based holding and management company of public relations and communications firms that ranks in the international top 25:

This transaction will enable AVENIR GLOBAL to continue expanding its footprint to bolster its position as a global leader in the communications industry. The firm has enjoyed strong growth, more than doubling its revenues in the last decade, and plans to double them again in the next five years, notably through expansion projects abroad and organic growth.

“As a Québec-owned company that still has deep roots in the province, we are proud of the participation of CDPQ, a world-class partner that will support us in achieving our growth ambitions and that shares our long-term vision,” said Jean-Pierre Vasseur, President and Chief Executive Officer of AVENIR GLOBAL.

“For CDPQ, strengthening the global positioning of Québec companies is one of the priorities of our strategy. With this investment, AVENIR GLOBAL will be able to execute its ambitious plan to grow through acquisitions in order to maintain its strong presence on the international stage,” highlights Kim Thomassin, Executive Vice-President and Head of Québec of CDPQ.

AVENIR GLOBAL has 1,000 employees in 22 cities in Canada, the United States, Europe and the Middle East. It has been headquartered in Montréal since it was founded in 1976, and its network includes eight brands, including NATIONAL Public Relations and Time & Space in Canada.

Over the last eight years, the firm has undergone accelerated international growth with the acquisition of SHIFT Communications (2016, United States), Padilla (2018, United States), Cherry (2018, United Kingdom), Hanover (2019, Europe and Middle East), and more recently, Time & Space (2023, Canada).

With these recent acquisitions, AVENIR GLOBAL also broadened its playing field and ability to meet its clients’ current communications and marketing needs, notably in innovative fields such as data analytics, digital communication and online paid media.

“Companies’ communications needs change quickly, and often, unpredictably. By pursuing growth, we are seizing opportunities to increase our reach and impact, and we bring together the best resources to help our partners meet the challenges they face,” added Mr. Vasseur.

Read the press release here.

4) HOOPP shared new discussion paper by Stephen Poloz, the ninth Governor of the Bank of Canada. HOOPP is a longtime advocate of improving retirement security for all Canadians. In Pensions in the Next Age of Uncertainty, Poloz considers how Canadians will respond to an increasingly uncertain world and how pensions will become even more essential as a result.

According to the 2023 Canadian Retirement Survey, Canadians are worried about the impact of inflation and high interest rates on their ability to save for retirement, with more than half (60%) saying they’ll be forced to push out their target retirement date if inflation continues to climb. In the discussion paper, Poloz takes this a step further, arguing that various factors, including an aging population, technological advancements, rising debt and climate change, are tectonic forces with the potential to interact in unprecedented ways. It's this "unforecastable" future that could leave even more Canadians struggling to save as retirement risks grow.

This high level of uncertainty leads many Canadians to wonder how much money they’ll need to save for retirement, a question compounded by even more questions: how long will they live? What will their future investment returns look like? What will their family home be worth?

Improved access to good workplace pensions, and particularly defined benefit pensions, Poloz explains, can mitigate these challenges by better protecting individuals against longevity risk and market volatility. Further, he notes that while some may think of pensions as a cost, the reality is they more than pay for themselves with the economic growth they generate.

Pensions in the Next Age of Uncertainty makes a compelling companion to our own research, including the newly released 2023 Canadian Employer Pension Survey, which found growing momentum for retirement benefits amongst employers. In fact, the number of employers who plan to introduce or enhance their retirement benefit offerings this year or next increased to 23%, up six per cent since 2022.

We believe these findings provide an intriguing backdrop to Poloz’s detailed look at the future of retirement security and pensions in Canada, in which he offers a unique view and raises new questions. We are pleased to share this discussion paper and encourage you to take a few minutes to read it.

Read the discussion paper, Pensions in the Next Age of Uncertainty. The executive summary and full paper are available here.

5) Vestcor released its second annual Responsible Investment Report, outlining the active investment related activities that were conducted during 2022 under the direction of its publicly posted set of Responsible Investment Guidelines (the Guidelines):

The intent of this report is to continue to fulfill the core principle of Transparency that is outlined in the Guidelines; it also continues to be formatted in-line with our other noted core principles including Active Ownership and Engagement, and to illustrate the Incorporation of Environmental Social and Governance (ESG) Information into our investment processes.

