A Lacklustre Week in Markets as We Head Into Easter

The S&P 500 ticked higher in choppy trading on Thursday, but finished the holiday-shortened trading week lower as tariffs continued to worry investors.

The broad index advanced 0.13% to close at 5,282.70 after swinging between gains and losses earlier in the session. The Nasdaq Composite inched down 0.13% to end at 16,286.45.

But the Dow Jones Industrial Average shed 527.16 points, or 1.33%, to settle at 39,142.23. The 30-stock index was weighed down by a 22% decline in UnitedHealth following the insurer’s earnings miss. Both the Dow and the Nasdaq posted three days of losses.

Nvidia retreated almost 3% on Thursday, building on its drop of nearly 7% in the previous session. The artificial intelligence darling on Tuesday disclosed a quarterly charge of about $5.5 billion tied to exporting its H20 graphics processing units, or GPUs, to China and other destinations due to U.S. export controls.

While UnitedHealth and Nvidia weighed on the market, other well-known stocks provided upward momentum. Eli Lilly surged 14% after delivering positive trial results for a weight-loss pill. Netflix popped 1% ahead of the streaming giant’s earnings report.

Stocks briefly took a leg up on Thursday afternoon after President Donald Trump said he expects trade deals to be reached with China and the European Union. That comes a day after Federal Reserve Chair Jerome Powell spooked investors by saying Trump’s tariff policies could drive up inflation in the near term and cause challenges for the central bank.

Still, the major averages posted losses on the week, which concludes with Thursday’s close, as the market is dark for Good Friday. The Dow and Nasdaq each lost more than 2% week to date, while the S&P 500 slid 1.5%.

Investors have been on alert since Trump first announced his plan for “reciprocal” tariffs — which he later walked back — on April 2. The S&P 500 has dropped nearly 7% since then. The Dow and the Nasdaq have both lost more than 7% in that period.

“This is a market that is waiting and looking for direction,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. “Right now, it’s more about waiting to see what happens with those trade deals.”

It's Thursday, markets are closed tomorrow as it's Good Friday. Catholic and Orthodox Easter fall on the same day this Sunday and I will take the long weekend off.

In terms of markets, Netflix posted a major earnings beat today, as revenue grew 13% during the first quarter of 2025 and the stock up 3% in after-hours trading.

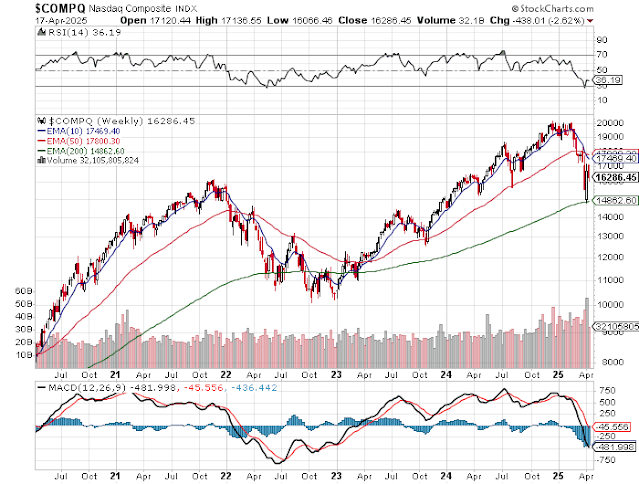

A couple of charts this week. First, the Nasdaq where upward momentum has shifted abruptly again:

The Nasdaq is range-bound here, stuck between its 200-week and 50-week exponential moving average and incapable of breaking above its 10-week exponential moving average to start a new uptrend.

Not surprisingly, Technology and Consumer Discretionary (Amazon and Tesla) are the two worst sectors in the S&P 500 year-to-date, down 18.4% and 19.7% respectively:

Only Consumer Staples (5.8%) and Utilities (2.7%) are up year-to-date.

It certainly feels like a bear market as tech stocks get clobbered, defensive sectors are rallying or doing relatively better and gold is surging.

Speaking of gold, it was all the rage on CNBC this week but I think a correction is coming given the latest parabolic move up:

I know, CTAs are all LONG GOLD, Ray Dalio likes gold, gold shares keep ripping higher but be careful chasing it here, the GDX for example can easily decline below its 50-week exponential moving average.

Let me wrap it up with this week's top performing large-cap stocks:

Enjoy the long weekend and Happy Easter for all of you celebrating.

I am leaving you with some great interviews to watch.

Below, Senator Elizabeth Warren, ranking member of the Banking Committee, joins CNBC's 'Squawk on the Street' to discuss why she believes its critical for Jerome Powell to remain as Fed Chair, concerns about tariff policy, reactions to Harvard's funding cuts, and more.

Peter Kraus, Aperture Investors chairman and CEO, joins 'Squawk Box' to discuss the latest market trends, President Trump's tariff policy, impact of policy uncertainty, the Fed's rate path outlook, President Trump's criticism of Fed Chair Powell, and more.

Third, Peter Boockvar, Bleakley Financial Group, joins 'Fast Money' to talk the market's response to Fed Chair Powell's comments.

Fourth, Dan Niles, Niles Investment Management founder, joins 'The Exchange' to discuss Nvidia taking a $.5. billion export charge and what it means for the stock.

Fifth, Eric Johnston, Cantor Fitzgerald chief equity & macro strategist, joins 'Closing Bell Overtime' to talk economic and market impact of tariffs.

Sixth, Blackstone President and COO Jon Gray joins 'Squawk Box' to discuss the company's quarterly earnings results, impact of President Trump's tariff policy, state of the real estate market, the Fed's inflation fight, President Trump's criticism of Fed Chair Powell, and more.

Seventh, Rebecca Patterson, former Chief Investment Strategist at Bridgewater Associates, joins for an extended discussion on the US dollar, Treasuries, and US exceptionalism. The demand dynamic for US Treasuries is shifting, with foreign demand declining, and the relationship between the US dollar and Treasury yields is weakening, leading to concerns about the dollar's haven status and the US deficit. She speaks with Bloomberg's Tom Keene and Paul Sweeney.

Lastly watch Federal Reserve Chair Jerome Powell's remarks at the Economic Club of Chicago.

Comments

Post a Comment