Vestcor’s investment and risk management teams consider responsible investment issues when conducting their initial investment due diligence and through their ongoing monitoring activities. This report highlights how we integrate ESG information into our investment decision making process and includes two new case studies that demonstrate our active investment activities in long-term carbon emission reduction opportunities in our existing real estate portfolio and through new energy infrastructure investments.

Finally, the report provides an updated climate related greenhouse gas emissions (GHG) disclosure for the majority of our investment portfolio utilizing the guidelines of the Task Force on Climate-related Financial Disclosures (TCFD). This disclosure has been significantly expanded by including more asset class types in this year’s calculation and we are very pleased to report a material reduction in GHG emissions over the comparable 2021 metrics that were part of last year’s report.

Vestcor looks forward to continuing to annually disclose TCFD aligned information as companies work towards meeting their global climate targets.

View the report at Vestcor.org/responsibleinvestment.

About Vestcor

A Partner in Creating and Delivering Sustainable Financial Security.

Vestcor is an independent not-for-profit company located in Fredericton, New Brunswick which provides global investment management services to 10 different public sector client groups representing approximately $20 billion in assets under management as of December 31, 2022, and administration services to 11 public sector pension plans and 4 employee benefit plans.

Vestcor’s team of more than 150 service professionals provides innovative, integrated, cost-effective investment management and pension and benefit administration services solutions to public sector entities. Vestcor currently services the requirements of over 111,000 individual plan members and 140 participating employer groups.

Read the press release here.

6) IMCO's CEO Bert Clark wrote a comment on LinkedIn on how large investors have comparative advantages to enhance returns. He concludes;

Large institutional investors have the investment time horizon, liquidity requirements and scale to invest in private assets on a cost-effective basis, shift between private and listed investments, invest in opportunities that do not fit neatly into traditional asset classes, act as a capital sponsor to companies and effectively navigate longer term trends. These advantages allow larger institutions like IMCO to take on incremental risk that they are better placed accept, analyze and manage. Leveraging these investment advantages are some of the strategies IMCO uses to enhance returns on behalf of our clients.

Read his full comment here.

My take: I would say the key advantage IMCO and other large Canadian pension funds is certainty of cash flows and access to top private equity, real estate, infrastructure and private debt partners around the world. It allows for more degrees of diversification and smoother returns over long run.

7) Gordon Pape wrote and op-ed for the Globe and Mail stating the Canada Pension Plan changes will raise contributions at a very wrong time.

My take: There's never a right time but we need to get on with enhancing the CPP for future generations. The sooner we do it, the better off they will be.

8) David Crane writes for The Hill that Canada urgently needs more capital here at home:

Canada does not suffer from a lack of savings. But every year a significant share of our reserves end up supporting growth in other countries at a time when we urgently need more capital here at home to create our own economy of the future. This needs to change.

Our pension funds, mutual funds, insurance firms, and other managers of Canadian savings send billions of dollars every year to the United States, the Asia-Pacific, and Europe to invest in their growth companies while young Canadian businesses find themselves starved of funds. This limits their growth, and many end up selling out to foreign corporations since they cannot pursue their potential to scale up into world companies owned and headquartered in Canada.

Read full article here.

My take: Canada desperately needs a new federal government that creates winning conditions to allow our large pension funds to invest in more large-scale infrastructure projects at home. Forget the dual mandate, works well for CDPQ but it's fraught with risks and not always in the best interest of contributors and beneficiaries.

Here are some of the top investment stories this week:

1) Analyst Meredith Whitney is known for her call that anticipated the 2008

financial crisis. Now she is predicting that the housing market is due

for some dramatic changes starting in 2024:

Prices will start to go down and the supply of homes for sale will go up, she said Tuesday, reversing current dynamics that make the home-buying process difficult for many Americas.

The reason: a "silver tsunami" of baby boomers who are expected to start downsizing.

Citing AARP estimates, Whitney says 51% of people over the age of 50 — a group that owns more than 70% of US homes — are set to downsize to smaller homes. That would bring more than 30 million units of housing onto the market.

"You'll see a supply-demand dynamic shift," Whitney, founder and CEO of Whitney Advisory Group, told Yahoo Finance’s Invest Conference on Tuesday.

Whitney sees the shift beginning late next year into 2025 and said it's a multi-decade cycle.

"Americans are sitting on a tremendous amount of equity in their homes. It's a question of when they tap into it," Whitney said.

Read full article here.

2) It’s the buzz word on Wall Street and in the hallways of the Federal Reserve and Treasury Department. It’s blamed for triggering bond selloffs, shifts in debt auctions and interest-rate policy. That few agree on what exactly it reflects, or how to measure it, seems to matter little — the term premium is a powerful new force in the market:

Typically described as the extra yield investors demand to own longer-term debt instead of rolling over shorter-term securities as they mature, the term premium, in the broadest sense, is seen as protection against unforeseen risks such as inflation and supply-demand shocks, encapsulating everything other than expectations for the path of near-term interest rates.

The problem is it’s not directly observable. Various Wall Street and central bank economists have developed models to estimate it, often with wildly conflicting results. The one thing that most market observers, including Federal Reserve Chair Jerome Powell, can agree on is that in recent months the term premium has soared, likely fueling the dramatic ascent in long-term rates that only recently has started to fade.

The implications for the trajectory of monetary policy are substantial. Powell and other Fed officials have said that the jump in the term premium could hasten the end of their interest-rate hikes by squeezing growth in the economy, effectively doing some of the work for them as they try to rein in inflation. Yet with traders having long struggled to handicap the Fed’s next moves, some warn the central bank’s focus on the notoriously hard-to-understand feature of the US government debt market is making it even more difficult to anticipate the path of rates going forward.

“It seems like a strange door for the Fed to open,” said Jason Williams, a global market strategist at Citigroup Inc. “It’s puzzling as the term premium is something that by definition you can’t know, which the Fed realizes but still is saying its rise is important and can offset some potential hikes.”

Read full article here.

3) The amount of money that investors are parking at a major Federal Reserve facility dropped below $1 trillion for the first time in more than two years.

A total of 94 participants on Thursday put a combined $993 billion at the Fed’s overnight reverse repurchase agreement facility, used by banks, government sponsored enterprises and money-market mutual funds to earn interest. It marks a steep decline from a record $2.554 trillion stashed on Dec. 30 and is the smallest sum since August 2021.

“It’s a big number,” said Deutsche Bank strategist Steven Zeng, referring to the decline past $1 trillion. “I can see it falling further with dealers owning so much of the new bond.”

Primary dealers on Thursday took down about twice as much of the Treasury’s $24 billion 30-year bond auction as normal. Dealers often finance those purchases in the repo market, and the additional collateral stands to push overnight rates higher — a move that could prompt investors to pull more cash out of the Fed’s repo facility.

Demand for the facility, however, has been fading this year as the Treasury ramped up fresh bill issuance, offering an alternative for short-term investors. Money-market funds have been scooping up the Treasury’s deluge of bills since June, after President Joe Biden signed legislation suspending the debt ceiling until 2025.

That buying has accelerated as traders bet that the Fed is near the end of its interest-rate hiking cycle, giving them room to allocate their record amount of assets into bills — without the fear that they’ll miss out on further rate increases.

The Treasury has issued roughly $1.76 trillion of bills on net, and that’s helped drive their interest rates above the offering yield on the US central bank facility — currently 5.30%. This deluge has also helped push up rates on other money-market assets like private repo.

But as usage of the Fed’s facility fades, Wall Street strategists are weighing whether there will be further impact on the central bank’s policy decisions. If demand falls toward zero, strategists say, the Fed will have to halt its quantitative tightening program because excess liquidity will have been completely drained and bank reserves will have reached a point of scarcity.

Read full article here and more from Reuters here.

4) Mark Spitznagel, the Universa Investments founder and chief investment officer whose firm is advised by Black Swan author Nassim Nicholas Taleb, said the stock market is likely to surge — then turn drastically when the Federal Reserve starts cutting interest rates:

“That’s when things are going to get really awful,” Spitznagel said in an interview this week in New York.

Spitznagel is extending his concerns about the market’s reliance on Fed support through more than a decade of low interest rates and its bond-buying program, which it’s now in the process of trying to reverse. Earlier this year, he told investors we’re living in “the greatest tinderbox-timebomb in financial history,” even worse than the late 1920s run-up to the Great Depression.

“This is my own crazy theory: I think our rates are going to go back to zero as well. I mean, a lot of people would think I’m nuts,” said Spitznagel, 52. “But remember when a credit bubble pops, remember what a deflationary event that is. It’s like taking a giant pile of cash and lighting it on fire.”

Universa, based in Miami, is a tail-risk fund, which means it’s designed to protect investors when markets turn south. Tail-fund managers are inclined to warn against the next blowup, touting their strategies to clients as an insurance policy against extreme moves in financial markets. Spitznagel’s greatest payouts to investors come during extreme market crashes, such as the pandemic-spurred one in March 2020.

He said this week that he believes the Fed will have a hard time with its quantitative-tightening efforts, and that the central bank may even have to start easing once again.

“I think they’re gonna have to come back with vengeance, I really do,” he said.

The Fed’s balance sheet, which had roughly $9 trillion in assets at its peak in 2022, has declined to less than $7.9 trillion. That’s still some $3.7 trillion more than where they stood at the beginning of 2020, before the Covid-19 pandemic spurred the central bank to support markets even more drastically.

Spitznagel said he believes the Fed will need to reaffirm its support because he sees a recession as likely. Yet the market will continue to rise before tumbling because “the Fed just paused — that’s a good start right there — and people are positioned in a way like we’re about to crash,” he said.

“We’re probably deferring a recession to next year, and the yield curve has spent some time being uninverted,” Spitznagel said. “Put all those things together and we’re going vertical. But the sentiment is very, very negative.”

The S&P 500 has been on a week-and-a-half rally, held up in particular by dovish signals of late from Federal Reserve policymakers. While borrowing costs in the US have risen to a 22-year high, yields have begun to subside recently.

Spitznagel said the lagged effects of such high rates have yet to be fully realized throughout the economy, and future cuts will reflect the inability of borrowers to stomach higher borrowing costs after saddling themselves with debt.

“We’re likely now in a brief Goldilocks zone, and no one expects it — more squeeze-up and blow-off in risk assets, which I’ve been writing and saying for a year,” he said. “Then Papa Bear shows up, and it will be too late to react.”

Read full article here.

5) Americans are feeling worse about the state of the US economy:

The preliminary reading on consumer sentiment in November from the University of Michigan showed the index came in at 60.4 this month, well below the 63.7 expected by economists and the lowest for the measure since May. Friday's reading also marked the fourth straight month of declines.

"While current and expected personal finances both improved modestly this month, the long-run economic outlook slid 12%, in part due to growing concerns about the negative effects of high interest rates," Surveys of Consumers director Joanne Hsu said in the release. "Ongoing wars in Gaza and Ukraine weighed on many consumers as well."

Notably, consumer expectations for long-run inflation ticked up to a level not seen since 2011. Consumers now see inflation at 3.2% over the next five years, a move up from the 3% seen as of last month.

Expectations for gas prices also rose to their highest levels of the year.

Read full article here.

Alright, let me wrap it up there.

Below, the opening ceremony of the seventh edition of the McGill International Portfolio Challenge (MIPC) discussing building resilience in the face of persistent inflation featuring Ramy Rayes, Executive Vice President, Investment Strategy & Risk at BCI and Millan Mulraine, Chief Economist at OTPP.

The event, in collaboration with the Sustainable Growth Initiative (SGI), was moderated by Sebastien Betermier, Associate Professor of Finance at McGill’s University’s Desautels Faculty of Management.

Great discussion, kudos to Ramy, Millan and Sebastien.

I also embedded some clips with Stephen Poloz, former governor of the Bank of Canada who was interviewed by Amanda Lang on Taking Stock last week. Steve discussed the affordability crisis and the risks and opportunities that lie ahead.Take the time to watch and listen to his views.

Lastly, Ken Griffin, Founder & CEO, Citadel speaks with Erik Schatzker, Editorial Director, Bloomberg New Economy at the 2023 Bloomberg New Economy Forum in Singapore

It's rare that Griffin speaks so take the time to listen to his views, he's really sharp.

Comments

Post a Comment